Regarding the legitimacy of RaiseFX forex brokers, it provides FSCA, FSCA and WikiBit, (also has a graphic survey regarding security).

Is RaiseFX safe?

Pros

Cons

Is RaiseFX markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

RAISE GLOBAL SA (PTY) LTD

Effective Date:

2020-10-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

BUILDING 2 TRADE HOUSE 33 IMPALA ROAD CHISLEHURSTON SANDTON GAUTENG 2196Phone Number of Licensed Institution:

0000 0832687363Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

INSELE CAPITAL PARTNERS

Effective Date:

2019-12-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

19 IMPALA ROAD BUILDING 1CHISELHURSTONSANDTON2196Phone Number of Licensed Institution:

011 581 3435Licensed Institution Certified Documents:

Is RaiseFX A Scam?

Introduction

RaiseFX has emerged as a player in the online forex trading market since its establishment in 2018. Based in South Africa, the broker claims to offer a wide range of trading instruments, including forex, commodities, and cryptocurrencies. However, as the forex market expands, traders face numerous challenges in identifying legitimate brokers. The risk of falling victim to scams is a pressing concern, making it essential for traders to conduct thorough evaluations before entrusting their funds. This article aims to provide an objective analysis of RaiseFX, assessing its legitimacy and safety through a structured framework that includes regulatory standing, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. RaiseFX claims to be regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. However, the broker has also faced scrutiny, being blacklisted by the French Autorité des Marchés Financiers (AMF) for unauthorized trading activities. This raises significant concerns about its operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 50506 | South Africa | Active |

| AMF | N/A | France | Blacklisted |

The FSCA is a recognized regulatory body that oversees financial entities in South Africa, ensuring they adhere to strict compliance standards. However, the AMF's blacklisting of RaiseFX highlights serious concerns regarding the broker's practices. The AMF's warning indicates that RaiseFX is not authorized to operate in France, which is a significant red flag for potential investors.

Company Background Investigation

RaiseFX is operated by Raise Group LLP, which is registered in Kazakhstan. The company claims to have a robust management team with over 25 years of experience in the financial sector. However, the lack of transparency surrounding its ownership structure and the history of the management team raises questions about its credibility.

The company's website provides limited information about its founders or key personnel, which further complicates the assessment of its legitimacy. Transparency in operations and clear communication about the management team are crucial for fostering trust among potential clients. Without this information, traders may feel apprehensive about investing their hard-earned money with RaiseFX.

Trading Conditions Analysis

The trading conditions offered by RaiseFX include a minimum deposit requirement of €200 and leverage options of up to 1:500. While these conditions may seem attractive, they warrant closer scrutiny.

| Cost Type | RaiseFX | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.0 pips | 1.0 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | Varies | Varies |

The broker advertises tight spreads starting from 0.0 pips, which is significantly lower than the industry average. However, such low spreads often come with hidden costs or unfavorable trading conditions. Additionally, the commission structure, which is variable, can lead to unexpected charges that may affect overall profitability. Traders should be cautious of brokers that advertise unusually low trading costs, as this can sometimes indicate a lack of transparency.

Customer Funds Security

The safety of client funds is paramount in the forex trading industry. RaiseFX claims to implement measures such as segregated accounts to protect client deposits. However, the effectiveness of these measures is questionable, especially given the broker's blacklisting by the AMF.

The broker does not provide clear information on investor protection schemes or negative balance protection, which are essential for safeguarding clients against potential losses. Historical issues related to fund security, such as withdrawal delays and account freezes, have been reported by users, further highlighting the risks associated with trading through RaiseFX.

Customer Experience and Complaints

User feedback is a valuable resource for assessing the reliability of a broker. Many clients have reported negative experiences with RaiseFX, including difficulties in withdrawing funds and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Freezes | High | Poor |

| Unclear Fees | Medium | Average |

Typical complaints involve accounts being frozen without notice and challenges in receiving funds after withdrawal requests. One user reported that their account was blocked without warning, with the broker citing fraudulent transactions without providing evidence. Such instances raise serious concerns about the broker's practices and customer service quality.

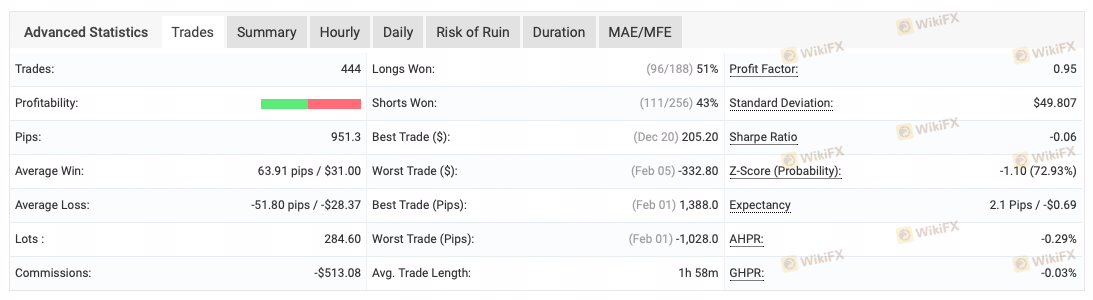

Platform and Trade Execution

The trading platform offered by RaiseFX is MetaTrader 4 (MT4), a widely used and reliable platform in the forex industry. However, the performance of the platform, including order execution quality and slippage rates, has been a point of contention among users.

Many traders have reported issues with delayed order execution and high slippage, which can significantly impact trading outcomes. Additionally, any signs of potential platform manipulation should be taken seriously, as they can indicate deeper issues within the broker's operations.

Risk Assessment

Using RaiseFX presents several risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Blacklisted by AMF |

| Fund Security | High | Lack of investor protection |

| Customer Support | Medium | Poor responsiveness |

Given the high-risk factors associated with RaiseFX, including its regulatory status and customer complaints, traders are advised to approach with caution. Implementing risk management strategies, such as limiting exposure and diversifying investments, can help mitigate potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that RaiseFX exhibits several red flags that warrant caution. The broker's blacklisting by the AMF, coupled with numerous customer complaints and a lack of transparency, raises significant concerns about its legitimacy.

Traders should thoroughly evaluate their options before investing with RaiseFX. For those seeking alternative brokers, reputable options include XM, IG Group, and Pepperstone, all of which are regulated by recognized authorities and offer a more transparent trading environment. Ultimately, conducting thorough research and exercising caution is crucial in navigating the forex trading landscape.

Is RaiseFX a scam, or is it legit?

The latest exposure and evaluation content of RaiseFX brokers.

RaiseFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RaiseFX latest industry rating score is 2.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.