Regarding the legitimacy of IFEXCAPITAL forex brokers, it provides FSC and WikiBit, (also has a graphic survey regarding security).

Is IFEXCAPITAL safe?

Pros

Cons

Is IFEXCAPITAL markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

Valentis Markets

Effective Date: Change Record

2021-10-22Email Address of Licensed Institution:

info@blueazurite.comSharing Status:

Website of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SUITE 803, 8TH FLOOR HENNESSY TOWER, POPE HENNESSY STREET, PORT LOUIS 11328, MauritiusPhone Number of Licensed Institution:

+230 214 2237Licensed Institution Certified Documents:

Is Ifexcapital A Scam?

Introduction

Ifexcapital is a relatively new player in the forex market, positioning itself as an online brokerage that offers a range of trading services, including forex, cryptocurrencies, commodities, and more. As the financial trading landscape continues to evolve, traders must exercise caution and conduct thorough evaluations before choosing a broker. The potential for scams in the forex industry is significant, with many unregulated entities operating with little oversight. Therefore, it is crucial for traders to assess the legitimacy of brokers like Ifexcapital to protect their investments. This article aims to provide a comprehensive evaluation of Ifexcapital, utilizing various sources and structured analysis to determine if it is a trustworthy brokerage or a potential scam.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in assessing its legitimacy. Ifexcapital claims to operate under the supervision of the Financial Services Commission (FSC) in Mauritius, which is known for its relatively lenient regulatory framework. While the FSC does provide oversight, it is often viewed as a tier-4 regulator, which means it may not offer the same level of investor protection as more stringent regulatory bodies like the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB21026812 | Mauritius | Valid |

The lack of robust regulatory oversight raises concerns about the safety of client funds and the overall reliability of Ifexcapital. Furthermore, while the broker claims to adhere to certain standards, the effectiveness of these regulations in protecting traders remains questionable, especially given the offshore registration.

Company Background Investigation

Ifexcapital is operated by Zenith Origin Holding Ltd, a company registered in Mauritius. The brokerage began its operations in 2021, suggesting it is a relatively new entrant in the competitive forex market. The ownership structure and management team are essential components in assessing a broker's credibility. However, detailed information about the management team and their professional backgrounds is sparse, which can be a red flag for potential investors. Transparency in this area is critical, as it helps build trust and confidence among clients.

The company's website provides limited insights into its operational history and regulatory compliance, which further complicates the evaluation of its legitimacy. A lack of clear information may indicate an attempt to obscure potential issues related to its operations and regulatory standing.

Trading Conditions Analysis

When evaluating a broker, understanding the cost structure associated with trading is essential. Ifexcapital offers a variety of trading accounts, each with different spreads and leverage options. However, the overall fee structure appears to be competitive, with claims of zero commissions and spreads starting from 0.025 pips.

| Fee Type | Ifexcapital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.025 pips | 0.5 pips |

| Commission Model | 0% | 0.1% - 0.5% |

| Overnight Interest Range | Varies | Varies |

While the zero-commission model may seem attractive, it raises questions about how the broker generates revenue. Such models often rely on wider spreads or hidden fees, which can disadvantage traders in the long run. Additionally, there are reports of unusual fees, such as a $30 charge for withdrawals below $50, which could deter traders from accessing their funds.

Client Fund Security

Client fund security is a paramount concern for any trader. Ifexcapital claims to implement various measures to protect client funds, including segregated accounts and compliance with anti-money laundering (AML) regulations. However, the effectiveness of these measures is often contingent on the regulatory environment in which the broker operates.

The broker's offshore status means that the level of investor protection may not be as robust as it would be under stricter regulations. Furthermore, there have been no notable incidents reported regarding fund security issues, but the lack of transparency about their security protocols is concerning. Traders should be wary of brokers that do not provide clear information about how their funds are protected.

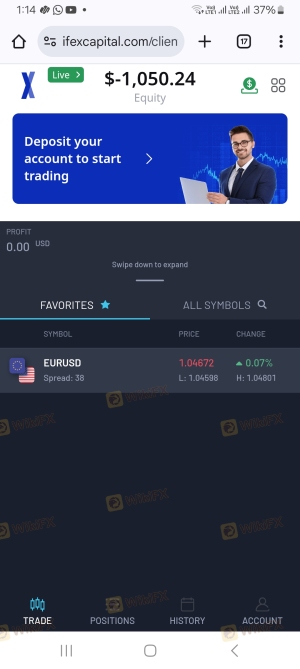

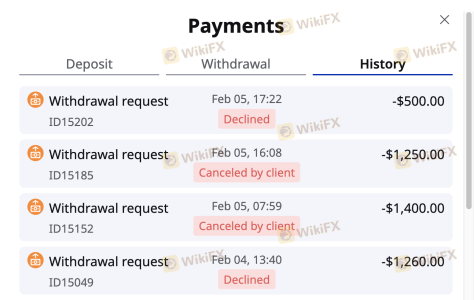

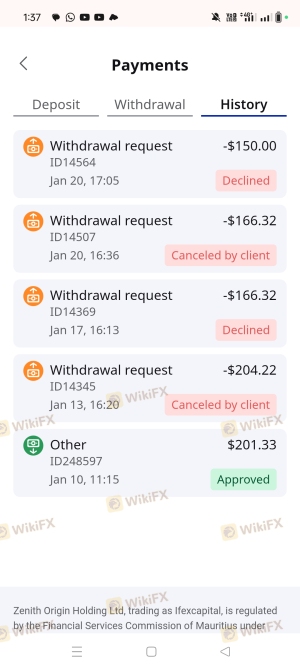

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Many reviews of Ifexcapital highlight issues with fund withdrawals and customer support responsiveness. Common complaints include delays in processing withdrawal requests and difficulties in reaching customer service representatives.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Unresponsive |

Several users have reported waiting weeks for their funds to be processed, which raises significant concerns about the broker's operational integrity. In some instances, traders have alleged that their accounts were drained, resulting in a loss of funds. These patterns of complaints should serve as a cautionary tale for potential clients considering Ifexcapital.

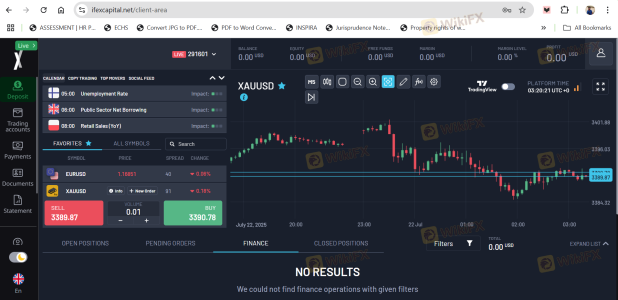

Platform and Trade Execution

The trading platform provided by Ifexcapital is a web-based solution that offers access to various assets and trading tools. While the platform is user-friendly, there have been mixed reviews regarding its performance and reliability. Issues such as slippage and order rejections have been reported, which can severely impact trading outcomes.

The quality of order execution is critical for traders, especially in a fast-paced market. Ifexcapitals claims of low execution times may not always hold true, as user experiences suggest that the platform may not consistently deliver on these promises. Traders should be vigilant about potential manipulation or technical issues that could affect their trades.

Risk Assessment

Using Ifexcapital carries several risks that traders should consider before committing their funds. The offshore regulatory status, combined with the lack of transparency regarding company operations and management, creates an environment of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack robust protections. |

| Fund Security Risk | Medium | Limited transparency on fund protection measures. |

| Withdrawal Risk | High | Reports of delayed withdrawals and account issues. |

To mitigate these risks, traders should conduct thorough research, start with a small investment, and regularly monitor their accounts for any unusual activity.

Conclusion and Recommendations

In conclusion, Ifexcapital raises several red flags that warrant caution. Its offshore regulatory status, combined with inconsistent customer feedback and operational transparency, suggests that it may not be a reliable broker. Potential traders should be aware of the risks involved and consider alternative options with stronger regulatory oversight and proven track records.

For those seeking reputable alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized. These brokers offer a higher level of investor protection, transparent fee structures, and a more reliable trading environment. Always ensure to conduct due diligence and consider the experiences of other traders before making a commitment.

Is IFEXCAPITAL a scam, or is it legit?

The latest exposure and evaluation content of IFEXCAPITAL brokers.

IFEXCAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFEXCAPITAL latest industry rating score is 2.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.