FGFSL 2025 Review: Everything You Need to Know

Executive Summary

FGFSL is a financial services provider. The company has 14 years of operational history and keeps its headquarters in Hong Kong. This fgfsl review looks at the broker's offerings and overall market position in the competitive forex trading landscape. FGFSL is a company that mainly serves institutional clients including Frasers Group and Studio Retail. The broker operates within a specialized niche of the financial services sector.

The broker's business model focuses on providing financial services rather than traditional retail forex trading. This approach sets it apart from conventional online trading platforms. Based on available information and user feedback that follows local regulations, FGFSL maintains a neutral overall rating in the market. The company's long-standing presence in the industry suggests operational stability. However, specific details about retail trading services remain limited.

For potential investors considering FGFSL's services, it's important to note that the broker's primary focus is on institutional financial services rather than individual retail trading accounts. This positioning may appeal to traders seeking specialized financial services or those with connections to the company's existing client base.

Important Disclaimers

When evaluating FGFSL, traders should know that regulatory requirements and operational models may vary significantly across different countries and jurisdictions. The broker's Hong Kong-based operations may be subject to specific regional regulations. These regulations could impact service availability and trading conditions for international clients.

This review is compiled based on publicly available information and user feedback. Specific regulatory documentation and detailed service specifications were not readily accessible through standard industry channels. Different sources may present varying information about FGFSL's services. Potential clients should conduct independent verification of all trading conditions and regulatory status before making investment decisions.

Rating Framework

Broker Overview

FGFSL operates as a financial services provider. The company has an established presence spanning 14 years in the industry. Based in Hong Kong, the company has built its reputation primarily through providing specialized financial services to institutional clients. FGFSL has notable partnerships with Frasers Group and Studio Retail. This institutional focus distinguishes FGFSL from typical retail-oriented forex brokers that primarily target individual traders.

The company's business model centers around delivering comprehensive financial services rather than operating as a traditional online trading platform. This approach suggests that FGFSL may cater to clients requiring more sophisticated financial solutions or those seeking institutional-grade services. The broker's Hong Kong headquarters positions it strategically within one of Asia's major financial centers. This location potentially provides access to regional markets and regulatory frameworks.

Unlike many contemporary forex brokers that rely heavily on popular trading platforms such as MetaTrader 4 or MetaTrader 5, FGFSL appears to operate through alternative systems. This fgfsl review notes that the broker's platform choices may reflect its specialized service approach rather than mass-market appeal. The company's focus on forex trading within its service portfolio aligns with its financial services mandate. However, the specific scope of tradeable instruments and market access remains to be fully detailed through direct consultation with the broker.

Regulatory Jurisdiction: Available information does not specify particular regulatory authorities overseeing FGFSL's operations. Its Hong Kong base suggests potential compliance with local financial regulations.

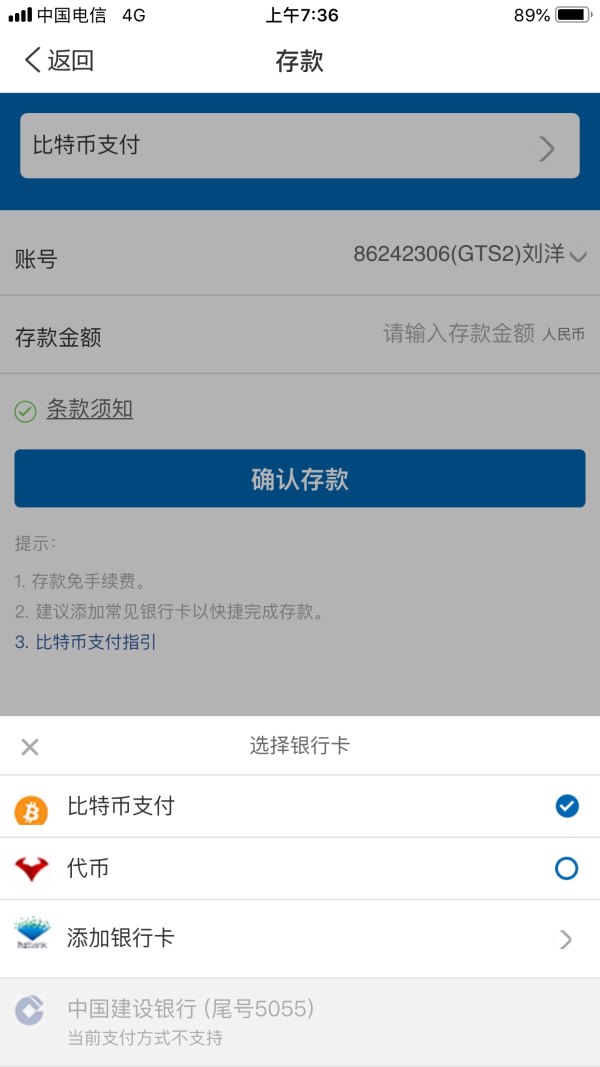

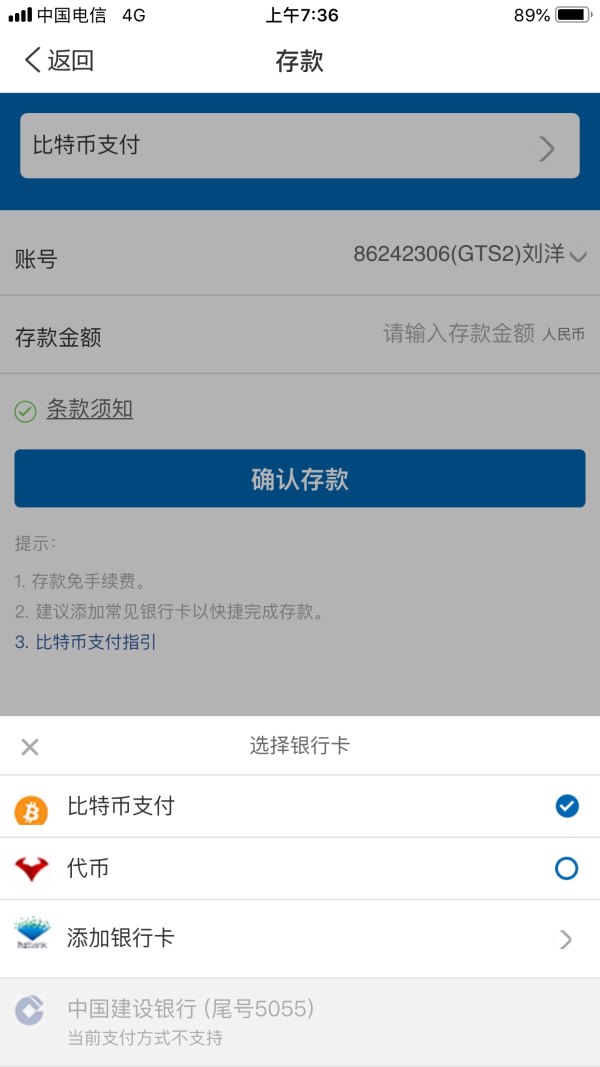

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures have not been detailed in accessible documentation. This requires direct inquiry with the broker for comprehensive information.

Minimum Deposit Requirements: Entry-level funding requirements are not specified in available materials. This indicates the need for prospective clients to contact FGFSL directly.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not outlined in standard broker information channels.

Available Trading Assets: The broker's service portfolio includes forex trading capabilities. However, the complete range of available currency pairs and additional instruments requires clarification through direct communication.

Cost Structure: Detailed information regarding spreads, commission rates, overnight financing charges, and other trading costs is not readily available through standard information sources. This fgfsl review recommends obtaining comprehensive fee schedules directly from the broker.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Technology: FGFSL operates without utilizing the popular MT4/MT5 platform ecosystem. Instead, the company employs alternative trading technology solutions.

Geographic Restrictions: Specific limitations on service availability by country or region are not detailed in accessible materials.

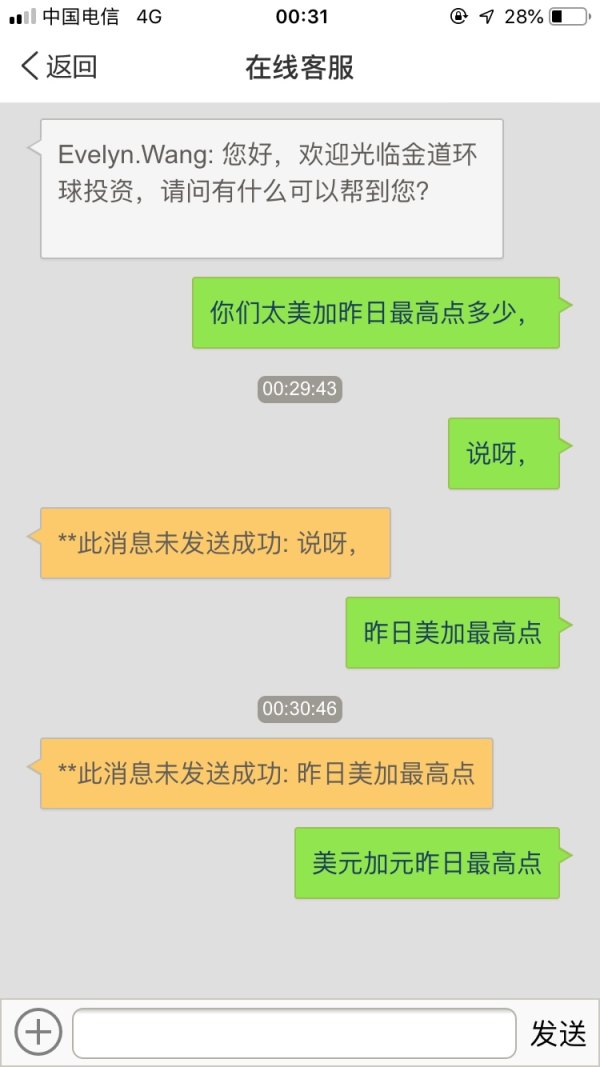

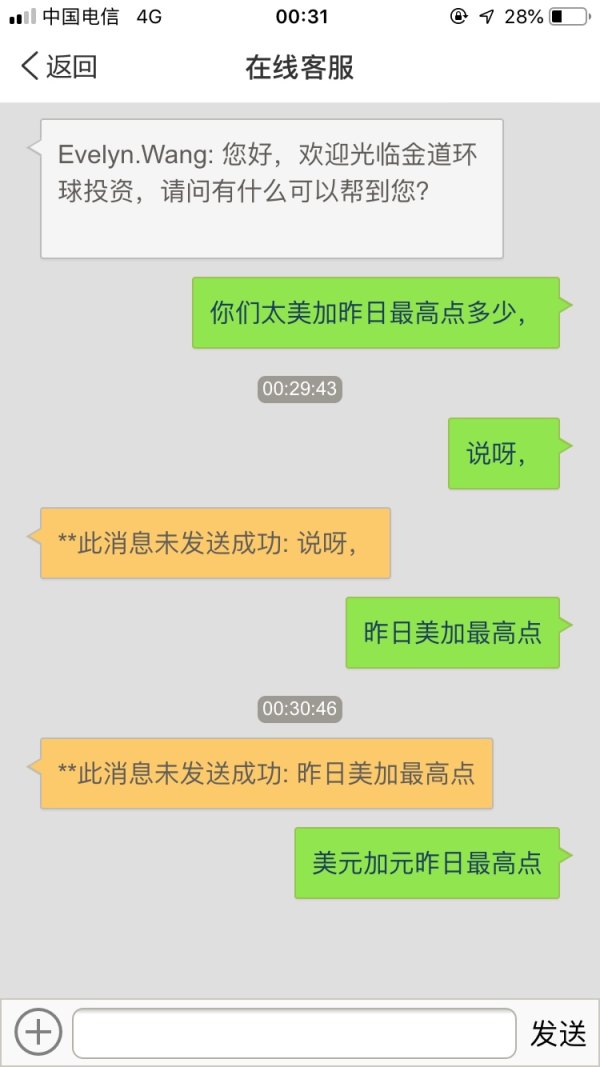

Customer Support Languages: Available customer service languages and communication options require direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of FGFSL's account conditions remains challenging due to limited publicly available information regarding specific account structures and requirements. Traditional retail forex brokers typically offer multiple account tiers with varying minimum deposits, spreads, and features. However, FGFSL's institutional focus may result in a different approach to account categorization.

Without detailed documentation of account types, minimum funding requirements, or special account features such as Islamic trading accounts, potential clients cannot adequately assess whether FGFSL's offerings align with their trading needs and financial capabilities. The absence of standard account information suggests that FGFSL may operate on a more personalized service model. This approach requires direct consultation to determine suitable account structures.

The account opening process, verification requirements, and ongoing account maintenance conditions are not standardized in available materials. This fgfsl review emphasizes the importance of direct communication with FGFSL representatives to understand the complete account framework and associated terms. Prospective clients should inquire specifically about any special account features, trading privileges, or restrictions that may apply to their particular circumstances.

Assessment of FGFSL's trading tools and analytical resources proves difficult without access to comprehensive platform documentation or user guides. Modern forex brokers typically provide extensive charting capabilities, technical indicators, automated trading support, and market analysis tools to enhance trading decisions and execution efficiency.

The absence of detailed information regarding FGFSL's technological offerings, research capabilities, and educational resources limits the ability to evaluate the broker's support for trader development and market analysis. Professional trading environments often include advanced order types, risk management tools, and real-time market data feeds that are essential for effective trading operations.

Educational resources, market commentary, and analytical support represent crucial components of a comprehensive trading service. Without specific information about FGFSL's commitment to trader education and market insights, potential clients cannot assess the broker's value proposition beyond basic trade execution. The broker's institutional focus may indicate that clients are expected to possess independent analytical capabilities rather than relying on broker-provided resources.

Customer Service and Support Analysis

Evaluation of FGFSL's customer service framework remains incomplete due to insufficient information regarding support channels, availability hours, and service quality standards. Effective customer support represents a critical component of any financial services relationship. This is particularly true for trading activities that may require immediate assistance or technical resolution.

The absence of detailed customer service information prevents assessment of response times, multilingual support capabilities, or specialized assistance for technical issues. Professional trading environments demand reliable customer support that can address account inquiries, technical difficulties, and trading-related questions promptly and effectively.

Without access to user feedback regarding customer service experiences or documented service level agreements, this evaluation cannot provide meaningful insights into FGFSL's support quality. Potential clients should prioritize direct assessment of customer service responsiveness and expertise through initial inquiries before establishing trading relationships.

Trading Experience Analysis

The trading experience evaluation for FGFSL encounters significant limitations due to the absence of detailed platform specifications, execution quality data, and user experience feedback. Trading platform performance, including order execution speed, system stability, and interface functionality, directly impacts trading outcomes and user satisfaction.

Without specific information about FGFSL's trading technology, mobile accessibility, or platform features, traders cannot assess whether the broker's systems meet their operational requirements. Professional trading demands reliable platform performance, competitive execution quality, and comprehensive functionality that supports various trading strategies and risk management approaches.

The lack of available performance metrics, user testimonials, or platform demonstrations prevents meaningful evaluation of FGFSL's trading environment. Potential clients should request platform demonstrations or trial access to assess system suitability before committing to trading relationships.

Trust and Reliability Analysis

Trust assessment for FGFSL proves challenging without comprehensive regulatory documentation, safety measure specifications, or detailed company transparency information. Financial services credibility depends heavily on regulatory oversight, client fund protection, and operational transparency that demonstrates commitment to client interests.

The absence of specific regulatory authority information, client fund segregation details, or insurance protection specifications limits the ability to evaluate FGFSL's safety framework. Professional trading relationships require clear understanding of fund security measures and regulatory protections that safeguard client interests.

Without access to regulatory filings, audit reports, or third-party assessments of FGFSL's operational integrity, potential clients cannot adequately evaluate the broker's trustworthiness. The company's 14-year operational history suggests stability. However, specific trust-building measures require direct verification through regulatory channels and company documentation.

User Experience Analysis

User experience evaluation for FGFSL remains incomplete due to limited availability of client feedback, satisfaction surveys, or detailed user interface assessments. Overall user satisfaction depends on multiple factors including platform usability, service efficiency, and problem resolution effectiveness.

The absence of comprehensive user reviews, satisfaction ratings, or experience testimonials prevents meaningful assessment of FGFSL's service quality from the client perspective. User experience encompasses everything from initial account setup through ongoing trading activities and customer service interactions.

Without detailed information about common user concerns, service improvements, or client retention rates, this evaluation cannot provide insights into FGFSL's actual performance in meeting client expectations. Potential users should seek references from existing clients or request trial periods to assess service suitability.

Conclusion

This fgfsl review reveals a financial services provider with established market presence but limited publicly available information regarding specific trading services and conditions. FGFSL's 14-year operational history and Hong Kong base suggest institutional stability. However, the broker's specialized focus may not align with typical retail trading expectations.

The broker appears most suitable for experienced traders or institutional clients seeking specialized financial services rather than standard retail forex trading platforms. FGFSL's clear business model and established client relationships represent positive attributes. Meanwhile, the lack of transparent operational information presents challenges for comprehensive evaluation.

Prospective clients should conduct thorough due diligence through direct communication with FGFSL representatives to obtain detailed information about trading conditions, regulatory status, and service specifications before making trading decisions.