Is GrandCapital safe?

Software Index

License

Is Grand Capital Safe or a Scam?

Introduction

Grand Capital is an international brokerage firm that has been operating in the forex market since 2006. With a presence in multiple countries and a range of trading instruments, it positions itself as a versatile option for traders looking to engage in forex, CFDs, and cryptocurrencies. However, the rapid growth of online trading has also led to a proliferation of brokers, making it crucial for traders to carefully assess the legitimacy and reliability of each platform. In this context, evaluating whether "Is Grand Capital safe" is essential for potential investors.

This article aims to provide a comprehensive analysis of Grand Capital, focusing on its regulatory status, company background, trading conditions, and customer experiences. The evaluation is based on various online sources, user reviews, and regulatory data to offer a balanced perspective on the broker's credibility and performance in the forex market.

Regulatory and Legitimacy

When assessing any forex broker, the regulatory framework under which it operates is a critical factor. Regulation ensures that brokers adhere to specific standards that protect traders. Unfortunately, Grand Capital operates under a regulatory environment that raises concerns.

Regulatory Information

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Financial Commission | 24598 IBC | St. Vincent and the Grenadines | Self-regulatory, not tier-1 |

Grand Capital is registered in St. Vincent and the Grenadines, a jurisdiction known for its lax regulatory requirements. Although it claims to be a member of the Financial Commission, which offers some level of dispute resolution and compensation (up to €20,000), this organization does not have the same authority or strict oversight as tier-1 regulators like the FCA (UK) or ASIC (Australia). Thus, the lack of robust regulatory oversight raises significant questions regarding the safety of trading with Grand Capital.

Company Background Investigation

Grand Capital was established in 2006, primarily originating from Russia. Over the years, it has expanded its operations, claiming to serve clients across various regions, including Asia and Africa. The ownership structure of the company is somewhat opaque, with limited information available regarding its management team and their qualifications.

While the firm has received awards and recognition in the past, the lack of transparency in its ownership and operations can be concerning for potential clients. A brokers credibility is often tied to the experience and qualifications of its management team, and without clear information, it is difficult to assess their reliability. This leads to the question: Is Grand Capital safe for traders seeking a trustworthy platform?

Trading Conditions Analysis

Understanding the trading conditions offered by Grand Capital is essential for evaluating its overall reliability. The broker provides various account types, each with different fee structures and trading conditions.

Cost Structure Comparison

| Fee Type | Grand Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.5 - 1.0 pips |

| Commission Model | $5 per lot (ECN) | $3 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Grand Capital are relatively high compared to industry averages, particularly for major currency pairs. Additionally, the commission structure can be burdensome for active traders, as fees apply to many account types. This raises a red flag regarding the overall cost-effectiveness of trading with this broker, leading traders to question Is Grand Capital safe when it comes to managing their trading expenses.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. Grand Capital claims to implement several measures to ensure the security of client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

While the Financial Commission offers a compensation fund, it is crucial to note that this does not provide the same level of investor protection as tier-1 regulatory bodies. Furthermore, the historical context of any security incidents or disputes involving Grand Capital can significantly impact its perceived safety. Thus, potential investors must carefully consider whether Is Grand Capital safe regarding the protection of their capital.

Customer Experience and Complaints

Analyzing customer feedback is an essential aspect of evaluating any broker. Numerous reviews and complaints have surfaced regarding Grand Capital, indicating a mixed customer experience.

Complaint Types and Severity Assessment

| Complaint Type | Severity | Company Response |

|---|---|---|

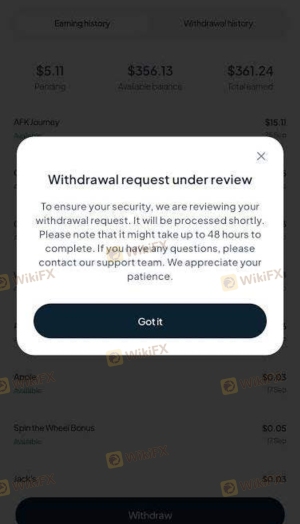

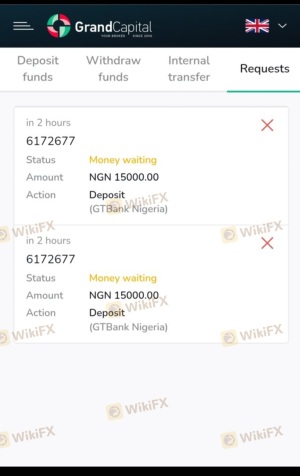

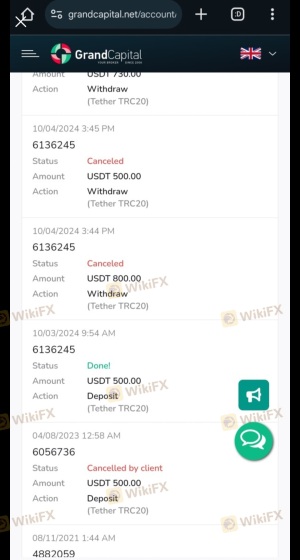

| Withdrawal Issues | High | Slow or unresponsive |

| High Fees | Medium | Minimal acknowledgment |

| Account Verification | Medium | Lengthy process |

Common complaints include difficulties with withdrawals, high fees, and a cumbersome account verification process. Many users report that their withdrawal requests were delayed or denied, which raises significant concerns about the broker's reliability. This leads to the question: Is Grand Capital safe for traders who may need access to their funds promptly?

Platform and Execution

The trading platform offered by Grand Capital is another critical aspect to consider. The broker provides access to MetaTrader 4 and MetaTrader 5, both of which are widely respected in the trading community. However, users have reported issues with platform stability and execution quality.

Traders have expressed concerns regarding slippage and order rejections during volatile market conditions. Such issues can severely impact trading performance and raise doubts about the broker's reliability and fairness in trade execution. Therefore, when evaluating whether Is Grand Capital safe, the platform's performance and reliability must be taken into account.

Risk Assessment

Engaging with any broker entails inherent risks, and Grand Capital is no exception.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of tier-1 regulation |

| Financial Risk | Medium | High spreads and commissions |

| Operational Risk | Medium | Platform issues and withdrawal complaints |

Given the high regulatory risk associated with Grand Capital, traders should approach this broker with caution. The combination of high fees, potential withdrawal issues, and regulatory concerns suggests a need for careful consideration before proceeding.

Conclusion and Recommendations

In conclusion, the evidence surrounding Grand Capital raises significant concerns about its safety and reliability as a forex broker. While it offers a range of trading instruments and competitive features, the lack of robust regulatory oversight and numerous customer complaints suggest that traders should exercise caution.

For those considering trading with Grand Capital, it is essential to weigh the potential risks against the benefits. If you prioritize regulatory safety and transparency, it may be wise to explore alternative brokers with higher regulatory standings. Options such as FP Markets or IG Markets may provide a more secure trading environment.

Ultimately, potential traders must ask themselves: Is Grand Capital safe for their trading needs? The answer may vary based on individual risk tolerance and trading objectives, but the prevailing sentiment leans towards a cautious approach.

Is GrandCapital a scam, or is it legit?

The latest exposure and evaluation content of GrandCapital brokers.

GrandCapital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GrandCapital latest industry rating score is 2.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.