Regarding the legitimacy of FXCG forex brokers, it provides ASIC, CIMA and WikiBit, (also has a graphic survey regarding security).

Is FXCG safe?

Pros

Cons

Is FXCG markets regulated?

The regulatory license is the strongest proof.

ASIC Deriv Transmission License (RTO)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Deriv Transmission License (RTO)

Licensed Entity:

CAPSTONE GLOBAL AUSTRALIA PTY LTD

Effective Date: Change Record

2017-06-15Email Address of Licensed Institution:

compliance@capstoneglobal.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

RON HOLLANDS L 38 71 EAGLE ST BRISBANE QLD 4000Phone Number of Licensed Institution:

61721409284Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Capstone Global Markets Limited

Effective Date:

2021-05-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXCG A Scam?

Introduction

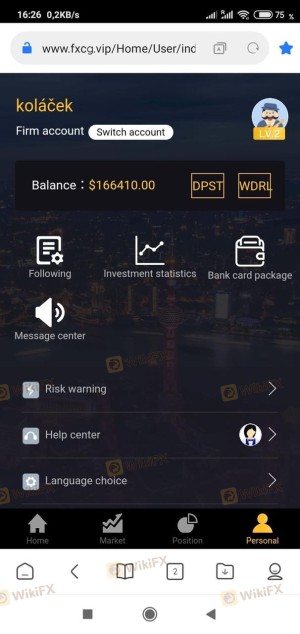

FXCG, also known as Capstone Global Markets LLC, positions itself as a global forex broker offering a range of financial instruments, including forex, commodities, and indices. Established in 2003, the broker claims to provide competitive trading conditions, including low spreads and high leverage. However, the forex market is fraught with risks, and traders must exercise caution when evaluating brokers. Many unregulated or poorly regulated brokers have been known to engage in deceptive practices, leading to significant financial losses for traders. This article aims to provide a comprehensive analysis of FXCG's legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The information is gathered from multiple sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

The regulatory environment is crucial for any forex broker, as it ensures that the broker adheres to specific standards designed to protect traders. FXCG claims to be regulated by various authorities, including the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA). However, a closer examination reveals inconsistencies in their claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 494799 | Australia | Not Found |

| CIMA | 1587670 | Cayman Islands | Exceeded |

| SVG FSA | 119 LLC 2019 | St. Vincent | Registered |

Upon reviewing the ASIC register, no broker by the name of FXCG or Capstone Global Australia Pty Ltd was found, raising significant concerns about its regulatory claims. The lack of a legitimate license from a recognized authority indicates that FXCG operates in a high-risk environment. Furthermore, being registered in St. Vincent and the Grenadines, a known offshore jurisdiction, adds to the skepticism surrounding its legitimacy. Offshore brokers often have fewer regulatory requirements, making them less accountable to their clients.

Company Background Investigation

FXCG, owned by Capstone Global Markets LLC, has a history that dates back to 2003. The company operates under various names, which can create confusion regarding its regulatory status and ownership structure. The management team behind FXCG has not been thoroughly disclosed, leading to concerns about transparency and the level of expertise guiding the firm.

In terms of transparency, FXCG's website provides limited information about its operations, management, and financial practices. The lack of clarity on its ownership and the absence of detailed biographies for key personnel raise red flags for potential investors. A well-established broker typically offers comprehensive information about its management team, including their qualifications and industry experience, which FXCG fails to provide.

Trading Conditions Analysis

FXCG advertises a range of trading conditions, including competitive spreads and high leverage. However, the actual costs associated with trading can significantly impact a trader's profitability.

| Cost Type | FXCG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $2 per lot | $3 - $5 per lot |

| Overnight Interest Range | Varies | Varies |

While FXCG claims to offer spreads starting from 0.0 pips on certain accounts, the average spread of 1.6 pips for major currency pairs is higher than the industry average. Additionally, the commission structure, although competitive, should be scrutinized for hidden fees or conditions that may apply. Traders need to be aware of any unusual charges that could erode their profits, such as withdrawal fees or minimum trading volume requirements tied to bonuses.

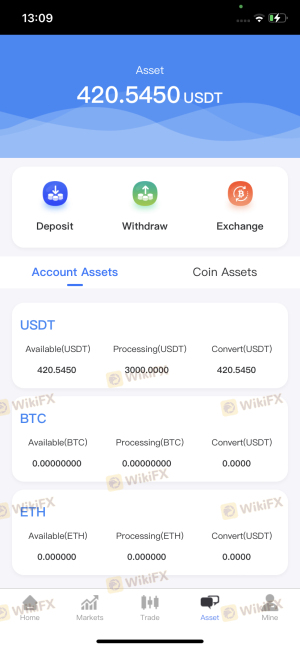

Client Fund Security

The security of client funds is paramount when selecting a forex broker. FXCG claims to offer segregated accounts, which means that client funds are kept separate from the broker's operational funds. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

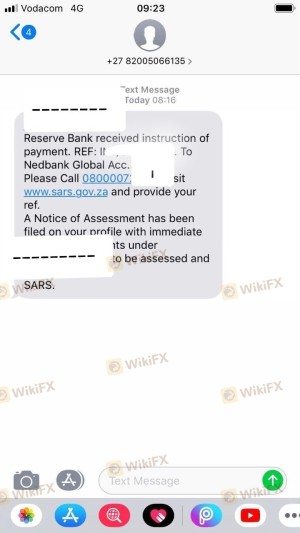

FXCG does not provide clear information on investor protection schemes, such as negative balance protection or compensation schemes for clients. This absence of safeguards can expose traders to significant risks, especially during volatile market conditions. Historical complaints from clients regarding difficulties in withdrawing funds further exacerbate concerns about the broker's commitment to fund security.

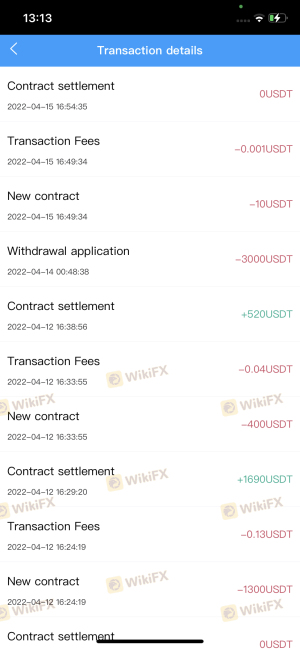

Customer Experience and Complaints

Customer feedback is an essential factor in assessing a broker's reliability. A review of user experiences with FXCG reveals a troubling pattern of complaints, particularly regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Hidden Fees | Medium | Inconsistent |

| Poor Customer Support | High | Largely Unresponsive |

Numerous clients have reported challenges in withdrawing their funds, often citing unexpected fees and delays. The company's response to these complaints has been criticized as inadequate, with many users feeling ignored or dismissed. For instance, one user reported being unable to withdraw their funds for several weeks, leading to frustration and distrust in the broker's operations.

Platform and Execution

FXCG utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, the broker's performance on this platform has been questioned, particularly regarding order execution quality and slippage rates.

Traders have reported instances of significant slippage during high-volatility periods, which can adversely affect their trading outcomes. Additionally, complaints about order rejections have raised concerns about the broker's execution reliability. Such issues can be detrimental, especially for traders who rely on precise execution for their strategies.

Risk Assessment

Using FXCG presents several risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated or poorly regulated status exposes traders to potential fraud. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues suggest a lack of transparency. |

| Execution Risk | Medium | Reports of slippage and order rejections can impact trading performance. |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with FXCG. It may also be prudent to consider alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXCG operates in a high-risk environment, with significant concerns regarding its regulatory status, customer fund security, and overall reliability. The lack of transparency in its operations and the numerous complaints from clients indicate that traders should exercise extreme caution when considering this broker.

For traders seeking a reliable and secure trading environment, it is advisable to explore alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers such as Interactive Brokers, eToro, and OANDA are examples of firms that offer robust regulatory protections and transparent trading conditions. Always prioritize safety and due diligence in your trading endeavors.

Is FXCG a scam, or is it legit?

The latest exposure and evaluation content of FXCG brokers.

FXCG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCG latest industry rating score is 6.07, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.07 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.