TradeEU 2025 Review: Everything You Need to Know

Executive Summary

TradeEU operates as the trading name of Titanedge Securities Ltd. This tradeeu review shows a CFD-focused forex broker that has received mixed reactions from traders in the community. The broker excels in customer support responsiveness but struggles with withdrawal processing times, which creates a complex picture for potential clients who are considering their services.

The broker's key features include the MetaTrader 5 trading platform across multiple devices and a diverse range of trading assets. These assets span forex, commodities, indices, and stock CFDs for traders seeking variety in their portfolios. TradeEU offers free demo trading accounts for newcomers to the trading world. This provides a risk-free environment where new traders can develop their skills and learn how the platform works.

TradeEU primarily targets beginner and intermediate traders who want exposure to forex and CFD markets. The broker focuses on accessibility and user-friendly services, though certain operational aspects may impact the overall trading experience that clients receive. Users consistently praise the quality and speed of customer support responses. However, the extended withdrawal processing times represent a significant concern that potential clients should carefully consider before opening an account with this broker.

Important Disclaimer

The absence of specific regulatory authority information and license numbers in available materials creates uncertainty for users. Users in different regions may face varying levels of legal protection and regulatory oversight depending on their location. The regulatory framework under which TradeEU operates remains unclear. This potentially affects the security and recourse available to traders who choose to use their services.

This evaluation is based on collected information and user feedback from various sources. The assessment aims to provide an objective and comprehensive review of the broker's services and features. However, prospective clients should conduct their own due diligence and verify current regulatory status before making investment decisions that could affect their financial situation.

Rating Framework

Broker Overview

TradeEU operates as the trading name of Titanedge Securities Ltd. The company positions itself as a CFD trading specialist in the competitive forex brokerage landscape where many firms compete for clients. The company focuses primarily on providing Contract for Difference (CFD) trading services across multiple asset categories. These categories include foreign exchange currencies, commodities, stock indices, and individual stock CFDs for traders seeking diverse investment opportunities. While the exact establishment date remains unspecified in available documentation, the broker has developed a presence in the online trading community over time.

The company's business model centers around CFD trading services. This approach offers clients leveraged access to various financial markets without requiring direct ownership of underlying assets, which can be expensive or impractical for individual traders. This method allows traders to potentially profit from both rising and falling market conditions across diverse asset classes. TradeEU's service portfolio encompasses forex pairs, commodity CFDs covering precious metals and energy products, major global indices, and stock CFDs from various international markets that provide extensive trading opportunities.

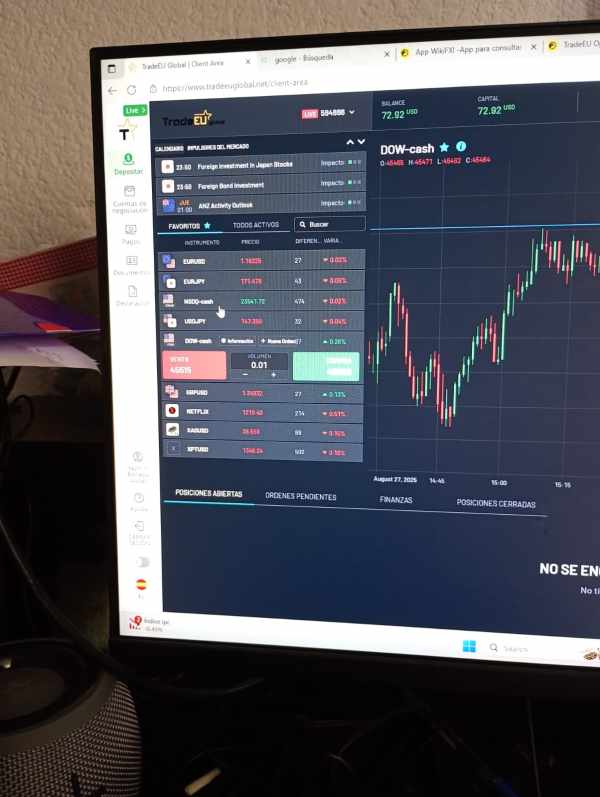

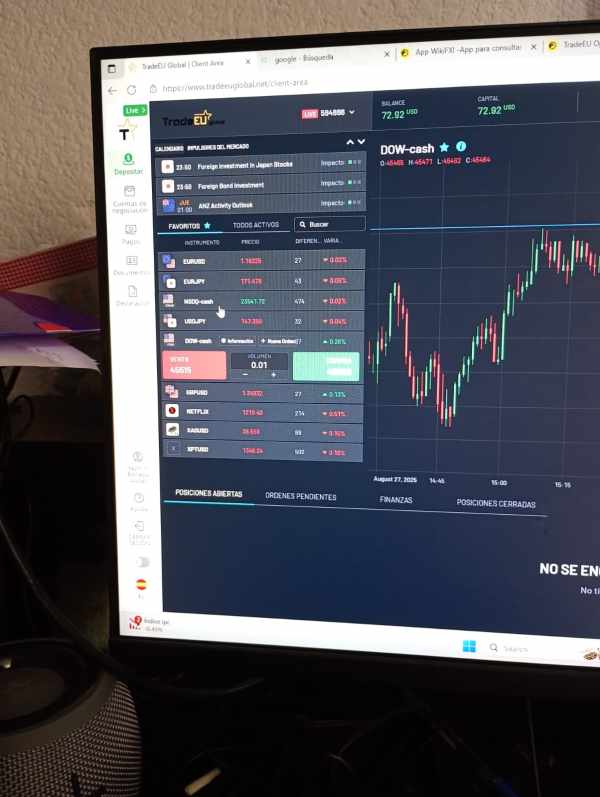

The broker utilizes the widely recognized MetaTrader 5 trading platform for its clients. This platform provides access across mobile devices, desktop computers, and web browsers for maximum flexibility and convenience. The multi-platform approach ensures traders can monitor and execute trades regardless of their preferred device or location. The platform integration supports various asset classes and includes the essential tools and features expected by modern CFD traders who require sophisticated functionality. However, specific details regarding regulatory oversight and licensing remain unclear in this tradeeu review. This lack of clarity may impact trader confidence and legal protections available to clients.

Regulatory Jurisdiction: The specific regulatory authorities and license numbers governing TradeEU's operations are not clearly specified in available documentation. This creates uncertainty about oversight and client protection measures that may be available to traders.

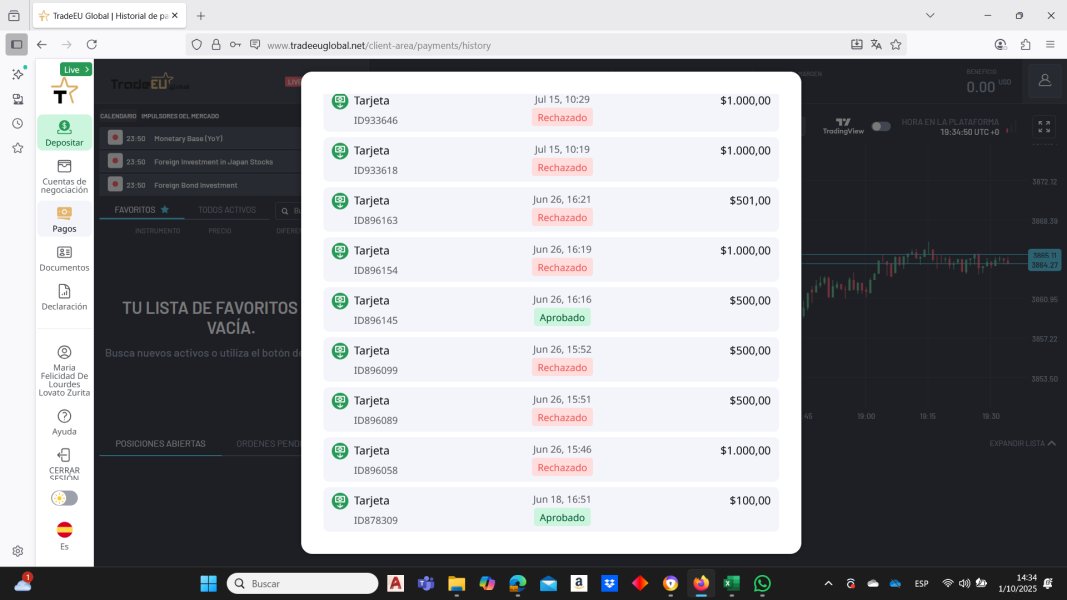

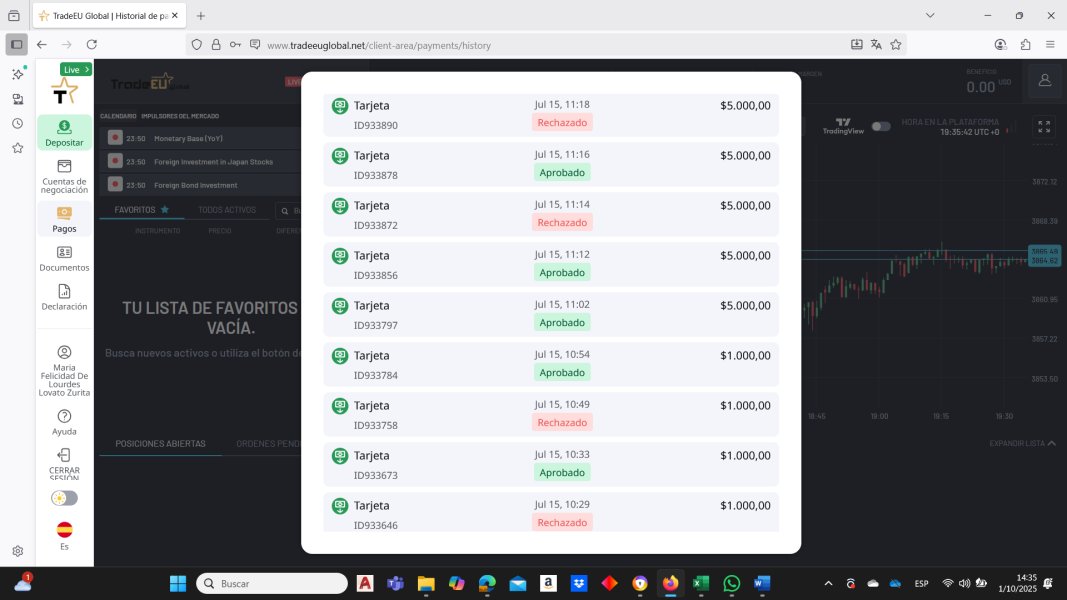

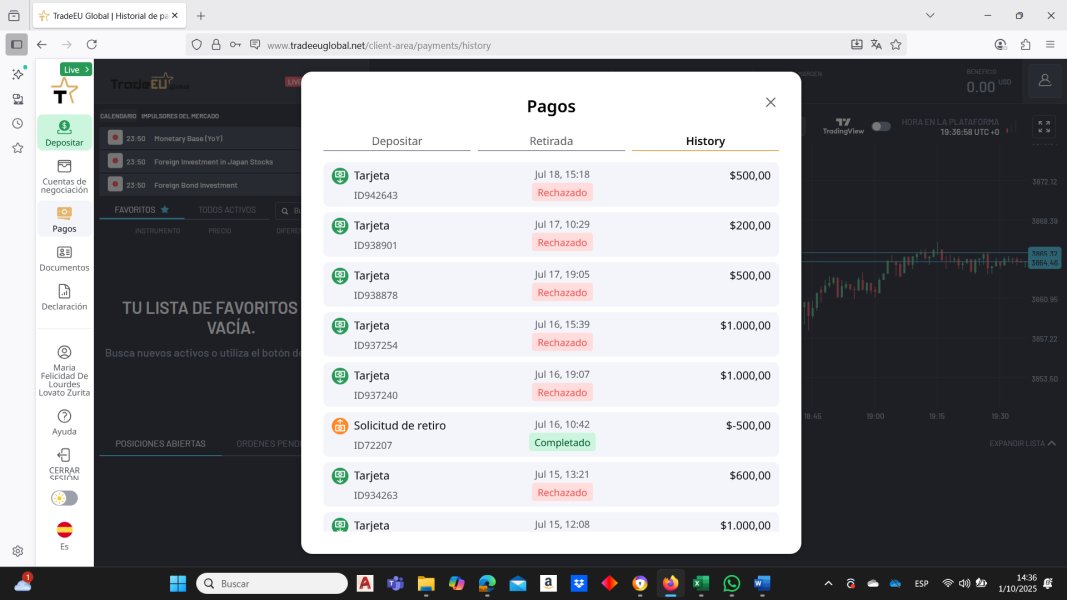

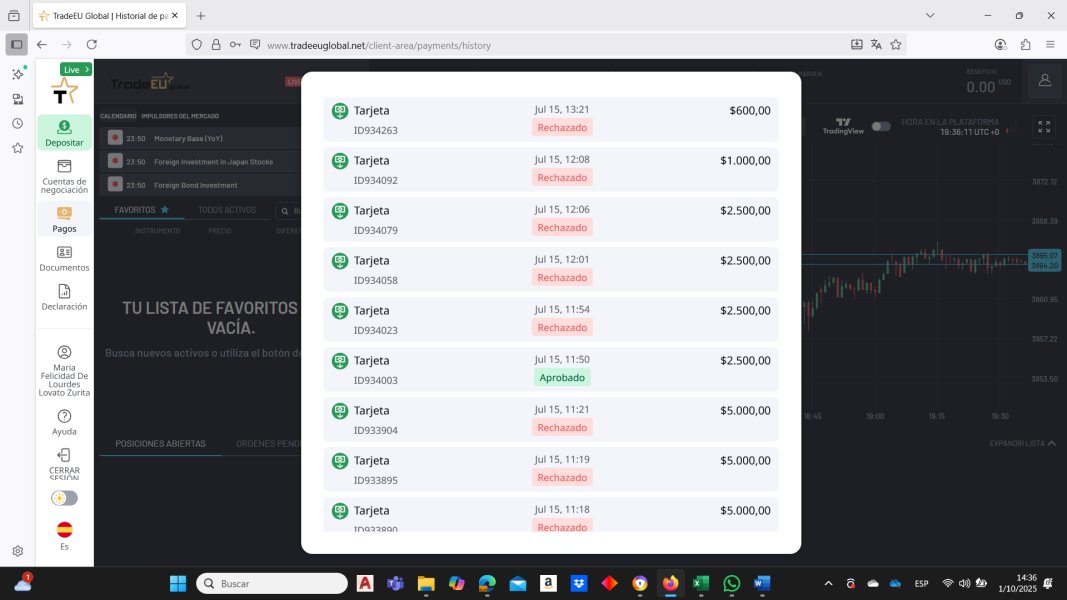

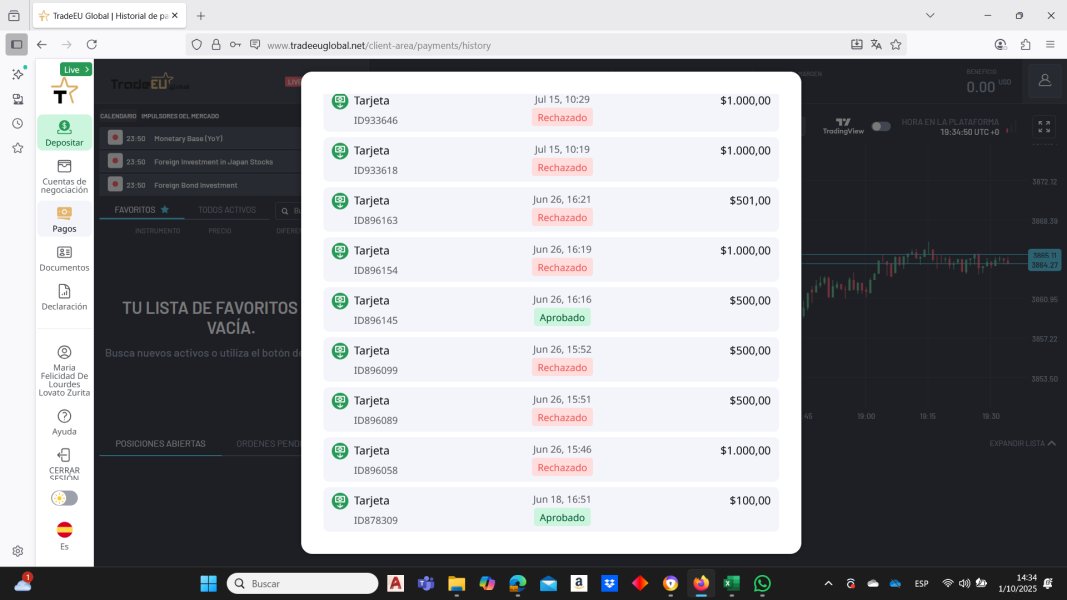

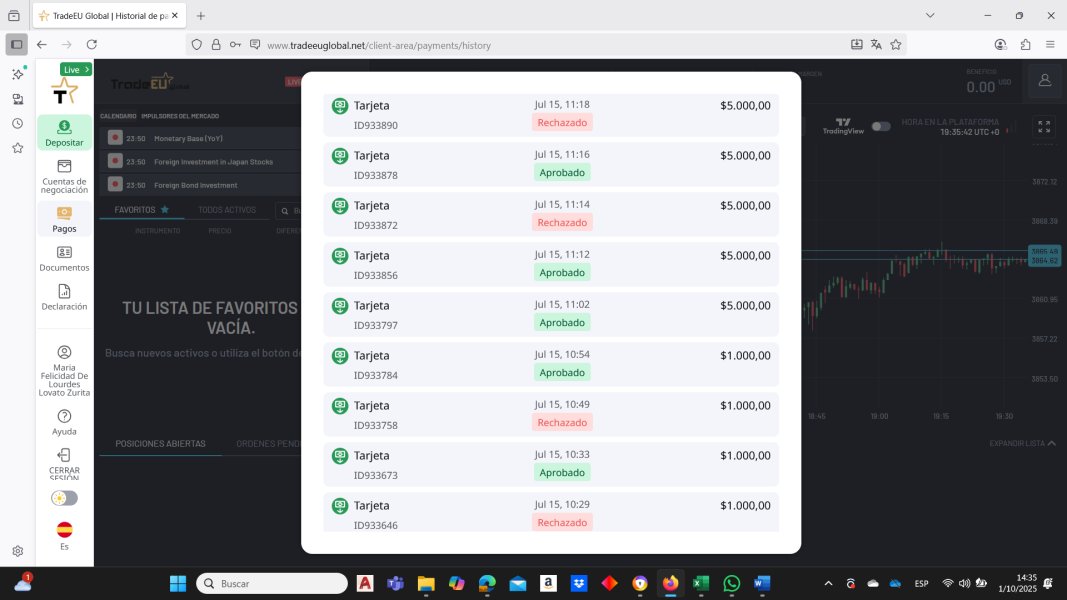

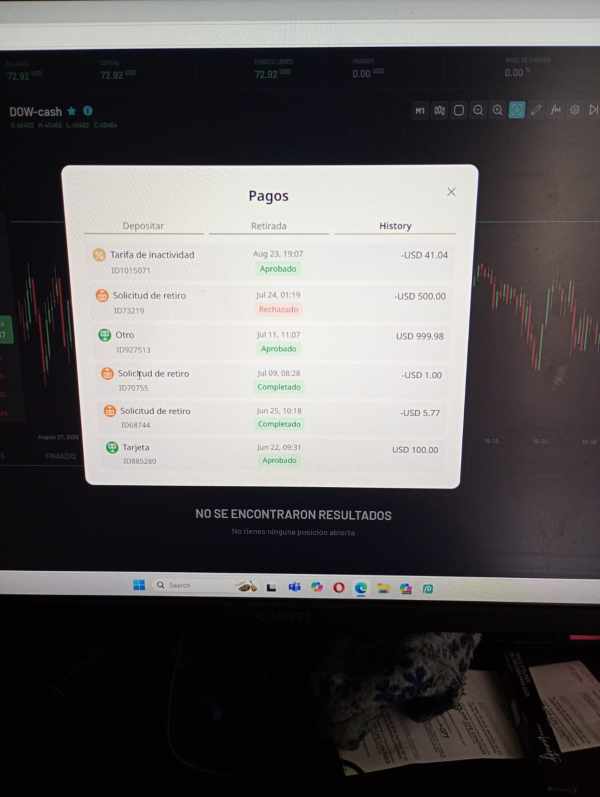

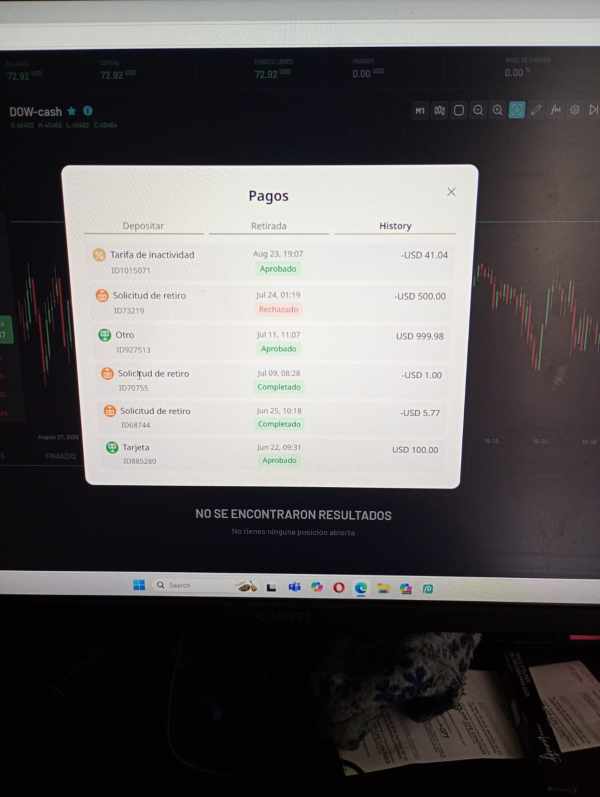

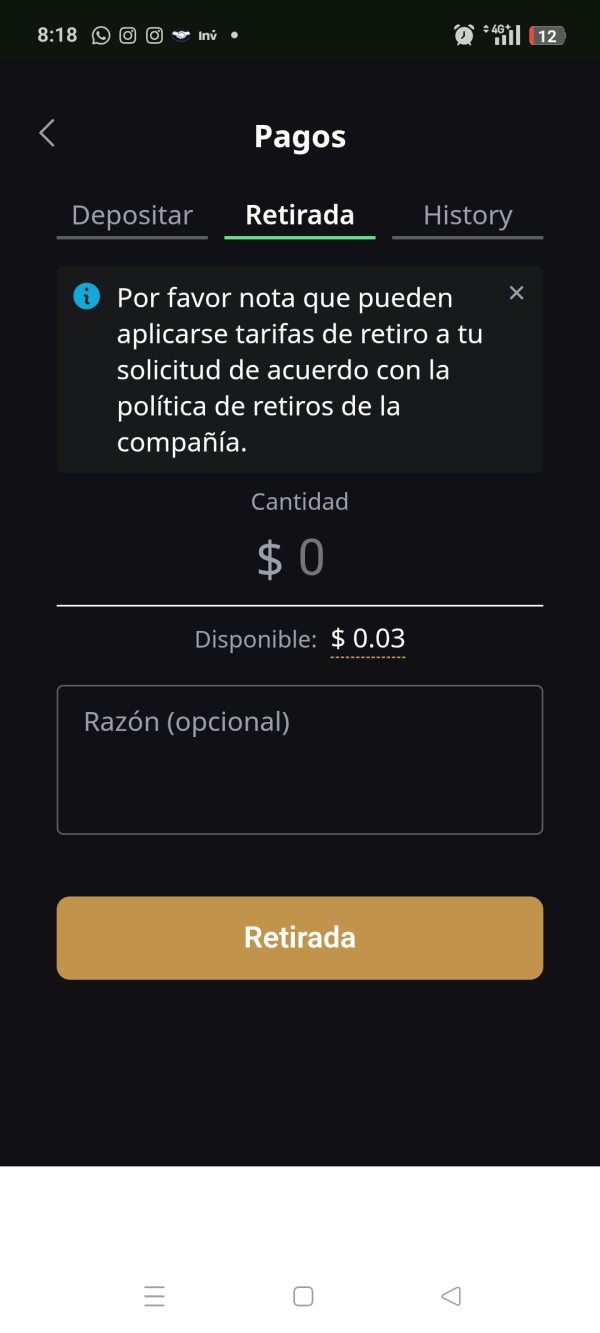

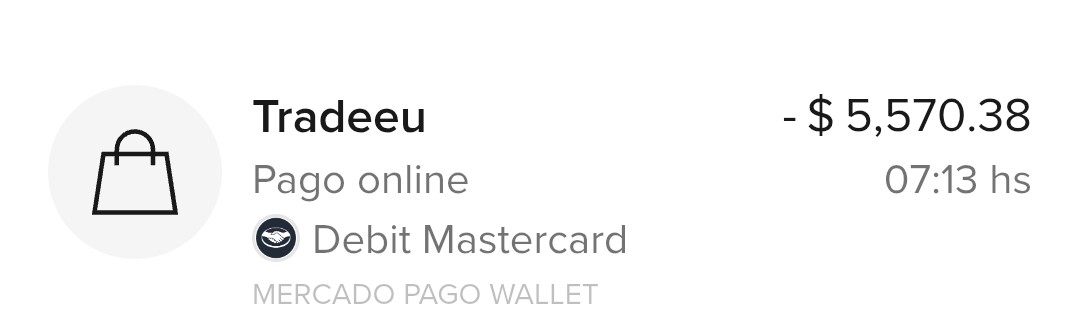

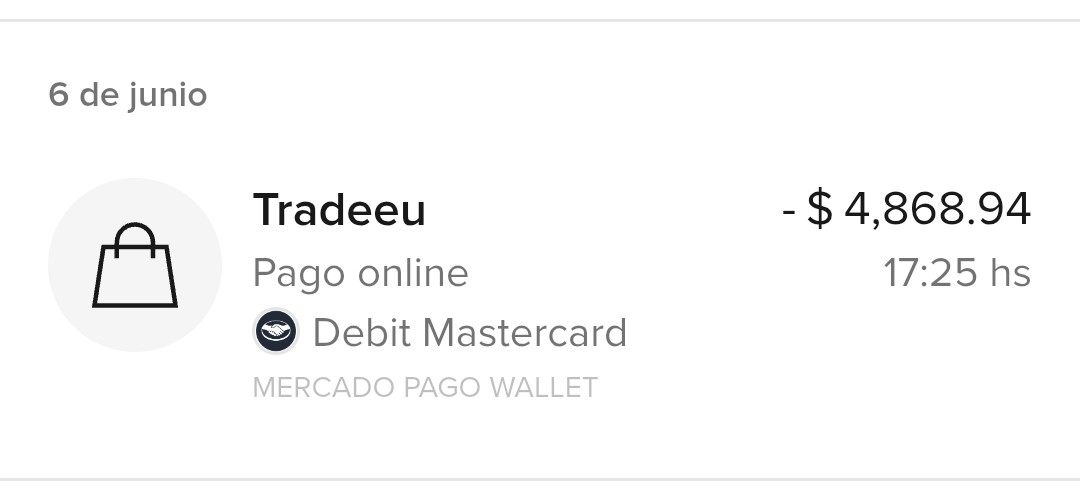

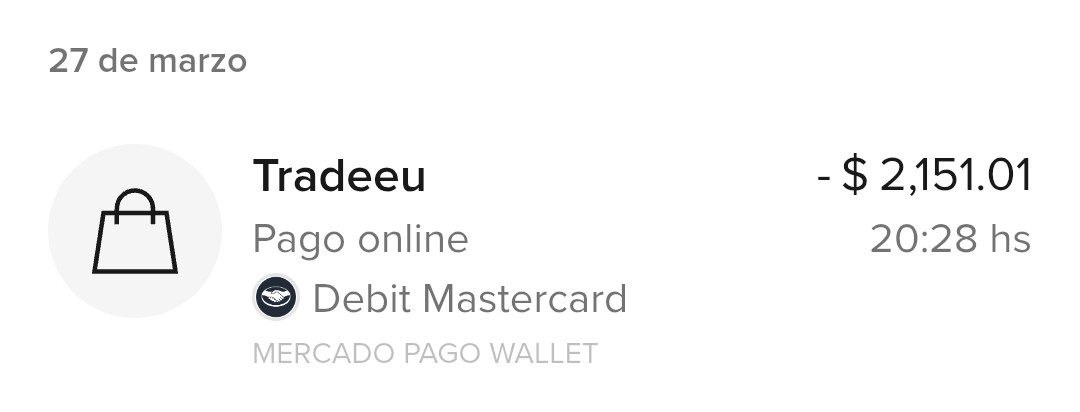

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods has not been detailed in accessible materials. However, withdrawal processing times have been identified as a concern by users who have experienced delays in accessing their funds.

Minimum Deposit Requirements: The minimum deposit amount required to open a trading account with TradeEU is not specified in available information sources. This information would be helpful for potential clients planning their initial investment with the broker.

Bonuses and Promotions: Current promotional offers, welcome bonuses, or ongoing incentive programs are not detailed in the available broker information. Many traders look for such offers when selecting a new broker for their trading activities.

Tradeable Assets: TradeEU offers CFD trading across four main categories for client diversification. These categories include foreign exchange currency pairs, commodities including precious metals and energy products, major global stock indices, and individual stock CFDs from various international markets that provide comprehensive trading opportunities.

Cost Structure: The broker implements a pricing model with spreads starting from 0.7 pips for major currency pairs. Commission charges apply with a minimum fee of €50, though the specific calculation method and applicable trading volumes for this commission structure require clarification from the broker.

Leverage Ratios: Maximum leverage ratios available to traders are not specified in the available documentation. This represents important information for risk management planning that traders need to make informed decisions about their trading strategies.

Platform Options: TradeEU provides the MetaTrader 5 trading platform with compatibility across multiple devices. These devices include mobile applications, desktop software, and web-based access for enhanced trading flexibility that accommodates different user preferences and trading styles.

Geographic Restrictions: Specific countries or regions where TradeEU services may be restricted are not detailed in available information. This information would be valuable for international traders considering the broker's services.

Customer Service Languages: The range of languages supported by TradeEU's customer service team is not specified in accessible materials. However, this tradeeu review notes positive feedback regarding support responsiveness from users who have interacted with the support team.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 6/10)

TradeEU's account conditions present a mixed picture for potential traders who are evaluating their options. The available information reveals spreads starting from 0.7 pips, which positions the broker in the middle range of industry standards for retail trading services. While this spread level is competitive for retail traders, it may not satisfy those seeking ultra-tight spreads offered by some premium brokers in the market. The commission structure includes a minimum fee of €50. However, the specific circumstances triggering this commission and the calculation methodology remain unclear to potential clients.

The absence of detailed information regarding account types represents a significant limitation in evaluating TradeEU's offerings. Most established brokers provide multiple account tiers with varying features, minimum deposits, and trading conditions to accommodate different trader profiles and experience levels. Without clear account categorization, potential clients cannot properly assess which option best suits their trading capital and experience level. This lack of transparency makes it difficult for traders to make informed decisions about their account selection.

Account opening procedures and requirements are not detailed in available materials. This makes it difficult to assess the efficiency and user-friendliness of the onboarding process that new clients will experience. Additionally, special account features such as Islamic accounts for Muslim traders, professional account classifications, or VIP services for high-volume traders are not mentioned in the available documentation. The lack of transparency regarding minimum deposit requirements further complicates the evaluation. This information is crucial for traders planning their initial investment with the broker. This tradeeu review finds that while basic trading conditions appear reasonable, the limited transparency regarding account structures and requirements impacts the overall assessment of this crucial aspect of the broker's services.

TradeEU demonstrates strong performance in the tools and resources category. This strength primarily comes through its provision of the MetaTrader 5 platform for client trading activities. MT5 is widely regarded as one of the industry's leading trading platforms. The platform offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors that can enhance trading efficiency. The platform's multi-device compatibility ensures traders can access their accounts and execute trades seamlessly across mobile, desktop, and web environments.

The availability of free demo accounts represents a valuable resource for traders. This feature is particularly beneficial for the broker's target demographic of beginner and intermediate traders who need practice opportunities. Demo accounts allow new traders to familiarize themselves with the platform functionality, test trading strategies, and gain experience without risking real capital in the markets. This educational approach demonstrates TradeEU's commitment to supporting trader development and responsible trading practices.

However, specific information regarding additional research and analysis resources is not detailed in available materials. Many brokers enhance their platform offerings with market analysis, economic calendars, trading signals, and educational content that can help traders make better decisions. The absence of detailed information about such supplementary resources limits the ability to fully assess TradeEU's comprehensive support for trader decision-making processes. Similarly, while MT5 supports automated trading through Expert Advisors, specific information about TradeEU's policies regarding algorithmic trading, strategy hosting, or VPS services is not available to potential clients.

Despite these information gaps, the combination of a robust trading platform and demo account availability provides a solid foundation. This foundation serves traders seeking reliable tools and learning opportunities to develop their trading skills and strategies.

Customer Service and Support Analysis (Score: 7/10)

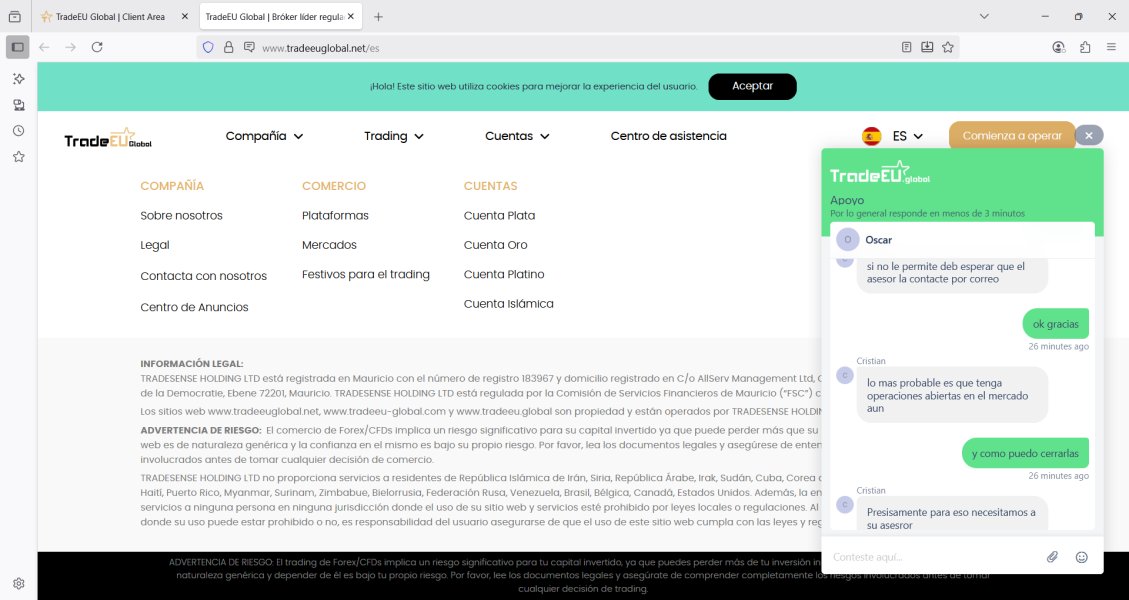

Customer service emerges as one of TradeEU's stronger areas based on available user feedback from the trading community. Multiple sources indicate that users appreciate the responsiveness and effectiveness of the broker's customer support team in addressing their concerns. Traders report that support representatives are quick to respond to inquiries and demonstrate competence in addressing various issues and questions that arise during the trading process. This level of responsiveness is particularly important for active traders who need quick resolution to trading-related issues.

The positive customer service experience appears to extend beyond mere response times. The quality of assistance provided also receives favorable feedback from users who have interacted with the support team. Users indicate that support staff are knowledgeable about the platform and can effectively guide traders through technical issues or account-related concerns that may arise. This level of service quality is particularly important for beginner and intermediate traders who may require more frequent assistance as they develop their trading skills and familiarity with the platform.

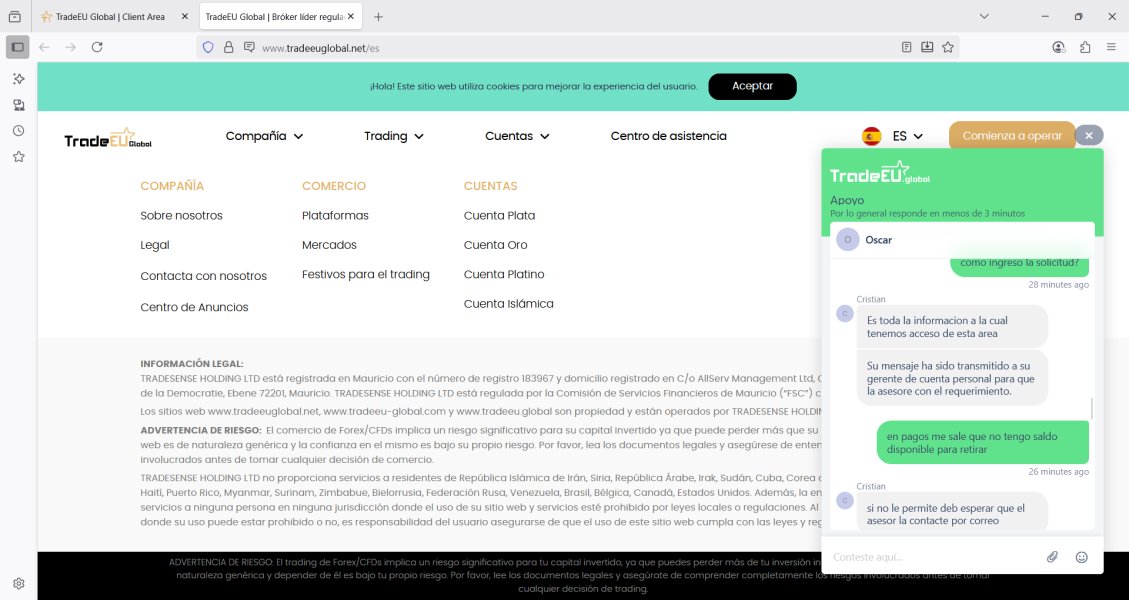

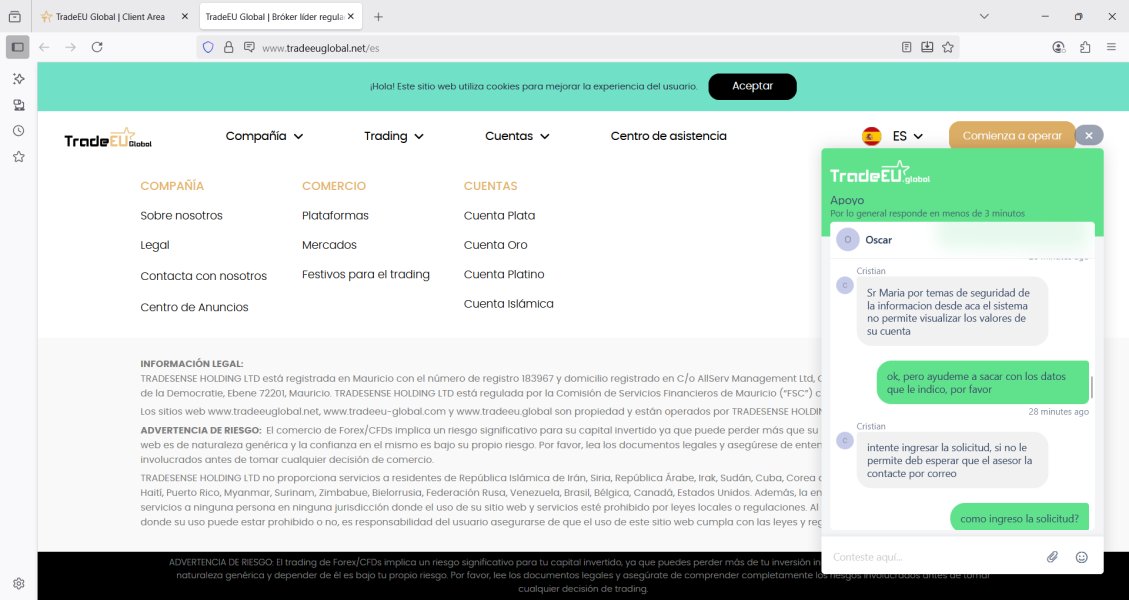

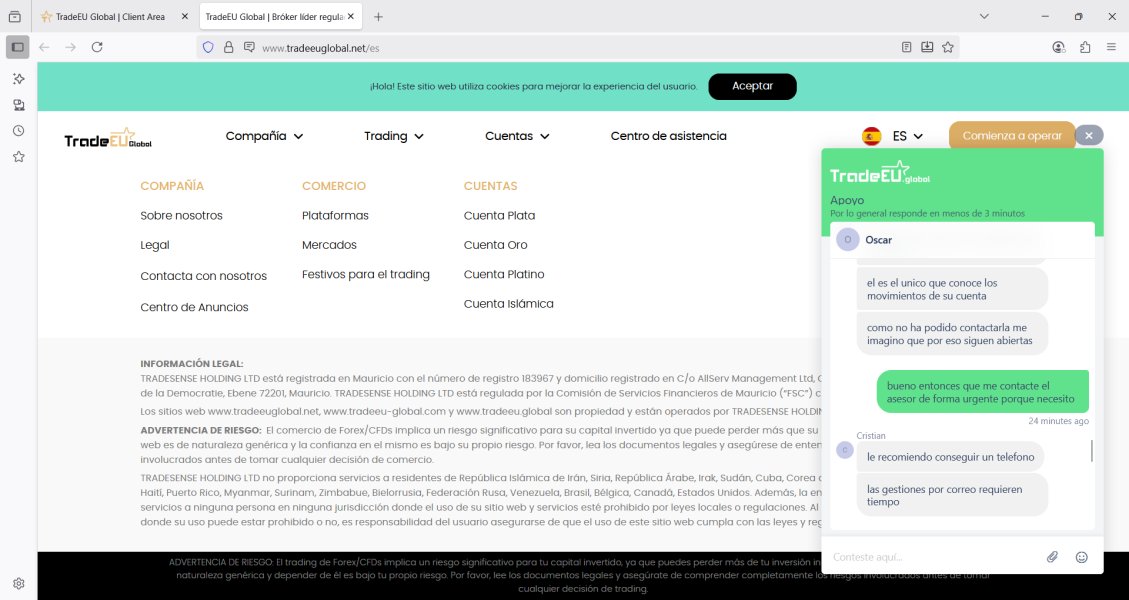

However, specific details regarding customer service channels, availability hours, and multilingual support are not clearly outlined in available information. Most professional brokers offer multiple contact methods including live chat, email, and telephone support with extended or 24/7 availability to accommodate global trading hours and different time zones. The absence of detailed information about service channels and availability represents a limitation in fully assessing the accessibility and convenience of TradeEU's support services for international clients.

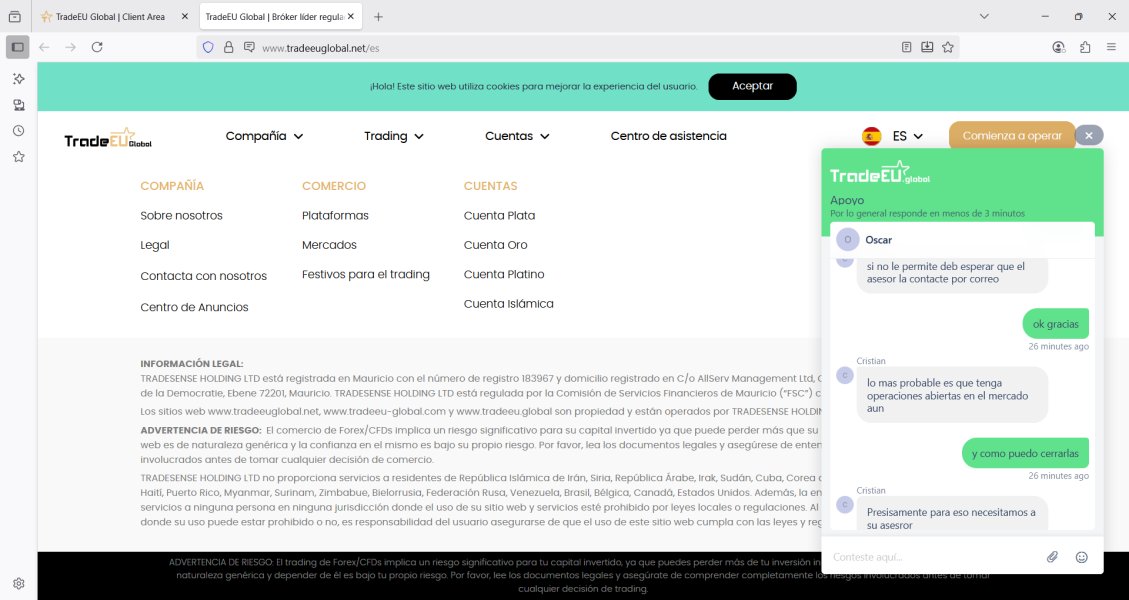

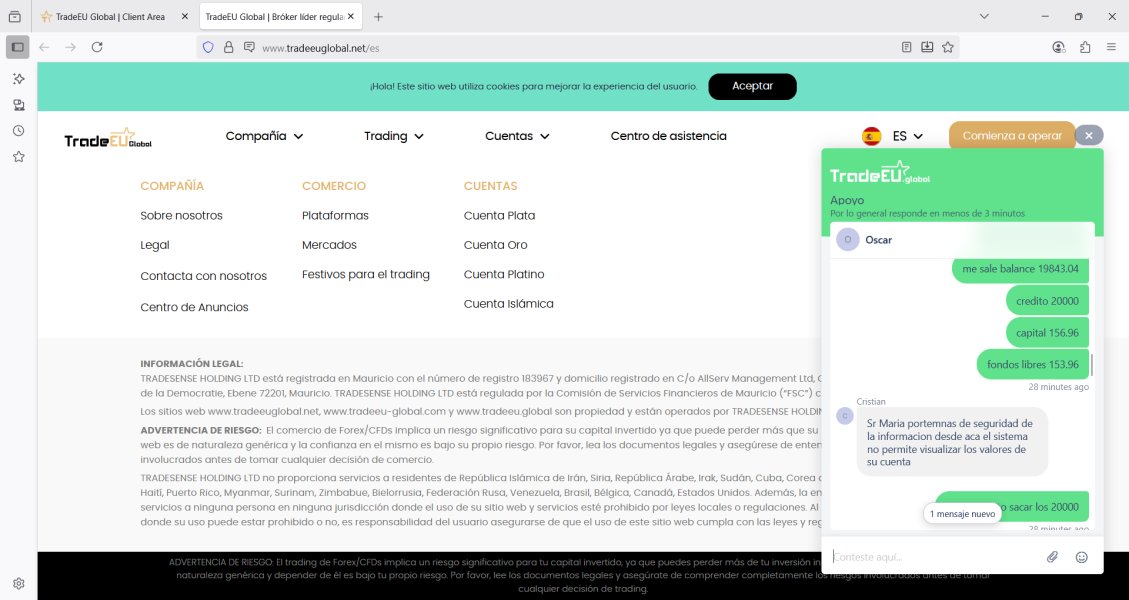

Additionally, while general customer service receives positive feedback, the slower withdrawal processing times suggest issues. Back-office operations may not maintain the same efficiency standards as front-line customer support, creating an inconsistency in the overall service experience that clients receive from the broker.

Trading Experience Analysis (Score: 7/10)

The trading experience with TradeEU receives generally positive feedback from users. Users particularly praise platform stability and overall functionality in their daily trading activities. Traders report satisfactory experiences with the MetaTrader 5 platform's performance. This indicates that the technical infrastructure supports reliable trading operations for clients across different market conditions. The platform's comprehensive feature set, including advanced charting tools, technical indicators, and order management capabilities, provides traders with the necessary tools for effective market analysis and trade execution.

User feedback suggests that order execution quality meets acceptable standards for most trading situations. However, specific information about execution speeds, slippage rates, or fill quality during volatile market conditions is not detailed in available materials that could provide more insight. The stability of the trading environment appears to support consistent access to markets. This consistency is crucial for traders who need to respond quickly to market movements or manage existing positions during active trading sessions.

The multi-asset trading environment covering forex, commodities, indices, and stock CFDs provides traders with diversification opportunities. All of these opportunities are available within a single platform, which simplifies account management and trading operations. This comprehensive asset coverage allows traders to capitalize on various market opportunities and implement diverse trading strategies without requiring multiple broker relationships. The convenience of having multiple asset classes in one place can enhance trading efficiency and portfolio management.

However, the absence of detailed information about trading conditions during news events limits the evaluation. Market spreads during volatile periods and specific execution policies are also not clearly outlined for potential clients. Additionally, mobile trading experience specifics are not detailed, though the availability of mobile platform access suggests basic functionality is supported for traders on the go. This tradeeu review finds that while the general trading experience appears satisfactory, more detailed performance metrics would strengthen the evaluation and provide better insight for potential clients.

Trust and Reliability Analysis (Score: 5/10)

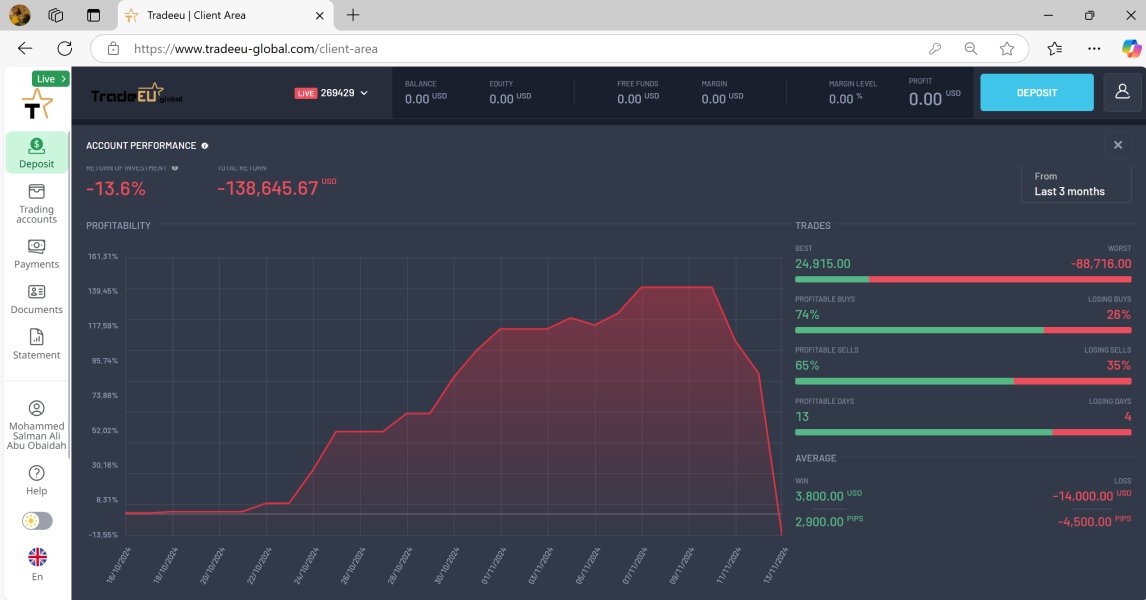

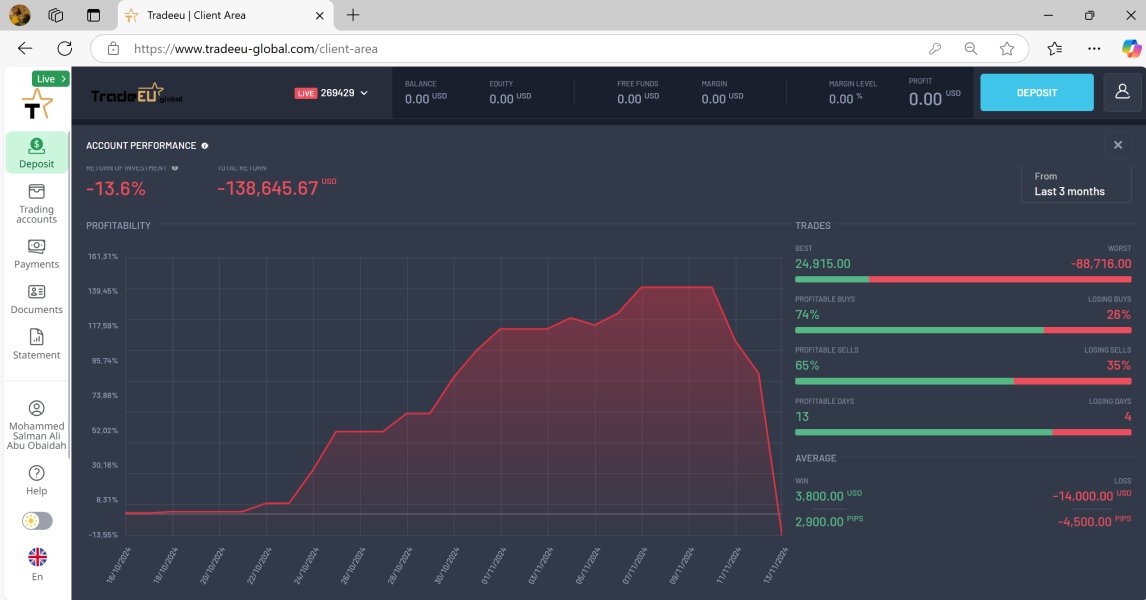

Trust and reliability represent significant concerns in this TradeEU evaluation. The lack of clear regulatory information creates substantial uncertainty about oversight and client protection measures that may be available. The absence of specific regulatory authority details and license numbers creates uncertainty about the level of oversight and client protection measures in place for traders. Regulatory compliance is a fundamental aspect of broker trustworthiness. It provides traders with legal recourse and ensures adherence to industry standards for client fund protection and business practices that safeguard investor interests.

The limited transparency regarding regulatory status may impact trader confidence significantly. This is particularly true for those prioritizing security and regulatory protection in their broker selection process and due diligence procedures. Without clear regulatory information, potential clients cannot verify the broker's compliance with specific jurisdictional requirements or assess the level of investor protection available to them. This uncertainty can be a major deterrent for risk-conscious traders who prioritize regulatory oversight and consumer protection.

User feedback regarding trust appears mixed among the trading community. Some traders express concerns about the platform's reliability and transparency in its operations and business practices. While customer service receives positive feedback, trust extends beyond support quality to encompass regulatory compliance, fund security measures, and overall business transparency. The lack of detailed information about client fund segregation, insurance coverage, or regulatory reporting further complicates the trust assessment for potential clients. These factors are crucial for traders who want assurance that their funds are protected and properly managed.

Company transparency regarding business operations, financial reporting, and regulatory compliance is not clearly demonstrated in available materials. Established brokers typically provide comprehensive information about their regulatory status, company ownership, and operational procedures to build client confidence and demonstrate their legitimacy. The information gaps in these areas contribute to the lower trust rating. They suggest that potential clients should exercise additional caution and conduct thorough due diligence before committing funds to this broker.

User Experience Analysis (Score: 6/10)

User experience with TradeEU presents a mixed picture with both positive aspects and notable concerns. Feedback regarding the platform interface and general usability appears favorable among users who have tested the system. This suggests that the MetaTrader 5 implementation provides an intuitive and functional trading environment for most users. Users seem to navigate the platform effectively. This indicates that the interface design and feature organization support efficient trading operations for both beginners and experienced traders.

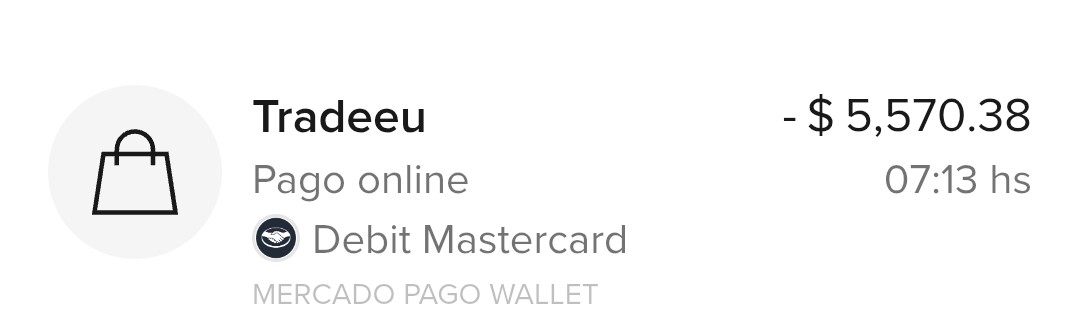

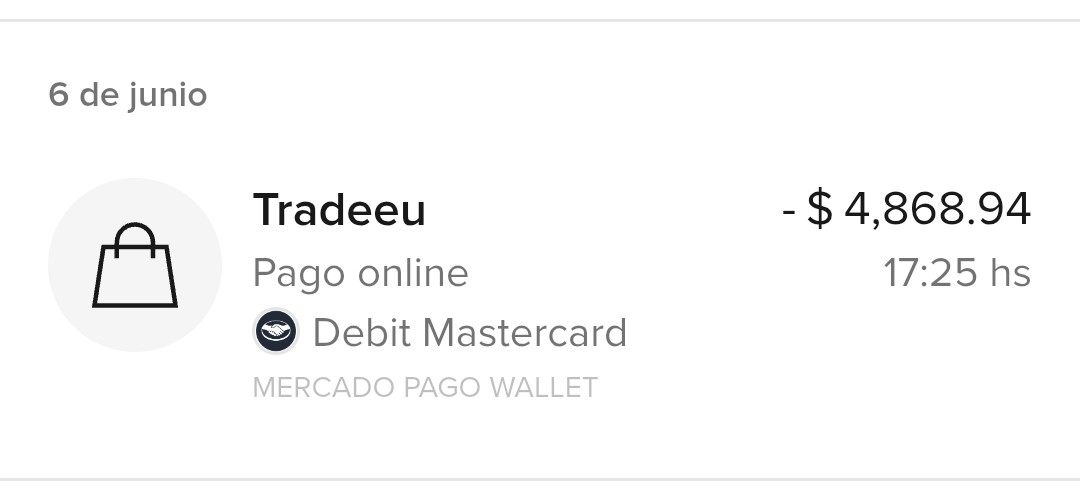

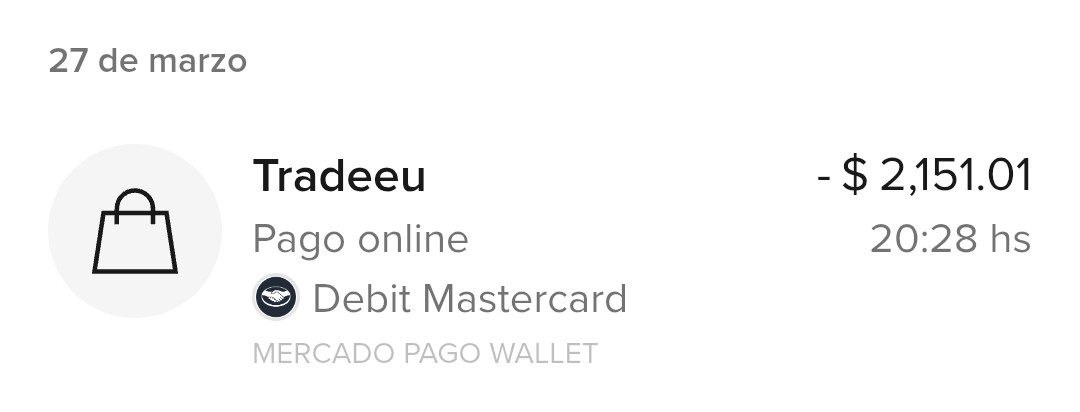

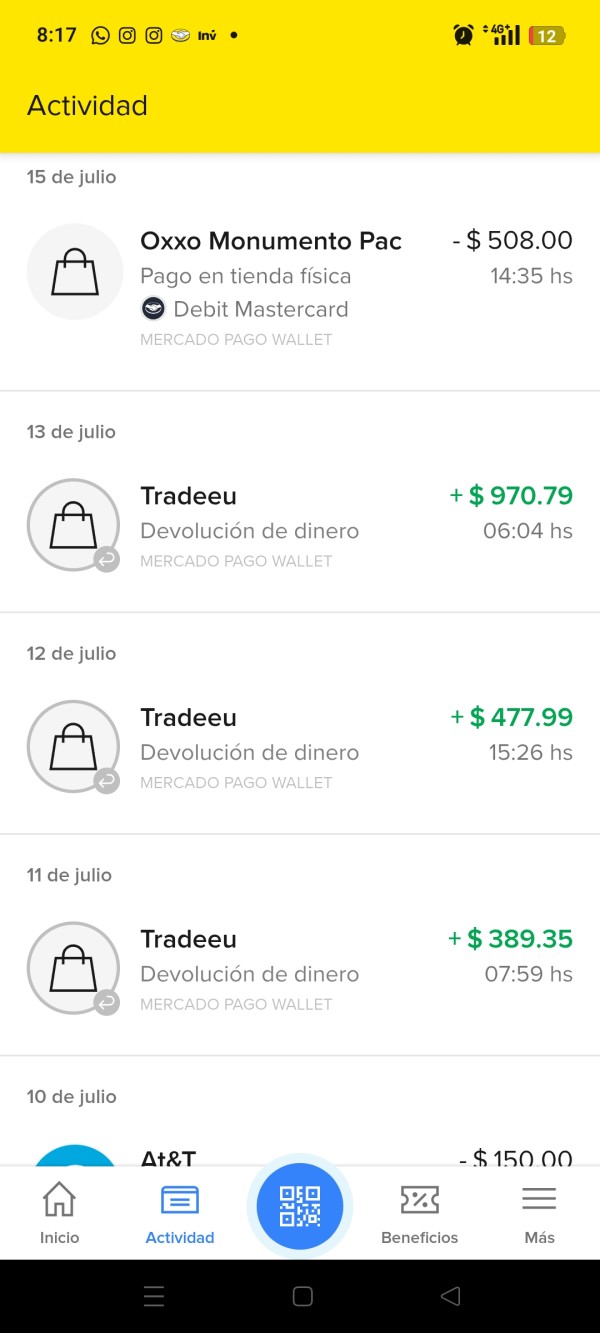

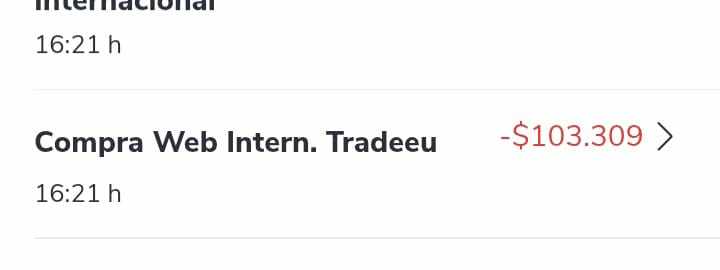

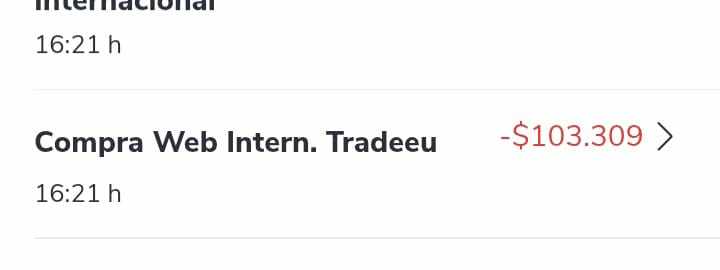

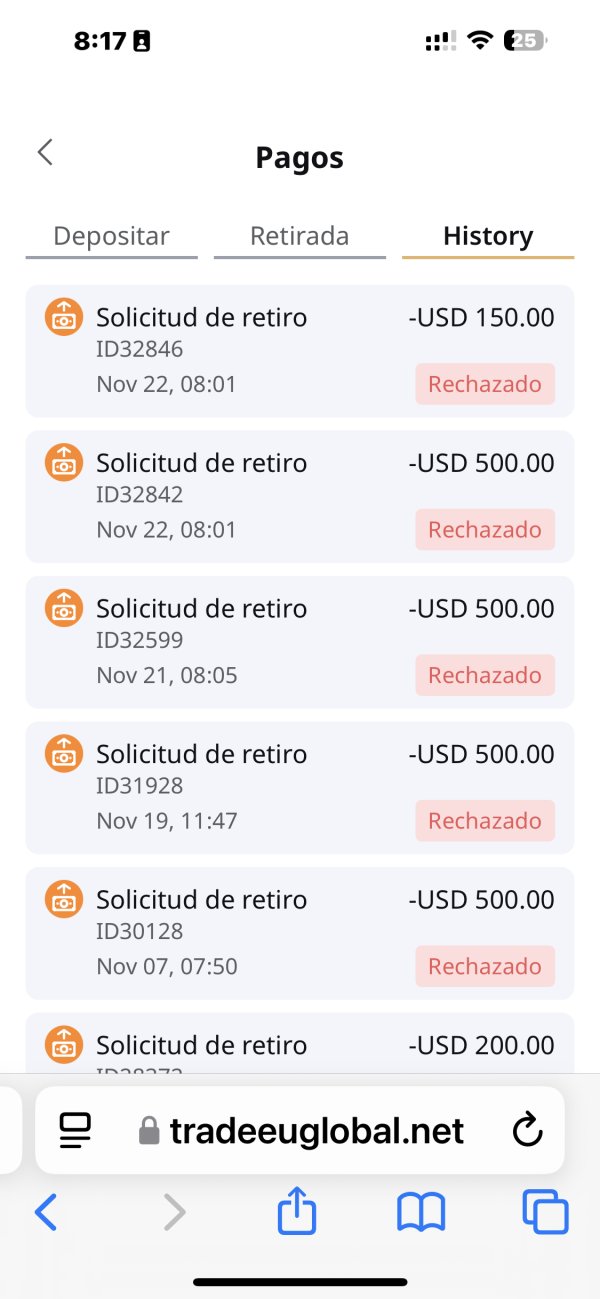

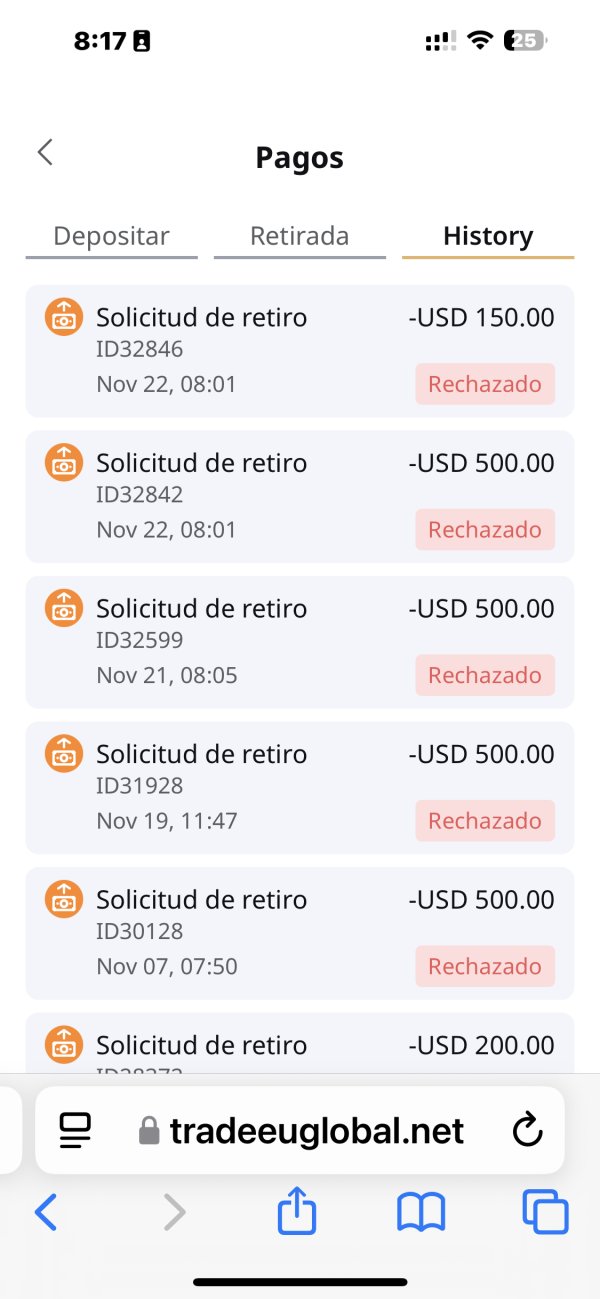

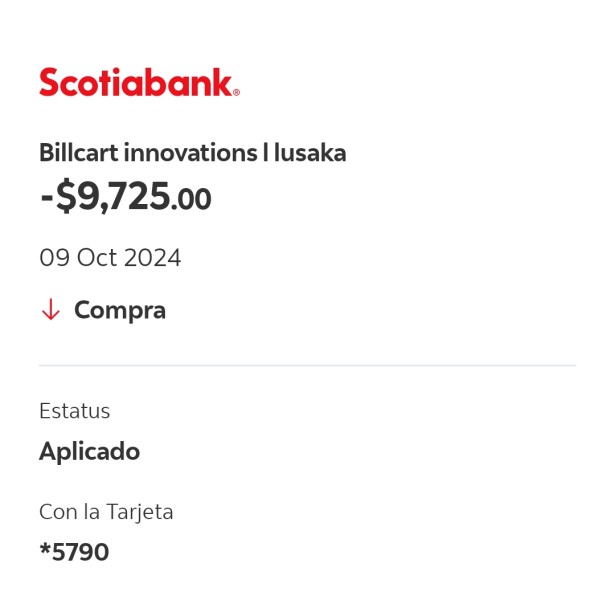

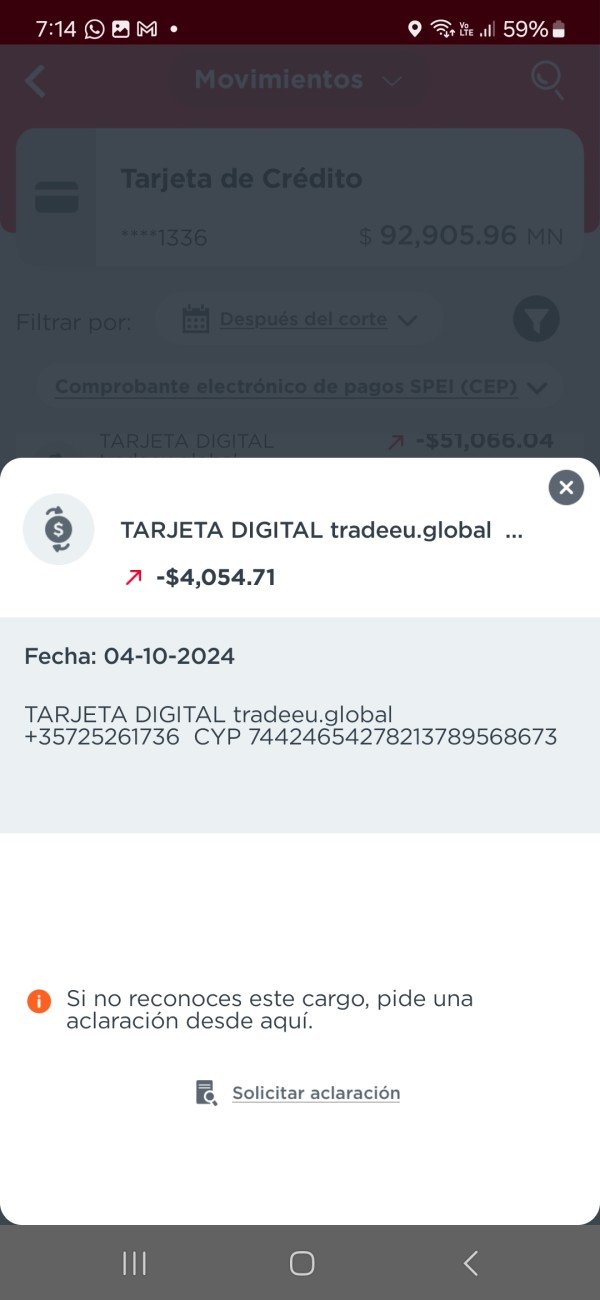

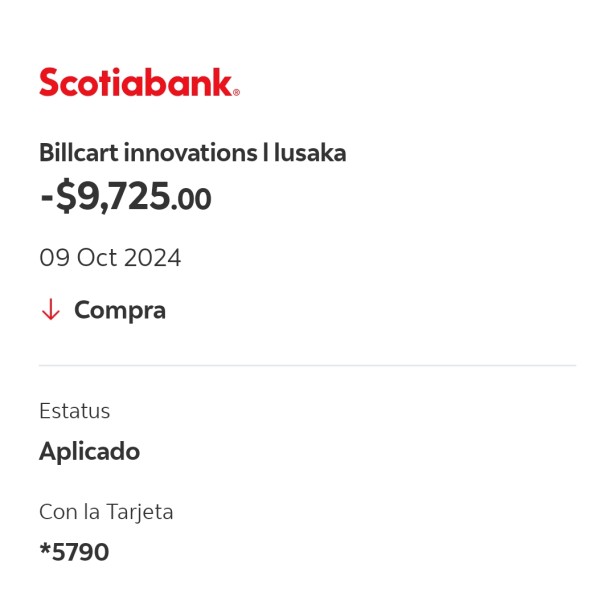

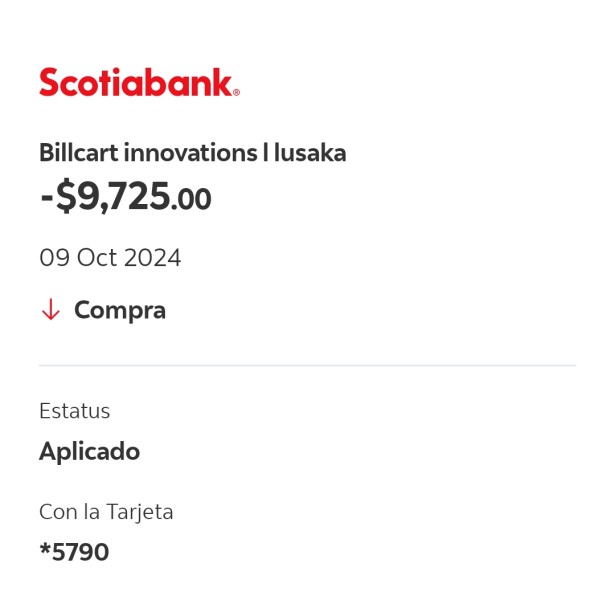

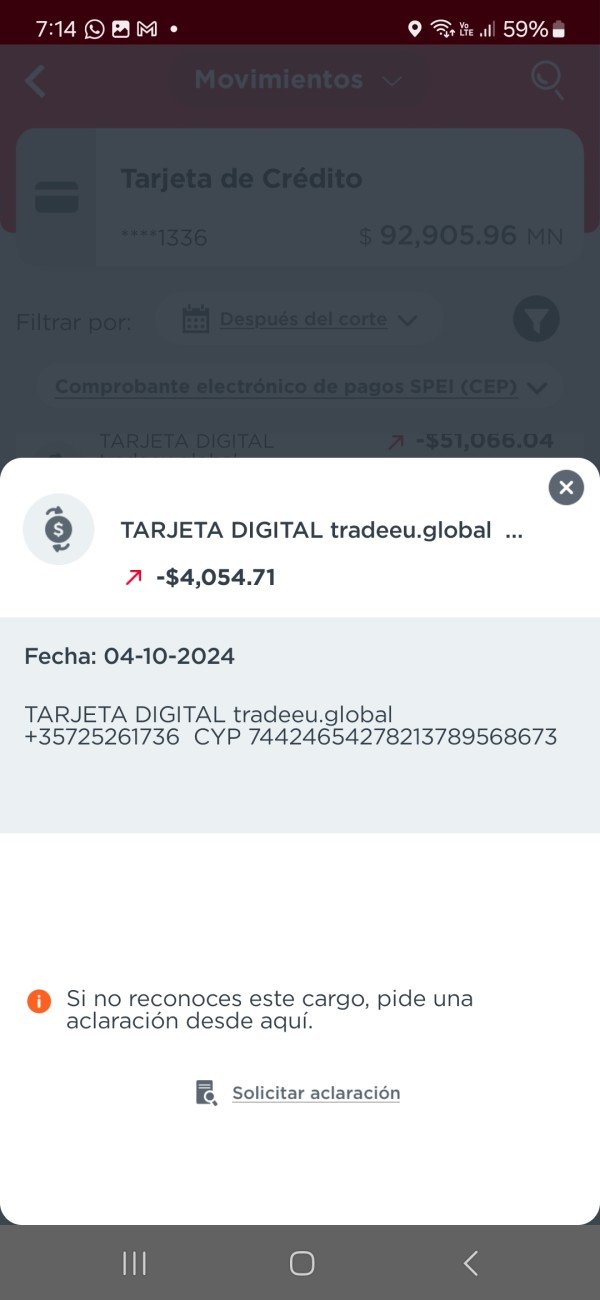

However, withdrawal processing speed emerges as a significant user experience concern. This issue impacts overall satisfaction levels among clients who have attempted to withdraw funds from their accounts. Extended withdrawal times can create frustration and inconvenience for traders. This is particularly problematic for those who require quick access to their funds for personal or business reasons that cannot wait for extended processing periods. This operational inefficiency contrasts with the positive customer service feedback. It suggests inconsistency in different aspects of the user experience that clients receive from the broker.

The availability of demo accounts enhances the user experience for new traders significantly. It provides a risk-free environment where they can learn and practice their trading skills without financial pressure. This feature demonstrates consideration for user development and helps reduce the learning curve associated with starting CFD trading for the first time. The multi-device platform access also contributes positively to user convenience and flexibility. This allows traders to manage their accounts and execute trades from various devices depending on their location and preferences.

Registration and account verification process details are not specified in available materials. This makes it difficult to assess the onboarding experience efficiency that new clients will encounter when opening accounts. Similarly, specific information about user interface customization options, platform personalization features, or user preference settings is not detailed in the available documentation. The target demographic of beginner and intermediate traders suggests that TradeEU aims to provide an accessible experience. However, the withdrawal processing concerns may impact overall user satisfaction and retention rates among clients who prioritize quick access to their funds.

Conclusion

This tradeeu review reveals a broker with distinct strengths and notable weaknesses. Potential clients should carefully consider these factors before making their decision to open an account with this broker. TradeEU demonstrates competency in customer support services. Users consistently praise the responsiveness and effectiveness of the support team in addressing their concerns and questions. The provision of MetaTrader 5 across multiple devices and the availability of demo accounts also represent positive aspects of the broker's service offering.

However, significant concerns exist regarding withdrawal processing times and the lack of regulatory transparency. The absence of clear regulatory information and extended withdrawal periods represent substantial drawbacks. These issues may impact trader confidence and operational efficiency for clients who prioritize quick fund access and regulatory oversight. These concerns are particularly important for traders prioritizing security and quick access to their funds for personal or business purposes.

TradeEU appears most suitable for beginner and intermediate traders who value responsive customer support. These traders should also be comfortable with the identified limitations regarding withdrawal times and regulatory transparency. The broker's focus on CFD trading across multiple asset classes provides opportunities for portfolio diversification. However, the regulatory uncertainty and operational inefficiencies in fund processing require careful consideration before account opening and initial deposit decisions.