Matsui 2025 Review: Everything You Need to Know

Matsui Securities Co., Ltd. has garnered mixed reviews in the financial community, with user experiences ranging from positive remarks on its user-friendly platform to serious concerns regarding withdrawal issues and customer service. Key findings indicate that while Matsui is regulated in Japan, the lack of transparency around fees and withdrawal processes raises red flags for potential investors.

Note: It is crucial to recognize that Matsui operates under different entities in various regions, which may affect user experiences and regulatory oversight. The analysis presented here aims for fairness and accuracy, drawing on multiple sources.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Founded in 2005, Matsui Securities Co., Ltd. is a Japanese online brokerage firm that provides a range of trading services, including forex, stocks, mutual funds, and more. The broker operates under the supervision of the Financial Services Agency (FSA) in Japan, which adds a layer of credibility. Matsui offers several trading platforms, including dedicated apps for Japanese and U.S. stocks, forex, and futures trading. However, the lack of a widely recognized trading platform like MT4 or MT5 may limit its appeal to some traders.

Detailed Breakdown

Regulatory Regions

Matsui is primarily regulated in Japan by the FSA, which oversees its operations and ensures compliance with local financial laws. However, there are concerns about the lack of regulation in other regions where the broker may operate, potentially exposing users to higher risks.

Deposit/Withdrawal Currencies

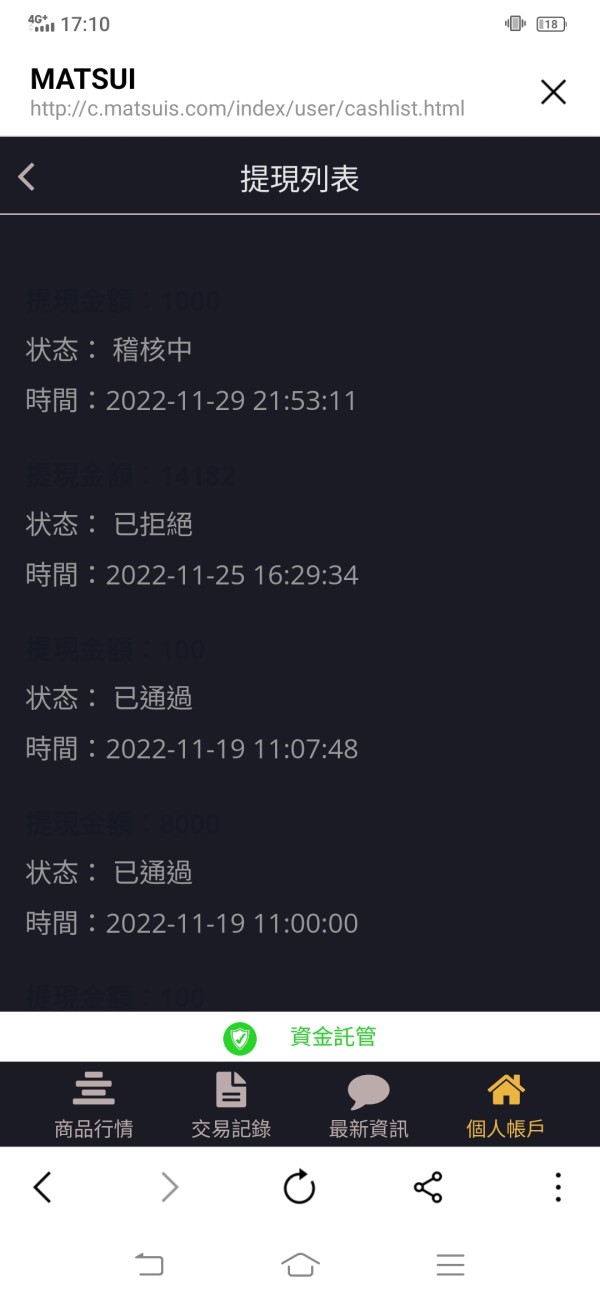

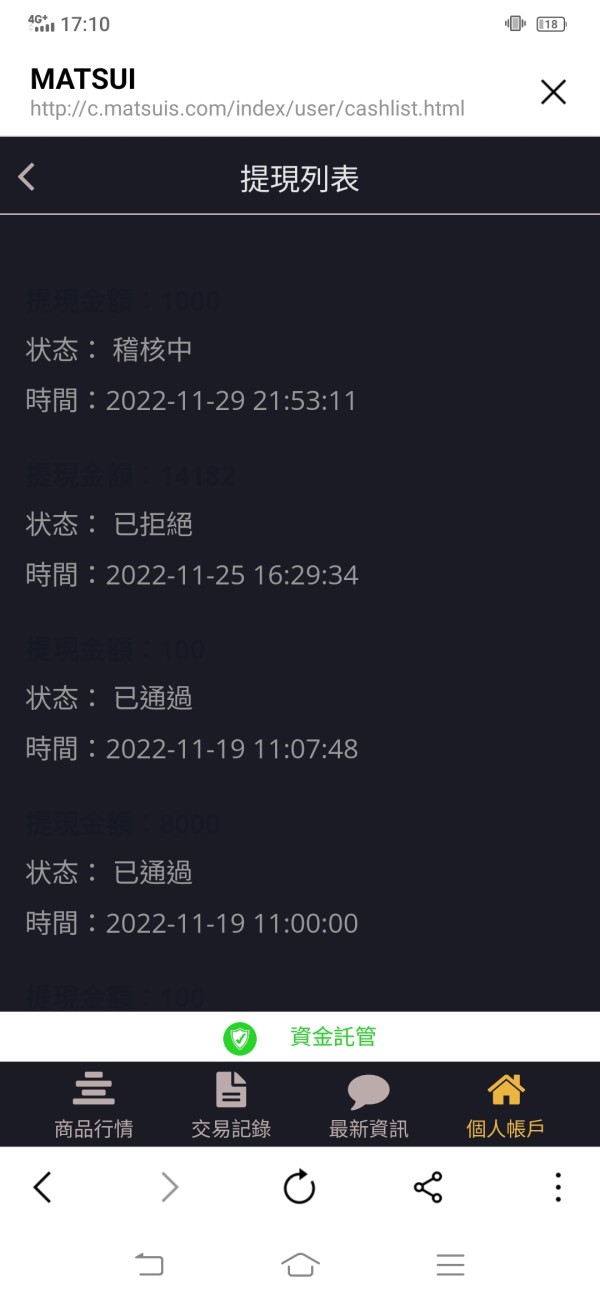

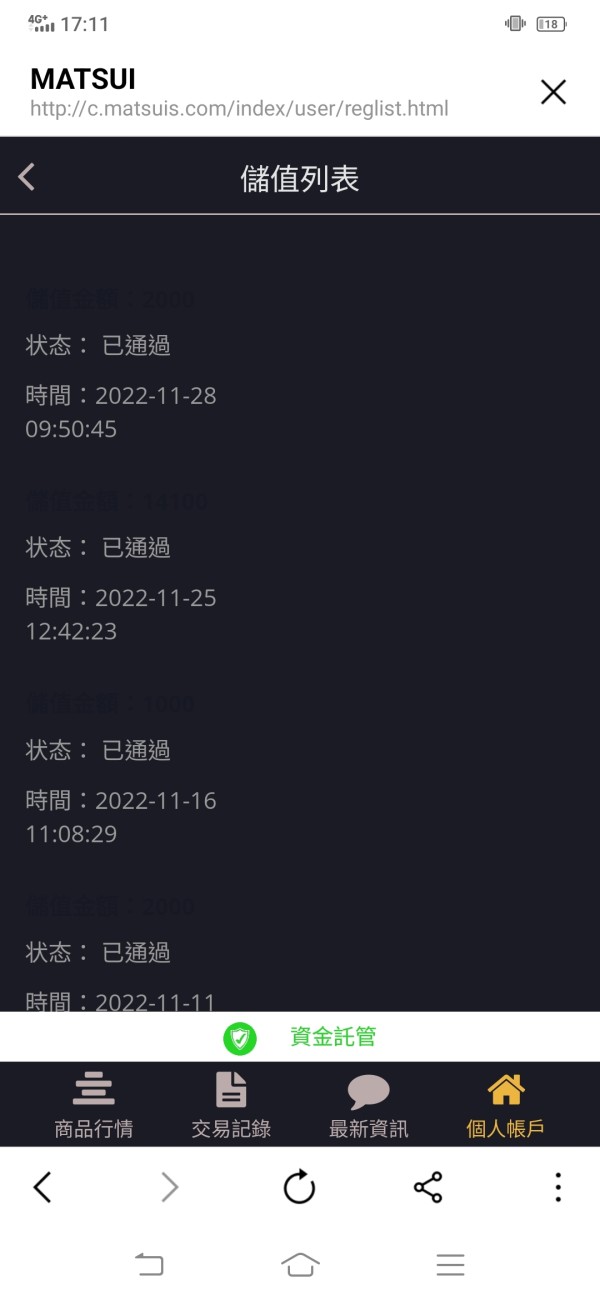

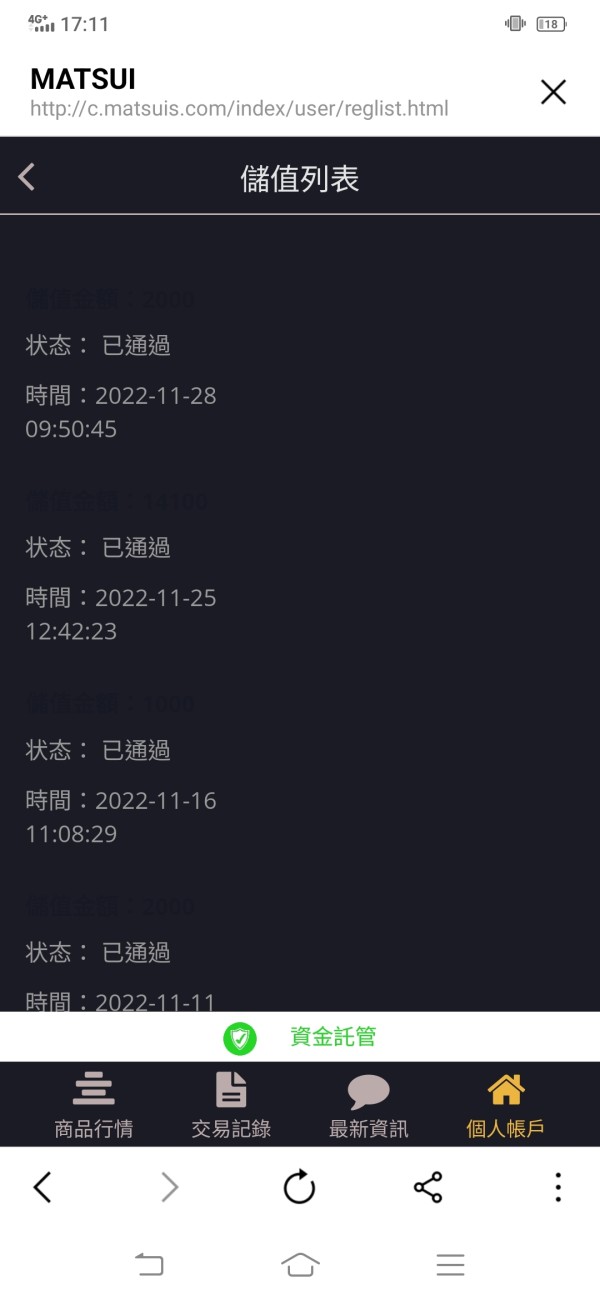

Matsui allows deposits and withdrawals primarily in Japanese Yen (JPY), with options for bank transfers and netlink deposits. However, users have reported issues with withdrawal processes, indicating delays and difficulties in accessing their funds.

Minimum Deposit

The broker does not specify a minimum deposit requirement, which may attract new traders looking to enter the market with limited capital. However, the absence of this information could also lead to confusion for potential clients.

Matsui does not prominently feature any promotional offers or bonuses, which is a common practice among many brokers to attract new clients. This could be a disadvantage for traders seeking incentives to start trading.

Tradable Asset Classes

Matsui offers a diverse range of tradable assets, including Japanese stocks, U.S. stocks, mutual funds, forex, futures, and options. This variety allows traders to create a diversified portfolio, but the lack of cryptocurrency trading may deter some investors.

Costs (Spreads, Fees, Commissions)

The costs associated with trading on Matsui are not clearly defined across various sources, with some users expressing concerns about hidden fees. The absence of detailed fee structures makes it difficult to assess the overall cost of trading with this broker.

Leverage

Matsui does not specify maximum leverage levels, which can be a critical factor for traders looking to maximize their investment potential. This lack of information may cause uncertainty for those accustomed to brokers offering clear leverage terms.

While Matsui offers several proprietary trading platforms, the absence of popular platforms like MT4 or MT5 may limit its appeal to more experienced traders who prefer those environments. Users may find the proprietary systems less familiar, which could affect their trading efficiency.

Restricted Regions

There is limited information available regarding regions where Matsui is restricted from operating. However, users in certain regions may face challenges due to regulatory issues, which could affect their ability to trade.

Available Customer Service Languages

Matsui primarily offers customer support in Japanese, which may pose challenges for non-Japanese speaking clients. Limited language support can hinder effective communication and resolution of issues.

Rating Recap

Detailed Ratings Explanation

-

Account Conditions (6/10): While the absence of a minimum deposit is a plus, the lack of clear information regarding account types and conditions detracts from this rating.

Tools and Resources (5/10): Matsui provides various trading platforms but lacks popular options like MT4/MT5, limiting its tools for experienced traders.

Customer Service and Support (4/10): User reviews highlight significant issues with customer service, particularly regarding responsiveness and support during withdrawal processes.

Trading Setup (Experience) (6/10): The trading experience is generally smooth, but issues with withdrawals and fees can mar the overall experience.

Trustworthiness (5/10): While regulated in Japan, concerns about transparency and user experiences with withdrawals raise questions about its reliability.

User Experience (4/10): Many users report frustrations with the platform, particularly in relation to customer service and withdrawal difficulties.

In conclusion, while Matsui Securities Co., Ltd. offers a range of trading options and is regulated in Japan, potential clients should exercise caution due to reported issues with customer service and withdrawal processes. It is advisable for traders to conduct thorough research and consider their specific trading needs before engaging with this broker.