Axel 2025 Review: Everything You Need to Know

Executive Summary

In this comprehensive axel review, we examine a forex broker that presents a mixed picture for potential traders in 2025. Axel was established in 2019 and has its headquarters in Canada, where it operates as a forex and financial products trading service provider under ASIC regulation. However, the broker landscape reveals concerning elements, particularly with Axel Private Market being flagged as high-risk by regulatory watchdogs.

The broker's key attractions include competitive spreads starting from 0 pips, leverage up to 1:500, and zero commission structures. These features are all delivered through the popular MT4 trading platform. These features primarily target small to medium-sized investors and traders seeking high-leverage opportunities. The minimum deposit requirement of $100 makes it accessible to entry-level traders.

Despite these advantages, our analysis reveals significant concerns regarding customer service responsiveness and the overall trustworthiness of certain Axel entities. User feedback indicates mixed experiences. Particular criticism is directed at support quality and withdrawal processing times. The regulatory oversight by the Australian Securities and Investments Commission (ASIC) provides some legitimacy, yet the high-risk classification of related entities raises important red flags for potential investors.

关键词使用: This axel review aims to provide objective insights based on available public information and user feedback to help traders make informed decisions.

Important Disclaimer

Regional Entity Differences: Prospective traders should exercise extreme caution when evaluating Axel-related entities. Our research indicates that while some Axel companies operate under legitimate regulatory frameworks, Axel Private Market has been specifically flagged as high-risk by industry watchdogs. This classification suggests potential regulatory violations or questionable business practices that could endanger client funds.

Review Methodology: This evaluation is compiled from publicly available information, user testimonials, and regulatory filings current as of 2025. Given the complexity of multi-entity broker structures, traders are strongly advised to verify the specific regulatory status of their intended trading entity before committing funds.

Rating Framework

Broker Overview

Company Foundation and Background

Axel emerged in the forex trading landscape in 2019. The company established its headquarters in Canada with a focus on providing comprehensive forex and financial product trading services. The company positioned itself as a technology-driven broker, aiming to serve the growing demand for accessible online trading platforms. According to available company information, Axel's business model centers on offering multiple asset class trading opportunities while maintaining competitive cost structures for retail traders.

The broker's operational approach emphasizes leveraging established trading infrastructure, particularly through the widely-adopted MetaTrader 4 platform. This approach allows them to deliver trading services across various financial instruments. This strategic choice reflects the company's focus on providing familiar trading environments rather than developing proprietary technology solutions.

Trading Infrastructure and Asset Coverage

Axel's trading ecosystem revolves around the MT4 platform. It provides access to diverse asset categories including currency pairs, commodities, stocks, indices, and cryptocurrency instruments. This multi-asset approach targets traders seeking portfolio diversification within a single trading account. The broker's regulatory oversight falls under the Australian Securities and Investments Commission (ASIC), which provides a framework for client protection and operational standards.

The company's service delivery model emphasizes low-barrier entry combined with high-leverage opportunities. This positioning particularly targets traders seeking aggressive trading strategies. However, this axel review notes that the broker's multi-entity structure requires careful evaluation by potential clients to ensure they engage with properly regulated entities.

Regulatory Jurisdiction: Axel operates under Australian Securities and Investments Commission (ASIC) supervision. This provides regulatory protection for qualifying clients within ASIC's jurisdiction.

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available documentation. This requires direct inquiry with the broker for comprehensive information.

Minimum Deposit Requirements: The broker maintains a $100 minimum deposit threshold. This makes it accessible to entry-level traders and those testing new strategies with limited capital.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available materials. This suggests either limited promotional focus or information accessibility issues.

Tradeable Assets: The platform supports trading across multiple asset classes. These include major and minor currency pairs, commodity futures, equity indices, individual stocks, and select cryptocurrency instruments.

Cost Structure: Axel advertises spreads beginning from 0 pips with zero commission charges. This potentially offers competitive trading costs for high-volume traders and scalping strategies.

Leverage Ratios: Maximum leverage reaches 1:500. This caters to traders seeking significant position amplification, though this level carries corresponding risk exposure.

Platform Options: Trading services are delivered primarily through the MetaTrader 4 platform. This provides access to automated trading, technical analysis tools, and mobile trading capabilities.

Geographic Restrictions: Specific regional limitations are not clearly outlined in available documentation. This requires verification based on individual jurisdiction requirements.

Customer Support Languages: Available customer service language options are not specified in current materials. This necessitates direct contact for multilingual support confirmation.

This axel review emphasizes the importance of verifying these details directly with the broker. Information availability varies significantly across different sources.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Axel's account structure presents a mixed evaluation profile that merits careful consideration. The broker's $100 minimum deposit requirement positions it favorably among entry-level trading options. This enables new traders to begin with manageable capital exposure. This threshold compares competitively with industry standards and removes significant barriers for traders testing strategies or platforms.

However, available documentation lacks detail regarding account type variety. These typically include standard, premium, or VIP account classifications with varying benefits. The absence of clear account tier information suggests either simplified account structures or inadequate information transparency. User feedback indicates general satisfaction with the low entry threshold, though some express concerns about the limited account customization options.

The 1:500 maximum leverage availability represents a significant attraction for traders seeking position amplification. However, this level requires sophisticated risk management. Combined with zero commission structures, these conditions appeal particularly to scalping strategies and high-frequency trading approaches. Nevertheless, the lack of specialized account features, such as Islamic accounts for Sharia-compliant trading, may limit accessibility for certain trader demographics.

User feedback indicates: "The low minimum deposit made it easy to start, but I wished there were more account options for different trading styles." This axel review notes that while basic account conditions appear competitive, the limited variety may constrain long-term trader development within the platform.

The trading tools and resources evaluation reveals a platform built around solid foundations with notable limitations. Axel's primary reliance on the MetaTrader 4 platform provides traders with a stable, widely-recognized trading environment. This supports automated trading through Expert Advisors, comprehensive charting capabilities, and mobile trading access. User feedback consistently praises the platform's stability and familiar interface.

However, the broker's offering appears limited in terms of proprietary research and analysis resources. Available information suggests minimal provision of market research, economic calendars, or educational materials that typically distinguish full-service brokers. This limitation particularly affects newer traders who benefit from comprehensive learning resources and market analysis to develop trading competencies.

The absence of advanced trading tools beyond the standard MT4 package may disappoint more sophisticated traders. These tools include sentiment indicators, advanced order types, or integrated news feeds. Additionally, the lack of detailed educational resources, including webinars, trading guides, or market commentary, represents a significant gap in trader development support.

User feedback reflects: "The MT4 platform works well and is reliable, but I had to look elsewhere for market analysis and learning materials." This suggests that while the core trading experience meets basic requirements, traders seeking comprehensive broker support may find the offering insufficient for their development needs.

Customer Service and Support Analysis (5/10)

Customer service represents one of Axel's most significant challenge areas based on available user feedback and operational assessments. Multiple user reports indicate extended response times for support inquiries. Some traders experience delays of several days for non-urgent matters. This response lag significantly impacts trader confidence, particularly during market volatility when timely support becomes crucial.

The quality of problem resolution appears inconsistent, with users reporting varying experiences in support effectiveness. Some traders describe satisfactory resolution of technical issues. Others express frustration with inadequate responses to account or trading-related problems. The lack of detailed information regarding available support channels suggests limited accessibility options beyond standard email or ticket systems.

Language support availability remains unclear from available documentation. This potentially limits accessibility for non-English speaking traders. Additionally, support hours and availability during different market sessions are not clearly specified, which could impact traders operating across various time zones. The absence of live chat or phone support options, if confirmed, would represent a significant limitation compared to full-service competitors.

User experiences include: "Getting help took much longer than expected, and the responses didn't always address my specific concerns." These service limitations significantly impact the overall trading experience and trader confidence in the broker's operational capabilities.

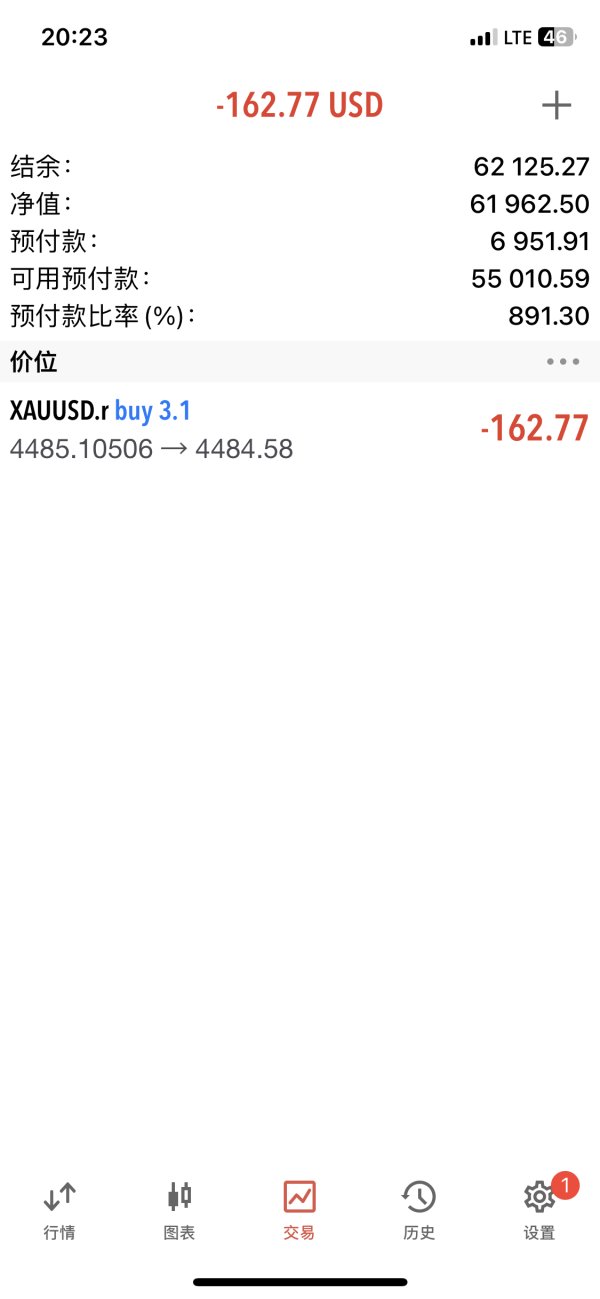

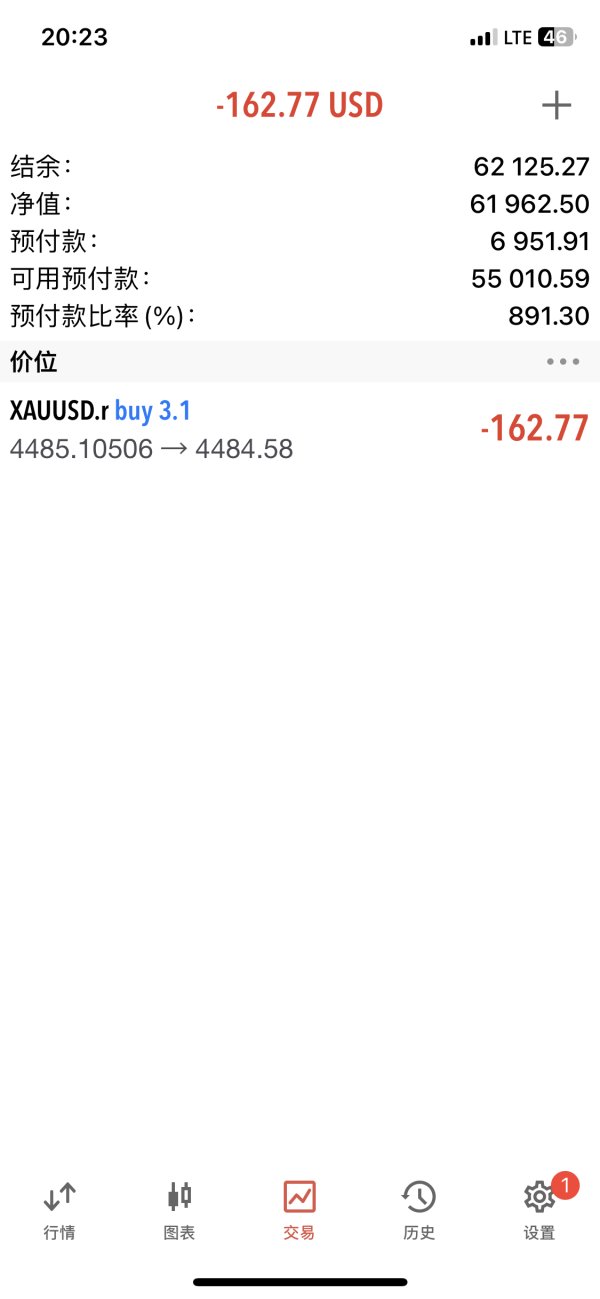

Trading Experience Analysis (7/10)

The trading experience evaluation presents generally positive feedback regarding platform performance and execution quality. Users consistently report stable platform operation with minimal downtime. This suggests robust technical infrastructure supporting the MT4 implementation. The platform's responsiveness and order processing capabilities receive favorable mentions in user feedback, indicating reliable execution under normal market conditions.

However, some traders report occasional slippage during high-volatility periods, which is common across the industry but worth noting for strategy planning. The spread stability generally meets user expectations. The advertised zero-pip starting spreads appear achievable under optimal market conditions. Order execution speed receives mixed feedback, with most users satisfied but some expressing concerns during peak trading hours.

The mobile trading experience, while not extensively detailed in available feedback, appears to meet basic requirements for traders requiring platform access outside desktop environments. The familiar MT4 interface reduces learning curves for experienced traders while providing sufficient functionality for various trading strategies.

Technical performance feedback includes: "The platform rarely crashes and orders go through quickly most of the time, though I've noticed some slippage during major news events." This axel review notes that while the core trading experience meets industry standards, occasional execution concerns may impact high-frequency or news-based trading strategies.

Trustworthiness Analysis (4/10)

Trustworthiness represents the most concerning aspect of this evaluation. It is significantly impacted by the high-risk classification of related Axel entities. While the main Axel entity operates under ASIC regulation, providing legitimate regulatory oversight, the flagging of Axel Private Market as high-risk creates substantial uncertainty about the broader corporate structure and operational practices.

The ASIC regulatory framework does provide client protection measures, including segregated account requirements and dispute resolution mechanisms. However, the existence of high-risk related entities raises questions about corporate governance and operational consistency across the Axel brand. This regulatory inconsistency significantly impacts overall trustworthiness assessments.

Available information lacks detail regarding client fund protection measures, such as insurance coverage or compensation schemes, which typically enhance broker credibility. The absence of transparent financial reporting or third-party audits further complicates trustworthiness evaluation. Additionally, limited information about company ownership structure and management backgrounds restricts comprehensive due diligence capabilities.

Regulatory concerns include: The high-risk designation of related entities suggests potential compliance issues that could affect client interests. User feedback regarding fund security shows mixed confidence levels. Some traders express concerns about the overall corporate structure. These factors combine to create significant trustworthiness challenges that require careful consideration by potential clients.

User Experience Analysis (6/10)

User experience evaluation reveals significant variation in trader satisfaction levels. This suggests inconsistent service delivery across different aspects of the trading relationship. Platform usability receives generally positive feedback, with traders appreciating the familiar MT4 interface and straightforward navigation. However, operational processes beyond trading execution show notable weaknesses.

Account opening and verification procedures are not well-documented in available materials, though user feedback suggests potentially complex or time-consuming processes. Deposit and withdrawal experiences receive particular criticism. Multiple reports cite extended processing times and unclear procedures. These operational friction points significantly impact overall user satisfaction.

The platform's learning curve appears manageable for traders familiar with MT4, though newcomers may struggle without comprehensive educational support. Interface design receives adequate ratings for functionality. However, users note the absence of modern features common in contemporary trading platforms. Customer onboarding processes appear limited, potentially leaving new users without adequate platform orientation.

User satisfaction feedback includes: "The trading part works fine, but everything else takes too long and feels unnecessarily complicated." The most frequent complaints center on customer service responsiveness and withdrawal processing efficiency. These operational challenges suggest that while the core trading functionality meets basic requirements, the broader service experience requires significant improvement to achieve competitive user satisfaction levels.

Conclusion

This comprehensive axel review reveals a broker with notable strengths in trading conditions but significant weaknesses in service delivery and trustworthiness. Axel's competitive spreads, accessible minimum deposits, and high leverage options create attractive trading conditions for specific trader segments. However, substantial concerns regarding customer service quality, operational efficiency, and regulatory consistency across related entities present considerable risks.

Recommended User Types: Axel may suit experienced traders who prioritize trading conditions over comprehensive service support. This particularly applies to those comfortable with MT4 platforms and requiring high leverage capabilities. Small to medium-sized investors seeking low-barrier entry might find the minimum deposit attractive, though they should carefully consider service limitations.

Key Advantages and Disadvantages: Primary advantages include competitive pricing structures, familiar platform technology, and accessible entry requirements. Critical disadvantages encompass inadequate customer support, concerning regulatory inconsistencies, and operational inefficiencies that impact overall trading relationships. The high-risk classification of related entities represents a fundamental concern requiring careful evaluation by all potential clients.