Maxify 2025 Review: Everything You Need to Know

Executive Summary

MaxifyFX Ltd is a trusted financial services company in the competitive forex trading world. The company has built its reputation through positive user feedback on Trustpilot and other review platforms, which shows that clients value their services. This comprehensive maxify review reveals a broker that positions itself as a reliable partner for both retail and institutional investors seeking secure and professional trading solutions.

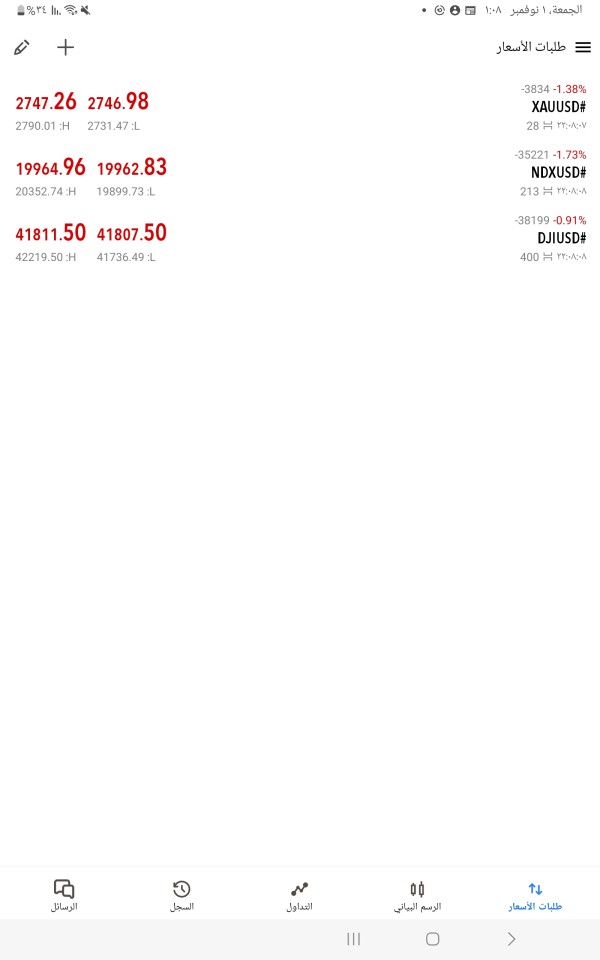

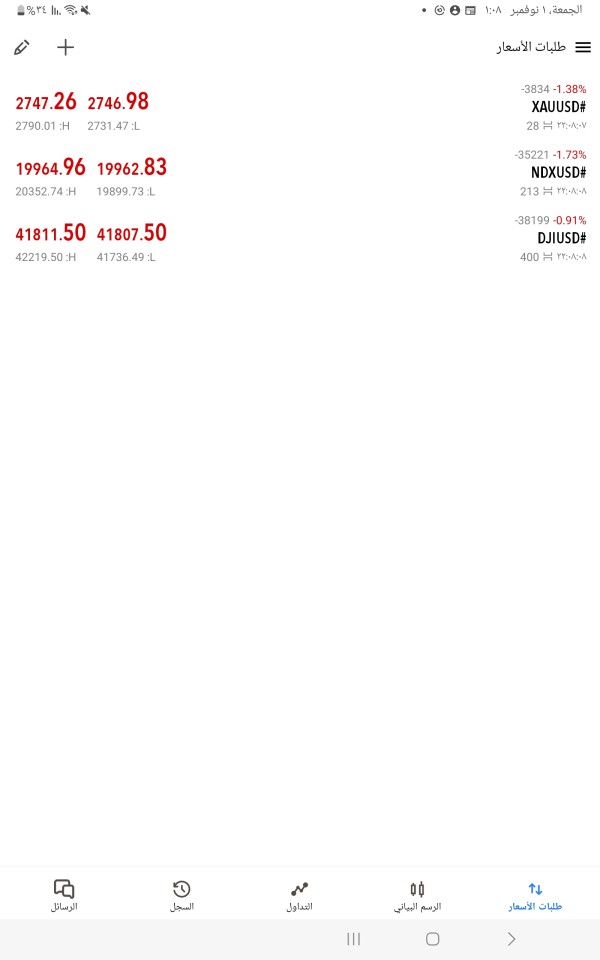

The broker offers tight spreads and flexible leverage options across many different trading assets. These assets include forex pairs, stocks, commodities like gold and oil, and global indices that represent different markets around the world. MaxifyFX Ltd shows a commitment to transparency and security, which has earned recognition from users who value integrity and professionalism in their trading partnerships.

This broker targets investors who want safety and professional trading experiences. Whether they are seasoned traders or newcomers to the financial markets, the company focuses on providing industry-leading expertise and maintaining strong security standards. However, potential clients should note that certain regulatory and operational details require further investigation to make fully informed decisions.

Important Notice

Investors should do their own research about different regional trading rules and legal environments before starting any trading activities. This is important because limited regulatory information is available in public sources, which makes it harder to understand all the requirements. The regulatory framework and compliance standards may vary significantly across different jurisdictions where MaxifyFX Ltd operates.

This evaluation uses user feedback analysis, market performance data, and publicly available information from sources including Trustpilot and other review platforms. Potential traders should verify all information independently and consider their individual financial circumstances and risk tolerance before making investment decisions.

Rating Framework

Broker Overview

MaxifyFX Ltd works as a comprehensive financial services company that delivers secure and professional online forex trading solutions to clients around the world. While the company's start date is not specified in available sources, MaxifyFX Ltd has built its reputation on providing reliable trading experiences across multiple asset classes. The broker's business model centers on offering diverse trading opportunities including forex currency pairs, individual stocks, precious metals and energy commodities, and major global market indices.

The company sees itself as a trusted partner for traders at all experience levels. This includes beginners taking their first steps in financial markets and sophisticated institutional investors managing substantial portfolios. MaxifyFX Ltd's approach emphasizes integrity, transparency, and security as fundamental pillars of their service delivery.

This maxify review shows that the broker has successfully built a positive reputation among its user base, particularly regarding customer service quality and trading reliability. According to available information, MaxifyFX Ltd focuses on maintaining industry-leading expertise while ensuring clients can trade with confidence. The broker's commitment to professional standards and security measures appears to resonate well with users who prioritize these aspects in their trading relationships.

However, specific details about trading platforms, regulatory oversight, and operational infrastructure require additional verification from potential clients.

Regulatory Regions: Specific regulatory information is not detailed in available sources, requiring traders to independently verify compliance standards in their respective jurisdictions.

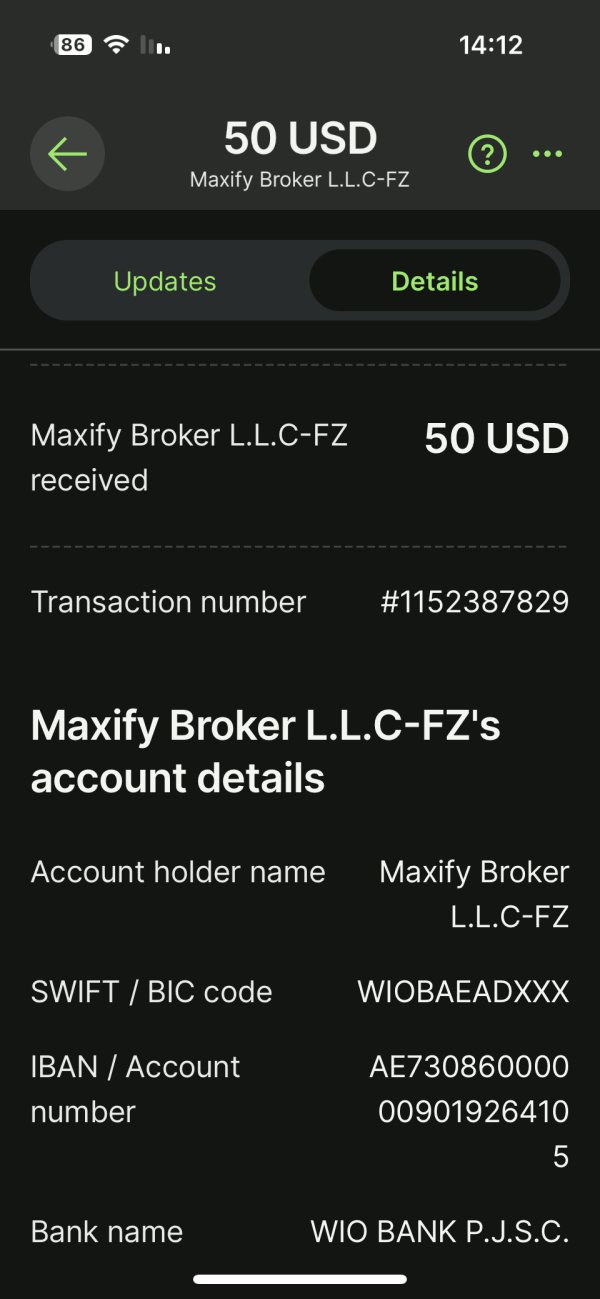

Deposit and Withdrawal Methods: Information about funding options and withdrawal processes is not specified in current public sources.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available documentation.

Bonuses and Promotions: Details about promotional offers and bonus structures are not provided in accessible sources.

Tradeable Assets: MaxifyFX Ltd offers a comprehensive range of trading instruments including major and minor forex currency pairs, individual stocks from various global markets, commodities such as gold and crude oil, and prominent global indices representing different regional economies.

Cost Structure: The broker provides tight spreads across its trading instruments, though specific spread values and commission structures are not detailed in available sources. This maxify review notes that competitive pricing appears to be a key feature of the broker's offering.

Leverage Ratios: MaxifyFX Ltd offers flexible leverage options to accommodate different trading strategies and risk preferences, though exact leverage ratios are not specified in current documentation.

Platform Options: Specific information about trading platforms and technological infrastructure is not detailed in available sources.

Regional Restrictions: Geographic limitations and availability restrictions are not specified in accessible documentation.

Customer Service Languages: Information about multilingual support options is not provided in current sources.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for MaxifyFX Ltd faces significant limitations due to insufficient publicly available information about specific account types and their respective features. This makes it difficult for potential clients to understand what options are available to them. This maxify review cannot provide detailed analysis of account tier structures, minimum balance requirements, or special account features that might be available to different client categories.

Potential clients must directly contact the broker to understand available options because there is no clear information about account opening procedures, verification requirements, or documentation needed for different account types. The absence of details about Islamic accounts, professional trading accounts, or institutional account features makes it challenging for traders to assess whether MaxifyFX Ltd can accommodate their specific needs.

The lack of transparency regarding account conditions affects the overall rating, as traders typically require comprehensive information about fees, minimum deposits, and account benefits before making informed decisions. While user feedback suggests satisfaction with the broker's services, the absence of detailed account information represents a significant gap in publicly available resources. This limitation particularly impacts traders who need to compare account features across multiple brokers or those with specific requirements such as high-frequency trading capabilities or specialized institutional services.

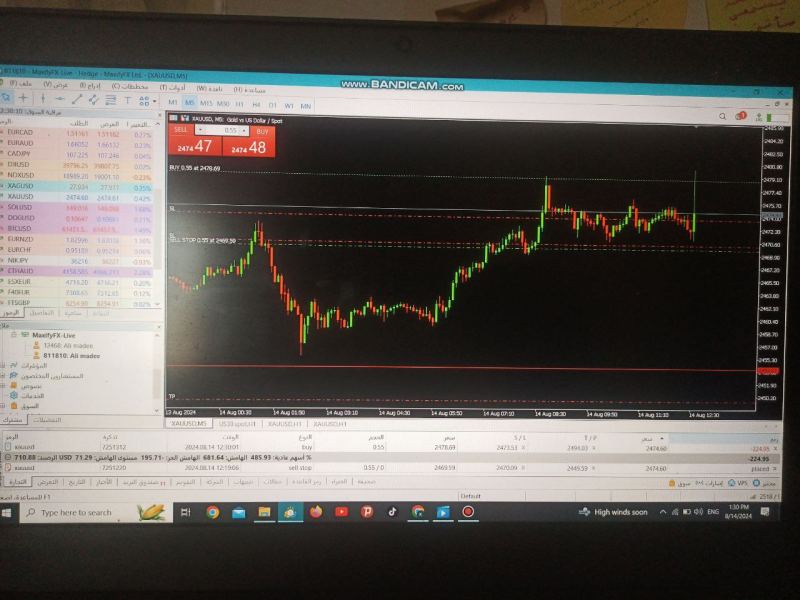

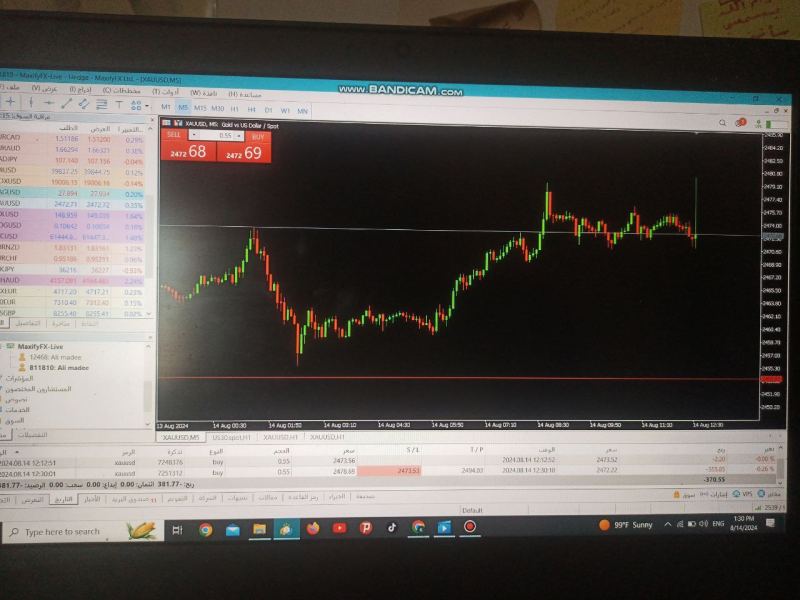

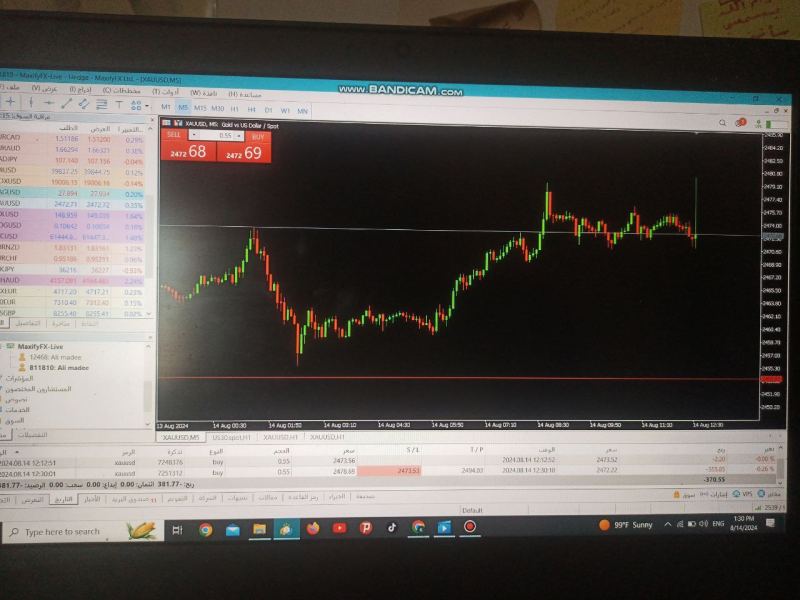

MaxifyFX Ltd demonstrates strength in providing diverse trading instruments across multiple asset classes, which contributes positively to the tools and resources evaluation. The broker offers access to forex markets, stock trading opportunities, commodity investments including precious metals and energy products, and global index trading options.

The variety of available trading assets suggests that MaxifyFX Ltd has invested in building comprehensive market access for its clients. This allows for portfolio diversification and various trading strategies that can help traders manage risk and pursue opportunities. This range of instruments can accommodate both conservative investors seeking stable investments and more aggressive traders pursuing higher-risk, higher-reward opportunities.

However, specific information about research tools, market analysis resources, educational materials, or automated trading support is not detailed in available sources. The absence of information about charting capabilities, technical analysis tools, or fundamental analysis resources limits the complete assessment of the broker's technological offerings. While the asset diversity is commendable, the lack of detailed information about analytical tools, trading indicators, or educational resources prevents a higher rating in this category.

Traders increasingly expect comprehensive research support and educational materials as standard offerings from their brokers.

Customer Service and Support Analysis (8/10)

Customer service emerges as a notable strength for MaxifyFX Ltd, with positive user feedback on Trustpilot indicating strong performance in client support and service quality. The favorable reviews suggest that the broker has established effective communication channels and responsive support systems that meet client expectations.

User testimonials indicate satisfaction with the broker's approach to client service, suggesting that MaxifyFX Ltd has successfully implemented customer-focused policies and procedures. The positive sentiment reflected in review platforms demonstrates that clients feel valued and supported in their trading activities. However, specific details about customer service channels, response times, availability hours, or multilingual support options are not provided in available sources.

Information about live chat capabilities, phone support, email response times, or dedicated account management services would strengthen the evaluation of customer service quality. The strong user feedback provides confidence in the broker's commitment to customer satisfaction, but the absence of detailed information about service infrastructure and support protocols limits the ability to provide comprehensive analysis of customer service capabilities.

Trading Experience Analysis (7/10)

The trading experience evaluation for MaxifyFX Ltd benefits from positive user reviews that suggest satisfactory performance in trade execution and overall platform reliability. User feedback indicates that clients have generally favorable experiences with the broker's trading environment, suggesting adequate platform stability and execution quality.

The availability of tight spreads mentioned in broker information suggests competitive trading conditions that can enhance the overall trading experience. Flexible leverage options also indicate that the broker attempts to accommodate different trading styles and risk preferences, which contributes positively to user experience. However, this maxify review notes that specific information about platform stability, execution speeds, order types, or mobile trading capabilities is not detailed in available sources.

Information about slippage rates, requote frequency, or platform downtime would provide more comprehensive insight into actual trading conditions. The absence of detailed technical performance data, platform feature descriptions, or specific trading tools limits the complete assessment of the trading experience. While user feedback is positive, more detailed information about platform capabilities and performance metrics would strengthen the evaluation.

Trust and Security Analysis (6/10)

The trust and security evaluation for MaxifyFX Ltd presents mixed results due to limited regulatory transparency in available sources. While the broker has established a positive reputation among users as evidenced by favorable Trustpilot reviews, the absence of detailed regulatory information impacts the overall trust assessment.

User feedback suggests that MaxifyFX Ltd has successfully maintained client confidence through professional service delivery and reliable operations. The positive reviews indicate that clients trust the broker with their trading activities and funds, which speaks to the company's operational integrity. However, specific information about regulatory oversight, licensing authorities, client fund protection measures, or segregated account policies is not detailed in accessible sources.

Information about deposit insurance, regulatory compliance standards, or audit procedures would significantly enhance the trust evaluation. The lack of transparent regulatory information represents a significant concern for traders who prioritize regulatory oversight and fund protection. While user sentiment is positive, the absence of detailed security and regulatory information prevents a higher rating in this critical category.

User Experience Analysis (7/10)

User experience analysis for MaxifyFX Ltd shows generally positive results based on client feedback and review platform sentiment. The positive reviews on Trustpilot suggest that users find the broker's services satisfactory and appreciate the professional approach to client relationships.

The broker's focus on serving both retail and institutional investors indicates an understanding of diverse user needs and preferences. This positioning suggests that MaxifyFX Ltd has developed user interfaces and service offerings that can accommodate different experience levels and trading requirements. User feedback indicates overall satisfaction with the broker's service delivery, suggesting that the registration process, platform usability, and general user interface meet client expectations.

The positive sentiment reflects well on the broker's attention to user experience design and implementation. However, specific information about user interface design, registration procedures, verification processes, or common user complaints is not detailed in available sources. Information about platform navigation, feature accessibility, or user onboarding procedures would provide more comprehensive insight into the actual user experience quality.

Conclusion

This comprehensive maxify review reveals MaxifyFX Ltd as a broker with notable strengths in customer service and asset diversity, though limited transparency in regulatory and operational details presents areas for improvement. The broker demonstrates particular strength in maintaining positive client relationships, as evidenced by favorable user feedback and Trustpilot reviews.

MaxifyFX Ltd appears most suitable for investors who prioritize customer service quality and seek access to diverse trading instruments across forex, stocks, commodities, and indices. The broker's commitment to professional service delivery and security makes it potentially attractive to both retail and institutional investors seeking reliable trading partnerships. The main advantages include strong customer satisfaction ratings, diverse asset offerings, competitive spreads, and flexible leverage options.

However, the primary drawbacks center on limited regulatory transparency and insufficient publicly available information about account conditions, platform features, and operational procedures. Potential clients should conduct thorough due diligence and direct communication with the broker to address these information gaps before making trading decisions.