Regarding the legitimacy of NSFX forex brokers, it provides MFSA and WikiBit, (also has a graphic survey regarding security).

Is NSFX safe?

Pros

Cons

Is NSFX markets regulated?

The regulatory license is the strongest proof.

MFSA Market Making License (MM) 19

Malta Financial Services Authority

Malta Financial Services Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ALCHEMY MARKETS LTD.

Effective Date: Change Record

2012-11-23Email Address of Licensed Institution:

--Sharing Status:

Website of Licensed Institution:

https://nsfx.com/, https://alchemymarkets.com/eu/, https://nsbroker.com/Expiration Time:

--Address of Licensed Institution:

SUITE 124, SIGNATURE PORTOMASO , VJAL PORTOMASO SAN GILJAN Malta PTM 01Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is NSFX A Scam?

Introduction

NSFX is an online Forex and CFD broker based in Malta, known for providing trading services primarily in the European and Asian markets. Established in 2010, the broker positions itself as a provider of advanced trading technology and a range of financial instruments, including Forex pairs, commodities, and indices. With the proliferation of online trading platforms, it has become increasingly vital for traders to thoroughly evaluate the credibility and reliability of these brokers before committing their funds. This article aims to provide an objective assessment of NSFX by analyzing its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The findings are based on a comprehensive review of multiple credible sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and trustworthiness. NSFX is regulated by the Malta Financial Services Authority (MFSA), which is a tier-3 regulatory body. While it is essential for brokers to be regulated, the quality and strictness of the regulatory framework play a significant role in ensuring client protection. Below is a summary of NSFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Malta Financial Services Authority (MFSA) | IS/56519 | Malta | Verified |

The MFSA oversees financial services in Malta and implements regulations to protect consumers and maintain the integrity of financial markets. However, it is worth noting that while MFSA regulation provides a level of oversight, it does not match the stringent standards of tier-1 regulators such as the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Additionally, NSFX has faced scrutiny regarding its compliance history, with some reports indicating potential issues related to client fund withdrawals and customer service responsiveness. This raises questions about the broker's operational integrity and adherence to regulatory standards.

Company Background Investigation

NSFX was founded in 2010 by a group of finance professionals aiming to create a regulated trading environment. The company is headquartered in Valletta, Malta, and operates under the legal entity NSFX Limited. Over the years, the broker has expanded its services to cater to a diverse range of traders, from novices to experienced professionals. The management team is comprised of individuals with extensive backgrounds in finance, trading, and technology, which enhances the broker's credibility.

Transparency is a key aspect of NSFX's operations, as the company provides detailed information about its services, trading conditions, and regulatory compliance on its website. However, the broker has faced criticism regarding its communication practices and responsiveness to client inquiries. While NSFX appears to maintain a commitment to transparency, the effectiveness of its information disclosure and the clarity of its operational practices remain areas of concern.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is crucial for assessing potential profitability and cost-effectiveness. NSFX offers a variety of account types, including standard and ECN accounts, with varying spreads and commission structures. The overall fee structure is as follows:

| Fee Type | NSFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3.0 pips | 1.0-1.5 pips |

| Commission Structure | $8 per lot (ECN) | $4.5 per lot |

| Overnight Interest Range | Varies | Varies |

The broker's spreads, particularly on the standard account, are relatively high compared to industry averages, which could impact profitability, especially for frequent traders. The commission structure for ECN accounts is also on the higher side, potentially deterring traders who rely on tight spreads for active trading strategies. Additionally, NSFX charges a withdrawal fee of 2.9% for certain payment methods, which is above the industry standard where many brokers offer fee-free withdrawals. These factors may lead to increased trading costs for clients, warranting careful consideration before opening an account.

Client Fund Safety

Client fund safety is paramount in the Forex trading environment. NSFX implements several measures to protect client funds, including the segregation of client accounts, negative balance protection, and participation in the Maltese investor compensation scheme. Under this scheme, qualifying clients may receive compensation of up to €20,000 in the event of broker insolvency. However, the effectiveness of these measures has been questioned in light of past complaints regarding withdrawal delays and issues with accessing funds.

In terms of fund segregation, NSFX claims to keep client funds separate from its operational funds, which is a standard practice among regulated brokers. This segregation is critical in ensuring that client funds are protected even in the event of financial difficulties faced by the broker. However, the broker's history of customer complaints raises concerns about the actual implementation of these safety measures.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. NSFX has received mixed reviews from users, with some praising its trading conditions and platform performance, while others have raised concerns about withdrawal issues and customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

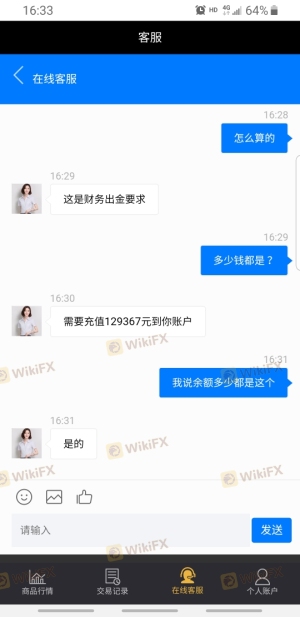

| Withdrawal Delays | High | Slow response, often requiring multiple follow-ups |

| Customer Support | Medium | Limited availability, inconsistent responses |

| Spread Misalignment | Low | Occasional discrepancies reported |

One notable case involved a trader who experienced significant delays in fund withdrawals, claiming to have submitted multiple requests without resolution. This situation highlights potential weaknesses in NSFX's customer support and operational efficiency. While some users report positive experiences, the recurring nature of withdrawal complaints suggests that potential clients should exercise caution.

Platform and Trade Execution

NSFX offers two primary trading platforms: MetaTrader 4 and its proprietary JForex platform. Both platforms are known for their stability and user-friendly interfaces. However, the execution quality has been a point of contention. Traders have reported instances of slippage and delays in order execution, which can significantly impact trading outcomes, particularly in volatile market conditions.

The broker's order execution policies are designed to provide competitive pricing and fast execution speeds. However, the presence of slippage during high-impact news events raises concerns about the platform's reliability. Additionally, there have been anecdotal reports suggesting potential manipulation of spreads during periods of low liquidity, which could further exacerbate trading risks for clients.

Risk Assessment

Using NSFX comes with a range of risks that potential traders should consider. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated by a tier-3 authority, raising concerns about compliance and client protection. |

| Financial Risk | Medium | High spreads and withdrawal fees may affect profitability and access to funds. |

| Operational Risk | High | Complaints regarding withdrawal delays and customer support responsiveness. |

To mitigate these risks, traders are advised to conduct thorough research, start with a demo account, and be cautious with fund amounts deposited. Additionally, maintaining a diversified trading strategy can help manage exposure to potential losses.

Conclusion and Recommendations

In conclusion, while NSFX is a regulated broker with a decade of operational history, several factors warrant caution. The broker's tier-3 regulatory status, high trading costs, and recurring customer complaints about fund withdrawals raise significant concerns about its reliability. Although NSFX implements measures for client fund safety, the effectiveness of these measures has been questioned based on user feedback.

For traders considering NSFX, it is advisable to approach with caution, particularly if they are risk-averse or new to trading. Those seeking more robust regulatory protections and better trading conditions may wish to explore alternatives such as brokers regulated by tier-1 authorities like the FCA or ASIC. Ultimately, thorough due diligence and a careful assessment of personal trading needs are essential before engaging with this broker.

Is NSFX a scam, or is it legit?

The latest exposure and evaluation content of NSFX brokers.

NSFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NSFX latest industry rating score is 4.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.