OWM 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive owm review examines Oriental Wealth Markets Limited. OWM is a forex and CFD broker established in 2017 and registered in Vanuatu. Based on available information, OWM presents a mixed profile with both opportunities and concerns for potential traders. The broker offers trading services across multiple asset classes including forex, commodities, futures CFDs, and stock CFDs through the widely recognized MetaTrader 4 platform.

OWM's key strengths lie in its provision of diverse trading instruments and the utilization of MT4. This platform offers advanced charting tools and automated trading capabilities. The broker claims to provide fast execution speeds and aims to deliver an efficient trading experience for its users. However, significant transparency concerns emerge regarding regulatory oversight, as specific regulatory authority information and license numbers are not clearly disclosed in available materials.

The broker appears to target traders seeking a multi-asset trading environment with access to global markets. However, potential clients should exercise caution due to the lack of detailed information about trading conditions, customer service standards, and regulatory compliance. OWM explicitly avoids providing services in regions where such activities might violate local laws or regulations. This indicates awareness of compliance requirements but raises questions about operational transparency.

Important Notice

This OWM evaluation is based on publicly available information and company materials accessed during the review period. Traders should note that OWM operates from Vanuatu, established in 2017, but specific regulatory authority details are not prominently disclosed in available sources. The broker states it avoids operating in jurisdictions where such services might conflict with local regulations.

Our assessment methodology relies on available company information, industry standards, and publicly accessible data. However, comprehensive user feedback and detailed trading condition specifics were limited in the source materials. Potential clients should conduct independent verification of all trading terms, regulatory status, and service conditions before engaging with any broker. Trading conditions and company policies may vary by region and are subject to change.

Rating Overview

Broker Overview

Oriental Wealth Markets Limited commenced operations on May 7, 2017. OWM established itself as a forex and CFD trading service provider registered in Vanuatu. The company positions itself as a comprehensive trading solutions provider, offering access to global financial markets through electronic trading platforms. OWM's business model centers on facilitating forex and contracts for difference trading while maintaining a policy of avoiding service provision in regions where such activities might contravene local legal frameworks or regulatory requirements.

The broker's operational approach demonstrates awareness of international compliance considerations. However, specific regulatory partnerships and oversight mechanisms remain unclear in available documentation. OWM targets traders seeking exposure to multiple asset classes within a single trading environment, emphasizing technological efficiency and market access breadth as core value propositions.

The company utilizes the globally recognized MetaTrader 4 platform as its primary trading interface. This provides clients with access to advanced charting capabilities, technical analysis tools, and automated trading functionalities. OWM supports trading across diverse asset categories including major and minor currency pairs, precious metals, energy commodities, agricultural products, stock indices, and individual equity CFDs. This multi-asset approach aims to cater to traders with varying market interests and portfolio diversification strategies, though specific instrument counts and market coverage details require further clarification through direct broker consultation.

Regulatory Jurisdiction: OWM operates from Vanuatu registration, established in 2017. However, available materials do not specify particular regulatory authority oversight or license numbers. This creates transparency concerns for compliance-conscious traders.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available source materials. Traders require direct broker inquiry for clarification.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in accessible documentation. This necessitates direct contact with the broker for account opening requirements.

Promotional Offers: Available information does not detail current bonus structures, promotional campaigns, or incentive programs. These may be offered to new or existing clients.

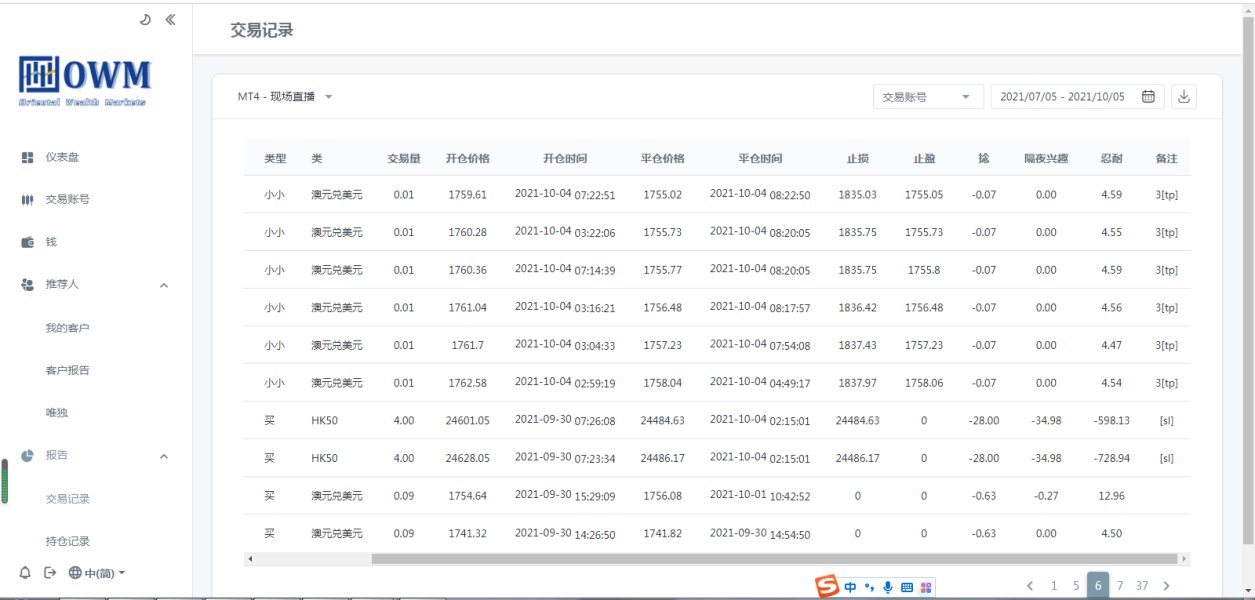

Tradeable Assets: OWM provides access to forex pairs, commodities including precious metals and energy products, futures CFDs across various markets, and stock CFDs covering global equity markets. However, exact instrument counts require verification.

Cost Structure: Specific spread ranges, commission rates, overnight financing charges, and other trading costs are not detailed in available materials. This represents a significant information gap for cost-conscious traders.

Leverage Ratios: Maximum leverage levels and margin requirements across different asset classes are not specified in accessible documentation.

Platform Options: The broker primarily utilizes MetaTrader 4. This supports both web-based and mobile device access for trading flexibility and market monitoring capabilities.

Regional Restrictions: OWM explicitly avoids providing services in jurisdictions where such activities might violate local regulations. However, specific restricted territories are not enumerated.

Customer Support Languages: Available language support for customer service communications is not specified in current owm review materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

OWM's account condition evaluation reveals significant information gaps that impact the overall assessment. The broker does not provide clear details about available account types, whether multiple tier structures exist, or what distinguishing features different accounts might offer. This lack of transparency makes it difficult for potential traders to understand what options are available and which account type might best suit their trading style and capital requirements.

The absence of minimum deposit information in available materials presents another concern for prospective clients. Without clear deposit thresholds, traders cannot effectively plan their account funding strategies or determine if the broker's requirements align with their available capital. Additionally, the account opening process details, required documentation, verification timelines, and approval procedures remain unclear in accessible sources.

Specialized account features such as Islamic accounts for Shariah-compliant trading, professional trader accounts with enhanced leverage, or managed account services are not mentioned in available documentation. The broker also does not specify whether demo accounts are available for strategy testing or platform familiarization. This represents a standard industry offering expectation.

The evaluation of account conditions is further hampered by the absence of user feedback regarding account setup experiences, funding processes, or ongoing account management satisfaction. Without this crucial user perspective, it becomes challenging to assess the practical reality of OWM's account services beyond company claims. This owm review must therefore assign a moderate score pending more comprehensive account condition transparency from the broker.

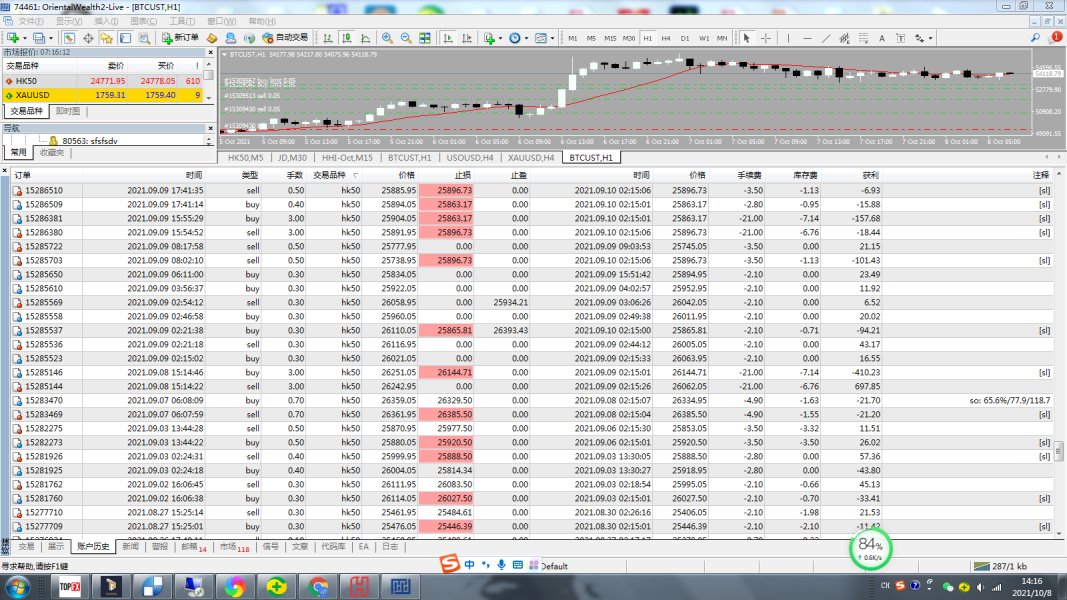

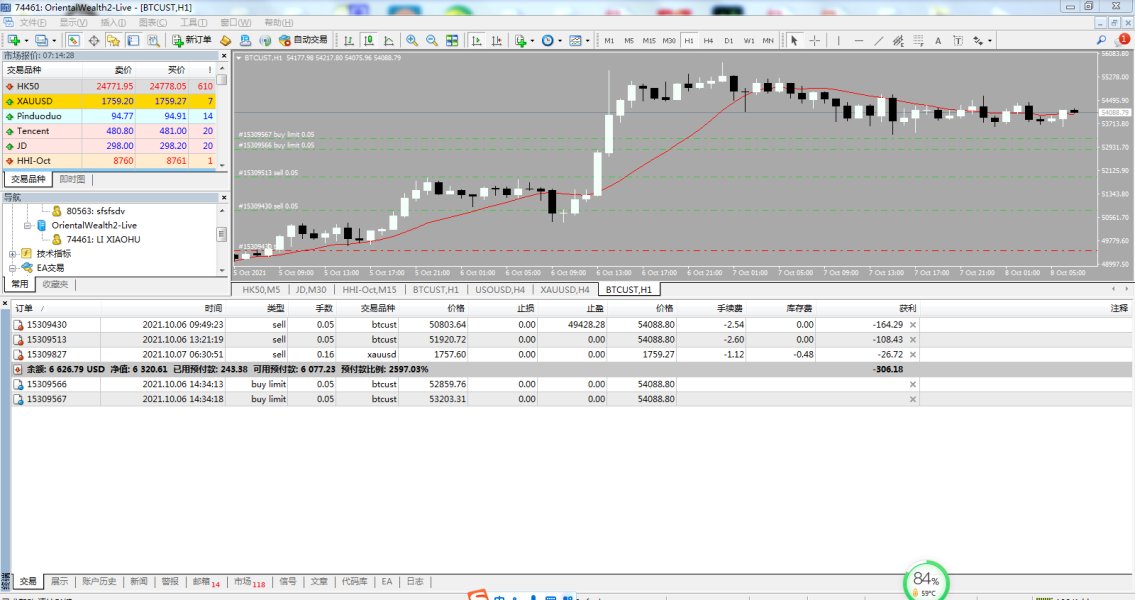

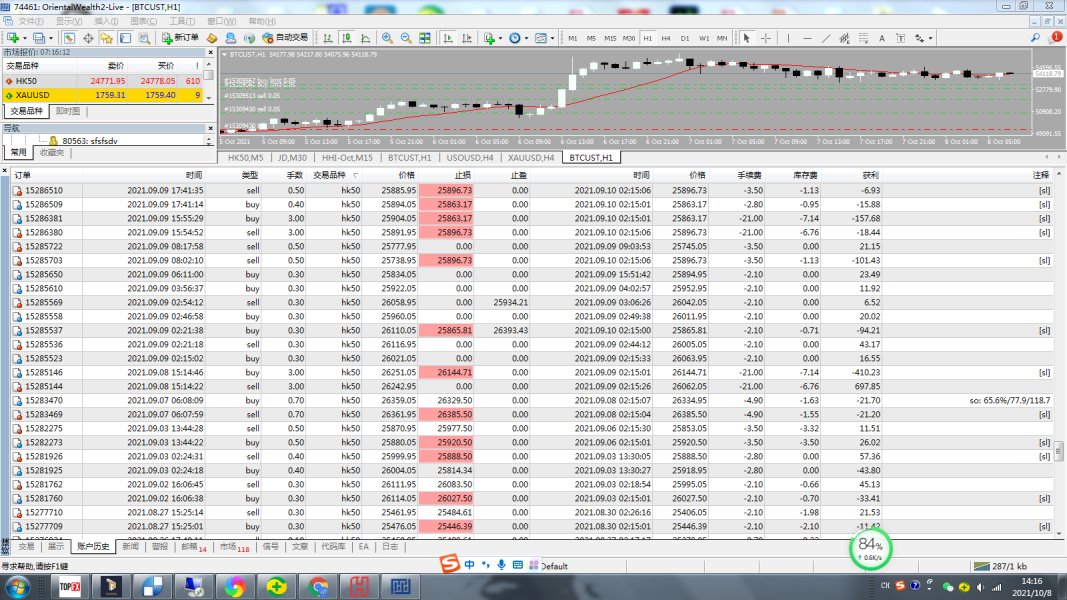

OWM demonstrates stronger performance in the tools and resources category primarily through its adoption of the MetaTrader 4 platform. MT4 represents an industry-standard trading interface offering comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and customizable interface options. This platform choice provides traders with access to advanced order types, multiple timeframe analysis, and extensive technical indicator libraries that support various trading strategies.

The broker's multi-asset offering enhances the tools category by providing access to forex, commodities, futures CFDs, and stock CFDs within a single platform environment. This diversity allows traders to pursue cross-market opportunities and portfolio diversification strategies without requiring multiple broker relationships. The platform's capability to handle different asset classes efficiently represents a significant operational advantage for active traders.

However, the tools and resources evaluation is limited by the absence of information about additional educational resources, market research provisions, economic calendar integration, or proprietary analysis tools. Many competitive brokers supplement platform capabilities with daily market commentary, webinar series, trading tutorials, or fundamental analysis reports. The lack of detail about such supplementary resources in available materials suggests either their absence or insufficient marketing communication about these offerings.

Automated trading support through MT4's Expert Advisor functionality provides algorithmic trading capabilities. However, specific restrictions, optimization tools, or broker-provided trading signals are not detailed. The platform's mobile accessibility ensures traders can monitor positions and execute trades remotely, supporting the modern trader's flexibility requirements.

Customer Service and Support Analysis (Score: 5/10)

The customer service evaluation for OWM faces significant limitations due to insufficient information about support infrastructure, communication channels, and service quality standards. Available materials do not specify whether the broker offers phone support, live chat functionality, email ticketing systems, or other communication methods that traders might require for assistance with account issues, technical problems, or trading inquiries.

Response time expectations, support availability hours, and service level commitments remain unclear in accessible documentation. For international traders operating across different time zones, understanding support availability becomes crucial for effective problem resolution. The absence of specific customer service hour information or regional support coverage details creates uncertainty about assistance accessibility when needed.

Language support capabilities represent another information gap in the customer service assessment. Given OWM's international positioning and multi-jurisdictional trader base, multilingual support would typically be expected, but specific language offerings are not detailed in available materials. This lack of clarity could impact non-English speaking traders' ability to receive effective assistance.

The evaluation is further constrained by the absence of user feedback regarding actual customer service experiences. User testimonials about response quality, problem resolution effectiveness, staff knowledge levels, and overall satisfaction with support interactions would provide valuable insights into service reality versus company claims. Without such feedback, this owm review cannot provide definitive assessments of customer service quality.

Training and onboarding support for new traders, platform tutorials, or dedicated account management services are not mentioned in available sources. This represents potential service gaps compared to full-service broker offerings in the competitive marketplace.

Trading Experience Analysis (Score: 6/10)

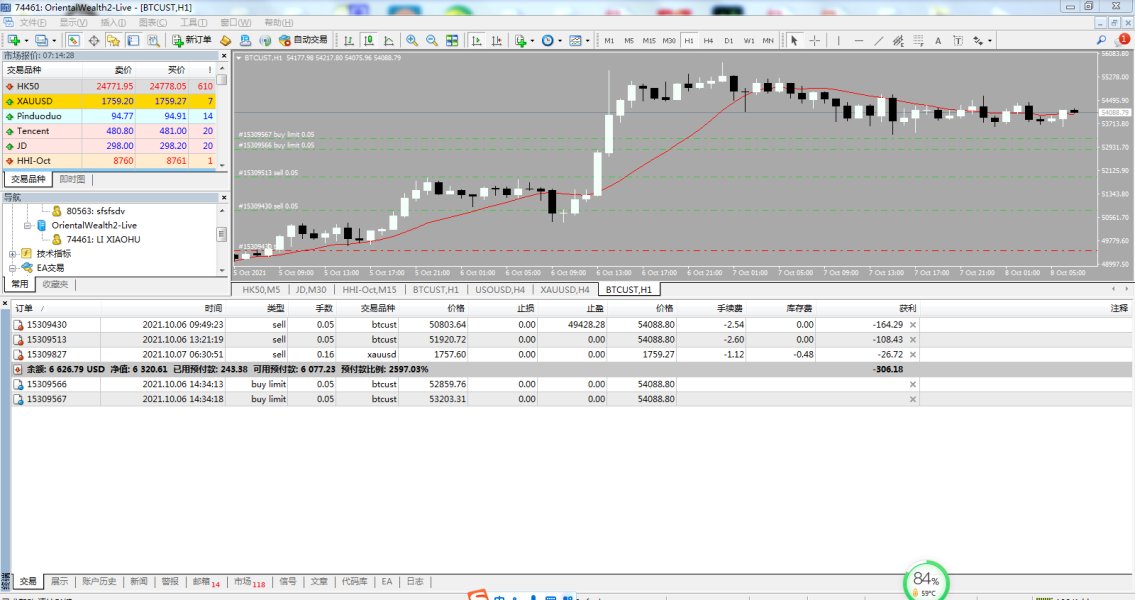

OWM's trading experience assessment centers on the broker's claims of fast execution speeds and user-friendly platform interface. However, independent verification of these performance claims is not available in source materials. The utilization of MetaTrader 4 provides a solid foundation for trading experience, offering stable platform architecture, comprehensive order management tools, and reliable market connectivity that many traders find familiar and efficient.

Platform stability and performance represent crucial factors for active trading, particularly during high-volatility market periods when rapid order execution becomes essential. While OWM emphasizes fast execution capabilities, specific performance metrics such as average execution speeds, slippage statistics, or uptime reliability data are not provided in available documentation. This information gap makes it difficult to verify execution quality claims against measurable standards.

Order execution quality extends beyond speed to include factors such as price improvement opportunities, requote frequency, and fill reliability across different market conditions. The broker's execution model, whether market maker, STP, or ECN, is not clearly specified in available materials. This impacts understanding of potential execution advantages or limitations that different models might present.

Mobile trading capabilities through MT4's mobile applications support trading flexibility and market monitoring from various locations. However, specific mobile platform features, performance optimization, or unique mobile-only functionalities are not detailed in accessible sources. The trading experience evaluation would benefit from user feedback about mobile platform reliability and feature completeness compared to desktop versions.

Market depth information, advanced order types availability, and trading automation capabilities through Expert Advisors provide additional trading experience dimensions. However, specific limitations or enhancements to standard MT4 functionality are not described. This owm review assigns a moderate score reflecting platform strengths while acknowledging verification limitations.

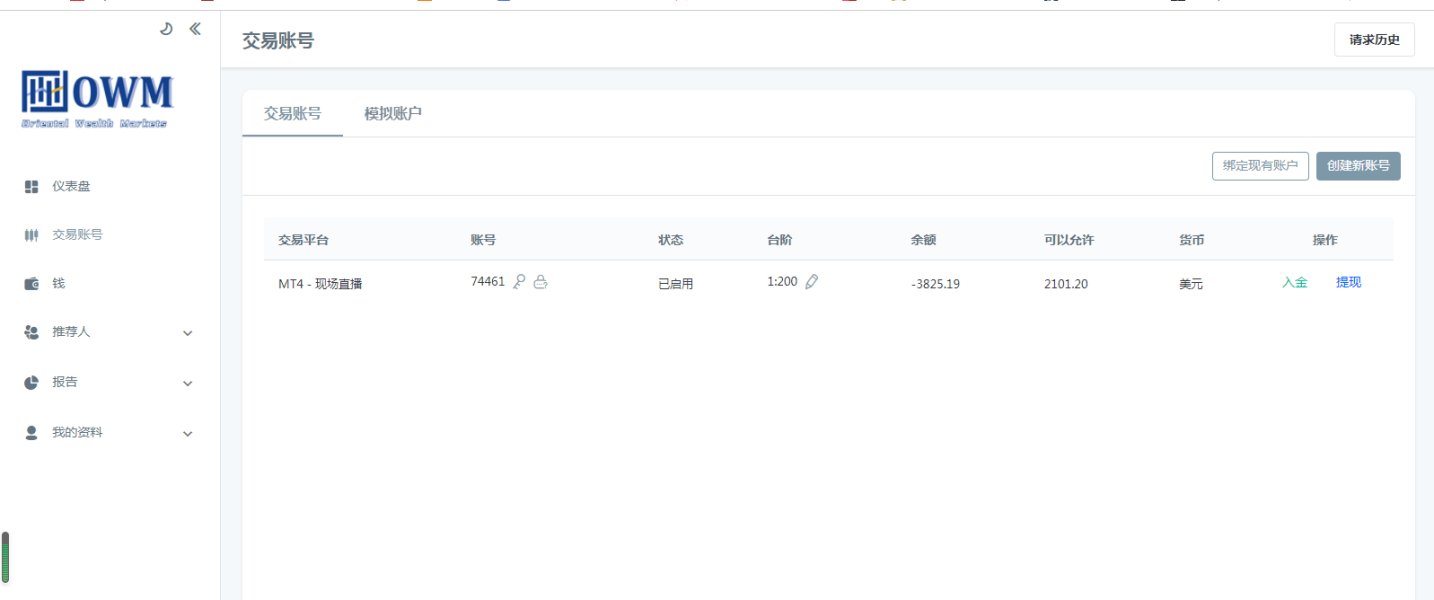

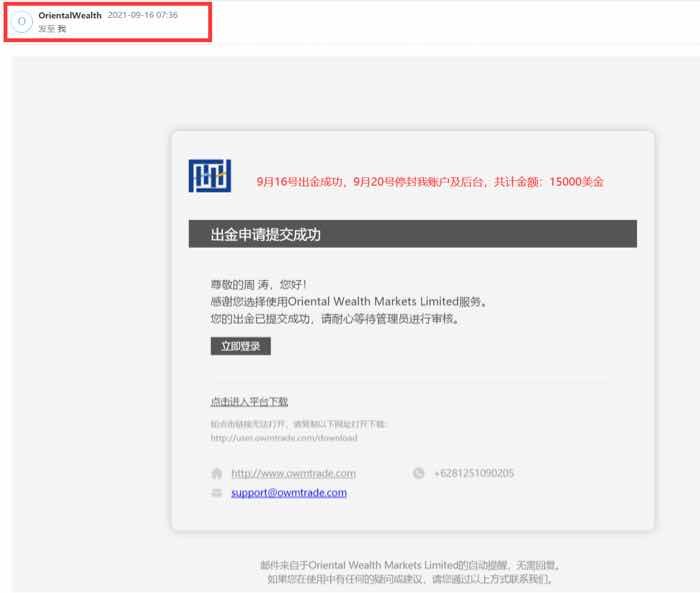

Trust and Regulation Analysis (Score: 4/10)

The trust and regulation assessment for OWM reveals significant concerns that impact overall broker credibility and trader confidence. The most notable issue is the absence of specific regulatory authority information and license numbers in available documentation. While the broker is registered in Vanuatu and established in 2017, clear regulatory oversight details that would typically reassure traders about compliance standards and investor protection measures are not prominently disclosed.

Regulatory transparency represents a fundamental aspect of broker trustworthiness. Proper oversight provides traders with recourse mechanisms, compensation schemes, and operational standards enforcement. The lack of specific regulatory authority partnerships or license verification information creates uncertainty about the broker's compliance framework and the protections available to client funds and trading activities.

Fund security measures, client money segregation policies, and deposit protection arrangements are not detailed in available materials. These elements typically form the cornerstone of trader confidence in broker relationships, as they directly impact capital safety and recovery possibilities in adverse scenarios. Without clear information about fund handling procedures and security protocols, traders cannot adequately assess their capital protection levels.

Company transparency regarding ownership structure, financial stability, operational history, and any regulatory actions or industry recognition is limited in accessible sources. Third-party verification of company claims, independent audits, or industry certifications that might support credibility assessments are not mentioned in available documentation.

The broker's policy of avoiding service provision in regions where activities might violate local regulations demonstrates compliance awareness. However, this cautious approach also raises questions about regulatory clarity and operational transparency. Without comprehensive regulatory disclosure, this trust evaluation must reflect the inherent risks associated with limited oversight visibility.

User Experience Analysis (Score: 5/10)

The user experience evaluation for OWM faces substantial limitations due to the scarcity of actual user feedback and testimonials in available source materials. Without comprehensive user reviews, satisfaction surveys, or community feedback, it becomes challenging to assess the practical reality of trading with OWM beyond company marketing claims and platform specifications.

Interface design and usability assessments rely primarily on the MetaTrader 4 platform's established user experience. This generally provides intuitive navigation, customizable layouts, and comprehensive functionality. However, any broker-specific customizations, additional tools, or unique interface enhancements that might differentiate OWM's offering from standard MT4 implementations are not detailed in accessible documentation.

The registration and account verification process experience remains unclear due to insufficient information about required documentation, approval timelines, identity verification procedures, and onboarding support. New trader experience often depends significantly on smooth account setup processes, but without user feedback about actual experiences, this aspect cannot be adequately evaluated.

Funding and withdrawal experience represents another crucial user experience component where information gaps exist. Processing times, fee structures, payment method reliability, and customer support quality during financial transactions directly impact overall satisfaction but are not detailed in available materials.

Common user concerns, frequently asked questions, or typical support issues that might arise during the trading relationship are not documented in accessible sources. Understanding recurring user challenges and the broker's response effectiveness would provide valuable insights into the practical user experience reality.

The absence of user rating aggregations, testimonial collections, or independent review platform feedback limits this evaluation to theoretical assessments based on platform capabilities rather than verified user satisfaction data.

Conclusion

This comprehensive owm review reveals a broker with mixed characteristics that present both opportunities and concerns for potential traders. OWM demonstrates strengths in platform selection through MetaTrader 4 adoption and multi-asset trading capability. This provides traders with access to forex, commodities, futures CFDs, and stock CFDs within a single trading environment. The broker's establishment since 2017 indicates operational longevity, while its cautious approach to regional compliance suggests awareness of regulatory requirements.

However, significant transparency gaps limit the ability to provide a fully positive assessment. The absence of clear regulatory authority information, specific trading conditions, comprehensive customer service details, and user feedback creates uncertainty about the broker's operational standards and trader protection measures. These information limitations are particularly concerning for traders who prioritize regulatory oversight and transparent operating conditions.

OWM may be suitable for traders seeking multi-asset trading opportunities who are less sensitive to regulatory transparency concerns and comfortable with conducting additional due diligence before account opening. However, traders prioritizing comprehensive regulatory protection, detailed cost transparency, and verified user experiences should consider these limitations carefully. The broker's moderate overall assessment reflects both its platform capabilities and the significant information gaps that impact confidence in its service delivery standards.