yadix 2025 Review: Everything You Need to Know

Abstract

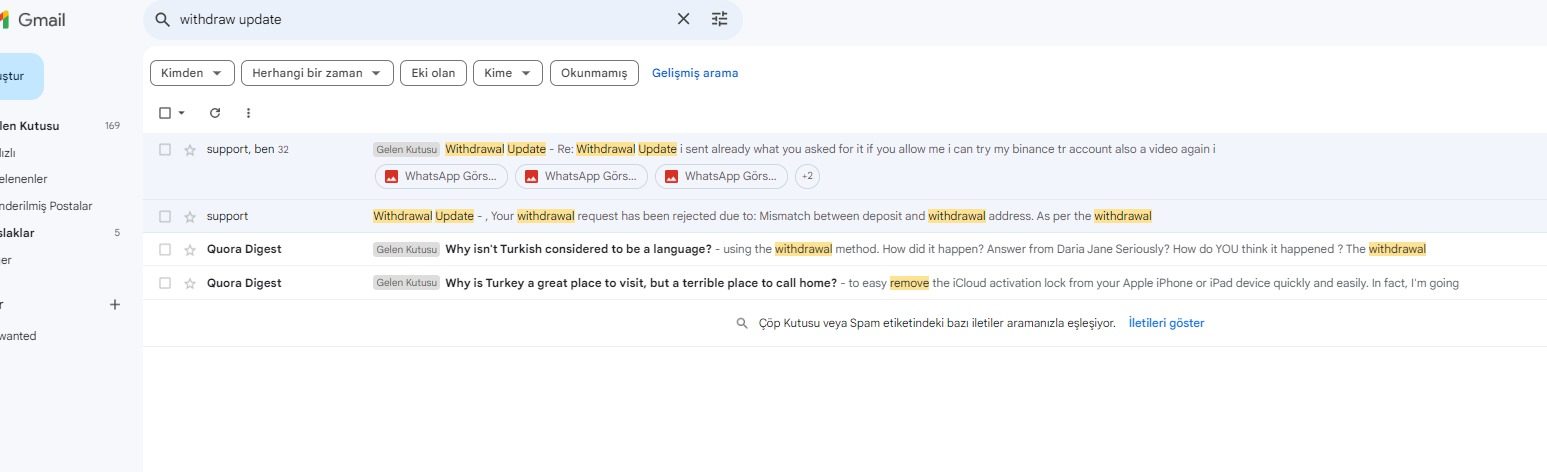

In this detailed yadix review, we look at a broker that has found its place among high-frequency and scalper traders. The company offers impressive features such as leverage of up to 1:1000 and a 20% commission refund plan. yadix operates under the regulation of the Vanuatu Financial Services Commission as an STP broker. The broker claims to deliver direct market access aimed at making trades more efficient. While the innovative commission rebate and high leverage options are clear advantages, the overall impression stays neutral. This is due to a modest user rating of 2.6 and only 44% of reviewers recommending its services. The platform primarily serves scalpers and high-frequency traders, supporting Expert Advisors and algorithmic trading strategies. However, there is a lack of clarity about the specifics of its trading platform and several operational details. This review details the broker's regulatory status, trading conditions, and user feedback. The analysis offers prospective traders a complete perspective on both its strengths and weaknesses. We base our evaluation on publicly available user feedback and the broker-stated information, ensuring transparency.

Important Caveats

It is important to note that yadix operates under the regulatory jurisdiction of the Vanuatu Financial Services Commission. This may differ significantly from other regional regulatory standards. This evaluation is based on publicly available user feedback and information disclosed by the broker. Therefore, certain details—such as deposit and withdrawal processes, minimum deposit requirements, specific platform details, and customer support responsiveness—are not fully disclosed in the available materials. Potential differences among various sources may exist. Readers are advised to consider this review as a starting point that may require further independent verification.

Scoring Framework

The following table shows our scoring for yadix across six key dimensions:

Broker Overview

Founded in 2010, yadix is a Vanuatu-based STP broker. The company primarily serves scalper and high-frequency traders. yadix uses its direct market access model to improve trading efficiency, making it an attractive option for traders who thrive on rapid execution and dynamic market conditions. Despite the appeal of high leverage and a profitable commission refund scheme, the broker's overall operational details remain somewhat unclear. For example, while it supports EA algorithms and automated trading systems, there is no clear indication about the specific platforms available to end users.

yadix also offers access to over 50 different trading tools, including both forex pairs and CFDs. This further shows its commitment to a wide range of asset classes. However, the broker's reliance on regulation by the Vanuatu Financial Services Commission rather than more strict regulatory bodies creates concerns about transparency and capital security. According to available reports and user reviews, the platform's innovative features such as high leverage and commission returns do not fully make up for the shortcomings in customer service and overall user experience. This section provides insight into the operational model and regulatory framework behind yadix. It outlines both its innovative offerings and potential problems.

-

Regulatory Region:

yadix is regulated by the Vanuatu Financial Services Commission , ensuring a basic level of oversight.

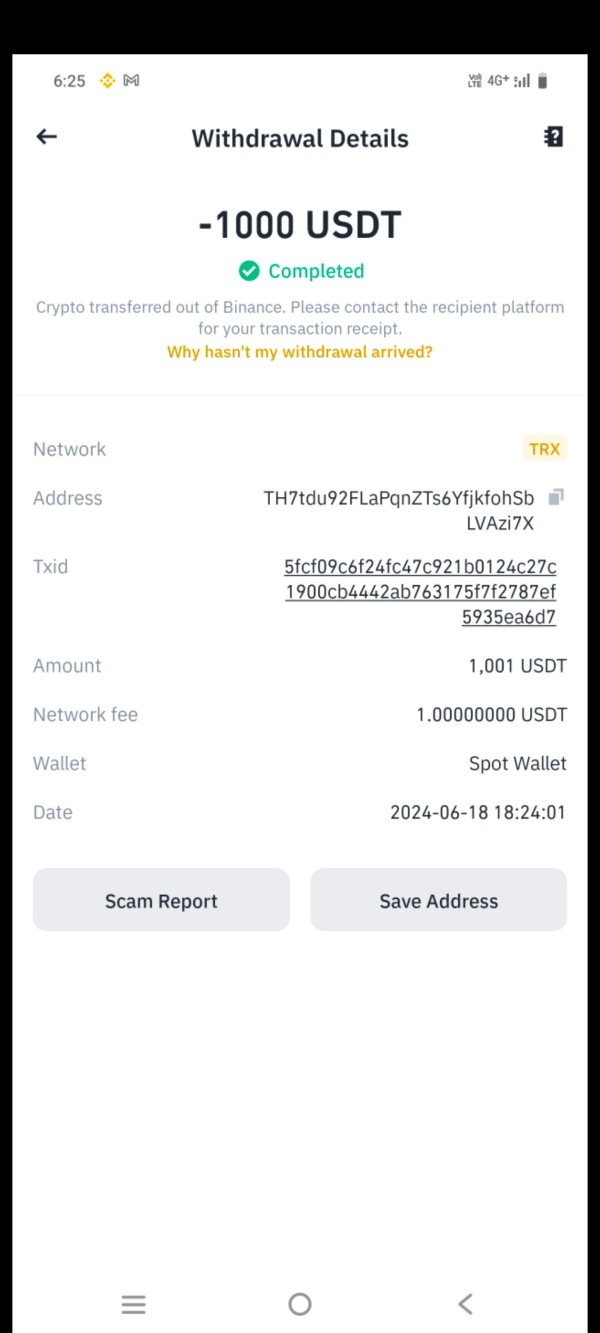

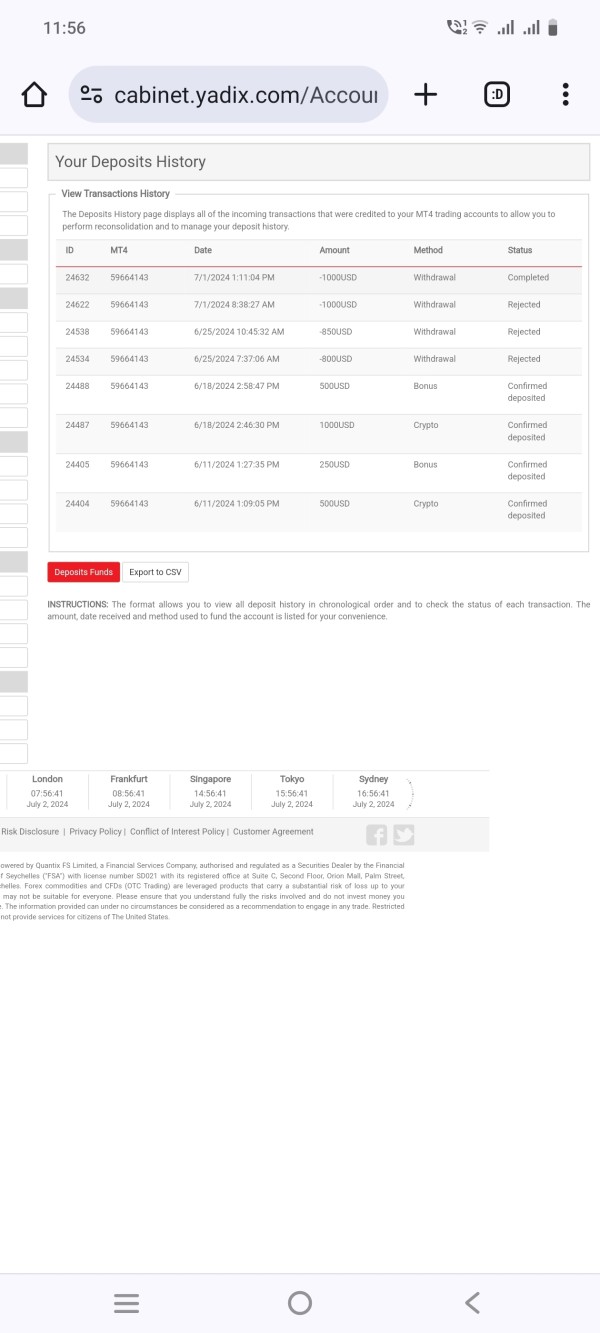

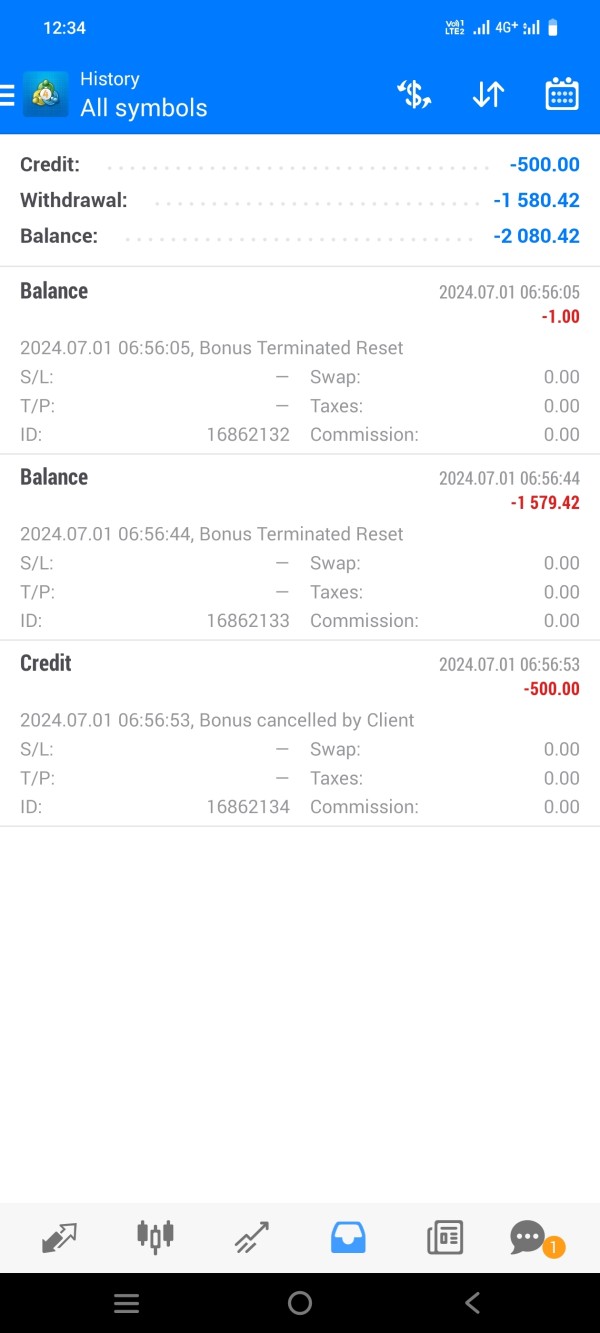

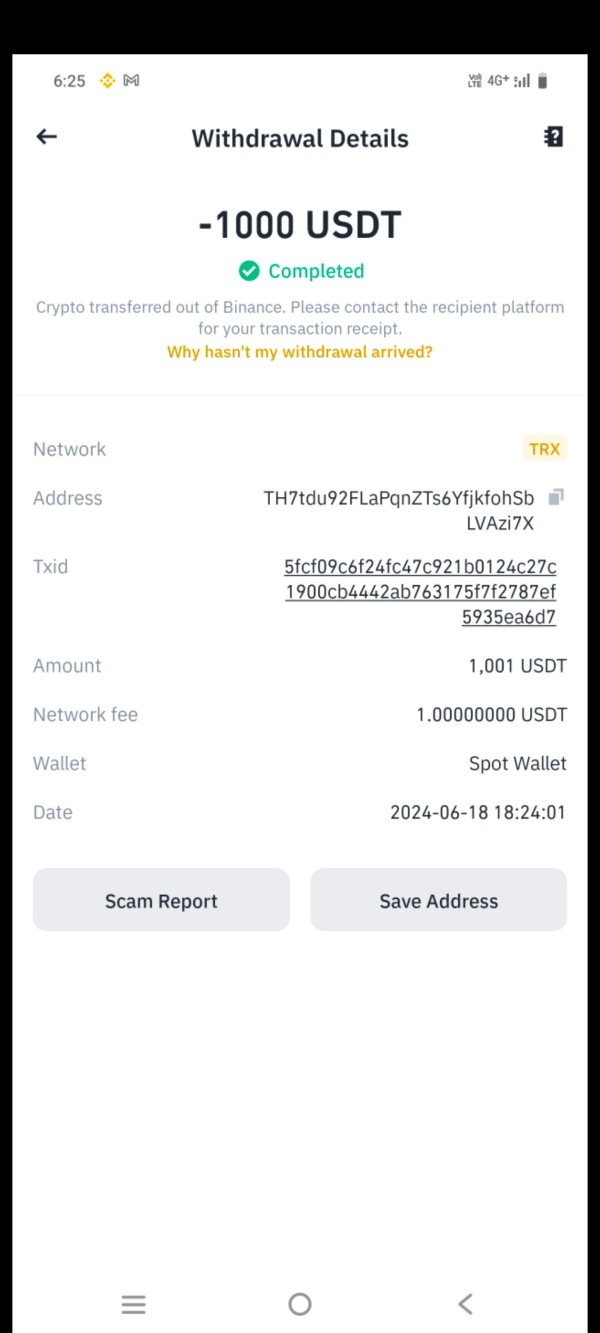

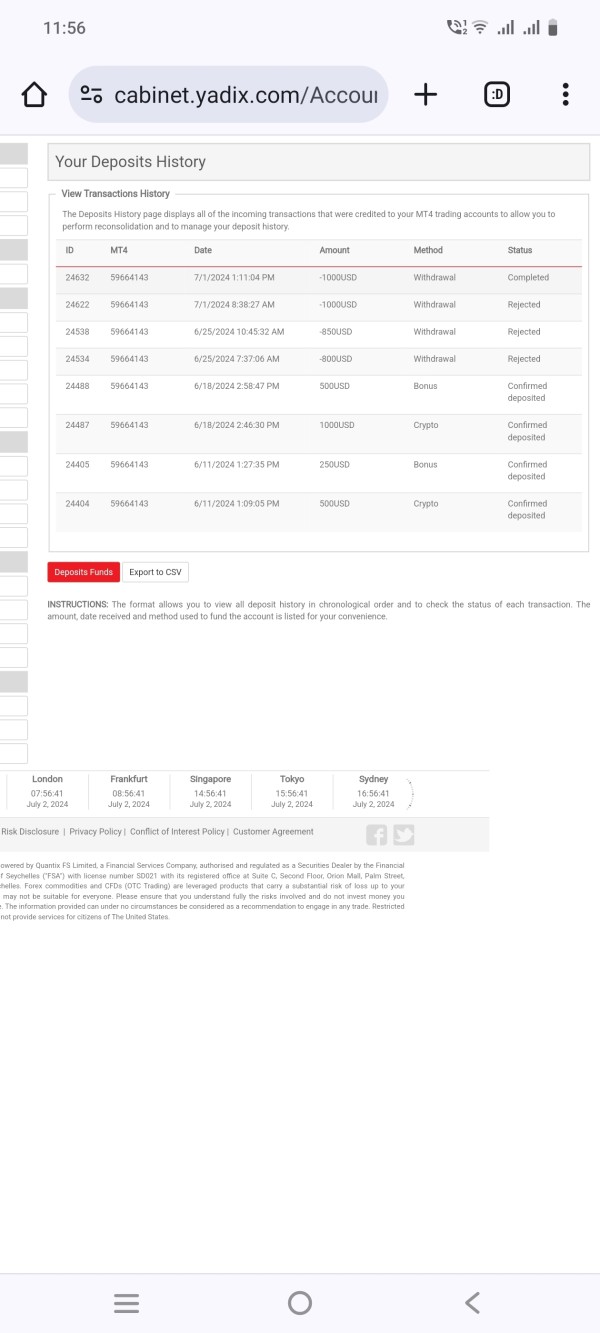

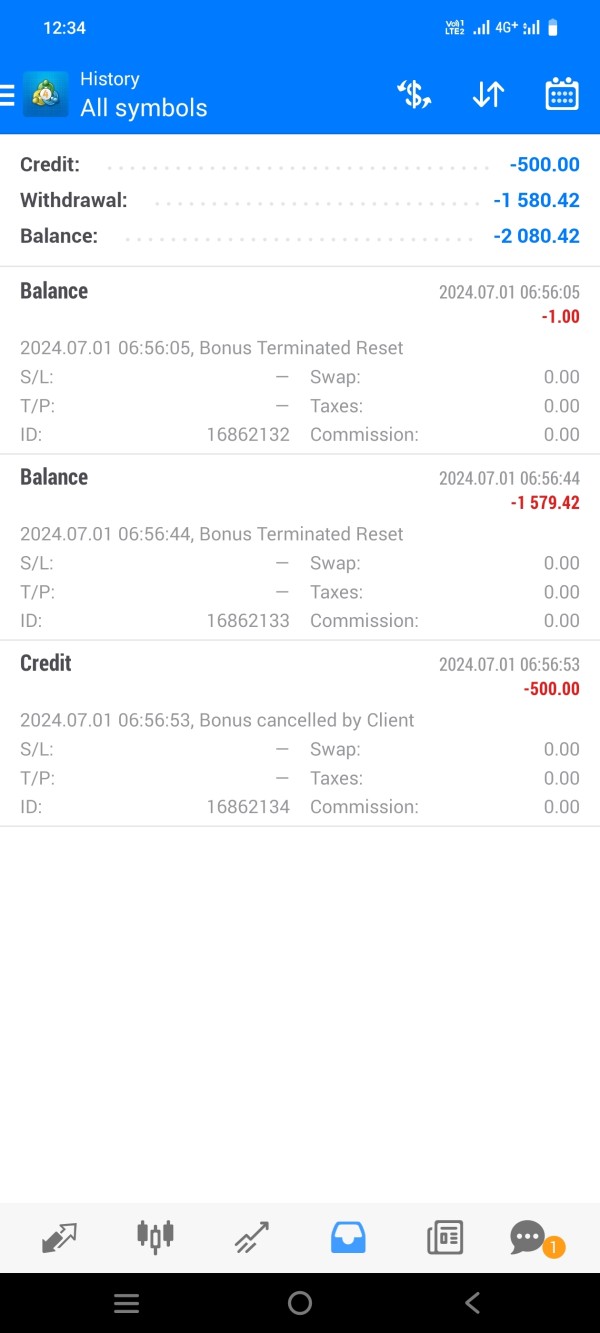

Deposit and Withdrawal Methods:

Specific details about deposit and withdrawal methods have not been provided within the available materials.

Minimum Deposit Requirement:

The minimum deposit requirement is not mentioned in the disclosed broker information.

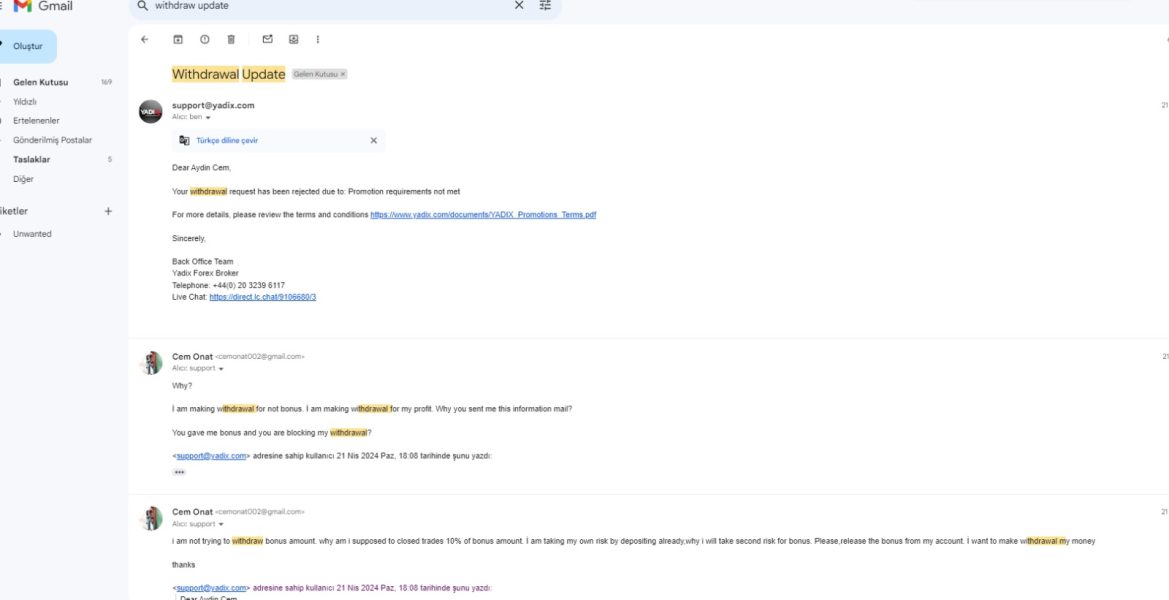

Bonuses and Promotions:

A notable feature is the 20% commission refund offered to scalper accounts. This is intended to reduce overall trading costs for frequent traders.

Tradable Assets:

The broker offers over 50 tradable assets, including forex pairs and CFDs. This allows traders to diversify their portfolios.

Cost Structure:

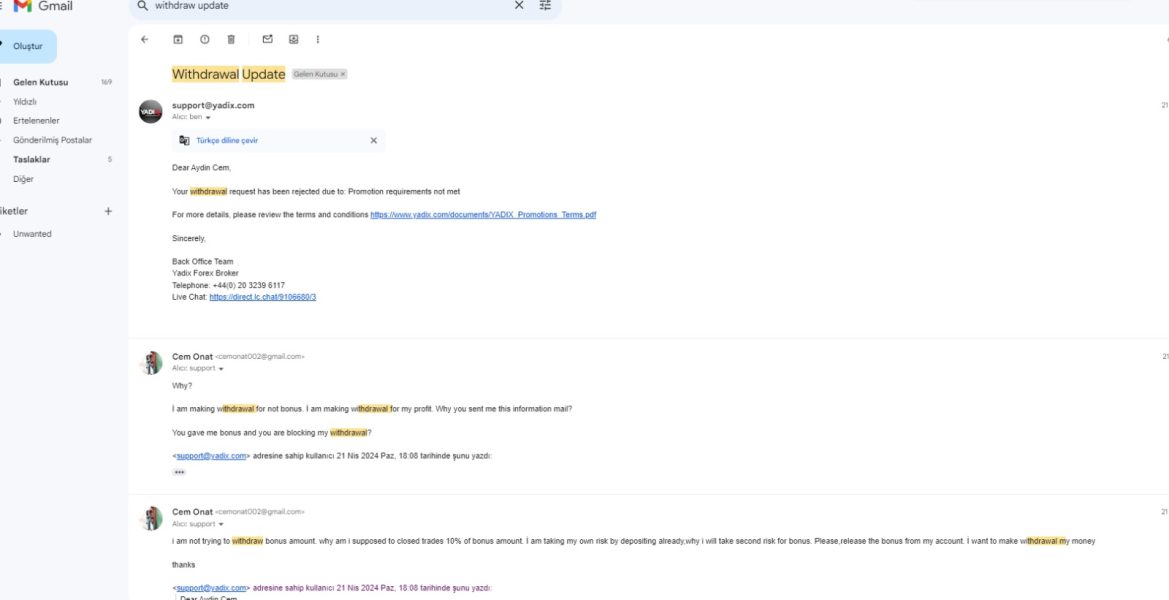

While the cost details primarily emphasize a 20% commission rebate, there is no detailed disclosure on point spreads or other transaction costs.

Leverage Ratio:

Traders can access extremely high leverage, with a maximum ratio of up to 1:1000.

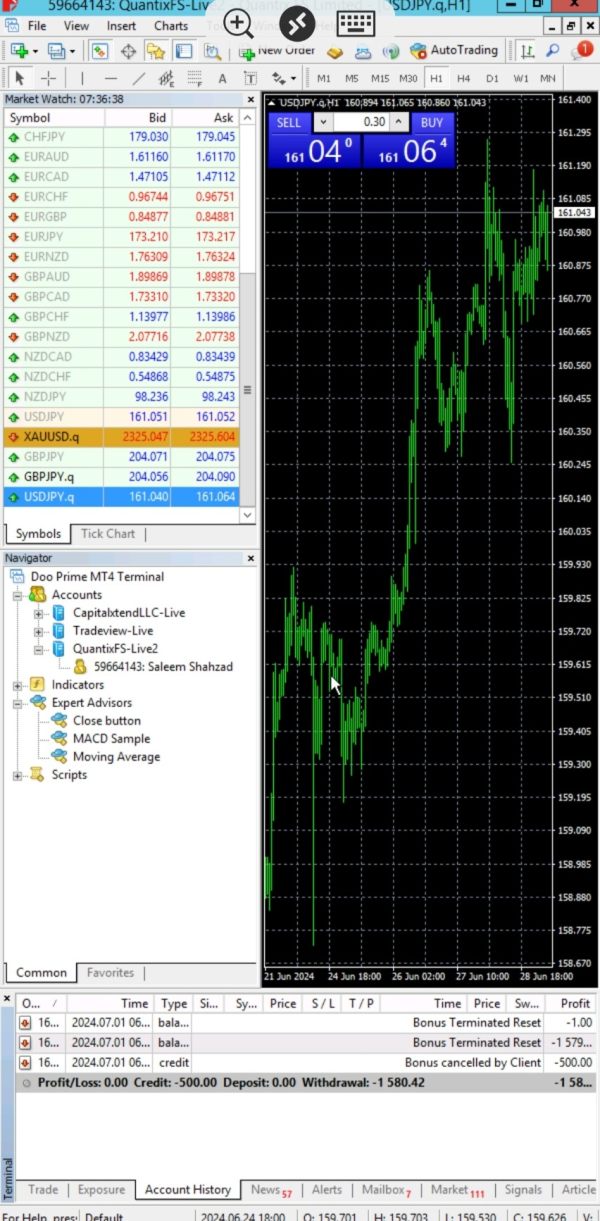

Platform Options:

Although the specific platform names are not detailed, yadix supports EAs and is optimized for high-frequency trading. This lack of detail means the user must verify platform capabilities independently.

Regional Restrictions:

Information about any regional restrictions is not explicitly mentioned.

Customer Support Languages:

No clear information on the languages supported by customer service has been provided.

Detailed Score Analysis

2.6.1 Account Conditions Analysis

yadix's account conditions are designed with the scalper and high-frequency trader in mind. The broker offers specialized scalper accounts that benefit from a 20% commission refund. This feature distinguishes it in a competitive market. The ability to access up to 1:1000 leverage stands out as an enticing prospect. However, key specifics, including the minimum deposit requirement and detailed account opening procedures, are not explicitly provided. This lack of detail leaves some room for uncertainty when comparing with other brokers. Despite these uncertainties, the commission rebate remains a significant advantage over standard account conditions offered by many competitors. With only 44% of users recommending the platform and taking into account the broadly neutral user rating of 2.6, the acceptance level for account conditions is moderate. Overall, while the high leverage and rebate serve as appealing factors, further clarity and transparency on the account setup process would improve trader confidence.

The yadix platform supports automated trading through Expert Advisors . It is designed to help high-frequency trading strategies. However, the review of available trading tools reveals a lack of specifics about the quality and breadth of these resources. Details on research, technical analysis tools, and educational materials are sparse. This leaves traders without a full picture of the platform's overall utility. While the support for automated and algorithmic trading is a distinct advantage, the absence of a detailed breakdown of platforms, charting software, and other analytical resources raises questions about the thoroughness of its toolset. Furthermore, there is little evidence from user feedback to confirm the adequacy of these tools. This creates uncertainty about their real-world performance. Overall, while the broker appears to cater to high-frequency trading needs, the limited disclosure on specific trading resources leaves room for further inquiry.

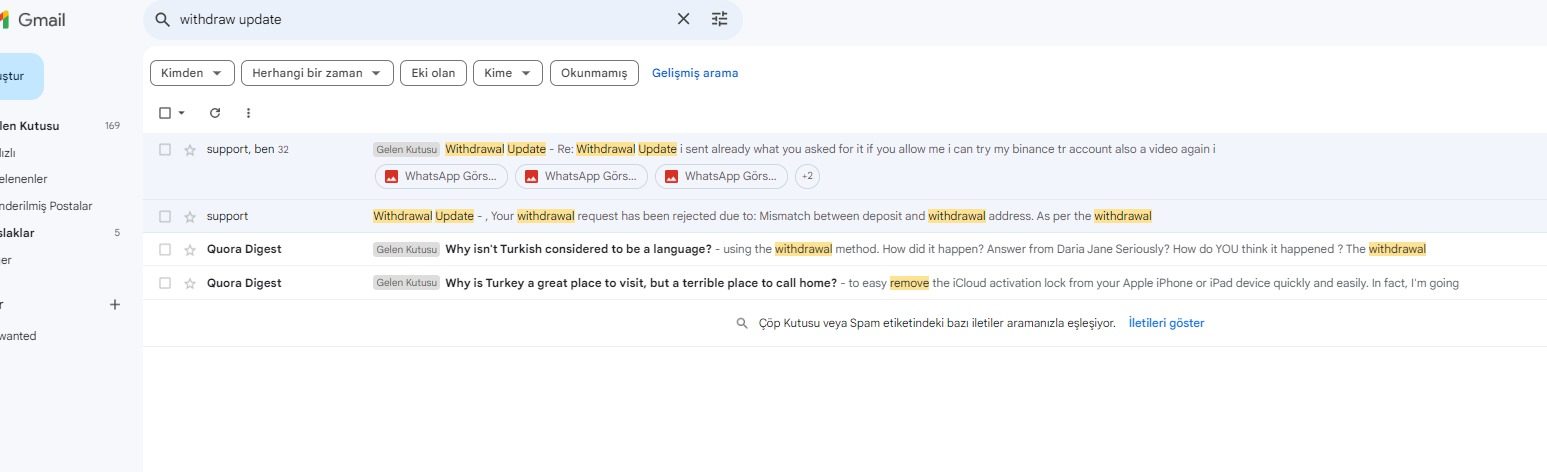

2.6.3 Customer Service and Support Analysis

In terms of customer service, the information available about yadix is notably limited. There is no clear breakdown of the customer support channels, recommended response times, or the range of support languages offered. User feedback, as reflected by the low overall rating of 2.6, suggests that customer service may be a weak point for the broker. The absence of detailed case studies or specific instances of how customer issues are resolved only intensifies concerns over service quality. Moreover, the lack of transparency about operational hours and the efficiency of support channels further complicates potential issues traders might face. Given these limitations, the customer support score is understandably lower. This reflects the overall sentiment expressed by users who have experienced subpar customer interaction experiences.

2.6.4 Trading Experience Analysis

The trading experience at yadix is defined by both its innovative service offerings and its areas of opacity. Although traders benefit from high leverage and access to more than 50 different assets, the overall experience is hurt by the unavailability of clear information about the trading platform's specifics. Critical aspects such as order execution speed, platform stability, and order management tools are not well documented. This leaves users uncertain about factors like slippage or re-quotes. While the platform supports automated strategies through EA integration, the absence of an officially named platform raises concerns about its maturity and technological backing. The mixed user reviews further reflect that while some traders may find the execution environment acceptable, others experience significant shortcomings in consistency and performance. Improvements in transparency about the platform's technical strength would likely improve user confidence and satisfaction.

2.6.5 Trust Analysis

Trust in a broker stems largely from its regulatory oversight and the transparency of its operations. yadix is regulated by the Vanuatu Financial Services Commission, providing a basic level of regulatory assurance. However, Vanuatu's regulatory standards are generally seen as less strict compared to jurisdictions with more established financial oversight frameworks. Additionally, there is a notable lack in transparent reporting on capital security measures, financial audits, and company financials. The absence of detailed disclosures about these aspects contributes to a moderate trust rating. While some traders may appreciate the innovative high-leverage structure, others might be wary of the potential risks associated with less comprehensive regulatory safeguards. Overall, the trust factor for yadix remains an area of concern.

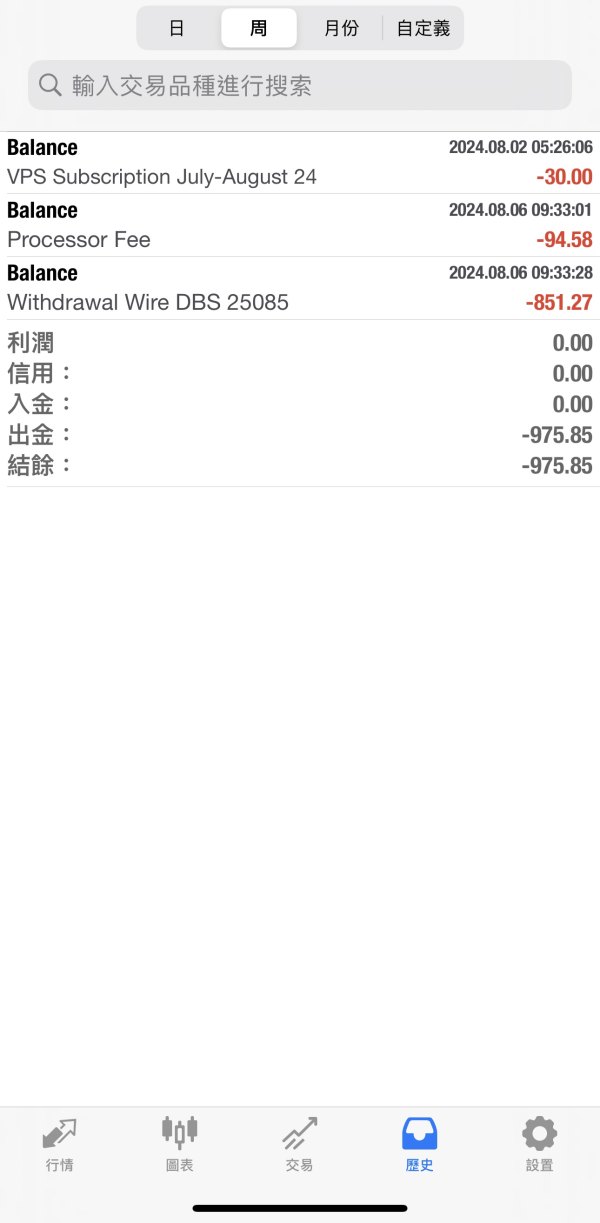

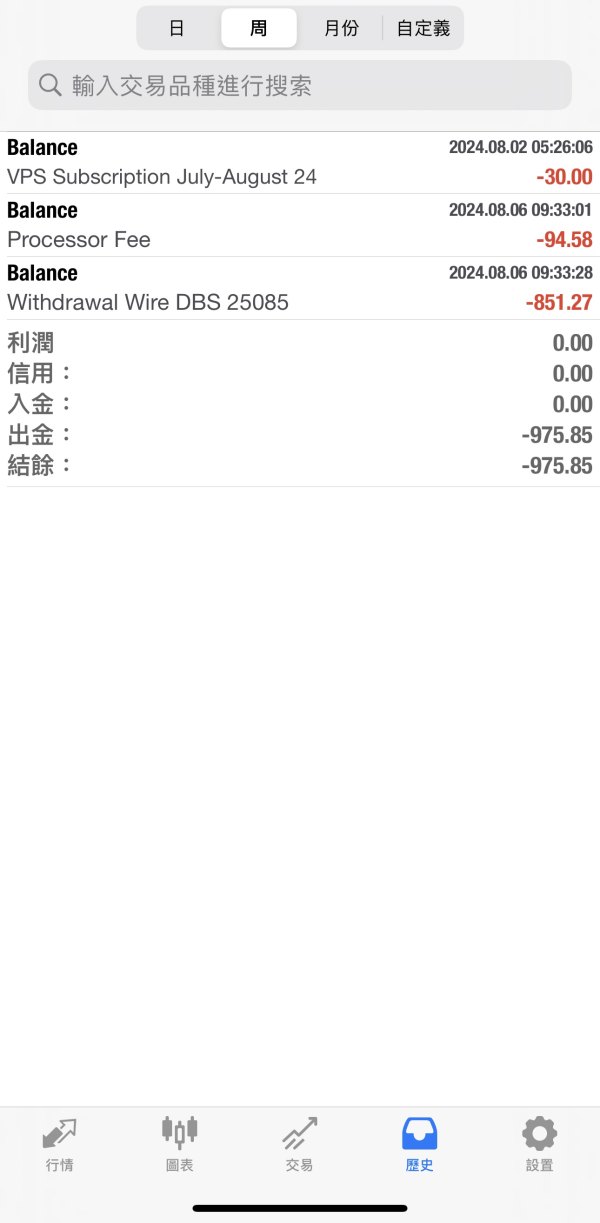

2.6.6 User Experience Analysis

User experience is a critical consideration, and feedback about yadix indicates several areas of concern. The overall satisfaction is relatively low, as reflected in the user rating of 2.6, coupled with only 44% of reviewers recommending the broker. Factors contributing to the poor user experience include an unclear registration process, opaque platform functionalities, and confusing deposit and withdrawal processes. While the tailored account types for high-frequency trading and scalping are designed to meet specific trading demands, the practical usability of the platform appears to be compromised by inconsistent performance and a lack of detailed operational guidance. This mixed feedback suggests that while the broker may be suitable for experienced high-frequency traders, improvements in interface design, technical stability, and customer support are essential to provide a smooth and satisfying user experience.

Conclusion

In summary, yadix presents a mixed offering for high-frequency and scalper traders. The broker's standout features—namely, its high leverage of up to 1:1000 and the attractive 20% commission refund—cater specifically to traders who rely on rapid execution and low trading costs. However, the overall user experience, customer support service, and transparency in critical operational details leave considerable room for improvement. Therefore, while yadix may be recommended primarily for experienced scalpers, potential users should carefully weigh its benefits against its current limitations before committing.