Is ARON GROUPS BROKER safe?

Pros

Cons

Is Aron Groups Broker A Scam?

Introduction

Aron Groups is an online forex broker that has gained attention in the financial markets since its inception in 2020. Positioned as a platform catering to both novice and experienced traders, Aron Groups offers a variety of trading instruments, including forex pairs, CFDs, commodities, and cryptocurrencies. However, the lack of regulation and the offshore status of the broker raise significant concerns regarding its trustworthiness. As forex trading can involve substantial risks and potential losses, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide a comprehensive analysis of Aron Groups, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. Aron Groups is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. The Financial Services Authority (FSA) of Saint Vincent explicitly states that it does not regulate forex trading, which means that brokers operating under this jurisdiction often lack the oversight that ensures the protection of client funds.

Here is a summary of the regulatory information for Aron Groups:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA (Saint Vincent) | N/A | Saint Vincent | Unregulated |

The absence of a license from a top-tier regulatory body, such as the UK‘s FCA or Australia’s ASIC, raises red flags about the brokers operational integrity. Regulatory bodies impose strict guidelines to protect traders, and without such oversight, Aron Groups may not adhere to industry standards. Consequently, potential clients should approach this broker with caution, as the lack of regulation can expose them to higher risks of fraud and mismanagement.

Company Background Investigation

Aron Groups is owned by Aron Markets Ltd, which operates under the jurisdiction of Saint Vincent and the Grenadines. The broker claims to have a team of experienced professionals in finance and technology; however, the lack of transparency regarding its ownership and management structure raises concerns. The companys website provides limited information about its founders and key personnel, making it difficult for potential clients to assess the expertise and reliability of the management team.

The history of Aron Groups is relatively short, having been established in 2020. While the broker markets itself as a modern trading platform, the absence of a proven track record in the industry is a significant drawback. Furthermore, the companys operations in an offshore jurisdiction known for lax regulations contribute to the skepticism surrounding its legitimacy. Transparency in operations and information disclosure is essential for building trust with clients, and Aron Groups appears to fall short in this regard.

Trading Conditions Analysis

Aron Groups offers a variety of trading accounts with different features and conditions, including nano, standard, swap-free, and VIP accounts. The minimum deposit requirement is as low as $1, which may attract novice traders. However, the overall fee structure and trading conditions warrant careful consideration.

Here is a comparison of the core trading costs associated with Aron Groups:

| Fee Type | Aron Groups | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (from 0.0 pips) | 1.0 - 2.0 pips |

| Commission Model | $0 | $3 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While Aron Groups advertises competitive spreads, the variability of these spreads can lead to unexpected costs, particularly during periods of high market volatility. Additionally, the absence of a commission structure on some accounts may seem appealing, but it is crucial to understand that brokers often incorporate these costs into their spreads. Traders should be wary of any hidden fees or unusual policies that could affect their profitability.

Customer Funds Security

Ensuring the safety of customer funds is paramount when assessing a forex broker. Aron Groups claims to implement various security measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is questionable given the broker's unregulated status.

The lack of a robust regulatory framework means that there are no guarantees for the protection of client funds. In regulated environments, brokers are required to maintain client funds in separate accounts, ensuring that traders can access their money even if the broker faces financial difficulties. However, the absence of such regulations in Aron Groups' operational jurisdiction raises concerns about the safety of client deposits.

Historically, unregulated brokers have been associated with cases of fund mismanagement and fraudulent practices. Therefore, potential clients should carefully consider these risks before opening an account with Aron Groups.

Customer Experience and Complaints

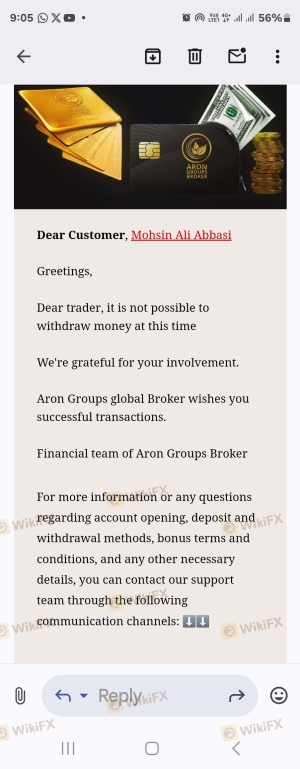

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Aron Groups are mixed, with some users praising the platform's features and customer support, while others report significant issues, particularly regarding withdrawals.

Here is a summary of common complaints and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Poor Customer Support | Medium | Mixed feedback |

| Misleading Marketing | High | No clear response |

Several users have reported difficulties in withdrawing their funds, with claims of unexplained delays and unexpected fees. These issues can severely impact traders' experiences and raise concerns about the broker's operational integrity. Additionally, the company's response to complaints appears to be inconsistent, with some users expressing frustration over unresponsive customer service.

Platform and Trade Execution

Aron Groups utilizes the MetaTrader 5 (MT5) platform, a widely recognized trading software known for its advanced features and user-friendly interface. While MT5 offers a robust trading environment, the effectiveness of the platform is undermined by the broker's lack of regulation.

The quality of order execution is a critical factor for traders, as delays and slippage can significantly affect trading outcomes. Users have reported mixed experiences with order execution, with some experiencing slippage during volatile market conditions. The absence of regulatory oversight raises concerns about potential manipulation or unfair trading practices that could disadvantage clients.

Risk Assessment

Trading with Aron Groups involves several risks, primarily due to its unregulated status and the potential for fund mismanagement. Here is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, potential for fraud |

| Fund Security Risk | High | Lack of investor protection |

| Customer Service Risk | Medium | Inconsistent response to complaints |

| Trade Execution Risk | Medium | Possible slippage and execution delays |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and only invest funds they can afford to lose. Utilizing demo accounts to practice trading strategies can also help reduce potential losses.

Conclusion and Recommendations

In conclusion, while Aron Groups presents itself as a competitive forex broker with attractive trading conditions, significant concerns regarding its regulatory status, company transparency, and customer experiences cannot be overlooked. The lack of regulation raises red flags about the safety of client funds and the overall integrity of the broker.

Traders should exercise caution when considering Aron Groups as their trading platform. It is advisable to explore alternatives that are regulated by reputable authorities, such as FCA, ASIC, or CySEC, to ensure a safer trading environment. Brokers like FP Markets, Exness, and CMC Markets offer reliable trading conditions and are well-regarded in the industry, making them worthy alternatives for potential investors.

Is ARON GROUPS BROKER a scam, or is it legit?

The latest exposure and evaluation content of ARON GROUPS BROKER brokers.

ARON GROUPS BROKER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ARON GROUPS BROKER latest industry rating score is 2.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.