Regarding the legitimacy of FXPIG forex brokers, it provides VFSC and WikiBit, .

Is FXPIG safe?

Pros

Cons

Is FXPIG markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Prime Intermarket Group Asia Ltd

Effective Date:

2018-05-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXPIG A Scam?

Introduction

FXPIG, a forex and CFD broker founded in 2010, has positioned itself as a multi-asset trading platform offering a wide range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. The broker claims to provide a user-friendly trading environment with competitive spreads and fast execution. However, the importance of thoroughly evaluating forex brokers cannot be overstated, especially in a market where regulatory compliance and financial security are paramount. Traders must exercise caution to ensure their funds are safe and their trading experience is satisfactory.

This article aims to provide an objective analysis of FXPIG's legitimacy by examining its regulatory status, company background, trading conditions, customer safety measures, customer experiences, platform performance, and associated risks. The evaluation is based on a comprehensive review of multiple sources, including user feedback and expert analyses, to present a balanced perspective on whether FXPIG is a trustworthy broker or a potential scam.

Regulation and Legitimacy

FXPIG operates under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). While it holds a license that allows it to function as a forex broker, the VFSC is often criticized for its lax regulatory standards compared to more stringent jurisdictions like the FCA (UK) or ASIC (Australia). The regulatory environment in Vanuatu raises concerns about the level of investor protection available to traders using FXPIG.

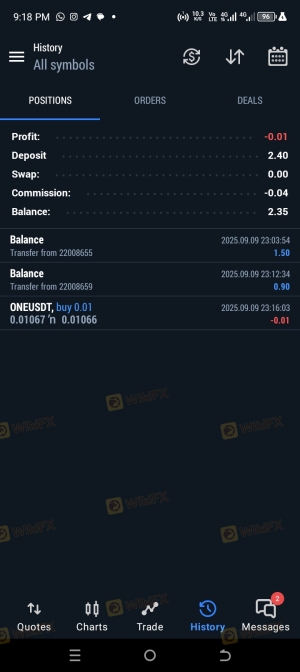

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 014578 | Vanuatu | Revoked |

The revocation of FXPIGs license by the VFSC has raised red flags among traders and regulatory observers. This suggests that FXPIG may not meet the necessary compliance standards expected from reputable brokers. Although the broker claims to adhere to strict operational guidelines, the lack of a solid regulatory framework can potentially expose traders to risks, including the mismanagement of funds and limited recourse in the event of disputes.

Company Background Investigation

FXPIG, formally known as Prime Intermarket Group Asia Pacific Limited, has been operational since 2010. Initially based in New Zealand, the company relocated to Vanuatu in 2016, presumably to benefit from the more lenient regulatory landscape. This shift raises questions about the companys commitment to maintaining high standards of compliance and transparency.

The management team at FXPIG is said to have extensive experience in the financial services sector, although specific details about their backgrounds are limited. The company's ownership structure remains somewhat opaque, which can hinder potential clients' ability to assess the broker's credibility fully. Transparency in corporate governance is crucial for building trust, and FXPIG's lack of detailed information may be a concern for prospective traders.

Moreover, FXPIG claims to prioritize transparency in its operations, yet the limited disclosure of its management team and ownership structure raises questions about its overall commitment to accountability.

Trading Conditions Analysis

FXPIG offers a variety of trading accounts, with the minimum deposit starting at $200. The broker promotes competitive trading conditions, including spreads starting from 0.0 pips and leverage up to 1:500. However, the overall cost structure can vary significantly based on the account type and trading strategy employed.

| Cost Type | FXPIG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Structure | $4 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the lower spread on major currency pairs is appealing, traders should be aware of the commission structure, which can add to the overall trading costs. FXPIG employs a commission-based model that may not be suitable for all traders, particularly those with smaller account balances or those who trade less frequently. The potential for hidden fees or unexpected costs should be a significant consideration for anyone looking to trade with this broker.

Client Fund Security

Safety of client funds is a critical factor when evaluating a broker. FXPIG claims to prioritize the security of its clients' funds by using segregated accounts, ensuring that client deposits are kept separate from the company's operational funds. This practice is essential for protecting traders' investments in the event of financial difficulties faced by the broker.

However, the absence of negative balance protection raises concerns, particularly in the volatile forex market where significant losses can occur. Additionally, while FXPIG asserts compliance with anti-money laundering (AML) protocols, the effectiveness of these measures remains uncertain given its regulatory status.

Historically, there have been reports of security issues related to FXPIG, although specific details are scarce. Traders should remain vigilant and conduct thorough research before entrusting their funds to this broker.

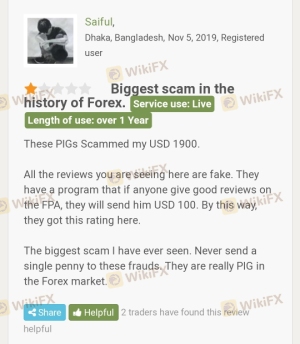

Customer Experience and Complaints

Customer feedback on FXPIG has been mixed, with some users praising the broker's competitive spreads and execution speeds, while others express dissatisfaction with withdrawal processes and customer service. Common complaints include delays in fund withdrawals and inadequate customer support, particularly during off-hours.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response, unresolved issues |

| Customer Support | Medium | Limited availability, slow responses |

One notable case involved a trader who reported significant delays in receiving funds after a withdrawal request, leading to frustration and concerns about the broker's reliability. While FXPIG has responded to some complaints, the overall quality of customer support appears to be inconsistent.

Platform and Execution

FXPIG offers several trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, which are known for their reliability and user-friendly interfaces. However, the performance of these platforms can vary, with some users reporting issues related to order execution quality, slippage, and order rejections.

In terms of execution quality, FXPIG promotes a fast and efficient trading environment, but anecdotal evidence suggests that traders may experience slippage during high volatility periods. The absence of negative balance protection further complicates the risk landscape for traders, especially during market fluctuations.

Risk Assessment

Engaging with FXPIG carries several risks that traders should carefully consider. The lack of robust regulatory oversight, combined with reports of customer complaints and operational issues, indicates a higher level of risk associated with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Revoked VFSC license raises concerns about legitimacy. |

| Fund Safety | Medium | Segregated accounts, but no negative balance protection. |

| Customer Support | Medium | Inconsistent response times and availability. |

To mitigate these risks, traders should conduct thorough due diligence, consider using a demo account to test the broker's services, and be prepared to withdraw funds promptly if they encounter issues.

Conclusion and Recommendations

In conclusion, while FXPIG offers competitive trading conditions and a variety of trading instruments, significant concerns regarding its regulatory status, customer service, and historical complaints warrant caution. The revoked VFSC license raises serious questions about the broker's legitimacy and operational practices.

Traders should approach FXPIG with a high degree of skepticism, particularly if they are new to forex trading or lack experience with offshore brokers. For those seeking reliable alternatives, brokers regulated by more stringent authorities such as the FCA or ASIC may provide a safer trading environment with better protections for client funds.

Ultimately, the decision to trade with FXPIG should be made cautiously, weighing the potential benefits against the inherent risks.

Is FXPIG a scam, or is it legit?

The latest exposure and evaluation content of FXPIG brokers.

FXPIG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXPIG latest industry rating score is 2.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.