ifexcapital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ifexcapital review examines a regulated yet controversial forex broker that has garnered mixed reactions from the trading community. Ifexcapital operates as the trading name of Zenith Origin Holding Ltd and presents itself as a provider of online investment and trading services with regulation from the FSC (Financial Services Commission of Mauritius).

The broker offers high leverage up to 1:500 and provides access to over 250 trading assets across multiple categories including forex, cryptocurrencies, metals, stocks, commodities, and indices. Their trading platform is described as a highly secure CFD trading environment that accommodates various investment strategies with advanced security features.

However, this ifexcapital review reveals significant concerns regarding user trust and service quality. While the broker provides five different account types and claims regulatory oversight, user feedback remains mixed with notable negative reviews discussing potential fraudulent activities and service issues. The platform appears to target risk-tolerant startup investors who are willing to navigate the uncertainties associated with this broker's controversial reputation in exchange for access to diverse trading opportunities and competitive leverage ratios that may appeal to aggressive trading strategies.

Important Notice

Regional Entity Differences: Ifexcapital's regulatory status and service offerings may vary significantly across different jurisdictions. While the broker claims regulation under the FSC (Financial Services Commission of Mauritius), specific license numbers and detailed regulatory information were not clearly provided in available sources, which raises transparency concerns. Potential clients should verify the regulatory status applicable to their specific region before engaging with the platform.

Review Methodology: This evaluation is based on currently available information from multiple sources including user reviews, regulatory databases, and broker comparison platforms. The assessment does not encompass all possible user experiences and should be considered alongside individual due diligence that includes independent research and verification. Information accuracy may vary, and prospective traders are advised to conduct independent verification of all claims and services before making any investment decisions.

Rating Framework

Broker Overview

Company Background and Establishment

Ifexcapital operates as the trading name of Zenith Origin Holding Ltd and positions itself within the competitive online trading services sector. While specific establishment dates were not clearly mentioned in available sources, the broker has developed a presence in the forex and CFD trading space with a focus on providing diverse investment opportunities to retail and institutional clients. The company's business model centers around offering online investment and trading services through a proprietary platform designed to accommodate various trading strategies and risk appetites while maintaining competitive market access.

The broker's corporate structure appears to be designed for international operations with regulatory oversight claimed through the Financial Services Commission of Mauritius. However, detailed information about the company's founding team, corporate history, or specific milestones in its development remains limited in publicly available sources, which may contribute to some of the trust concerns highlighted in user reviews and regulatory transparency discussions.

Trading Infrastructure and Asset Coverage

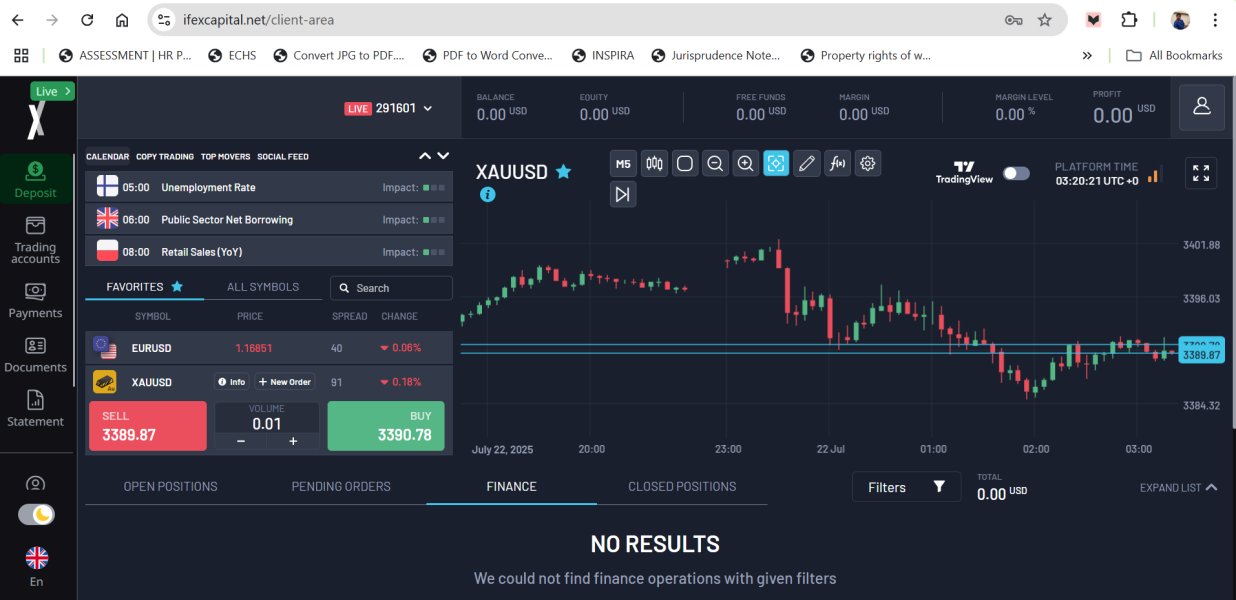

Ifexcapital's trading ecosystem is built around a highly secure CFD trading platform that provides access to an extensive range of financial instruments across global markets. The broker offers trading opportunities across six major asset categories: foreign exchange (forex), cryptocurrencies, precious metals, stocks, commodities, and market indices, which allows for comprehensive portfolio diversification strategies. This comprehensive approach allows traders to diversify their portfolios and explore various market sectors through a single platform interface that consolidates multiple trading opportunities.

The platform's infrastructure supports over 250 trading assets, providing substantial variety for both novice and experienced traders seeking diverse market exposure. The broker emphasizes security in its platform design, though specific technical details about security protocols, server locations, or platform architecture were not extensively detailed in available sources, which limits complete technical assessment. Regulatory oversight is claimed through the FSC (Financial Services Commission of Mauritius), though specific license numbers and detailed regulatory compliance information require further verification for complete transparency and regulatory confirmation.

Regulatory Jurisdiction: Ifexcapital claims regulation under the FSC (Financial Services Commission of Mauritius), though specific license numbers were not clearly provided in available sources.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and associated fees for deposits and withdrawals was not detailed in available sources, requiring direct inquiry with the broker.

Minimum Deposit Requirements: Minimum deposit thresholds for different account types were not specified in the information sources reviewed.

Bonus and Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns were not mentioned in available sources, suggesting limited promotional activity.

Available Trading Assets: The broker provides access to over 250 trading instruments across forex pairs, cryptocurrencies, precious metals, individual stocks, commodities, and major market indices.

Cost Structure and Fees: Specific information about spreads, commission rates, overnight financing charges, or other trading costs was not detailed in available sources, requiring direct inquiry with the broker for complete cost transparency.

Leverage Ratios: Maximum leverage of up to 1:500 is offered, though specific leverage ratios for different asset classes may vary based on regulatory requirements and risk management policies.

Platform Selection: Trading is conducted through a proprietary highly secure CFD trading platform, though details about additional platform options or third-party integrations were not specified in available materials.

Geographic Restrictions: Information about restricted countries or regional limitations was not provided in available sources.

Customer Support Languages: Specific languages supported by customer service teams were not mentioned in available sources, limiting accessibility assessment for international clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Ifexcapital's account structure demonstrates both strengths and areas requiring improvement in terms of transparency and client communication. The broker offers five distinct account types, suggesting an attempt to cater to different trader profiles and investment levels ranging from beginner to advanced trading strategies. However, this ifexcapital review identifies significant gaps in transparency regarding account specifications, particularly concerning minimum deposit requirements and specific features associated with each account tier, which creates uncertainty for potential clients.

The variety in account offerings indicates the broker's recognition of diverse client needs, from beginner traders to more sophisticated investors seeking advanced features. However, the lack of clearly published minimum deposit requirements creates uncertainty for potential clients attempting to determine their eligibility for different account levels and associated benefits. This information gap may contribute to user frustration and decision-making difficulties that could impact the overall client acquisition process.

Account opening procedures and verification processes were not detailed in available sources, making it challenging to assess the efficiency and user-friendliness of the onboarding experience. Additionally, information about special account features such as Islamic accounts, demo account availability, or professional trader accounts was not specified, limiting the comprehensive evaluation of account condition quality and specialized service offerings.

The scoring reflects the positive aspect of multiple account options while acknowledging the transparency issues that may impact user experience and decision-making processes.

The broker's technological infrastructure receives recognition for providing access to a diverse range of trading instruments across 250+ assets, demonstrating commitment to offering comprehensive market exposure across multiple asset classes. The platform is described as highly secure, suggesting attention to cybersecurity and data protection, though specific security features and protocols were not detailed in available sources, which limits complete technical assessment.

However, detailed information about specific trading tools, technical analysis resources, or research capabilities was not extensively covered in available materials. The absence of detailed descriptions regarding charting tools, market analysis resources, or automated trading support limits the complete assessment of the platform's analytical capabilities and trader support features.

Educational resources, which are crucial for trader development, were not mentioned in available sources. This represents a potential gap in the broker's offering, particularly for novice traders who benefit from comprehensive educational support including tutorials, webinars, and market analysis training. Similarly, information about research reports, market commentary, or expert analysis was not provided, which may impact trader decision-making support.

The scoring acknowledges the platform's security emphasis and broad asset coverage while recognizing the need for more detailed information about specific tools and educational resources that enhance the trading experience.

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a critical area requiring attention based on available feedback and transparency concerns. User reviews indicate mixed experiences with service quality, with some clients expressing concerns about responsiveness and problem resolution that may impact overall client satisfaction. The lack of detailed information about customer service channels, operating hours, and response time commitments contributes to uncertainty about support quality and availability.

Specific customer service contact methods, including phone support, live chat availability, or email response protocols, were not clearly outlined in available sources. This information gap makes it difficult for potential clients to understand how they can access support when needed and what level of service they can expect during critical trading situations.

Multi-language support capabilities were not specified, which may impact the broker's accessibility for international clients seeking native language assistance. Given the global nature of forex trading, comprehensive language support is often essential for effective customer service delivery and client relationship management.

The mixed user feedback, combined with limited transparency about service protocols and availability, results in a moderate scoring that reflects both the apparent service challenges and the need for improved communication about support capabilities.

Trading Experience Analysis (Score: 6/10)

The trading experience evaluation for this ifexcapital review reveals moderate performance with room for improvement in transparency and execution quality reporting. While the broker offers high leverage up to 1:500 and access to multiple asset classes, specific details about execution quality, slippage rates, and requoting frequency were not provided in available sources, which limits comprehensive performance assessment.

Platform stability and execution speed, which are crucial factors for trading success, lack detailed user feedback or technical performance metrics. The absence of specific information about order execution times, server uptime statistics, or trading environment quality makes comprehensive assessment challenging for potential clients evaluating execution reliability.

Mobile trading capabilities were not extensively detailed, representing a potential limitation in today's mobile-focused trading environment where traders expect seamless cross-platform functionality. Additionally, information about advanced order types, algorithmic trading support, or platform customization options was not specified, which may impact advanced trader satisfaction.

User feedback about trading experience appears limited, with available reviews not providing detailed insights into execution quality, platform functionality, or trading environment satisfaction. This lack of detailed user experience data contributes to the moderate scoring, as it's difficult to assess actual trading conditions without comprehensive user testimonials or performance data.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent the most concerning aspects of this ifexcapital review that potential clients must carefully consider. While the broker claims regulation under the FSC (Financial Services Commission of Mauritius), specific license numbers and detailed regulatory compliance information were not clearly provided, raising transparency concerns about actual regulatory oversight.

More significantly, available sources indicate discussions about potential fraudulent activities and questions about the broker's legitimacy that create substantial risk considerations. User feedback includes concerns about possible scam activities, which severely impacts the trust assessment and requires careful evaluation by potential clients.

The lack of detailed information about client fund protection measures, segregated account policies, or insurance coverage further compounds trust concerns. Transparency about financial reporting, auditing procedures, or third-party oversight was not provided in available sources, which limits assessment of financial security measures and client protection protocols.

Company transparency regarding ownership structure, management team, or corporate governance practices appears limited, which may contribute to user uncertainty about the broker's reliability. The combination of regulatory transparency gaps and user concerns about potential fraudulent activities results in a low trust score that reflects significant risk considerations requiring thorough due diligence.

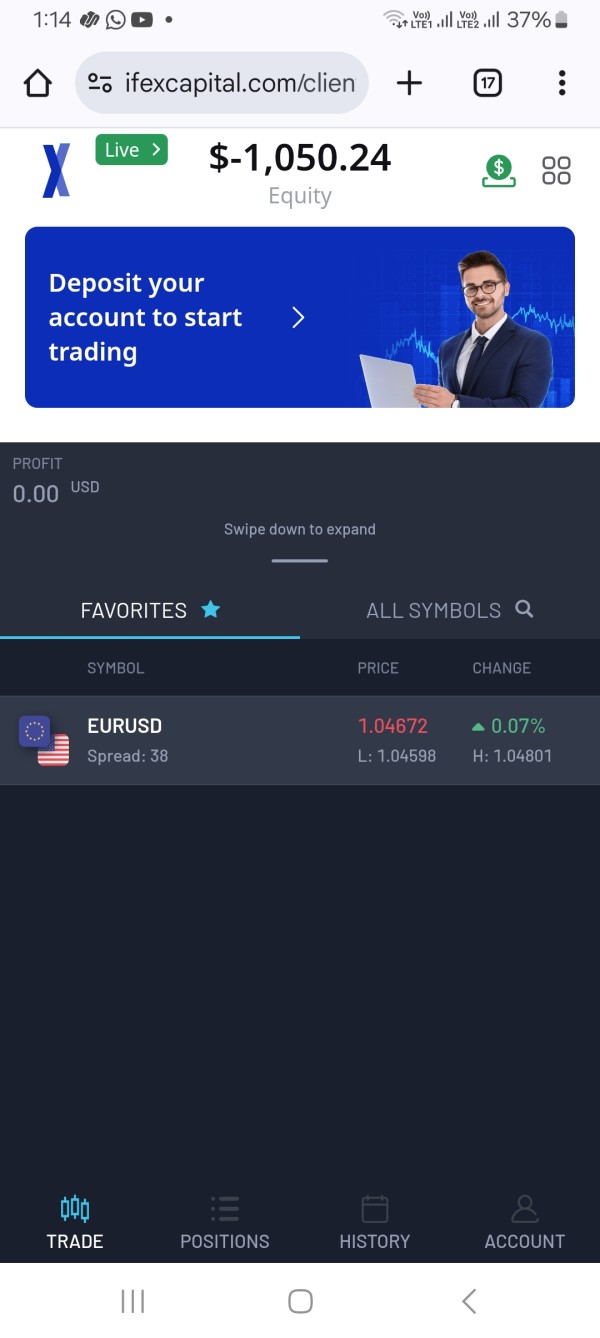

User Experience Analysis (Score: 5/10)

Overall user experience reflects the mixed nature of client feedback, with reviews showing both positive and negative experiences across different service areas. The broker appears to attract risk-tolerant startup investors, suggesting some appeal to specific trader demographics, but overall satisfaction levels appear inconsistent based on available feedback.

Interface design and platform usability details were not extensively covered in available sources, making it difficult to assess the quality of user interaction with the trading platform. Registration and verification process efficiency, which significantly impact initial user experience, lack detailed description or user feedback that would help potential clients understand onboarding expectations.

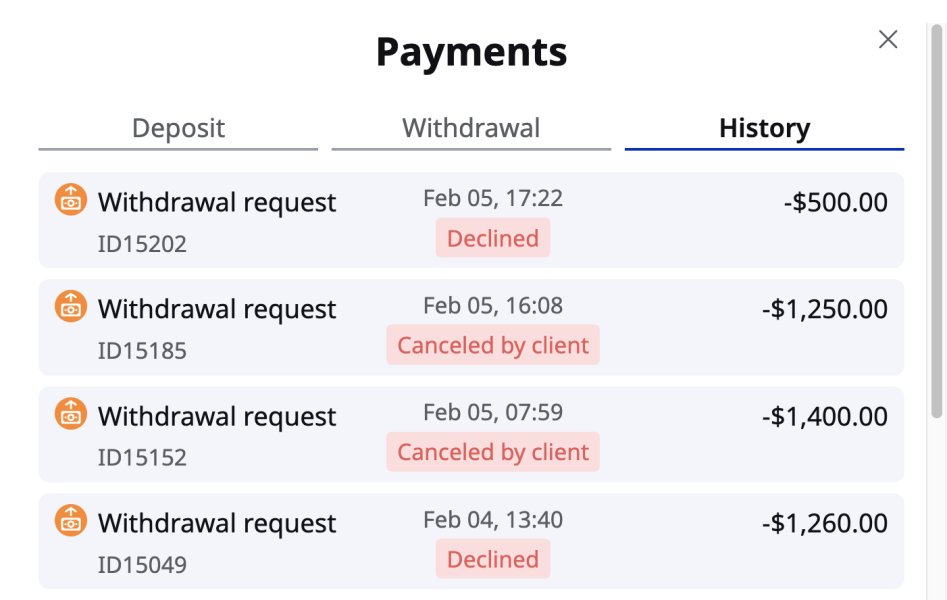

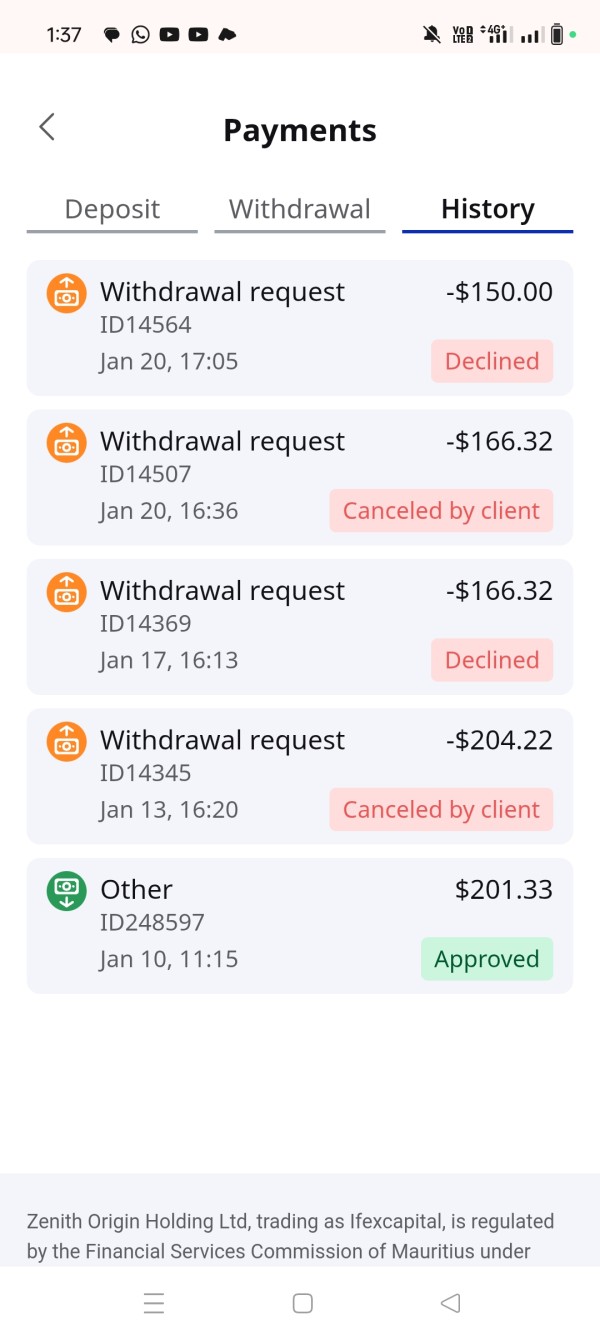

Funding operations experience, including deposit and withdrawal convenience, processing times, and associated costs, were not detailed in available sources. This represents a significant information gap, as funding operations are crucial components of overall user experience that directly impact client satisfaction and platform usability.

Common user complaints appear to center around trust and reliability concerns rather than specific platform functionality issues, though detailed feedback about specific user experience elements was limited. The moderate scoring reflects the mixed user feedback while acknowledging the need for more comprehensive user experience data to provide a complete assessment of client satisfaction levels.

Conclusion

This comprehensive ifexcapital review reveals a broker with both opportunities and significant concerns that potential traders must carefully evaluate before making investment decisions. Ifexcapital presents itself as a regulated forex and CFD broker offering high leverage up to 1:500 and access to over 250 trading assets across multiple categories, which represents competitive market access for diverse trading strategies and portfolio diversification opportunities.

However, the evaluation identifies substantial trust and transparency issues that overshadow the broker's potential advantages. Mixed user feedback, regulatory transparency gaps, and discussions about potential fraudulent activities create a risk environment that requires careful consideration and thorough due diligence before engagement.

The broker appears most suitable for risk-tolerant startup investors who are willing to navigate uncertainty in exchange for access to diverse trading opportunities and competitive leverage ratios. Key advantages include comprehensive asset coverage, high leverage options, and multiple account types that cater to different trader profiles.

Primary concerns encompass trust and reliability issues, limited customer service transparency, and insufficient information about costs and procedures that impact decision-making. Potential clients should conduct thorough due diligence, verify regulatory status, and carefully consider the risk-reward balance before engaging with this broker or making any financial commitments.