SLG Markets 2025 Review: Everything You Need to Know

Executive Summary

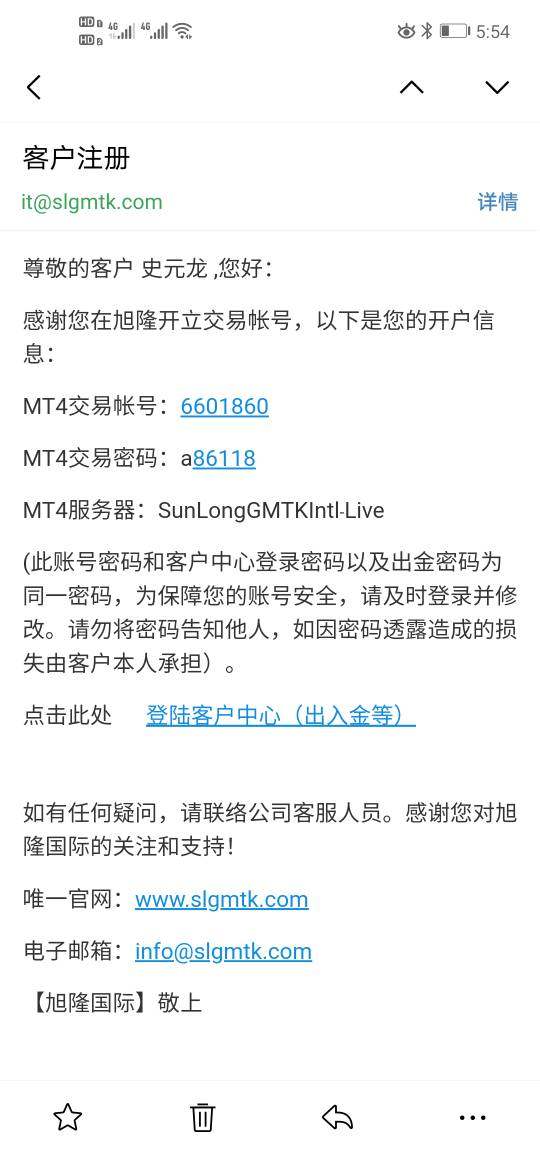

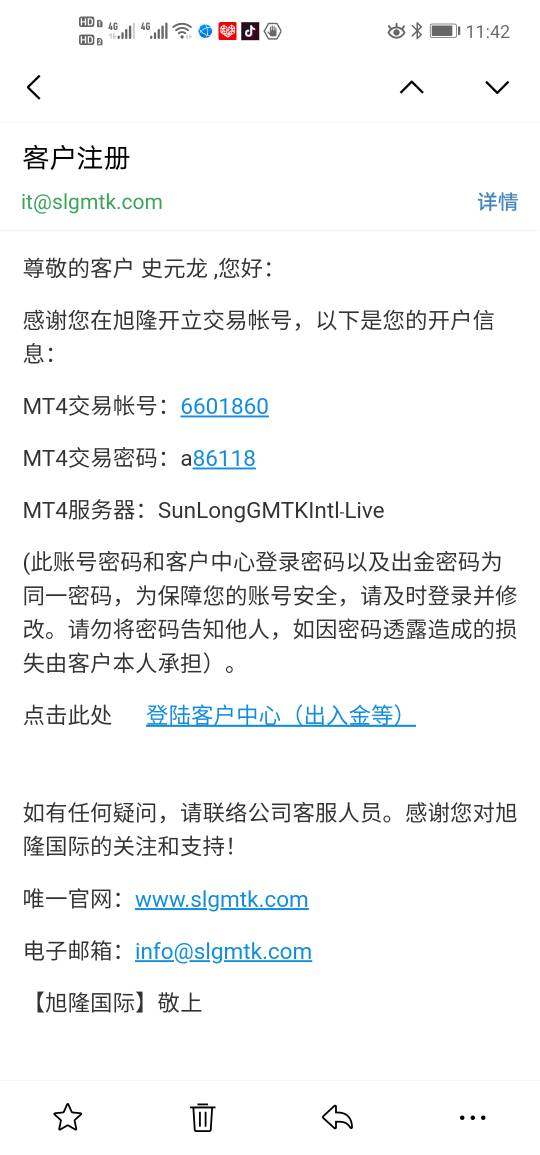

This slg markets review provides a comprehensive analysis of a relatively new offshore broker that entered the market in 2023. SLG Markets positions itself as an industry-leading precious metal investment trading platform. The company offers contract for differences brokerage services for global financial products. The broker claims to handle an average monthly trading volume exceeding 10 billion units and operates under the regulatory oversight of the Vanuatu Financial Services Commission.

SLG Markets caters primarily to traders seeking diversified investment opportunities across multiple asset classes. These include precious metals, commodities, futures, indices, and cryptocurrencies. The platform leverages the popular MT4 and MT5 trading platforms to deliver its services. However, our evaluation reveals significant information gaps regarding specific trading conditions, user feedback, and detailed operational procedures.

The broker emphasizes its strong group background, competitive transaction costs, convenient deposit and withdrawal methods, and 24/5 multilingual professional services. Despite these claims, the lack of comprehensive publicly available information about trading conditions, user experiences, and transparent operational details presents challenges for potential traders. Traders need this information to make informed decisions.

Given the limited available data and the broker's offshore regulatory status, this review maintains a neutral stance. We highlight both the potential opportunities and areas of concern for prospective clients.

Important Notice

Regulatory Considerations: SLG Markets operates as an offshore broker registered in Vanuatu under the Vanuatu Financial Services Commission. Traders should be aware that offshore jurisdictions typically offer more relaxed regulatory frameworks compared to major financial centers like the UK, EU, or US. This regulatory environment may impact investor protection measures and dispute resolution processes.

Review Methodology: This evaluation is based on official company information, available public data, and market analysis. Due to limited comprehensive user feedback and detailed operational information in public domains, some aspects of this review rely on officially published materials from the broker itself. Traders are encouraged to conduct additional due diligence and request detailed information directly from the broker before making investment decisions.

Overall Rating Framework

Broker Overview

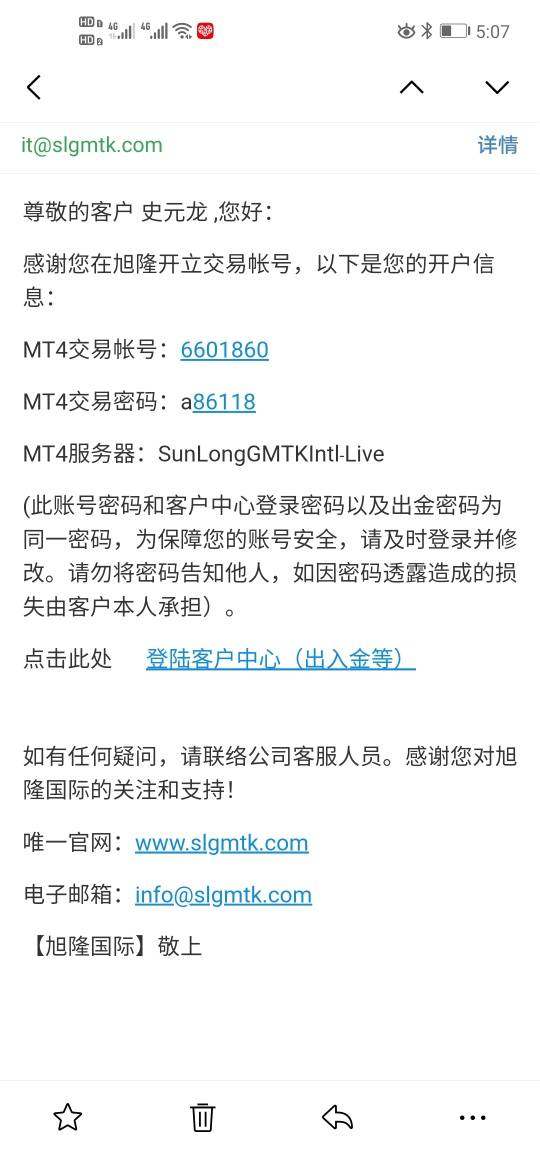

SLG Markets emerged in the financial services landscape in 2023 as a specialized CFD broker focusing on precious metals and diversified financial instruments. The company positions itself as an industry-leading investment trading platform with headquarters in Vanuatu. It operates under the regulatory framework of the Vanuatu Financial Services Commission. According to official company materials, SLG Markets aims to serve professional investors seeking exposure to global financial products through contract for differences trading.

The broker's business model centers on providing comprehensive CFD brokerage services across multiple asset categories. The company claims to facilitate substantial trading volumes, with reported average monthly trading volumes exceeding 10 billion units. This volume claim, while impressive, requires independent verification and should be considered alongside the broker's relatively recent market entry. The platform emphasizes its commitment to delivering professional-grade trading services supported by what it describes as a strong group background and competitive operational framework.

SLG Markets differentiates itself through its focus on precious metals trading while simultaneously offering access to commodities, futures, indices, and cryptocurrency markets. The broker utilizes the widely recognized MetaTrader 4 and MetaTrader 5 platforms. This ensures traders have access to familiar and robust trading environments. The company's service delivery model includes 24/5 multilingual customer support, aiming to accommodate international traders across different time zones and language preferences.

The regulatory structure under the Vanuatu Financial Services Commission provides the legal framework for the broker's operations. However, traders should understand the implications of this offshore regulatory environment. This slg markets review notes that while Vanuatu regulation allows for operational flexibility, it may offer different investor protection standards compared to more established financial regulatory jurisdictions.

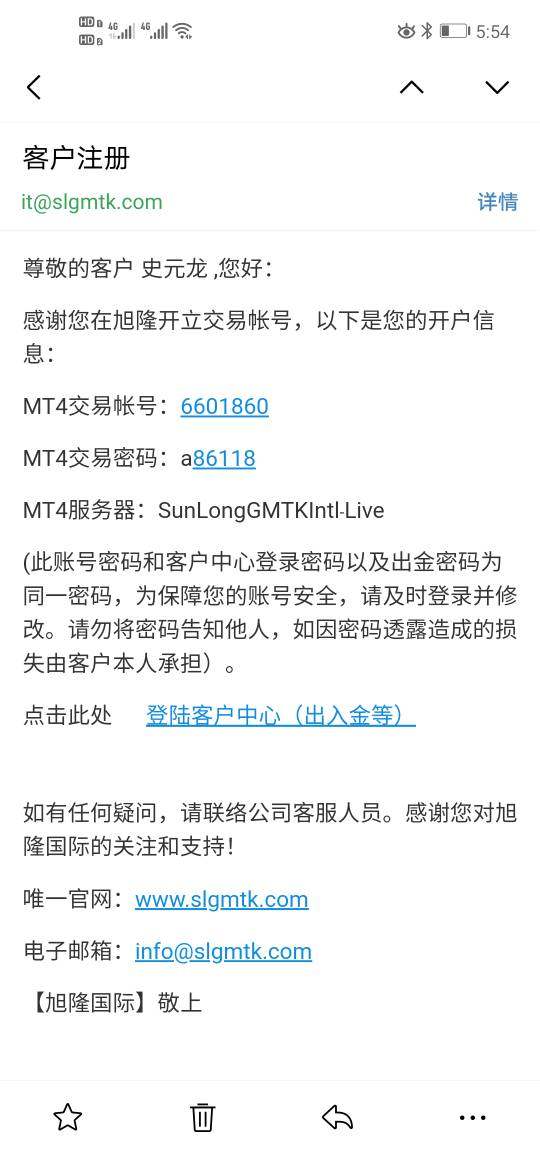

Regulatory Status: SLG Markets operates under the regulatory oversight of the Vanuatu Financial Services Commission. This offshore regulatory framework provides the legal foundation for the broker's operations. However, specific license details and regulatory compliance measures are not extensively detailed in available public information.

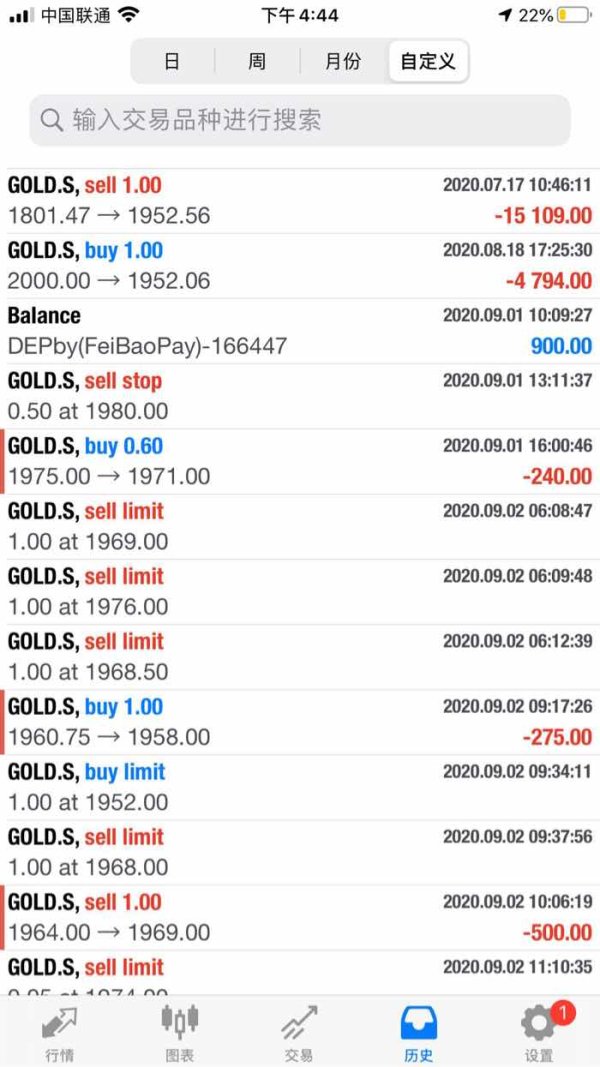

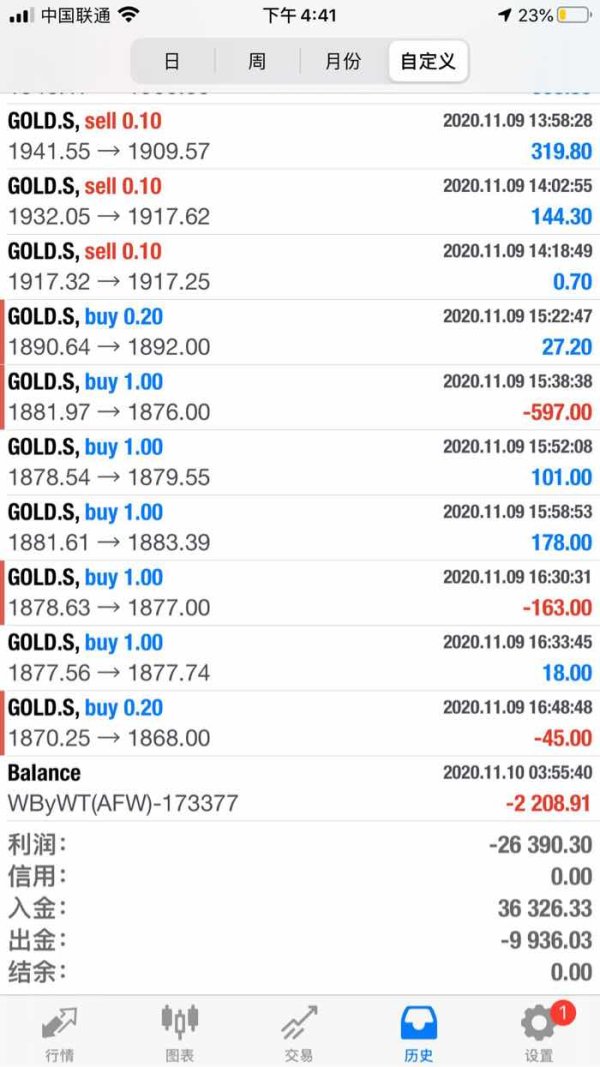

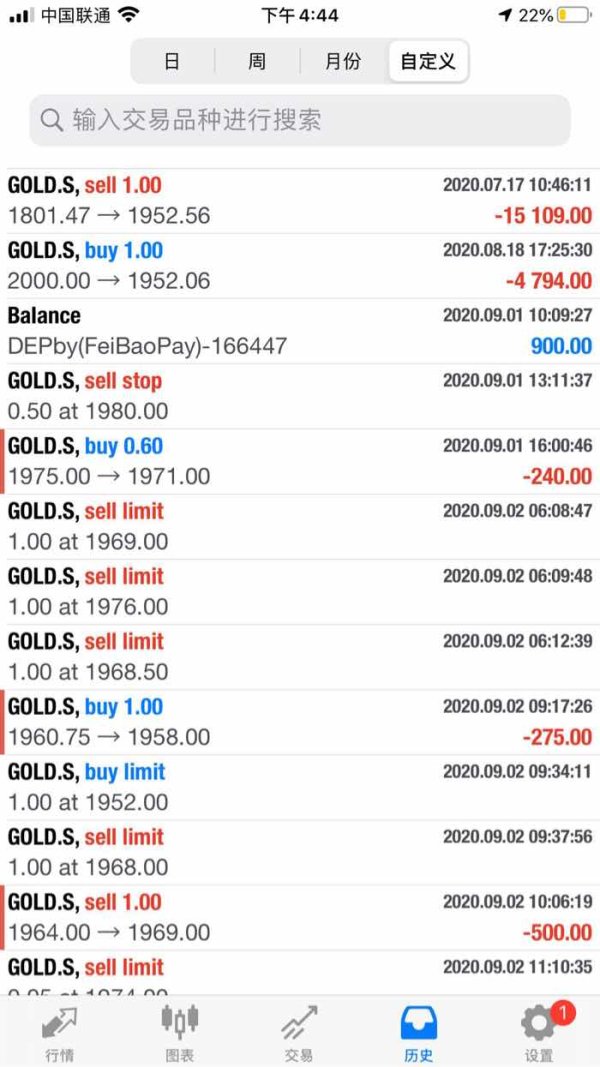

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods has not been comprehensively disclosed in available materials. The broker mentions "convenient deposit and withdrawal methods" but detailed payment options, processing times, and associated fees require direct inquiry with the company.

Minimum Deposit Requirements: The minimum deposit requirements for different account types are not specified in available public information. This represents a significant information gap for potential traders evaluating entry barriers.

Bonus and Promotional Offers: Current promotional offers, welcome bonuses, or ongoing trading incentives are not detailed in available materials. Traders interested in promotional benefits should contact the broker directly for current offers.

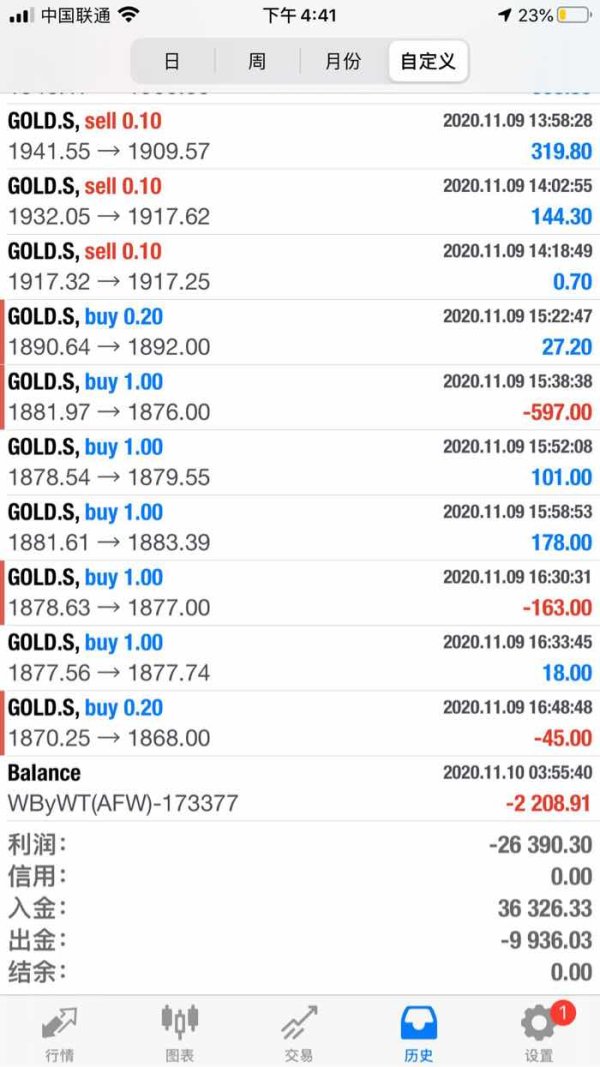

Tradeable Assets: SLG Markets provides access to multiple asset classes including precious metals, commodities, futures, indices, and cryptocurrencies. Precious metals appears to be their primary focus. The specific instruments within each category and the total number of available trading instruments require further clarification from the broker.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not transparently available in public materials. The broker claims "highly competitive transaction costs" but specific pricing structures remain undisclosed. This makes cost comparison with other brokers challenging.

Leverage Ratios: Maximum leverage ratios for different asset classes and account types are not specified in available information. This represents another area where traders need direct communication with the broker.

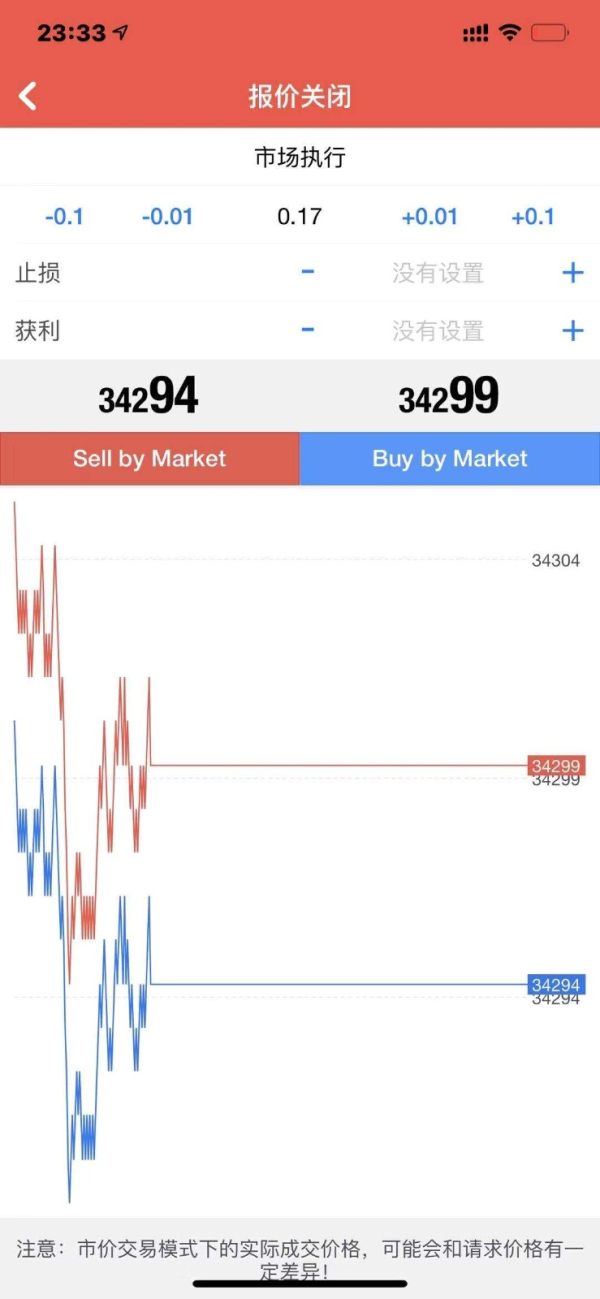

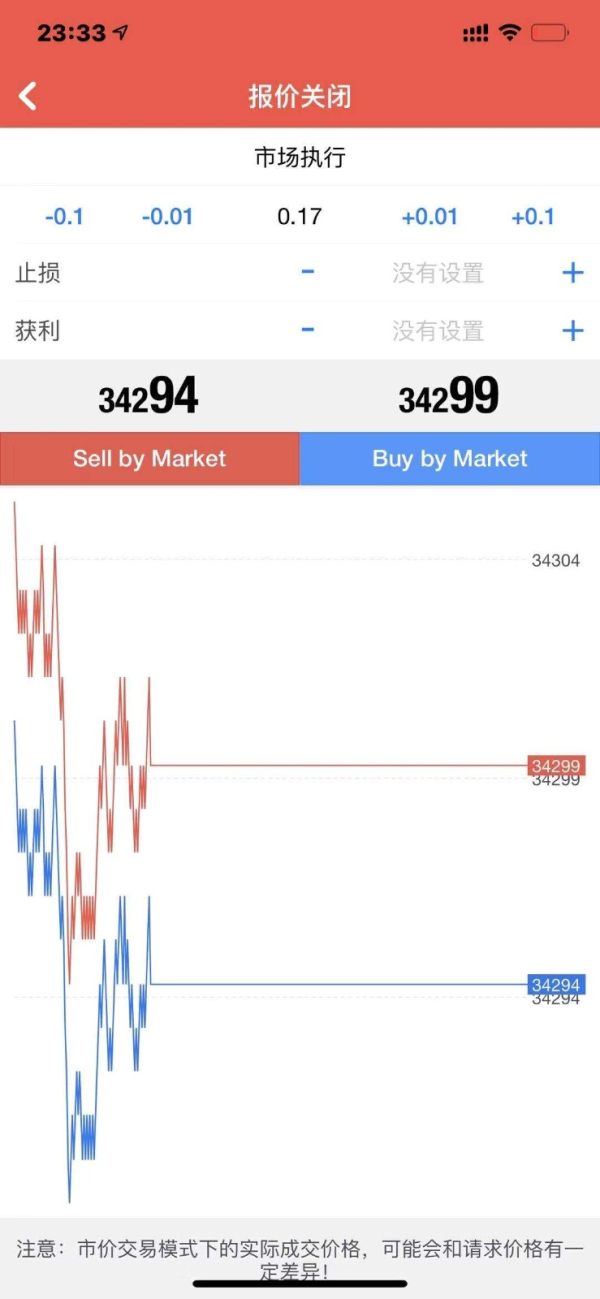

Platform Options: The broker offers MetaTrader 4 and MetaTrader 5 platforms. These provide traders with access to well-established and feature-rich trading environments suitable for various trading strategies and experience levels.

Geographic Restrictions: Specific information about geographic restrictions or country-specific limitations is not detailed in available materials.

Customer Service Languages: The broker provides multilingual customer support services. However, the specific languages supported are not comprehensively listed in available information.

This slg markets review highlights the need for greater transparency in operational details to enable informed trader decision-making.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions evaluation for SLG Markets reveals significant information gaps that impact the overall assessment. Available materials do not provide comprehensive details about account types, their specific features, or the requirements for each tier. This lack of transparency makes it challenging for potential traders to understand what account options are available. It also prevents them from determining how these options might align with different trading needs and experience levels.

The absence of clearly stated minimum deposit requirements represents a substantial information void. Most reputable brokers clearly communicate their entry requirements. This allows traders to assess whether the broker fits their budget and investment capacity. Without this fundamental information, traders cannot make informed decisions about account accessibility.

Account opening procedures and verification processes are not detailed in available materials. Modern traders expect clear information about documentation requirements, verification timelines, and account activation procedures. The lack of this information suggests either limited transparency or insufficient public communication about operational procedures.

Special account features such as Islamic accounts, professional trader accounts, or other specialized offerings are not mentioned in available materials. Given the broker's international focus and multilingual support claims, the absence of information about religiously compliant trading options or professional trader accommodations represents a notable gap.

This slg markets review emphasizes that the limited transparency regarding account conditions significantly impacts the ability to provide a comprehensive evaluation. This results in the lower score for this category.

SLG Markets demonstrates strength in platform selection by offering both MetaTrader 4 and MetaTrader 5. These are two of the most respected and widely-used trading platforms in the industry. These platforms provide comprehensive charting tools, technical analysis capabilities, automated trading support through Expert Advisors, and mobile trading functionality. The availability of both platforms allows traders to choose based on their preferences and trading requirements.

The broker's asset diversity represents another positive aspect, with offerings across precious metals, commodities, futures, indices, and cryptocurrencies. This multi-asset approach enables portfolio diversification. It also provides traders with opportunities across different market sectors. The emphasis on precious metals trading aligns with the broker's positioning as a specialized platform in this sector.

However, the evaluation reveals significant gaps in research and analysis resources. Available materials do not detail market research reports, economic calendars, trading signals, or analytical tools beyond the standard MT4/5 platform features. Modern traders often expect comprehensive research support, including market commentary, technical analysis, and educational resources.

Educational resources and trader development materials are not prominently featured in available information. While the MT4/5 platforms provide basic educational components, dedicated learning resources, webinars, tutorials, or trading guides are not detailed. This represents a missed opportunity for trader support and development.

The slg markets review acknowledges the solid foundation provided by MT4/5 platforms and asset diversity. However, we note the need for enhanced research and educational support to achieve a higher rating in this category.

Customer Service and Support Analysis (Score: 6/10)

SLG Markets promotes 24/5 multilingual professional services as a key component of their customer support framework. This availability schedule aligns with global trading hours. It demonstrates recognition of international client needs. The multilingual support capability is particularly relevant for a broker serving diverse geographic markets and suggests investment in customer service infrastructure.

However, specific customer service channels and contact methods are not comprehensively detailed in available materials. Modern traders expect multiple communication options including live chat, email support, telephone assistance, and potentially social media responsiveness. The absence of detailed contact information and response time commitments represents a transparency gap.

Service quality metrics such as average response times, issue resolution rates, or customer satisfaction scores are not available in public materials. These metrics provide important insights into actual service delivery versus promotional claims. Without user feedback or performance data, assessing the real quality of customer support becomes challenging.

The professional competency of support staff, their trading knowledge, and ability to handle complex queries are not detailed in available information. Effective customer support in financial services requires staff who understand trading platforms, market conditions, and can provide technical assistance beyond basic account inquiries.

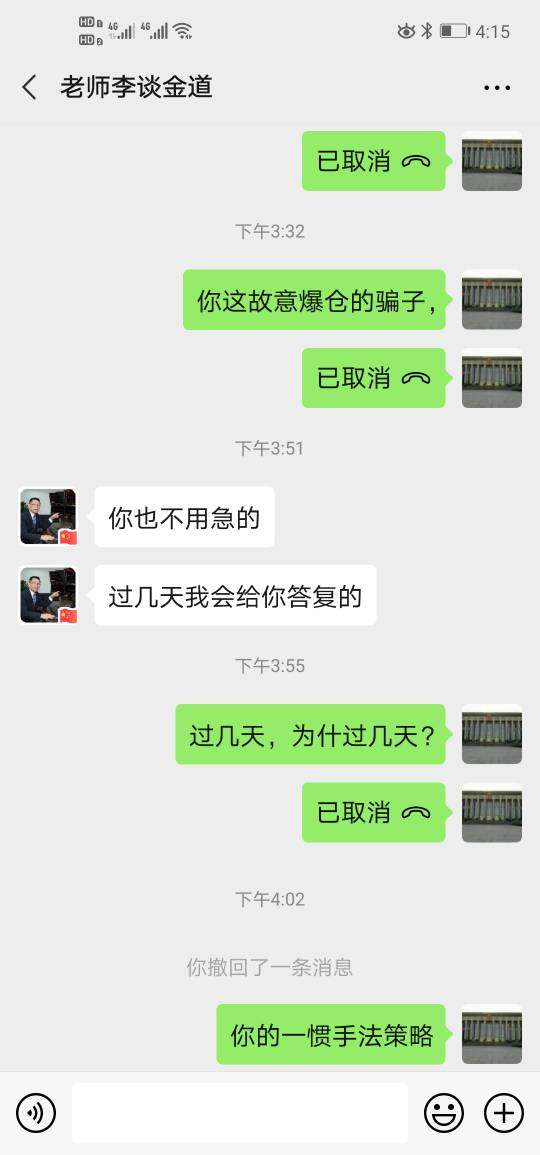

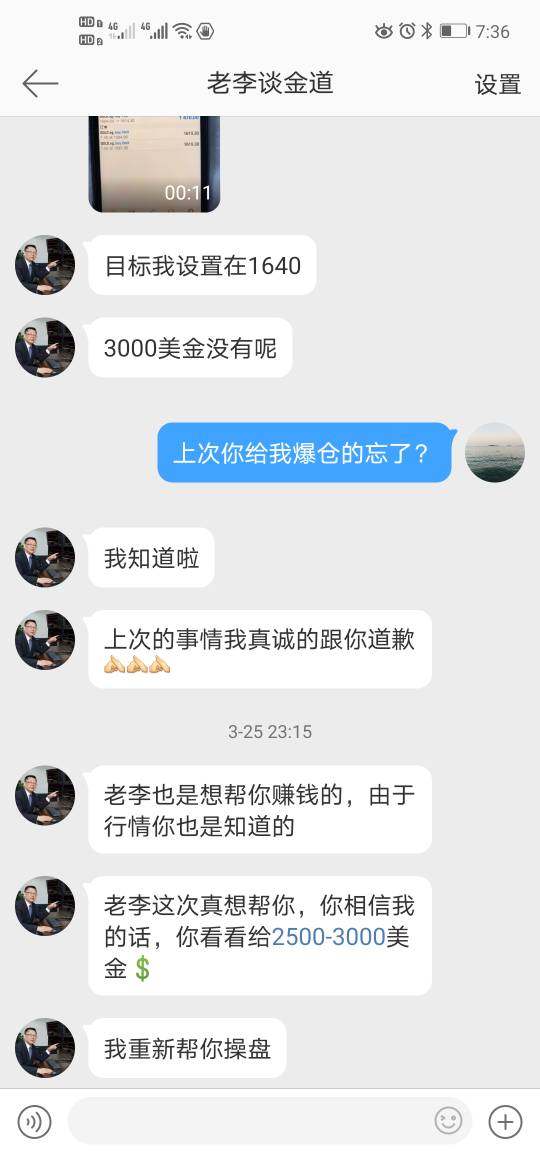

Problem resolution processes and escalation procedures are not outlined in available materials. Traders need confidence that issues will be handled efficiently and that complex problems have clear resolution pathways. The absence of this information impacts the overall customer service assessment despite the positive aspects of availability and multilingual support.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation for SLG Markets faces significant challenges due to limited user feedback and performance data availability. While the broker offers established MT4 and MT5 platforms, which generally provide reliable trading environments, specific performance metrics for SLG Markets' implementation are not available in public materials.

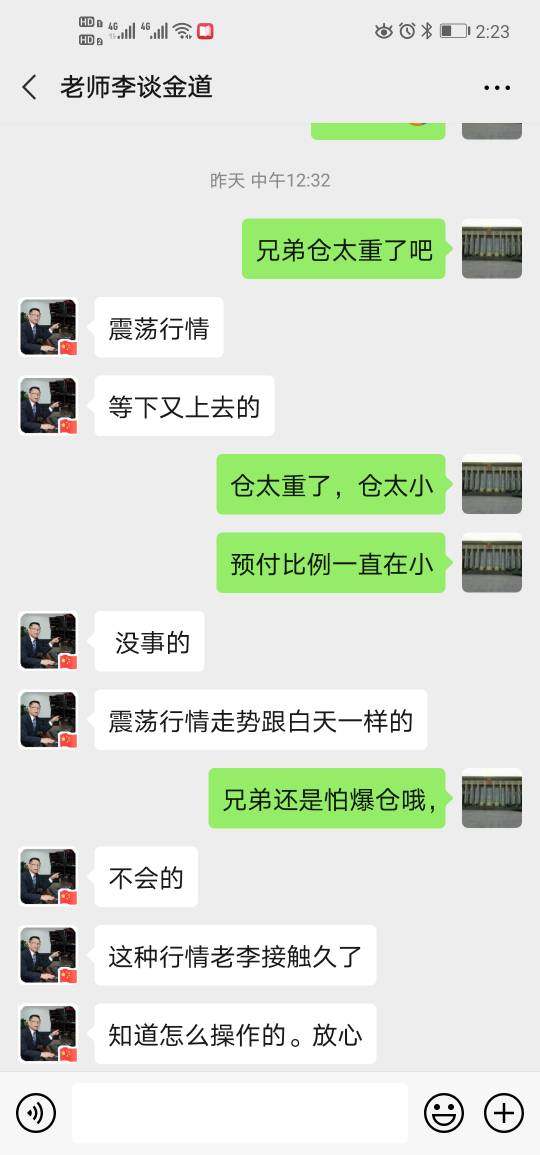

Platform stability and execution speed are critical factors for trading success. However, user reports or independent testing results are not available to verify actual performance. The MT4/5 platforms have strong reputations, but individual broker implementations can vary significantly in terms of server reliability, execution quality, and overall technical performance.

Order execution quality, including fill rates, slippage statistics, and execution speed metrics, are not detailed in available materials. These factors directly impact trading profitability and user satisfaction. Without transparent reporting on execution statistics, traders cannot assess whether the broker delivers competitive execution quality.

The trading environment details such as typical spreads, market depth, and liquidity provision are not comprehensively disclosed. While the broker claims competitive transaction costs, specific spread information across different instruments and market conditions would provide better insight into actual trading costs.

Mobile trading capabilities and platform functionality across different devices are not detailed beyond the general MT4/5 availability. Modern traders require seamless experiences across desktop, web, and mobile platforms. Specific information about mobile app features and performance would enhance the evaluation.

Trust and Reliability Analysis (Score: 5/10)

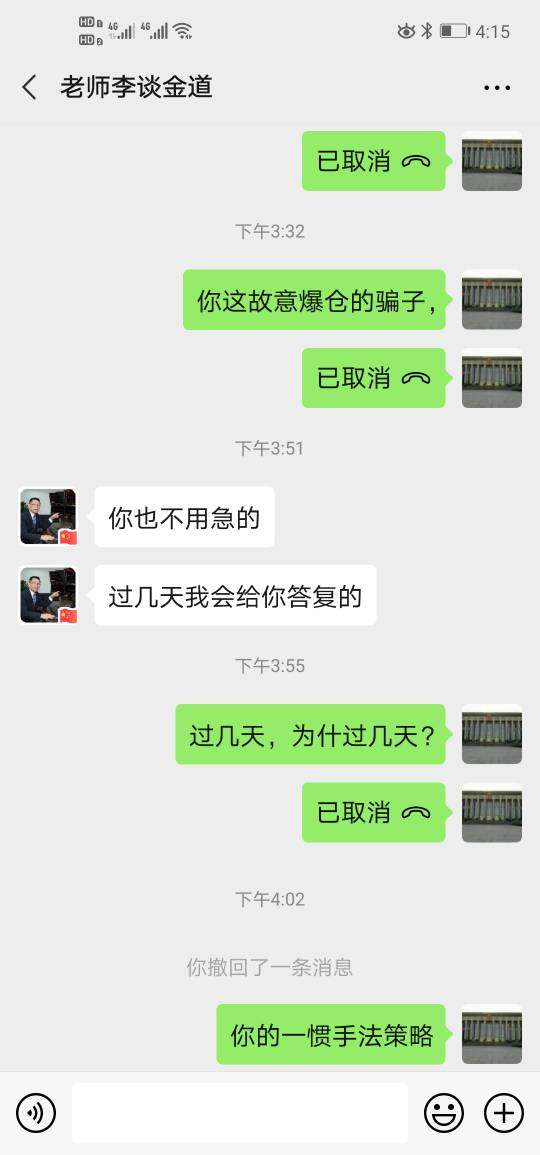

SLG Markets operates under Vanuatu Financial Services Commission regulation, which provides a legal framework but may offer different investor protection standards compared to major financial regulatory jurisdictions. Vanuatu's regulatory environment is generally considered less stringent than established financial centers. This impacts the overall trust assessment.

The broker's regulatory compliance measures and investor protection mechanisms are not detailed in available materials. Information about client fund segregation, insurance coverage, negative balance protection, or dispute resolution procedures would strengthen the trust evaluation but is not readily available.

Company transparency regarding ownership structure, management team, and corporate background is limited in public materials. While the broker mentions a "strong group background," specific details about parent companies, management experience, or corporate history are not provided. This lack of transparency impacts the ability to assess corporate stability and reliability.

Financial stability indicators such as capital adequacy, audited financial statements, or regulatory capital requirements are not disclosed in available materials. These factors provide important insights into the broker's ability to meet client obligations and maintain operations during market stress.

The absence of significant negative reports or regulatory actions is noted. However, this may partly reflect the broker's recent market entry rather than established positive performance. Independent third-party assessments or industry recognition would strengthen the trust evaluation but are not available in current materials.

User Experience Analysis (Score: 5/10)

User experience evaluation for SLG Markets is significantly limited by the absence of comprehensive user feedback and satisfaction data in available materials. Without substantial user reviews or testimonials, assessing actual client experiences becomes challenging. This evaluation relies primarily on feature availability rather than user satisfaction metrics.

The registration and account verification process details are not provided in available materials. Modern traders expect streamlined onboarding with clear timelines and requirements. The absence of this information prevents assessment of how user-friendly the initial experience might be.

Platform usability beyond the standard MT4/5 interface is not detailed. While these platforms have established user bases, broker-specific customizations, additional tools, or interface modifications could significantly impact user experience. Information about any proprietary tools or platform enhancements is not available.

Fund management experience including deposit and withdrawal processes, processing times, and user interface quality for account management functions are not detailed in available materials. These operational aspects significantly impact overall user satisfaction but cannot be evaluated without more comprehensive information.

The target user profile appears to focus on traders seeking diversified asset exposure, particularly in precious metals. However, specific user success stories or case studies are not provided. Understanding how different trader types experience the platform would enhance the evaluation but requires more detailed user feedback data.

Conclusion

This slg markets review presents a mixed evaluation of a relatively new broker entering the competitive CFD trading market. SLG Markets demonstrates certain strengths, particularly in platform selection through MT4/5 availability and asset diversification across precious metals, commodities, futures, indices, and cryptocurrencies. The broker's commitment to multilingual support and 24/5 availability suggests recognition of international trader needs.

However, significant information gaps regarding trading conditions, cost structures, and user experiences limit the ability to provide a comprehensive positive assessment. The lack of transparent pricing information, detailed account conditions, and substantial user feedback creates uncertainty for potential traders seeking to make informed decisions.

SLG Markets may be most suitable for traders specifically interested in precious metals trading who value platform familiarity through MT4/5 and seek access to diversified asset classes. However, traders prioritizing transparency, comprehensive educational resources, and established track records may want to consider more established alternatives. They should also request detailed information directly from the broker before proceeding.

The offshore regulatory status under Vanuatu's VFSC provides operational flexibility but may offer different investor protection standards compared to major financial jurisdictions. Potential clients should carefully consider their risk tolerance and protection requirements when evaluating this broker option.