Regarding the legitimacy of TradeEU forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is TradeEU safe?

Pros

Cons

Is TradeEU markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

Titanedge Securities Ltd

Effective Date:

2021-10-18Email Address of Licensed Institution:

compliance@titan-edge.comSharing Status:

Website of Licensed Institution:

www.tradeeu.com, www.titan-edge.comExpiration Time:

--Address of Licensed Institution:

95 Griva Digeni, GRIGORIOU BUILDING, Mezzanine floor, Flat 1, Saint Nicholas, 3101 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 261 736Licensed Institution Certified Documents:

Is TradeEU A Scam?

Introduction

TradeEU is a relatively new player in the online forex and CFD trading market, having been established in 2021. It positions itself as a platform catering to both novice and experienced traders, offering access to a diverse range of financial instruments including forex, commodities, indices, and cryptocurrencies. Given the numerous brokers available, it's crucial for traders to conduct thorough evaluations of their chosen platforms to ensure safety and reliability. The forex market, known for its volatility and the potential for significant financial loss, necessitates a careful assessment of each broker's legitimacy. This article aims to provide a comprehensive analysis of TradeEU, focusing on its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and associated risks. The evaluation is based on a synthesis of online reviews, regulatory filings, and user feedback.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a fundamental aspect of its credibility. TradeEU is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is known for its stringent regulatory requirements that enhance investor protection.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 405/21 | Cyprus | Verified |

CySEC is recognized as a reputable regulatory authority within the European Union, and it mandates that brokers maintain a minimum capital requirement and adhere to strict operational guidelines. TradeEU's compliance with these regulations implies a commitment to maintaining transparency and protecting client funds. However, as a relatively new broker, its historical compliance record is still developing. While there have been no significant regulatory breaches reported, the broker's short operational history means that potential clients should remain vigilant and monitor any changes in its regulatory status.

Company Background Investigation

TradeEU is operated by Titanedge Securities Ltd, a company incorporated in Cyprus. The firm has established its headquarters at the Panayides Building in Limassol, Cyprus. Although the company is relatively new, it has quickly garnered a client base of over one million users, which speaks to its effective marketing and user-friendly approach.

The management team behind TradeEU comprises professionals with extensive backgrounds in finance and trading. Their expertise is crucial in navigating the complexities of the forex market and in implementing effective risk management strategies. Transparency regarding the company's ownership structure and management team is vital for building trust among potential clients. TradeEU has made efforts to provide clear information about its operations, although further details about its management team could enhance its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to assess the potential profitability of their trading strategies. TradeEU employs a commission-free model, generating revenue primarily through spreads.

| Fee Type | TradeEU | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips (Silver Account) | 1.5 - 3.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | $50 - $500 | $10 - $100 |

The spreads at TradeEU can be considered average compared to industry standards, with the silver account starting at 2.5 pips. However, the broker charges an application fee of $50, which is somewhat unusual in the industry. Additionally, the inactivity fees can escalate significantly, reaching up to $500 per month after 300 days of inactivity. Such fees may deter traders who are not consistently active, and they highlight the importance of understanding the full cost structure before opening an account.

Customer Funds Safety

The safety of client funds is paramount in the trading industry. TradeEU implements several measures to safeguard client deposits, including segregating client funds from company operational funds. This means that in the event of insolvency, client funds are protected. The broker also participates in the Investor Compensation Fund (ICF), which provides additional security by compensating clients up to €20,000 in case of broker failure.

TradeEU employs negative balance protection, ensuring that clients cannot lose more than their initial investment. This feature is particularly important in the volatile forex market, where leverage can magnify losses. However, the broker has not faced any significant controversies or security breaches since its inception, which is a positive indicator for prospective clients.

Customer Experience and Complaints

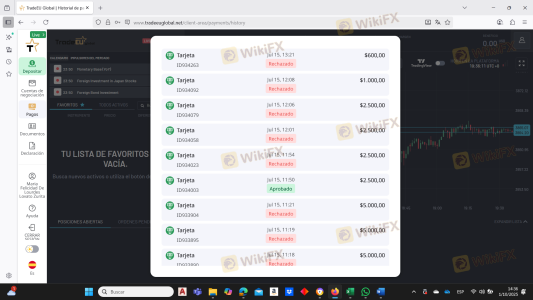

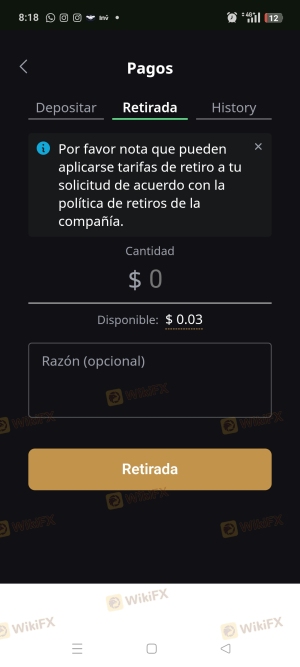

Customer feedback plays a vital role in evaluating the reliability of a broker. Reviews of TradeEU reveal a mixed bag of experiences. While many users appreciate the user-friendly interface and the variety of trading instruments, there are recurring complaints regarding the responsiveness of customer support and issues with withdrawal processing times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Average response |

| Inactivity Fee Complaints | Medium | Addressed |

For instance, some traders have reported delays in receiving their funds after withdrawal requests, which can be frustrating. The lack of a live chat option for immediate assistance has also been noted as a drawback. While the company has made efforts to address these complaints, the consistency of their responses and resolution times remains a concern for many clients.

Platform and Trade Execution

The performance of a trading platform is critical to a trader's experience. TradeEU offers the MetaTrader 5 (MT5) platform, known for its robust capabilities and user-friendly interface. Traders report that the platform is stable and provides a range of analytical tools. However, there have been some concerns about order execution quality, with reports of occasional slippage and rejections during high volatility periods.

The absence of a proprietary web-based platform may also limit accessibility for some users. Overall, while MT5 is a reputable platform, the execution quality and potential for slippage are areas that require scrutiny, especially for high-frequency traders.

Risk Assessment

Using TradeEU comes with inherent risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | New broker with limited history. |

| Withdrawal Issues | High | Complaints about delays and responsiveness. |

| Trading Costs | Medium | Inactivity fees can accumulate quickly. |

| Platform Reliability | Medium | Occasional slippage noted during trading. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining clear communication with customer support and regularly monitoring account activity can help address potential issues before they escalate.

Conclusion and Recommendations

In conclusion, TradeEU is a regulated broker offering a variety of trading instruments and a user-friendly platform. While it does not exhibit overt signs of being a scam, potential clients should remain cautious due to the broker's relatively short operational history and some concerning client feedback regarding withdrawal processes and customer support responsiveness.

For traders seeking a reliable broker, it may be prudent to consider alternatives that have established reputations and a longer history of positive client experiences. Some recommended alternatives include brokers like IG, OANDA, or Forex.com, which have demonstrated robust regulatory compliance and customer service. Overall, while TradeEU has the potential to be a viable trading option, thorough due diligence is essential before committing significant capital.

Is TradeEU a scam, or is it legit?

The latest exposure and evaluation content of TradeEU brokers.

TradeEU Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeEU latest industry rating score is 2.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.