Is TELA safe?

Pros

Cons

Is TELA Safe or Scam?

Introduction

TELA is a forex broker that has emerged in the competitive landscape of online trading. Established in 2021 and registered in Hong Kong, TELA offers various trading services, including forex, commodities, and CFDs, primarily using the popular MetaTrader 4 platform. However, as the forex market continues to grow, so does the need for traders to exercise caution when selecting a broker. The potential for scams is prevalent, and it is crucial for traders to conduct thorough due diligence before committing their funds. This article investigates TELA's legitimacy, focusing on its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework for forex brokers is essential for ensuring that traders' funds are protected and that the broker operates transparently and ethically. In TELA's case, it is important to note that the broker currently lacks valid regulatory oversight. The absence of a license from recognized authorities raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that TELA is not subject to the stringent compliance requirements typically imposed by regulatory bodies. This absence of oversight can expose traders to higher risks, including the potential for fraud or mismanagement of funds. Historical data indicates that unregulated brokers often face issues related to transparency, fund security, and ethical trading practices. Therefore, the lack of regulation is a critical red flag for prospective clients.

Company Background Investigation

TELA Group Limited, the entity behind TELA, is relatively new to the forex industry, having been established in 2021. While it claims to operate from a registered address in Hong Kong, investigations have revealed inconsistencies regarding its physical presence. Reports indicate that the purported office location does not exist, which raises questions about the company's transparency and reliability.

The management team at TELA appears to lack extensive experience in the financial services sector, and there are no publicly available profiles that provide insight into their professional backgrounds. This lack of information can be concerning for potential clients, as a well-qualified management team is often indicative of a broker's reliability and operational integrity. Furthermore, the company's information disclosure practices are minimal, making it difficult for traders to assess the legitimacy of TELA.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is crucial. TELA offers various trading instruments and claims to provide competitive spreads and leverage options. However, without regulatory oversight, traders must be cautious about hidden fees or unfavorable trading conditions that might not be fully disclosed.

| Fee Type | TELA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

The absence of a clear commission structure and the potential for high overnight interest rates can significantly impact a trader's profitability. Moreover, TELA's variable spreads may widen during volatile market conditions, leading to unexpected trading costs. Therefore, traders should thoroughly review TELA's fee structure before making any commitments.

Client Funds Safety

The safety of client funds is a paramount concern when selecting a forex broker. TELA does not provide adequate information regarding its fund security measures. There is no indication of client fund segregation, which is a standard practice among reputable brokers to protect clients' deposits in case of insolvency. Additionally, TELA does not appear to offer any investor protection schemes or negative balance protection policies, further increasing the risk for traders.

Historically, unregulated brokers like TELA have faced allegations related to fund mismanagement and difficulties in processing withdrawals. These issues can leave clients vulnerable to significant financial losses. Therefore, potential clients should exercise extreme caution regarding TELA's fund security measures.

Customer Experience and Complaints

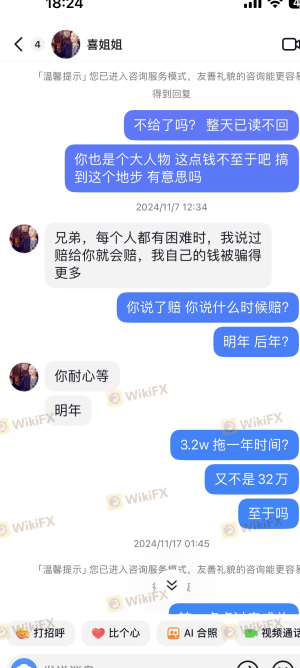

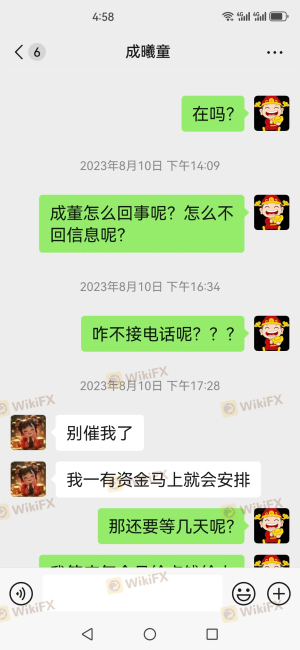

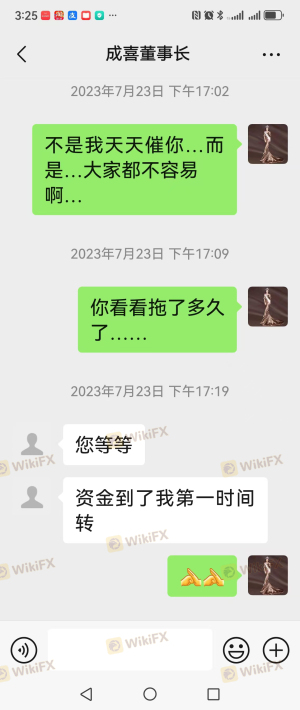

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews and testimonials from TELA's clients reveal a concerning trend of withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, with complaints about delayed or denied withdrawal requests being common.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Service Quality | Medium | Inconsistent Support |

Typical cases include clients who have invested significant sums but faced obstacles when attempting to withdraw their funds. One notable complaint involved a user who was unable to withdraw their investment, leading to frustration and claims of potential fraud. Such patterns of complaints are alarming and suggest that TELA may not prioritize customer satisfaction or fund security.

Platform and Trade Execution

The trading platform is a critical element of the trading experience. TELA utilizes the MetaTrader 4 platform, which is well-regarded for its user-friendly interface and robust functionality. However, user reviews indicate potential issues with platform stability and execution quality.

Traders have reported instances of slippage and rejected orders, which can severely impact trading outcomes. In volatile market conditions, these issues can be exacerbated, leading to significant losses for traders. While the MT4 platform itself is reliable, TELA's execution quality raises concerns about the broker's operational integrity.

Risk Assessment

Using TELA as a forex broker presents several risks that potential clients should carefully consider. The absence of regulation, coupled with numerous customer complaints, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Withdrawal Risk | High | Common complaints about withdrawal issues |

| Execution Risk | Medium | Reports of slippage and rejected orders |

To mitigate these risks, potential clients should consider starting with a minimal investment and closely monitor their trading experience. Additionally, seeking brokers with established regulatory oversight and positive customer feedback is advisable.

Conclusion and Recommendations

In conclusion, TELA raises significant concerns regarding its legitimacy and safety as a forex broker. The lack of regulatory oversight, coupled with numerous customer complaints about withdrawal issues and poor service, suggests that traders should approach TELA with caution. There are clear signs of potential fraud, and the risk of financial loss is substantial.

For traders seeking reliable forex brokers, it is recommended to consider well-regulated alternatives with a proven track record of customer satisfaction and fund security. Brokers regulated by top-tier authorities like the FCA, ASIC, or NFA offer a safer trading environment and better protection for client funds. Ultimately, thorough research and careful consideration are essential when choosing a forex broker, especially in the case of TELA.

Is TELA a scam, or is it legit?

The latest exposure and evaluation content of TELA brokers.

TELA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TELA latest industry rating score is 2.00, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.00 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.