Regarding the legitimacy of XTRADE forex brokers, it provides ASIC, CYSEC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is XTRADE safe?

Pros

Cons

Is XTRADE markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

Xtrade international Ltd

Effective Date: Change Record

2010-04-12Email Address of Licensed Institution:

aristein@xtrade.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-04-26Address of Licensed Institution:

Suite 1 Level 2, 424 St Kilda Road, MELBOURNE VIC 3004, 35 New Road, 2nd floor flat, Belize City, BelizePhone Number of Licensed Institution:

0061 0281236650Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Merba Limited

Effective Date: Change Record

2010-01-14Email Address of Licensed Institution:

compliance@offersfx.comSharing Status:

No SharingWebsite of Licensed Institution:

offersfx.comExpiration Time:

--Address of Licensed Institution:

140, Vasileos Konstantinou, Tofias Building 2, CY-3080 LimassolPhone Number of Licensed Institution:

+357 25 030 476, +357 25 030 742Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

PEAK WEALTH 8INVEST (PTY) LTD

Effective Date:

2013-10-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

THE BUSINESS EXCHANGEWATERWAY HOUSE SOUTH, 1ST FLOOR3 DOCK ROAD8001Phone Number of Licensed Institution:

+27 745899469Licensed Institution Certified Documents:

Is Xtrade A Scam?

Introduction

Xtrade is a prominent player in the forex and CFD trading market, established in 2003 and headquartered in Cyprus. The broker positions itself as a global trading platform, offering access to a variety of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Given the complexity and volatility of the forex market, it is crucial for traders to carefully evaluate the legitimacy and reliability of their chosen broker. This article aims to provide an objective assessment of Xtrade by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The evaluation is based on a thorough analysis of various credible online sources, including reviews, regulatory filings, and user feedback.

Regulation and Legitimacy

Understanding the regulatory framework in which a broker operates is essential for assessing its legitimacy. Regulatory bodies impose strict standards on brokers to ensure the protection of traders and the integrity of the financial markets. Xtrade claims to be regulated by several authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the International Financial Services Commission (IFSC) in Belize.

| Regulatory Body | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| CySEC | 108/10 | Cyprus | Verified |

| ASIC | 343628 | Australia | Verified |

| IFSC | FSC/60/383/TS/18 | Belize | Verified |

The regulation by CySEC is particularly significant as it provides a level of security for traders, including the requirement for brokers to segregate client funds and participate in an investor compensation scheme. However, its noteworthy that Xtrade faced regulatory challenges in Australia, where ASIC recently canceled its license due to compliance failures. This incident raises concerns about the broker's operational integrity and adherence to regulatory standards.

Company Background Investigation

Xtrade, originally known as XFR Financial Ltd, has a history of operating under various names and licenses. The company has expanded its reach globally, claiming to serve clients in over 140 countries. The management team comprises industry professionals with diverse backgrounds in finance and trading, which is a positive indicator of the broker's operational capability.

However, the company's transparency has been questioned, particularly regarding its ownership structure and the historical changes in its regulatory status. The frequent changes in its branding and regulatory affiliations could be seen as a red flag for potential investors. A thorough examination of the company's history suggests that while it has established itself as a player in the market, the shifting regulatory landscape and past compliance issues warrant caution.

Trading Conditions Analysis

Xtrade offers a variety of trading conditions, including a minimum deposit requirement of $250 and leverage options up to 1:400 for international clients. The broker employs a fixed spread model, which means traders can expect consistent pricing regardless of market fluctuations. However, the transparency regarding the exact spread levels is limited, which can be a concern for traders looking for clarity in their trading costs.

| Cost Type | Xtrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 - 5 pips | 1 - 2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the absence of commissions may seem attractive, the fixed spreads can be higher than the industry average, potentially impacting profitability, especially for high-frequency traders. Additionally, the broker charges an inactivity fee, which can accumulate if accounts remain dormant for extended periods. Such fees could deter casual traders or those looking to test the waters without significant financial commitment.

Customer Fund Safety

The safety of customer funds is a primary concern for any trader. Xtrade claims to implement several safety measures, including segregated accounts for client funds, which are kept separate from the broker's operating capital. This practice is crucial for ensuring that client funds remain protected in case of insolvency. Furthermore, Xtrade is a member of the investor compensation fund, which provides additional security to clients in the event of the broker's financial difficulties.

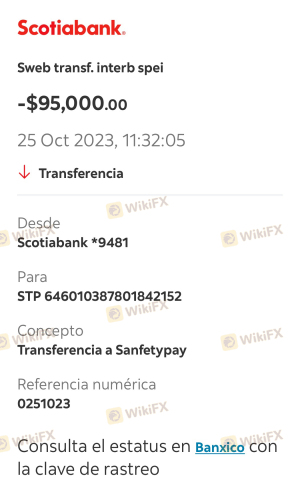

Despite these measures, historical complaints regarding fund withdrawals and transparency issues have surfaced, indicating potential weaknesses in the broker's operational practices. Such incidents can undermine trust and raise questions about the overall security of client funds.

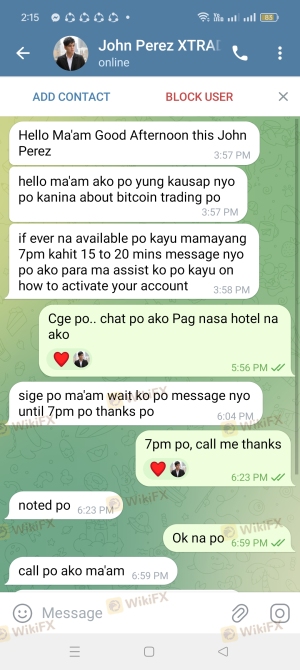

Customer Experience and Complaints

User feedback on Xtrade is mixed, with some clients praising its user-friendly platform and responsive customer service, while others have reported significant issues. Common complaints include difficulties in fund withdrawals, lack of adequate educational resources, and the perceived high costs associated with trading.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Educational Material | Medium | Limited resources |

| High Spreads | Medium | Not addressed |

For example, one user reported a frustrating experience when attempting to withdraw funds, citing delays and a lack of communication from customer support. This case highlights a recurring theme in user reviews, where responsiveness and support quality appear to be inconsistent.

Platform and Trade Execution

Xtrade provides its proprietary trading platform, which is designed to be user-friendly and accessible on various devices. While the platform offers essential trading tools and features, such as real-time charts and technical analysis indicators, it lacks the advanced capabilities of more established platforms like MetaTrader 4 or 5.

The quality of trade execution is another critical aspect to consider. Users have reported mixed experiences, with some indicating satisfactory execution speed and minimal slippage, while others have expressed concerns about order rejections during volatile market conditions. These discrepancies can significantly impact trading outcomes, especially for those employing high-frequency trading strategies.

Risk Assessment

Using Xtrade carries inherent risks, particularly given its regulatory challenges and mixed customer feedback. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Recent license cancellation by ASIC |

| Fund Safety Risk | Medium | Historical complaints about withdrawals |

| Platform Reliability Risk | Medium | Mixed feedback on execution and stability |

To mitigate these risks, traders should conduct thorough research, start with smaller investments, and consider using demo accounts to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while Xtrade presents itself as a legitimate broker with various regulatory affiliations, recent compliance issues and mixed customer experiences raise concerns about its overall reliability. Traders should approach Xtrade with caution, particularly given the high-risk environment associated with forex trading.

For those considering Xtrade, it may be prudent to start with a smaller investment and utilize the demo account feature to test the platform's capabilities. Alternatively, traders seeking more robust regulatory protection and a broader range of trading tools may consider other reputable brokers, such as eToro or IG, which have established trust and reliability in the market.

Overall, while Xtrade is not outright a scam, potential traders should remain vigilant and well-informed before making any financial commitments.

Is XTRADE a scam, or is it legit?

The latest exposure and evaluation content of XTRADE brokers.

XTRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XTRADE latest industry rating score is 1.77, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.77 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.