Renaissance Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive renaissance capital review examines one of the leading emerging and frontier markets investment banks. It has gained significant attention from traders and investors worldwide. Renaissance Capital stands out as a reputable financial services provider with operations spanning over 50 markets across Africa, Central and Eastern Europe, the Middle East, and North America. The firm has built its reputation on delivering professional financial services with a particular focus on emerging market opportunities.

User feedback consistently highlights the exceptional quality of Renaissance Capital's services. Many clients express high satisfaction levels and recommend the platform to others. The company's specialized approach to frontier and emerging markets makes it particularly attractive to investors seeking exposure to these dynamic regions. Renaissance Capital operates under regulatory oversight, providing clients with essential investor protections while maintaining its commitment to professional service delivery across diverse global markets.

Important Notice

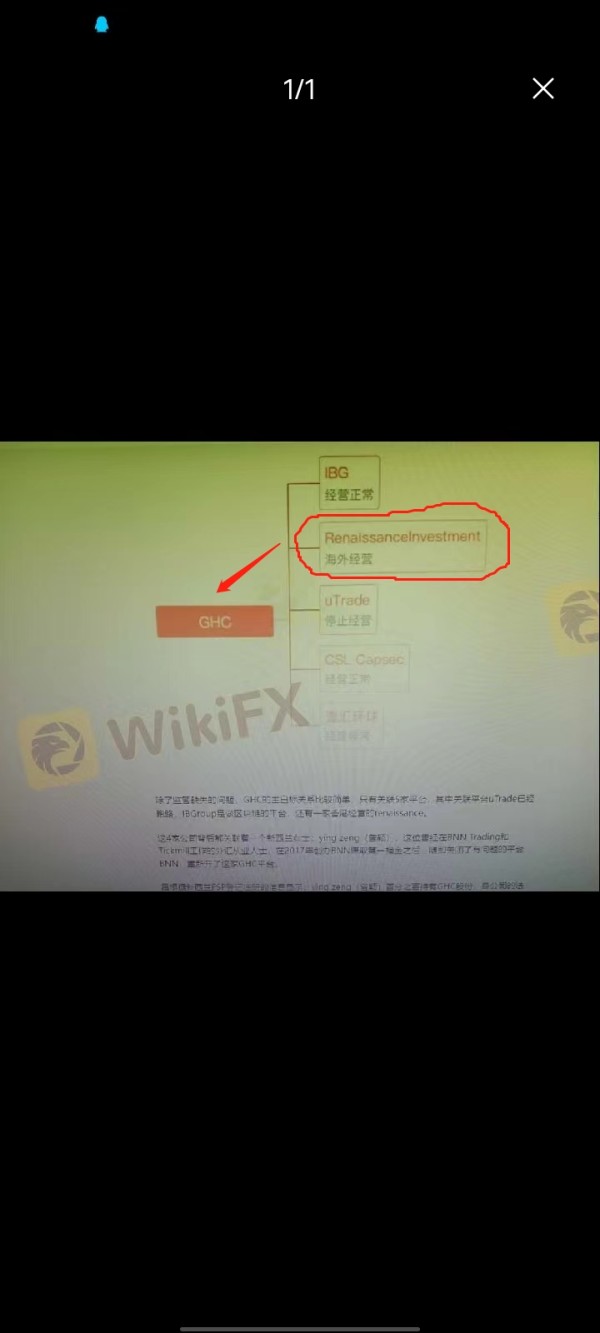

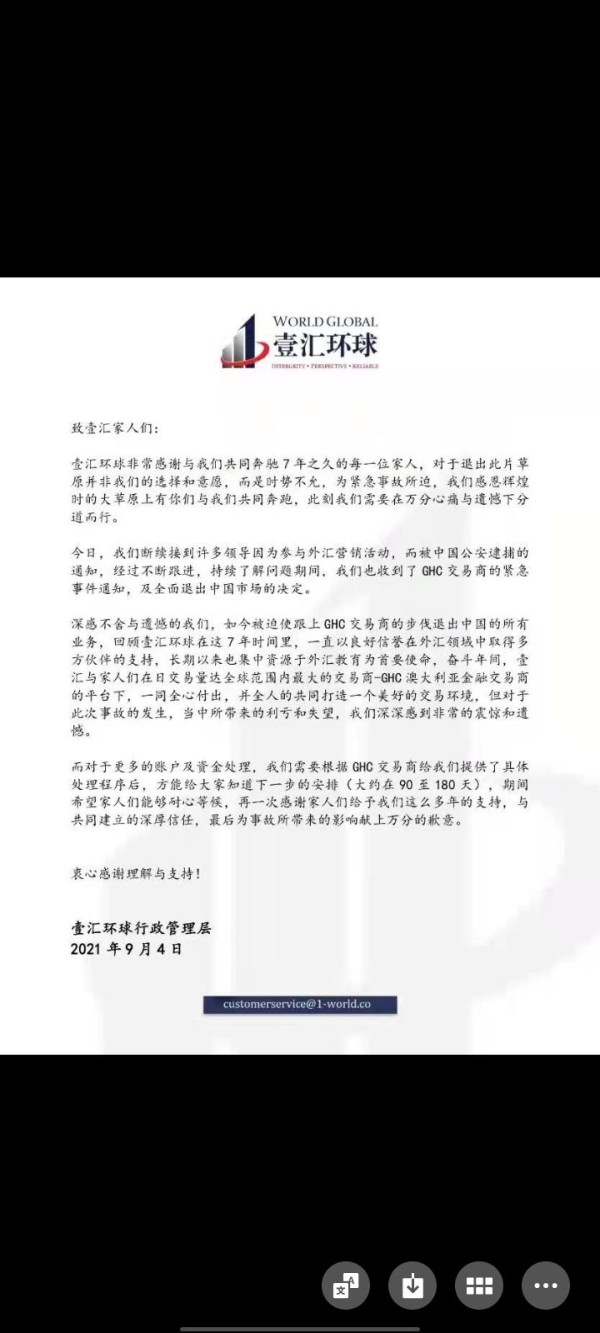

It's crucial to understand that Renaissance Capital may operate through different regional entities. Each entity is potentially subject to varying regulatory frameworks and service offerings. The regulatory landscape for emerging markets investment banking can differ significantly across jurisdictions, and clients should verify the specific regulatory status applicable to their region.

This evaluation is based on available information from multiple sources, user feedback, and publicly accessible data. According to available information, Renaissance Capital operates under CYSEC regulatory framework, though specific regulatory details may vary by region. Prospective clients should conduct their own due diligence and verify current regulatory status before engaging with any financial services provider.

Rating Framework

Broker Overview

Renaissance Capital has established itself as a prominent player in the emerging and frontier markets investment banking sector since its founding in 1995. The firm operates as a comprehensive investment bank, specializing in providing access to over 50 markets globally with a particular emphasis on emerging economies. Renaissance Capital's business model encompasses a broad range of financial services including securities trading, foreign exchange, derivatives, and comprehensive capital market solutions.

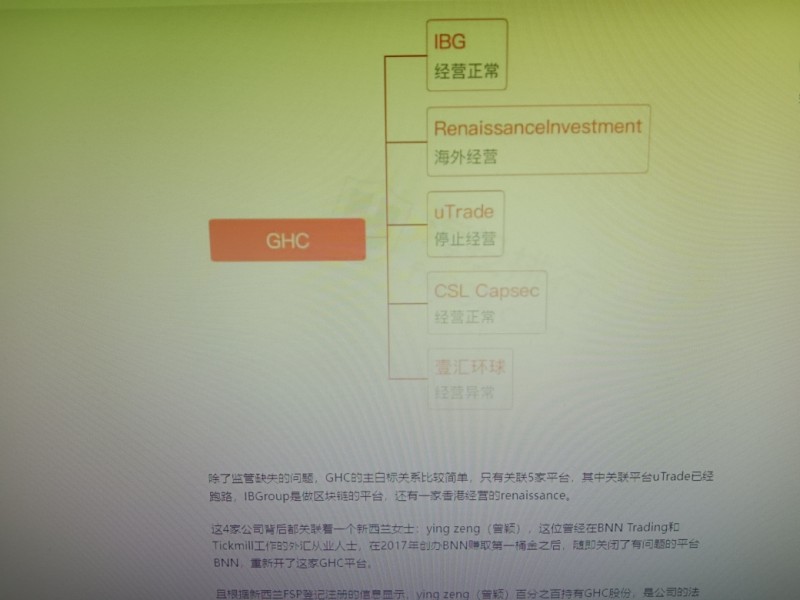

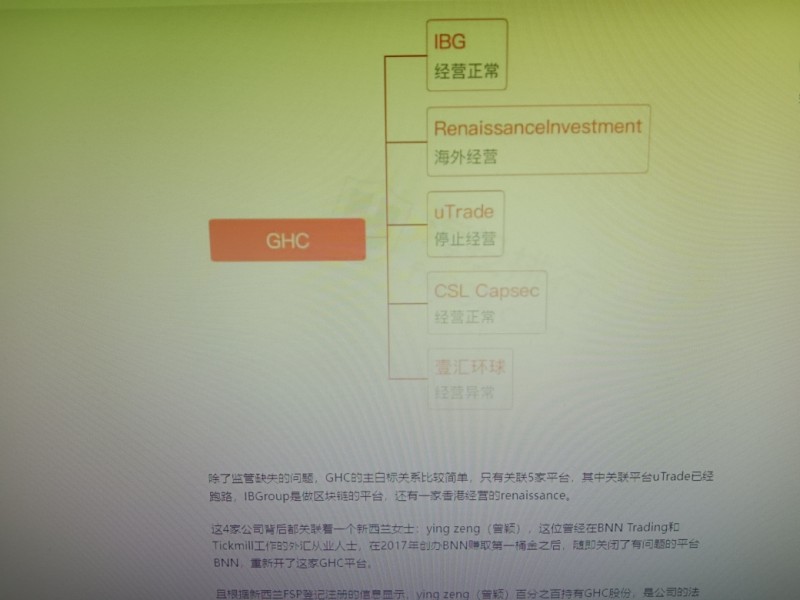

The company's strategic focus on emerging and frontier markets distinguishes it from mainstream brokers. It positions itself as a specialist provider for investors seeking exposure to these high-growth potential regions. Renaissance Capital's operations span multiple continents, with established presences in Africa, Central and Eastern Europe, the Middle East, and North America, enabling comprehensive coverage of key emerging market regions.

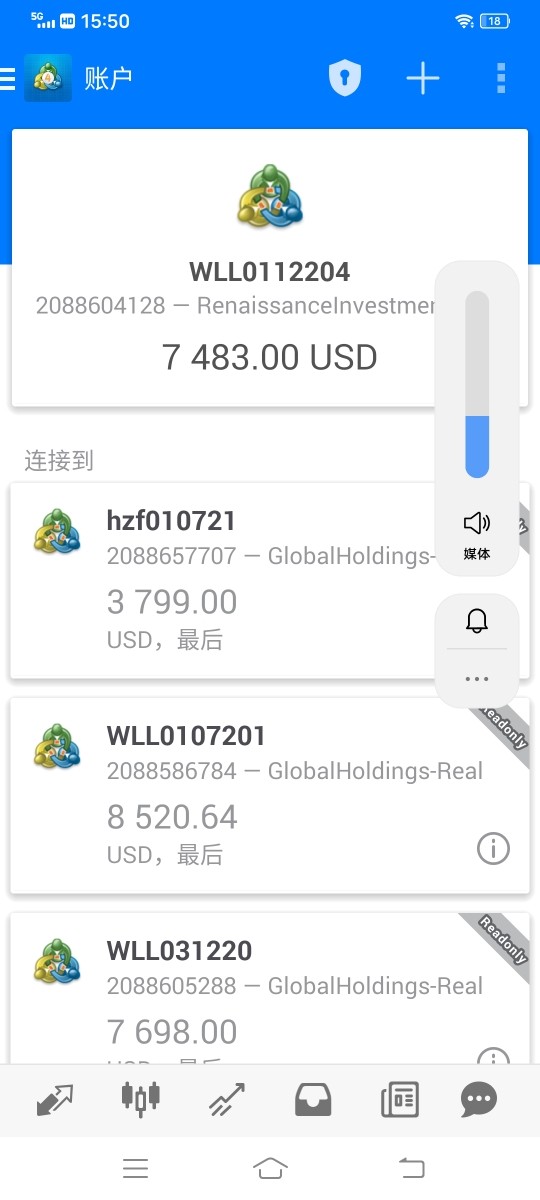

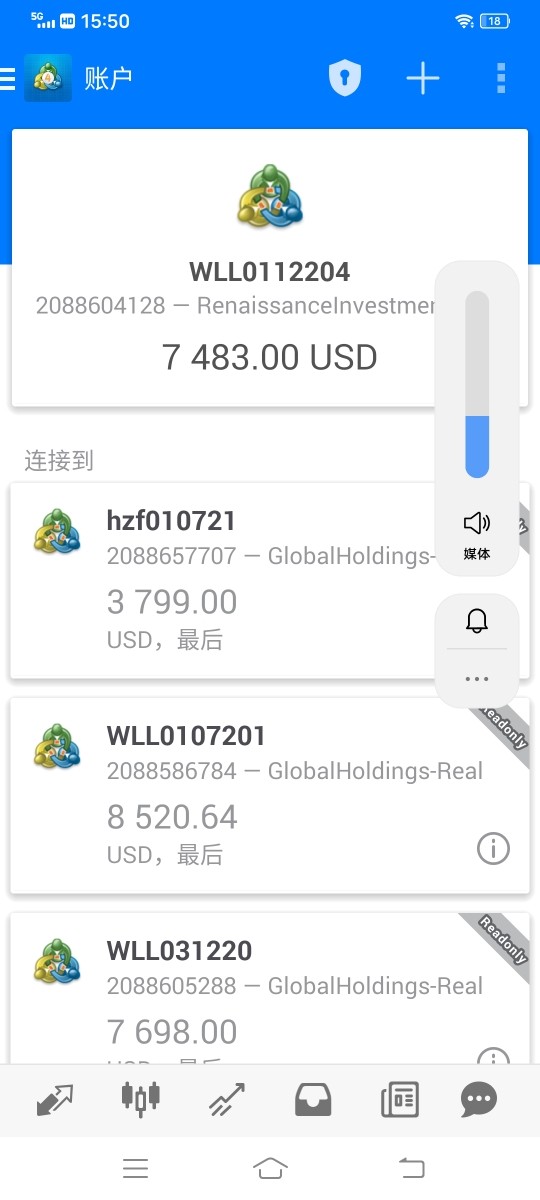

Renaissance Capital utilizes modern technology platforms, including mobile applications, to deliver its services to clients worldwide. The firm's service portfolio encompasses securities, foreign exchange, derivatives, equity and debt capital markets, providing clients with diverse investment opportunities across emerging market asset classes. Regulatory oversight is provided by CYSEC, ensuring compliance with established financial services standards and providing essential investor protections within the European regulatory framework.

Regulatory Status: Renaissance Capital operates under CYSEC regulation. This provides clients with fundamental investor protections under European financial services legislation. This regulatory framework ensures adherence to established operational standards and client fund protection protocols.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available sources. However, as an established investment bank, standard banking channels are typically supported.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in available documentation. This is common for institutional-focused service providers where requirements may vary based on service type.

Promotional Offers: Current bonus or promotional structures are not detailed in available information sources.

Tradeable Assets: Renaissance Capital provides access to a comprehensive range of financial instruments. These include securities, foreign exchange, derivatives, and both equity and debt capital market products across emerging and frontier markets.

Cost Structure: Detailed information regarding spreads, commissions, and fee structures is not provided in available sources. However, institutional-grade pricing models are typically employed.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation.

Platform Options: The firm provides mobile application access for trading activities. However, comprehensive platform specifications are not detailed in this renaissance capital review.

Geographic Restrictions: Specific regional limitations are not outlined in available sources.

Customer Support Languages: Multilingual support capabilities are not specifically detailed in available information.

Detailed Rating Analysis

Account Conditions Analysis

The specific details regarding Renaissance Capital's account conditions are not comprehensively outlined in available sources. This makes it challenging to provide a detailed assessment of account types, minimum deposit requirements, or opening procedures. This information gap is not uncommon among institutional-focused investment banks that often customize account structures based on individual client needs and investment objectives.

Without specific information about account tiers, Islamic account availability, or special account features, potential clients would need to contact Renaissance Capital directly. They must understand the available account structures. The absence of standardized retail account information suggests the firm may focus more on institutional or high-net-worth individual services rather than standard retail forex accounts.

The account opening process details are not specified in available documentation. However, regulated investment banks typically require comprehensive know-your-customer procedures and documentation. This renaissance capital review cannot provide specific guidance on account minimums or features without access to current account documentation from the firm.

Renaissance Capital's tools and resources offering appears to focus on providing access to global emerging markets rather than traditional retail trading tools. The firm's strength lies in its specialized market access capabilities. It offers exposure to over 50 markets across multiple continents. This global reach represents a significant resource for investors seeking diversified emerging market exposure.

While specific trading tools, research platforms, or analytical resources are not detailed in available sources, the firm's positioning as a leading emerging markets investment bank suggests access to institutional-grade market research and analysis. The mobile application platform indicates modern technology adoption. However, specific platform features and capabilities are not outlined.

Educational resources and automated trading support details are not provided in available information. The firm's focus on emerging and frontier markets suggests that market intelligence and research capabilities would be core offerings. However, specific details about research quality, frequency, or analytical tools are not available in current documentation.

Customer Service and Support Analysis

User feedback regarding Renaissance Capital's customer service consistently indicates high satisfaction levels and professional service delivery. Available testimonials suggest that clients appreciate the quality of support provided. Users specifically note their willingness to recommend the service to others, indicating strong satisfaction with the overall service experience.

The professional nature of Renaissance Capital's service approach appears to be a key differentiator. Users highlight the firm's ability to meet client expectations effectively. While specific details about customer service channels, response times, or availability hours are not provided in available sources, the positive user feedback suggests effective problem resolution and professional client relationship management.

Multilingual support capabilities and specific customer service hours are not detailed in available documentation. However, given the firm's global operations across multiple regions and time zones, comprehensive support coverage would be expected. An investment bank of this scope and reputation should provide adequate coverage.

Trading Experience Analysis

Specific details regarding platform stability, execution speed, or order quality are not provided in available sources. This limits the ability to assess the technical trading experience comprehensively. The availability of mobile application access indicates modern platform technology adoption, suggesting that clients can access services through contemporary digital channels.

The trading environment details, including platform functionality, charting capabilities, or advanced trading features, are not specified in current documentation. However, the firm's focus on emerging markets suggests that platform capabilities would be optimized for accessing diverse global markets. This would be rather than traditional forex trading features.

User feedback does not specifically address trading platform performance or execution quality in available sources. The institutional focus of Renaissance Capital suggests that trading infrastructure would be designed to meet professional standards. However, specific performance metrics or user experience details are not available in this renaissance capital review.

Trust and Reliability Analysis

Renaissance Capital's regulatory status under CYSEC provides a foundation for trust and reliability. It ensures compliance with European financial services standards and investor protection requirements. This regulatory oversight offers essential safeguards for client funds and operational transparency, though specific details about fund segregation or additional security measures are not outlined in available sources.

The firm's establishment in 1995 and continued operations across multiple global markets suggests operational stability and industry experience. However, specific information about company transparency measures, financial reporting, or third-party audits is not provided in available documentation.

Industry reputation details and any historical regulatory actions or negative events are not specifically addressed in available sources. The positive user feedback suggests satisfactory client relationships. However, comprehensive trust assessment would require additional information about fund protection measures, insurance coverage, and operational transparency that is not currently available.

User Experience Analysis

Available user feedback indicates positive overall satisfaction with Renaissance Capital's services. Clients express willingness to recommend the platform to others. This suggests that the firm successfully meets client expectations and delivers satisfactory service experiences across its user base.

The specific aspects of user experience such as interface design, ease of use, or registration processes are not detailed in available sources. However, the availability of mobile application access indicates attention to modern user experience expectations and digital accessibility.

User demographics appear to align with the firm's specialization in emerging and frontier markets. This suggests that the platform attracts investors specifically interested in these market segments. Common user complaints or areas for improvement are not identified in available feedback, though the limited scope of available user testimonials may not represent the complete user experience spectrum.

Conclusion

Renaissance Capital emerges from this analysis as a specialized investment bank with a strong focus on emerging and frontier markets. It offers clients access to over 50 global markets with professional service delivery. The consistently positive user feedback and regulatory oversight under CYSEC provide confidence in the firm's operational standards and client satisfaction capabilities.

The platform appears most suitable for investors specifically interested in emerging market exposure and those seeking professional investment banking services rather than traditional retail forex trading. While certain key information areas such as specific account conditions, detailed fee structures, and comprehensive platform features are not available in current sources, the firm's established presence and positive user testimonials suggest a reliable service provider within its specialized market niche.

The main advantages include professional service delivery, extensive emerging market access, and high user satisfaction levels. The primary limitation is the lack of detailed information about specific service features and conditions that would enable more comprehensive evaluation.