NSFX 2025 Review: Everything You Need to Know

Summary

NSFX is a regulated broker that has garnered mixed reviews from users, highlighting both its strengths and weaknesses. While it offers competitive trading conditions, including a variety of account types and access to popular platforms like MT4 and JForex, there are notable concerns regarding withdrawal processes and customer service experiences.

Note: Its important to recognize that NSFX operates under different regulatory entities across regions, which can influence the trading experience. The assessment methods employed ensure fairness and accuracy in the evaluation of this broker.

Rating Overview

We evaluate brokers based on a comprehensive analysis of user feedback, expert opinions, and factual data.

Broker Overview

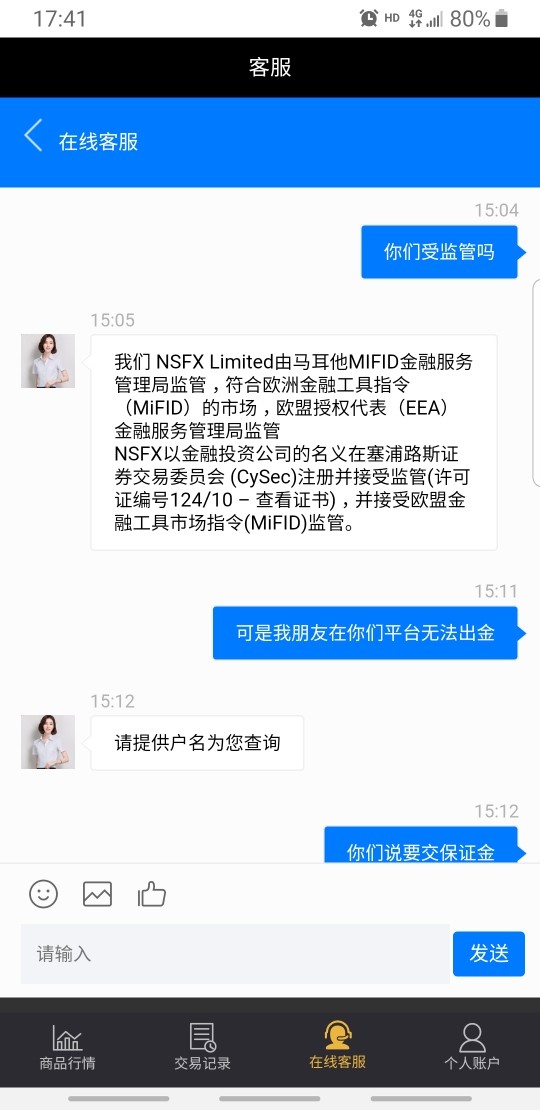

Founded in 2010, NSFX is based in Malta and is regulated by multiple authorities, including the Malta Financial Services Authority (MFSA) and BaFin in Germany. The broker offers access to a variety of trading platforms, such as MetaTrader 4 (MT4) and JForex, catering to different trading styles. Traders can engage in forex, indices, and commodities trading, although cryptocurrency trading is currently not supported.

Regulated Areas

NSFX is regulated in multiple jurisdictions, including Malta, Germany, France, Spain, and Denmark. This multi-jurisdictional regulation provides a layer of security for traders, ensuring compliance with European standards.

Deposit/Withdrawal Currencies

The broker supports deposits and withdrawals in USD, EUR, and GBP. However, it does not currently offer cryptocurrency transactions.

Minimum Deposit

The minimum deposit required to open an account with NSFX is $300, which is relatively standard compared to other brokers.

NSFX does not offer any welcome bonuses or promotions at this time, which may be a drawback for traders looking for incentives.

Tradable Asset Classes

Traders can access a range of assets, including over 50 forex pairs, indices, and commodities such as gold and silver. However, the absence of cryptocurrencies may limit options for some traders.

Costs (Spreads, Fees, Commissions)

NSFX offers both fixed and variable spreads depending on the account type. The MT4 fixed account has spreads starting at 3.0 pips, while the MT4 ECN account features variable spreads from 0.6 pips, with a commission of $8 per lot. This pricing structure is competitive but may be higher than some other brokers.

Leverage

The maximum leverage offered by NSFX is 1:50, which is in line with European regulations but may be considered low by traders looking for higher leverage options.

Traders can use MT4 and JForex platforms, both of which are well-regarded in the industry. However, some users have noted that the interfaces could be more modern and user-friendly.

Restricted Regions

NSFX does not accept clients from the United States, which is a common restriction among many brokers due to regulatory concerns.

Available Customer Service Languages

Customer support is available in multiple languages, including English, German, Spanish, and French, with support accessible via email, live chat, and phone.

Repeat Rating Overview

Detailed Breakdown

Account Conditions

NSFX offers three main account types: MT4 Fixed, MT4 ECN, and JForex. The MT4 Fixed account has a minimum deposit of $300 and offers fixed spreads, making it suitable for traders who prefer predictable costs. The MT4 ECN account requires a $3,000 deposit and provides variable spreads but incurs a commission, which might not appeal to all traders. The JForex account, requiring a minimum of $5,000, is designed for algorithmic trading and offers advanced features but may be inaccessible for novice traders.

The broker provides a variety of tools, including technical analysis resources and economic calendars, which can enhance trading decisions. The partnership with Trading Central adds value through market insights and analysis. However, the overall educational resources could be expanded to better support novice traders.

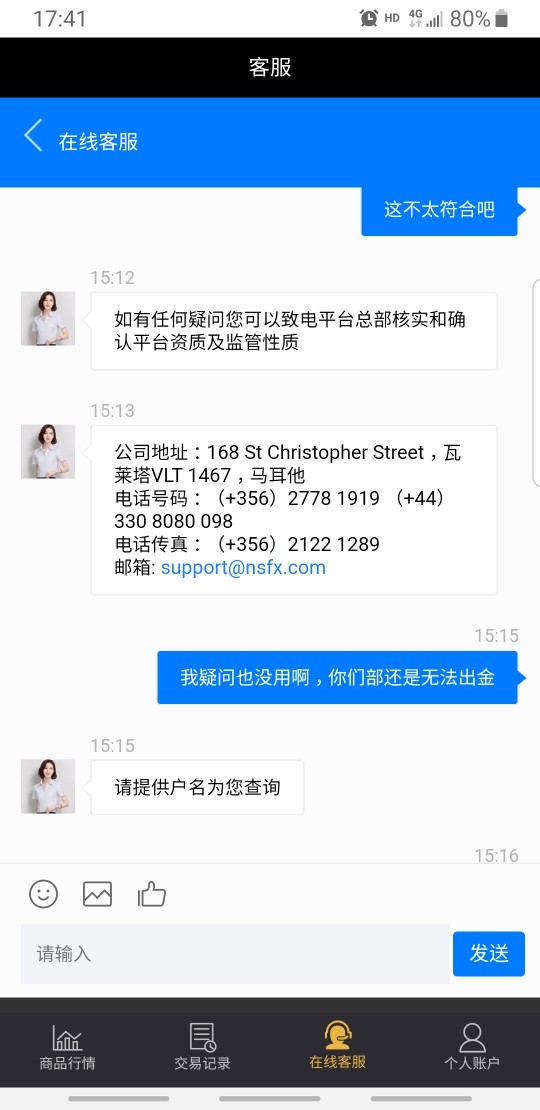

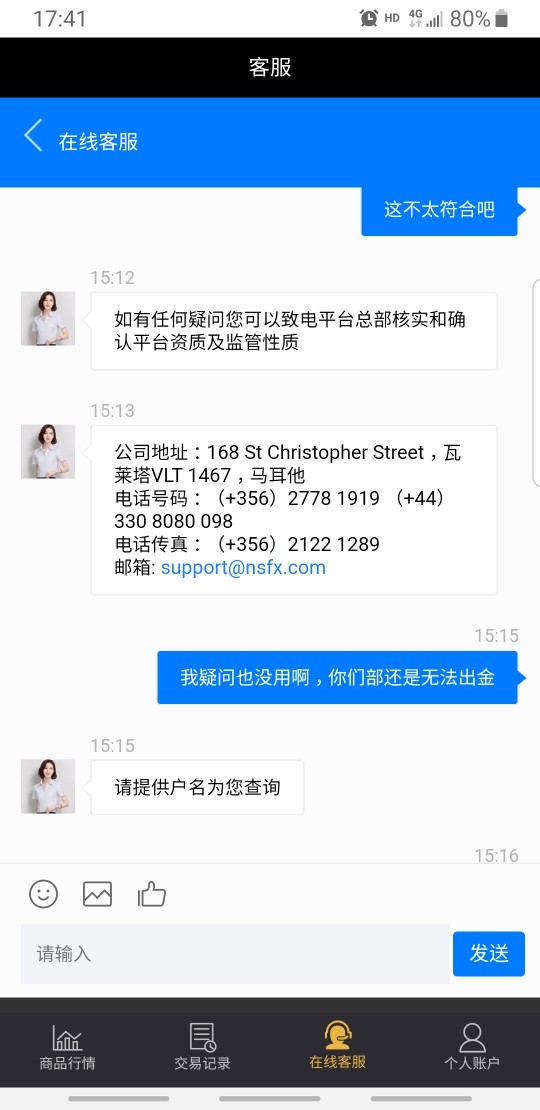

Customer Service and Support

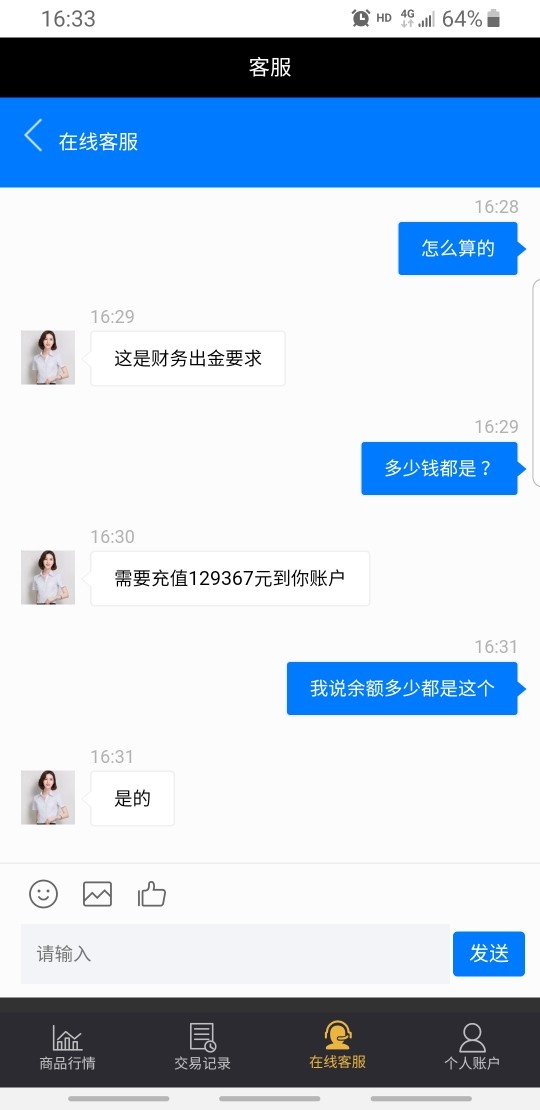

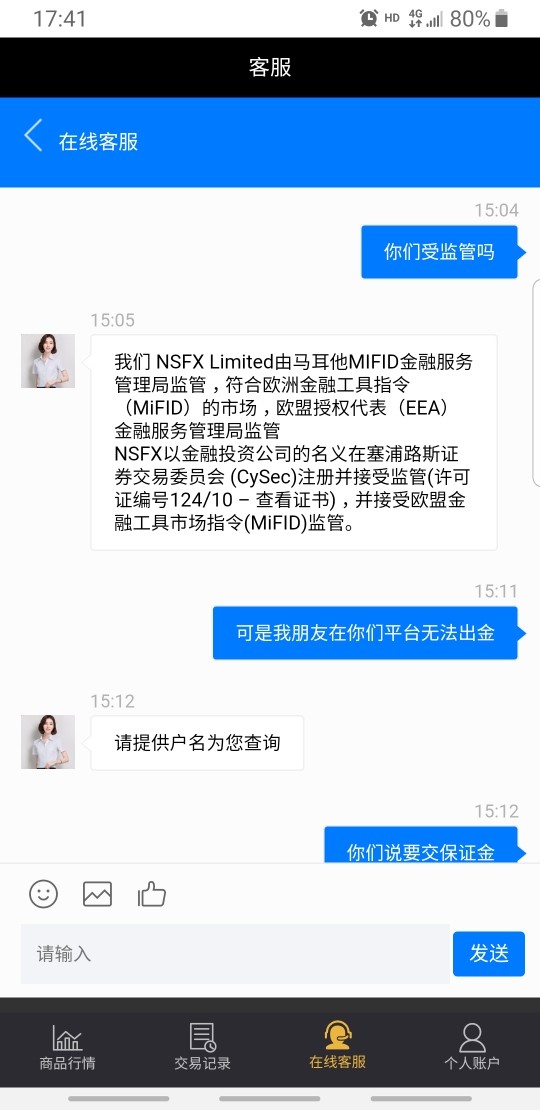

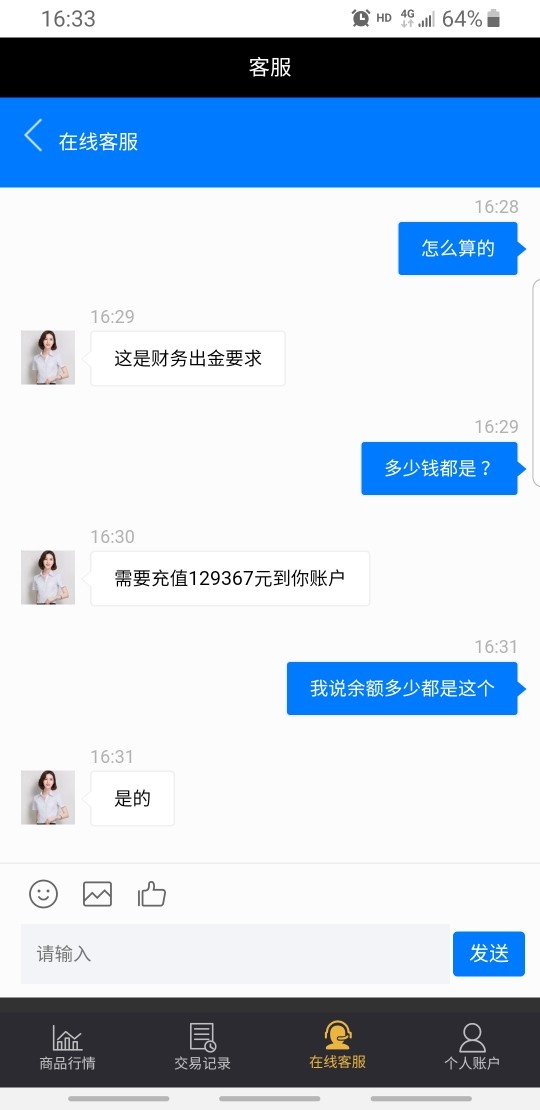

User feedback indicates that customer service is a significant area for improvement. Many users have reported delays in responses and issues with withdrawals, which can undermine trust. Although support is available in multiple languages, the effectiveness and speed of service need enhancement.

Trading Experience

The trading experience is generally positive, with competitive spreads and access to reliable platforms. However, some users have reported difficulties with order execution speeds and withdrawal processes, which can detract from the overall trading experience.

Trustworthiness

NSFX is regulated by several authorities, which adds to its credibility. However, some users have expressed concerns regarding withdrawal issues and the responsiveness of customer service, suggesting that while the broker is legitimate, there are areas that require attention to improve trust.

User Experience

Overall, the user experience is mixed. While the trading platforms are functional and provide essential tools, the outdated interfaces and reported customer service issues may lead to frustration for some users.

In conclusion, NSFX presents a solid choice for traders seeking a regulated environment with access to multiple trading platforms and asset classes. However, potential clients should weigh the reported withdrawal issues and customer service experiences before committing to this broker.