phyntex markets 2025 Review: Everything You Need to Know

Abstract

This phyntex markets review gives a balanced look at a new broker. The overall rating stays neutral because of mixed customer feedback and concerns about its regulatory status. Founded in 2023, the broker focuses mainly on Southeast Asian traders and offers one of its most appealing features—a high leverage of up to 1:3000—along with access to the well-known MetaTrader 5 platform. The high leverage and industry-standard trading platform provide potential advantages. However, the fact that the broker is regulated only by the Mwali International Services Authority raises serious questions about fund security and overall investor protection. Customer feedback has been mixed, with some traders liking the user-friendly interface, while others worry about regulatory oversight and customer service quality. This review uses user feedback, regulatory documents, and company data to give a complete picture of what to expect when trading with phyntex markets review, especially for those in the Southeast Asian market.

Notice

Please note that phyntex markets currently accepts clients only from the Asia and Pacific regions. This limits its global reach significantly. The evaluation here is based on available user feedback, regulatory details, and published company information. The broker's business model and service quality have been assessed within these regional limits. Readers should know that some details, such as deposit methods, minimum deposit requirements, and bonus offers, are not clearly explained in the available information. Therefore, potential clients should verify these details directly before proceeding. The present evaluation comes from a thorough review of current sources and may be updated as more information becomes available.

Rating Framework

Broker Overview

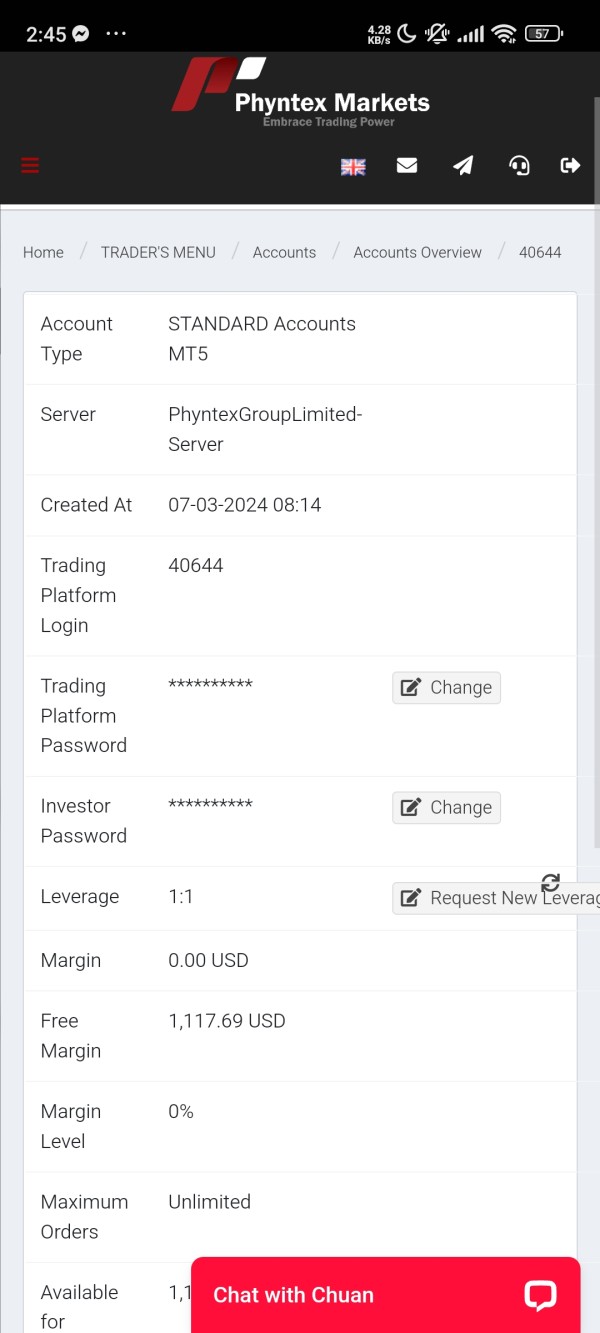

Phyntex Markets was established in 2023. It has quickly positioned itself within the competitive landscape of online trading. The company is headquartered in the Comoros and primarily targets the Southeast Asian market, focusing on delivering forex and Contract for Difference trading services. The company's decision to focus on this region allows it to serve the unique needs of Asian traders and take advantage of emerging market trends in this area. Despite the promising focus, several aspects of the firm, such as its account offerings and cost structure, remain unclear. This overview shows a broker that is still in its early growth phase, with both potential benefits and uncertainties that prospective traders should carefully consider.

The broker also stands out by using the MetaTrader 5 platform. This choice serves traders who are used to high-quality trading environments and advanced analytical tools. Phyntex markets review offers not only forex trading but also CFDs, broadening the range of tradeable assets available to its clients. The Mwali International Services Authority provides regulatory oversight exclusively, lending some legitimacy; however, this also raises concerns among investors about the strength of regulatory protections compared to more widely recognized regulatory bodies. While the platform's technical setup and asset flexibility are good, the regulatory environment remains a critical factor for potential users to consider carefully.

Phyntex Markets is regulated by the Mwali International Services Authority. It holds licenses HY00823421 for its International Business Company classification, and T2023344 for its operations as an international brokerage and clearing entity. These regulatory credentials, although valid, have prompted questions among clients about the strictness of oversight and the safety of funds.

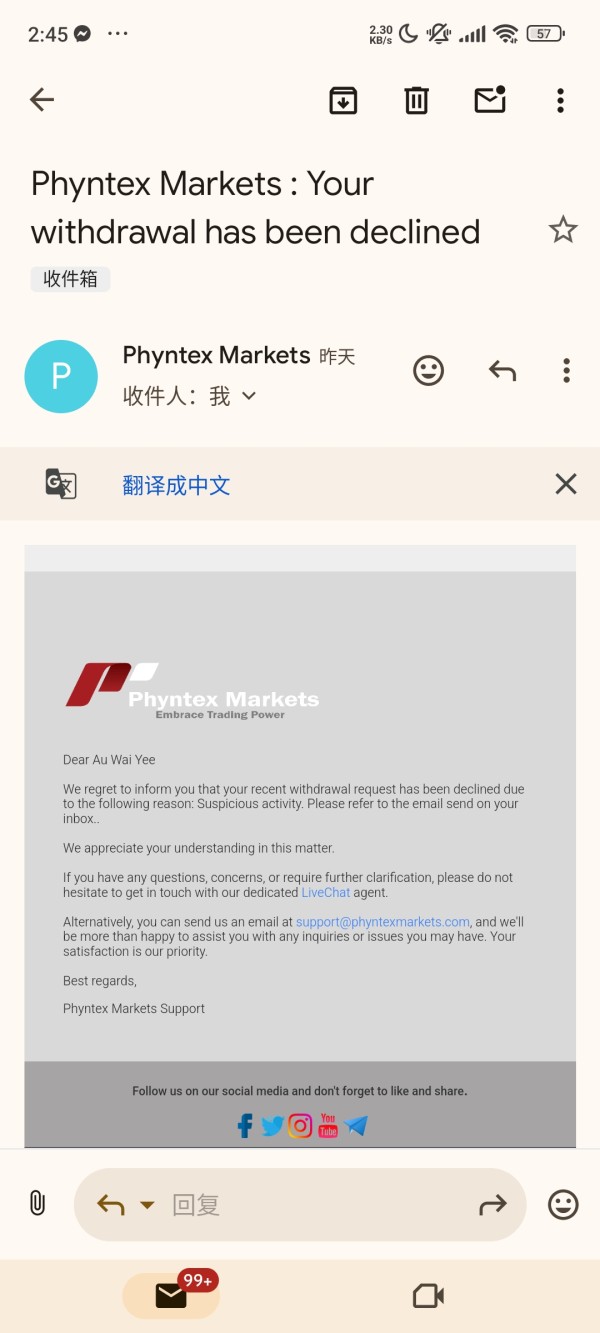

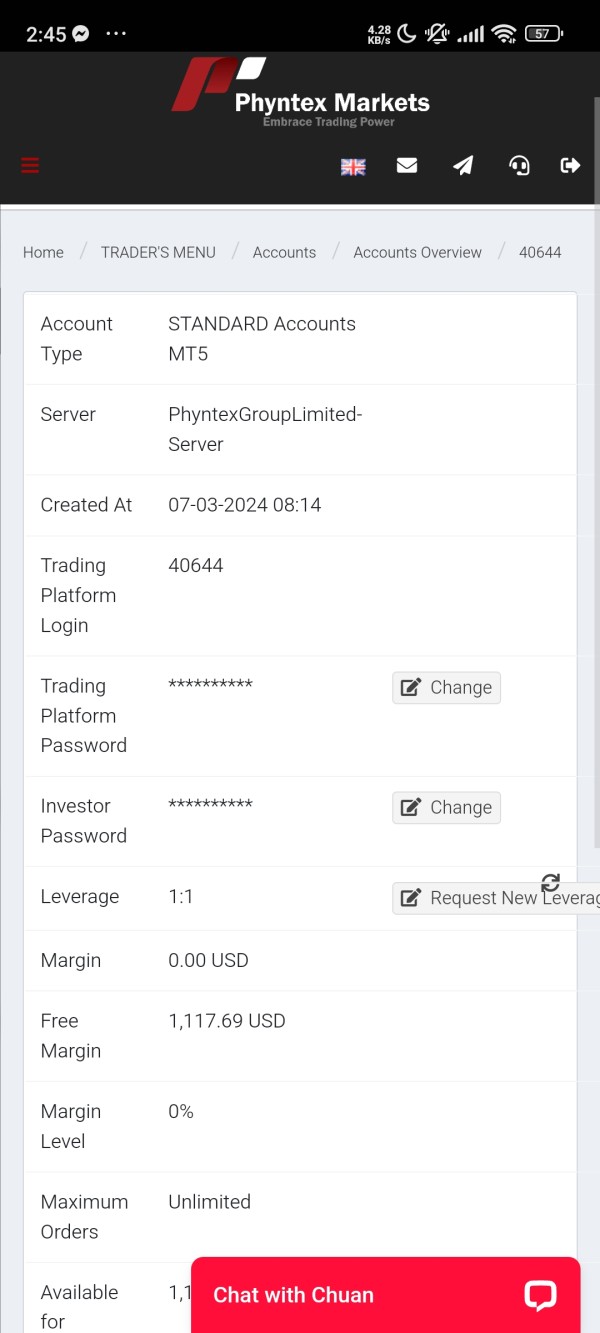

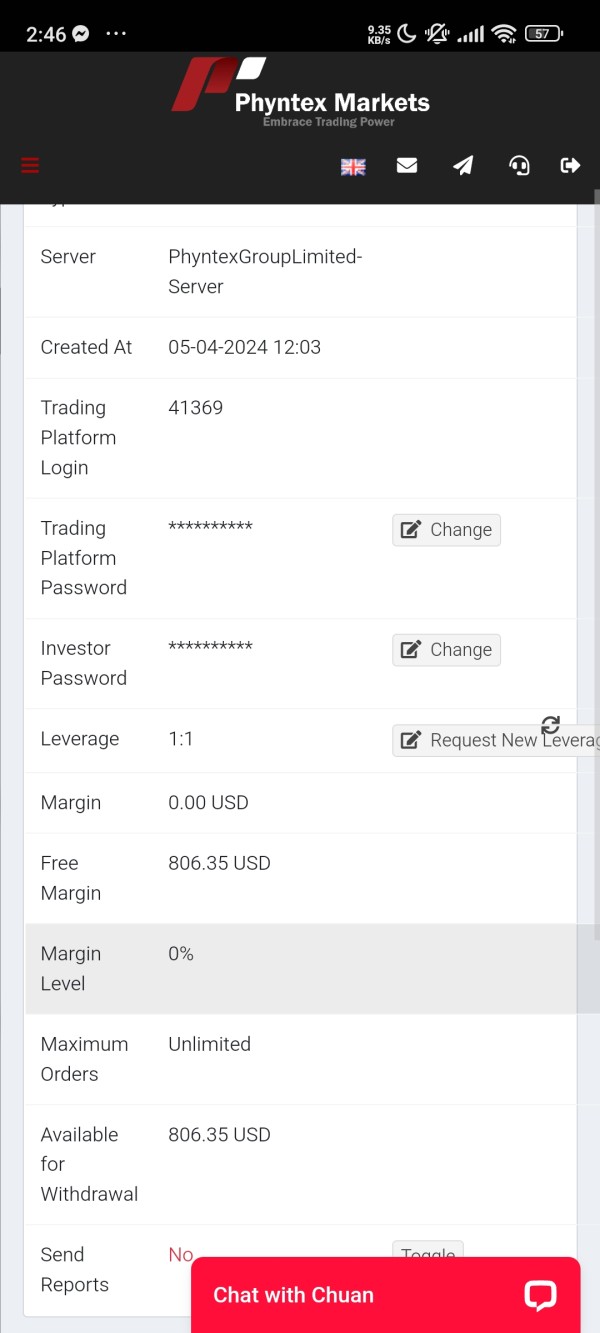

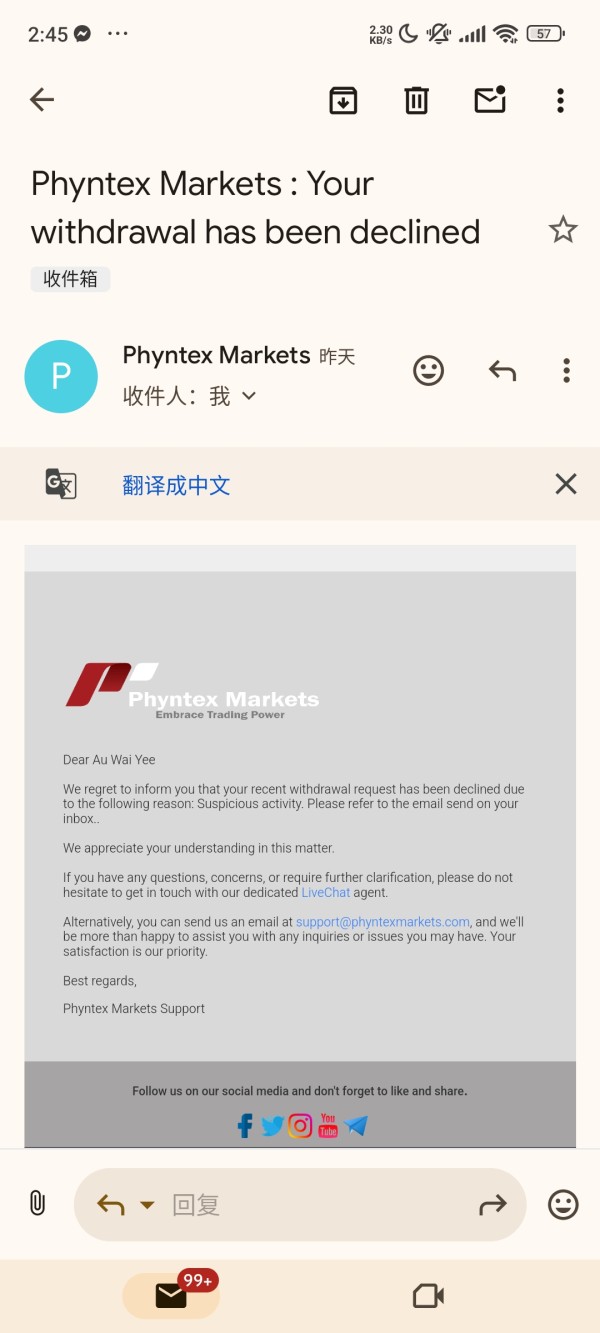

The specific deposit and withdrawal options remain undisclosed in the available data. This leaves potential clients without clear insight into transaction processes and associated speed or fees. Similarly, the minimum deposit requirement is not clearly defined in the current information, making it challenging for traders to understand the initial cost of opening a trading account. The broker does not offer detailed information on bonus promotions or other incentive schemes. This leaves a gap for clients who want to benefit from such offers.

Phyntex markets provides access to both forex pairs and a range of CFDs when it comes to tradeable assets. This allows traders to diversify their portfolios across various instruments. However, the cost structure, including spreads and commission fees, lacks clear disclosure, suggesting that these details require further confirmation from the broker's official documents.

One of the key selling points of the broker is its generous leverage, offering ratios as high as 1:3000. It is important to note that the actual leverage available to a client may vary depending on their location and regulatory rules. The trading platform choice is the MetaTrader 5 , a well-respected platform known for its advanced functionality and user-friendly interface.

Phyntex Markets currently limits its services by accepting only clients from Asia and the Pacific regions. This policy reflects its specific market focus yet limits its appeal for global traders. Additionally, the available information does not detail the customer service language options, leaving the extent of multilingual support uncertain. This phyntex markets review highlights both the technological strengths and the informational gaps that traders should be aware of.

Detailed Rating Analysis

1. Account Conditions Analysis

The account conditions for phyntex markets review remain one of the less detailed aspects in the broker's offering. There is no clear explanation about the variety of account types available or the features that may serve different trading styles as some competitors offer. The absence of specified minimum deposit requirements and detailed commission structures makes it harder to fully assess the account conditions. Compared to other brokers in the same market area, the lack of transparency about account setup and ongoing maintenance suggests that traders might face unexpected costs or delays. Additionally, there is no detailed outline of the account opening process, which leaves room for confusion about verification and compliance demands. Given the mixed customer feedback about account setups and the absence of specific incentives or tailored account options, this part of the service falls short of meeting the more complete standards set by industry leaders. Prospective users are thus advised to request further details directly from the broker to avoid potential problems.

Phyntex markets review benefits from its use of the MetaTrader 5 platform. This is a highly regarded tool in the industry that offers advanced charting, multiple technical indicators, and customizable interfaces for executing trades. The platform supports a broad range of tradeable instruments, specifically focusing on forex pairs and CFDs, which are essential for diversified trading strategies. Despite the advantages of using MT5, the broker's offering appears to be limited in terms of additional research and analysis tools. The provision of in-depth market research, trading signals, and educational resources remains unclear, which could put new traders at a disadvantage compared to competitors offering strong learning modules and timely market updates. While the automated trading capabilities are built into MT5, there is little information on whether phyntex markets uses these features to provide value-added services. Therefore, traders seeking extensive educational content or advanced analytical insights may need to rely on third-party sources. Overall, while the technological foundation is sound, the additional support tools and educational resources require enhancement for a more complete trading experience.

3. Customer Service and Support Analysis

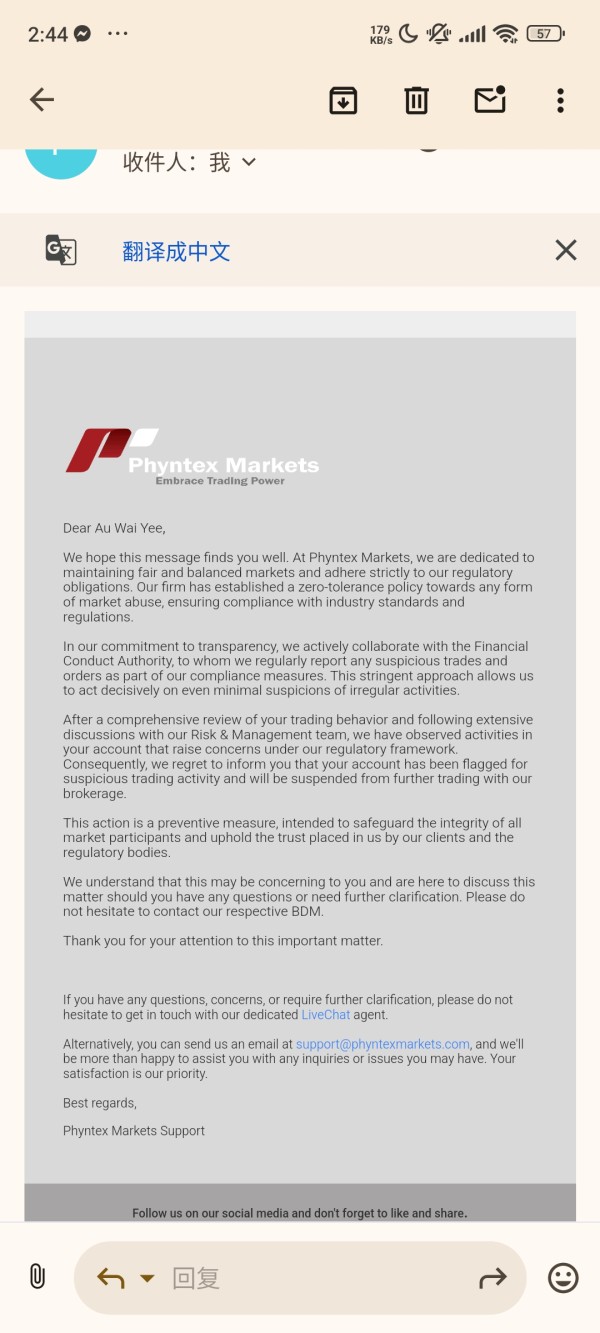

Customer service and support are critical for any trading platform. In the case of phyntex markets review, the broker offers 24/5 support channels. Although the promise of near-continuous availability is appealing, the actual response times and quality of assistance have received mixed reviews from current users. Some clients report that while general questions are addressed quickly, issues requiring complex problem-solving, particularly related to withdrawals and account verifications, sometimes remain unresolved for longer periods. The service is primarily delivered via standard communication channels; however, the absence of detailed information on the range of contact methods—such as chat, email, or telephone—and the languages supported further clouds the overall picture. Moreover, while the broker emphasizes quick handling of withdrawal requests, several reports from users indicate variability in the experience, especially during busy periods. This inconsistency, compared to industry standards, suggests that while the framework for customer support is in place, operational execution still needs improvement. Prospective traders should consider these factors carefully and think about reaching out for initial support tests before committing significant investments.

4. Trading Experience Analysis

The overall trading experience with phyntex markets review benefits from the strong MetaTrader 5 platform. This is a familiar and trusted tool among traders worldwide. Users have noted that the platform's interface is generally easy to use and allows for smooth navigation of charts, order placements, and technical analysis. However, despite these strengths, some aspects of the trading experience remain unclear. Specific details on order execution quality, such as slippage, re-quotes, and latency, are not thoroughly documented, leaving room for uncertainty about the consistency and reliability of trade executions during volatile market conditions. Additionally, while the platform has standard features expected from MT5, the absence of information on mobile trading experiences or any dedicated applications limits the broker's appeal for traders who prefer trading on the go. Furthermore, while the interface is praised for its usability, the lack of advanced customization options and a clearly defined cost structure—particularly regarding spreads and commission fees—could detract from the overall trading environment. Therefore, although the core platform functionality meets industry standards, a more detailed disclosure of execution performance metrics would be beneficial for traders aiming to optimize their strategies.

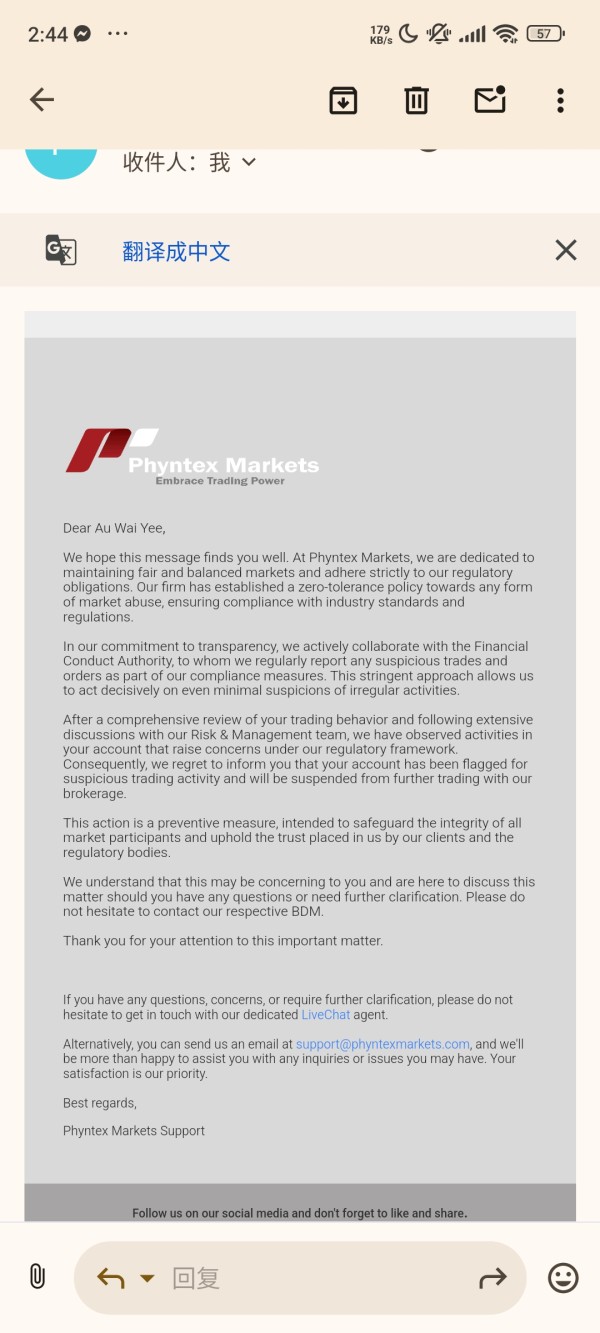

5. Trust Analysis

Trust remains a top concern for traders. In the case of phyntex markets review, this is where significant reservations arise. The broker operates under the regulatory oversight of the Mwali International Services Authority, with license numbers HY00823421 and T2023344; however, this single regulatory oversight does not offer the same level of reassurance as more globally recognized regulatory bodies. Several users have voiced concerns about the adequacy of fund protection measures and the overall transparency of the broker's operational practices. The current information does not detail specific measures for protecting client funds, such as account segregation or independent audits, which further increases skepticism. In a market where regulatory strength is often linked with investor safety, the absence of additional certifications or a broader regulatory framework has led to cautious assessments by potential clients. Industry comparisons show that while emerging brokers may initially rely on alternative regulatory bodies, sustained success and client confidence typically depend on moving towards more established supervisory frameworks. This trust deficit, as reflected in user feedback and market analysis, remains a significant hurdle that the broker needs to overcome to secure a more favorable reputation.

6. User Experience Analysis

The user experience with phyntex markets review shows a mix of good aspects and areas for improvement. On one hand, the MT5 platform is widely appreciated for its clean interface and ease of navigation, providing users with the essential tools needed to monitor market trends and execute trades efficiently. Many traders have praised the platform's design for its straightforward layout, which particularly benefits those who are new to trading. On the other hand, the process of registration and account verification has received criticism for lacking clear, step-by-step guidance, which sometimes leads to delays and frustration among users. Additionally, while the initial trading interface is easy to use, the absence of detailed documentation about funds transfer procedures—such as deposit processing times and withdrawal speed—has been noted as a shortcoming. Common user complaints often center around inconsistent customer service responses and unclear regulatory communications, which take away from the overall positive aspects of the platform. Although the broker has adopted a simple design approach, further improvements in process transparency and comprehensive support documentation would greatly improve overall user satisfaction.

Conclusion

In conclusion, phyntex markets emerges as a broker with clear potential, particularly designed for traders in the Southeast Asian market who want to use high leverage and the trusted MT5 platform. However, this phyntex markets review also highlights several areas that need improvement—primarily its limited regulatory oversight and the mixed feedback about customer service quality. While the broker does offer an appealing trading platform and asset flexibility, prospective users must weigh these advantages against the uncertainties in account conditions and overall transparency. Ultimately, phyntex markets may work well for traders comfortable with taking on additional regulatory risks in exchange for high leverage, but a careful approach is advised.