ARON GROUPS BROKER foreign exchange brokers specializing in providing foreign exchange trading services, the company's official website https://arongroups.co/en/, about the company's legal and temporary regulatory information, the company's address Agios Athanasios Avenue, D. Vrachimis Building, 4102 Agios, Athanasios, Limassol, Cyprus.

ARON GROUPS BROKER Forex Broker

Basic Information

Marshall Islands

Marshall IslandsCompany profile

Pros

Cons

Aron Groups Broker Forex Broker - Complete Information Guide

1. Overview of the Broker

Aron Groups, established in 2020, is an online trading platform that has quickly made its mark in the financial markets. The company operates under the name Aron Markets Ltd and is registered in Saint Vincent and the Grenadines, with its headquarters located at 59 Agios Athanasios Avenue, D. Vrachimis Building, Limassol, Cyprus. As a privately held entity, Aron Groups focuses on providing retail forex trading services to a diverse clientele, which includes both novice and experienced traders.

In a relatively short span, Aron Groups has developed a reputation for offering a wide range of trading instruments, including over 1,000 financial assets. The broker's growth trajectory includes significant milestones such as the introduction of innovative trading features and educational resources, aimed at enhancing the trading experience for its users. Aron Groups operates primarily in the retail forex market, utilizing an ECN (Electronic Communication Network) model to facilitate direct trading between clients and liquidity providers.

This Aron Groups broker broker aims to provide a user-friendly platform that caters to the needs of traders at all levels, offering various account types and trading instruments to ensure a comprehensive trading experience.

2. Regulation and Compliance Information

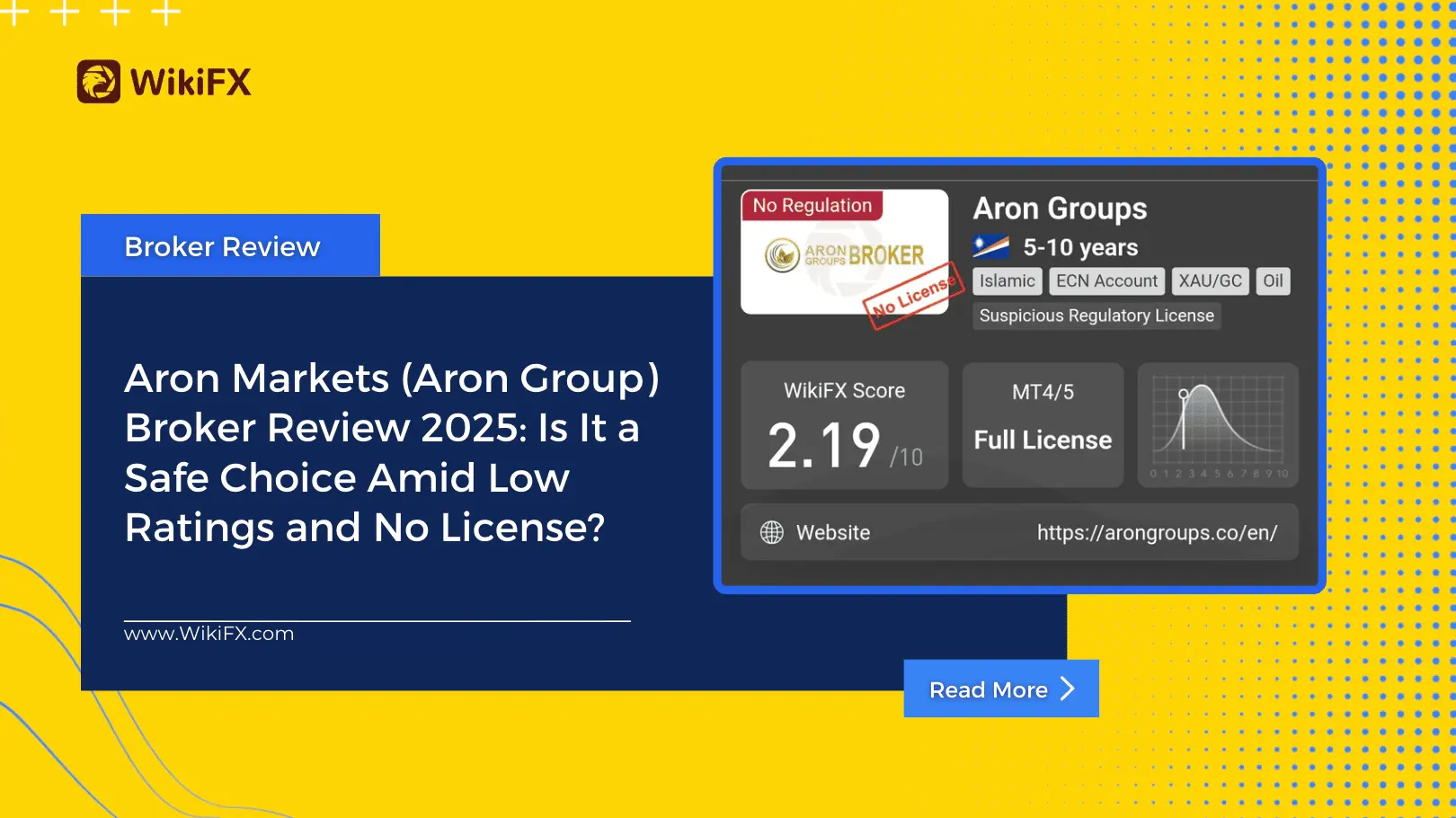

Aron Groups operates in a regulatory environment that raises several concerns for potential investors. The broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. Notably, the Financial Services Authority (FSA) of Saint Vincent does not regulate forex trading, which means that Aron Groups lacks oversight from a recognized regulatory body.

As of now, Aron Groups does not hold any licenses from major financial authorities such as the FCA in the UK, ASIC in Australia, or CySEC in Cyprus. This lack of regulation poses significant risks to traders, as it diminishes the protection of client funds and reduces accountability in case of disputes. Furthermore, the broker does not participate in any investor compensation schemes, which further exacerbates the risk associated with trading through Aron Groups.

In terms of compliance, Aron Groups implements KYC (Know Your Customer) and AML (Anti-Money Laundering) policies to prevent fraud and ensure the legitimacy of its clients. However, the absence of stringent regulatory oversight remains a critical concern for traders considering this broker.

This Aron Groups broker broker is primarily focused on providing trading services without the backing of a reliable regulatory framework, which may deter cautious investors.

3. Trading Products and Services

Aron Groups offers a diverse array of trading products aimed at fulfilling the needs of various traders. The broker provides access to over 100 forex currency pairs, including major pairs such as EUR/USD and GBP/USD, enabling traders to capitalize on currency fluctuations.

In addition to forex trading, Aron Groups offers a range of CFD (Contract for Difference) products across several categories, including:

- Indices: Traders can speculate on major global indices, allowing for diversified exposure to the stock market.

- Commodities: The platform provides trading options for essential commodities such as oil and gold, which are often used as hedges against inflation.

- Stocks: Traders have the opportunity to buy and sell shares of individual companies, allowing for targeted investment strategies.

- Cryptocurrencies: Aron Groups supports trading in over 130 cryptocurrencies, including Bitcoin, Ethereum, and various altcoins, catering to the growing interest in digital assets.

The broker regularly updates its product offerings, ensuring that traders have access to the latest financial instruments. Aron Groups also provides retail trading services, while institutional client services are available, though specifics on these offerings are less detailed.

This Aron Groups broker broker is committed to providing a broad spectrum of trading products, enabling clients to diversify their portfolios and take advantage of market opportunities.

4. Trading Platforms and Technology

Aron Groups utilizes the MetaTrader 5 (MT5) platform, a widely recognized trading terminal known for its advanced functionalities and user-friendly interface. Launched in 2010 by MetaQuotes, MT5 offers traders a comprehensive suite of tools for market analysis, algorithmic trading, and automated trading strategies.

The platform supports both desktop and mobile applications, allowing traders to manage their accounts and execute trades on the go. Aron Groups does not offer any proprietary trading platform, which may limit the customization options available to traders.

In terms of execution models, Aron Groups operates primarily on an ECN model, facilitating direct market access and ensuring competitive pricing. The broker claims to provide fast execution speeds and low latency, essential for high-frequency trading strategies.

Aron Groups hosts its trading servers in various locations, ensuring optimal connectivity and reliability for its users. The broker also supports API access for automated trading, allowing traders to integrate their trading strategies seamlessly.

This Aron Groups broker broker provides a robust trading environment through its reliance on the MetaTrader 5 platform, ensuring traders have the necessary tools to succeed in the financial markets.

5. Account Types and Trading Conditions

Aron Groups offers several account types designed to meet the diverse needs of its clients. The available accounts include:

- Nano Account: This account type is suitable for novice traders and requires a minimum deposit of just $1. It offers leverage of up to 1:1000 and is designed for low-risk trading.

- Standard (ECN) Account: Intended for more experienced traders, this account requires a minimum deposit of $50 and offers leverage of up to 1:500. It features variable spreads starting from 1 pip.

- Swap-Free (ECN) Account: Designed for traders who cannot engage in swap trading due to religious beliefs, this account requires a minimum deposit of $500 and provides floating spreads.

- VIP (ECN) Account: This account is tailored for high-volume traders, requiring a minimum deposit of $2,500. It offers leverage of up to 1:200 and lower margin requirements.

Aron Groups also offers a demo account for traders to practice their strategies without financial risk. The leverage ratios across different account types vary, and traders should be aware of the associated risks of high leverage.

In terms of overnight fees, Aron Groups applies a $2 monthly inactivity fee for accounts that remain inactive for over 90 days. This fee structure is essential for traders to consider when managing their accounts.

This Aron Groups broker broker provides a variety of account types and trading conditions, catering to traders with different levels of experience and capital.

6. Fund Management

Aron Groups supports a variety of deposit methods, making it convenient for traders to fund their accounts. The available options include:

- Bank Transfers: Traditional and reliable, bank transfers are accepted for funding accounts.

- Credit/Debit Cards: Aron Groups accepts Visa and MasterCard, providing a quick and secure way to deposit funds.

- E-Wallets: The broker supports various e-wallets, including Perfect Money, WebMoney, and Payeer, for efficient online transactions.

- Cryptocurrencies: A range of cryptocurrencies, including Bitcoin, Ethereum, and Tether, can also be used for deposits.

The minimum deposit requirement varies by account type, with the Nano account starting at just $1. Deposit processing times are generally quick, but may vary depending on the method used.

For withdrawals, Aron Groups offers several methods, including bank transfers and e-wallets, with processing times ranging from instant to one business day. However, some methods may incur withdrawal fees, which traders should be aware of before initiating transactions.

This Aron Groups broker broker provides a flexible and user-friendly approach to fund management, ensuring traders can easily deposit and withdraw their funds.

7. Customer Support and Educational Resources

Aron Groups offers a comprehensive customer support system designed to assist traders with their inquiries. The available support channels include:

- Email Support: Traders can reach out via email for assistance with their accounts.

- Live Chat: The broker provides a live chat option for real-time support.

- Telephone Support: Customers can contact Aron Groups through dedicated phone lines for immediate assistance.

The support team operates 24/5, ensuring that traders can receive help across different time zones. Aron Groups also offers multilingual support, catering to a diverse clientele.

In terms of educational resources, Aron Groups provides access to various materials designed to enhance traders' knowledge and skills. These resources include:

- Webinars: Regularly conducted webinars cover various trading topics and strategies.

- Market Analysis: The broker provides daily analysis and insights to help traders make informed decisions.

- Trading Tools: Useful tools, such as calculators and economic calendars, are available to assist traders in their planning.

This Aron Groups broker broker emphasizes the importance of education and support, providing traders with the necessary resources to navigate the financial markets successfully.

8. Regional Coverage and Restrictions

Aron Groups operates in multiple regions, providing trading services to a diverse clientele. The primary markets served include:

- Europe: The broker caters to clients from various European countries, although it is not regulated in this region.

- Middle East: Aron Groups has a significant presence in the Middle Eastern market, attracting traders from this region.

However, there are notable restrictions on certain countries. Aron Groups does not accept clients from the United States, Canada, and several other jurisdictions where stringent regulatory frameworks exist. This limitation may raise concerns for traders seeking a compliant trading environment.

In summary, while Aron Groups offers a range of services to various regions, potential clients should be cautious of the regulatory status and ensure they are eligible to trade with the broker.

In conclusion, Aron Groups presents a range of trading opportunities and features that may appeal to various traders. However, the lack of regulation and potential risks associated with trading through an unlicensed broker should be carefully considered by those looking to engage in forex and CFD trading.

ARON GROUPS BROKER Similar Brokers

Latest Reviews

FX1346876197

Poland

I've worked with several brokers before, but the trade execution speed with this one is noticeably higher. Even during major news events like NFP, I haven't seen any slippage at all

Positive

2025-11-17

FX1111716316

Thailand

I dare to say that trading fees of this broker are the lowest, including commissions, inactivity fees. Aron Group Broker is the cheapest broker I have ever met.

Positive

2022-12-06

ARON GROUPS BROKER

News

Exposure Aron Groups Review: Fund Losses, High Commission & Trade Manipulation Keep Traders on Tenterhooks

Have you lost your hard-earned capital while trading via Aron Groups Broker? Has the high commission charged by the broker substantially reduced your trading profits? Does the Marshall Islands-based forex broker constantly manipulate spreads to widen your capital losses? Have you been lured into trading courtesy of Aron Groups No Deposit Bonus, only to find that you had to deposit capital to get a bonus? All these and many more trading issues have become synonymous with the experience of Aron Groups’ traders. Consequently, many traders have shared negative Aron Groups reviews online. In this article, we have shared some of their reviews.

News Aron Markets (Aron Group) Broker Review 2025: Is It a Safe Choice Amid Low Ratings and No License?

Is Aron Markets safe? Offshore registration, no valid oversight, 1:1000 leverage. Read pros/cons, account types, and user experiences.

Exposure Aron Markets Review 2025: Is It A High-Risk Broker?

Aron Markets is an unregulated offshore broker with high leverage and mounting risk warnings—read this 2025 review before depositing funds.

Exposure What WikiFX Found When It Looked Into Aron Markets

When it comes to online trading, the broker you choose can make or break your trading journey. A reputable and regulated broker offers a sense of security and accountability, while unregulated brokers often pose significant risks to traders. Aron Markets is one such broker that raises multiple concerns due to its lack of valid regulation and its registration in a high-risk offshore location.

Exposure Cautious Investing: Unmasking the Risks of Aron Groups Broker

Aron Groups Broker: Unlicensed, Unregulated, and Untrustworthy. Discover the deceit behind this shadowy brokerage house. Protect your investments wisely.

Mohsin Ali8640

Pakistan

Subject: Review of Aron Market scammer Broker - my Mt5 Account No.195552 Dear Sir/Madam, I am writing to provide my review of the services provided by Aron Market scammer Broker. My name is Mohsin Ali Abbasi, and I opened an account with Aron Market with the MT5 A/C No..195552 would like to bring to your attention an incident that has occurred with my account, which has led me to believe that Aron Market is a fraudulent broker. On 15th November 2024, I deposited 270 USD into my account and opened a sell trade of 50 shares of US shares TAGET (TGT ). I made a profit 1454 USD, and when I requested to withdraw my profits, so Aron Market scammer company canceled all of my profits and Also Eat my Capital too and emailed me that I had done fraudulent trading.And Misuse of Negative balance Protection facility. I fail to understand how trading based on speculation or news can be considered fraudulent. And This company have automatic removal of Negative balance Protection facility.I made a profit, and when I asked for it, they refused to give it to me. If I make money, they refuse to give it to me, but if I lose money in a trade, they do not seem to care or ask.So I would like to warn all retail traders to be cautious when trading with Aron Market scammer company. It appears that they run standalone servers that are not connected to exchanges. I am warning all readers be ware of this fraudulent broker. I am attentioning CEO of Aron Market that your broker is doing scam with me, kindly return my profit And my Capital 1721$, i didn't do any wrong, just do a normal trade in US share provided by your broker. If i loss with same strategy then will company compensate my loss ? I request all retail traders to withdraw their money from Aron Market scammer company sooner rather than later because, even if you make a profit, you will eventually lose your hard-earned money. I would appreciate your help in spreading the news about this incident so that others do not lose their fund

Exposure

2024-11-21