Is WeekendFX safe?

Pros

Cons

Is WeekendFX A Scam?

Introduction

WeekendFX is a forex broker that positions itself as a convenient trading platform for those looking to engage in foreign exchange and cryptocurrency trading over the weekends. Established in 2020, it has attracted attention due to its unique offering of weekend trading, which is not commonly available through many brokers. However, as with any financial service, it is crucial for traders to exercise caution and thoroughly evaluate the trustworthiness of a broker before committing their funds. The forex market is rife with potential scams and unreliable platforms, making it essential for traders to conduct due diligence. This article aims to provide an objective assessment of WeekendFX by exploring its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most critical factors in determining its legitimacy. WeekendFX claims to be regulated by the Financial Services Commission (FSC) of the British Virgin Islands, but its license status is marked as "exceeded," raising concerns about its effectiveness. Below is a summary of the key regulatory information regarding WeekendFX:

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | 9453 | British Virgin Islands | Exceeded |

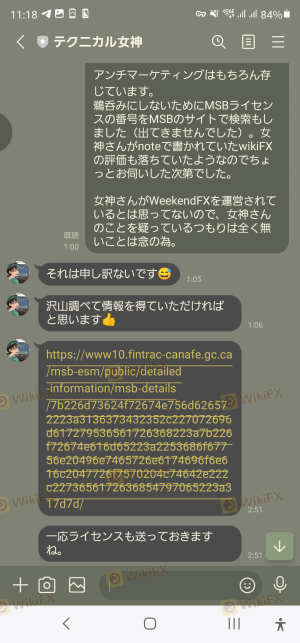

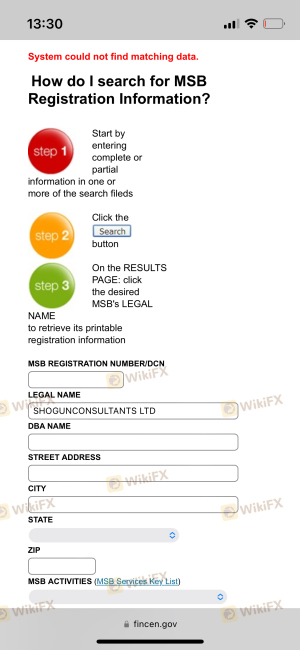

The FSC is known for a relatively lenient regulatory environment, which can often lead to brokers exploiting this to operate with minimal oversight. Furthermore, there are reports indicating that WeekendFX has made claims of holding licenses from the National Futures Association (NFA) in the United States, but these claims have been disputed, with evidence suggesting that the NFA registration was withdrawn in February 2023. This lack of effective regulation could mislead investors and pose substantial risks, as brokers operating without stringent regulatory oversight may not prioritize client protection.

Company Background Investigation

WeekendFX operates under the brand name of Shogun Consultants Limited, a company registered in the British Virgin Islands. Since its inception, it has aimed to provide a platform for trading various financial instruments, including forex, cryptocurrencies, and indices. However, the company's transparency is questionable, as it has not disclosed its registration certificate, nor provided sufficient information about its ownership structure or management team. This lack of transparency can be a red flag for potential investors, as it raises concerns about accountability and the ability to resolve disputes.

The management teams experience and qualifications are pivotal in establishing trust. Unfortunately, there is limited information available on the backgrounds of the individuals leading WeekendFX, which further obscures the company's credibility. Without a clear understanding of the team's expertise, traders may find it challenging to assess whether the broker is capable of providing reliable services.

Trading Conditions Analysis

WeekendFX presents itself as a competitive broker with various trading conditions, but a closer examination reveals some troubling aspects. The broker requires a minimum deposit of $1,000, which is significantly higher than the industry average. This high barrier to entry can deter novice traders and may indicate a lack of commitment to accessibility.

The following table summarizes the core trading costs associated with WeekendFX:

| Fee Type | WeekendFX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable (often higher) | 0.1 - 1.5 pips |

| Commission Model | None | Varies (0 - $7 per lot) |

| Overnight Interest Range | High | Varies (0 - 5%) |

WeekendFX's spread structure has been reported to be higher than average, which can eat into traders' profits. Additionally, the absence of a transparent commission model raises concerns, as hidden fees can significantly impact trading performance. Traders should be wary of any broker that does not clearly outline its fee structure, as this can lead to unexpected costs.

Client Fund Security

The safety of client funds is a paramount concern for any trader. WeekendFX claims to implement several security measures, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable, given the broker's regulatory shortcomings.

Many traders have reported difficulties in withdrawing their funds, which raises alarms about the broker's financial practices. The lack of a robust regulatory framework means that there is little recourse for clients who face issues accessing their funds. Historical complaints regarding fund safety and withdrawal challenges further complicate the broker's reputation, suggesting that potential clients should tread carefully.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of WeekendFX reveal a mixed bag of experiences. While some users have praised the platform for its unique weekend trading options, others have reported significant issues, particularly regarding withdrawals and customer support responsiveness.

The following table categorizes common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Difficulty in Withdrawals | High | Slow response times |

| Lack of Customer Support | Medium | Inconsistent support quality |

| High Spreads and Fees | Medium | Limited transparency |

A notable case involved a trader who found it nearly impossible to withdraw their funds after a profitable trading period, leading to frustration and a loss of trust in the platform. Such experiences can deter potential clients and highlight the risks associated with trading with WeekendFX.

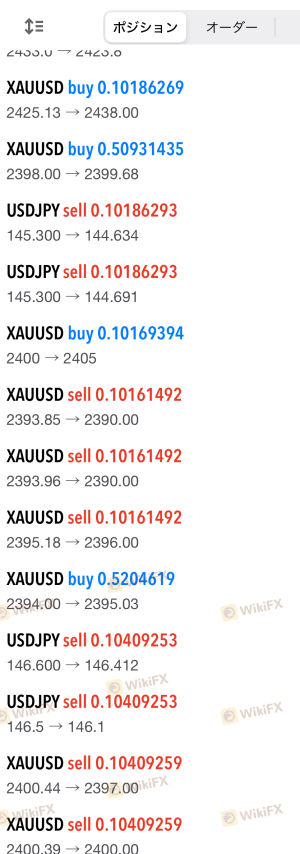

Platform and Trade Execution

The trading platform offered by WeekendFX is primarily MetaTrader 4 and 5, which are well-regarded in the industry for their functionality and user-friendly interfaces. However, reports of execution delays and slippage have surfaced, which can hinder trading performance. Traders have expressed concerns about the reliability of order execution, particularly during volatile market conditions.

Furthermore, any signs of potential platform manipulation should be taken seriously. Traders must remain vigilant and monitor their execution quality closely, as issues in this area can significantly impact profitability.

Risk Assessment

Using WeekendFX comes with inherent risks that traders should consider before opening an account. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of effective regulation |

| Fund Safety Risk | High | Reports of withdrawal issues |

| Transparency Risk | Medium | Limited information on company structure |

| Execution Risk | Medium | Reports of slippage and execution delays |

To mitigate these risks, traders are advised to start with a demo account, thoroughly test the platform, and only invest funds they can afford to lose. Additionally, seeking brokers with robust regulatory frameworks and transparent fee structures can help protect traders from potential pitfalls.

Conclusion and Recommendations

In conclusion, while WeekendFX offers unique weekend trading opportunities, its regulatory shortcomings, high fees, and customer complaints raise significant red flags. The evidence suggests that the broker may not be trustworthy, and potential clients should exercise extreme caution.

For traders seeking reliable alternatives, it is advisable to explore brokers that are well-regulated, offer competitive fees, and have a proven track record of customer satisfaction. Some recommended alternatives include brokers with strong regulatory oversight, transparent fee structures, and robust customer support systems. Ultimately, thorough research and due diligence are essential for navigating the complexities of the forex market safely.

Is WeekendFX a scam, or is it legit?

The latest exposure and evaluation content of WeekendFX brokers.

WeekendFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WeekendFX latest industry rating score is 2.09, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.09 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.