Regarding the legitimacy of YADIX forex brokers, it provides FSA and WikiBit, .

Is YADIX safe?

Pros

Cons

Is YADIX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Quantix FS Ltd

Effective Date:

--Email Address of Licensed Institution:

info@quantixfs.comSharing Status:

Website of Licensed Institution:

https://www.quantixfs.com, https://yadix.comExpiration Time:

--Address of Licensed Institution:

Office 3, Suite C, Orion Mall, Palm Street, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Yadix A Scam?

Introduction

Yadix is an online forex broker that positions itself as a provider of ECN (Electronic Communication Network) and STP (Straight Through Processing) trading services. Founded in 2010 and headquartered in Seychelles, Yadix claims to offer competitive trading conditions, including high leverage, low spreads, and a variety of trading instruments. However, the forex market is rife with brokers, and not all are trustworthy. Traders must exercise caution when choosing a broker, as the stakes are high and the potential for loss is significant. This article aims to provide an objective assessment of Yadix, analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

Regulation is a critical factor in determining a broker's legitimacy and the safety of client funds. Yadix operates under the jurisdiction of the Seychelles Financial Services Authority (FSA), which is considered an offshore regulatory body. While it does have a license, the effectiveness of such regulation is often questioned due to the lenient requirements compared to more reputable authorities like the FCA in the UK or ASIC in Australia.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 021 | Seychelles | Verified |

The FSA is responsible for regulating non-bank financial services in Seychelles. However, it lacks a compensation scheme to protect traders in the event of broker insolvency. Furthermore, the regulatory environment in Seychelles is known for being less stringent, which raises concerns about the broker's compliance with high operational standards. Reports suggest that Yadix has faced scrutiny and complaints regarding its practices, particularly around withdrawal issues, which further complicates its regulatory standing.

Company Background Investigation

Yadix is owned by Quantix Financial Services Limited, a company registered in Seychelles. The broker has been operational since 2010, but details about its ownership and management team are somewhat opaque. The lack of transparency in the company's structure can be alarming for potential clients, as it raises questions about accountability and governance.

The management team's professional experience is not widely publicized, which makes it difficult to assess their expertise in the financial services industry. Transparency is crucial for building trust, and Yadix seems to fall short in this area. The company does provide some information about its services and trading conditions on its website, but this is often seen as insufficient for a broker operating in a high-risk industry.

Trading Conditions Analysis

Yadix offers a variety of trading accounts, each with different fee structures and trading conditions. The overall cost of trading is a significant factor for traders, and Yadix claims to provide competitive pricing. However, some reviews indicate that the broker may impose hidden fees or unfavorable conditions that can affect profitability.

| Fee Type | Yadix | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.5 - 1.5 pips |

| Commission Model | Varies | $3 - $10 per lot |

| Overnight Interest Range | High | Moderate |

The spreads offered by Yadix can be higher than industry averages, particularly for its classic account, which charges a spread of 1.0 pips. Additionally, the commission model varies significantly depending on the account type, which can lead to confusion among traders. The lack of clarity regarding fees can be problematic, especially for those who are new to trading.

Customer Funds Safety

Customer fund safety is paramount in the forex trading industry. Yadix claims to maintain segregated accounts for client funds, which is a standard practice that helps protect traders' capital in the event of broker insolvency. However, the effectiveness of this measure is contingent upon the regulatory framework in which the broker operates.

Yadix does offer negative balance protection, which prevents clients from losing more than their deposited funds. However, the absence of a robust compensation scheme raises concerns about the overall safety of client funds. Historical complaints regarding withdrawal issues and fund access further complicate the perception of Yadix as a safe trading environment.

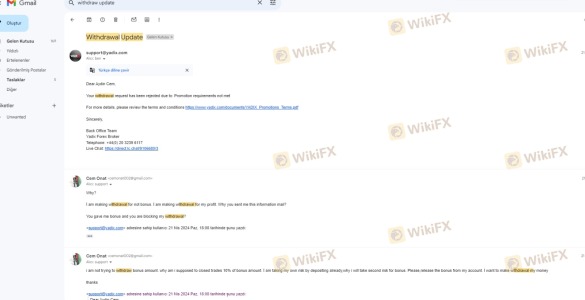

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Reviews of Yadix are mixed, with some users praising its trading conditions and execution speeds, while others report serious issues with withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Closure Complaints | High | Poor |

Common complaints include difficulties in withdrawing funds, with some users reporting that their withdrawal requests were denied or delayed without satisfactory explanations. This pattern of complaints raises red flags about the broker's operational integrity and customer service responsiveness.

Platform and Trade Execution

Yadix utilizes the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, the performance of the platform has been questioned by some users, particularly regarding order execution quality and slippage.

The broker claims to provide low latency and high execution speeds, which are critical for successful trading, especially for scalpers and algorithmic traders. However, reports of slippage and order rejections have surfaced, leading to concerns about the reliability of the platform.

Risk Assessment

Using Yadix carries inherent risks that traders should carefully consider. The regulatory status, customer complaints, and historical issues with fund withdrawals contribute to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Operational Risk | High | History of withdrawal issues and customer complaints. |

| Market Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and consider using brokers with stronger regulatory frameworks and better reputations.

Conclusion and Recommendations

In conclusion, Yadix presents a mixed picture. While it offers some attractive trading conditions, the regulatory environment, historical complaints, and issues with fund withdrawals raise significant concerns. The lack of transparency in its corporate structure and management further complicates the decision to trade with this broker.

For traders seeking a reliable and safe trading environment, it may be prudent to consider alternatives that are regulated by more reputable authorities, such as the FCA or ASIC. Brokers like FP Markets or IC Markets, known for their strong regulatory oversight and positive customer feedback, may offer a more secure trading experience. Ultimately, potential clients should weigh the risks and benefits carefully before engaging with Yadix.

Is YADIX a scam, or is it legit?

The latest exposure and evaluation content of YADIX brokers.

YADIX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YADIX latest industry rating score is 3.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.