Regarding the legitimacy of MarketsVox forex brokers, it provides FSA and WikiBit, .

Is MarketsVox safe?

Pros

Cons

Is MarketsVox markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MarketsVox (SC) Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.marketsvox.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 8G, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373790Licensed Institution Certified Documents:

Is MarketsVox A Scam?

Introduction

MarketsVox, a forex broker that emerged from the rebranding of ForexVox, positions itself as a competitive player in the online trading landscape. Operating under the Financial Services Authority (FSA) of Seychelles, it offers a variety of trading instruments, including forex, indices, commodities, and metals. Given the volatile nature of the forex market, traders must exercise caution when selecting a broker, as the wrong choice could lead to substantial financial losses. This article aims to provide an objective analysis of MarketsVox, evaluating its regulatory status, company background, trading conditions, client security, customer experiences, platform performance, and associated risks. The investigation is based on a review of multiple credible sources, including user reviews, regulatory information, and expert assessments.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its reliability and safety for traders. MarketsVox operates under the regulation of the Financial Services Authority (FSA) in Seychelles, which is considered a tier-3 regulatory body. While the FSA provides a level of oversight, it lacks the stringent requirements and investor protection schemes found in tier-1 jurisdictions such as the FCA (UK) or ASIC (Australia).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | SD 142 | Seychelles | Verified |

Despite being regulated, the FSA does not offer the same level of investor protection as more established regulators. This raises concerns about the broker's ability to safeguard client funds. Moreover, the historical compliance of MarketsVox has not been extensively documented, which further complicates the trustworthiness of the broker. Although there are no recorded instances of MarketsVox failing to meet its obligations, the inherent risks associated with trading with a broker regulated by a less stringent authority should not be overlooked.

Company Background Investigation

MarketsVox, originally known as ForexVox, was established in 2019 and is registered in Seychelles. The company was founded by a team of experienced traders with a shared vision to democratize access to trading tools and knowledge that were previously reserved for larger investment banks. However, the transition from ForexVox to MarketsVox raises questions about the continuity of management and operational practices.

The management team's background is crucial in assessing the broker's credibility. While specific details about the founders and their professional experience are somewhat limited, the emphasis on trader education and support suggests a commitment to fostering a knowledgeable trading environment. However, the lack of transparency regarding the ownership structure and operational history may deter potential clients from trusting the broker fully.

In terms of information disclosure, MarketsVox provides basic details about its services and regulatory status on its website. However, the absence of comprehensive information about its operational practices and management team can hinder potential clients' ability to make informed decisions.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. MarketsVox offers a range of account types, including standard, ECN, and cent accounts, with a minimum deposit requirement of $100. The broker claims to provide competitive spreads and high leverage options, with maximum leverage reaching up to 1:2000.

However, the fee structure is not entirely transparent. Traders have reported varying experiences with spreads and commissions, leading to questions about the consistency of trading costs.

| Fee Type | MarketsVox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 0.3-1.0 pips |

| Commission Model | Varies by account type | Standardized across the industry |

| Overnight Interest Range | Varies | Varies |

The spread on major currency pairs is reported to be competitive, starting at 0.2 pips for standard accounts. However, there are concerns regarding the commission structure for ECN accounts, which may not be as favorable as advertised. The inconsistency in fee structures and the potential for hidden costs could pose challenges for traders seeking to manage their trading expenses effectively.

Client Funds Security

The safety of client funds is paramount when choosing a broker. MarketsVox claims to implement several security measures, including segregated accounts for client funds and negative balance protection. This means that clients cannot lose more than their initial investment, which is a positive aspect of the broker's risk management practices.

However, the level of investor protection provided by the FSA in Seychelles is limited compared to tier-1 regulators. There is no specific compensation scheme in place to protect clients in the event of broker insolvency, which raises concerns about the overall safety of funds. Additionally, there have been no reported incidents of fund mismanagement or security breaches, but the lack of historical data on this aspect leaves some uncertainty.

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability and service quality. Reviews of MarketsVox reveal a mixed bag of experiences. While some users praise the broker for its responsive customer support and user-friendly platform, others have reported issues with withdrawal processes and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Lack of Transparency | Medium | Limited engagement |

| High Inactivity Fees | Medium | Addressed occasionally |

One common complaint involves delays in processing withdrawals, which can be a significant red flag for potential clients. Users have expressed frustration over the time taken to access their funds, which can lead to a lack of trust in the broker's operational integrity.

Additionally, the company's response to complaints has been inconsistent, with some users reporting satisfactory resolutions while others feel their concerns were not adequately addressed. This inconsistency in customer service can impact the overall user experience and trust in the broker.

Platform and Trade Execution

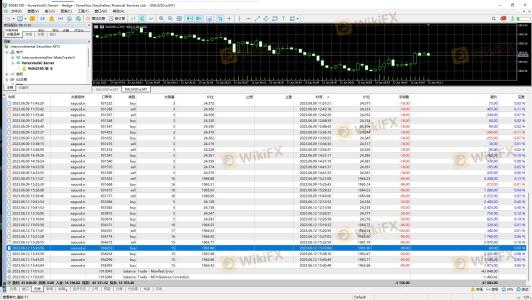

Evaluating the trading platform's performance is critical for traders. MarketsVox utilizes the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. The platform supports various trading strategies, including automated trading through Expert Advisors (EAs).

Traders have generally reported positive experiences with MT5, citing its reliability and comprehensive toolset. However, there are concerns regarding order execution quality, with some users experiencing slippage and requotes during volatile market conditions.

The broker's commitment to maintaining a stable trading environment is essential, as any signs of platform manipulation could severely impact traders' trust. While there have been no widespread reports of such issues, the potential for slippage and execution delays should be acknowledged.

Risk Assessment

Using MarketsVox comes with inherent risks that traders should consider. The combination of high leverage, regulatory concerns, and mixed customer feedback contributes to a complex risk landscape.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under tier-3 regulation |

| Trading Costs | Medium | Potential for hidden fees |

| Customer Support Reliability | Medium | Mixed feedback on responsiveness |

| Platform Stability | Medium | Occasional execution issues |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and implement effective risk management strategies, such as setting stop-loss orders and limiting exposure to high-leverage trades.

Conclusion and Recommendations

In conclusion, MarketsVox presents a mixed picture. While the broker offers competitive trading conditions, a user-friendly platform, and some level of regulatory oversight, significant concerns remain regarding its regulatory status, customer experiences, and potential hidden fees.

Traders should approach MarketsVox with caution, particularly if they are risk-averse or new to the forex market. It may be advisable to explore alternative brokers with stronger regulatory frameworks and a proven track record of customer satisfaction. Some recommended alternatives include brokers regulated by tier-1 authorities such as FCA or ASIC, which provide higher levels of investor protection and transparency.

Ultimately, conducting due diligence and remaining vigilant is crucial for any trader considering MarketsVox or similar brokers in the ever-evolving forex landscape.

Is MarketsVox a scam, or is it legit?

The latest exposure and evaluation content of MarketsVox brokers.

MarketsVox Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MarketsVox latest industry rating score is 4.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.