Regarding the legitimacy of OROKU EDGE forex brokers, it provides MISA and WikiBit, .

Is OROKU EDGE safe?

Pros

Cons

Is OROKU EDGE markets regulated?

The regulatory license is the strongest proof.

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Oroku Edge LLC

Effective Date: Change Record

2024-10-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Lebuhraya Sultanah, MalaysiaPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Oroku Edge A Scam?

Introduction

Oroku Edge is a forex broker that emerged in the online trading landscape in 2021, claiming to provide traders with competitive trading conditions and innovative technology. As the forex market continues to grow, it attracts an increasing number of traders, making it essential for them to thoroughly assess the reliability and trustworthiness of brokers like Oroku Edge. With numerous reports of scams and fraudulent activities in the trading industry, traders must exercise caution when selecting a broker. This article aims to investigate the credibility of Oroku Edge through an in-depth analysis of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

To conduct this evaluation, we have compiled information from various reputable sources, including expert reviews, user testimonials, and regulatory databases. By synthesizing this data, we aim to provide a balanced perspective on whether Oroku Edge is a safe trading platform or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining a broker's legitimacy and the safety of traders' funds. Oroku Edge operates under the jurisdiction of Saint Vincent and the Grenadines (SVG), which is known for its lax regulatory environment. The broker claims to be registered as Oroku Edge LLC, but it does not hold a specific forex brokerage license, which raises significant concerns regarding its regulatory compliance and investor protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of a robust regulatory framework means that traders using Oroku Edge are not afforded the same level of protection as they would receive from brokers regulated by more stringent authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). The lack of effective regulation can expose traders to various risks, including potential loss of funds and limited recourse in the event of disputes.

Moreover, the SVG financial authorities have issued warnings about unregulated forex activities, emphasizing the potential dangers associated with trading through brokers that lack proper oversight. Given these factors, it is vital for traders to consider the regulatory landscape before engaging with Oroku Edge.

Company Background Investigation

Oroku Edge was established in 2021 and claims to be headquartered in Saint Vincent and the Grenadines. However, the broker's limited history raises questions about its credibility and long-term viability. The ownership structure of Oroku Edge is not transparently disclosed, which is a common red flag among many online brokers. Furthermore, the lack of information regarding the management team and their professional backgrounds adds to the uncertainty surrounding the broker.

Transparency is a critical aspect of any financial institution, especially in the forex trading environment. A reputable broker should provide clear information about its ownership, management, and operational practices. In the case of Oroku Edge, the absence of such information may indicate a lack of accountability and a potential risk for traders.

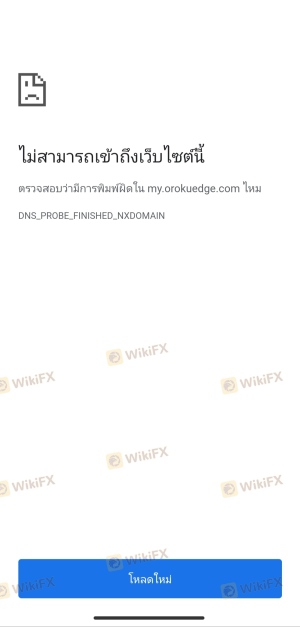

Moreover, the broker's website does not provide comprehensive details about its services, trading conditions, or any educational resources for traders. This lack of information can hinder traders' ability to make informed decisions and understand the risks associated with trading on the platform.

Trading Conditions Analysis

Oroku Edge claims to offer competitive trading conditions, including low spreads and high leverage options. However, the broker's overall fee structure and policies warrant careful examination. While the broker advertises a minimum deposit requirement as low as $1, the trading costs associated with different account types can vary significantly.

| Fee Type | Oroku Edge | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.0 pips |

| Commission Structure | None | $5 per lot |

| Overnight Interest Range | N/A | 2-3% |

The spreads offered by Oroku Edge, while appearing competitive, are still higher than the industry average. Additionally, the lack of clarity regarding overnight interest rates and other potential fees raises concerns about hidden costs that may affect traders' profitability.

Furthermore, the broker's commission structure is not clearly defined, which can lead to confusion among traders. Hidden fees or unexpected charges can significantly impact trading outcomes, making it imperative for traders to fully understand the fee structure before committing their capital.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's trustworthiness. Oroku Edge claims to implement security measures to protect clients' funds; however, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Key aspects to consider include:

- Segregation of Funds: Oroku Edge does not provide clear information regarding whether client funds are held in segregated accounts, which is a standard practice among reputable brokers to ensure that clients' funds are protected in the event of the broker's insolvency.

- Investor Protection: There is no indication that Oroku Edge participates in any investor compensation schemes, which are designed to protect clients in case of broker default.

- Negative Balance Protection: The broker's policies regarding negative balance protection remain unclear, leaving traders vulnerable to significant losses in volatile market conditions.

The absence of robust fund safety measures, combined with the broker's unregulated status, creates an environment where traders' funds may be at risk.

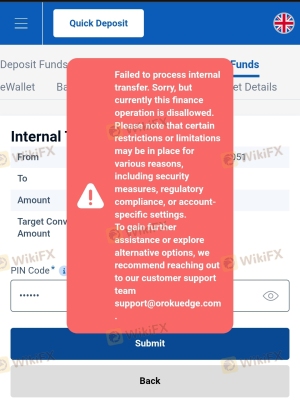

Customer Experience and Complaints

Customer feedback is a critical component in assessing the reliability of a broker. Reviews and testimonials from Oroku Edge clients reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Poor |

| Hidden Fees | High | Poor |

Many users have reported difficulties in withdrawing their funds, with some claiming that their withdrawal requests were either delayed or denied altogether. Furthermore, the quality of customer support has been criticized, with clients stating that their inquiries often go unanswered or receive vague responses.

For example, one user from Indonesia expressed frustration over the inability to withdraw profits, stating, "Until now, the withdrawal process from the profits I made has not been processed. If we contact support, the answer always has no solution." Such feedback raises significant concerns about the broker's reliability and responsiveness to client needs.

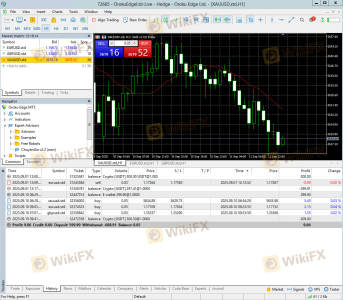

Platform and Trade Execution

The trading platform is a crucial aspect of any broker's service offering. Oroku Edge claims to use the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading features. However, reports regarding order execution quality, slippage, and overall platform stability indicate potential issues.

Traders have reported experiencing high levels of slippage, meaning that orders are executed at prices significantly different from what was expected. This can lead to unexpected losses and create an unfavorable trading environment. Additionally, the lack of transparency regarding order execution policies raises concerns about potential manipulation.

Risk Assessment

Engaging with Oroku Edge carries several risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about fund safety. |

| Fund Safety | High | Unclear policies on fund segregation and investor protection. |

| Withdrawal Issues | High | Numerous complaints regarding withdrawal delays. |

| Customer Support | Medium | Limited responsiveness and quality of support. |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Before engaging with any broker, ensure that you have conducted comprehensive research on their regulatory status, trading conditions, and user experiences.

- Start with a Demo Account: If available, use a demo account to familiarize yourself with the platform and its features before committing real funds.

- Limit Initial Investments: If you choose to trade with Oroku Edge, consider starting with a minimal investment to assess the broker's performance and reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Oroku Edge may not be a safe or reliable option for traders, particularly those who value regulatory protection and customer support. The lack of proper oversight, combined with numerous complaints regarding withdrawal issues and inadequate transparency, raises significant red flags.

While Oroku Edge offers competitive trading conditions and a user-friendly platform, the potential risks associated with trading on an unregulated platform may outweigh the benefits. Traders are advised to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability.

If you are seeking trustworthy alternatives, consider brokers regulated by established authorities such as the FCA or ASIC, which provide the necessary protections and transparency that traders deserve.

Is OROKU EDGE a scam, or is it legit?

The latest exposure and evaluation content of OROKU EDGE brokers.

OROKU EDGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OROKU EDGE latest industry rating score is 2.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.