TELA 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

TELA, an unregulated brokerage based in Hong Kong, presents traders with a complex mix of opportunities and pitfalls. Established in 2013, this broker primarily offers forex and Contracts for Difference (CFDs) with a focus on providing diverse trading instruments to its clientele. However, it operates in a highly concerning environment, marked by numerous complaints regarding difficulties in fund withdrawals and unresponsiveness from customer support. TELA's lack of regulatory oversight raises significant concerns about the safety of trader funds and the legitimacy of its operational practices.

While the potential for high returns may attract risk-taking traders, the trade-offs include profound risks associated with its unregulated status. Investors must weigh the allure of expansive trading options against the unsettling feedback from the trading community. This review aims to provide an insightful analysis of TELA's features, risks, and overall trustworthiness to help traders make informed decisions about engaging with this broker.

⚠️ Important Risk Advisory & Verification Steps

Be aware that trading with TELA entails significant risks. Consider the following:

- Lack of Regulation: TELA operates without oversight from recognized financial authorities, increasing risk during trading.

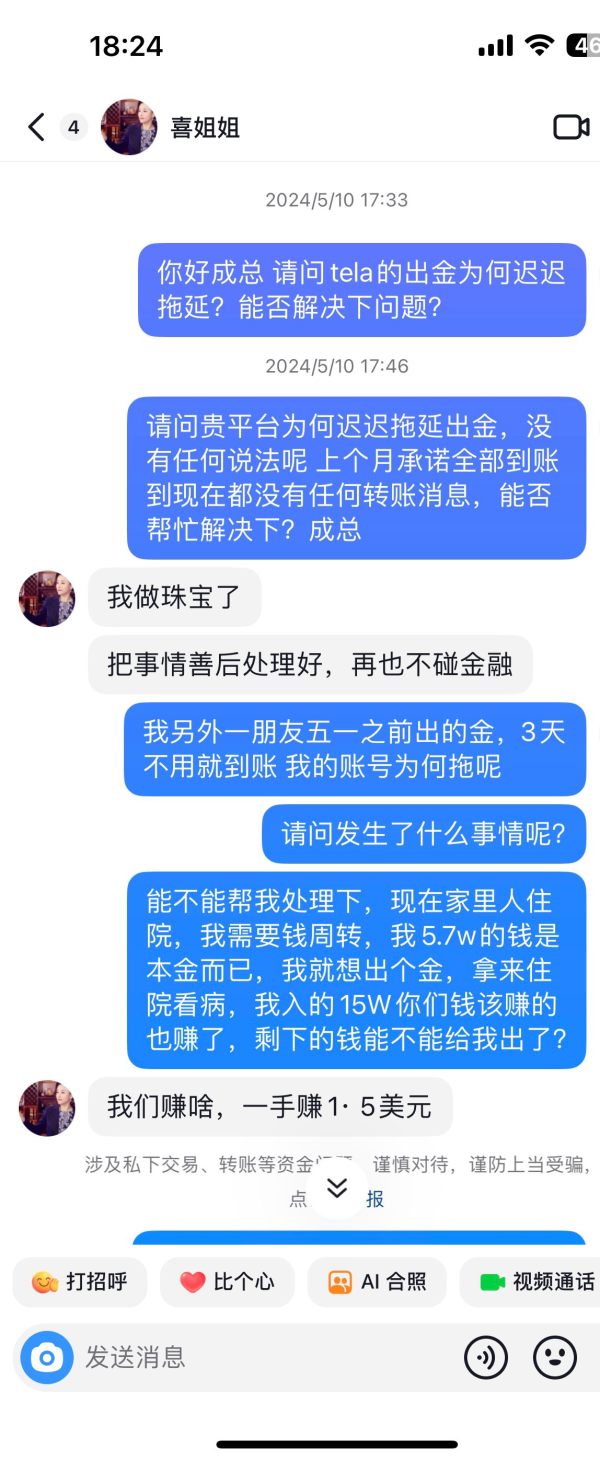

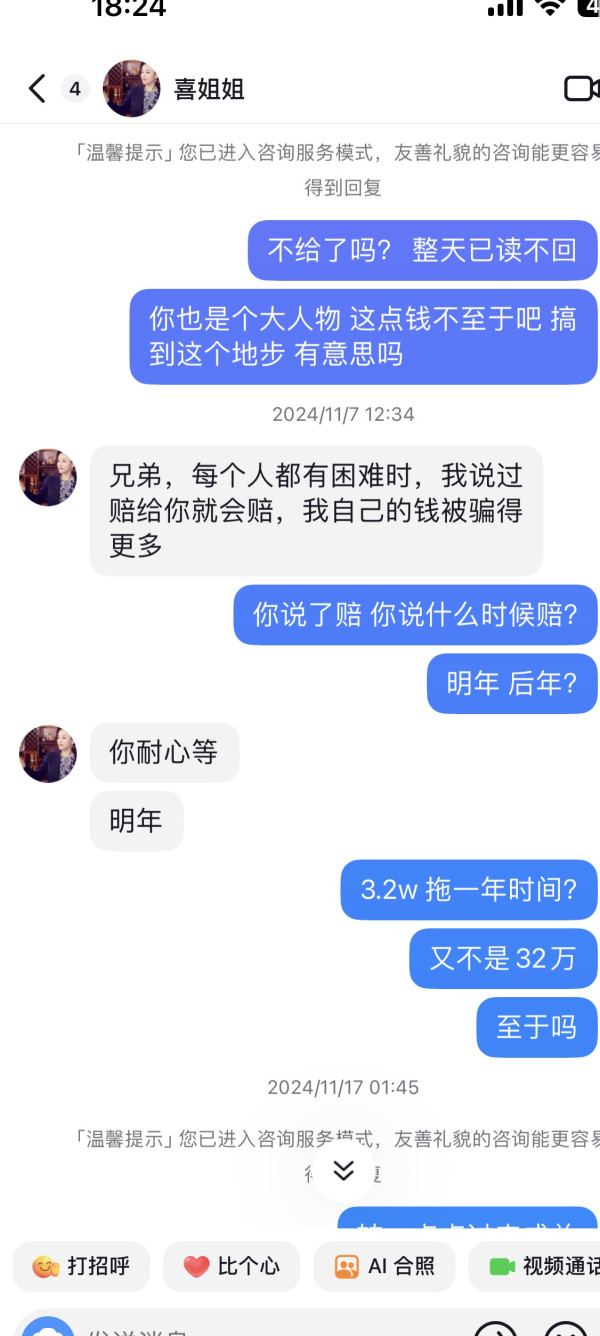

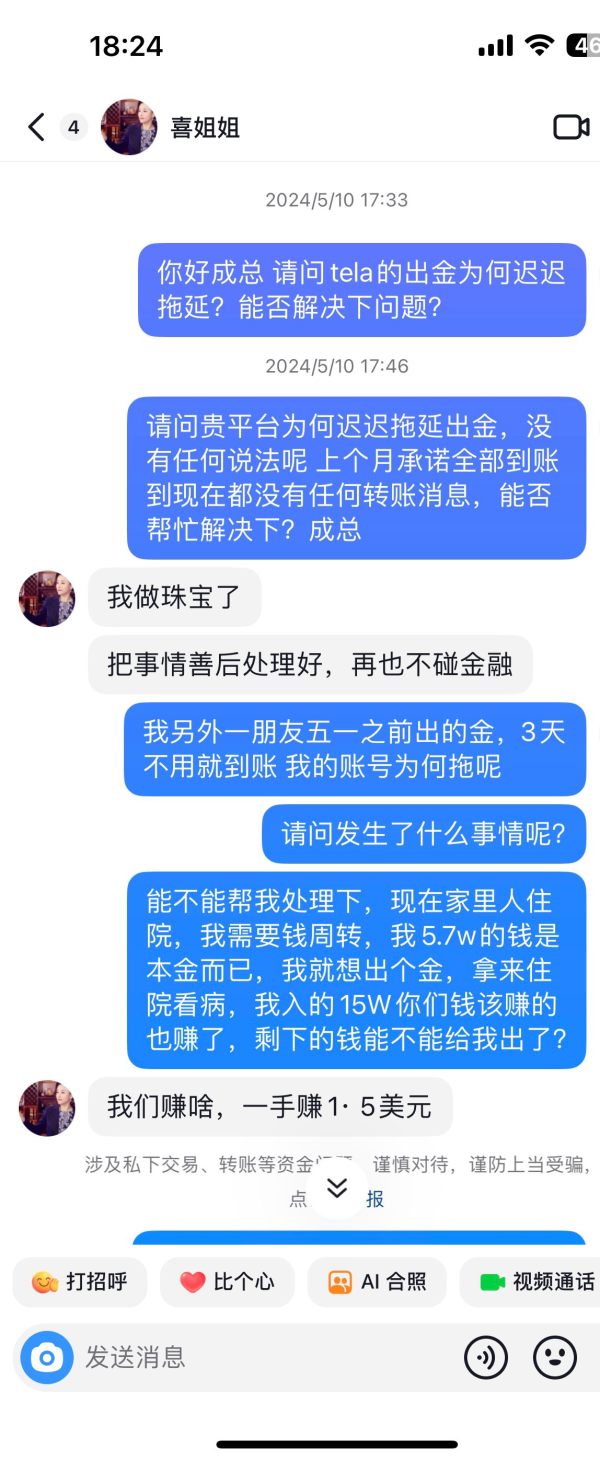

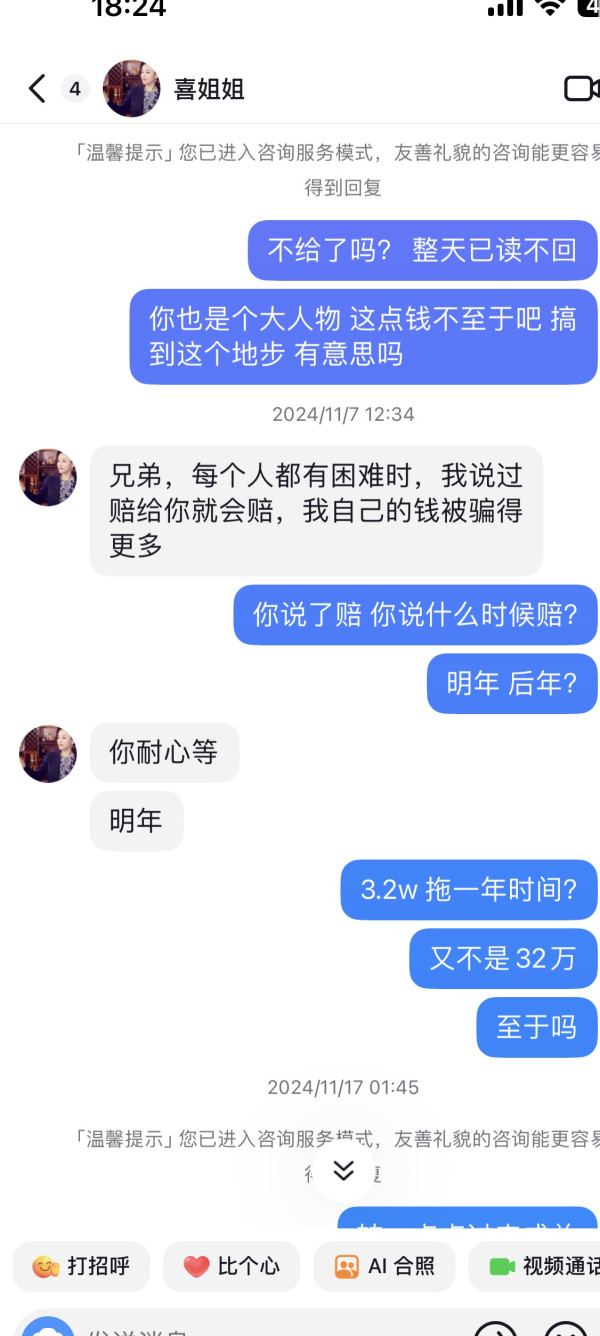

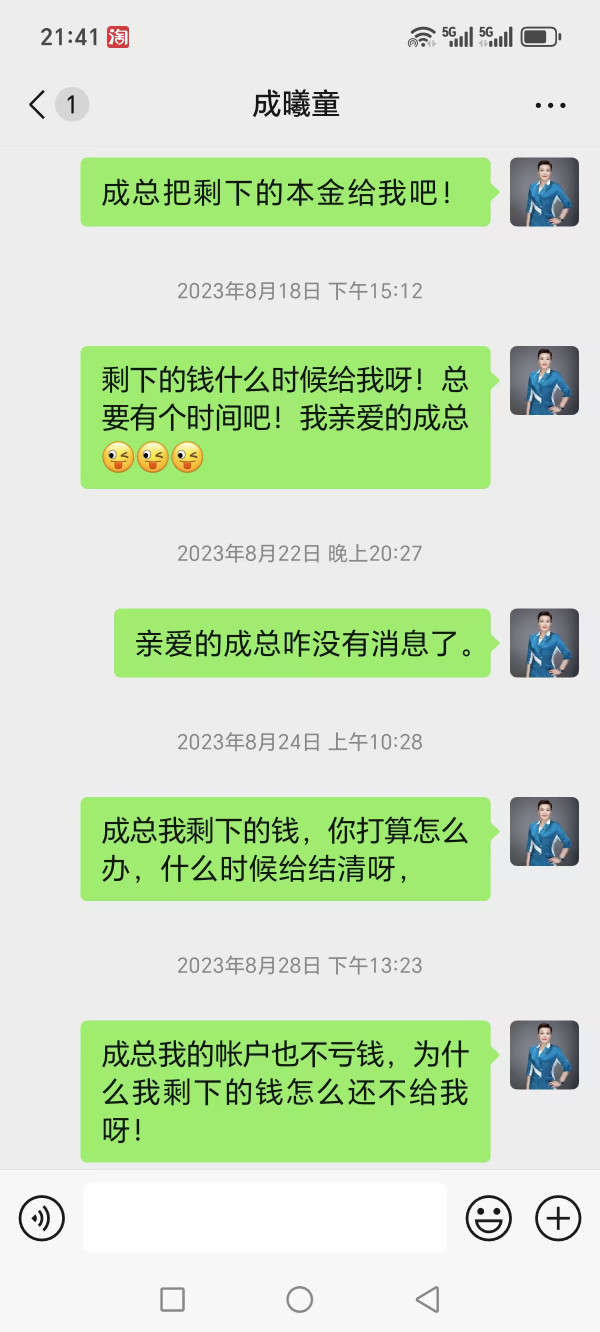

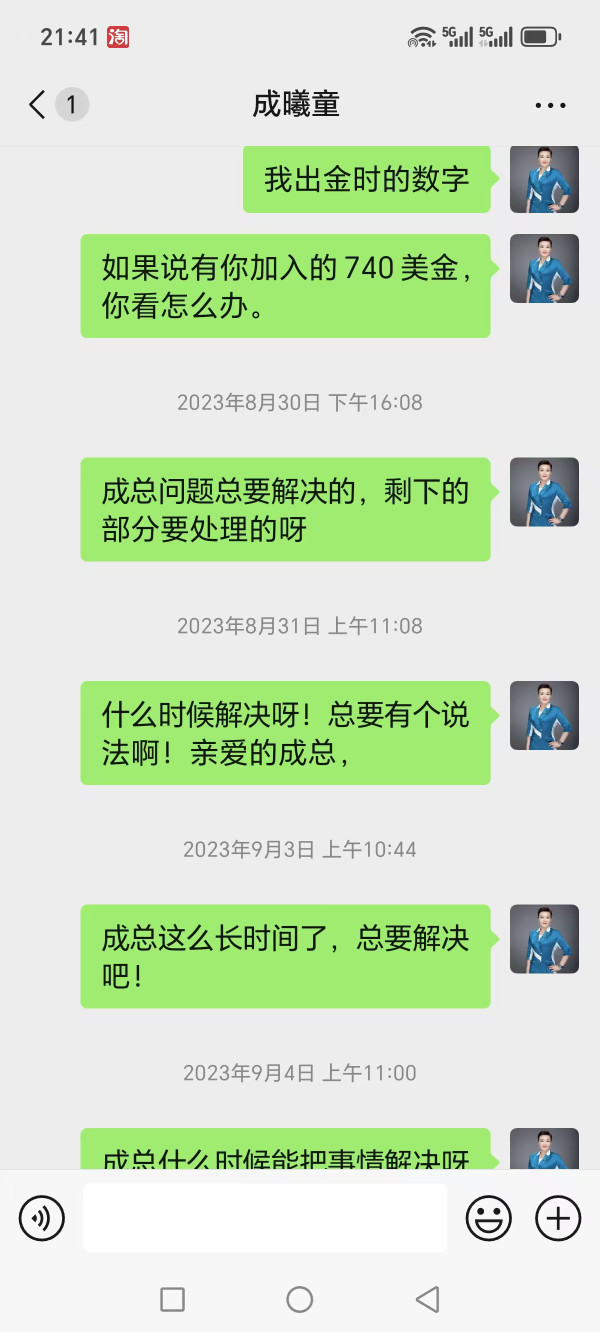

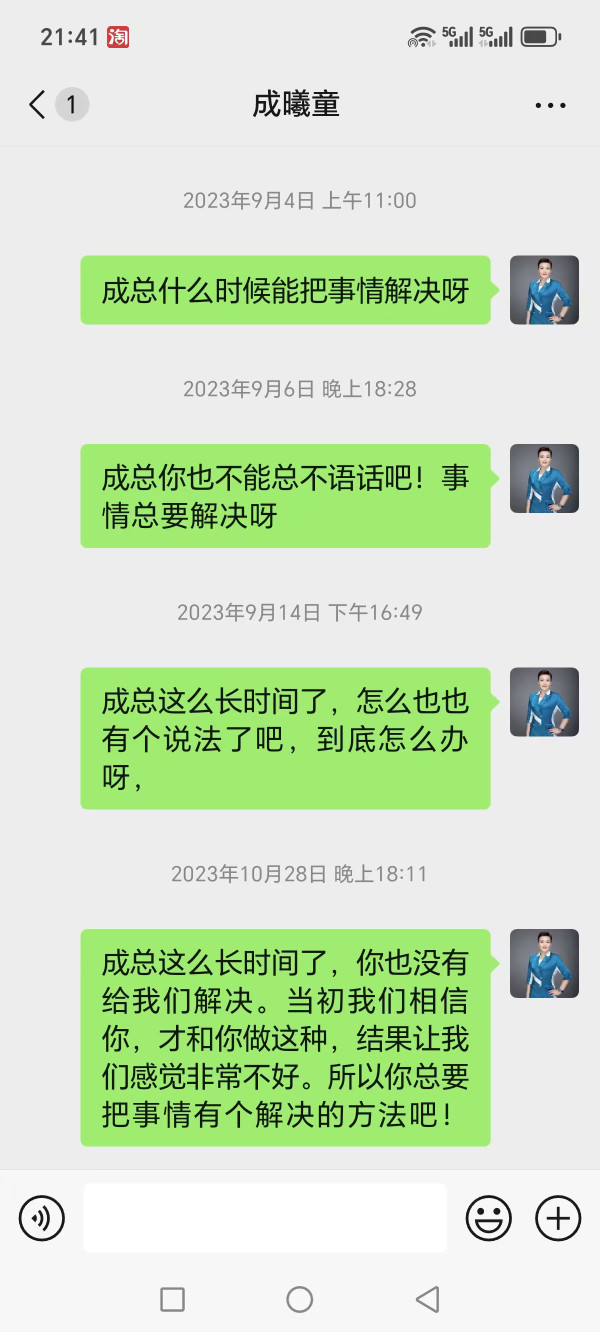

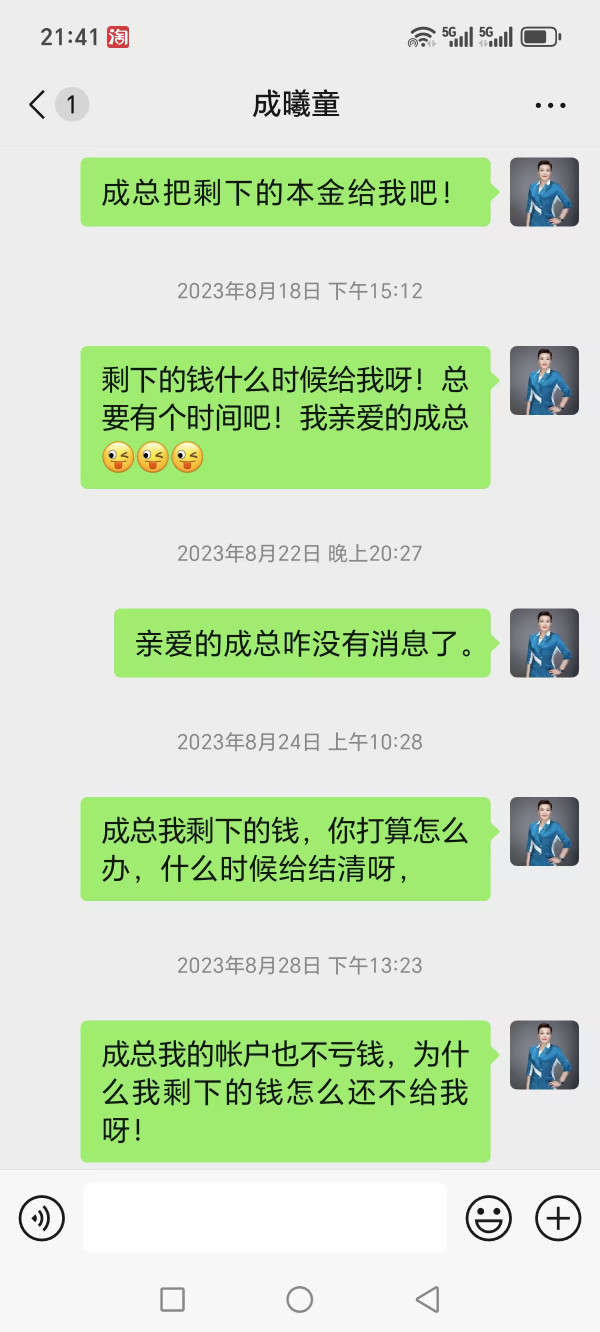

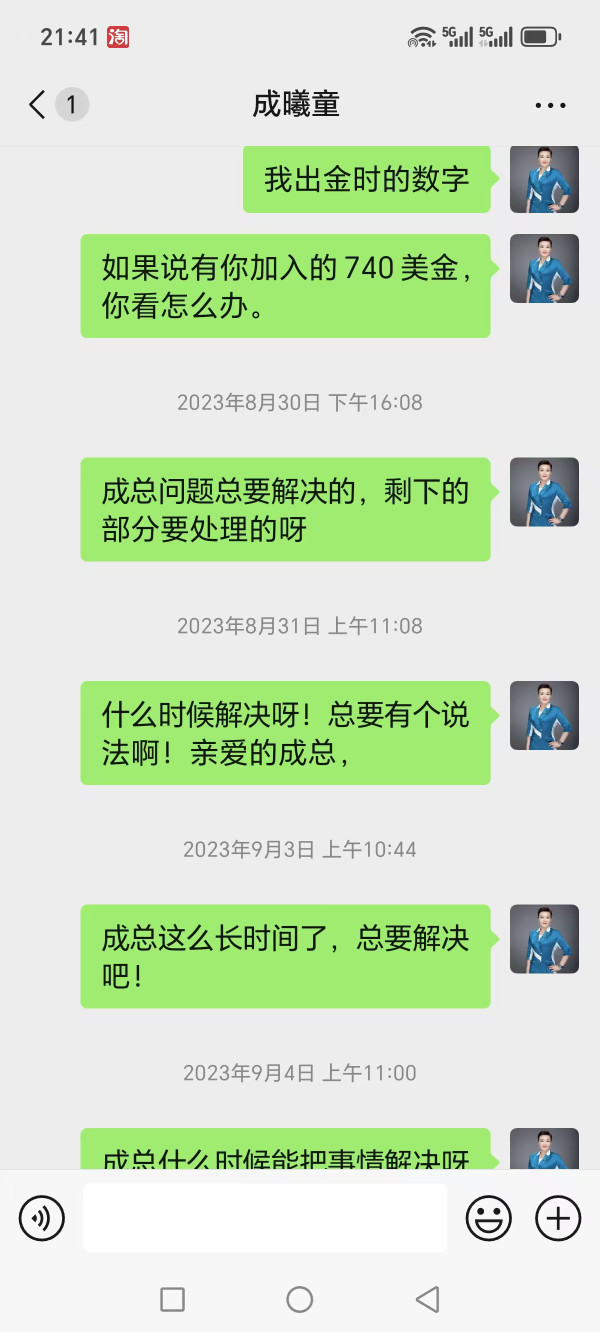

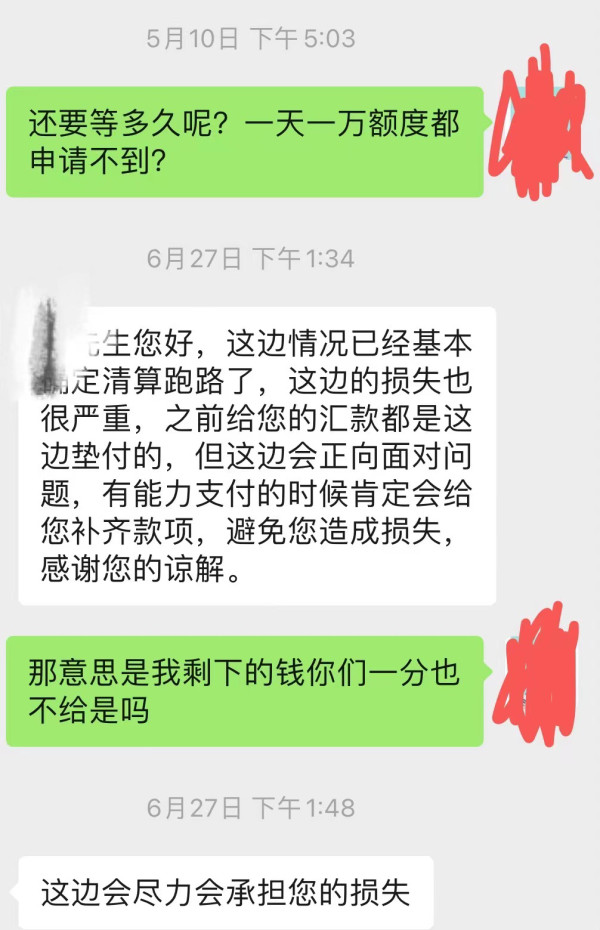

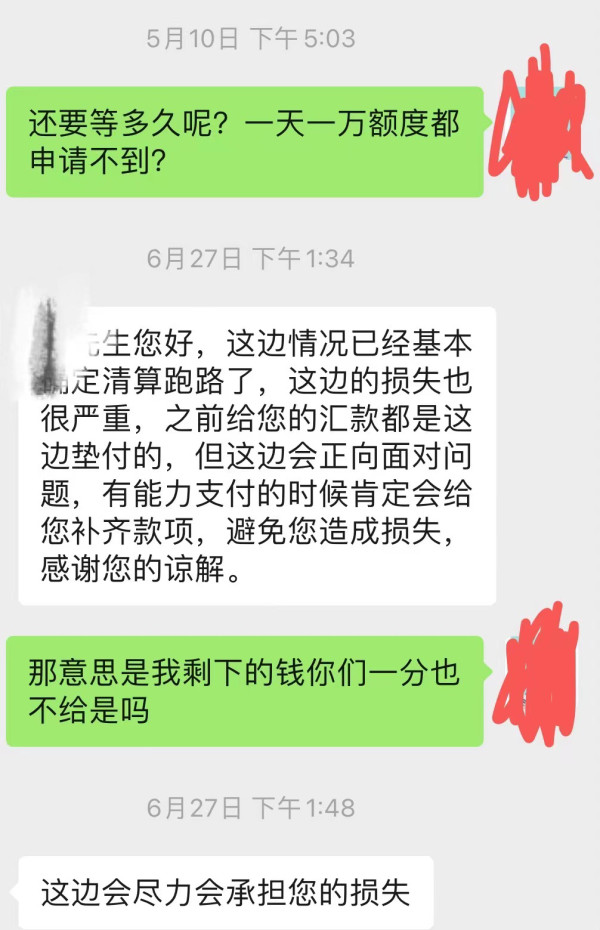

- Numerous Complaints: Many traders report severe difficulties in withdrawing funds. Be cautious and withdraw your investment promptly.

- Fund Safety Risks: Without regulatory protections, your funds could be at risk.

Verification Steps:

- Check for Regulatory Information: Always check the broker's regulatory status. Review their website and cross-verify with official financial authority sites.

- Read User Reviews: Go beyond the brokers own information; look for third-party reviews and feedback from actual users.

- Contact Support: Test customer service responsiveness before committing any investment.

Rating Framework

Broker Overview

Company Background and Positioning

TELA Group Limited, the entity behind TELA, was founded on May 9, 2013, and is based in Guangzhou, Guangdong, China. While it has managed to establish a presence in the global forex trading market, TELA bears the mark of being an unregulated broker, which significantly undermines its credibility. Its operational model emphasizes trading in various financial instruments, including forex, CFDs, commodities, and indices. However, the overarching theme from user feedback emphasizes the lack of trust and serious concerns regarding its operational legitimacy.

Core Business Overview

TELA focuses largely on retail forex trading and provides CFDs across multiple asset classes. It primarily operates through the MetaTrader 4 (MT4) platform, a popular choice among traders looking for intuitive design and extensive capabilities. Despite claims of offering a broad array of trading tools and resources, the absence of disclosed fees, account types, and transparent trading conditions contribute to a murky customer experience.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The absence of regulatory oversight is a critical aspect of TELA's operation. Without an authoritative financial body overseeing its practices, traders are exposed to significant risks, including potential fraud or mismanagement of funds. Many users have expressed concern over TELA's evasive stance regarding regulatory compliance, leading to widespread distrust.

To verify the legitimacy of TELA, individuals should follow these steps:

- Visit the official website to check for any disclosure of regulatory information.

- Cross-reference this information with national financial regulatory databases.

- Look for independent reviews and user feedback on third-party platforms.

Overall, the consensus among current and past users suggests a troubling reputation for TELA regarding fund withdrawals and customer service responsiveness.

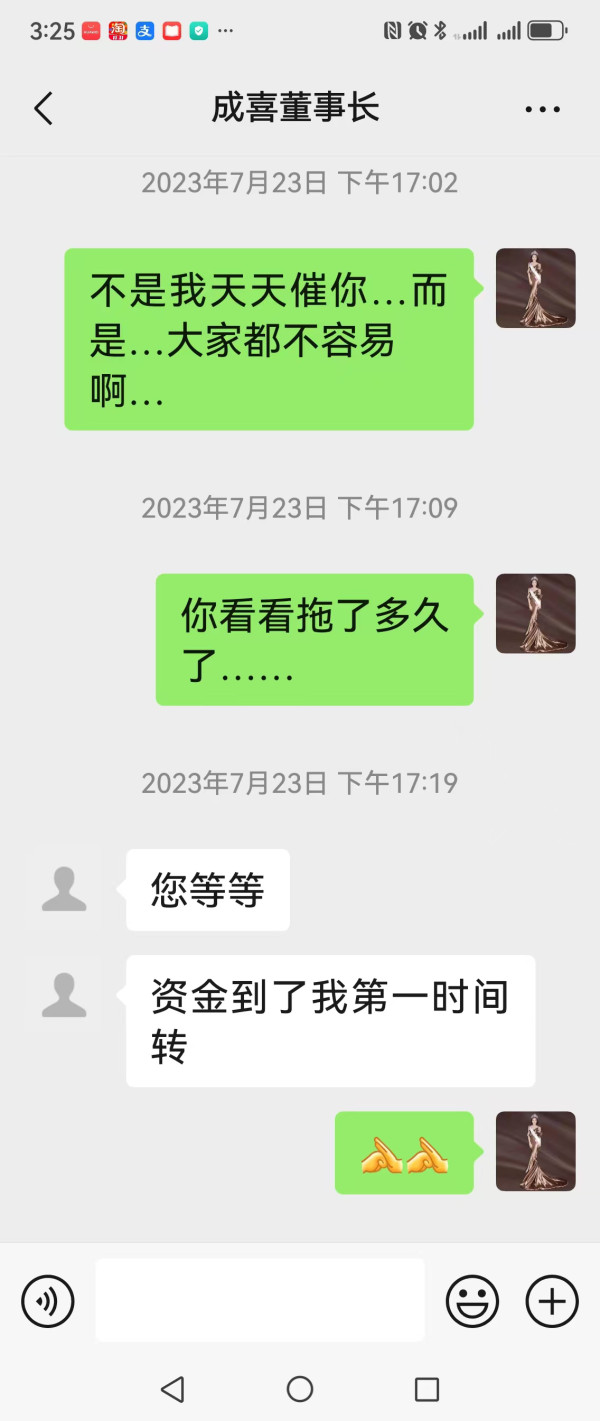

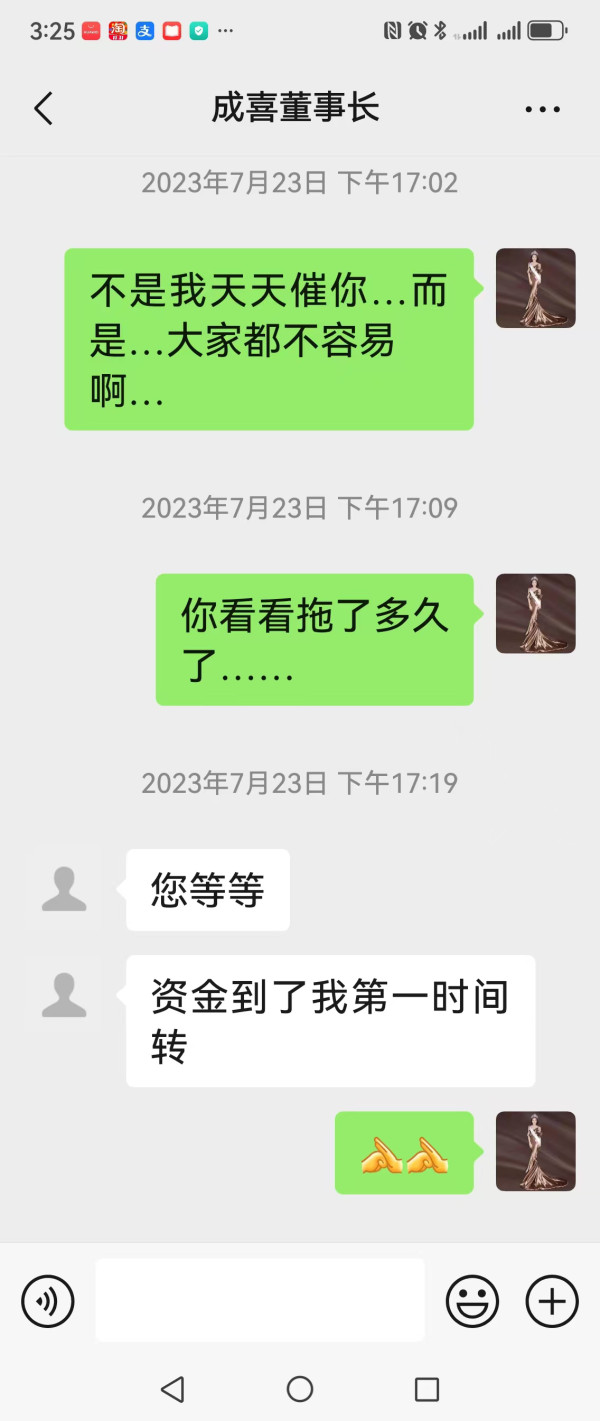

Trading Costs Analysis

TELA appears to offer competitive commission rates, a feature often praised by its users. However, user feedback indicates the presence of hidden fees that significantly impact the cost of trading. Specific complaints have been noted regarding withdrawal fees being unexpectedly high, with reports indicating fees as high as $30 to access funds.

User Insights on Fees:

"I initiated a withdrawal of over 50,000 in April, but the platform has been transferring only 5,000 at a time, often citing a lack of platform capacity!"

This feedback highlights the need for traders to carefully assess the cost structure before committing to TELA's services, as unexpected costs can greatly diminish trading margins.

TELA primarily supports the MetaTrader 4 platform, lauded for its user-friendliness and extensive capabilities, including automated trading features. However, it often lacks more advanced trading tools and resources offered by regulated brokers, which can be a significant shortfall for professional traders seeking deeper analytical capabilities.

User feedback regarding TELA's platform experience is mixed. While many find MT4 to be intuitive, concerns have been raised about the absence of quality educational resources and analytical tools, which can hinder the development of less experienced traders.

User Experience Analysis

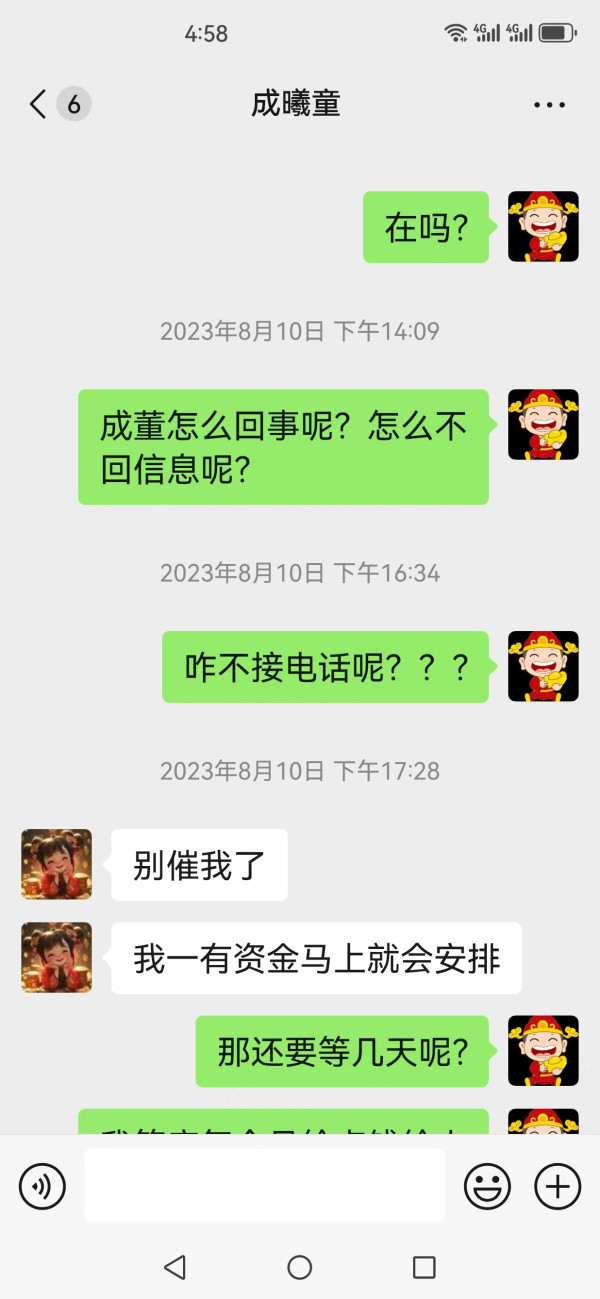

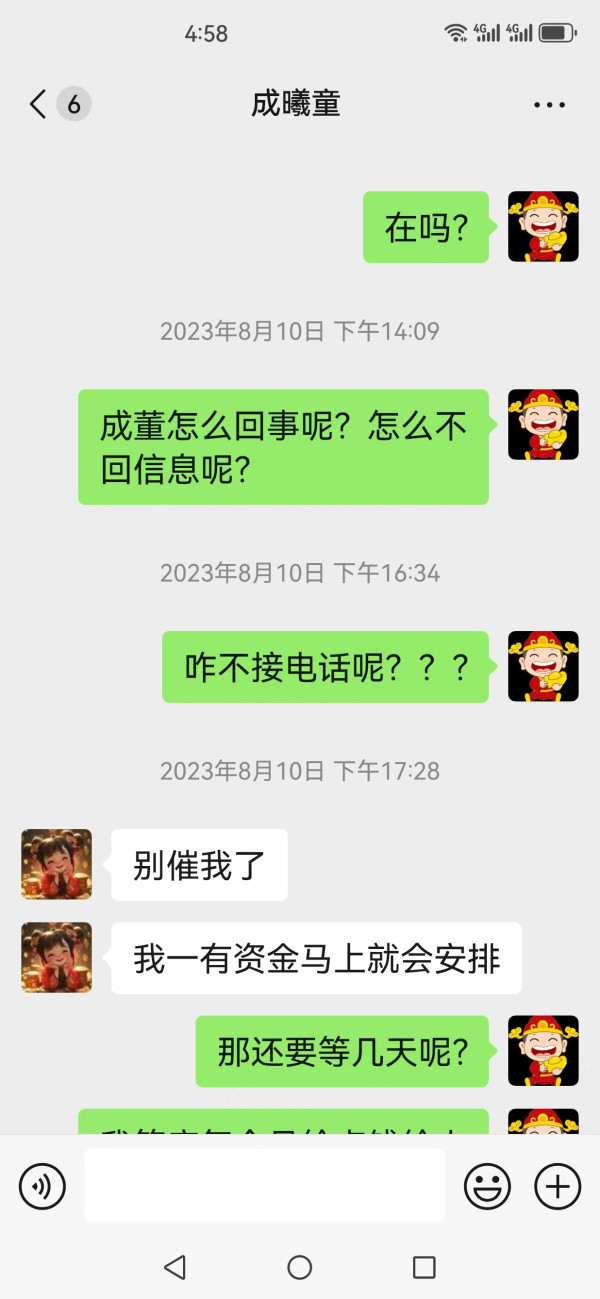

User experience on TELA's platform is hindered by inconsistent support and a lack of responsive customer service. Reports of delayed responses, unanswered queries, and difficulties in reaching support personnel reflect a broader theme of dissatisfaction. Many users lament the time wasted in trying to resolve issues, which is particularly detrimental in the fast-paced trading environment.

Customer Support Analysis

TELA's customer support has consistently come under fire, with numerous reports highlighting unresponsiveness and inadequate assistance. Traders facing withdrawal issues or troubleshooting platform problems describe long wait times and a lack of helpful responses, leading to frustration and concerns about the overall reliability of the broker.

Account Conditions Analysis

TELA lacks transparency regarding its account conditions, leaving prospective users in the dark about critical aspects of trading. Information about account types, associated fees, and operational practices remains opaque, contributing to a general sense of unease among users. Consequently, traders may find themselves operating under unclear conditions that could lead to unexpected challenges and costs.

Conclusion

In summary, TELA presents itself as a compelling option for experienced traders seeking diverse trading opportunities in forex and CFDs. However, the alarming lack of regulation, coupled with troubling feedback regarding withdraws and customer service, indicates that potential gains could be overshadowed by risks of fund mismanagement and insufficient support.

For traders considering TELA, it is crucial to balance the allure of potentially high returns with the serious risks of unregulated trading environments. Ensuring thorough due diligence and verification of regulatory statuses before engaging with TELA is vital to safeguarding investments.