Orbi Trading 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Orbi Trading is an offshore CFD broker that stands out for its low minimum deposit requirements and a broad range of trading products, making it appealing to beginner traders. With a minimum deposit as low as $50, novice investors can venture into the trading landscape with ease. The broker offers access to a variety of local and international assets, including forex, commodities, indices, and cryptocurrencies. However, Orbi Trading's lack of significant regulatory oversight raises considerable alarms regarding fund safety and overall reliability. This unregulated status is cause for concern, as it can lead to increased risks such as potential financial losses and difficulties with customer support and withdrawals. Consequently, while Orbi Trading presents attractive trading conditions (especially for newcomers), traders must weigh these benefits against the substantial risks associated with engaging with an unregulated broker.

⚠️ Important Risk Advisory & Verification Steps

Warning: Trading with unregulated brokers can lead to loss of funds and lack of recourse. Before considering Orbi Trading, note the following:

- Risk Statement: Unregulated brokers like Orbi Trading may not comply with industry standards, endangering your investments.

- Potential Harms: Risks include poor customer support, high withdrawal fees, and potential fraud or inability to access your funds.

How to Self-Verify:

- Check for regulation status on official financial authority websites.

- Look for customer reviews and feedback on independent review platforms.

- Investigate the companys physical address and verify its existence through reputable sources.

- Test the responsiveness of customer support channels.

Broker Overview

Company Background and Positioning

Established in 2021, Orbi Trading is an offshore brokerage based in Saint Vincent and the Grenadines. While it has entered the market with a competitive offering of low initial investments and a diverse range of trading products, its proposed offshore regulation raises eyebrows. The company claims a license from the Seychelles Financial Services Authority (FSA). However, this regulatory framework is often viewed as significantly less stringent compared to first-tier regulations, creating doubts about the broker's reliability.

Core Business Overview

Operating under the trade name Orbi Trading, the broker allows clients to engage in contracts for difference (CFDs) across a multitude of asset classes such as forex pairs, commodities (gold, silver, oil), stocks, and indices. The trading platform utilized is primarily MetaTrader 5, a well-known choice that caters to both novice and experienced traders alike. However, the lack of oversight might lead clients to question their security when trading or investing capital with Orbi Trading.

Quick-Look Details

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The absence of a robust regulatory environment for Orbi Trading is a fundamental issue that potential investors need to grapple with. Without the oversight of esteemed regulatory authorities, investors may not have any guarantee regarding the safety of their funds. There have been conflicting reports regarding the regulatory status of the broker, raising further concerns about compliance and reliability in their trading practices.

Analysis of Regulatory Information Conflicts: Reports indicate that Orbi Trading claims the regulatory certifications but fails to fulfill the requisite standards of security and operational transparency that are typical with established regulatory bodies. The overlapping claims of regulation, especially tied to offshore jurisdictions, can create confusion for investors.

User Self-Verification Guide:

Verify the broker's regulatory claims via the Seychelles FSA's official website.

Research Orbi Trading on finance forums and review websites for trader experiences.

Check the companys physical address using satellite imagery or local business licenses.

Contact customer support directly to assess their responsiveness and professionalism.

Industry Reputation and Summary: Feedback regarding fund safety ranges considerably among users, with notable concerns expressed particularly about withdrawal processes.

“When I tried to withdraw, the process dragged on for weeks, and it felt frustrating.”

User ratings highlight a considerable level of apprehension regarding the fund's security and the nature of potential losses they might incur under the broker's service.

Trading Costs Analysis

The fee structure at Orbi Trading has its advantages and disadvantages. While the broker presents low trading commissions, the existence of hidden fees emphasizes the need for prudence.

Advantages in Commissions: The competitive commissions attached to forex and commodity trading positions provide a favorable environment for cost-conscious traders, particularly beginners looking to explore various trading opportunities and mitigate initial financial risk.

The "Traps" of Non-Trading Fees: Despite competitive trading costs, several users reported exorbitant withdrawal fees. For instance, one user cited that a withdrawal cost them $50 despite their initial investment being low.

“Withdrawing my money felt more like a punishment; they charged me $50 just to get my own funds!”

- Cost Structure Summary: The structure can be favorable primarily for occasional traders; however, regular traders who frequently withdraw might find the costs prohibitive.

One of the most appealing aspects of Orbi Trading is its use of MetaTrader 5, providing various tools and functionalities designed for serious trading.

Platform Diversity: Orbi Trading supports the widely used MetaTrader 5 platform, known for its advanced charting tools, diversified indicators, and relative ease of use which appeals to both novice and expert traders.

Quality of Tools and Resources: The platform provides access to a range of charting tools and technical analysis features but lacks in-depth educational resources which could hinder less experienced traders.

Platform Experience Summary: Users generally report satisfaction with the platform's performance, though some highlighted issues navigating the system during peak trading times,

“The platform works well most of the time, but during busy sessions, it can be slow.”

User Experience Analysis

User experience at Orbi Trading appears inconsistent, with varying reports about the usability of trading platforms and overall satisfaction levels.

Ease of Use: Beginner traders who appreciate a straightforward interface may find Orbi Trading accommodating, yet improvements in functionality, especially under high usage, are necessary for optimal performance.

User Feedback: While some appreciated the low deposit thresholds, others concerned about the brokers reliability emphasized negative experiences related to fund withdrawals and customer support.

User Experience Summary: Overall user satisfaction fluctuates, undermined principally by reports of sluggish responses from support and problematic withdrawal execution.

Customer Support Analysis

Customer support forms a critical dimension in assessing a brokers credibility and responsiveness.

Availability: Orbi Trading offers varied support channels, including phone, email, and online chat service; however, the frequency of complaints regarding unhelpfulness raises doubts about their overall service quality.

User Reports: Multiple users lamented long wait times for responses and unaddressed issues.

“I reached out about a withdrawal issue and ended up waiting for days without a clear answer.”

- Customer Support Summary: Customer support attempts may not meet the expectations of investors who require reliable assistance, especially in times of urgent need.

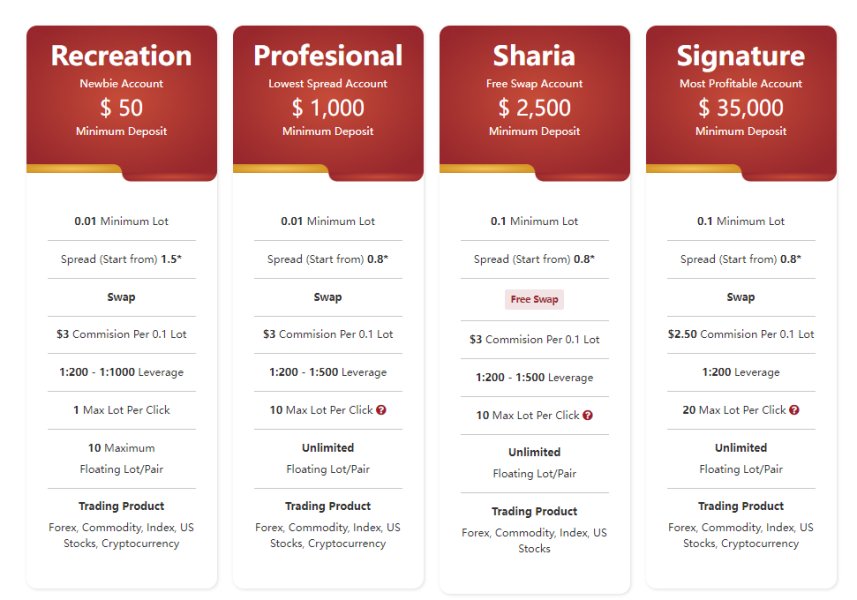

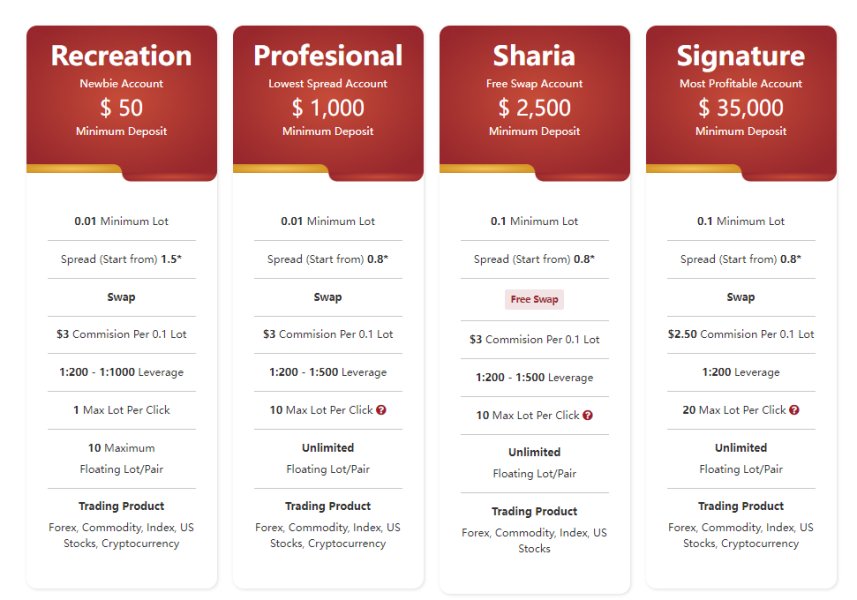

Account Conditions Analysis

Orbi Trading presents a range of account types tailored to different investor needs, making it attractive to new traders.

Entry Requirements: A minimum deposit of $50 opens the door for many, ensuring that beginner traders can capitalize on market opportunities without significant upfront capital.

Account Types: With account types catering to varying needs, such as recreation and professional accounts, traders can select the one that aligns with their trading strategy and goals.

Account Conditions Summary: Despite the attractive low-entry account conditions, seasoned traders may find them lacking in terms of the sophisticated options that more robust brokers provide.

In conclusion, while Orbi Trading offers appealing incentives for new traders through low deposit requirements and a wide array of asset classes, the considerable risks posed by unregulated trading and inconsistent customer experiences underscore a need for caution. In a landscape where safety is paramount, traders need to continuously weigh the seductive lure of low entry costs against the inherent dangers associated with operating in a loosely regulated environment. For anyone considering this broker, thorough due diligence is not just wise but essential.