Is Phyntex Markets safe?

Pros

Cons

Is Phyntex Markets A Scam?

Introduction

Phyntex Markets is a forex broker that positions itself within the Southeast Asian financial landscape, offering a range of trading instruments including forex, cryptocurrencies, commodities, and CFDs. As the forex market continues to grow, the presence of numerous brokers makes it essential for traders to conduct thorough evaluations to ensure their safety and legitimacy. The rise of fraudulent schemes in the trading world underscores the necessity for due diligence when selecting a broker. This article aims to provide an objective analysis of Phyntex Markets, focusing on its regulatory standing, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. The evaluation is based on a comprehensive review of available online resources, customer feedback, and regulatory information.

Regulation and Legitimacy

The regulatory environment is a critical aspect of assessing any forex broker. Regulatory bodies are established to protect investors and ensure fair trading practices. A broker's legitimacy is often tied to its regulatory status, which can provide traders with a sense of security and recourse in the event of disputes.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T 2023344 | Comoros | Not Verified |

Phyntex Markets claims to operate under the oversight of the Mwali International Services Authority (MISA) in the Comoros. However, the lack of readily verifiable regulatory information raises significant concerns about the broker's legitimacy. Current publicly available resources do not indicate that Phyntex is operating under any recognized financial regulatory body, which is a major red flag for potential users. The absence of regulatory oversight limits recourse for traders in cases of disputes or fraudulent activity, making it crucial for traders to approach this broker with caution.

Company Background Investigation

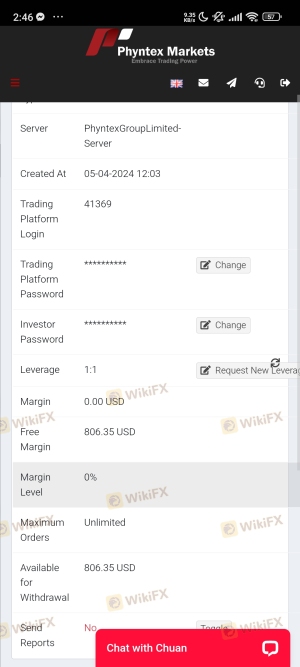

Phyntex Markets is operated by Phyntex Group Limited, with its registration reportedly located in the Comoros. The company was established in 2023, and its ownership structure is not widely disclosed, raising concerns about transparency. The management teams background and professional experience are also unclear, which may further exacerbate the issue of trustworthiness.

The lack of detailed information regarding the company's history and ownership can lead to skepticism among potential clients. Transparency in operations is vital for building trust, and the absence of such information may deter experienced traders from engaging with Phyntex Markets. Furthermore, the company's relatively recent establishment may indicate a lack of operational stability, which is often a concern for traders seeking long-term partnerships.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to assess the potential profitability of their trades. Phyntex Markets presents a variety of trading accounts with different fee structures, which may appeal to diverse trading styles. However, the overall fee structure and potential hidden costs must be evaluated carefully.

| Fee Type | Phyntex Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.8 pips | 1.0 - 1.5 pips |

| Commission Structure | No commission | Varies (0-10 USD) |

| Overnight Interest Range | Varies | Varies |

Phyntex Markets offers spreads starting from 1.8 pips, which is higher than the industry average for major currency pairs. While the broker claims to operate on a no-commission basis, traders should be aware of potential overnight interest fees and other hidden charges that may apply. The fee transparency is crucial for traders to make informed decisions, and any unusual or unclear fee policies should raise alarms.

Customer Funds Security

The safety of client funds is paramount in the forex trading environment. Phyntex Markets claims to implement various security measures to protect customer funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures must be scrutinized.

Phyntex does not provide comprehensive information regarding its fund security practices, which raises questions about the level of investor protection. The lack of established regulatory oversight further complicates the assurance of fund safety. Traders should seek brokers with robust security measures, including negative balance protection and clear fund segregation policies, to mitigate potential risks.

Customer Experience and Complaints

Customer feedback provides valuable insights into a brokers reliability and service quality. Analyzing user experiences can help identify common complaint patterns and the broker's responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Closure | High | No Response |

| Customer Support | Medium | Average |

Common complaints against Phyntex Markets include difficulties with withdrawals and account closures. Users have reported instances where their accounts were closed without explanation, leading to frustration and a lack of trust in the broker. The responsiveness of customer support has also been criticized, with many users expressing dissatisfaction with the quality and speed of assistance provided. Such complaints should be taken seriously, as they can indicate deeper issues within the broker's operational practices.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders. Phyntex Markets offers the widely used MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the quality of order execution and the presence of slippage or rejections must also be evaluated.

Users have reported mixed experiences regarding execution quality, with some experiencing delays and slippage during high volatility periods. Any signs of platform manipulation or execution issues can significantly impact trading performance and profitability. Traders should be cautious and consider testing the platform with a demo account before committing real funds.

Risk Assessment

Using Phyntex Markets comes with inherent risks that potential clients should be aware of. The lack of regulatory oversight, combined with customer complaints and transparency issues, contribute to an elevated risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No recognized regulatory body overseeing operations. |

| Fund Safety Risk | High | Limited information on fund security measures. |

| Customer Service Risk | Medium | Complaints regarding withdrawal and support response. |

Traders are advised to mitigate these risks by conducting thorough research, maintaining cautious trading practices, and considering alternative brokers with robust regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, while Phyntex Markets presents itself as an accessible trading platform with competitive conditions, significant concerns regarding its regulatory status, transparency, and customer feedback cannot be overlooked. The absence of recognized regulatory oversight and the prevalence of user complaints suggest that potential traders should exercise caution.

For those prioritizing low costs and a user-friendly interface, Phyntex Markets may seem appealing, but the risks involved may outweigh the benefits. Traders seeking a more secure trading environment are encouraged to explore alternative brokers that offer strong regulatory protections, transparent fee structures, and positive customer experiences. Reliable options include brokers like IG, OANDA, and Forex.com, which have established reputations and regulatory oversight.

Ultimately, the choice of a trading partner should align with individual trading goals and risk tolerance, and careful consideration is essential to ensure a safe and rewarding trading experience.

Is Phyntex Markets a scam, or is it legit?

The latest exposure and evaluation content of Phyntex Markets brokers.

Phyntex Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Phyntex Markets latest industry rating score is 2.03, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.03 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.