Pocket Option 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Pocket Option review examines one of the newer entrants in the forex and binary options trading space. Established in 2017 and headquartered in the Republic of Vanuatu, Pocket Option has received mixed feedback from the trading community. This presents both opportunities and concerns for potential investors who want to start trading.

Pocket Option operates as a market maker. The platform offers over 100 trading assets across multiple categories including forex, indices, stocks, commodities, and cryptocurrencies. The platform's most attractive features include an extremely low minimum deposit of just $5 and leverage up to 1:1000. This makes it particularly accessible to newcomers to trading, and the broker uses its own trading platform rather than the more common MetaTrader solutions.

However, traders should approach with caution. While user feedback shows generally positive experiences regarding the trading interface and asset variety, concerns have been raised about customer service consistency and the regulatory framework. Pocket Option is regulated by IFMRRC (International Financial Market Relations Regulation Center). This provides less strong investor protection compared to tier-1 regulators like FCA or CySEC.

The platform primarily targets beginner traders and those with higher risk tolerance. It particularly appeals to users seeking low-barrier entry into financial markets, and the combination of minimal capital requirements and high leverage makes it suitable for those wanting to start trading with limited funds. Though this also increases potential risks significantly.

Important Notice

Regional Entity Differences: Pocket Option's regulatory status under IFMRRC may result in varying levels of investor protection and oversight depending on your geographical location. The level of regulatory safeguards available to traders may differ significantly from those provided by more established regulatory bodies in major financial centers.

Review Methodology: This evaluation is based on analysis of user feedback, platform functionality assessment, regulatory information verification, and market positioning analysis. All information presented reflects publicly available data and user experiences as of 2025.

Rating Framework

Broker Overview

Pocket Option entered the competitive online trading market in 2017. The company positioned itself as an accessible broker for retail traders seeking diverse asset exposure, and based in the Republic of Vanuatu, the company operates under a market maker model. This provides liquidity for client trades across multiple asset classes. The broker has focused on creating a user-friendly environment that caters particularly to newcomers in trading. This is evidenced by their minimal capital requirements and simplified account opening procedures.

The company's business approach centers on offering a comprehensive trading experience through their own platform. This diverges from the industry standard of MetaTrader integration, and this Pocket Option review reveals that while this approach allows for customized functionality, it also means traders must adapt to a less familiar interface compared to widely-used platforms. The broker supports trading across forex pairs, major stock indices, individual equities, commodities, and an expanding range of cryptocurrency options.

Pocket Option's regulatory framework falls under IFMRRC supervision. This provides basic operational oversight but doesn't match the strict requirements of major regulatory bodies, and the platform emphasizes quick account setup and immediate trading access. This appeals to users who prioritize speed and simplicity over extensive regulatory protection. Their funding options include traditional credit and debit cards, various e-wallet solutions, and cryptocurrency deposits. This reflects modern payment preferences.

Regulatory Jurisdiction: Pocket Option operates under IFMRRC (International Financial Market Relations Regulation Center) regulation. This provides basic regulatory oversight suitable for international traders, though with less comprehensive protection than tier-1 regulators.

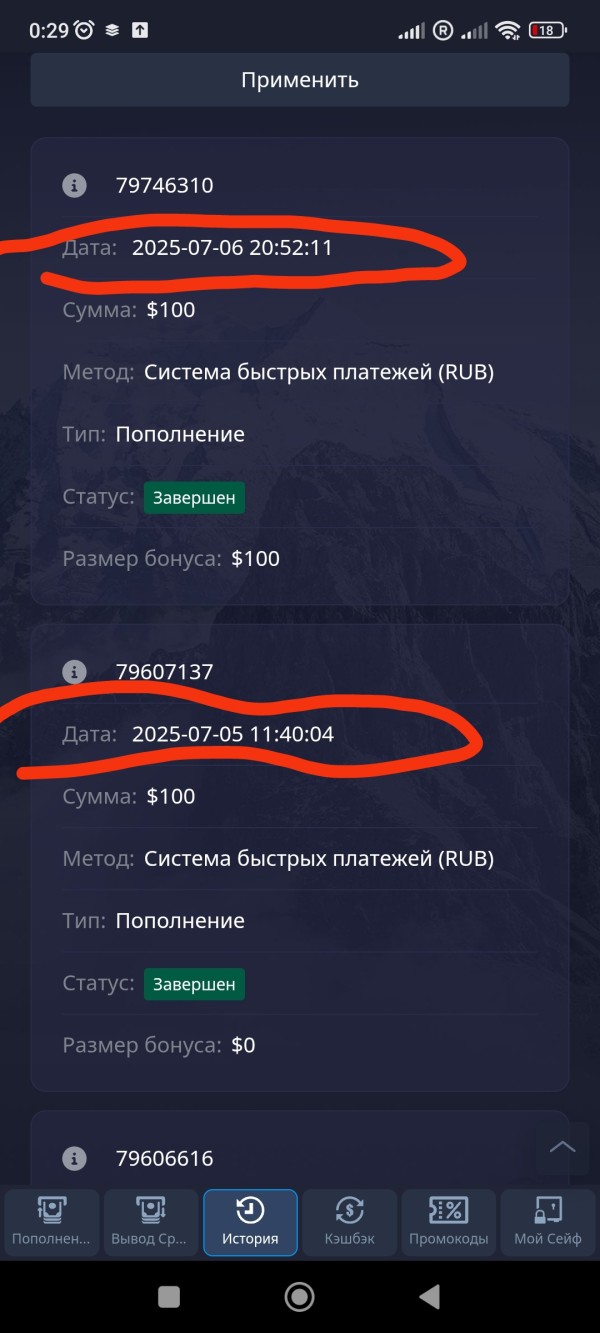

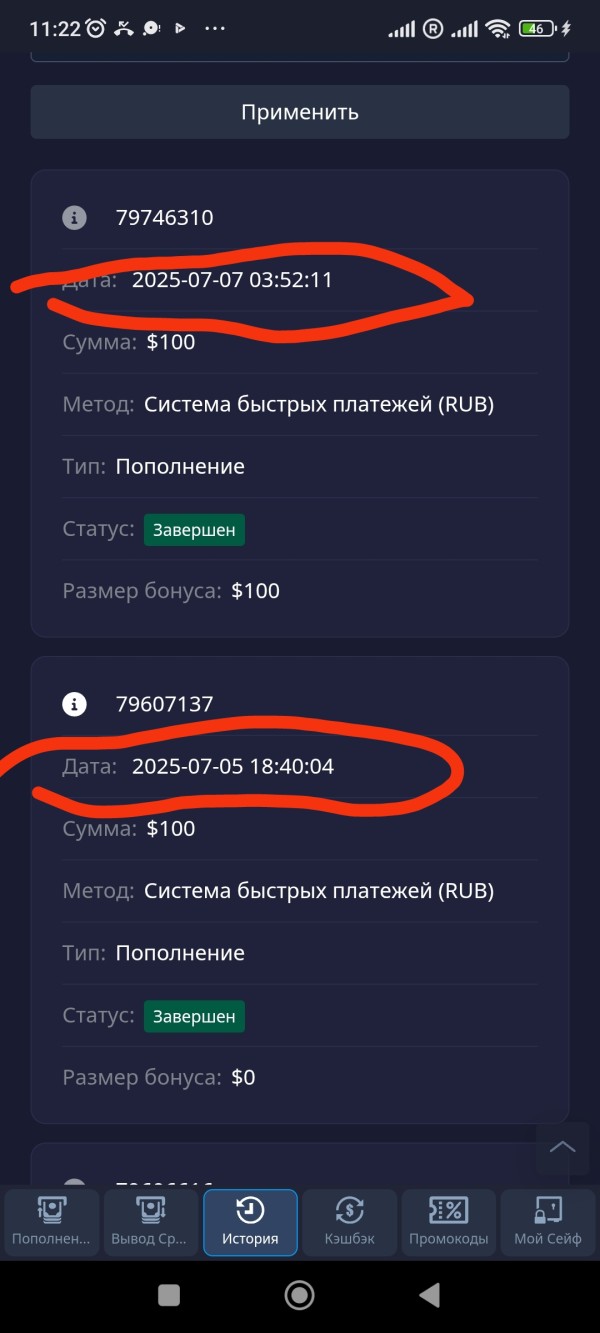

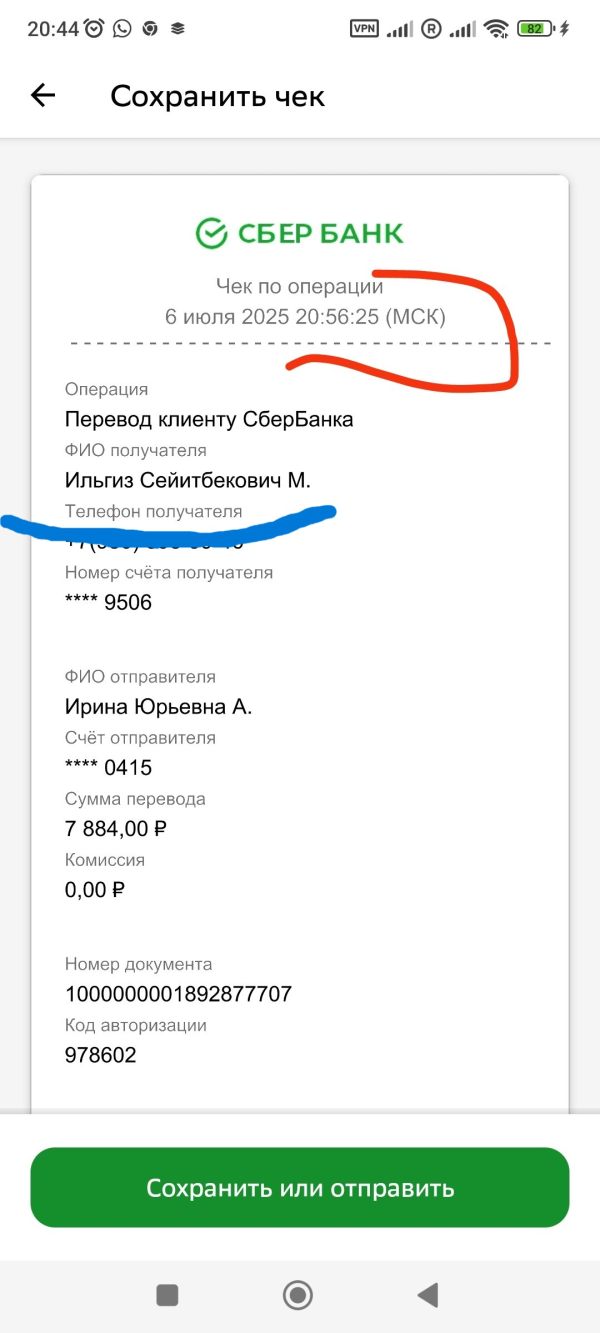

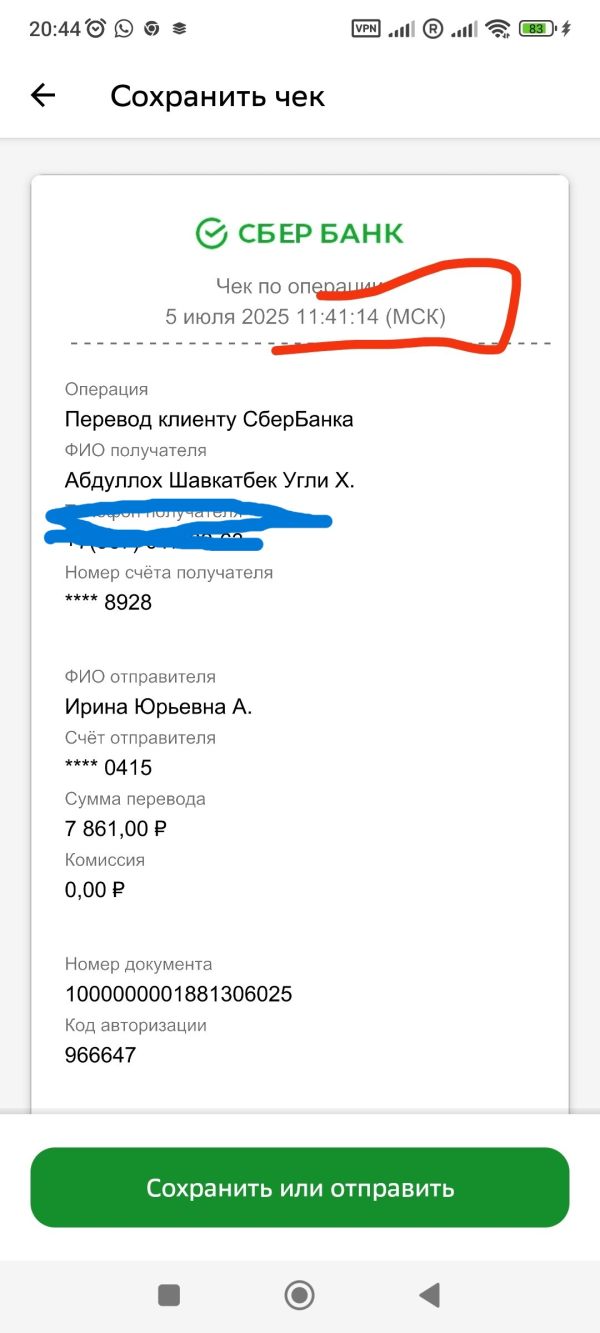

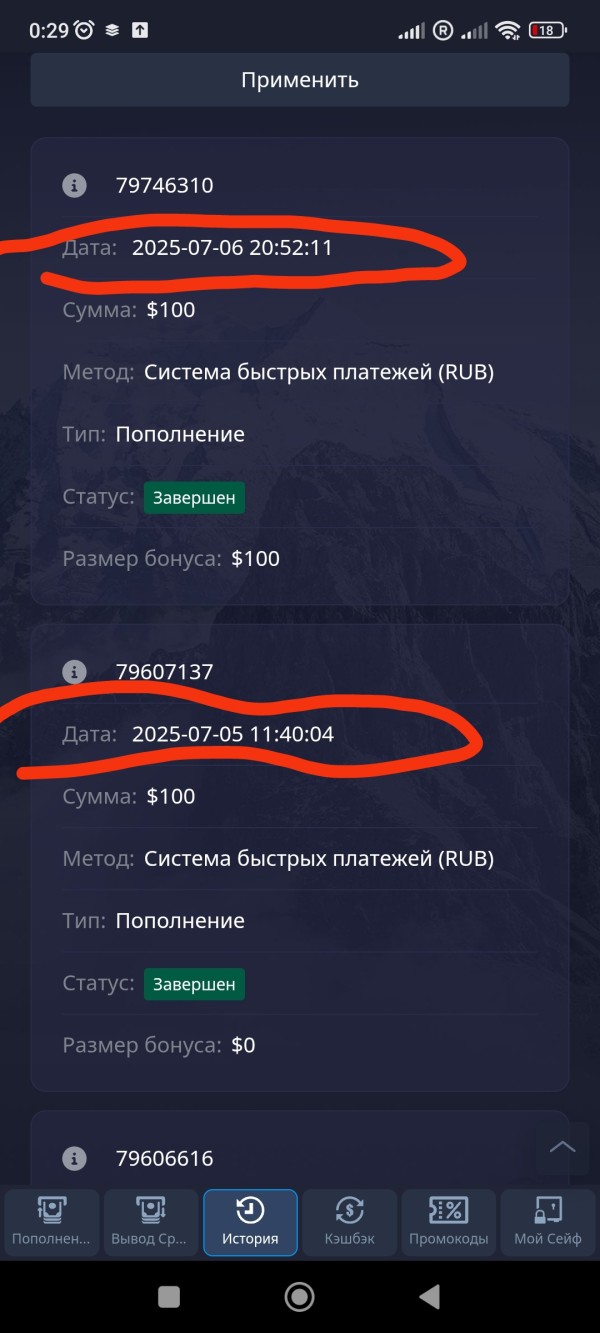

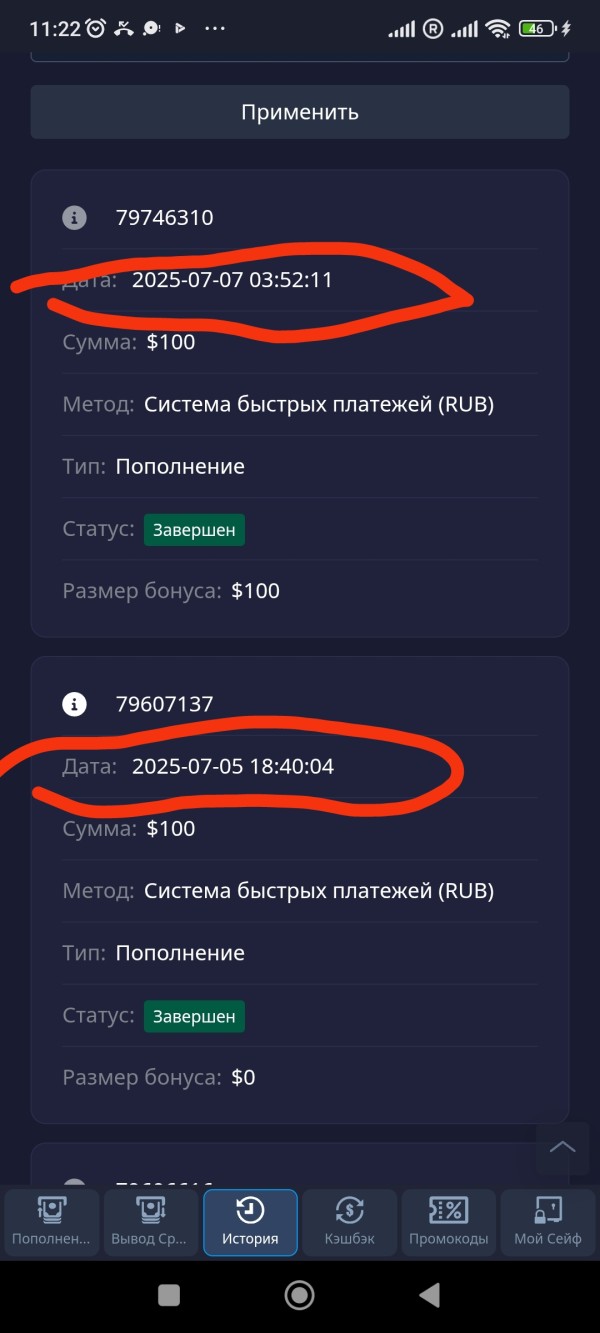

Deposit and Withdrawal Methods: The platform supports multiple funding options including major credit and debit cards, popular e-wallet services, and cryptocurrency transactions. This offers flexibility for diverse user preferences.

Minimum Deposit Requirements: With a minimum deposit of just $5, Pocket Option sets one of the lowest entry barriers in the industry. This makes it exceptionally accessible for beginning traders or those testing the platform.

Bonus and Promotions: Specific promotional offers and bonus structures were not detailed in available information. This suggests users should inquire directly with the platform about current incentives.

Tradeable Assets: The broker provides access to over 100 different trading instruments spanning forex currency pairs, stock indices, individual company shares, commodity futures, and cryptocurrency pairs. This offers substantial diversification opportunities.

Cost Structure: The platform operates on a variable spread model with no specific commission structure mentioned in available materials. Though traders should verify current pricing details directly with the broker.

Leverage Ratios: Maximum leverage reaches 1:1000. This provides significant capital amplification opportunities for experienced traders while requiring careful risk management due to increased exposure potential.

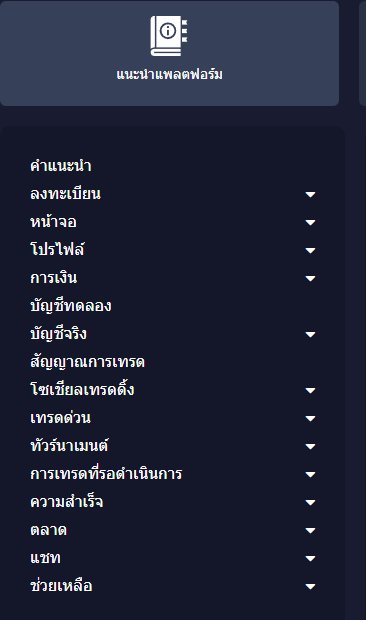

Platform Options: Pocket Option uses its own trading platform rather than standard MetaTrader solutions. This offers customized functionality but requires user adaptation to their specific interface design.

Geographic Restrictions: Specific regional limitations were not detailed in available information. Though users should verify accessibility based on their location.

Customer Support Languages: Available support language options were not specified in source materials. This requires direct platform inquiry for multilingual assistance availability.

This Pocket Option review indicates the broker offers competitive basic conditions while maintaining areas requiring further investigation by potential users.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

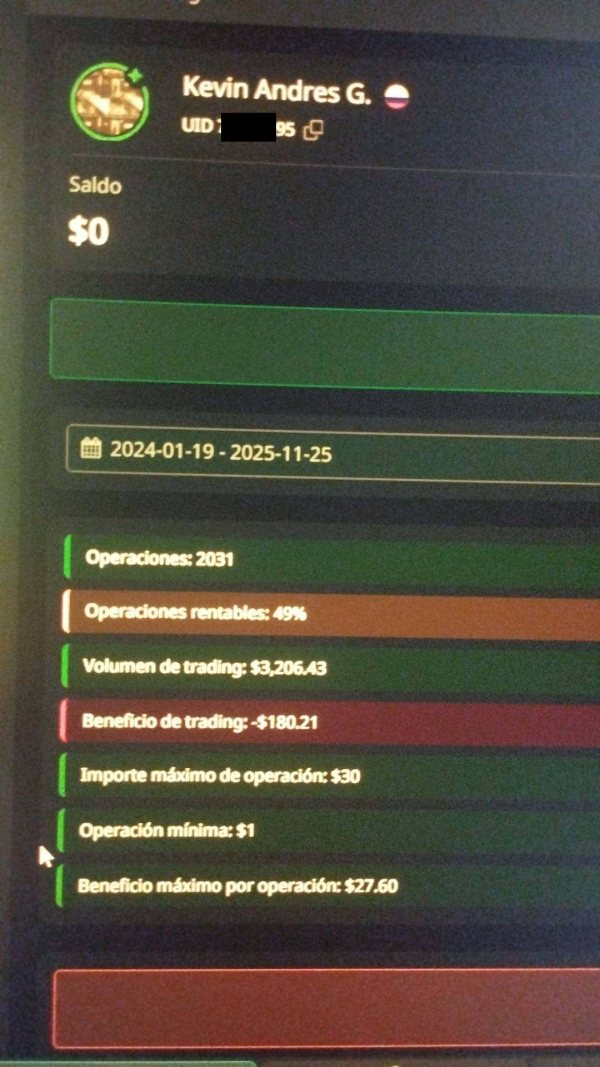

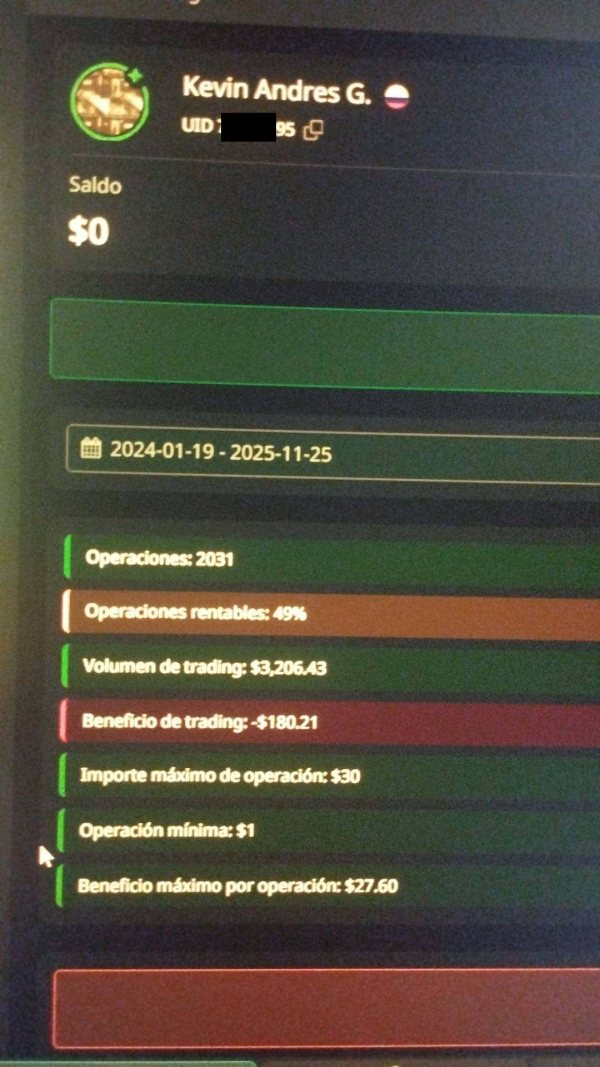

Pocket Option excels in providing accessible account conditions that cater particularly well to newcomers and traders with limited capital. The standout feature remains the $5 minimum deposit requirement, which represents one of the lowest barriers to entry in the forex and binary options industry. This accessibility factor significantly contributes to the platform's appeal among beginning traders who want to test strategies without substantial financial commitment.

The leverage offering of up to 1:1000 provides experienced traders with significant capital amplification opportunities. Though this high ratio also amplifies risk exposure, and according to user feedback, account opening processes are streamlined and relatively quick. This allows traders to begin activities without extensive delays. However, specific account type variations and their particular features weren't detailed in available information.

User testimonials generally praise the low entry requirements. Many note that the minimal deposit allows for genuine trading experience rather than demo-only practice, and the variable spread structure provides competitive pricing. Though specific spread ranges weren't detailed in source materials. When compared to industry standards, Pocket Option's account conditions rank favorably for accessibility while maintaining reasonable trading terms.

The absence of detailed information about specialized accounts represents a potential limitation for some user segments. Such as Islamic accounts for Sharia-compliant trading. Overall, the account conditions effectively serve the broker's target demographic of beginner and cost-conscious traders.

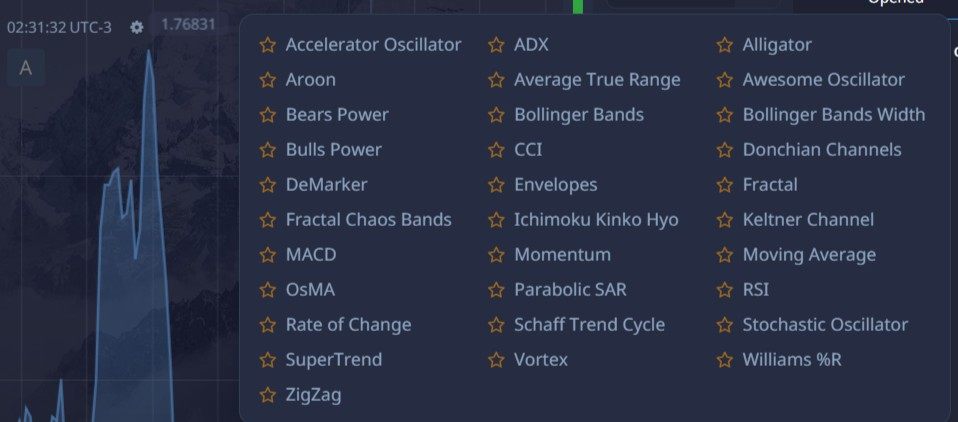

The trading tools and resources evaluation for this Pocket Option review reveals a mixed picture regarding platform capabilities. The platform offers basic functionality necessary for executing trades across the broker's asset range, though detailed information about advanced analytical tools wasn't comprehensively available in source materials.

User feedback suggests the platform provides adequate charting capabilities and basic technical indicators. This meets fundamental trading needs, but the absence of MetaTrader integration means traders cannot access the extensive third-party tools and expert advisors typically available through these established platforms. This limitation particularly affects experienced traders who rely on sophisticated analytical tools and automated trading strategies.

Educational resources and market analysis materials weren't specifically detailed in available information. This suggests potential limitations in trader development support, and the platform appears to focus more on execution capabilities rather than comprehensive educational offerings. This may disadvantage newcomers seeking learning resources.

Research and analysis resources weren't highlighted in source materials. Including economic calendars, market news feeds, and expert analysis, this gap potentially limits traders' ability to make informed decisions based on fundamental analysis. The platform's strength appears to lie in its execution capabilities rather than comprehensive analytical support. This earns a moderate score in this category.

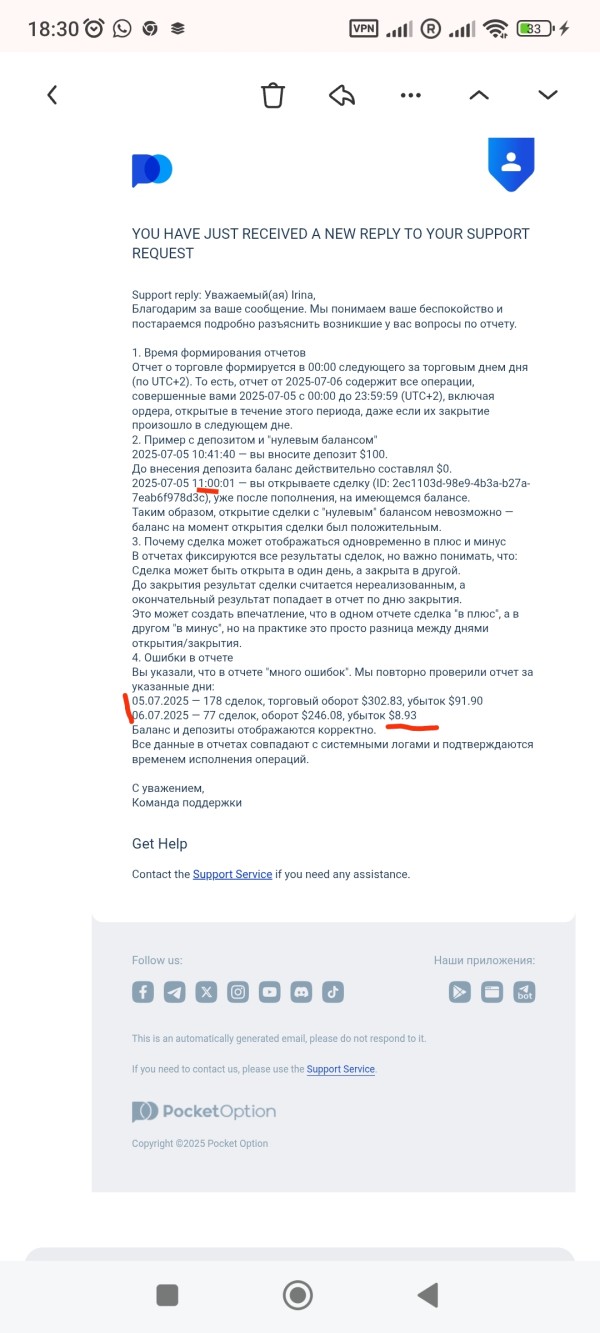

Customer Service and Support Analysis (Score: 5/10)

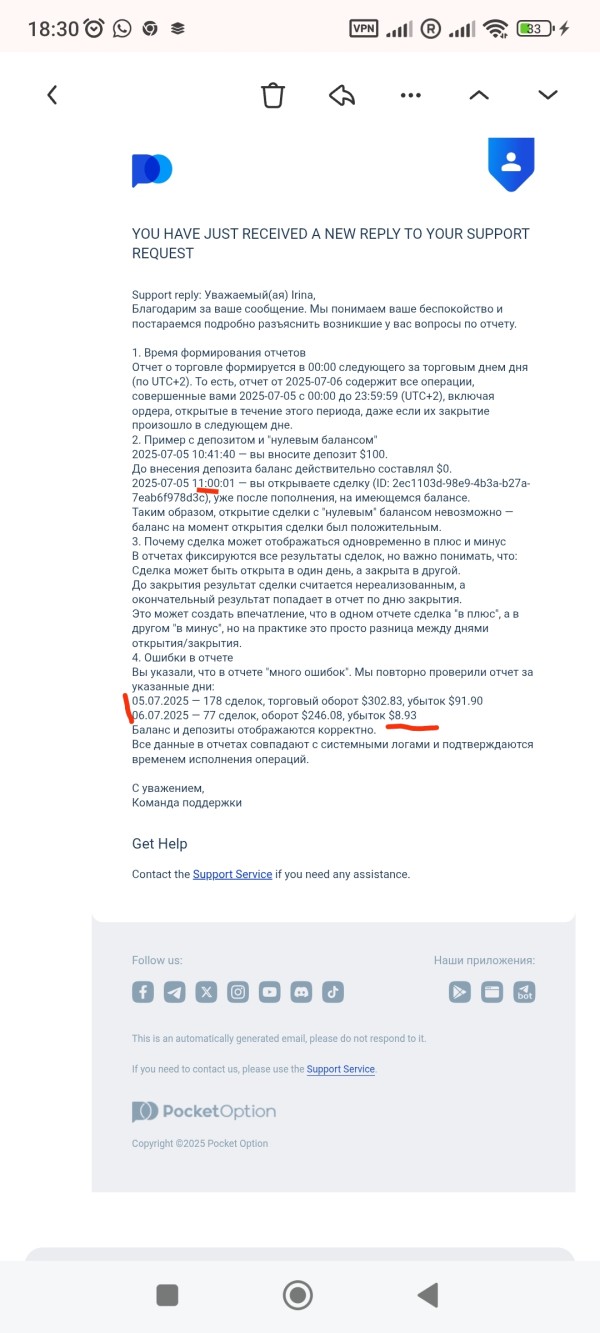

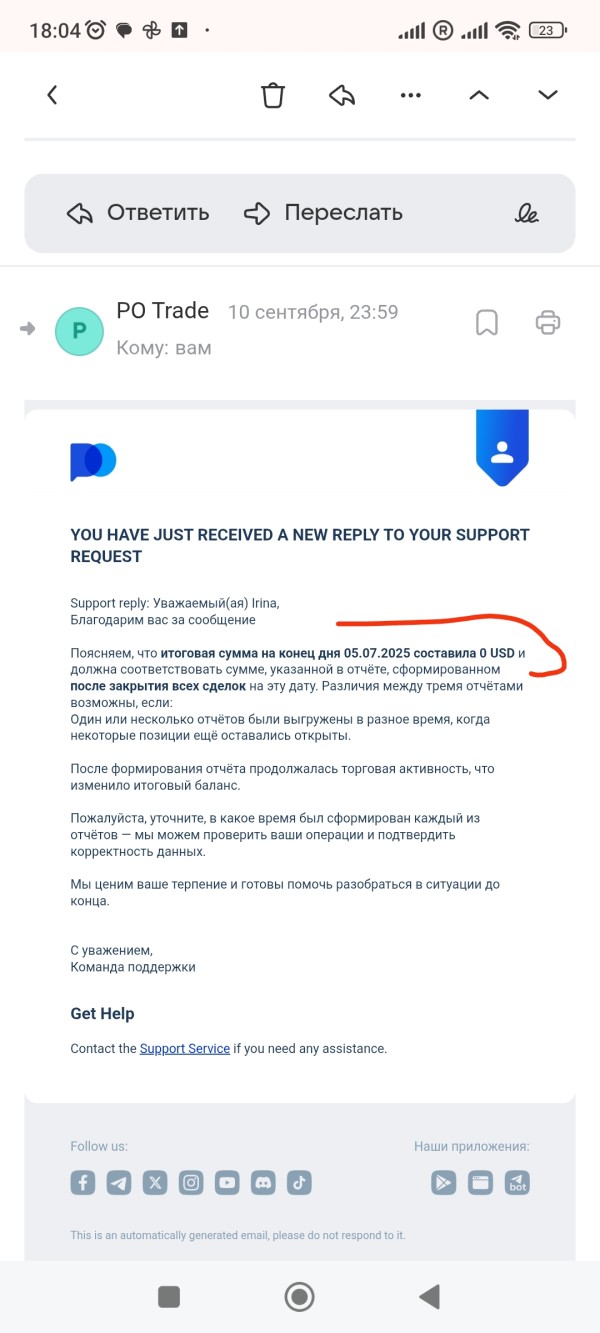

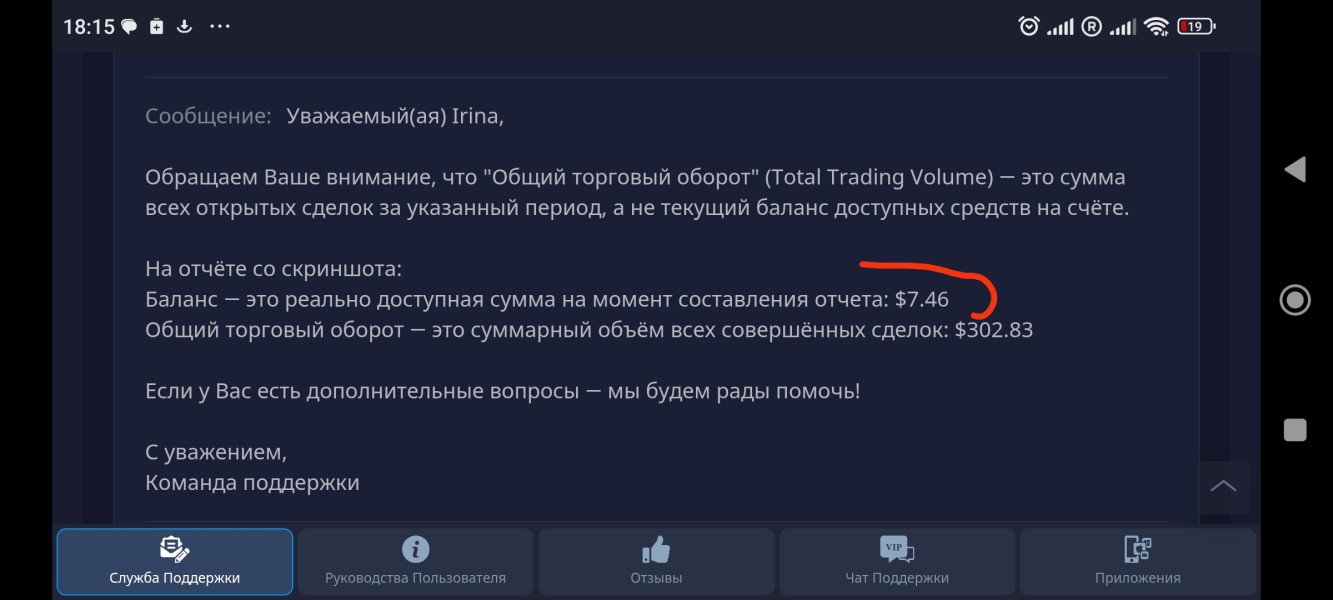

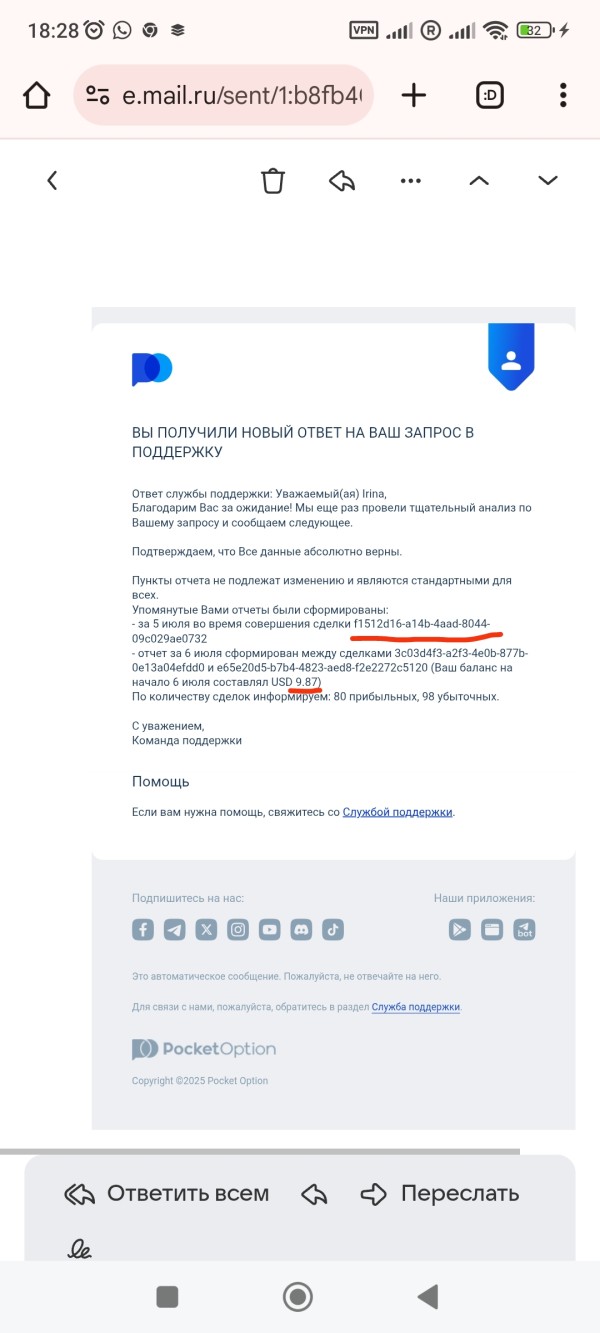

Customer service represents a mixed area for Pocket Option. User feedback reveals inconsistent experiences regarding support quality and responsiveness, and available information suggests that while customer service channels exist, the quality and speed of responses vary significantly among users. This creates uncertainty about reliable support availability.

User testimonials present conflicting reports about customer service effectiveness. Some traders report satisfactory resolution of issues and reasonable response times. While others express frustration with delayed responses and inadequate problem resolution, this inconsistency suggests potential staffing or training issues within the support department.

Specific customer service channels weren't detailed in source materials. Including live chat availability, email support responsiveness, and telephone support options, the absence of clear information about support availability hours and multilingual assistance represents additional concerns for international users requiring assistance outside standard business hours.

Problem resolution case studies weren't available in source materials. This makes it difficult to assess the effectiveness of customer service in handling complex issues, and the lack of detailed support structure information, combined with mixed user feedback, results in a below-average rating for this crucial service aspect.

Trading Experience Analysis (Score: 7/10)

The overall trading experience with Pocket Option receives generally positive feedback from users. Though some concerns exist regarding consistency and reliability, user reports suggest the platform maintains reasonable stability during normal market conditions. Most traders experience satisfactory order execution speeds.

Platform functionality appears adequate for basic to intermediate trading needs. Users report successful navigation of the interface and access to necessary trading functions, and the variety of available assets (over 100 instruments) provides substantial diversification opportunities. This contributes positively to the overall trading experience. However, specific technical performance data regarding execution speeds and slippage rates weren't available in source materials.

Mobile trading experience details weren't comprehensively covered in available information. Though the importance of mobile accessibility in modern trading cannot be understated, users seeking extensive mobile trading capabilities should verify platform compatibility with their devices and operating systems.

Order execution quality receives mixed feedback. Some users report satisfactory fills while others note occasional issues during volatile market periods, and the absence of detailed information about requote policies and slippage management represents areas where additional transparency would benefit trader confidence.

This Pocket Option review indicates that while the trading experience generally meets user expectations, improvements in consistency and transparency could enhance overall satisfaction levels.

Trust and Safety Analysis (Score: 4/10)

Trust and safety represent significant concerns in this Pocket Option evaluation. Primarily due to regulatory limitations and transparency issues, the broker's regulation under IFMRRC provides basic operational oversight but lacks the comprehensive investor protection measures associated with tier-1 regulatory bodies like FCA, CySEC, or ASIC.

IFMRRC regulation, while legitimate, doesn't offer the same level of compensation schemes, segregated account requirements, or regulatory scrutiny found with major financial regulators. This limitation potentially exposes traders to higher risks regarding fund safety and dispute resolution mechanisms, and the regulatory framework provides basic operational standards but may not adequately protect traders in case of broker insolvency or malpractice.

Company transparency regarding financial statements, management structure, and operational procedures wasn't detailed in available information. The absence of readily available information about fund segregation policies, insurance coverage, and audit procedures raises additional concerns about operational transparency.

User feedback includes warnings about potential scam risks. Though these appear to be general cautions rather than specific incident reports, the lack of industry awards, recognitions, or third-party certifications further limits confidence in the broker's reputation and standing within the financial services industry.

Negative event handling and complaint resolution procedures weren't detailed in source materials. This makes it difficult to assess how effectively the broker addresses user concerns and disputes.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with Pocket Option presents a mixed picture. Experiences vary significantly among different trader types and expectations, and beginning traders generally report more positive experiences. They particularly appreciate the low entry barriers and simplified account setup procedures. However, more experienced traders express concerns about platform limitations and support consistency.

Interface design and usability receive moderate praise from users. Most find the platform navigable despite initial unfamiliarity, and the learning curve for users accustomed to MetaTrader platforms may present temporary challenges. Though basic functionality remains accessible, registration and verification processes appear streamlined. This contributes positively to initial user experiences.

Funding operation experiences vary among users. Some report smooth deposit and withdrawal processes while others encounter delays or complications, and the variety of payment methods, including cryptocurrency options, receives positive feedback from users seeking flexible funding solutions. However, specific processing times and fee structures weren't detailed in available information.

Common user complaints center around customer service inconsistency and transparency concerns rather than fundamental platform functionality. Users seeking extensive educational resources or advanced analytical tools may find the platform lacking compared to more comprehensive broker offerings.

The user demographic appears well-suited to beginning traders and those prioritizing low-cost entry over extensive features. Risk-tolerant traders comfortable with higher leverage ratios may find the platform suitable. Though conservative investors might prefer more regulated alternatives.

Conclusion

This comprehensive Pocket Option review reveals a broker that offers both opportunities and challenges for potential traders. The platform's greatest strengths lie in its accessibility features, particularly the $5 minimum deposit and high leverage ratios up to 1:1000. This makes it exceptionally suitable for beginning traders and those with limited capital.

Pocket Option best serves newcomers to trading who prioritize low entry barriers and basic functionality over comprehensive regulatory protection and advanced tools. Risk-tolerant traders comfortable with IFMRRC regulation and seeking diverse asset exposure may find the platform adequate for their needs. However, conservative investors or those requiring extensive analytical tools and robust customer support should consider alternatives with stronger regulatory frameworks.

The primary advantages include exceptional accessibility, diverse asset offerings, and competitive basic trading conditions. Key disadvantages include limited regulatory protection, inconsistent customer service quality, and transparency concerns. Potential users should carefully weigh these factors against their individual trading requirements and risk tolerance levels before committing funds to the platform.