Regarding the legitimacy of SUN LONG GMTK INTERNATIONAL forex brokers, it provides VFSC, ASIC and WikiBit, .

Is SUN LONG GMTK INTERNATIONAL safe?

Software Index

Risk Control

Is SUN LONG GMTK INTERNATIONAL markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

SUN LONG GMTK INTERNATIONAL LIMITED

Effective Date: Change Record

2024-10-16Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

FORTUNE PRIME GLOBAL CAPITAL PTY LTD

Effective Date: Change Record

2011-05-13Email Address of Licensed Institution:

linda.lin@fortuneprime.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

U 5 20 PROSPECT ST BOX HILL VIC 3128Phone Number of Licensed Institution:

0399175819Licensed Institution Certified Documents:

Is SLG Markets Safe or Scam?

Introduction

SLG Markets, operating under the name Sun Long GMTK International Limited, positions itself as an online trading platform offering services in forex, CFDs, cryptocurrencies, and commodities. As the forex market continues to expand, traders are increasingly urged to conduct thorough due diligence before engaging with any brokerage. This is particularly critical given the prevalence of scams and fraudulent activities in the trading industry. In this article, we will evaluate the safety and legitimacy of SLG Markets, focusing on its regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on a comprehensive analysis of multiple online sources, user reviews, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a trading platform is a fundamental aspect that determines its legitimacy and safety. SLG Markets claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC). However, a closer inspection reveals that these claims are misleading. The VFSC license number 40518 is reported to be revoked, indicating that SLG Markets is operating without valid regulatory oversight. Moreover, the ASIC license is labeled as a "suspicious clone," further raising concerns about the authenticity of the broker's claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40518 | Vanuatu | Revoked |

| ASIC | N/A | Australia | Suspicious Clone |

The absence of a credible regulatory framework means that SLG Markets does not adhere to the stringent compliance standards typically enforced by reputable regulatory bodies. This lack of oversight can expose clients to various risks, including potential fraud, mismanagement, and inadequate recourse in the event of disputes. Therefore, the question "Is SLG Markets safe?" leans heavily towards a negative response, as traders are advised to be cautious when dealing with unregulated entities.

Company Background Investigation

SLG Markets was established relatively recently, with its domain registered in 2019 and the company officially formed in 2023. The company is based in Vanuatu, a jurisdiction known for its lax regulatory standards. The ownership structure of SLG Markets is not transparently disclosed, raising concerns about accountability and trustworthiness. Without clear information about the management team or the individuals behind the broker, potential clients may find it challenging to assess the company's reliability.

The management team's background and professional experience are crucial in evaluating the broker's credibility. However, SLG Markets fails to provide adequate information regarding its leadership, which is a significant red flag. Transparency in operations and clear communication are essential attributes for any reputable brokerage, and SLG Markets appears to fall short in this regard. This lack of transparency contributes to the growing skepticism surrounding the question, "Is SLG Markets safe?"

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. SLG Markets provides access to various financial instruments, including forex, commodities, and cryptocurrencies. However, the specific details regarding trading costs, such as spreads, commissions, and overnight interest rates, are not well-documented on their website.

| Cost Type | SLG Markets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding trading costs is concerning, as it may indicate hidden fees or unfavorable trading conditions. Traders should be wary of brokers that do not provide comprehensive information about their fee structures, as this can lead to unexpected costs that eat into profits. Therefore, potential clients should question the safety of engaging with SLG Markets, especially considering the lack of transparency in their trading conditions.

Client Funds Safety

The safety of client funds is paramount when assessing a broker's reliability. SLG Markets claims to implement measures for fund security; however, the absence of regulatory oversight raises significant doubts about the effectiveness of these measures. The broker does not provide information about segregated accounts or investor protection schemes, which are standard practices among regulated brokers.

Without segregated accounts, client funds may be at risk of being misused for the broker's operational expenses. Additionally, the lack of a negative balance protection policy means that clients could potentially lose more than their initial investment. Historical issues regarding fund safety have also been reported, with numerous complaints from users about difficulties in withdrawing their capital. These concerns further emphasize the importance of asking, "Is SLG Markets safe?" The evidence suggests that potential clients may be exposing themselves to unnecessary risks.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Reviews of SLG Markets reveal a pattern of negative experiences, with many users reporting issues related to withdrawal requests and account management. Common complaints include forced liquidations, unresponsive customer service, and difficulties in closing profitable positions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management Problems | High | Poor |

For instance, one user reported being unable to withdraw funds after multiple attempts, while another highlighted forced liquidations occurring without their consent. These complaints indicate a troubling trend that raises significant concerns about the broker's operational integrity. Therefore, it is prudent for potential clients to consider the question, "Is SLG Markets safe?" based on the overwhelming negative feedback from existing users.

Platform and Trade Execution

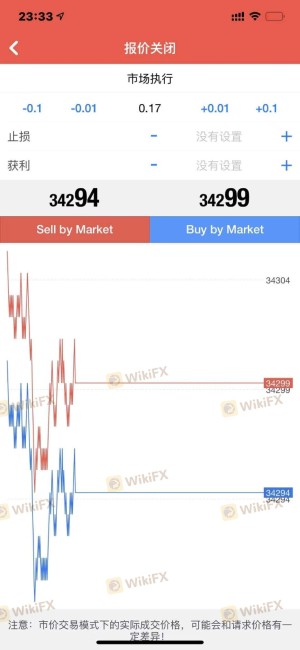

The trading platform offered by SLG Markets is the widely recognized MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, the performance of the platform and the quality of trade execution are critical factors that impact a trader's experience. Reports suggest that users have encountered issues with order execution, including slippage and rejected orders, which can be detrimental to trading outcomes.

The presence of such issues raises concerns about the broker's reliability and the overall trading environment. Traders must be cautious and consider whether SLG Markets can provide the necessary conditions for successful trading.

Risk Assessment

Engaging with SLG Markets presents several risks that potential clients should carefully consider. The lack of regulation, transparency, and customer support issues contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated status increases fraud risk. |

| Fund Security | High | No segregation of client funds reported. |

| Customer Support Issues | Medium | Negative feedback on responsiveness. |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative brokers with established regulatory frameworks and positive user reviews. This proactive approach can help safeguard investments and enhance trading experiences.

Conclusion and Recommendations

In conclusion, the evidence gathered regarding SLG Markets raises significant concerns about its safety and legitimacy. The broker's unregulated status, lack of transparency, and negative customer experiences suggest that it may not be a safe option for traders. Therefore, it is crucial for potential clients to approach SLG Markets with caution and skepticism.

For those seeking reliable trading options, it is recommended to consider well-regulated brokers with a proven track record of customer satisfaction and transparent practices. Examples of trustworthy alternatives include brokers regulated by respected authorities such as the FCA, ASIC, or CySEC. Ultimately, the question "Is SLG Markets safe?" leans towards a resounding no, and traders are encouraged to prioritize their financial security by choosing reputable brokers.

Is SUN LONG GMTK INTERNATIONAL a scam, or is it legit?

The latest exposure and evaluation content of SUN LONG GMTK INTERNATIONAL brokers.

SUN LONG GMTK INTERNATIONAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUN LONG GMTK INTERNATIONAL latest industry rating score is 3.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.