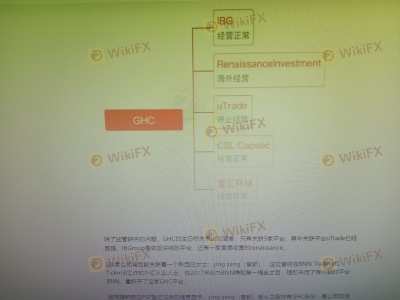

Regarding the legitimacy of Renaissance Capital forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Renaissance Capital safe?

Business

Risk Control

Is Renaissance Capital markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Renaissance Securities (Cyprus) Ltd

Effective Date:

2004-12-22Email Address of Licensed Institution:

compliancecyprus@rencap.euSharing Status:

No SharingWebsite of Licensed Institution:

www.rencap.comExpiration Time:

--Address of Licensed Institution:

Labs Tower, Foti Pitta 4, 3rd Floor, 1065 Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 505 800Licensed Institution Certified Documents:

Is Renaissance Capital Safe or a Scam?

Introduction

Renaissance Capital is a Cyprus-based forex broker established in 2004, primarily focused on providing trading services in foreign exchange, commodities, and indices. As a participant in the competitive forex market, Renaissance Capital positions itself as a reputable broker catering to a diverse clientele, including retail and institutional traders. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the integrity and reliability of a broker can significantly impact a trader's financial success. This article aims to provide a comprehensive evaluation of Renaissance Capital, exploring its regulatory standing, company background, trading conditions, customer experiences, and overall safety. The analysis is based on information gathered from multiple reliable sources, including regulatory disclosures and user reviews.

Regulation and Legitimacy

Renaissance Capital operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), which is a crucial aspect of its legitimacy. Regulatory oversight is essential for any forex broker, as it ensures compliance with industry standards designed to protect traders. A regulated broker is subject to regular audits and must adhere to strict rules regarding capital adequacy, client fund protection, and operational transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 053/04 | Cyprus | Verified |

The regulation by CySEC provides a level of assurance to traders, indicating that Renaissance Capital is obligated to maintain certain operational standards. However, it is important to note that the quality of regulation can vary significantly across jurisdictions. While CySEC is considered a mid-tier regulator, it does not carry the same weight as top-tier regulators like the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission). Historical compliance records show that Renaissance Capital has not faced major regulatory actions, which is a positive sign. However, there have been complaints about fund withdrawal issues, which raises concerns about its operational reliability.

Company Background Investigation

Founded in 2004, Renaissance Capital has a substantial history in the financial services sector. The company is structured as Renaissance Securities (Cyprus) Limited and has expanded its operations to various international markets. The ownership structure indicates that it is part of a larger investment group, which adds a layer of credibility.

The management team at Renaissance Capital boasts a wealth of experience in finance and investment banking, with many members having backgrounds in top-tier financial institutions. This expertise can be beneficial in navigating the complexities of the forex market and providing quality services to clients. Transparency in operations is crucial for building trust, and Renaissance Capital provides clear information about its services, including trading conditions and fee structures. However, some users have reported difficulties in accessing timely information regarding their accounts, which could be a sign of potential transparency issues.

Trading Conditions Analysis

Renaissance Capital offers a variety of trading instruments, including forex pairs, commodities, and indices. The broker's fee structure is an essential factor for traders to consider, as high fees can erode potential profits. The following table summarizes the core trading costs associated with Renaissance Capital:

| Fee Type | Renaissance Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.5-1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 4% | 2-3% |

While the spreads for major currency pairs appear competitive, they are slightly higher than the industry average, which could affect profitability for high-frequency traders. Additionally, the variable commission model may introduce unpredictability in trading costs. Traders should be cautious of any hidden fees or unusual policies that could impact their trading experience.

Client Fund Safety

The safety of client funds is a paramount concern for any forex trader. Renaissance Capital claims to implement several measures to secure client funds, including segregated accounts and adherence to regulatory requirements. Funds are reportedly held in separate accounts to ensure that client deposits are protected in the event of financial difficulties.

However, the absence of negative balance protection is a significant drawback, as it exposes traders to the risk of losing more than their initial investment. Furthermore, there have been historical complaints regarding difficulties in fund withdrawals, which raises red flags about the broker's liquidity and operational practices. Traders should be aware of the risks associated with depositing funds with Renaissance Capital, especially considering the potential for withdrawal issues.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of Renaissance Capital reveal a mixed bag of experiences. While some users praise the platform's functionality and range of trading instruments, others have raised concerns about withdrawal difficulties and customer support responsiveness.

The following table summarizes the main types of complaints received about Renaissance Capital:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Quality | Medium | Average |

| Platform Stability | Low | Adequate |

Typical complaints revolve around the inability to withdraw funds, which is a critical issue for any trader. In one instance, a user reported that they were unable to access their funds for several weeks, leading to frustration and distrust. While Renaissance Capital has made efforts to address these issues, the frequency of such complaints warrants caution for prospective clients.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Renaissance Capital's platform has received positive feedback for its user-friendly interface and range of functionalities. However, some users have reported instances of slippage and order rejections, which could impact trading outcomes.

It is essential for traders to assess the quality of trade execution, as delays or inaccuracies can lead to significant financial losses. Signs of potential platform manipulation, such as frequent slippage during high volatility periods, should be closely monitored. Overall, while the platform is functional, traders should remain vigilant regarding execution quality.

Risk Assessment

Using Renaissance Capital carries several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by CySEC, but complaints exist. |

| Withdrawal Issues | High | Frequent complaints about fund access. |

| Platform Reliability | Medium | Occasional slippage and execution issues. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and its functionalities. Additionally, maintaining a cautious approach to fund deposits and withdrawals can help safeguard against potential issues.

Conclusion and Recommendations

In conclusion, the question of Is Renaissance Capital safe? requires careful consideration of multiple factors. While the broker is regulated by CySEC, which provides a degree of legitimacy, the frequent complaints regarding withdrawal issues and customer support responsiveness raise significant concerns.

For traders considering Renaissance Capital, it is crucial to weigh the potential risks against the benefits of trading with a regulated broker. If you are a cautious trader or new to forex trading, it may be prudent to explore alternative brokers with stronger reputations for reliability and customer service. Some recommended alternatives include brokers regulated by top-tier authorities like the FCA or ASIC, which typically offer better investor protections and more favorable trading conditions.

Ultimately, conducting thorough research and staying informed will help traders make sound decisions in their trading journey.

Is Renaissance Capital a scam, or is it legit?

The latest exposure and evaluation content of Renaissance Capital brokers.

Renaissance Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Renaissance Capital latest industry rating score is 5.73, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.73 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.