Is TOPONE Markets safe?

Pros

Cons

Is Top1 Markets A Scam?

Introduction

Top1 Markets is a forex and CFD broker that has been operating since 2019, positioning itself as a platform for retail traders looking to engage in various financial instruments including forex, commodities, indices, and cryptocurrencies. As the forex market continues to grow, the number of brokers also increases, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective analysis of Top1 Markets, assessing its credibility and safety for potential investors. The evaluation is based on a comprehensive review of regulatory status, company background, trading conditions, customer security measures, user experiences, and overall risk factors.

Regulation and Legitimacy

Regulation is a critical aspect of any financial broker as it serves as a safeguard for traders' interests. Top1 Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). However, the credibility of these claims needs careful scrutiny.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001276870 | Australia | Verified |

| VFSC | 40436 | Vanuatu | Verified |

While ASIC is known for its stringent regulatory framework, the VFSC has been criticized for its lax oversight. The presence of a license from ASIC adds a level of credibility; however, the broker's operational history and any past compliance issues must also be evaluated. Reports indicate that Top1 Markets has faced scrutiny regarding its regulatory claims, suggesting that it may not operate under the same rigorous standards as other reputable brokers. Traders should be cautious and consider the implications of operating with a broker that has connections to less reputable regulatory environments.

Company Background Investigation

Top1 Markets is owned by Top One Group, which has its headquarters in the Cayman Islands. The company has been operational for a relatively short period, which raises questions about its stability and reliability. The ownership structure is somewhat opaque, and details regarding the management team are limited.

An effective management team with a strong background in finance and trading is crucial for a broker's success. However, Top1 Markets does not provide comprehensive information about its executives or their qualifications, which can be a red flag for potential investors. Transparency is vital in the financial industry, and a lack of information can lead to skepticism regarding the broker's intentions and operational integrity.

Trading Conditions Analysis

The trading conditions offered by Top1 Markets are an essential consideration for traders. The broker provides a variety of trading instruments and claims to have competitive spreads and low fees. However, it is crucial to dissect these claims and compare them with industry standards.

| Fee Type | Top1 Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.6 pips | 0.1 – 0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | -3.48% to -4.02% | Varies |

The spreads offered by Top1 Markets are relatively high compared to industry averages, which may affect profitability for traders. Additionally, the absence of a clear commission structure raises concerns, as hidden fees can often emerge in other forms. A thorough understanding of the fee structure is essential for traders to avoid unexpected costs.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker. Top1 Markets claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. Segregation of funds is a critical practice that ensures clients' money is kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency.

However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory requirements. The nature of Top1 Markets' regulatory framework, particularly its ties to Vanuatu, raises questions about the robustness of its fund protection policies. Historical incidents involving withdrawal issues and customer complaints regarding fund access further exacerbate these concerns.

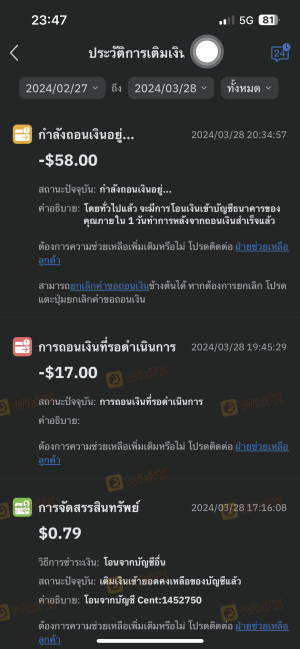

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Top1 Markets reveal a mixed bag of experiences, with numerous complaints regarding withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Account Blocking | High | Inconsistent |

| Poor Customer Support | Medium | Generally Negative |

Cases of users being unable to withdraw their funds after successful trading raise alarm bells about the broker's operational integrity. Furthermore, customer service experiences have been reported as lacking, with many users citing long wait times and unhelpful responses. These issues can significantly impact a trader's experience and trust in the broker.

Platform and Execution

The trading platform is a crucial component of the trading experience. Top1 Markets offers the widely used MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the performance of the platform in terms of execution quality and reliability is equally important.

Traders have reported mixed experiences with order execution, with some noting instances of slippage and order rejections. Such occurrences can lead to frustration and potential financial losses, particularly in a fast-moving market. The absence of any concrete evidence of platform manipulation is a positive sign, but traders should remain vigilant and monitor their execution quality closely.

Risk Assessment

Engaging with Top1 Markets carries inherent risks that potential investors should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Potential lack of oversight due to offshore operations. |

| Withdrawal Risk | High | Reports of withdrawal issues could indicate operational problems. |

| Customer Service Risk | Medium | Negative feedback on support can affect trading experience. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts when available, and consider diversifying their investments across multiple brokers. It is also advisable to start with smaller amounts to test the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while Top1 Markets presents itself as a regulated broker with a range of trading instruments, several red flags warrant caution. The combination of regulatory ambiguity, customer complaints regarding withdrawals, and a lack of transparency about company operations raises concerns about its overall credibility.

For traders considering Top1 Markets, it is crucial to weigh these risks against their trading goals and risk tolerance. If you are looking for a more reliable trading environment, consider exploring alternative brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Some recommended alternatives include well-established brokers such as eToro, IG, or OANDA, which have proven track records and robust regulatory frameworks. Always prioritize safety and due diligence when selecting a trading partner.

Is TOPONE Markets a scam, or is it legit?

The latest exposure and evaluation content of TOPONE Markets brokers.

TOPONE Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TOPONE Markets latest industry rating score is 2.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.