Regarding the legitimacy of Oriental Wealth Markets forex brokers, it provides VFSC and WikiBit, .

Is Oriental Wealth Markets safe?

Software Index

Risk Control

Is Oriental Wealth Markets markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

ORIENTAL WEALTH MARKETS LIMITED

Effective Date:

2023-04-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is OWM Safe or a Scam?

Introduction

Oriental Wealth Markets (OWM) is a forex broker that has positioned itself in the competitive landscape of online trading, offering a range of financial instruments including forex, commodities, CFDs, and cryptocurrencies. As the forex market is rife with opportunities, it also presents significant risks, making it imperative for traders to carefully assess the brokers they choose. The potential for loss, coupled with the prevalence of scams in the trading industry, underscores the need for thorough due diligence. In this article, we will explore whether OWM is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the forex industry, providing traders with a level of security and oversight. OWM claims to be regulated by the Vanuatu Financial Services Commission (VFSC), but the validity of this claim is questionable. The lack of stringent regulatory oversight raises concerns about the brokers legitimacy. Below is a summary of OWM's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 40299 | Vanuatu | Unverified |

The VFSC is known for its lenient regulatory framework, which often attracts brokers looking to operate with minimal oversight. This situation can lead to inadequate protection for traders, making it essential to approach OWM with caution. The absence of a robust regulatory framework could be a significant red flag for potential investors. As we analyze the broker further, we will delve into the implications of this regulatory status on the safety of funds and overall trading experience.

Company Background Investigation

OWM was established in 2017 and is headquartered in Port Vila, Vanuatu. The company operates with a relatively short history in the forex trading landscape. Its ownership structure and management team are not well-documented, which raises concerns about transparency. A lack of clear information regarding the companys leadership can lead to questions about accountability and trustworthiness.

The management team‘s professional background is crucial in assessing the broker’s reliability. While OWM claims to offer a professional trading environment, the absence of publicly available information on the qualifications and experience of its executives creates uncertainty. Transparency in operations and governance is a critical factor for traders when determining if OWM is safe or a scam.

Furthermore, the information disclosure level regarding the companys financial health and operational practices is limited. This lack of transparency can hinder potential clients from making informed decisions about their investments. Overall, while OWM presents itself as a legitimate trading platform, the insufficient transparency surrounding its ownership and management raises concerns.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. OWM provides various account types with differing minimum deposit requirements and leverage options. However, traders should be aware of the overall fee structure and any unusual charges that may apply. Below is a comparison of OWMs core trading costs:

| Fee Type | OWM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips (ECN) | 1.0 pips |

| Commission Model | None (Standard) | Varies |

| Overnight Interest Range | Varies | Varies |

The fee structure appears competitive, particularly with low spreads on ECN accounts. However, the absence of a demo account raises concerns, as potential traders cannot test the platform before committing funds. Additionally, OWM's minimum deposit requirement of $3,000 for ECN accounts is significantly higher than the industry average, which may deter novice traders.

Traders should also investigate any hidden fees, such as withdrawal or inactivity charges, which can impact overall profitability. The lack of clarity regarding the complete fee structure can lead to unexpected costs, further complicating the assessment of whether OWM is safe or a scam.

Customer Fund Safety

Customer fund safety is paramount in the trading industry. OWM claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Segregated accounts are designed to keep client funds separate from the broker's operational funds, providing an additional layer of security. However, the lack of robust regulatory oversight means that enforcement of such measures may not be guaranteed. Furthermore, the absence of any investor protection schemes raises concerns about the safety of client funds in the event of the broker's insolvency.

Historically, there have been reports of clients facing difficulties in withdrawing their funds, which is a significant warning sign. Such incidents can indicate deeper issues within the broker's operational practices. Therefore, it is crucial for potential clients to consider these factors when determining if OWM is safe or a scam.

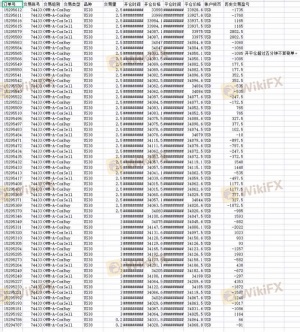

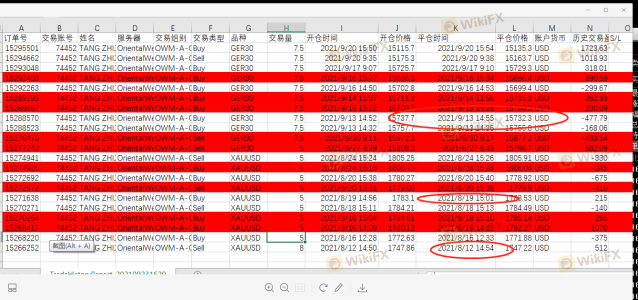

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. OWM has received mixed reviews from clients, with many expressing concerns about withdrawal difficulties and customer support responsiveness. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Account Blocking | High | Unresolved |

| Poor Customer Support | Medium | Inconsistent |

Common complaints include reports of clients being unable to withdraw their profits or facing account restrictions after achieving significant gains. Such issues are alarming and can be indicative of a broker's unwillingness to facilitate legitimate transactions.

One notable case involved a trader who reported a blocked account after making substantial profits, further highlighting the potential risks associated with trading through OWM. These patterns of customer dissatisfaction raise critical questions about whether OWM is safe or a scam.

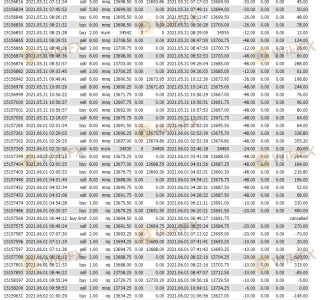

Platform and Execution

The trading platform offered by OWM is the widely-used MetaTrader 4 (MT4), known for its user-friendly interface and comprehensive trading tools. However, the platform's performance and execution quality are crucial in determining the overall trading experience. Traders have reported mixed experiences regarding order execution, slippage, and rejections.

While MT4 generally provides a stable trading environment, any signs of manipulation or excessive slippage can severely impact a trader's profitability. Traders should be cautious of any discrepancies between the expected and actual execution prices, as these can indicate underlying issues with the broker's practices.

Overall, while OWM utilizes a reputable trading platform, the execution quality and potential for manipulation should be scrutinized when considering if OWM is safe or a scam.

Risk Assessment

Using OWM presents several risks that traders should be aware of. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulation raises concerns. |

| Fund Safety Risk | High | Reports of withdrawal issues and account restrictions. |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness. |

Traders should consider implementing risk mitigation strategies, such as limiting exposure and conducting thorough research before committing funds. Engaging with regulated brokers can significantly reduce these risks, providing a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that OWM presents several significant red flags that warrant caution. The lack of robust regulation, combined with numerous reports of withdrawal difficulties and poor customer service, raises serious concerns about the broker's legitimacy. Therefore, it is crucial for traders to exercise due diligence and consider alternative options when looking for a forex broker.

For those seeking a safer trading environment, it may be advisable to explore well-regulated brokers with a proven track record of transparency and customer satisfaction. Ultimately, while OWM may offer competitive trading conditions, the potential risks associated with its operations make it essential for traders to carefully evaluate their options before investing.

In summary, is OWM safe? The consensus leans towards caution, as the combination of regulatory concerns, customer complaints, and potential risks suggests that OWM may not be the safest choice for traders.

Is Oriental Wealth Markets a scam, or is it legit?

The latest exposure and evaluation content of Oriental Wealth Markets brokers.

Oriental Wealth Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oriental Wealth Markets latest industry rating score is 3.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.