RaiseFX 2025 Review: Everything You Need to Know

Executive Summary

This detailed raisefx review shows major concerns about this CFD broker that potential traders should think about carefully. Our analysis of user feedback and public information reveals that RaiseFX has a troubling profile with multiple red flags that cannot be ignored.

RaiseFX works as a CFD broker offering trading across multiple asset classes including forex, indices, cryptocurrencies, stocks, and commodities through the MT5 platform. The broker advertises attractive features such as leverage up to 1:500 and 24/7 customer support. However, user experiences tell a very different story.

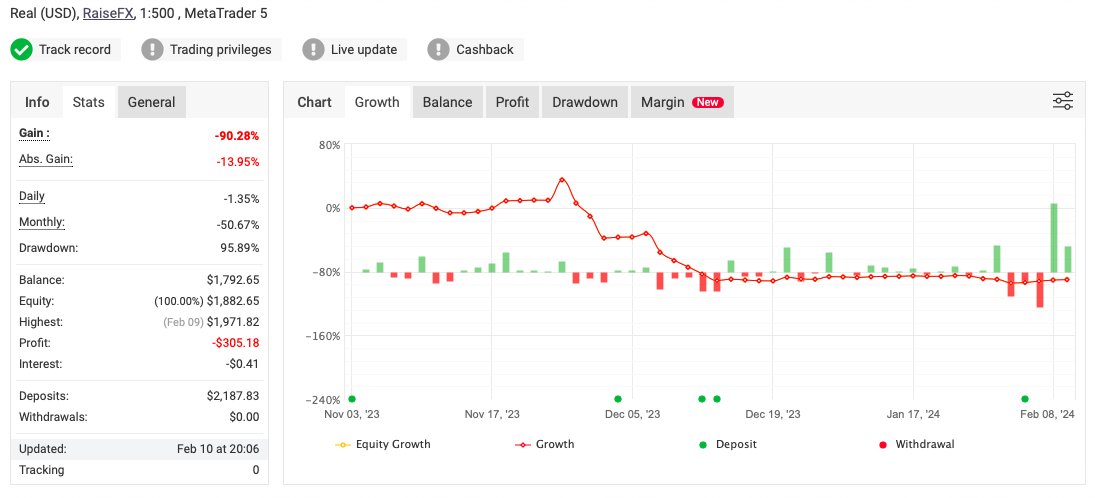

The most alarming part of this review is the overwhelming negative user feedback. RaiseFX has a shocking 0-star rating based on 144 user reviews and only 23% of 151 reviewers recommend the platform. This shows one of the worst user satisfaction records in the industry. Multiple sources have flagged the platform as a potential scam, which raises serious questions about whether it's legitimate.

The broker's regulatory status is limited to FSCA (South Africa), which may not provide enough protection for traders in other areas. The minimum deposit requirement is $200, and user testimonials raise concerns about fund security. RaiseFX appears to target traders who can handle higher risk while potentially exposing them to significant dangers.

Important Notice

Regional Regulatory Differences: RaiseFX operates under FSCA (South Africa) regulation only. This limited regulatory coverage may not meet the protection standards required in other areas, especially in Europe, the UK, or other major financial centers. Traders should check whether this regulatory framework provides enough protection in their region.

Review Methodology: This evaluation is based on detailed analysis of user feedback from multiple review platforms, publicly available information about the broker's services, and regulatory data. Given the concerning nature of user reports and potential scam warnings, this review puts user safety and transparency first over promotional content.

Overall Rating Framework

Broker Overview

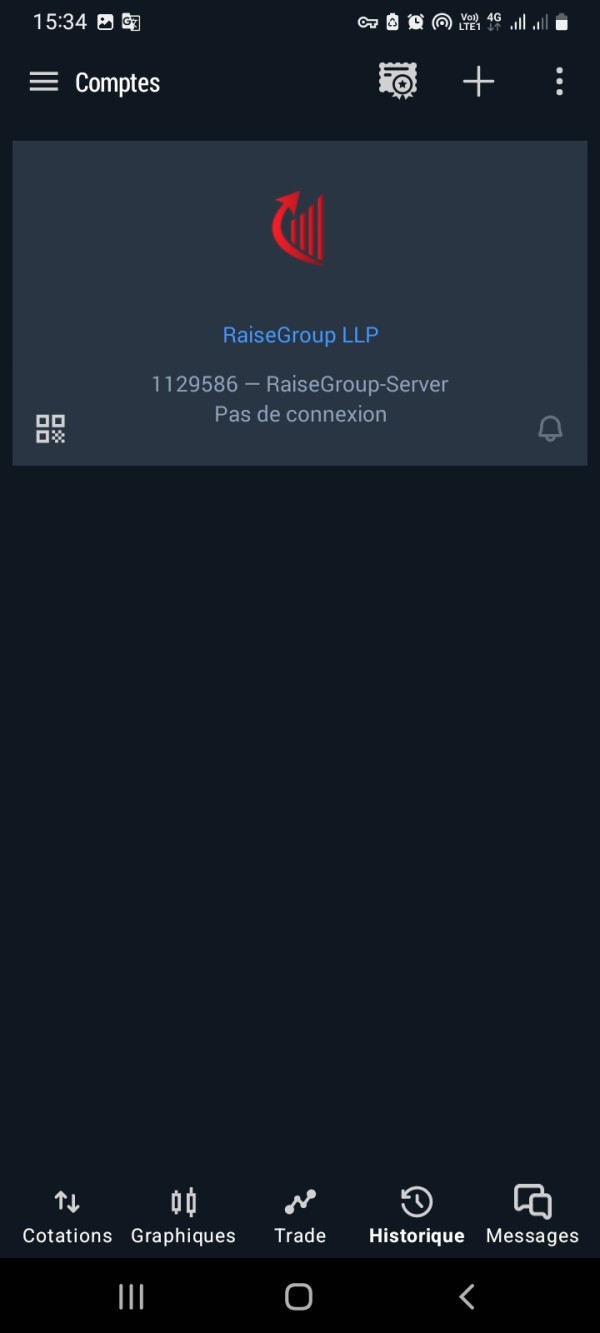

RaiseFX presents itself as a CFD broker providing access to global financial markets through the popular MetaTrader 5 platform. The company operates mainly under South African regulation through the FSCA, though specific details about its founding date and corporate background remain unclear in available documentation. This lack of transparency about basic corporate information already raises initial concerns for potential clients seeking a reliable trading partner.

The broker's business model focuses on providing leveraged trading opportunities across diverse asset classes. RaiseFX offers trading in foreign exchange pairs, stock indices, cryptocurrencies, individual stocks, and various commodities. This broad market access is made possible through the MT5 platform, which provides traders with advanced charting capabilities, automated trading options, and comprehensive market analysis tools.

However, what sets this raisefx review apart from typical broker evaluations is the stark contrast between the company's marketed offerings and actual user experiences. While the technical infrastructure appears standard for the industry, the overwhelming negative feedback suggests serious operational issues that potential clients must consider. The broker's limited regulatory footprint, combined with concerning user testimonials, creates a risk profile that demands careful scrutiny before any trading decisions.

Regulatory Jurisdiction: RaiseFX operates under FSCA (Financial Sector Conduct Authority) regulation in South Africa. This single-jurisdiction regulatory status limits the protection available to international clients and may not meet the strict requirements expected by traders in more heavily regulated markets.

Minimum Deposit Requirements: The broker requires a minimum initial deposit of $200, which is much higher than many industry competitors who offer account opening with lower barriers to entry.

Available Trading Assets: The platform provides access to foreign exchange currency pairs, major global stock indices, popular cryptocurrencies, individual company stocks, and commodity markets including precious metals and energy products.

Cost Structure: RaiseFX advertises spreads starting from 1 pip on major currency pairs like EUR/USD. However, detailed commission information is notably absent from readily available materials, creating uncertainty about the true cost of trading.

Leverage Options: The broker offers leverage ratios up to 1:500, which provides significant amplification of trading positions but also greatly increases risk exposure for traders.

Trading Platform: MetaTrader 5 serves as the primary trading platform, offering advanced charting, automated trading capabilities, and comprehensive market analysis tools.

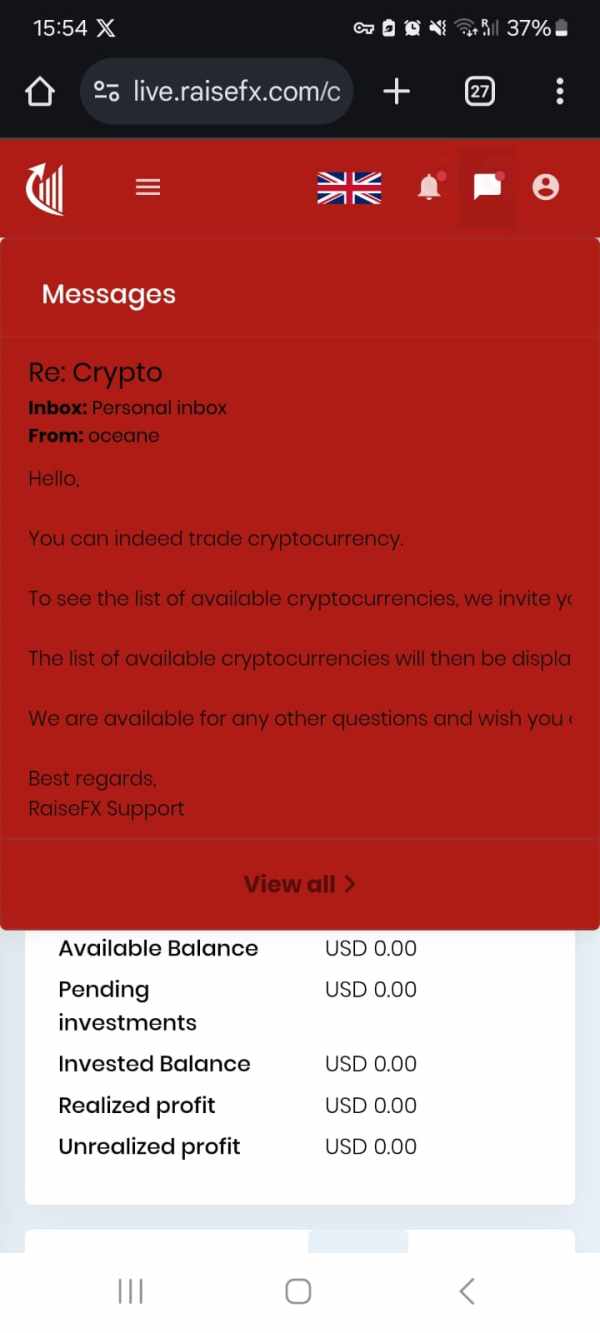

Customer Support: The company claims to provide 24/7 customer support, though user feedback suggests significant quality issues with the actual service delivery.

This raisefx review must emphasize that while these features may appear competitive on paper, the practical implementation and user experience tell a markedly different story.

Detailed Rating Analysis

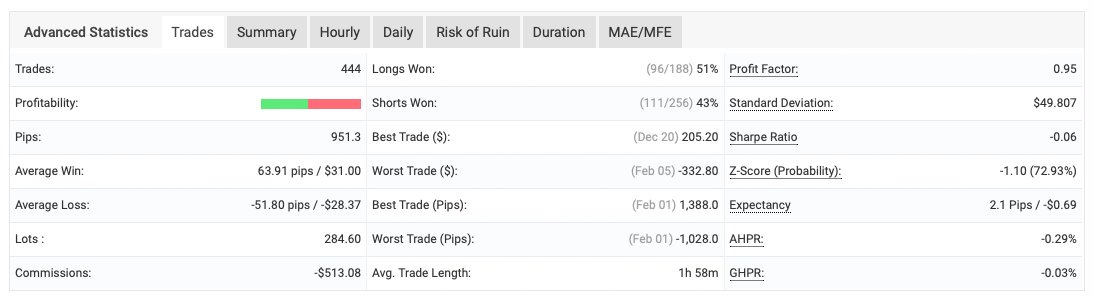

Account Conditions Analysis (4/10)

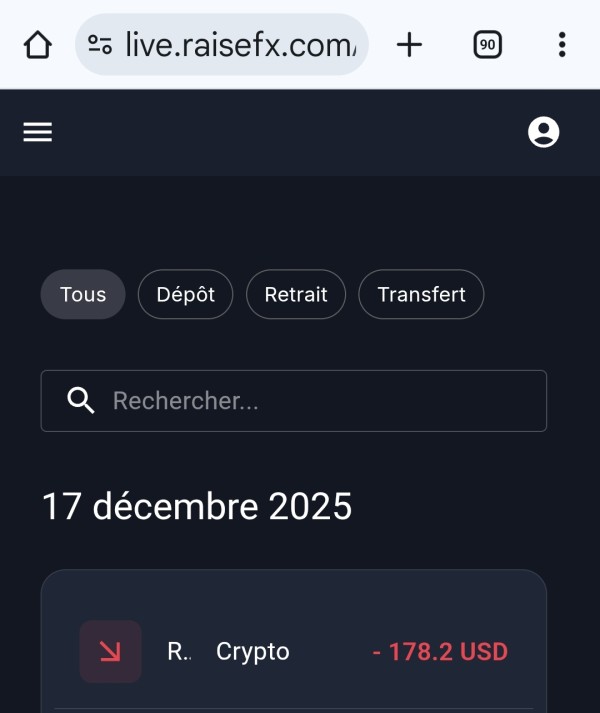

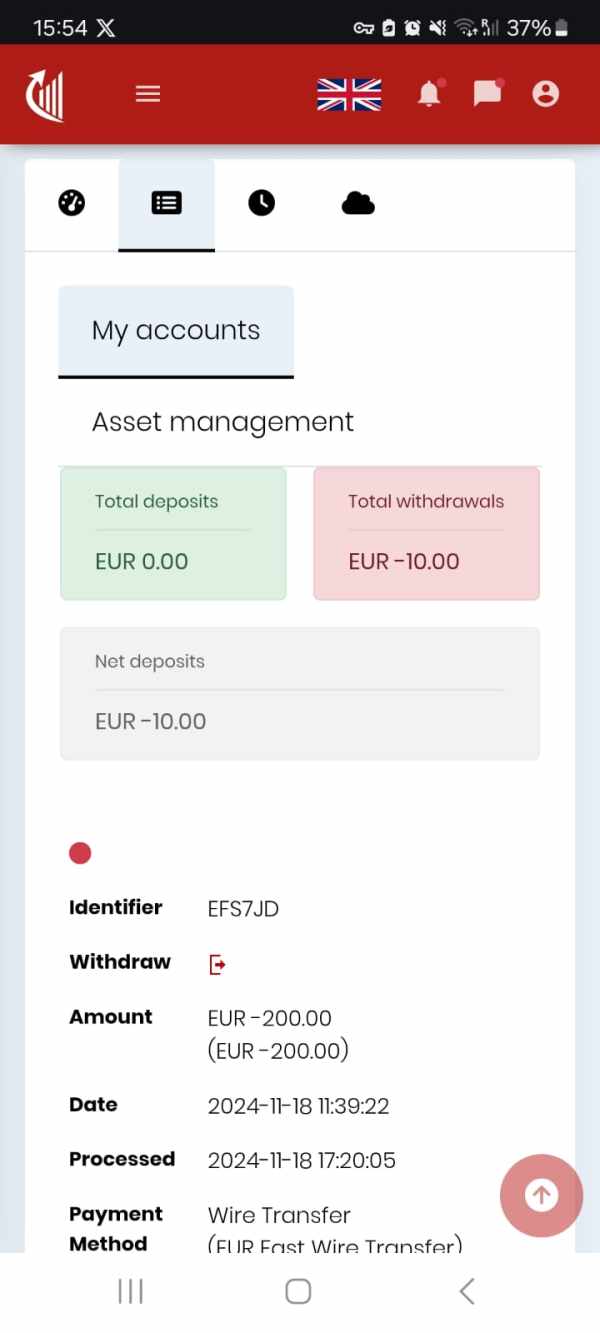

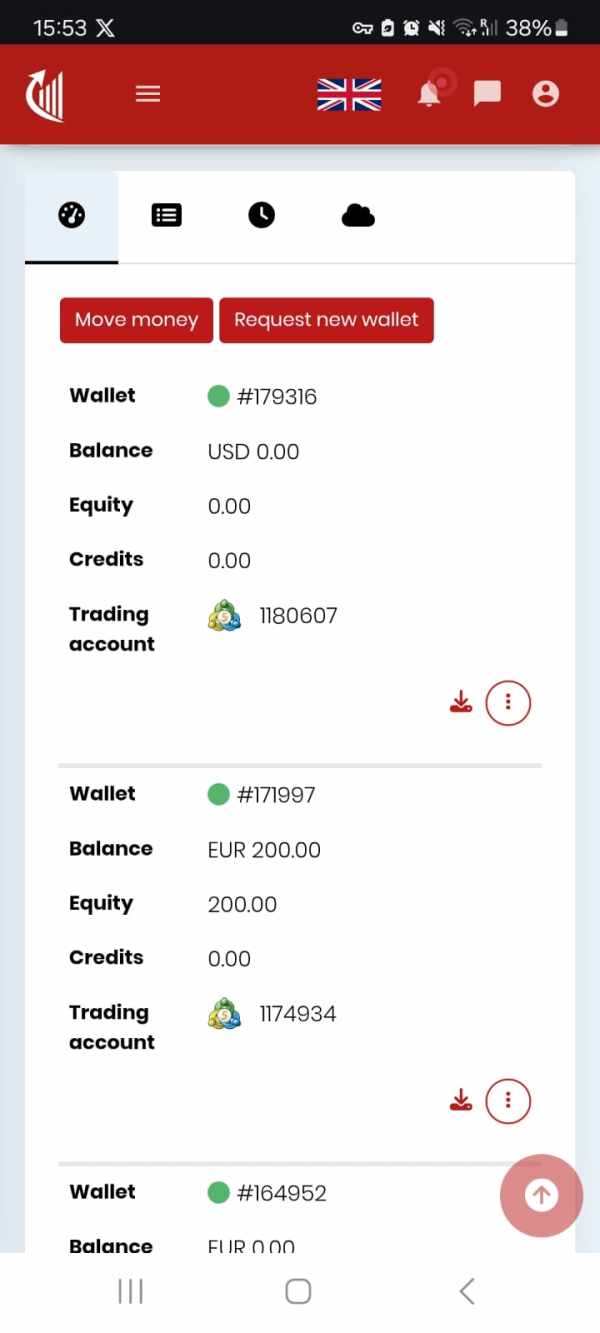

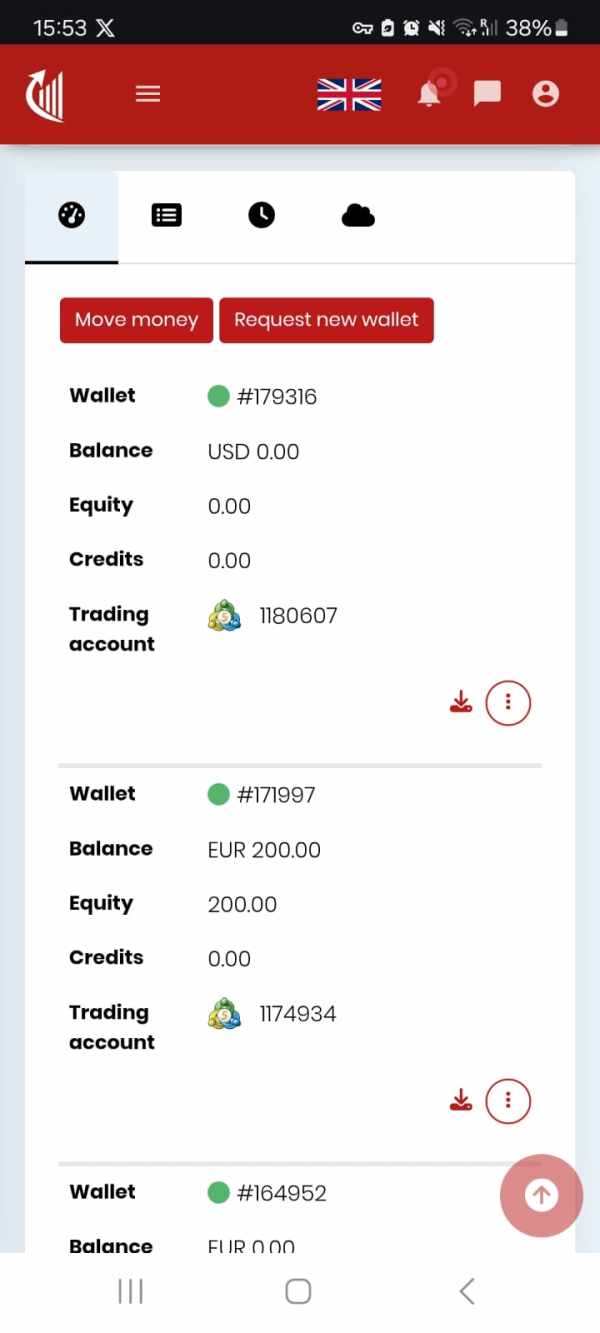

The account conditions offered by RaiseFX present a mixed picture that ultimately favors the broker rather than the trader. The $200 minimum deposit requirement places this broker in the higher-tier category for initial investment, making it less accessible to beginner traders who might prefer to start with smaller amounts. This elevated entry barrier becomes particularly concerning when combined with the numerous user complaints about fund security and withdrawal difficulties.

While the broker advertises competitive spreads starting from 1 pip on major currency pairs, the absence of clear commission structure information creates transparency issues. Traders cannot accurately calculate their total trading costs without understanding both spread and commission components. This lack of clarity in fee structure is a significant red flag that experienced traders should recognize as potentially problematic.

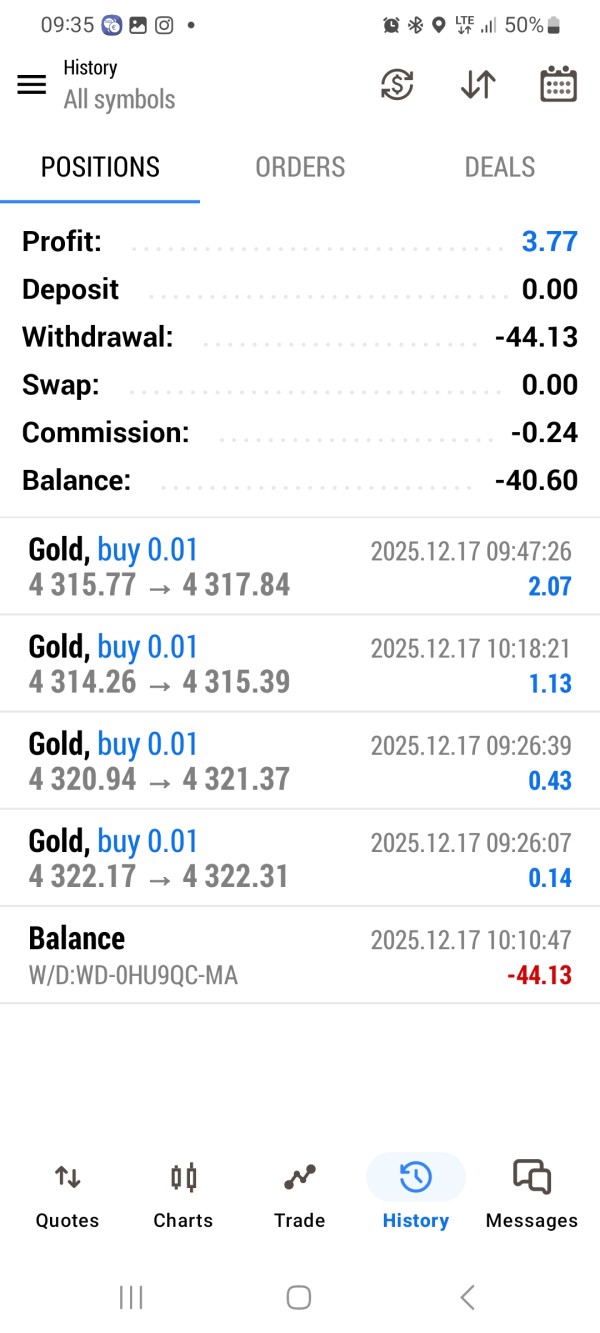

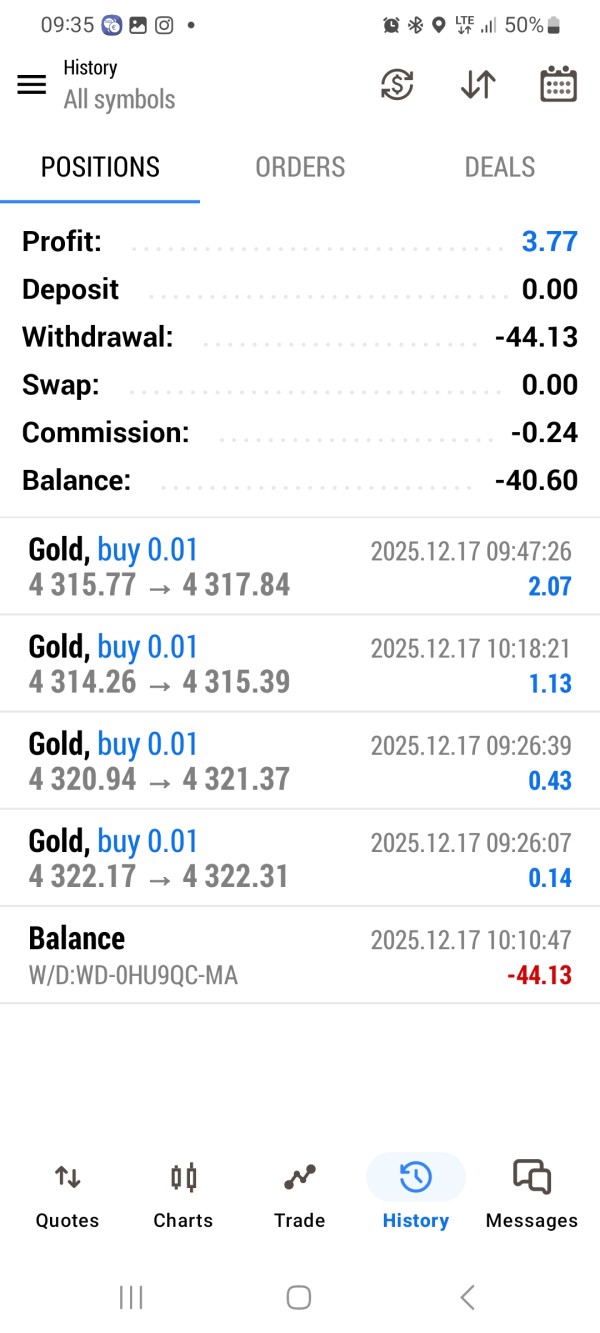

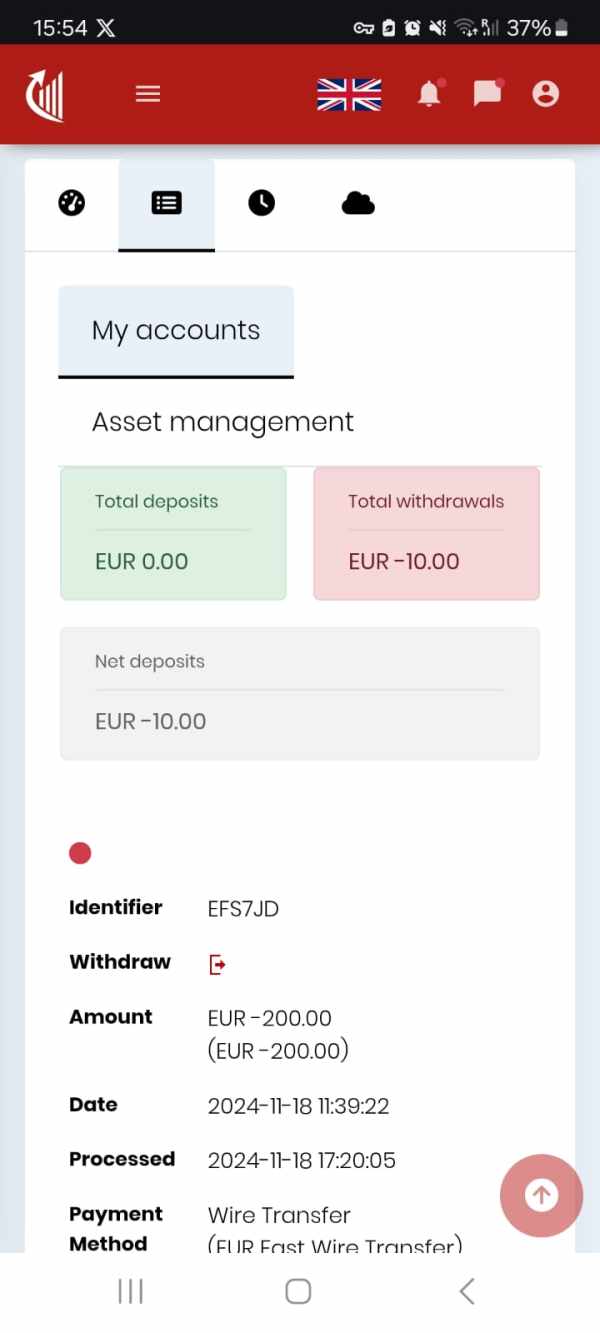

User feedback consistently indicates problems with account management and fund access. Multiple reviewers have reported difficulties with withdrawal processes and unexpected account restrictions. The combination of higher deposit requirements with withdrawal concerns creates an unfavorable risk-reward scenario for account holders.

This raisefx review finds that the account conditions, while appearing standard in marketing materials, fail to deliver the transparency and trader-friendly features that characterize reputable brokers in today's competitive market.

RaiseFX provides access to the MetaTrader 5 platform, which is an industry-standard trading environment offering comprehensive charting capabilities, technical indicators, and automated trading functionality. The platform itself is robust and provides the technical foundation necessary for professional trading activities across the multiple asset classes offered by the broker.

The range of tradeable instruments spans forex, indices, cryptocurrencies, stocks, and commodities, providing diversification opportunities for traders seeking exposure to various market sectors. This broad asset selection is competitive with industry standards and allows for portfolio diversification strategies.

However, the quality of educational resources and research materials appears limited based on available information. Professional traders typically expect access to market analysis, educational content, and research reports to support their trading decisions. The apparent lack of comprehensive educational support limits the platform's value proposition, particularly for developing traders.

User feedback suggests that while the technical tools are available, the overall trading environment suffers from reliability and execution issues that compromise the effectiveness of even the best trading tools. The platform's technical capabilities are undermined by operational problems that affect the practical trading experience.

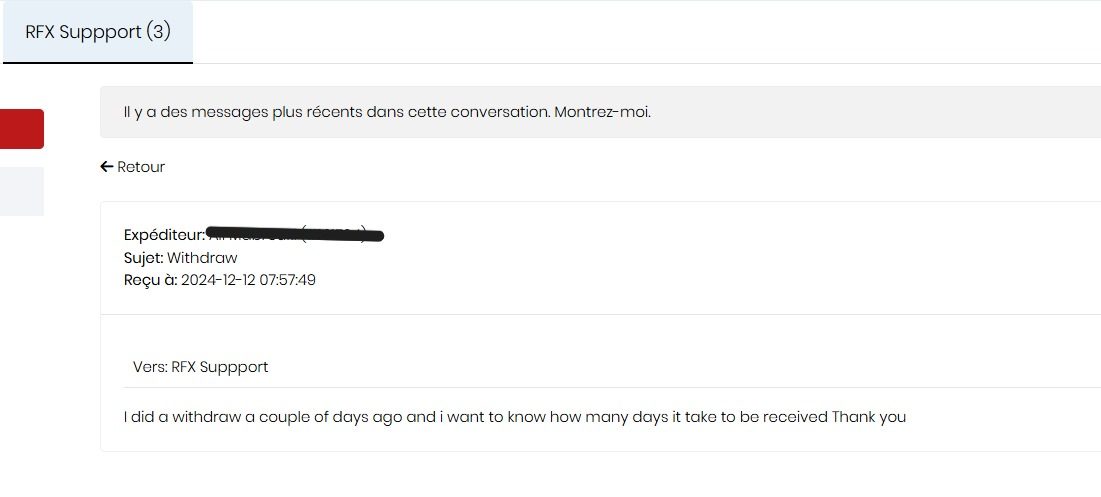

Customer Service and Support Analysis (6/10)

RaiseFX advertises 24/7 customer support availability, which represents a positive feature for traders operating across different time zones or requiring assistance outside standard business hours. Round-the-clock support access is particularly valuable in forex markets that operate continuously throughout the trading week.

However, user feedback reveals a significant disconnect between advertised support availability and actual service quality. Multiple user reviews indicate poor response times, inadequate problem resolution, and communication difficulties with support staff. These service quality issues are particularly concerning when traders face urgent account or trading-related problems.

The lack of detailed information about support channels, languages supported, and escalation procedures further limits the effectiveness of the customer service offering. Professional traders typically require multiple contact methods and specialized support for complex trading issues.

User testimonials consistently report frustration with support interactions, particularly regarding account access, withdrawal processes, and technical issues. The pattern of negative support experiences across multiple user reviews suggests systemic problems rather than isolated incidents.

Trading Experience Analysis (4/10)

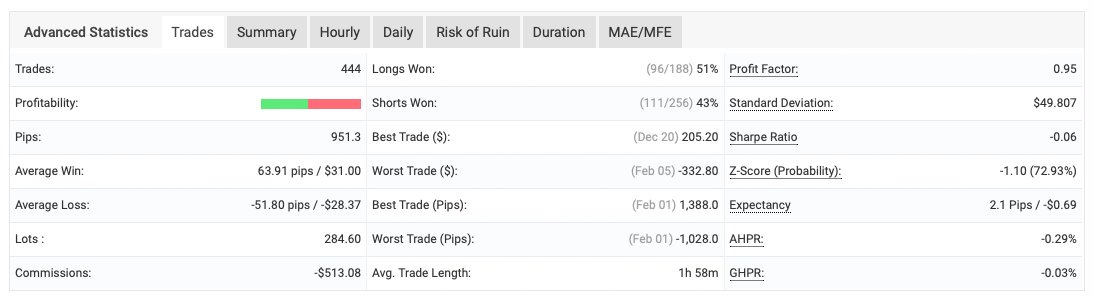

The trading experience offered by RaiseFX is severely compromised by widespread user complaints and technical issues that undermine platform reliability. While the MT5 platform provides a solid technical foundation, user feedback indicates significant problems with order execution, platform stability, and overall trading environment quality.

Multiple user reviews report issues with trade execution, including slippage problems and order processing delays that can significantly impact trading profitability. These execution issues are particularly problematic for active traders and those employing time-sensitive trading strategies.

The advertised leverage up to 1:500 provides substantial position amplification capabilities, but this high leverage becomes dangerous when combined with poor execution quality and platform reliability issues. Traders require consistent platform performance to manage high-leverage positions effectively.

User feedback consistently indicates problems with the overall trading environment, including unexpected account restrictions, platform access issues, and trading limitation impositions. These operational problems create an unreliable trading environment that fails to meet professional trading standards.

This raisefx review finds that the trading experience falls significantly short of industry expectations, with user satisfaction metrics indicating widespread dissatisfaction with core trading functionality.

Trust and Security Analysis (2/10)

The trust and security profile of RaiseFX presents serious concerns that potential traders cannot ignore. Multiple independent sources have flagged the platform as a potential scam, with warning notices appearing on various financial review websites and consumer protection platforms.

The broker's regulatory status is limited to FSCA (South Africa), which provides minimal protection for international traders. This single-jurisdiction regulatory coverage is insufficient compared to brokers operating under multiple regulatory frameworks in major financial centers.

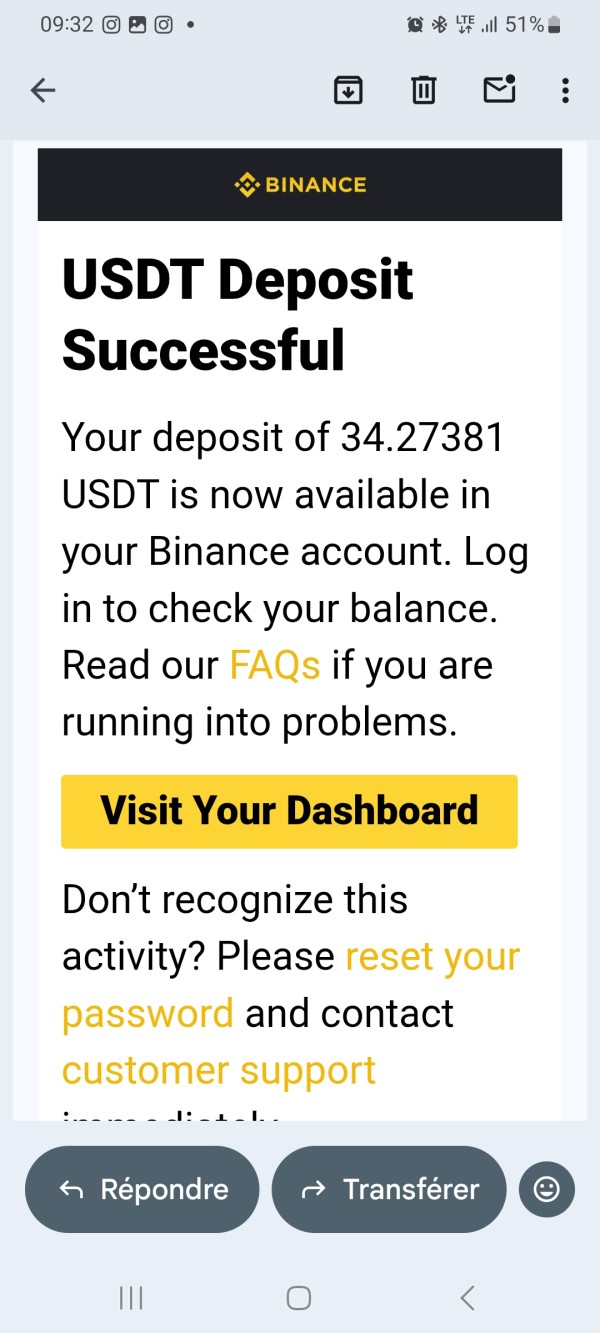

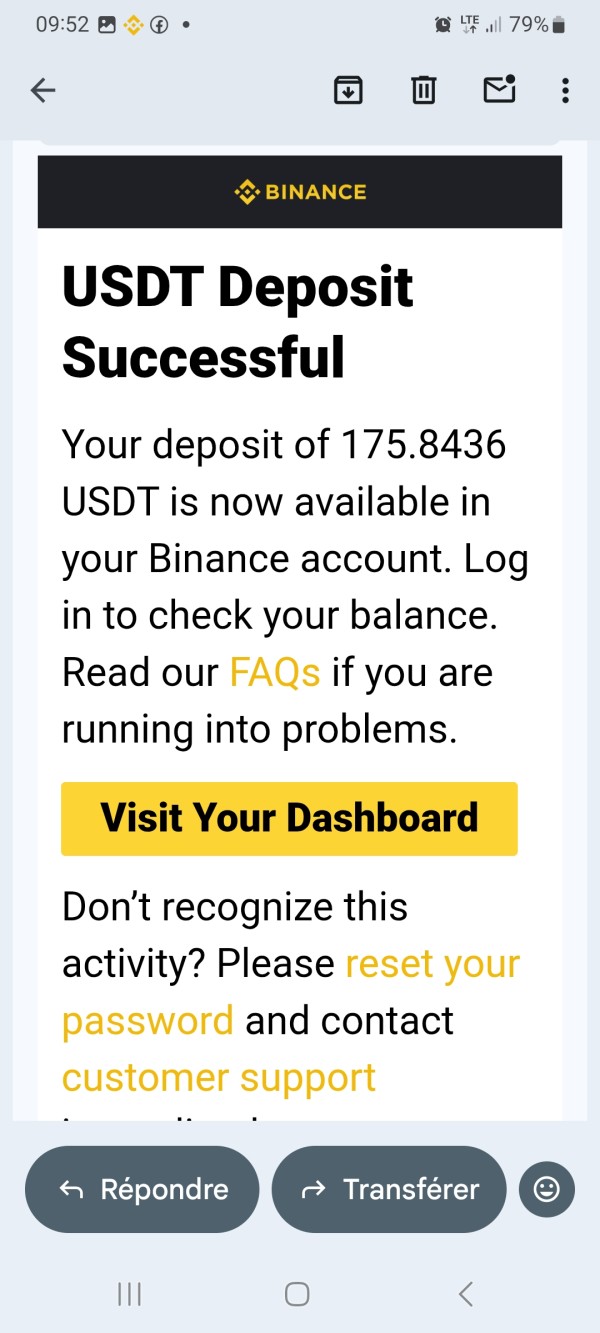

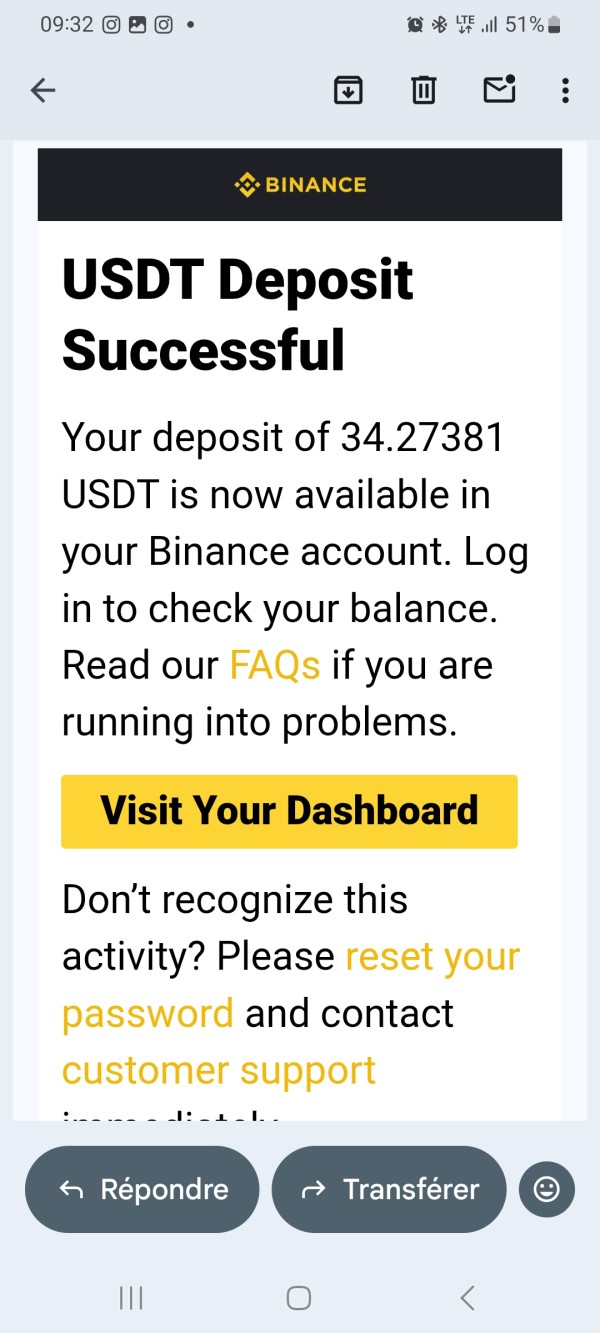

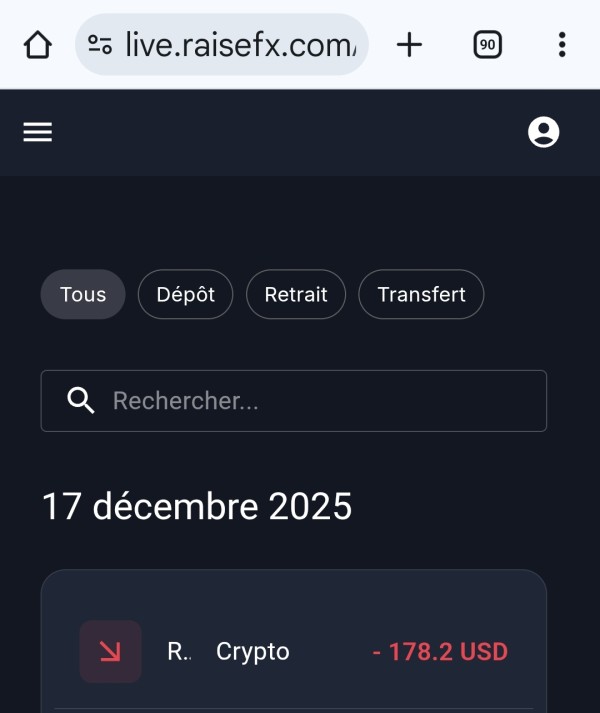

User testimonials repeatedly raise concerns about fund security and withdrawal difficulties. Multiple reviewers report problems accessing their funds, with some alleging complete loss of deposits. These fund security concerns represent the most serious risk factor for potential clients.

The lack of transparency regarding company ownership, corporate structure, and operational details further undermines trust. Legitimate brokers typically provide comprehensive information about their corporate background, regulatory compliance, and operational procedures.

Independent verification of regulatory claims and corporate information proves difficult, suggesting potential issues with the broker's claimed regulatory status and operational legitimacy.

User Experience Analysis (3/10)

The user experience delivered by RaiseFX is overwhelmingly negative, as evidenced by the shocking 0-star average rating from 144 user reviews and the mere 23% recommendation rate from 151 total reviews. These metrics represent some of the worst user satisfaction scores in the online trading industry.

User feedback consistently reports problems across all aspects of the trading experience, from account opening and platform access to trade execution and fund withdrawal. The breadth of reported problems suggests systemic operational issues rather than isolated technical difficulties.

Common user complaints include difficulty accessing accounts, problems with fund withdrawals, poor customer service interactions, and concerns about platform legitimacy. The consistency of these complaints across multiple review platforms indicates widespread operational problems.

The extremely low recommendation rate suggests that the vast majority of users would not suggest this platform to other traders, which represents a fundamental failure in service delivery and user satisfaction.

Based on user feedback patterns, RaiseFX appears unsuitable for traders of any experience level, with particular risks for newcomers who may be less equipped to recognize and respond to warning signs of problematic brokers.

Conclusion

This comprehensive raisefx review reveals a broker that poses significant risks to potential traders and fails to meet basic industry standards for safety, reliability, and user satisfaction. The overwhelming negative user feedback, combined with multiple scam warnings and limited regulatory protection, creates a risk profile that cannot be recommended for any trader category.

The platform's technical offerings, while appearing competitive in marketing materials, are undermined by serious operational problems and user safety concerns. The extremely low user satisfaction ratings and widespread reports of fund access problems represent unacceptable risks for traders seeking a reliable trading environment.

RaiseFX is particularly unsuitable for beginner traders who require secure, transparent, and supportive trading environments to develop their skills safely. Experienced traders should also avoid this platform due to the documented execution problems and fund security concerns that could jeopardize trading capital regardless of skill level.

Potential traders are strongly advised to consider well-regulated, highly-rated alternatives that demonstrate consistent user satisfaction and transparent operational practices. The forex and CFD trading industry offers numerous reputable brokers that provide secure, reliable trading environments without the risks associated with RaiseFX.