Is bitcastleFX safe?

Pros

Cons

Is Bitcastle Safe or Scam?

Introduction

Bitcastle is a relatively new player in the forex and cryptocurrency trading market, having been established in 2022 and registered in Saint Vincent and the Grenadines. As traders increasingly seek opportunities in the volatile forex market, it is crucial to evaluate the safety and legitimacy of trading platforms like Bitcastle. The rise of online trading has unfortunately also led to an increase in scams, making it imperative for traders to perform thorough due diligence before engaging with any broker. This article aims to investigate whether Bitcastle is a safe trading environment or if it raises red flags that warrant caution. Our evaluation will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

Regulation plays a vital role in establishing the legitimacy of a forex broker. A regulated broker is typically subject to oversight by financial authorities, ensuring that they adhere to industry standards and protect clients' interests. Unfortunately, Bitcastle operates without any valid regulatory oversight, which raises significant concerns regarding its adherence to industry norms and client protection. The absence of regulation could indicate a higher risk of fraud and malpractice.

Here is a summary of Bitcastle's regulatory status:

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Not Verified |

The lack of a regulatory framework means that traders have limited recourse in case of disputes or issues with fund withdrawals. Furthermore, the absence of oversight can lead to concerns about the broker's financial transparency and operational integrity. In summary, the lack of regulation is a significant red flag when assessing if Bitcastle is safe for trading.

Company Background Investigation

Bitcastle's history is relatively short, having been founded in 2022. The company is registered in Saint Vincent and the Grenadines, an offshore jurisdiction often scrutinized for lax regulatory standards. The ownership structure of Bitcastle is not transparent, as key details about the management team and their backgrounds are not readily available. This lack of transparency can be concerning for potential traders, as it raises questions about the qualifications and experience of those managing the platform.

Moreover, the company's operational history has been marked by a series of complaints regarding its services, particularly concerning withdrawal processes and customer support. The absence of public information about the management team further complicates the situation, as traders cannot assess the expertise and credibility of those at the helm. Overall, the opaque nature of Bitcastle's corporate structure and management team does not inspire confidence when evaluating if Bitcastle is safe for trading.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is essential to consider the overall fee structure, including spreads, commissions, and any hidden fees that may apply. Bitcastle claims to offer competitive trading conditions, but the lack of regulatory oversight raises questions about the transparency of its fee structure.

The following table summarizes the core trading costs associated with Bitcastle:

| Fee Type | Bitcastle | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.1 pips | From 0.5 pips |

| Commission Model | $8 per lot (Pro) | Varies widely |

| Overnight Interest Range | Not disclosed | Typically 0.5% - 2% |

While Bitcastle advertises low spreads and no deposit fees, it is crucial to note that the pro account incurs a commission of $8 per lot traded, which is higher than the industry average. Additionally, the lack of clarity regarding overnight interest rates could lead to unexpected costs for traders. Overall, while Bitcastle presents itself as a competitive option, the fee structure's opacity, combined with the absence of regulation, raises concerns about its overall safety.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Bitcastle claims to implement several measures to protect client assets, including two-factor authentication (2FA) and segregated accounts. However, the lack of regulation raises questions about the effectiveness and enforcement of these safety measures.

Traders should be particularly cautious about the following aspects:

- Segregation of Funds: While Bitcastle states that client funds are kept in segregated accounts, the absence of regulatory oversight means there is no guarantee that these claims are enforced.

- Investor Protection: Unlike regulated brokers, Bitcastle does not offer any form of investor compensation scheme, which means that in the event of insolvency, clients may not recover their funds.

- Negative Balance Protection: There is no mention of negative balance protection, which could leave traders liable for losses exceeding their account balance.

In light of these factors, the question "Is Bitcastle safe?" becomes increasingly complex, as the lack of regulatory oversight undermines the credibility of its safety claims.

Customer Experience and Complaints

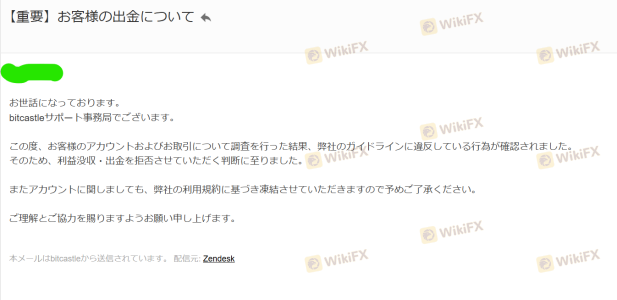

Customer feedback is a valuable indicator of a broker's reliability. Bitcastle has received numerous complaints from users, particularly concerning withdrawal difficulties and customer support responsiveness. Many users have reported long waiting times for withdrawals, with some claiming that their requests have gone unanswered for extended periods.

The following table summarizes the main types of complaints received about Bitcastle:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Often unresponsive |

| Poor Customer Support | Medium | Limited channels available |

| High Fees | Medium | Not addressed clearly |

For instance, one user reported that their withdrawal request took over two weeks to process, during which they received minimal communication from the support team. Another user expressed frustration with the lack of live chat support, stating that the only means of communication was through a contact form, which led to delays in responses. Such complaints raise significant concerns about the overall customer experience and the operational integrity of Bitcastle.

Platform and Execution

The trading platform offered by Bitcastle is based on the popular MetaTrader 5 (MT5) interface, which is known for its advanced charting capabilities and user-friendly design. However, the platform's performance and reliability have been questioned by some users, who reported instances of slippage and order rejections during high volatility periods.

Traders have expressed concerns about the following aspects of the platform:

- Execution Quality: Reports of delayed order execution and slippage during critical market events can significantly impact trading outcomes.

- Platform Stability: Users have noted occasional downtime or technical glitches, which can hinder trading activities and lead to potential losses.

- Signs of Manipulation: Some traders have raised suspicions about the platform's reliability, suggesting that certain market conditions may be manipulated to the broker's advantage.

Given these factors, the question remains: "Is Bitcastle safe?" The platform's performance issues and the lack of transparency regarding execution practices warrant careful consideration.

Risk Assessment

Engaging with Bitcastle carries various risks that potential traders should be aware of. A comprehensive risk assessment can help traders make informed decisions before committing their funds.

The following risk scorecard summarizes key risk areas associated with Bitcastle:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulation in place |

| Fund Safety | High | Lack of investor protection schemes |

| Customer Support | Medium | Complaints regarding responsiveness |

| Platform Reliability | Medium | Reports of slippage and execution issues |

To mitigate these risks, traders are advised to conduct thorough research, consider using smaller amounts for initial trades, and explore alternative brokers with established regulatory oversight and positive customer feedback.

Conclusion and Recommendations

In conclusion, the investigation into Bitcastle raises several significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, coupled with numerous customer complaints about withdrawal issues and poor support, suggests that traders should proceed with caution.

While Bitcastle offers a user-friendly platform and competitive trading conditions, the absence of regulatory protection and transparency raises red flags. Therefore, potential traders should carefully consider whether they are comfortable with the risks associated with trading on this platform.

For those seeking safer alternatives, consider brokers that are well-regulated and have a proven track record of positive customer experiences, such as [insert recommended brokers]. Ultimately, the decision to engage with Bitcastle should be made with a clear understanding of the associated risks and a critical evaluation of the available information.

Is bitcastleFX a scam, or is it legit?

The latest exposure and evaluation content of bitcastleFX brokers.

bitcastleFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bitcastleFX latest industry rating score is 2.01, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.01 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.