Oroku Edge 2025 Review: Everything You Need to Know

Executive Summary

This Oroku Edge review shows a complete analysis of a broker that has gotten lots of negative attention in the forex trading community. Oroku Edge was started in 2021 and has its headquarters in Saint Vincent and the Grenadines, where it works as an online forex broker under SVGFSA registration. But this registration gives very little regulatory oversight, since the SVGFSA clearly warns that forex activities are not regulated locally.

The broker's reputation has been badly hurt by many independent reviews that call it unreliable or possibly fraudulent. User feedback always points out concerns about transparency, customer service quality, and overall trustworthiness. Oroku Edge claims to offer forex trading services, but the lack of detailed information about trading conditions, platform specs, and cost structures creates big red flags for potential users.

Our analysis shows that Oroku Edge mainly targets people who want forex trading opportunities. However, the overwhelming negative feedback and regulatory concerns make it wrong for traders who care about safety and reliability. The platform's website currently supports only English, which might limit access for non-English speaking users. Given the many warnings from industry experts and negative user experiences documented across multiple review platforms, potential clients should be extremely careful when considering this broker.

Important Notice

Regional Entity Differences: Oroku Edge operates under registration with the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). However, you need to understand that this jurisdiction does not provide comprehensive regulatory oversight for forex activities. The SVGFSA itself warns that forex trading is not regulated locally, which means traders have limited options if disputes or issues happen.

Review Methodology: This evaluation uses publicly available information, user feedback from multiple platforms, and regulatory data. Our assessment does not include direct trading experience with the platform, but it relies on documented user experiences and industry expert analyses to give an objective overview of the broker's services and reputation.

Rating Framework

Broker Overview

Oroku Edge entered the forex brokerage market in 2021. It positioned itself as an online trading platform focused mainly on foreign exchange services. The company operates from Saint Vincent and the Grenadines, which is a jurisdiction known for its relatively lenient regulatory environment for financial services. Despite being recently established, the broker has quickly gained attention—unfortunately, much of it negative—within the trading community.

The company's business model centers around providing forex trading services to retail clients, though specific details about their operational structure remain largely undisclosed. According to multiple industry sources, Oroku Edge has struggled to establish credibility within the competitive forex brokerage landscape, with several independent review platforms raising concerns about its legitimacy and operational practices.

Regarding regulatory compliance, while Oroku Edge claims registration with the SVGFSA, this registration provides minimal protection for traders. The regulatory framework in Saint Vincent and the Grenadines does not include specific oversight mechanisms for forex trading activities, which leaves clients with limited recourse if disputes happen. This Oroku Edge review emphasizes that the lack of robust regulatory protection represents a significant risk factor for potential users considering the platform for their trading activities.

The broker's target market appears to be retail forex traders seeking accessible trading opportunities. However, the absence of detailed information about trading conditions, platform capabilities, and company background has contributed to widespread skepticism about the platform's legitimacy and reliability within the trading community.

Regulatory Jurisdiction: Oroku Edge operates under registration with the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). However, this jurisdiction clearly states that forex activities are not subject to local regulation, which provides minimal protection for traders.

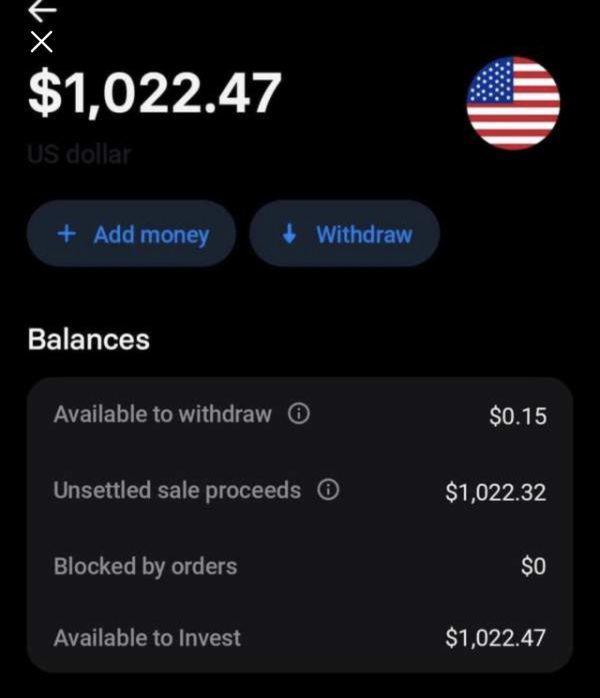

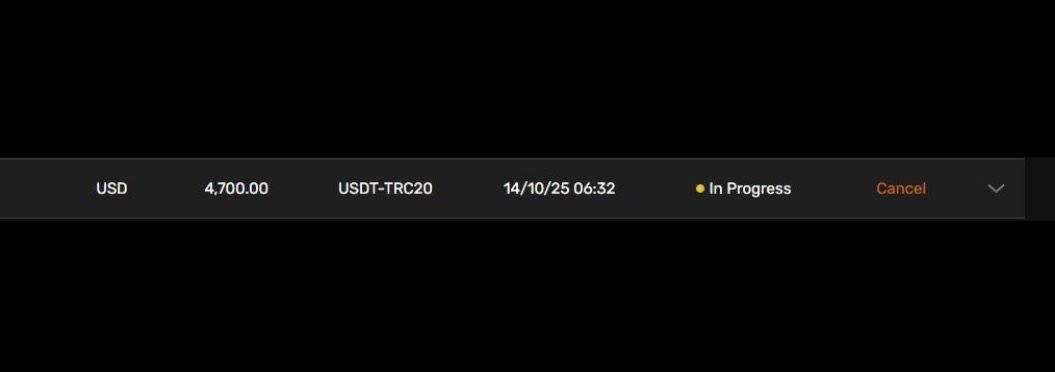

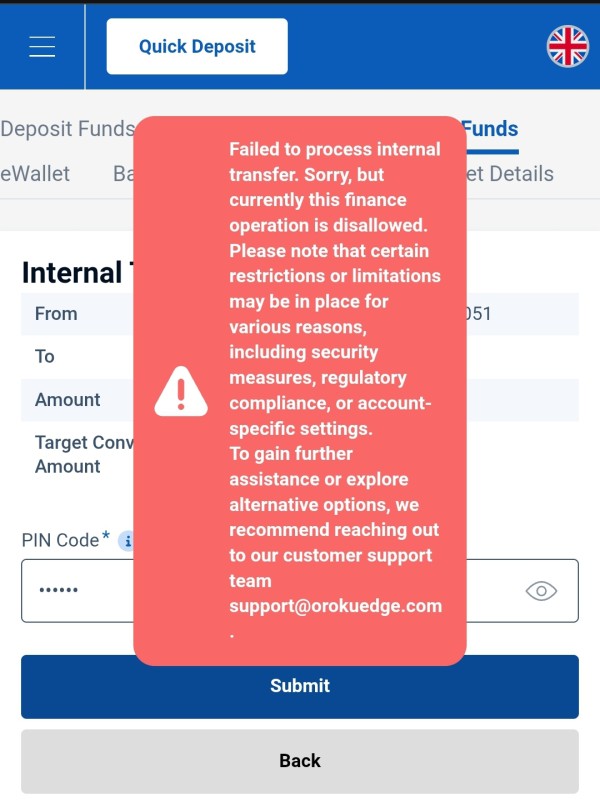

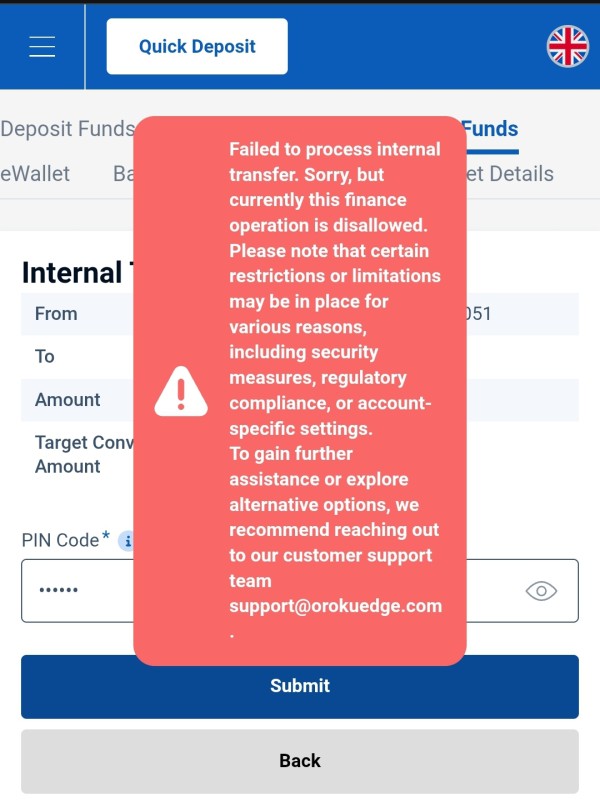

Deposit and Withdrawal Methods: Available information does not specify the deposit and withdrawal options offered by Oroku Edge. This lack of transparency regarding payment methods represents a significant concern for potential users seeking clarity about fund management procedures.

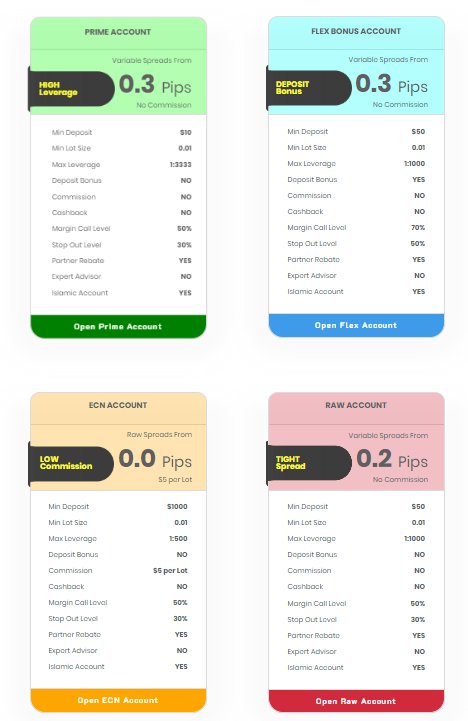

Minimum Deposit Requirements: The specific minimum deposit amount required to open an account with Oroku Edge is not disclosed in available documentation. This contributes to the overall lack of transparency surrounding the platform's terms and conditions.

Bonus and Promotional Offers: Current available information does not mention any specific bonus programs or promotional offers provided by Oroku Edge to new or existing clients.

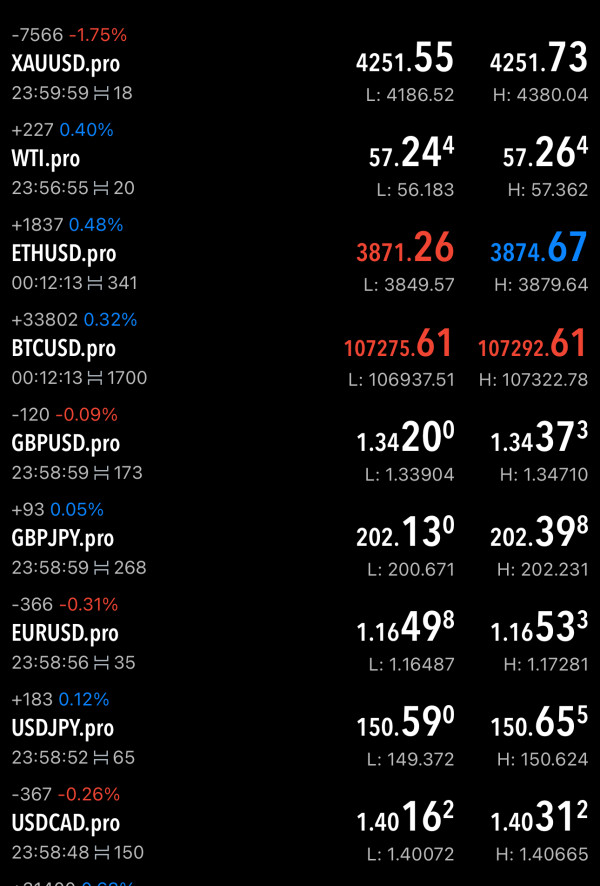

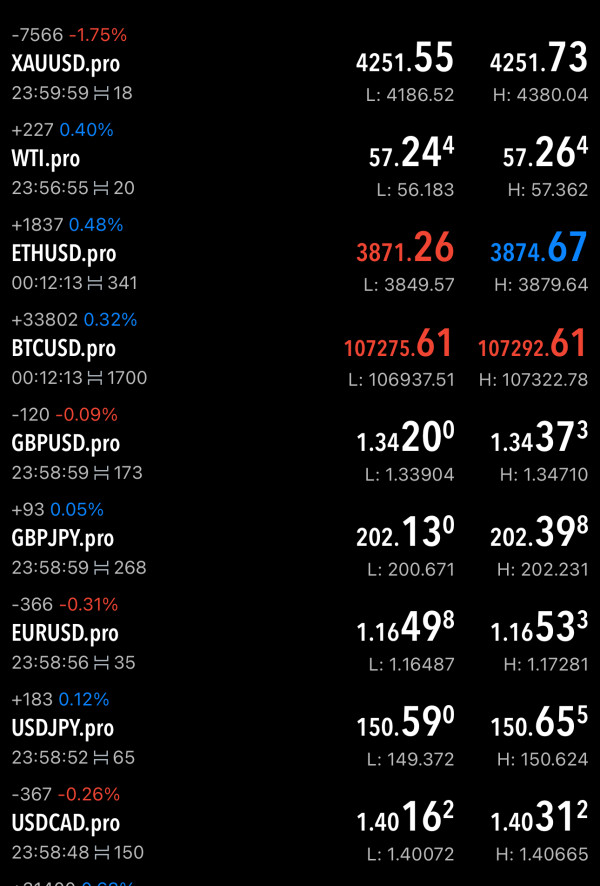

Tradeable Assets: Oroku Edge primarily focuses on forex trading services. However, detailed information about specific currency pairs, exotic options, or additional asset classes remains undisclosed in publicly available materials.

Cost Structure: Critical pricing information including spreads, commission rates, overnight fees, and other trading costs are not transparently disclosed. This makes it impossible for traders to accurately assess the platform's competitiveness in terms of trading expenses.

Leverage Options: The maximum leverage ratios offered by Oroku Edge are not specified in available documentation. This prevents potential users from understanding the risk parameters associated with trading on the platform.

Platform Selection: Information regarding the specific trading platforms supported by Oroku Edge is not available in current documentation. This includes whether they offer MetaTrader 4, MetaTrader 5, or proprietary solutions.

Geographic Restrictions: Specific information about countries or regions where Oroku Edge services are restricted or prohibited is not clearly outlined in available materials.

Customer Support Languages: While the platform website currently supports English only, information about additional language support for customer service interactions is not specified. This Oroku Edge review notes that the English-only interface may create barriers for non-English speaking traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Oroku Edge present significant transparency concerns that contribute to its poor rating in this category. Available documentation fails to specify crucial details about account types, minimum deposit requirements, or specific features that differentiate various account tiers. This lack of clarity makes it extremely difficult for potential clients to make informed decisions about whether the platform meets their trading needs.

The absence of information regarding account opening procedures, required documentation, or verification processes raises additional red flags about the platform's operational standards. Industry-standard features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or premium account tiers with enhanced benefits are not mentioned in available materials.

User feedback consistently highlights confusion about account terms and conditions. Several traders report unexpected restrictions or unclear fee structures that were not adequately disclosed during the account opening process. The lack of transparent communication about account features and limitations significantly undermines user confidence and contributes to the platform's poor reputation.

Compared to established brokers in the industry, Oroku Edge's approach to account condition disclosure falls well below acceptable standards. Reputable brokers typically provide detailed comparison charts, clear fee schedules, and comprehensive terms of service that allow traders to make informed decisions. This Oroku Edge review emphasizes that the platform's failure to meet these basic transparency standards represents a significant disadvantage for potential users.

The tools and resources category represents one of Oroku Edge's weakest areas. Virtually no information is available about trading tools, analytical resources, or educational materials. This absence of essential trading infrastructure severely limits the platform's appeal to both novice and experienced traders who rely on comprehensive analytical tools to make informed trading decisions.

Available documentation does not mention the availability of technical analysis tools, economic calendars, market news feeds, or research reports that are considered standard offerings among reputable forex brokers. The lack of educational resources such as trading guides, webinars, or tutorial materials particularly disadvantages new traders who require guidance to develop their trading skills effectively.

User feedback indicates frustration with the limited functionality and absence of professional-grade tools that are typically expected from modern forex trading platforms. Several reviews mention the lack of advanced charting capabilities, automated trading support, or risk management tools that experienced traders consider essential for effective trading operations.

The absence of third-party integrations, such as trading signal services, copy trading platforms, or advanced analytical software, further compounds the platform's limitations in this area. Industry-leading brokers typically offer extensive tool ecosystems that enhance the trading experience and provide users with competitive advantages in the market.

Customer Service and Support Analysis (Score: 4/10)

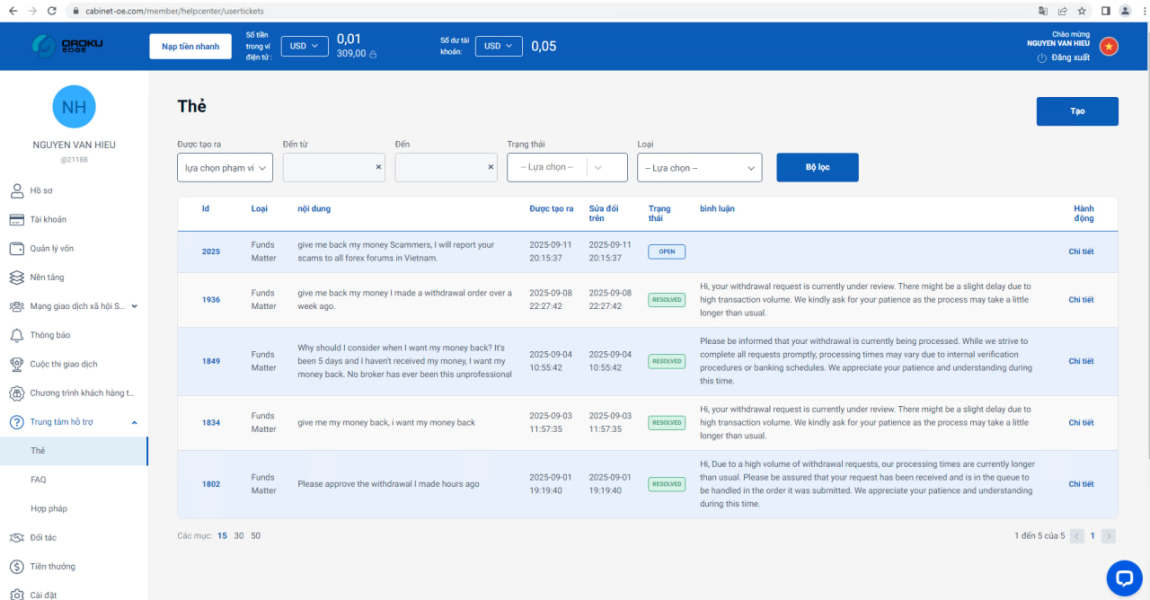

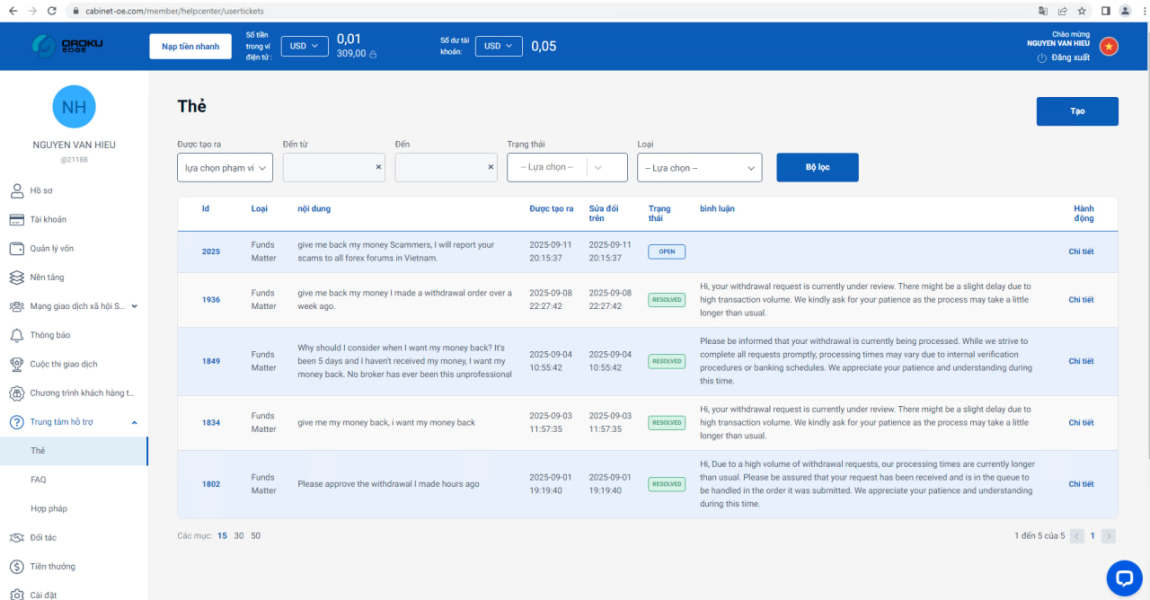

Customer service quality at Oroku Edge has received mixed feedback from users, with many reporting substandard support experiences that fail to meet industry expectations. While the platform provides basic contact methods including phone, email, and web forms, the effectiveness and responsiveness of these channels have been questioned by multiple user reviews.

Response times for customer inquiries appear to be inconsistent. Some users report delays of several days before receiving replies to urgent questions about account issues or trading problems. The quality of support responses has also been criticized, with users mentioning generic replies that fail to address specific concerns or provide actionable solutions.

The platform's customer support currently operates primarily in English, which may create barriers for traders who prefer assistance in their native languages. This limitation can be particularly problematic when dealing with complex technical issues or urgent account matters that require clear communication.

According to user feedback, the customer service team often lacks the technical expertise needed to resolve platform-specific issues or provide detailed explanations about trading conditions. Several reviews mention instances where support representatives provided conflicting information or were unable to escalate issues to appropriate technical teams for resolution.

Trading Experience Analysis (Score: 3/10)

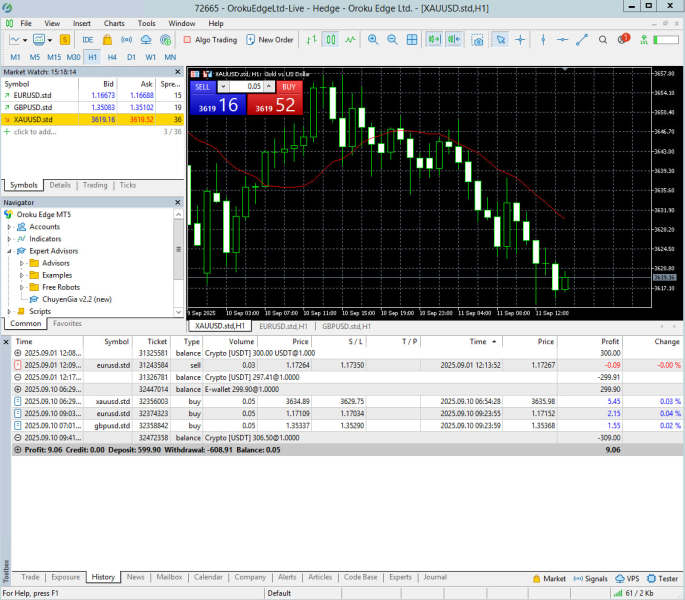

The trading experience on Oroku Edge has been characterized by significant concerns about platform stability, execution quality, and overall functionality. User feedback consistently highlights issues with order execution, including slippage problems and delays that can negatively impact trading performance, particularly during high volatility market conditions.

Platform stability appears to be a recurring issue. Several users report unexpected disconnections, system freezes, or inability to access accounts during critical trading periods. These technical problems can result in missed trading opportunities or, worse, inability to manage existing positions during adverse market movements.

The absence of detailed information about execution methods, whether the broker operates as a market maker or uses straight-through processing, creates uncertainty about potential conflicts of interest and execution quality. Transparent brokers typically provide clear information about their execution model and average execution speeds to help traders understand what to expect.

Mobile trading capabilities and cross-platform synchronization features are not well documented, which limits traders' ability to manage positions effectively when away from their primary trading stations. This Oroku Edge review notes that modern traders increasingly rely on mobile access for position management and market monitoring, making these limitations particularly problematic.

User reviews frequently mention concerns about the platform's interface design and user-friendliness. Several traders report difficulty navigating basic functions or accessing essential trading features efficiently.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent the most critical weakness in Oroku Edge's service offering. Multiple independent sources raise serious concerns about the platform's legitimacy and operational integrity. The broker's registration with SVGFSA provides minimal regulatory protection, as this jurisdiction explicitly states that forex activities are not subject to local regulatory oversight.

The company's transparency regarding corporate structure, ownership, and operational procedures is severely lacking. Essential information such as detailed company registration documents, management team backgrounds, or audited financial statements are not readily available, which makes it impossible for potential clients to verify the platform's legitimacy and financial stability.

Multiple review platforms and industry watchdogs have flagged Oroku Edge as potentially unreliable or fraudulent. Some sources explicitly warn traders to avoid the platform. These warnings are based on user complaints, operational irregularities, and the absence of proper regulatory oversight that would typically protect client interests.

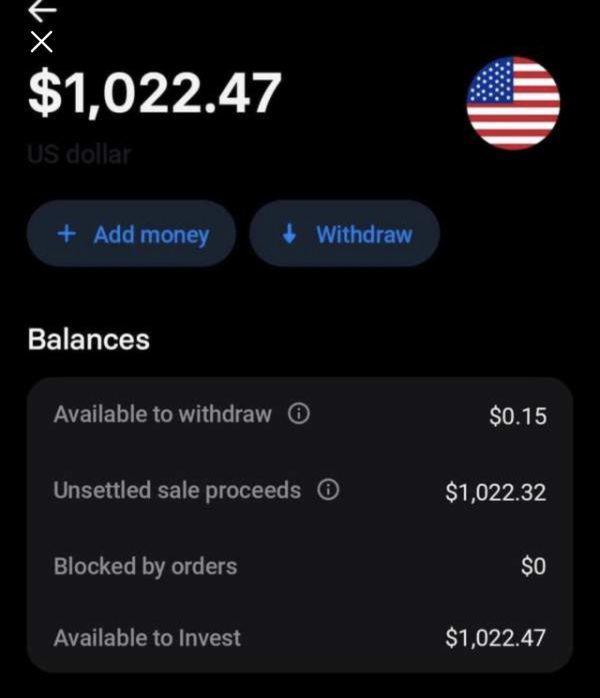

Fund security measures, such as segregated client accounts, deposit insurance, or third-party fund management, are not documented or verified through independent sources. This lack of financial protection mechanisms represents a significant risk for traders considering depositing funds with the platform.

The broker's handling of negative publicity and user complaints has been inadequate, with limited evidence of proactive measures to address legitimate concerns or improve operational standards based on user feedback.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Oroku Edge remains predominantly negative. User reviews consistently highlight significant issues across multiple aspects of the trading experience. The platform's interface design and usability have been criticized for lacking intuitive navigation and modern functionality that traders expect from contemporary trading platforms.

Registration and account verification processes have been reported as unnecessarily complicated or unclear. Some users experience extended delays in account activation or document verification procedures. These administrative inefficiencies create frustration and may indicate broader operational problems within the organization.

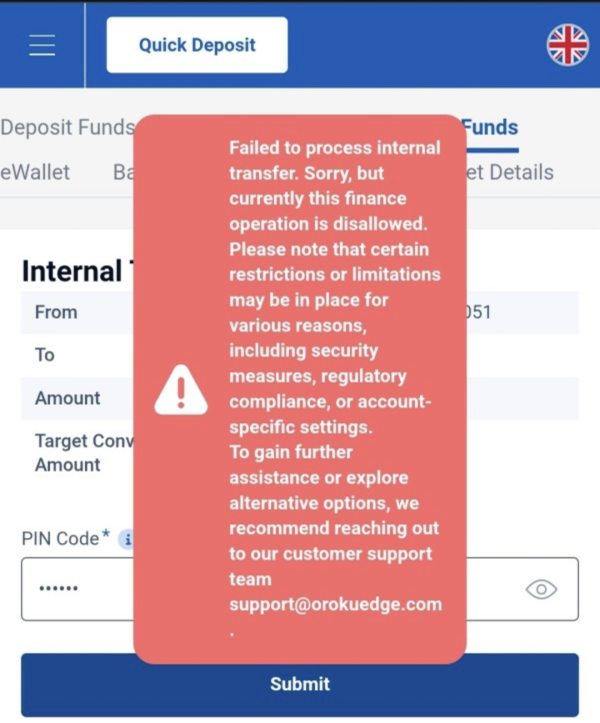

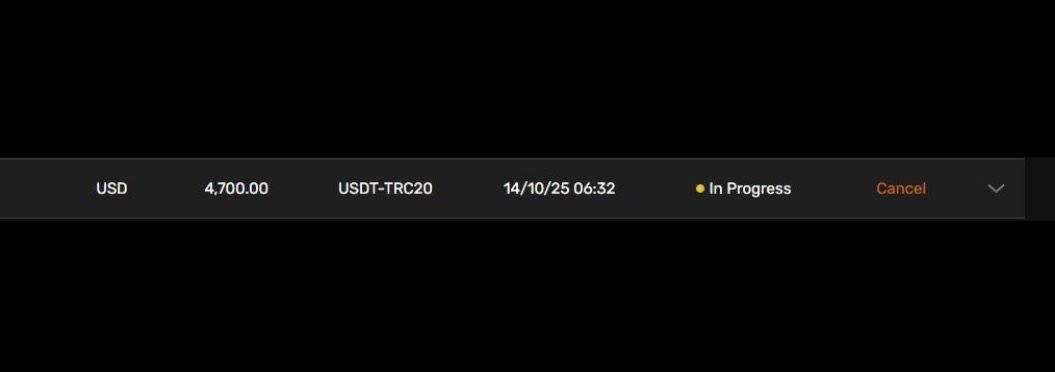

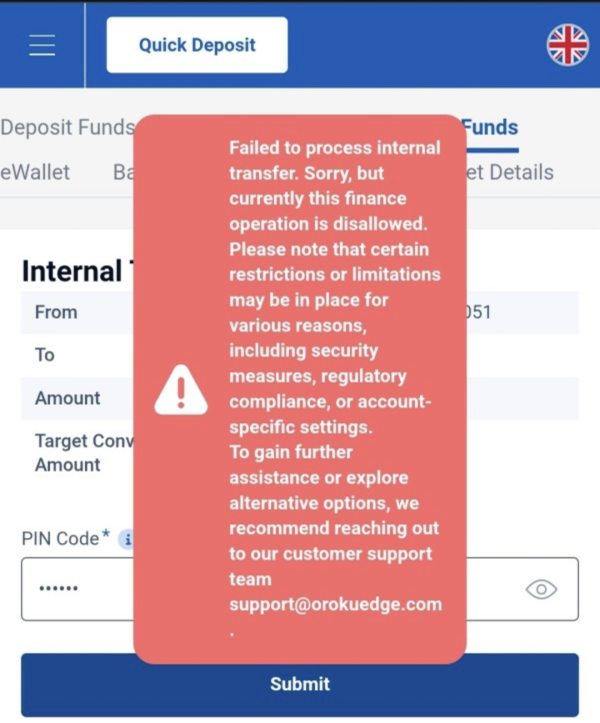

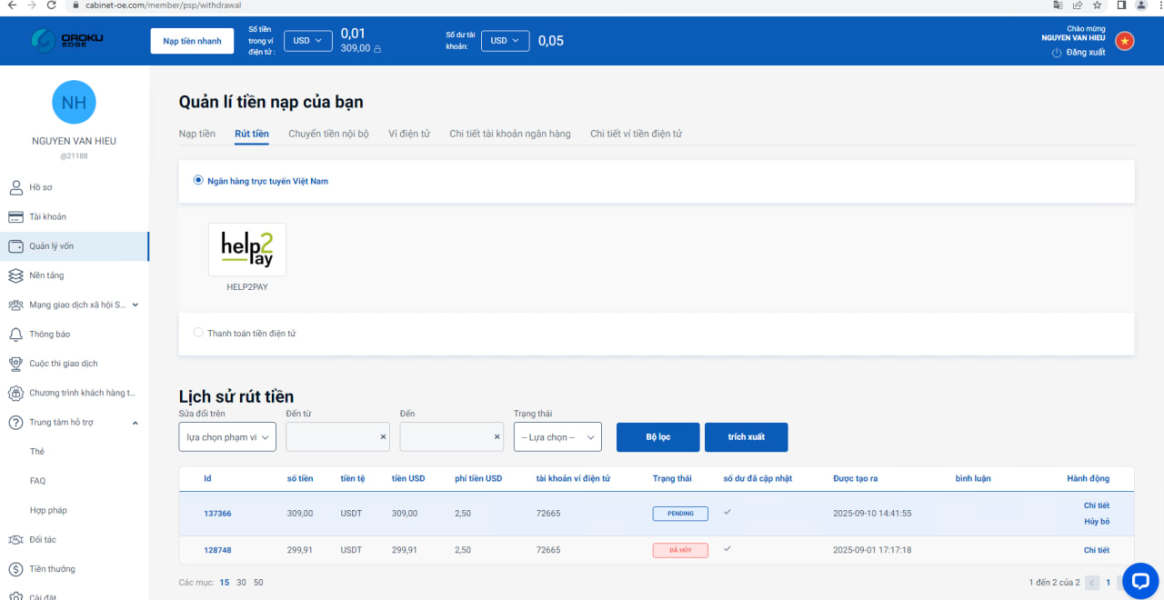

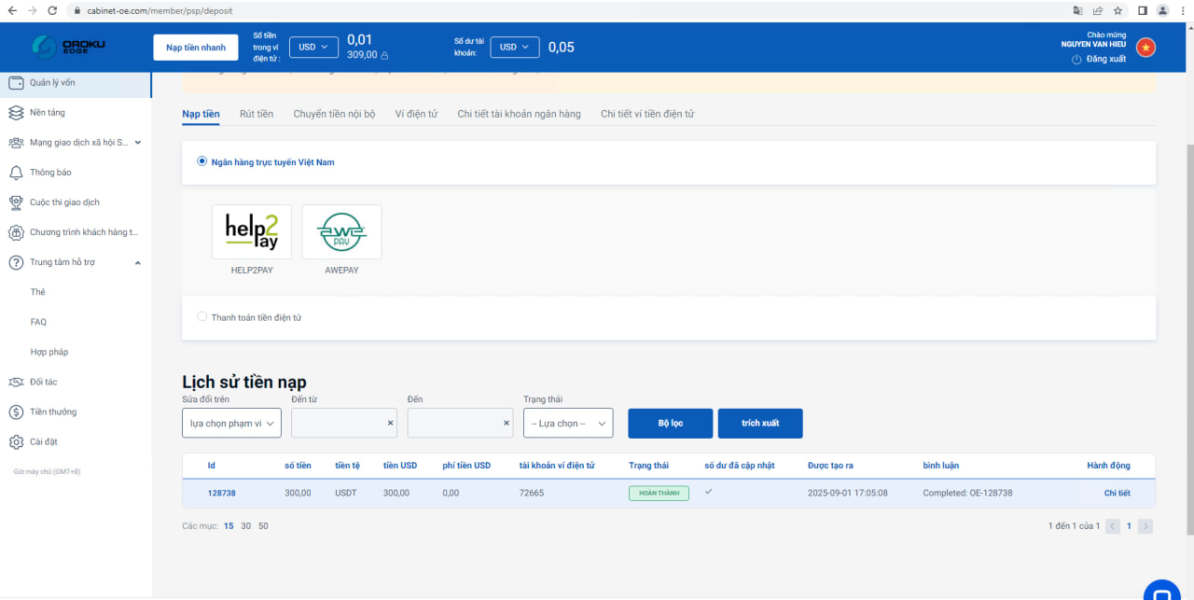

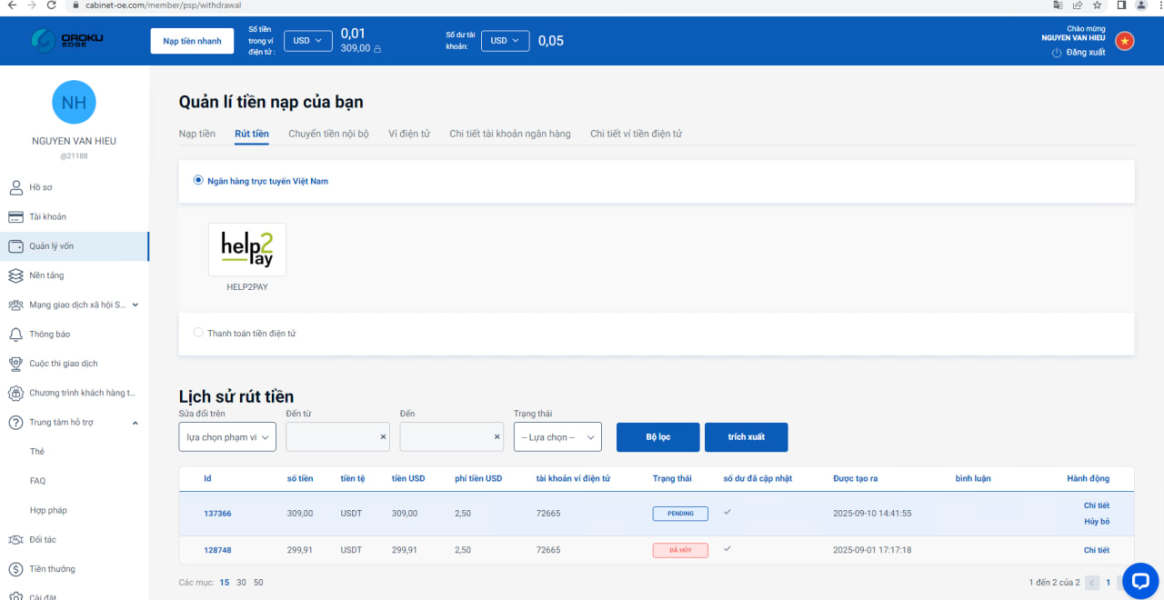

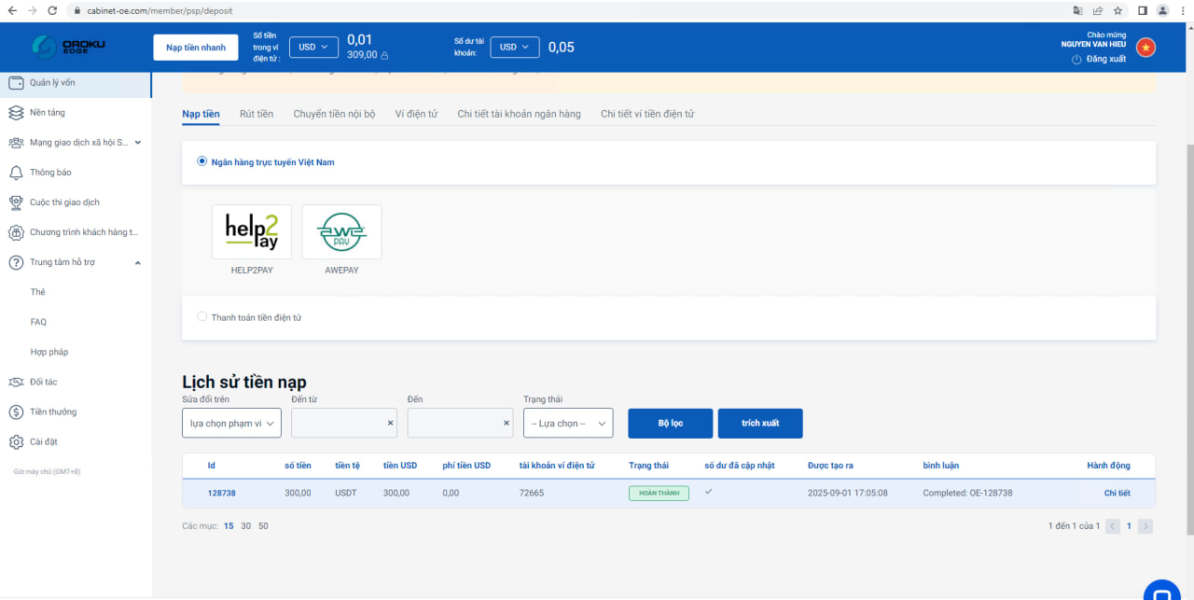

Fund management operations, including deposits and withdrawal requests, have generated numerous user complaints about processing delays, unexpected fees, or difficulties in accessing deposited funds. Several reviews mention instances where withdrawal requests were delayed or subjected to additional requirements not clearly outlined in initial terms and conditions.

Common user complaints center around lack of transparency, poor communication from customer support, and concerns about fund security. The absence of positive user testimonials or success stories further reinforces the platform's poor reputation within the trading community.

The user demographic that might find Oroku Edge suitable appears to be extremely limited, given the widespread negative feedback and regulatory concerns. This Oroku Edge review suggests that even traders with minimal requirements for platform features or support would likely find better alternatives among established, regulated brokers in the market.

Conclusion

This comprehensive Oroku Edge review reveals a broker that falls significantly short of industry standards across virtually all evaluation criteria. With an overall rating of 2.8/10, Oroku Edge demonstrates fundamental deficiencies in regulatory compliance, transparency, customer service, and operational reliability that make it unsuitable for serious forex traders.

The platform's registration in Saint Vincent and the Grenadines provides minimal regulatory protection, while the lack of transparent information about trading conditions, costs, and operational procedures raises serious concerns about the broker's legitimacy. Multiple independent sources have flagged the platform as potentially unreliable, and user feedback consistently highlights negative experiences across all aspects of the service.

This broker is not recommended for any category of trader. The combination of regulatory concerns, operational transparency issues, and overwhelmingly negative user feedback creates an unacceptable risk profile for potential clients. Traders seeking reliable forex trading services should consider well-established, properly regulated brokers that provide transparent terms, robust customer protection, and proven track records of reliable service delivery.