FXPIG 2025 Review: Everything You Need to Know

Executive Summary

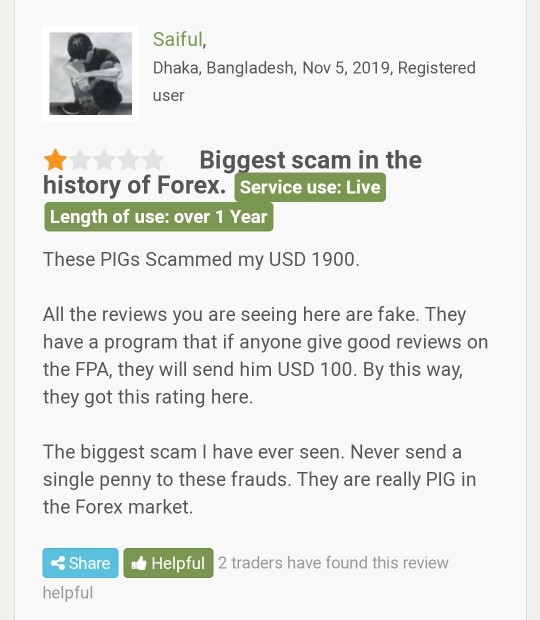

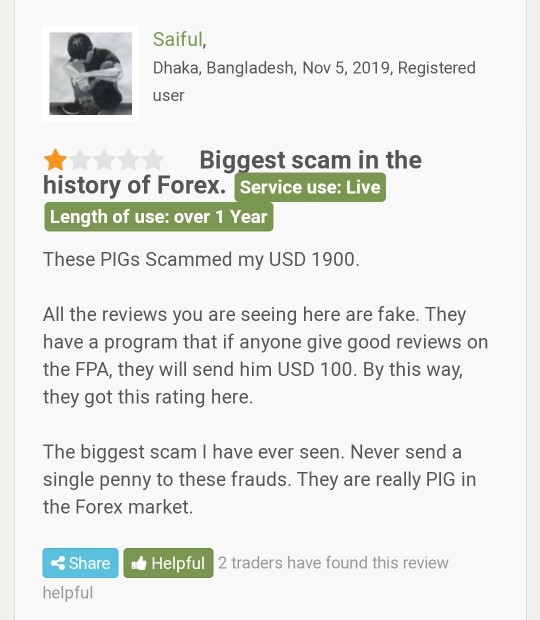

This detailed fxpig review shows major problems with this forex broker's work and trustworthiness. Our deep study of user comments and market information gives FXPIG a negative rating because it's labeled as a high-risk broker and gets consistently low scores from users.

FXPIG gives traders multiple platforms like MetaTrader 4, cTrader, and FIX API, plus different account types made for various trader needs. The broker lets you trade currencies, cryptocurrencies, indices, precious metals, energy products, and stocks. But these good features are hurt by big trust and service problems.

The platform mainly targets traders with some experience and investors who can handle higher risks and want platform choices over regulatory safety. Data shows FXPIG gets an overall rating of 2 out of 5 points, showing widespread user unhappiness. Trustpilot reviews keep pointing out bad experiences, with the broker getting a low trust score of about 41, showing major reliability problems that potential clients should think about carefully before using their services.

Important Disclaimer

Potential investors should be very careful when thinking about FXPIG, as regulatory information for different areas stays unclear in available documents. Traders must check all regulatory compliance and licensing information on their own before opening accounts or putting in money.

This review comes from user feedback analysis and market research, which may have subjective views. The information shown reflects conditions as of early 2025, and things may change. Investors should strongly do their own research and talk with financial professionals before making investment decisions with this broker.

Rating Framework

Broker Overview

FXPIG works as an online forex and multi-asset trading service provider, though specific information about when it started and its corporate background stays hidden in available documents. The company's business model focuses on giving retail and institutional clients access to global financial markets through electronic trading platforms, focusing mainly on foreign exchange, commodities, and derivative instruments.

The broker's operational structure emphasizes technology-driven trading solutions, offering multiple platform options to fit different trader preferences and technical needs. However, the lack of clear corporate information and unclear regulatory standing raises big questions about the company's legitimacy and long-term survival in the competitive forex brokerage landscape.

Available sources say FXPIG supports three main trading platforms: MetaTrader 4, cTrader, and FIX API connectivity. The broker gives access to six major asset categories including currencies, cryptocurrencies, indices, precious metals, energy products, and stocks. Despite offering diverse trading instruments, the absence of clear regulatory information and consistently negative user feedback significantly hurts the broker's credibility. This fxpig review emphasizes the importance of regulatory oversight, which appears to be a major weakness in FXPIG's operational framework.

Regulatory Jurisdiction: Available documents do not specify FXPIG's regulatory status or oversight jurisdictions, representing a major red flag for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific funding methods and withdrawal procedures are not detailed in accessible information, creating uncertainty about transaction processes and potential restrictions.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts in available materials, making it difficult for traders to assess account accessibility and initial investment requirements.

Bonus and Promotional Offers: No information about welcome bonuses, promotional campaigns, or trading incentives appears in current documentation, suggesting limited marketing initiatives or poor information transparency.

Available Trading Assets: FXPIG provides access to currencies, cryptocurrencies, indices, precious metals, energy products, and stocks, offering reasonable asset diversity for multi-market trading strategies.

Cost Structure and Fees: Detailed information about spreads, commissions, overnight fees, and other trading costs remains unavailable, preventing accurate cost analysis for potential clients.

Leverage Ratios: Specific leverage offerings and margin requirements are not disclosed in accessible documentation, creating uncertainty about trading conditions and risk management parameters.

Platform Options: The broker supports MetaTrader 4, cTrader, and FIX API connectivity, providing multiple technological solutions for different trading approaches and automation requirements.

Geographic Restrictions: Information about restricted countries or regional limitations is not specified in available sources.

Customer Support Languages: Available documents do not specify supported languages for customer service communications.

This fxpig review highlights significant information gaps that potential clients should address through direct broker communication before considering account opening procedures.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

FXPIG's account conditions get a below-average rating because of limited transparency and unclear terms. While the broker claims to offer multiple account types, specific details about account tiers, features, and requirements stay largely hidden in public documents. This lack of transparency makes it extremely difficult for potential clients to make informed decisions about account selection.

The absence of clear minimum deposit information represents a significant weakness in FXPIG's account structure. Most good brokers clearly show their account requirements, fee structures, and benefits to help traders choose appropriate account types. FXPIG's failure to provide this basic information suggests either poor marketing practices or deliberate hiding of potentially unfavorable terms.

User feedback about account conditions has been mostly negative, with many traders expressing frustration about unclear terms and unexpected restrictions. The lack of information about special account features, such as Islamic accounts for Muslim traders or VIP accounts for high-volume traders, further limits the broker's appeal to diverse trading communities.

Account opening procedures and verification requirements are not clearly outlined, creating additional uncertainty for prospective clients. Without transparent account conditions, traders cannot properly assess whether FXPIG meets their specific trading needs and risk management requirements. This fxpig review emphasizes that account transparency is fundamental to broker credibility.

FXPIG's tools and resources get a moderate rating mainly because it supports established trading platforms. The broker provides access to MetaTrader 4, one of the industry's most popular trading platforms, along with cTrader and FIX API connectivity. This platform diversity allows traders to choose familiar interfaces and use various trading strategies, including automated trading systems.

MetaTrader 4 support enables access to extensive charting tools, technical indicators, and expert advisors, providing traders with comprehensive analysis capabilities. cTrader offers advanced charting features and improved order execution, appealing to more sophisticated traders who require enhanced platform functionality. FIX API connectivity caters to institutional clients and high-frequency trading operations requiring direct market access.

However, the broker's educational resources and market analysis offerings remain unclear from available documents. Most competitive brokers provide daily market analysis, trading webinars, educational articles, and research tools to support trader development. The absence of clear information about these supplementary resources represents a significant limitation in FXPIG's value proposition.

The lack of proprietary trading tools or unique platform features also limits the broker's competitive advantage. While supporting established platforms is beneficial, successful brokers typically offer additional resources such as economic calendars, trading signals, or risk management tools that enhance the overall trading experience.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of FXPIG's weakest areas, earning a poor rating based on consistently negative user feedback. Available reviews show widespread dissatisfaction with support quality, response times, and problem resolution effectiveness. Many users report difficulties reaching customer service representatives and receiving inadequate assistance when issues arise.

The broker's support infrastructure appears insufficient for handling client inquiries effectively. Response time delays and unhelpful responses have been recurring themes in user complaints, suggesting systematic problems with FXPIG's customer service operations. This is particularly concerning for active traders who require prompt assistance with time-sensitive trading issues.

Communication channels and availability hours are not clearly specified in available documents, creating additional uncertainty about support accessibility. Professional brokers typically offer multiple contact methods including phone, email, live chat, and social media support with clearly defined operating hours and response time commitments.

Language support capabilities remain unclear, potentially limiting service accessibility for international clients. The absence of multilingual support could significantly restrict FXPIG's ability to serve diverse global markets effectively. Poor customer service significantly undermines trader confidence and represents a major risk factor for potential clients considering this broker.

Trading Experience Analysis (Score: 5/10)

FXPIG's trading experience gets a below-average rating because of mixed user feedback about platform stability and execution quality. While the broker supports established trading platforms, user reports suggest inconsistent performance that can impact trading effectiveness and profitability.

Platform stability concerns have been raised by multiple users, with reports of connection issues and system downtime during critical trading periods. These technical problems can result in missed trading opportunities and potential losses, particularly for traders using time-sensitive strategies or trading during high-volatility market conditions.

Order execution quality appears inconsistent based on available user feedback. Some traders report satisfactory execution speeds, while others experience delays, slippage, or requoting issues that can negatively impact trading results. Reliable order execution is crucial for successful trading, and inconsistencies in this area represent a significant weakness.

The broker's trading environment lacks detailed information about spread stability, liquidity provision, and execution policies. Transparent execution statistics and performance data would help traders assess whether FXPIG's trading conditions meet their requirements. Mobile trading experience and platform functionality on different devices also remain unclear from available documents.

This fxpig review emphasizes that trading experience quality directly impacts profitability, making platform reliability and execution consistency essential factors for broker selection.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent FXPIG's most significant weakness, earning the lowest rating in this evaluation. The broker's classification as a high-risk entity raises serious concerns about client fund security and regulatory compliance. The absence of clear regulatory information represents a major red flag for potential investors.

Regulatory oversight is fundamental to broker credibility and client protection. FXPIG's failure to clearly display regulatory licenses, oversight jurisdictions, and compliance information suggests either lack of proper authorization or deliberate concealment of regulatory status. Legitimate brokers typically highlight their regulatory credentials as key selling points.

Client fund protection measures are not clearly outlined in available documents. Good brokers implement segregated account policies, deposit insurance, and other safeguards to protect client funds from operational risks. The absence of clear fund protection information creates significant uncertainty about financial security.

Industry reputation and third-party assessments consistently rate FXPIG as high-risk, with multiple warning signals about the broker's operational practices. The lack of positive industry recognition or awards further undermines credibility. Negative publicity and risk warnings from financial authorities or industry watchdogs should be serious considerations for potential clients.

The broker's transparency about corporate structure, ownership, and financial reporting is also insufficient, making it difficult to assess long-term stability and reliability.

User Experience Analysis (Score: 4/10)

Overall user experience with FXPIG gets a poor rating based on widespread negative feedback across multiple review platforms. User satisfaction surveys and testimonials consistently highlight problems with service quality, platform reliability, and customer support effectiveness.

Interface design and platform usability information is limited in available documents, though users of supported platforms like MetaTrader 4 generally benefit from familiar, well-designed interfaces. However, the broker's own website and client portal usability appears to be problematic based on user complaints about navigation and functionality issues.

Registration and account verification processes are not clearly outlined, creating uncertainty about onboarding procedures and timeline expectations. Streamlined account opening with clear verification requirements is essential for positive user experience, and FXPIG appears to fall short in this area.

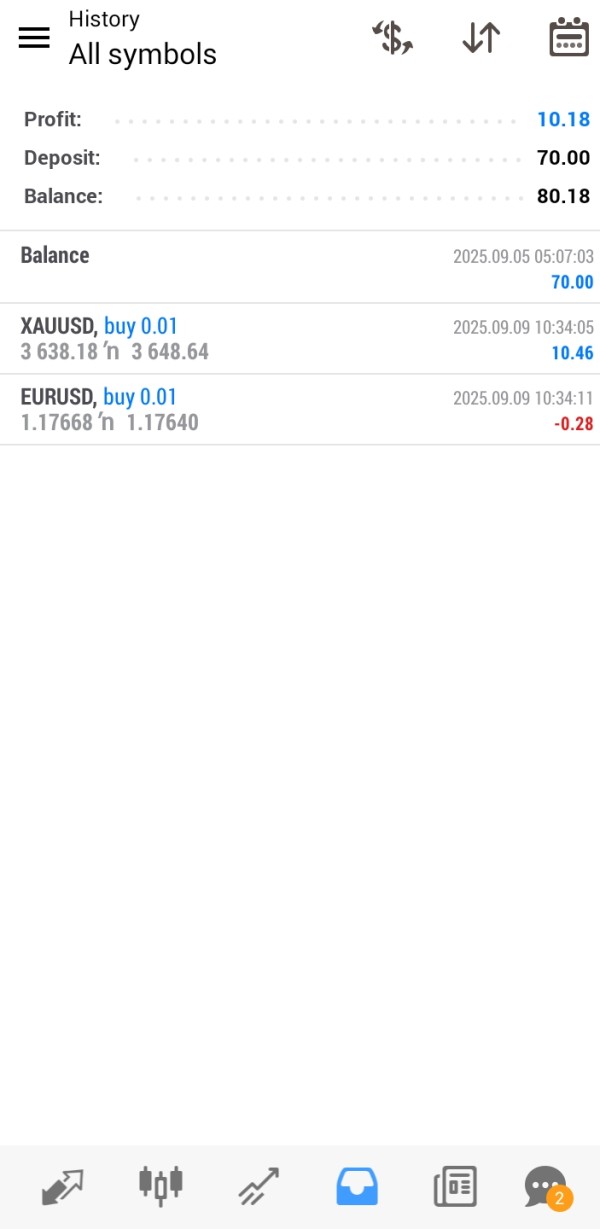

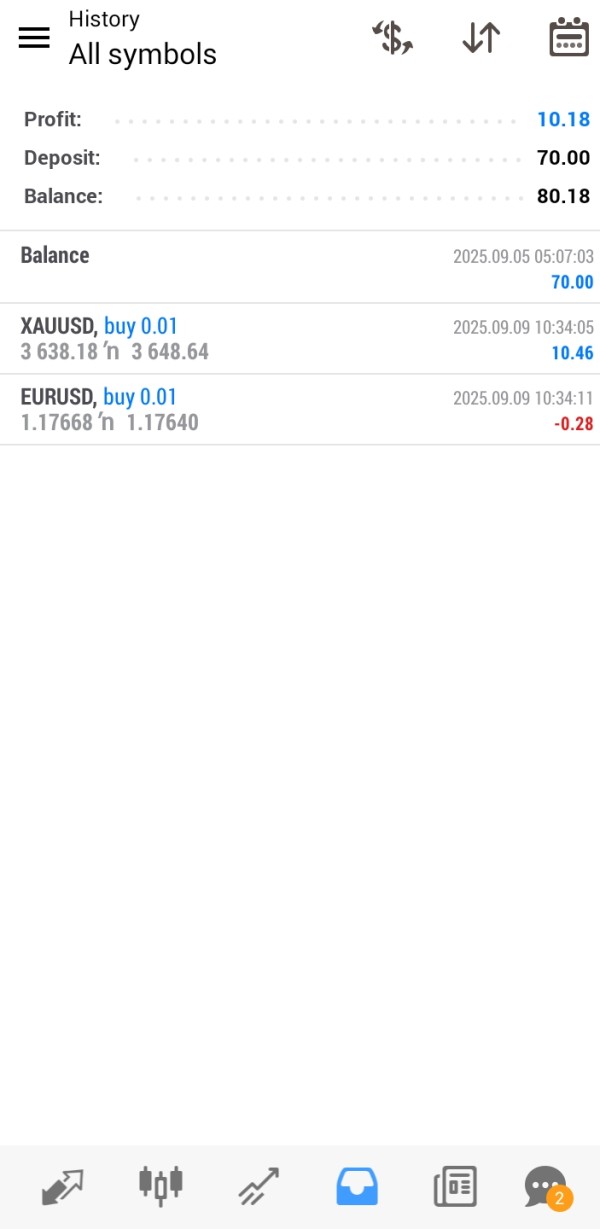

Funding operations experience has been a source of user complaints, with reports of withdrawal difficulties and unclear processing procedures. Efficient, transparent deposit and withdrawal processes are crucial for user satisfaction, and problems in this area significantly impact overall experience quality.

Common user complaints focus on customer service responsiveness, platform stability, and transparency issues. The broker would benefit from addressing these fundamental service quality problems to improve user satisfaction and retention rates.

Conclusion

This comprehensive fxpig review reveals significant concerns that potential traders should carefully consider. FXPIG's classification as a high-risk broker, combined with consistently negative user feedback and lack of regulatory transparency, creates substantial risks for potential clients. While the broker offers multiple trading platforms and asset diversity, these benefits are overshadowed by fundamental trust and service quality issues.

The broker may only be suitable for traders with extremely high risk tolerance who prioritize platform variety over regulatory security and service quality. However, most traders would benefit from choosing more established, properly regulated alternatives that offer better client protection and service standards.

Key advantages include platform diversity and asset variety, while major disadvantages include poor trust ratings, inadequate customer service, and unclear regulatory status. Given these significant limitations, potential clients should exercise extreme caution and thoroughly investigate alternatives before considering FXPIG for their trading activities.