Xtrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xtrade review looks at a Cyprus-based CFD trading platform that has served traders since 2010. Xtrade works under CySEC rules and offers multi-asset CFD trading across forex, stocks, cryptocurrencies, commodities, and indices. According to Trustpilot data, the platform keeps an average user rating of 4 out of 5, showing that users are generally happy with it. However, our analysis shows some concerns about trading costs, especially with major currency pair spreads starting from 5 pips, which puts Xtrade among brokers with higher trading costs in the market.

The platform stands out through its diverse asset offering and regulatory compliance. This makes it good for traders who want portfolio diversification across multiple markets. Xtrade's established presence in the industry, combined with its regulatory standing, appeals mainly to traders who value regulatory oversight and multi-asset trading capabilities over ultra-low trading costs.

Important Notice

Xtrade operates through multiple global entities with varying regulatory frameworks across different jurisdictions. The regulatory environment and available services may differ significantly depending on your location and the specific Xtrade entity serving your region. This review focuses mainly on information available for the CySEC-regulated entity. Trading CFDs involves substantial risk of loss, and past performance does not guarantee future results. Readers should do their own research and consider their financial situation before making trading decisions. The information presented in this review is based on publicly available data and user feedback at the time of writing and should be considered for informational purposes only.

Overall Rating Framework

Broker Overview

Xtrade has established itself as a notable player in the CFD trading space since its founding in 2010. With over a decade of market presence, the company has built its reputation around providing multi-asset CFD trading services to a global client base. The platform operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), which provides a framework of investor protection and operational standards. Xtrade's business model centers on offering Contract for Difference (CFD) trading, allowing clients to speculate on price movements across various asset classes without owning the underlying instruments.

The company's longevity in the competitive online trading industry suggests operational stability and market acceptance. According to available information, Xtrade has maintained its focus on expanding its asset offerings and maintaining regulatory compliance across its operational jurisdictions. The platform's approach to serving diverse trading needs through multiple asset classes positions it as a comprehensive trading solution rather than a specialized single-market broker.

Xtrade's trading environment covers five primary asset categories: foreign exchange (forex), individual stocks, cryptocurrencies, commodities, and stock indices. This diversification allows traders to build varied portfolios and capitalize on opportunities across different market sectors. The platform operates mainly through CFD instruments, which means traders can access leveraged positions and profit from both rising and falling markets. According to user feedback compiled on Trustpilot, the platform maintains operational standards that result in an average 4 out of 5 user rating, suggesting generally positive trading experiences among its client base. This xtrade review will examine each aspect of the platform's offerings to provide a comprehensive assessment for potential users.

Regulatory Framework: Xtrade operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), which provides regulatory oversight for financial services within the European Union framework. This regulatory status offers traders certain protections and ensures the broker follows established financial service standards.

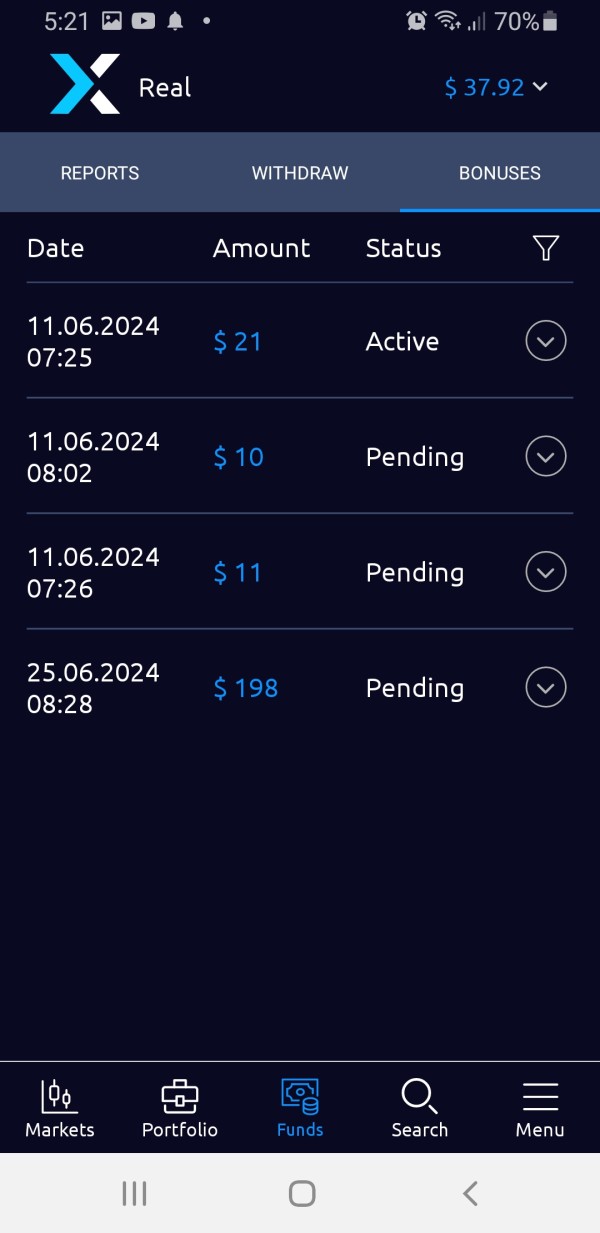

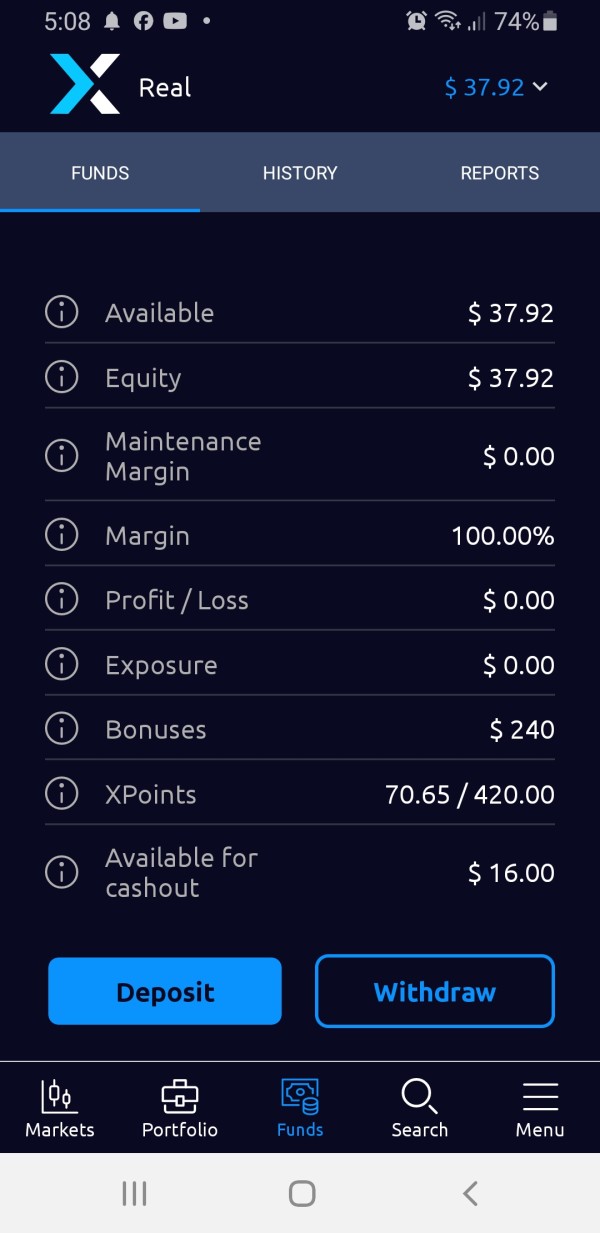

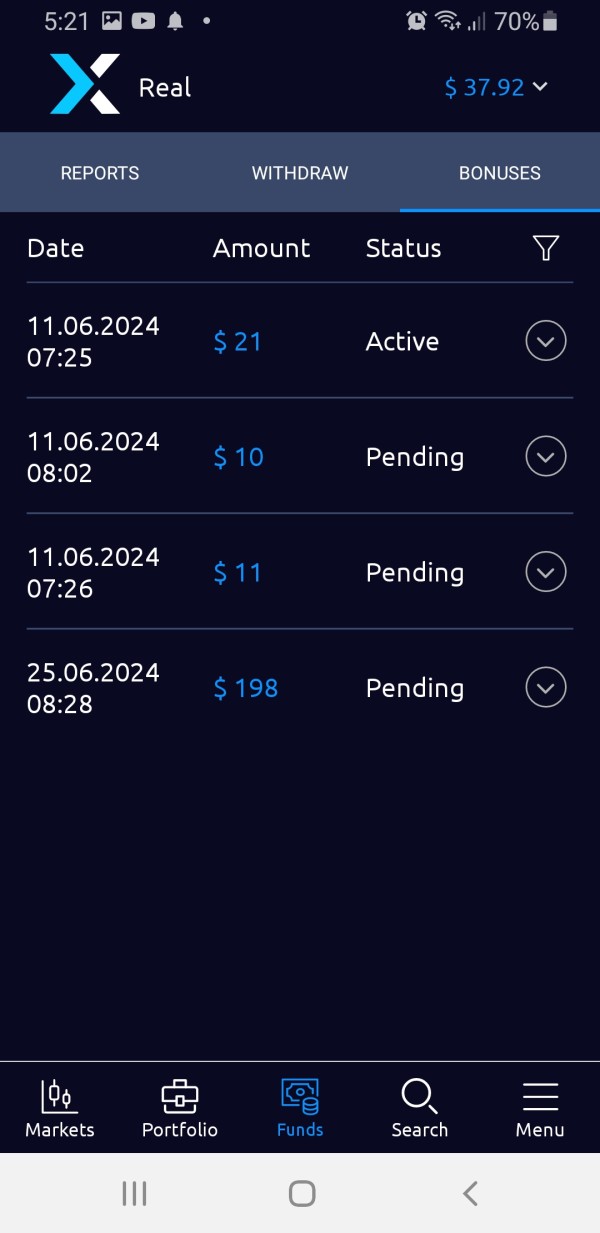

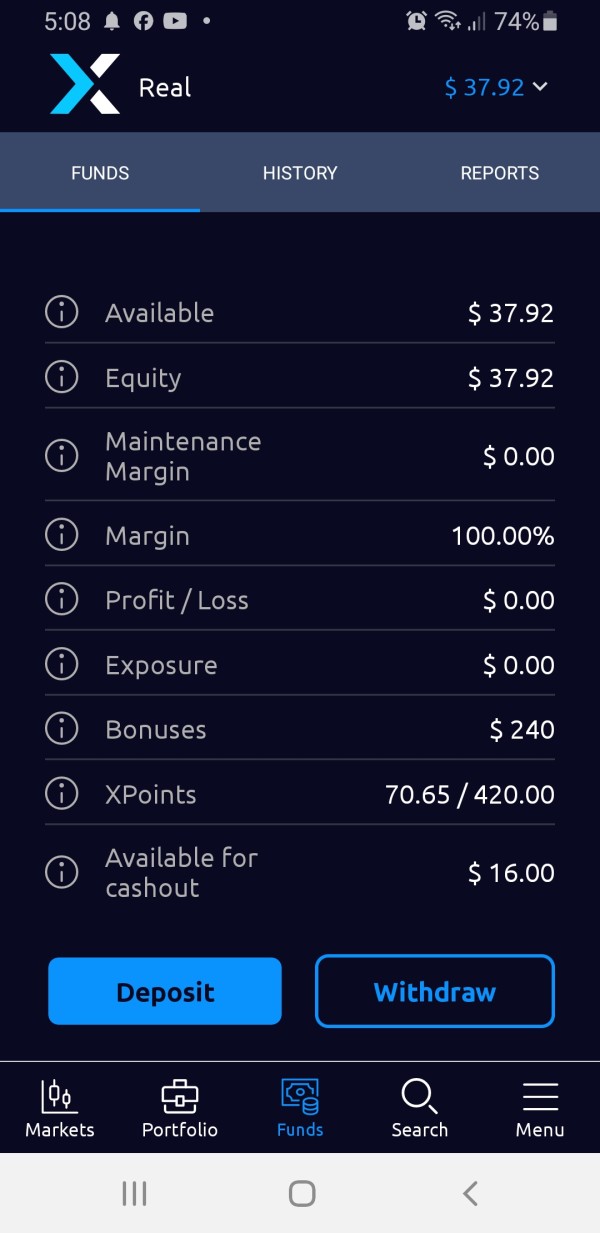

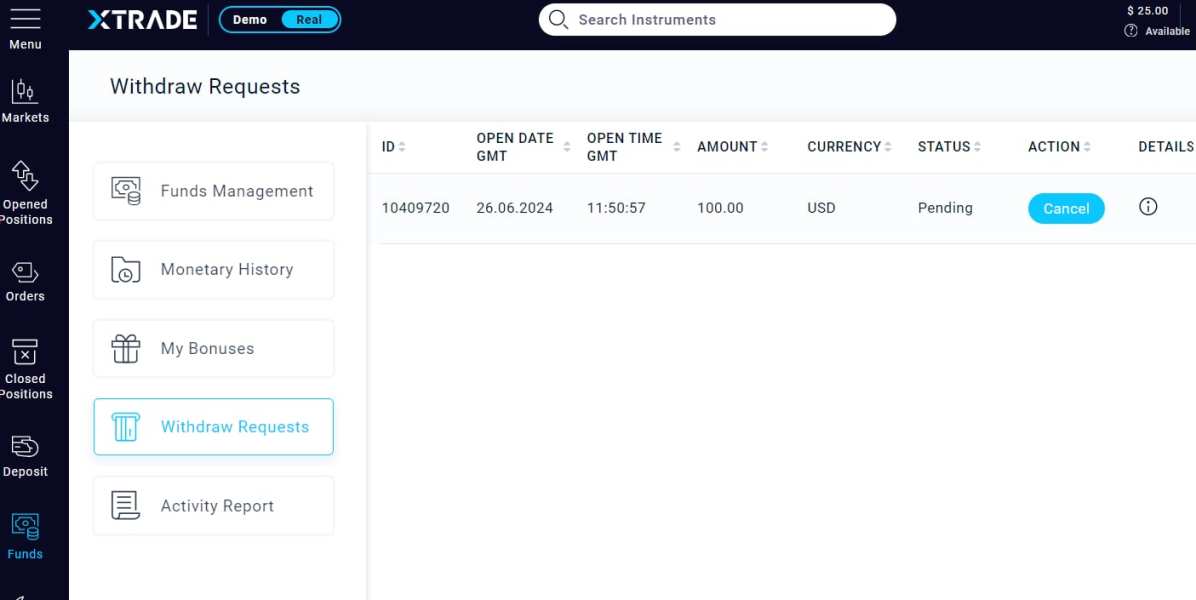

Funding Options: Specific deposit and withdrawal methods are not detailed in available resources. Potential clients need to contact the broker directly for comprehensive information about available payment channels and processing procedures.

Minimum Deposit Requirements: The platform's minimum deposit threshold is not specified in publicly available information. This means potential clients need to ask Xtrade's customer service directly for accurate entry-level funding requirements.

Promotional Offerings: Current bonus structures and promotional campaigns are not detailed in available documentation. This suggests potential clients should verify current offers directly with the platform.

Available Assets: The trading environment includes five primary categories: forex currency pairs, individual stock CFDs, cryptocurrency CFDs, commodity CFDs, and stock index CFDs. This comprehensive selection enables portfolio diversification across multiple market sectors and trading strategies.

Cost Structure: Major currency pairs feature spreads beginning at 5 pips, positioning Xtrade among brokers with higher trading costs in the competitive landscape. Commission structures and additional fees are not specified in available information, requiring direct verification with the broker.

Leverage Provisions: Specific leverage ratios available to traders are not detailed in accessible documentation. These would typically be subject to regional regulatory limitations and account classification.

Platform Technology: The specific trading platform(s) offered by Xtrade are not identified in available resources. This requires direct investigation of the broker's technological infrastructure and user interface capabilities.

Geographic Restrictions: Specific jurisdictional limitations and restricted territories are not outlined in available information. This means verification of service availability based on individual location and regulatory status is necessary.

Support Languages: The range of customer support languages available through Xtrade's service channels is not specified in current documentation. This xtrade review recommends verifying language support capabilities directly with the broker's customer service team.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Xtrade's account structure presents a mixed picture for potential traders, with the most significant concern being the high spread costs that begin at 5 pips for major currency pairs. This spread level places Xtrade at a competitive disadvantage compared to many contemporary brokers who offer spreads from 0.1 to 2 pips on major pairs. The absence of detailed information about account types, minimum deposit requirements, and specific account features makes it difficult for traders to fully evaluate the platform's suitability for their needs.

The lack of transparency regarding account tiers and their respective benefits represents a significant information gap. Most competitive brokers provide clear differentiation between account types, with varying spreads, minimum deposits, and additional features based on account level. Without this information readily available, potential Xtrade clients cannot make informed decisions about which account type might best serve their trading objectives and capital allocation.

Account opening procedures and verification requirements are not specified in available documentation. This could indicate either a streamlined process or additional complexity that requires direct broker contact. The absence of information about specialized account types, such as Islamic accounts for traders requiring swap-free trading, further limits the platform's appeal to diverse trading communities. Given the high spreads and limited available information about account benefits, this xtrade review assigns a moderate score that reflects both the cost concerns and information transparency issues.

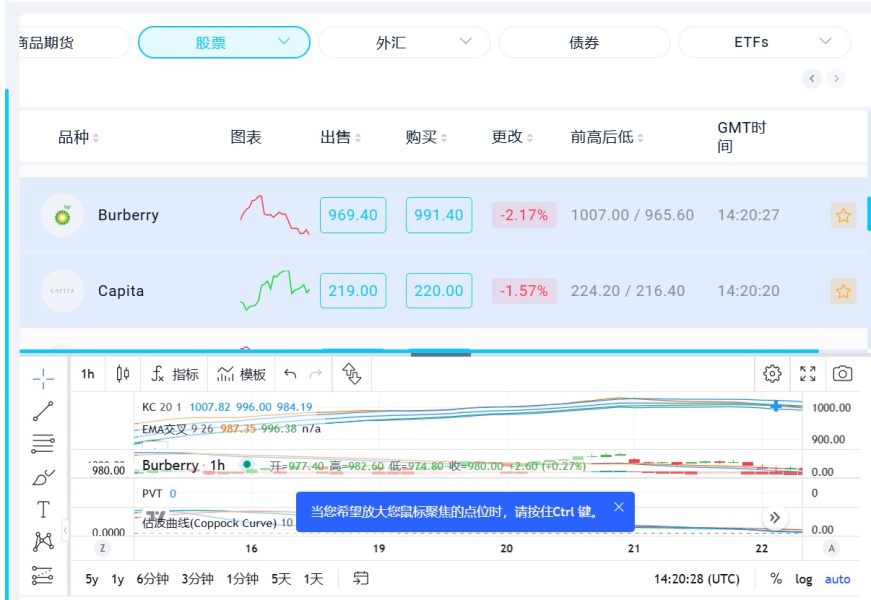

Xtrade demonstrates strong performance in its asset diversity and trading instrument availability, offering comprehensive CFD trading across five major market categories. The platform's coverage of forex, stocks, cryptocurrencies, commodities, and indices provides traders with significant diversification opportunities and the ability to capitalize on various market conditions and economic cycles. This multi-asset approach enables sophisticated portfolio construction and risk management strategies.

The inclusion of cryptocurrency CFDs positions Xtrade well for traders seeking exposure to digital asset price movements without the complexities of direct cryptocurrency ownership, wallet management, and security concerns. Similarly, the availability of individual stock CFDs allows traders to access global equity markets with leveraged positions and the ability to profit from both bullish and bearish market movements.

However, the evaluation is limited by the absence of detailed information about research tools, market analysis resources, educational materials, and trading aids that might be available to platform users. Modern traders increasingly expect comprehensive analytical tools, economic calendars, technical analysis features, and educational resources to support their trading decisions. The lack of specific information about these supplementary tools prevents a higher rating, despite the strong asset selection.

The platform's commodity and index CFD offerings provide additional portfolio diversification options. This allows traders to gain exposure to precious metals, energy markets, agricultural products, and broad market indices. This comprehensive asset coverage earns Xtrade recognition for meeting diverse trading needs and supporting various investment strategies across multiple market sectors.

Customer Service and Support Analysis (Score: 7/10)

Xtrade's customer service evaluation benefits from positive user feedback reflected in its Trustpilot rating of 4 out of 5, indicating that the majority of users have satisfactory experiences with the platform's support services. This rating suggests that when users encounter issues or require assistance, they generally receive adequate responses and resolution support from the Xtrade team.

However, the assessment is constrained by the absence of specific information about support channels, response times, availability hours, and the range of languages supported by the customer service team. Modern traders expect multiple contact methods including live chat, email, phone support, and potentially social media channels for quick query resolution. The lack of detailed information about these service aspects prevents a more comprehensive evaluation.

The global nature of CFD trading means that customer support availability across different time zones becomes crucial for traders operating in various international markets. Without specific information about 24-hour support availability or regional support coverage, it's difficult to assess how well Xtrade serves its international client base during their respective trading hours.

User feedback compilation suggests that existing clients generally find the support they receive to be adequate for their needs. This supports the moderate-to-positive scoring in this category. However, the absence of specific complaint resolution procedures, escalation processes, and detailed service level commitments limits the ability to provide a higher rating despite the positive user sentiment indicators.

Trading Experience Analysis (Score: 7/10)

The trading experience evaluation for Xtrade reflects a balance between positive user feedback and concerns about trading costs that could impact overall satisfaction. User ratings averaging 4 out of 5 on Trustpilot suggest that traders generally find the platform functional and reliable for executing their trading strategies. This positive feedback indicates that the platform likely provides stable connectivity, reasonable execution speeds, and user-friendly interface design.

However, the significant concern regarding spreads starting at 5 pips for major currency pairs creates a substantial cost burden that directly impacts trading profitability. High spreads mean that positions must move further in the trader's favor before reaching profitability, which can be particularly challenging for short-term trading strategies, scalping, and high-frequency trading approaches. This cost structure may limit the platform's appeal to active traders who prioritize tight spreads for optimal execution.

The absence of specific information about order execution quality, slippage rates, requotes frequency, and platform stability during high-volatility periods limits the depth of this analysis. Modern traders expect detailed execution statistics, including average execution speeds, rejection rates, and slippage data to evaluate platform performance objectively.

Mobile trading capabilities and cross-device synchronization are not specifically addressed in available information. These features have become standard expectations for contemporary trading platforms. The overall positive user sentiment suggests that the platform meets basic functionality requirements, but the high spread costs prevent a higher rating in this xtrade review assessment.

Trust and Security Analysis (Score: 8/10)

Xtrade's trust and security profile benefits significantly from its regulation by the Cyprus Securities and Exchange Commission (CySEC), which provides a framework of regulatory oversight and investor protection measures. CySEC regulation requires adherence to specific capital adequacy requirements, client fund segregation, and operational transparency standards that enhance trader protection and platform credibility.

The company's establishment in 2010 provides over a decade of operational history, which demonstrates business continuity and market survival through various economic cycles and market conditions. This longevity in the competitive online trading industry suggests operational stability and the ability to maintain regulatory compliance over extended periods.

However, the evaluation is limited by the absence of specific information about client fund protection measures, insurance coverage, segregated account details, and additional security protocols that might be in place. Modern traders increasingly expect detailed information about negative balance protection, fund segregation procedures, and compensation scheme participation to evaluate platform safety comprehensively.

The lack of detailed information about the company's financial transparency, including published financial statements, audit reports, or corporate governance information, prevents a more thorough assessment of organizational stability. Additionally, without specific information about data security measures, encryption protocols, and cybersecurity frameworks, it's difficult to evaluate the platform's protection against technical security threats.

Despite these information limitations, the combination of CySEC regulation, established operational history, and positive user feedback supports a strong trust rating. Additional transparency would enable an even higher assessment score.

User Experience Analysis (Score: 7/10)

Xtrade's user experience assessment draws primarily from the Trustpilot rating of 4 out of 5, which indicates that the majority of users find the platform satisfactory for their trading needs. This rating suggests that the platform successfully delivers core functionality that meets user expectations for reliability, accessibility, and operational efficiency.

The platform's appeal to traders seeking diversified investment opportunities across multiple asset classes indicates that the user interface successfully accommodates complex portfolio management and multi-market trading strategies. Users appear to appreciate the ability to access forex, stocks, cryptocurrencies, commodities, and indices through a single platform, which simplifies account management and trading execution across different market sectors.

However, the assessment is constrained by limited specific information about user interface design, navigation efficiency, customization options, and learning curve considerations for new users. Modern trading platforms are expected to provide intuitive interfaces, customizable dashboards, advanced charting capabilities, and streamlined order entry processes that enhance trading efficiency.

The absence of detailed information about account registration procedures, verification timeframes, and onboarding processes makes it difficult to evaluate the initial user experience. Similarly, without specific data about deposit and withdrawal procedures, processing times, and fee structures, it's challenging to assess the complete user journey from account opening through active trading.

The generally positive user sentiment reflected in the Trustpilot rating supports the moderate-to-positive scoring. However, the lack of detailed user experience metrics and specific functionality descriptions prevents a higher rating. The platform appears to meet basic user needs effectively, though more comprehensive information would enable a more thorough evaluation.

Conclusion

This comprehensive xtrade review reveals a broker that offers solid regulatory credentials and diverse trading opportunities, balanced against some significant cost considerations. Xtrade's CySEC regulation and decade-plus operational history provide a foundation of trust and regulatory compliance that appeals to traders prioritizing oversight and established market presence. The platform's multi-asset CFD offering across forex, stocks, cryptocurrencies, commodities, and indices creates opportunities for sophisticated portfolio diversification and varied trading strategies.

However, the platform's high spreads starting at 5 pips on major currency pairs represent a substantial cost burden that limits its competitiveness, particularly for active traders and those employing short-term strategies. This cost structure, combined with limited transparency about account types, fees, and platform features, creates barriers for traders seeking detailed information to make informed decisions.

Xtrade appears most suitable for traders who prioritize regulatory oversight and multi-asset trading capabilities over ultra-low trading costs. This especially applies to those building diversified portfolios across multiple market sectors. The platform may appeal less to high-frequency traders, scalpers, or cost-sensitive traders who require tight spreads for optimal strategy execution.