Upbest 2025 Review: Everything You Need to Know

Summary

This upbest review looks at a Hong Kong-based financial services provider that has created mixed reactions in the trading community. Upbest Group Ltd sits in Hong Kong with stock code 335 on HKEX and offers trading services across multiple asset classes including forex, equities, commodities, indices, and bonds. The company gives access through securities internet trading systems and commodity online trading platforms, positioning itself as a multi-asset broker for traders seeking different investment opportunities.

However, our analysis shows big concerns about the broker's legitimacy and trustworthiness. Multiple third-party evaluation platforms have raised questions about Upbest's regulatory standing and operational transparency. While the company keeps a physical presence in Hong Kong's Wah Kit Commercial Centre and provides customer support through email and telephone channels, the lack of clear regulatory information and mixed user feedback suggests potential traders should be very careful.

The broker appears to target traders interested in forex and multi-asset trading. The absence of detailed information about account conditions, fee structures, and regulatory protections makes it hard to recommend for serious trading activities.

Important Notice

This review uses publicly available information and user feedback from various sources. Traders should note that regulatory requirements and operational standards may vary a lot across different jurisdictions. The information presented here reflects data available at the time of writing, and potential clients are strongly advised to conduct independent verification of all claims and regulatory status before engaging with this broker.

Our evaluation method uses user feedback, third-party assessments, and publicly available company information. However, the limited transparency of operational details means this review cannot provide complete coverage of all aspects typically expected from established brokers.

Rating Framework

Broker Overview

Upbest Group Ltd operates as a Hong Kong-based financial services company. Specific establishment details remain unclear from available sources. The company keeps its headquarters at 2/F, Wah Kit Commercial Centre, 300 Des Voeux Road Central, Hong Kong, and trades on the Hong Kong Exchange under stock code 335. This public listing provides some level of corporate transparency, though it doesn't necessarily guarantee regulatory compliance for trading services.

The broker's business model centers on providing multi-asset trading services. It covers traditional forex markets alongside equities, commodities, indices, and bonds. This approach suggests an attempt to capture broader market segments beyond typical forex-focused operations. However, the specific operational mechanisms and business practices remain largely undisclosed in publicly available materials.

Upbest offers trading access through securities internet trading systems and commodity online trading platforms. This indicates a technology-focused approach to market access. The company provides customer support through traditional channels including email and telephone, maintaining standard communication protocols expected from financial service providers. Despite these conventional business elements, this upbest review must note the significant information gaps regarding regulatory oversight and operational transparency that characterize this broker.

Regulatory Oversight: Available information does not clearly specify regulatory authorities overseeing Upbest's trading operations. While the company appears on Hong Kong's stock exchange, this listing status doesn't automatically give trading license legitimacy or investor protections typically associated with regulated brokers.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees remains unavailable in accessible sources. This lack of transparency regarding financial transactions represents a big concern for potential clients.

Minimum Deposit Requirements: No specific minimum deposit amounts are disclosed in available materials. This makes it impossible to assess accessibility for different trader categories or compare with industry standards.

Promotional Offers: Available sources contain no information about bonus structures, promotional campaigns, or special offers that might attract new clients.

Tradeable Assets: The broker offers access to forex, equities, commodities, indices, and bonds. This provides a wide range of financial instruments. This multi-asset approach could appeal to traders seeking portfolio diversification within a single platform.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This absence of fee transparency makes cost comparison with other brokers impossible and raises concerns about hidden charges.

Leverage Ratios: No specific leverage information is available in the reviewed sources. This prevents assessment of risk management policies or compliance with regional leverage restrictions.

Platform Options: Upbest provides securities internet trading systems and commodity online trading platforms. However, detailed platform specifications and features remain unclear.

Geographic Restrictions: Available information does not specify which regions or countries may be restricted from accessing Upbest's services.

Customer Service Languages: The specific languages supported by customer service representatives are not detailed in accessible sources.

Account Conditions Analysis

The evaluation of Upbest's account conditions proves challenging due to the significant lack of publicly available information. Standard broker offerings typically include multiple account tiers designed for different trader experience levels and capital requirements, but this upbest review finds no detailed specifications about Upbest's account structure. This information gap extends to basic aspects such as minimum deposit requirements, account maintenance fees, and specific features that might differentiate various account types.

Without clear account opening procedures or requirements documentation, potential clients cannot properly assess the accessibility or suitability of Upbest's offerings. The absence of information about specialized account types, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the broker's appeal to diverse trader demographics. Additionally, the lack of transparency regarding account verification processes, required documentation, and approval timeframes creates uncertainty for prospective clients seeking efficient account establishment.

The scoring of 3/10 for account conditions reflects these substantial information deficiencies. These fall well below industry standards for transparency and client communication. Established brokers typically provide complete account information to enable informed decision-making, making Upbest's opacity particularly concerning for potential clients.

Upbest's technological infrastructure appears to center on securities internet trading systems and commodity online trading platforms. This suggests some level of platform diversity. However, the specific capabilities, features, and user interfaces of these platforms remain largely undocumented in available sources. Modern trading platforms typically offer advanced charting packages, technical analysis tools, economic calendars, and real-time market data, but the extent of such features within Upbest's systems cannot be verified.

The absence of detailed information about research resources, market analysis, or educational materials represents a big limitation for traders who rely on broker-provided insights for decision-making. Competitive brokers often distinguish themselves through complete market research, daily analysis, webinars, and educational content that supports trader development. The lack of visible commitment to such resources suggests either limited offerings or poor communication of available services.

Automated trading capabilities, including expert advisor support or algorithmic trading infrastructure, remain unspecified. This uncertainty particularly impacts advanced traders who depend on sophisticated trading tools and automation features. The 6/10 scoring reflects the apparent platform availability while acknowledging the substantial information gaps that prevent complete evaluation of tool quality and resource depth.

Customer Service and Support Analysis

Upbest provides customer support through conventional channels including email communication and telephone contact. These standard communication methods align with basic industry practices, though the quality, responsiveness, and availability of support services remain unverified through available sources. Effective customer service typically involves multiple contact options, extended operating hours, and multilingual support capabilities to serve diverse client bases.

The absence of information about response timeframes, service quality metrics, or customer satisfaction indicators makes it impossible to assess the actual effectiveness of Upbest's support infrastructure. Modern brokers often provide 24/5 or 24/7 support to accommodate global trading schedules, but Upbest's service hours remain unspecified. Additionally, the lack of alternative support channels such as live chat, social media support, or complete FAQ resources may limit client accessibility to assistance.

Without documented customer service policies, escalation procedures, or problem resolution frameworks, potential clients cannot gauge the level of support they might expect during critical trading situations or account issues. The 5/10 rating reflects the presence of basic contact methods while acknowledging the significant uncertainty surrounding service quality and availability that characterizes this aspect of Upbest's operations.

Trading Experience Analysis

The trading experience evaluation for this upbest review reveals a mixed picture of platform availability coupled with limited transparency about execution quality and trading conditions. Upbest's provision of securities internet trading systems and commodity online trading platforms suggests some technological infrastructure for market access, though the specific performance characteristics, reliability, and user experience of these systems remain largely undocumented.

Critical trading factors such as execution speed, slippage rates, requote frequency, and order fill quality cannot be assessed due to insufficient available data. These elements significantly impact trader profitability and satisfaction, making their absence from public information particularly concerning. Additionally, the lack of information about platform stability during high-volatility periods or market stress conditions prevents evaluation of system reliability when traders need it most.

The absence of mobile trading application details limits assessment of modern trading convenience and accessibility. Contemporary traders increasingly rely on mobile platforms for market monitoring and trade execution, making this information gap particularly relevant for active traders. While some positive user feedback suggests reasonable trading experiences, the overall lack of complete platform documentation and performance metrics results in a 7/10 rating that acknowledges apparent functionality while noting substantial transparency deficiencies.

Trust and Safety Analysis

The trust and safety evaluation reveals big concerns that substantially impact Upbest's credibility as a reliable trading partner. The most critical issue involves the absence of clear regulatory oversight information, which represents a basic red flag for potential clients. Regulated brokers typically prominently display their licensing information, regulatory compliance status, and oversight authority details, making Upbest's opacity in this area particularly troubling.

Third-party evaluation platforms have raised questions about Upbest's legitimacy and operational transparency. This contributes to broader concerns about the broker's trustworthiness. Without verified regulatory status, clients cannot access standard investor protection mechanisms such as compensation schemes, regulatory complaint procedures, or oversight authority intervention in disputes. This regulatory uncertainty extends to fund safety measures, as the absence of information about segregated client accounts or deposit insurance creates additional risk exposure.

The company's Hong Kong stock exchange listing provides some corporate transparency but doesn't guarantee trading service legitimacy or regulatory compliance. The lack of information about financial reporting, audit procedures, or management transparency further compounds trust concerns. These substantial safety and transparency deficiencies result in a 4/10 trust rating, reflecting serious concerns that potential clients should carefully consider before engaging with this broker.

User Experience Analysis

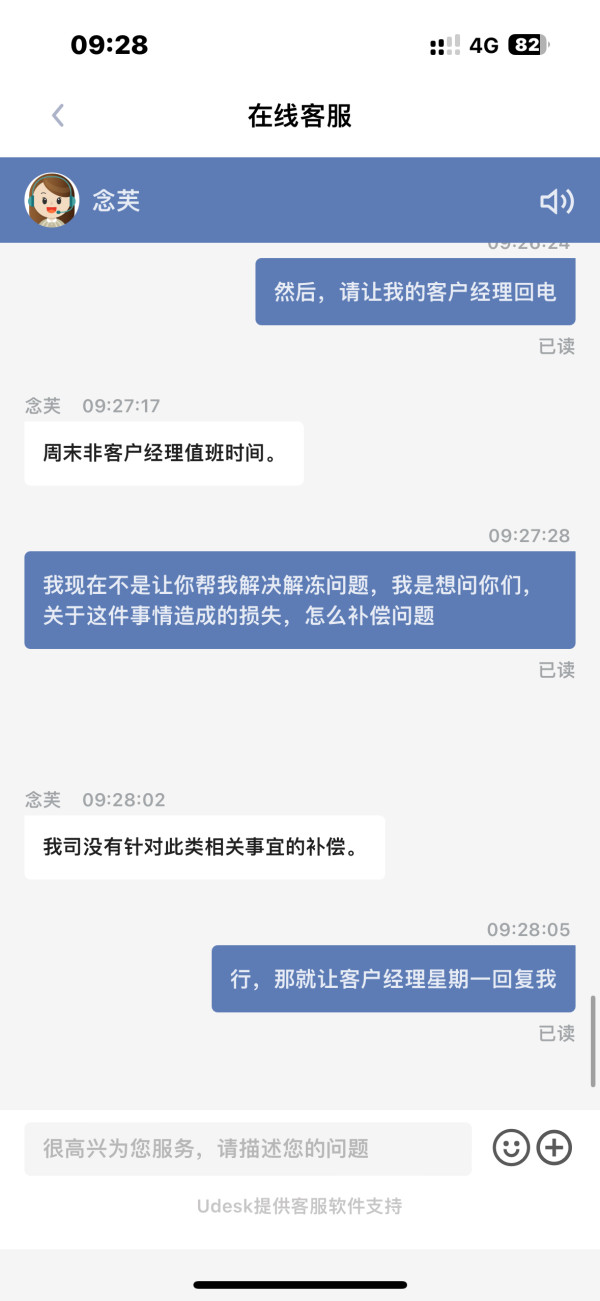

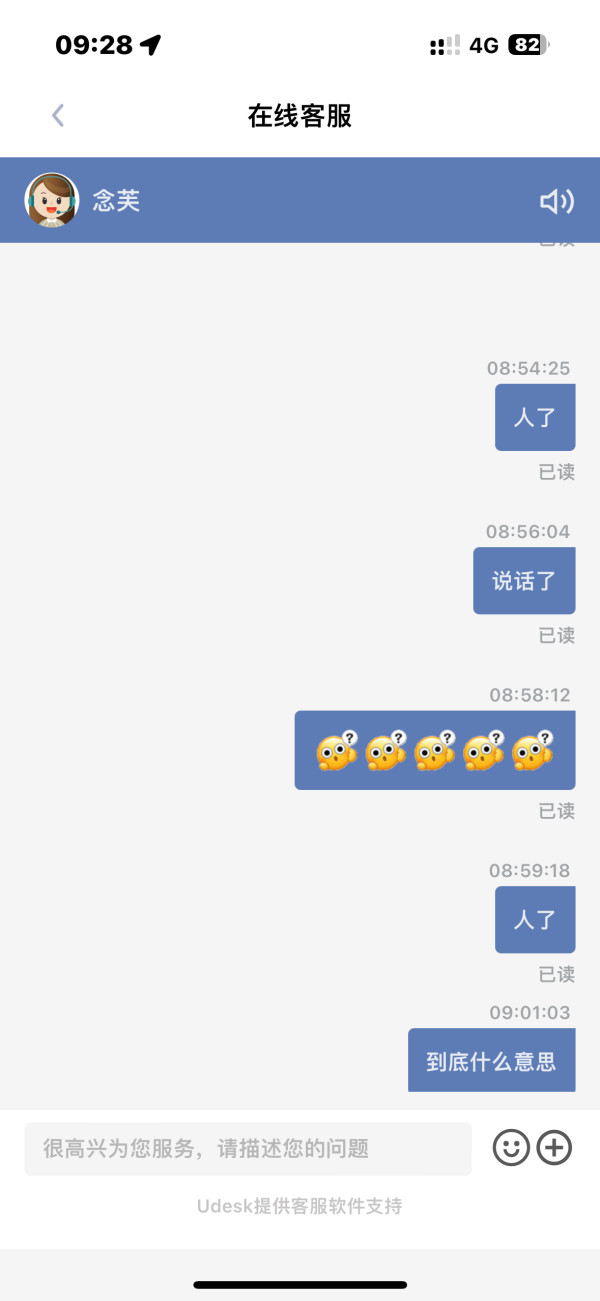

User experience assessment reveals mixed feedback patterns that suggest inconsistent service delivery and varied client satisfaction levels. Available sources indicate that some users have reported negative experiences, though specific details about common complaints or satisfaction drivers remain limited. This feedback variability often indicates inconsistent service quality or operational issues that affect different clients differently.

The absence of detailed information about user interface design, platform navigation, account management procedures, and overall service convenience makes complete user experience evaluation challenging. Modern trading platforms typically prioritize intuitive design, efficient workflows, and streamlined processes that enhance trader productivity and satisfaction. Without specific insights into these aspects of Upbest's offerings, potential clients cannot properly assess usability factors that significantly impact daily trading activities.

Registration and account verification processes remain undocumented. This prevents evaluation of onboarding efficiency and user-friendliness. Similarly, the lack of information about funding procedures, withdrawal processes, and account management tools limits understanding of operational convenience factors that influence overall user satisfaction. The 5/10 rating reflects the mixed nature of available feedback while acknowledging the substantial information gaps that prevent complete user experience assessment.

Conclusion

This upbest review concludes that while Upbest Group Ltd offers multi-asset trading opportunities across forex, equities, commodities, indices, and bonds, significant concerns about regulatory transparency and operational legitimacy overshadow potential benefits. The broker's Hong Kong stock exchange listing provides some corporate visibility, but the absence of clear regulatory oversight for trading services represents a substantial risk factor for potential clients.

The primary advantages include diversified asset access and multiple platform options. These could appeal to traders seeking complete market exposure. However, these benefits are significantly undermined by the lack of transparency regarding fees, account conditions, regulatory protections, and operational policies. The mixed user feedback and third-party concerns about legitimacy further compound these issues, making it difficult to recommend Upbest for serious trading activities.

Potential clients, particularly those new to forex and multi-asset trading, should exercise extreme caution and consider more established, clearly regulated alternatives that provide complete transparency and verified investor protections.