Regarding the legitimacy of UPBEST GROUP forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is UPBEST GROUP safe?

Pros

Cons

Is UPBEST GROUP markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Upbest Commodities Company Limited

Effective Date:

2010-10-12Email Address of Licensed Institution:

info@upbest.comSharing Status:

No SharingWebsite of Licensed Institution:

www.upbest.comExpiration Time:

--Address of Licensed Institution:

香港中環德輔道中302號華傑商業中心2樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Upbest Safe or Scam?

Introduction

Upbest is a Hong Kong-based forex broker that has been operating since 2010. Specializing in trading services, Upbest aims to provide a platform for both novice and experienced traders. However, the forex market is rife with scams and unregulated brokers, making it crucial for traders to carefully evaluate any broker before investing their hard-earned money. This article aims to assess the safety and reliability of Upbest by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The investigation is based on a review of various online sources, customer testimonials, and regulatory disclosures.

Regulation and Legitimacy

Understanding the regulatory environment is paramount when assessing whether Upbest is safe. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices. Upbest is regulated by the Securities and Futures Commission (SFC) of Hong Kong. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AEY 503 | Hong Kong | Verified |

The SFC is a well-respected regulatory body that imposes strict guidelines on brokers to protect investors. However, it is essential to note that not all regulatory frameworks offer the same level of investor protection. While Upbest is regulated, some reviews suggest that the regulatory environment in Hong Kong can be less stringent compared to other jurisdictions, potentially exposing clients to higher risks. Furthermore, no negative regulatory disclosures have been reported against Upbest during its operational history, which strengthens its credibility.

Company Background Investigation

Upbest's history, ownership structure, and management team play a vital role in determining its reliability. Established in 2010, Upbest is a subsidiary of Upbest Group, which has been in operation since 1988. The company primarily engages in securities broking, futures broking, and asset management. The management team comprises experienced professionals with backgrounds in finance and investment, which adds to the company's credibility.

Transparency is another critical factor to consider. Upbest provides information about its services and trading conditions on its website, but some reviews have criticized the level of detail provided. While the company is regulated, potential clients should still exercise caution and conduct their due diligence before investing.

Trading Conditions Analysis

When considering whether Upbest is safe, it is crucial to evaluate the trading conditions it offers. Upbest has a competitive fee structure, but there are some areas that may raise concerns. Below is a comparison of core trading costs:

| Fee Type | Upbest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (e.g., 1.5 pips) | 1.0 - 2.0 pips |

| Commission Model | No commission on most trades | Varies |

| Overnight Interest Range | Varies | Varies |

While Upbest does not charge commissions on most trades, the spreads can be higher than the industry average, which may affect profitability for frequent traders. Additionally, the lack of transparency regarding overnight interest rates may raise questions for traders who hold positions overnight. It is essential for potential clients to be aware of all fees involved to avoid unexpected costs.

Client Fund Security

The safety of client funds is a primary concern for any trader. Upbest claims to implement several measures to ensure the security of client funds. This includes segregating client accounts from the company's operational funds, which is a standard practice among regulated brokers. However, it is essential to verify whether these measures are consistently enforced.

Moreover, Upbest does not offer negative balance protection, which can expose traders to significant risks during volatile market conditions. While there have been no reported incidents of fund misappropriation or security breaches, potential clients should remain vigilant and consider these factors when deciding whether Upbest is safe for their investments.

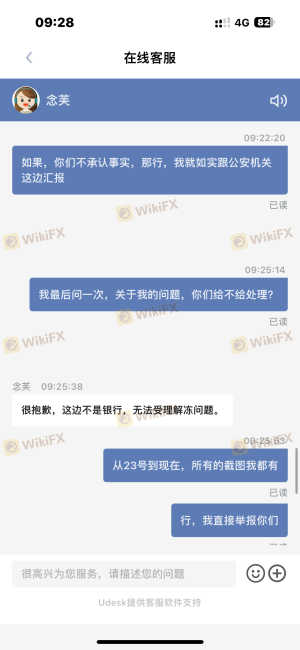

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining the reliability of Upbest. Many users report positive experiences, citing responsive customer service and a user-friendly trading platform. However, there are also complaints regarding withdrawal issues and the lack of transparency in fee structures. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Fee Transparency | Medium | Average |

| Platform Stability | Low | Positive |

Several users have reported difficulties in withdrawing funds, which raises concerns about the broker's reliability. While Upbest has responded to some complaints, the mixed feedback suggests that there may be underlying issues that need to be addressed. Potential clients should weigh these experiences against the positive reviews before making a decision.

Platform and Execution

The trading platform's performance is vital for a positive trading experience. Upbest offers a proprietary trading platform that is generally regarded as stable and user-friendly. However, some users have reported instances of slippage and order rejections, which could indicate potential manipulation or inefficiencies in execution. A thorough evaluation of the platform's performance is necessary to determine whether it meets traders' needs effectively.

Risk Assessment

Using Upbest comes with its own set of risks. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may imply less protection. |

| Financial Risk | High | Lack of negative balance protection increases exposure. |

| Operational Risk | Medium | Reports of withdrawal issues and platform performance concerns. |

To mitigate these risks, potential clients should consider starting with a demo account to familiarize themselves with the platform and its features. Additionally, traders should only invest funds they can afford to lose and remain informed about market conditions.

Conclusion and Recommendations

In conclusion, while Upbest has some positive attributes, several factors warrant caution. The regulatory oversight from the SFC adds a layer of credibility, but the lack of negative balance protection and mixed customer feedback raises concerns. Therefore, is Upbest safe? The answer is not straightforward.

For novice traders or those who are risk-averse, it may be prudent to explore alternative brokers with stronger regulatory frameworks and better customer reviews. On the other hand, experienced traders who are willing to accept higher risks may find Upbest a viable option, provided they conduct thorough research and remain vigilant.

In summary, potential clients should carefully weigh the pros and cons of Upbest and consider their individual trading needs before deciding to invest.

Is UPBEST GROUP a scam, or is it legit?

The latest exposure and evaluation content of UPBEST GROUP brokers.

UPBEST GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UPBEST GROUP latest industry rating score is 6.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.