nadex 2025 Review: Everything You Need to Know

Abstract

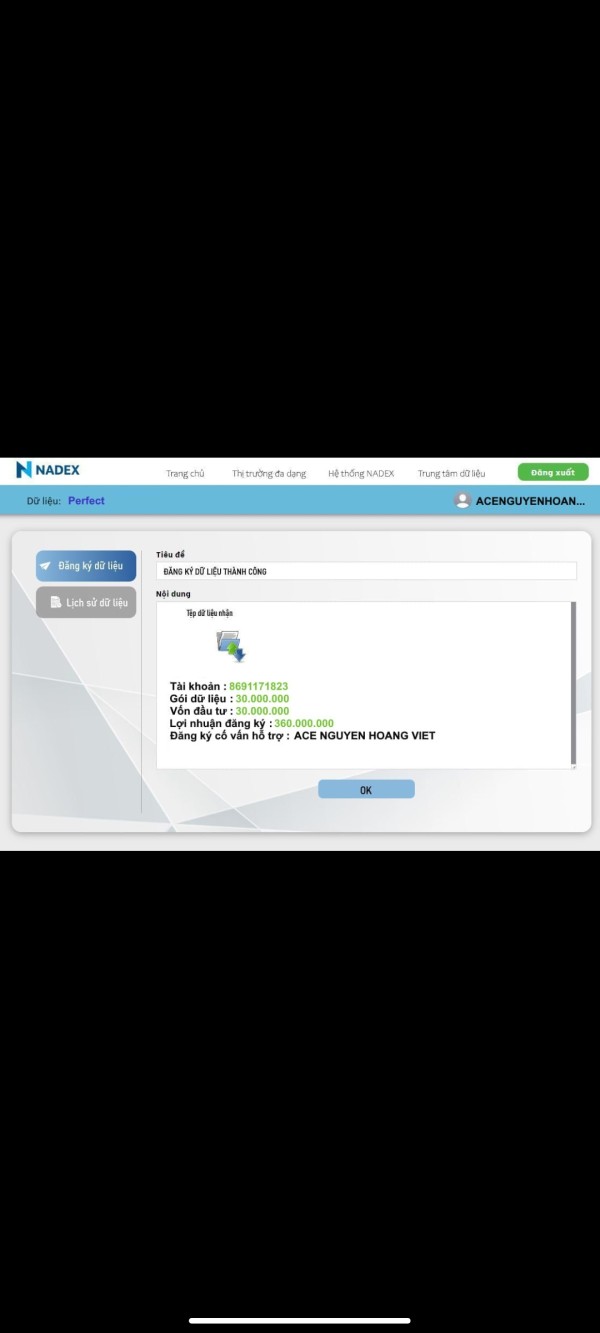

This nadex review looks at Nadex as a well-regulated and secure exchange that offers many different trading products for both beginners and experienced traders. The platform was created as a safe marketplace where traders can buy and sell binary options, Knock-outs™, and call spreads on various assets, giving users a flexible trading experience with strong oversight from the CFTC. Nadex offers more than 10,000 contracts on an hourly, daily, and weekly basis. The platform has built a good reputation for being easy to use and reliable. The review shows key features like competitive minimum deposit requirements of US$250, which makes the platform easy for new traders to access while still attracting experienced traders who want innovative tools. The regulated model also means that traders get better security measures and market integrity. This summary covers the main strengths and some limitations we found during our analysis, giving readers a complete picture of how the platform performs and what value it offers.

Considerations

Nadex only serves traders in the United States, and people from other countries cannot access its services. This review uses publicly available information and user feedback to make sure our evaluation is balanced and based on facts. Since the CFTC regulates Nadex, its operations follow strict US financial rules, which can be very different from offshore brokers. People from outside the US should be careful because the risk and regulatory landscape might be different in their countries. When writing this nadex review, we checked user testimonials, expert insights, and regulatory documents to give a clear picture of what traders can expect from the platform.

Rating Framework

Broker Overview

Nadex started in 2004 and has its headquarters in the United States, working as a regulated financial marketplace. The exchange helps buyers and sellers interact smoothly without taking part in market trades directly. Since it began, Nadex has focused on offering binary options, Knock-outs™, and call spreads, letting traders benefit from various market movements on popular commodities, forex pairs, and stock indices. Its foundation in regulated practices has made the platform appealing to both newcomers and seasoned traders. The regulated nature of Nadex, managed under CFTC oversight, has built confidence and trust among its users, even though some people criticize its customer service response times.

Nadex also offers two different platforms: the main Nadex Platform and the mobile-optimized NadexGO. This approach helps users who prefer either desktop-based trading or trading on the go, making sure the trading experience is accessible and efficient. The available asset classes include binary options, Knock-outs™, and call spreads on diverse underlying assets, giving room for strategic trade customization. With a focus on simplicity and safety, the platform has become a preferred choice for traders interested in instruments with defined risk parameters. As part of this nadex review, it is important to note that while the platform is solid on regulatory and safety fronts, there are areas such as detailed educational resources and the breadth of trading tools that could be better.

Nadex operates under strict regulatory oversight from the United States Commodity Futures Trading Commission , making sure all trading activities follow rigorous compliance standards and market integrity. The emphasis on regulation gives traders a safe environment, though the details about additional licensing are not fully outlined in available resources.

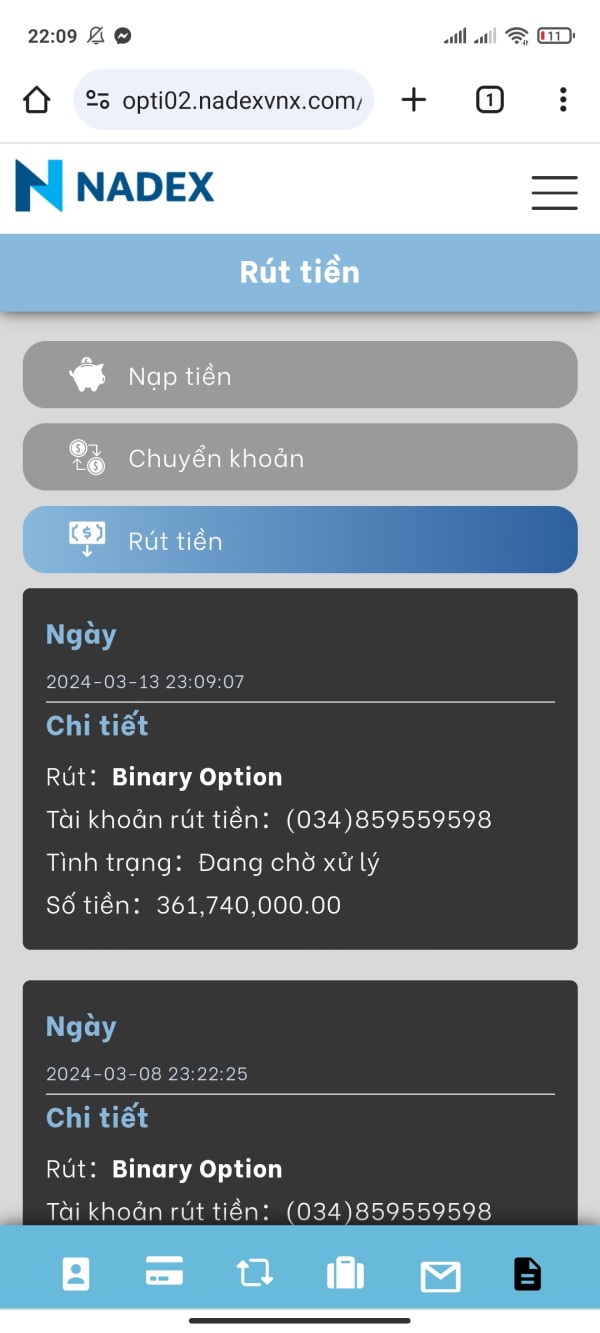

When it comes to deposit and withdrawal methods, the available data does not offer a detailed breakdown. However, it is clear that the minimum required deposit to open an account is US$250, which is relatively accessible for beginners. Information about any bonus or promotional offers is missing from current public documentation, leaving potential users without clear incentives beyond the trading features themselves.

The range of available assets is a strong point for Nadex. The platform supports binary options, Knock-outs™, and call spreads, offering traders a choice of instruments to match their risk preferences and market expectations. Despite the variety, details on commission structures, spread costs, and transaction fees remain limited in the provided summaries. The leverage available on the platform is set at a ratio of 1:40, presenting both opportunities and risks that traders must evaluate before engaging.

Traders can choose between the robust desktop-based Nadex Platform and the conveniently designed NadexGO mobile interface. While the desktop solution provides comprehensive data and detailed trading functions, the mobile platform ensures that traders can engage with the markets anytime, anywhere. Regional restrictions are clearly emphasized, as Nadex primarily serves the US market, with no extensive information provided for access in other regions. Additionally, while information about customer service languages is missing, traders are encouraged to verify support channels directly from official sources to ensure clear communication.

Detailed Score Analysis

2.6.1 Account Conditions Analysis

The account conditions on Nadex are designed to be straightforward and accessible, especially for newcomers. The platform requires a minimum deposit of US$250, which is considered reasonable compared to industry rivals, making it easier for beginners to enter the trading space. While there is no extensive detail on multiple account types or specialized accounts such as Islamic accounts, the standard account offers essential functionality necessary for trading binary options and call spreads. The process for account registration is mentioned only briefly in available materials, and details on verification or additional account benefits remain unclear. Despite this, user feedback shows that the low entry barrier is one of the platform's most attractive features, with many traders appreciating that it does not demand a large initial investment. Different sources have highlighted that while the account opening process is not overly complex, there is room for improvement in providing clearer guidance and additional account features. In summary, the usability of account conditions supports traders with limited capital while still maintaining professional-grade trading standards, as stated in this nadex review.

Nadex offers a streamlined suite of trading instruments, primarily focusing on binary options, Knock-outs™, and call spreads. The quality of these tools is sufficient to serve traders interested in defined-risk strategies. However, detailed descriptions about the range of analytical tools, educational materials, and other research resources are noticeably sparse. There is an apparent gap when it comes to providing in-depth tutorials or automated trading support, which some users found limiting compared to other brokers offering extensive educational libraries. Although the platform does present basic charting and market data within its trading environment, the absence of advanced research tools and comprehensive market analysis resources has been noted by traders seeking a more enriched trading experience. Expert reviews show that while Nadex's product offerings are robust in terms of regulatory safety and straightforward execution, they leave room for enhancement in technical and analytical support. This aspect of the platform is crucial, especially for traders who rely on detailed market insights to fine-tune their strategies. Overall, while the available tools are functional, the platform could greatly benefit from additional resources to meet the evolving demands of both new and experienced traders.

2.6.3 Customer Service and Support Analysis

Customer service and support are important parts of the trading experience, and Nadex has received mixed feedback in this area. Although the platform is backed by a robust regulatory framework, many users have expressed dissatisfaction with the responsiveness and quality of customer service. Several customers have reported that the available support channels do not consistently deliver prompt or effective assistance, particularly during periods of high market stress. In contrast to some international brokers that provide 24/7 multilingual support, Nadex appears to have limited responsiveness and customer care options. Public reviews on sites such as Trustpilot have highlighted recurring complaints about delayed response times and difficulty in getting resolution for account or technical issues. Furthermore, the absence of clearly detailed support hours and a comprehensive list of contact methods adds to the uncertainty for users seeking immediate help. While the safety and reliability of the platform are unquestioned, the overall customer service experience remains an area where improvements are needed. This lack of enhanced support infrastructure is a noteworthy drawback in this nadex review, suggesting that potential users should be prepared for occasional communication challenges when assistance is required.

2.6.4 Trading Experience Analysis

The trading experience on Nadex is characterized by its focus on safety and simplicity, elements that work well with both novice and seasoned traders. The platform is generally seen as stable and reliable, offering smooth order execution within a controlled, regulated environment. Users have particularly appreciated the ease of understanding the risk-reward dynamics inherent in binary options and call spreads. Despite the reassuring performance of its trading systems, there is limited information available about advanced execution metrics, such as order slippage or latency, which are essential for high-frequency trading strategies. The functionality of the desktop-based Nadex Platform and its mobile counterpart, NadexGO, has been positively received, though some traders have noted that the mobile interface lacks the depth of features available on the desktop version. In terms of trading tools, while the range is practical for its intended purpose, the degree of customization and advanced charting tools remains limited. Overall, the trading environment meets the basic expectations of effective and reliable order management. However, as this nadex review suggests, traders with a preference for detailed customization and additional trading analytics might find certain aspects of the platform less comprehensive compared to competitors. The balance between simplicity and functionality in the trading experience ultimately offers a safe yet somewhat constrained trading opportunity for those who value regulatory compliance over cutting-edge technology.

2.6.5 Trust Analysis

Trust and regulatory compliance are central to Nadex's identity, with the platform operating under the stringent oversight of the CFTC. This level of regulatory scrutiny ensures that traders get a secure trading environment where established rules for market operation and transparency are strictly enforced. According to various sources, the presence of CFTC regulation has significantly contributed to the platform's reputation as a safe trading venue. However, while the regulatory credentials provide a solid foundation, some users have raised concerns over the absence of detailed disclosures about security measures and additional licensing information. Such gaps in transparency can occasionally lead to hesitancy among traders who are used to more comprehensive disclosures from other brokers. Nonetheless, the overall industry reputation of Nadex remains positive, and its consistent adherence to US regulatory standards builds confidence among users. Despite occasional negative feedback about customer support and certain operational practices, the trust score of 8/10 reflects an acknowledgment that the platform's commitment to regulatory compliance is its strongest asset. As indicated by this review and various expert opinions, traders prioritizing security and regulation over an expansive feature set will likely find Nadex to be a trustworthy platform.

2.6.6 User Experience Analysis

The user experience offered by Nadex represents a mix of strengths and limitations that provide a balanced yet sometimes uneven trading environment. On one hand, the overall layout of the platform is designed to be intuitive, making navigation relatively straightforward for both novice and experienced traders. The clear presentation of available trading instruments and market data makes the trading process smooth; however, some users have noted that the registration and account verification procedures could benefit from additional streamlining and clarity. The desktop interface is well-organized, but while the mobile platform, NadexGO, offers essential functionality, it lacks some of the advanced features found in competing mobile trading applications. Additionally, issues related to customer service, as mentioned earlier, have contributed to a mixed user experience overall. Despite these concerns, many traders appreciate the platform's emphasis on risk management and the availability of instruments that allow for precise exposure control. The combination of regulated security and an interface that is both accessible and familiar to traders results in a user experience that effectively balances safety with usability. As comprehensive feedback from various sources indicates, improvements in support and additional customization options could further enhance the overall user satisfaction level on the platform.

Conclusion

In summary, Nadex stands out as a regulated trading platform that offers a secure environment and serves traders interested in binary options, Knock-outs™, and call spreads effectively. Suitable for both beginners and experienced traders, Nadex features a low entry barrier with a minimum deposit of US$250, backed by robust regulatory oversight from the CFTC. However, the review identifies several areas that need improvement, particularly in customer service responsiveness and the range of analytical tools and educational resources available. Overall, this nadex review shows that while the platform's strengths lie in its safety, simplicity, and regulatory trust, prospective users should be mindful of its limitations when evaluating their trading needs.