Aron Groups Broker 2025 Review: Everything You Need to Know

Executive Summary

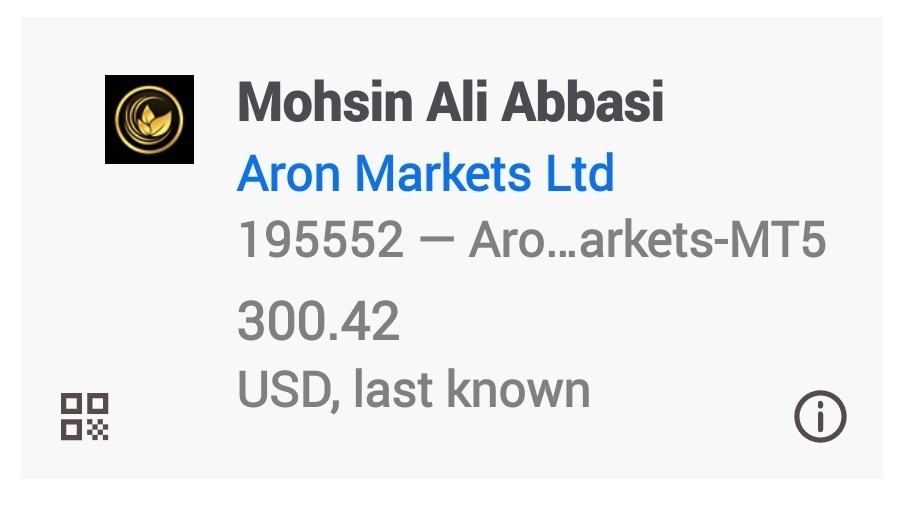

This aron groups broker review looks at a new multi-asset broker that has caught attention in the trading world since 2020. Aron Groups Broker calls itself a technology-driven brokerage firm that offers over 2,000 trading instruments to its growing client base of 250,000 registered users and 23,000 active introducing brokers (IBs).

The broker won the "Retail Broker of the Year – MENA 2023" award, showing its growing influence in the Middle East and North Africa region. Trading review platforms show that Aron Groups Broker works as a multi-asset brokerage firm focused on providing complete trading services across various financial markets, including forex, commodities, indices, and cryptocurrencies.

This broker stands out because it focuses on educational services and diverse trading programs. These include social trading, copy trading, and special trading programs designed for different trader preferences and experience levels. The platform appeals to traders who want educational support and those interested in diverse investment opportunities across multiple asset classes.

However, this aron groups broker review must note that the broker works in a competitive market where regulatory transparency and user feedback show mixed signals. This makes it important for potential clients to do careful research before using the platform.

Important Disclaimers

Regional Entity Differences: Potential traders should know that Aron Groups Broker may operate under different regulatory frameworks across various locations. The specific regulatory information and compliance requirements may vary depending on your geographical location and local financial regulations. Traders should verify the regulatory status that applies to their region before opening an account.

Review Methodology: This evaluation uses publicly available information from trading review platforms, user feedback from Trustpilot (263 reviews), and official company communications. Our assessment method includes user experience reports, platform features analysis, and industry standard comparisons. All ratings and conclusions come from available data sources and should be considered alongside individual trading requirements and risk tolerance levels.

Rating Framework

Broker Overview

Aron Groups Broker started in the financial markets in September 2020. Farzad Vajihi founded it with the vision of creating a complete multi-asset trading environment. Company information on review platforms shows the broker has quickly expanded its services to accommodate different trading preferences and experience levels. The company's business model focuses on providing social trading capabilities, copy trading services, and special trading programs designed to serve both individual retail traders and institutional partners.

The broker's growth has been notable, achieving recognition through industry awards and expanding its user base significantly within its first few years. The platform emphasizes cutting-edge technology integration, positioning itself as a modern alternative to traditional brokerage services. This technological focus appears to be a core part of their strategy to attract traders who value innovation and complete trading tools.

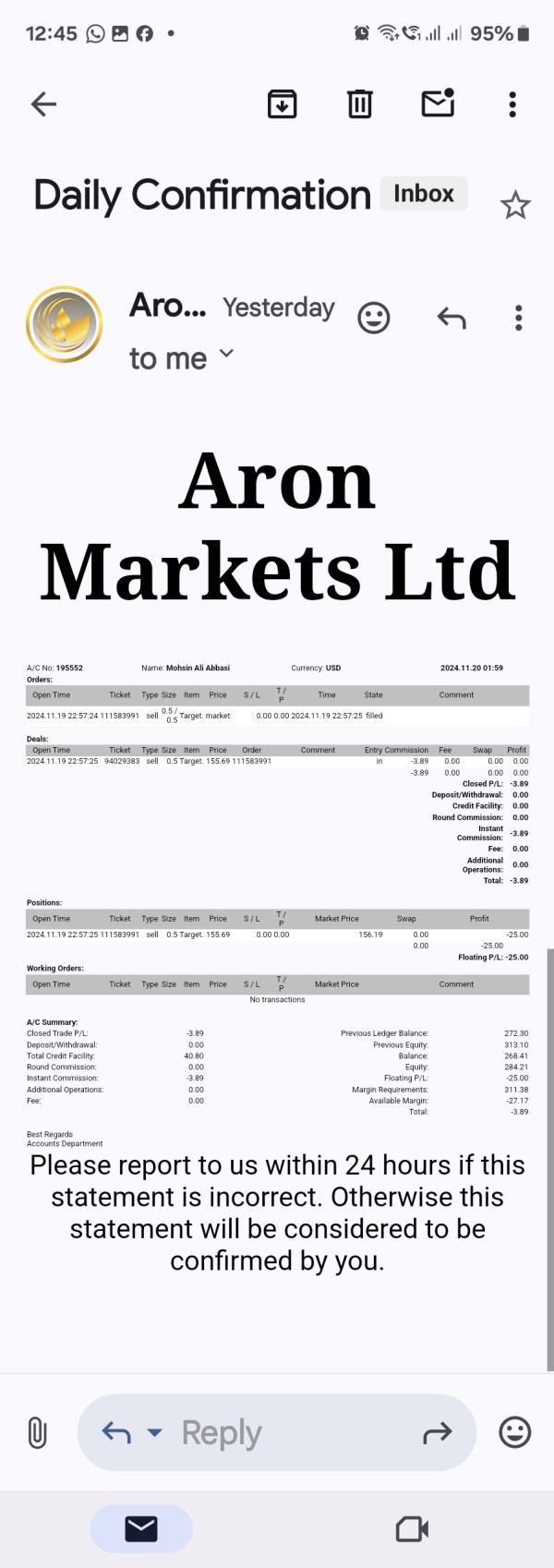

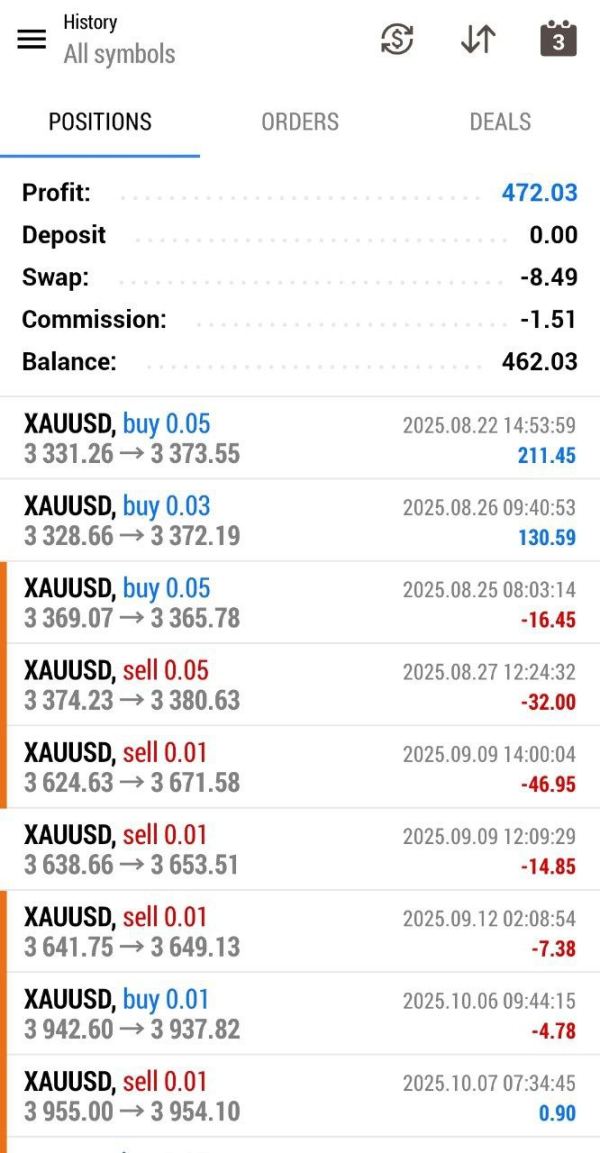

Aron Groups Broker's second main approach involves offering extensive educational resources and support systems. Available information shows the broker provides complete educational services aimed at helping traders make informed decisions across various market conditions. Their trading platform supports multiple asset classes, with primary focus areas including forex market trading and contracts for difference (CFDs) across indices, commodities such as gold, cryptocurrencies, and crude oil. While specific headquarters location information was not detailed in available sources, the broker's recognition in the MENA region suggests significant operational presence in that geographical area.

Regulatory Status: Specific regulatory information and licensing details were not fully detailed in available sources. This represents a significant information gap for potential traders seeking regulatory clarity.

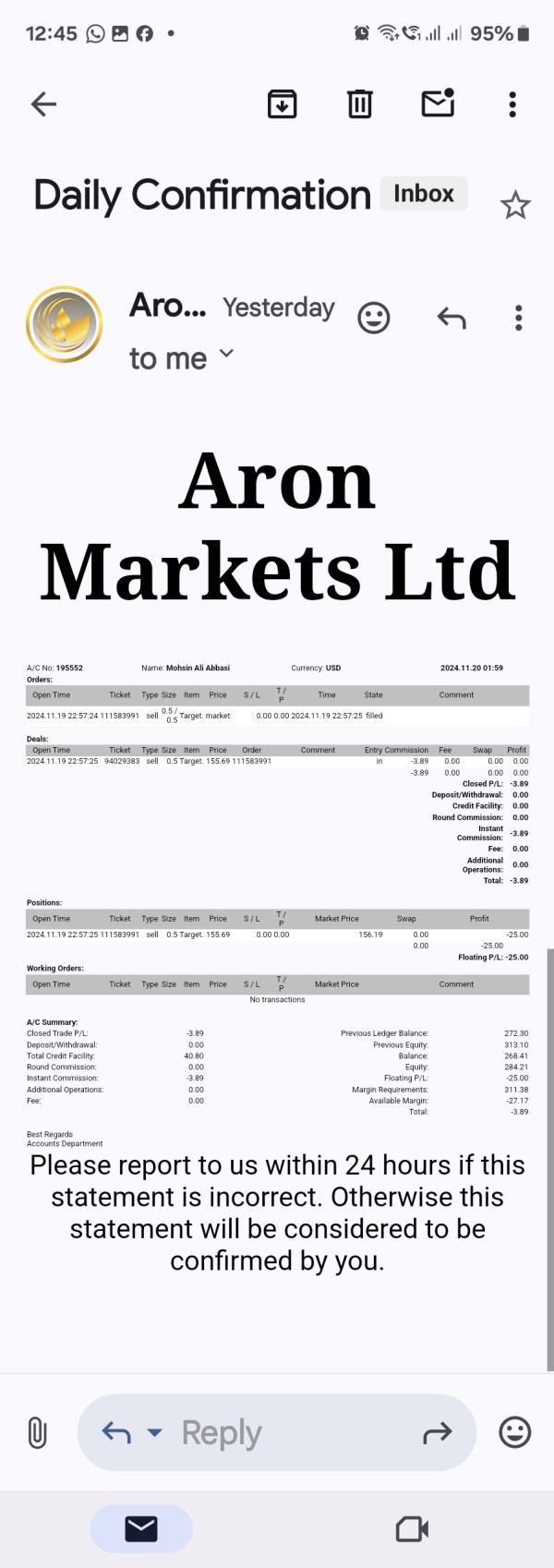

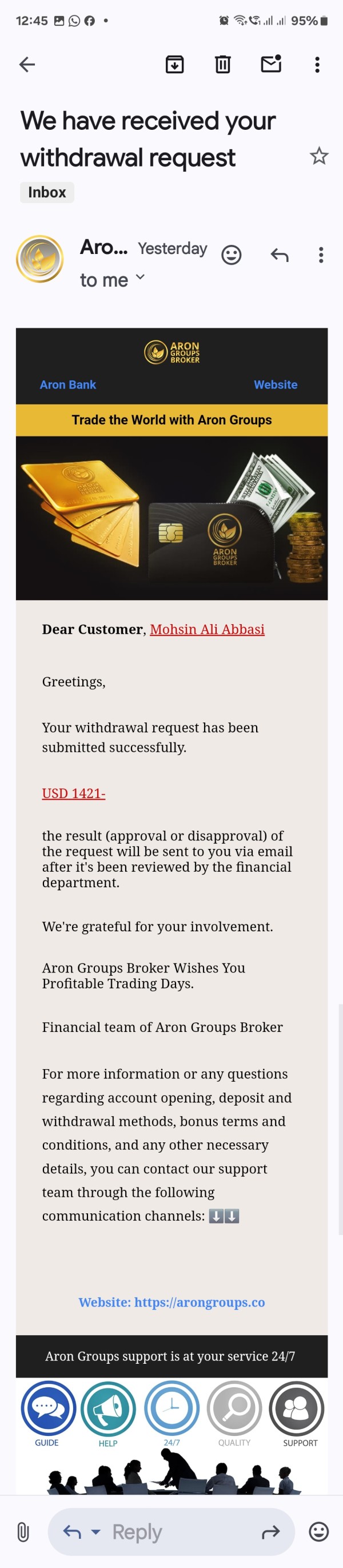

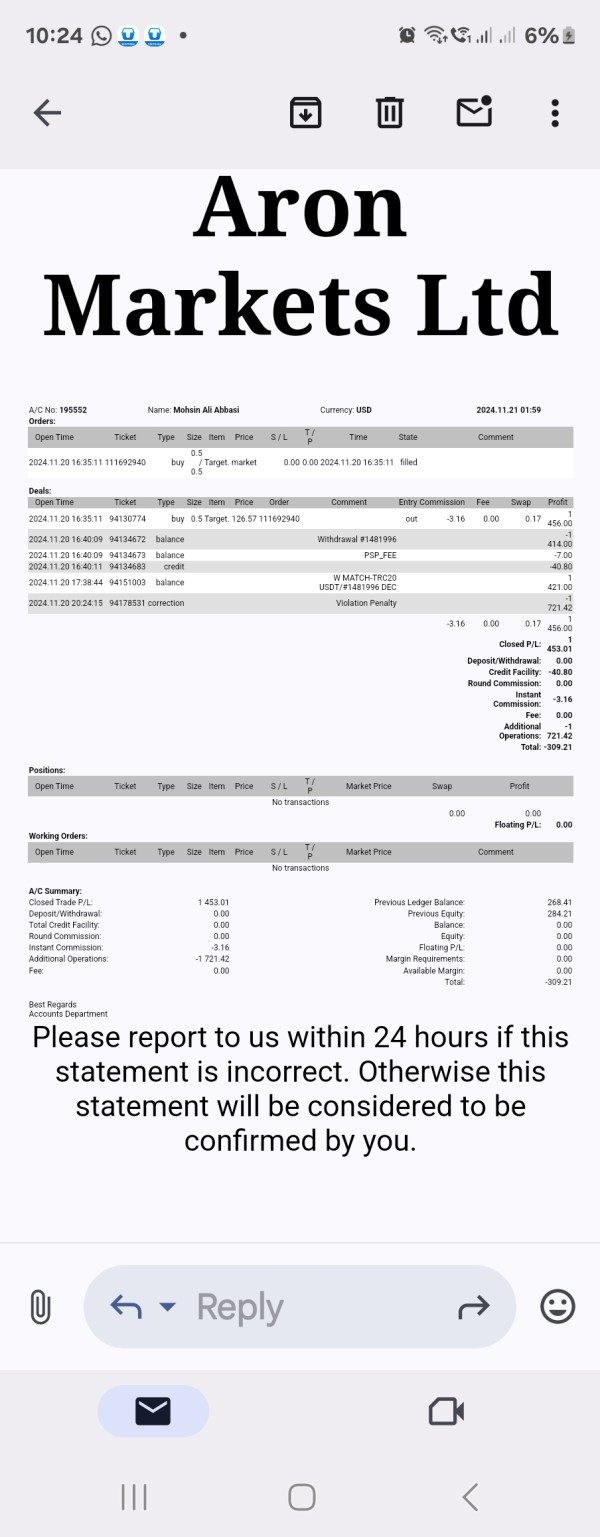

Deposit and Withdrawal Methods: The available sources did not provide detailed information about supported payment methods, processing times, or associated fees for funding account operations.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types were not specified in the reviewed materials. This requires direct contact with the broker for accurate information.

Bonuses and Promotions: Current promotional offers and bonus structures were not detailed in available public information. Industry practice suggests such programs may be available.

Tradeable Assets: The broker offers an extensive range of over 2,000 trading instruments spanning multiple asset classes. This includes forex currency pairs, commodities trading (including precious metals like gold, energy products like crude oil), cryptocurrency CFDs, and various market indices. This broad asset selection positions the platform as suitable for traders seeking portfolio diversification.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs was not available in the reviewed sources. This represents an important area for potential clients to investigate directly.

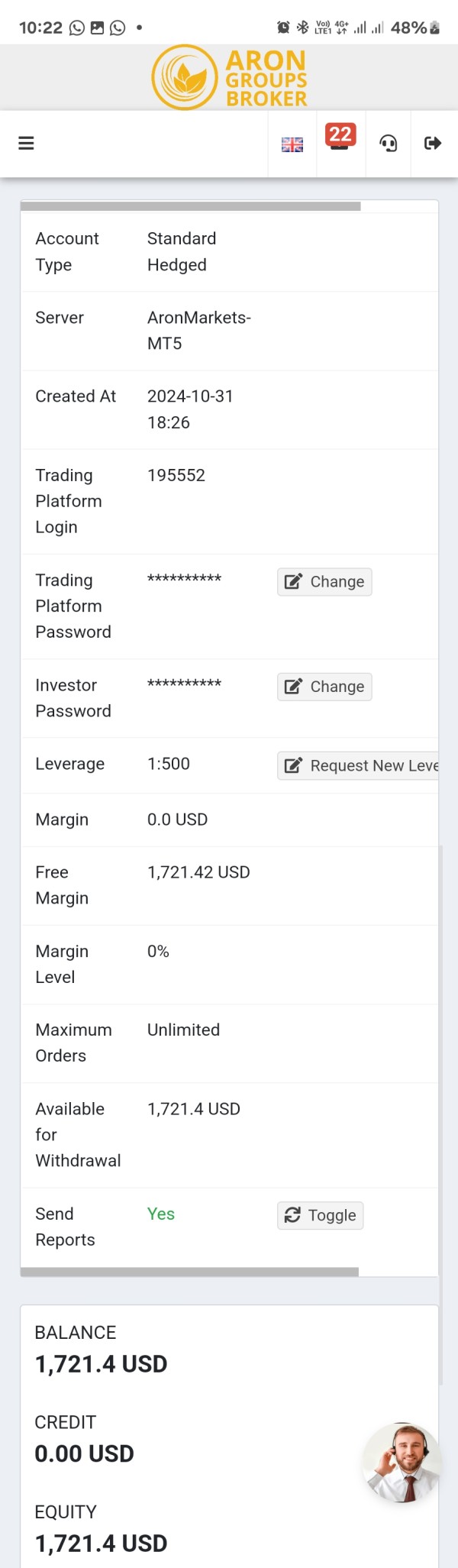

Leverage Ratios: Specific leverage offerings for different asset classes and account types were not detailed in available materials.

Platform Options: While the broker operates as a technology-focused platform, specific trading platform software details were not fully covered in available sources.

Geographic Restrictions: Information about restricted countries or regions was not specified in reviewed materials.

Customer Support Languages: The range of supported languages for customer service was not detailed in available sources. The MENA region focus suggests multilingual capabilities.

This aron groups broker review highlights the need for potential clients to seek additional detailed information directly from the broker regarding these operational aspects.

Detailed Rating Analysis

Account Conditions Analysis (Score: N/A)

The assessment of account conditions for Aron Groups Broker faces significant limitations due to insufficient detailed information in available sources. The materials reviewed did not fully outline specific account type varieties, their distinctive features, and associated benefits. This information gap extends to minimum deposit requirements across different account tiers, which is crucial information for traders planning their investment approach.

The account opening process and user experience during registration were not detailed in available user feedback sources. This makes it difficult to assess the efficiency and user-friendliness of the onboarding procedure. Additionally, specialized account features such as Islamic accounts for Sharia-compliant trading, professional accounts for experienced traders, or institutional account options were not mentioned in the reviewed materials.

Without clear information about account conditions, potential traders cannot adequately compare Aron Groups Broker's offerings with industry standards or competitor alternatives. This represents a significant transparency issue that prospective clients should address through direct communication with the broker before making account opening decisions.

The absence of detailed account condition information in this aron groups broker review underscores the importance of conducting thorough research. Potential clients should request complete account documentation directly from the broker's customer service team.

Aron Groups Broker shows strong performance in the tools and resources category. This is primarily due to its extensive offering of over 2,000 trading instruments across multiple asset classes. This complete selection positions the broker favorably for traders seeking diversification opportunities and access to various market sectors including forex, commodities, indices, and cryptocurrencies.

The broker's emphasis on educational services represents another significant strength in this category. Available information shows that Aron Groups Broker provides extensive educational resources designed to support trader decision-making across different market conditions. This educational focus particularly benefits novice traders who require foundational knowledge and ongoing learning support to develop their trading skills effectively.

The platform's integration of social trading and copy trading capabilities adds substantial value to the tools and resources offering. These features enable less experienced traders to learn from and potentially copy the strategies of more successful traders within the platform's community, creating an interactive learning environment that extends beyond traditional educational materials.

However, the specific details about research and analysis resources, market commentary, technical analysis tools, and automated trading support were not fully detailed in available sources. These elements are crucial parts of a complete trading toolkit, and their absence from available information prevents a more complete assessment of the broker's analytical capabilities and trading support infrastructure.

Customer Service and Support Analysis (Score: N/A)

The evaluation of customer service and support capabilities faces substantial limitations due to insufficient detailed information in available sources. Critical aspects such as available customer service channels were not specified in the reviewed materials. This includes live chat, email support, telephone assistance, and their respective availability hours.

Response time performance significantly impacts trader satisfaction and problem resolution efficiency, but was not documented in available user feedback or company information. Similarly, service quality metrics, customer satisfaction ratings, and specific examples of support team performance were not available for analysis.

Multilingual support capabilities are essential for a broker operating in diverse markets like the MENA region, but were not detailed in available sources. This information gap extends to customer service operating hours, timezone coverage, and regional support availability, all crucial factors for international traders.

The absence of documented user experiences regarding customer service interactions represents a significant information void. Without access to specific user testimonials about customer service experiences, it becomes challenging to assess the broker's commitment to client support and satisfaction. Problem resolution case studies and support team responsiveness were also not available for review.

This lack of customer service information in available sources suggests that potential clients should prioritize testing the broker's support responsiveness and quality through direct interaction before committing to account opening.

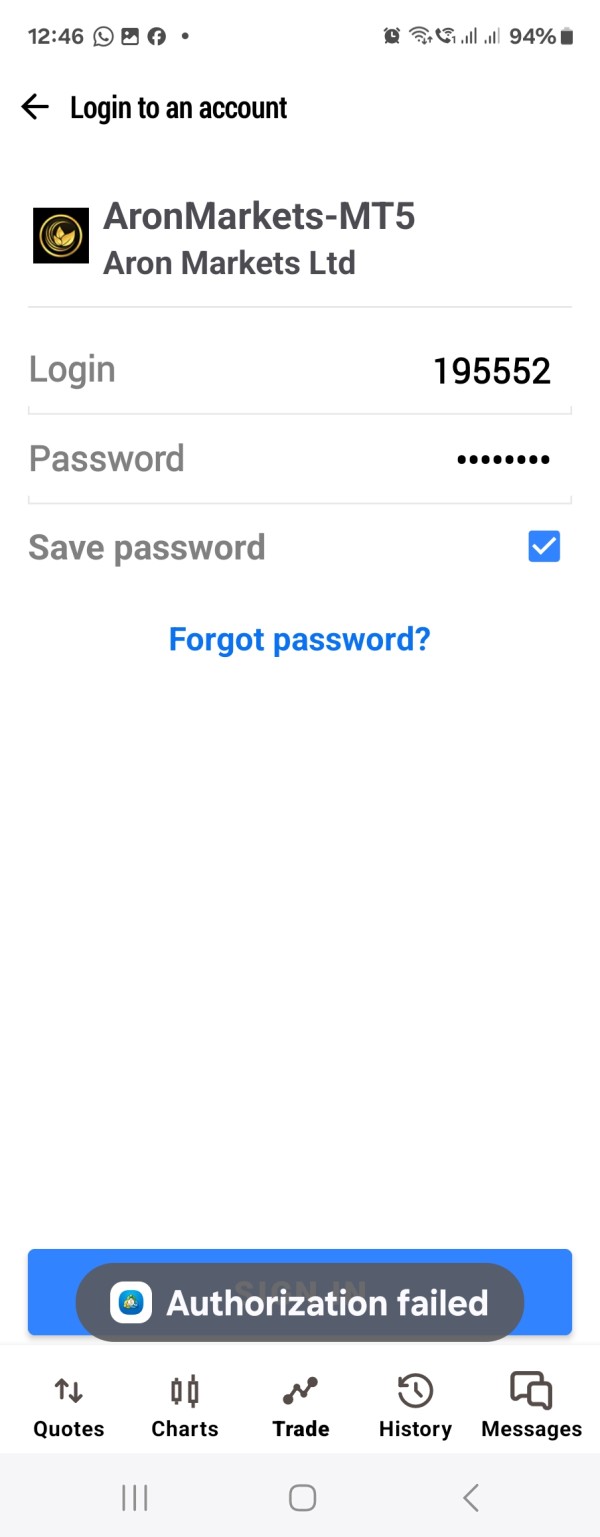

Trading Experience Analysis (Score: N/A)

The assessment of trading experience faces significant challenges due to limited detailed information about platform performance, stability, and execution quality in available sources. Critical factors such as platform uptime, server stability during high-volatility periods, and overall system reliability were not documented in the reviewed materials.

Order execution quality represents essential aspects of trading experience that were not detailed in available information. This includes execution speed, slippage rates, and requote frequency. These factors directly impact trading profitability and user satisfaction, making their absence from available sources a notable limitation for potential traders seeking performance insights.

Platform functionality completeness was not fully covered in available materials. This includes advanced order types, charting capabilities, technical analysis tools, and customization options. Similarly, mobile trading application performance, features, and user interface quality were not detailed, despite mobile trading being increasingly important for modern traders.

The trading environment characteristics were not specified in reviewed sources. This includes market depth information, pricing transparency, and execution model details. Without this information, traders cannot adequately assess whether the platform meets their specific trading style requirements and performance expectations.

This aron groups broker review emphasizes the importance of utilizing demo accounts or initial small-scale trading to personally evaluate platform performance before making significant commitments.

Trust and Reliability Analysis (Score: 4/10)

The trust and reliability assessment reveals concerning gaps that significantly impact the broker's credibility rating. Most notably, specific regulatory licensing information, regulatory body oversight, and compliance certifications were not detailed in available sources. Regulatory transparency represents a fundamental aspect of broker trustworthiness, and its absence raises important questions about operational oversight and client protection measures.

Despite these regulatory clarity issues, Aron Groups Broker has achieved some industry recognition. It notably received the "Retail Broker of the Year – MENA 2023" award. This recognition suggests some level of industry acknowledgment and operational competence within the Middle East and North Africa region.

However, available information indicates ongoing discussions and concerns among users regarding the broker's legitimacy and operational transparency. Review platform data shows there have been user discussions questioning the broker's authenticity and service reliability, which contributes to uncertainty about the platform's trustworthiness.

The absence of detailed information about client fund protection measures further compounds trust-related concerns. This includes segregated account arrangements, insurance coverage, and dispute resolution procedures. These protective measures are standard industry practices that help ensure client security and financial protection.

The mixed user feedback pattern shows varied experiences, with 263 reviews on Trustpilot indicating different satisfaction levels. While some users have positive experiences, others have encountered issues that affect their confidence in the broker's reliability and service quality.

User Experience Analysis (Score: 6/10)

The user experience analysis reveals a mixed picture based on available feedback from 263 Trustpilot reviews. This indicates varied user satisfaction levels and diverse experiences with the broker's services. This substantial review volume suggests active user engagement but also highlights the presence of both positive and negative experiences within the user base.

The broker's target demographic appears well-defined, focusing on traders who value educational support and seek diversified investment opportunities across multiple asset classes. This positioning particularly appeals to novice traders requiring complete learning resources and experienced traders interested in portfolio diversification through the extensive range of available instruments.

However, the specific details about user interface design, platform navigation ease, and overall usability were not fully detailed in available sources. These factors significantly impact daily trading experience and user satisfaction, making their absence from available information a notable limitation for this assessment.

The registration and account verification process efficiency was not detailed in reviewed materials. This affects initial user experience and onboarding satisfaction. Similarly, specific information about fund deposit and withdrawal experience, processing times, and associated user satisfaction levels were not available for analysis.

Common user concerns appear to center around questions regarding the broker's legitimacy and service quality consistency, as indicated by the mixed nature of available feedback. These concerns suggest that while some users achieve satisfactory experiences, others encounter issues that impact their overall platform satisfaction.

The broker's emphasis on educational resources and diverse trading programs appears to resonate positively with users seeking learning support and trading variety. However, specific user testimonials about these features were not detailed in available sources.

Conclusion

This complete aron groups broker review presents a complex picture of a relatively new broker that has achieved rapid growth and industry recognition while facing transparency challenges. Potential clients must carefully consider these factors. Aron Groups Broker shows clear strengths in its extensive instrument offering of over 2,000 trading options and its commitment to educational support, making it particularly suitable for traders seeking portfolio diversification and learning resources.

The broker's recognition as "Retail Broker of the Year – MENA 2023" indicates industry acknowledgment of its services and operational capabilities within its primary market region. For traders prioritizing educational support, extensive asset selection, and innovative trading features like social and copy trading, Aron Groups Broker presents compelling advantages.

However, the significant information gaps regarding regulatory status, detailed operational terms, and mixed user feedback regarding legitimacy create important considerations for potential clients. The absence of complete regulatory information and the presence of user concerns about service reliability suggest that thorough research is essential before account opening.

The broker appears best suited for traders who prioritize educational resources, seek diverse trading opportunities, and are comfortable conducting additional verification of operational details directly with the broker. Conservative traders or those requiring maximum regulatory transparency may prefer to seek additional information or consider alternative options until more complete operational details become available.