Is InbaseTrader safe?

Software Index

License

Is InbaseTrader A Scam?

Introduction

InbaseTrader is a relatively new entrant in the forex trading market, claiming to offer a variety of trading services across multiple asset classes, including forex, commodities, stocks, and cryptocurrencies. As with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is notorious for scams and unregulated brokers, making it imperative for investors to assess the legitimacy and safety of their chosen brokers carefully. This article aims to evaluate InbaseTrader's credibility by investigating its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a review of multiple sources, including regulatory bodies, user feedback, and expert analyses.

Regulation and Legitimacy

One of the most critical aspects of assessing a forex broker's legitimacy is its regulatory status. Regulation serves as a safety net, ensuring that brokers adhere to certain standards and protect clients' funds. InbaseTrader claims to be regulated by several authorities, including the National Futures Association (NFA) in the United States, the Financial Transactions and Reports Analysis Centre (FINTRAC) in Canada, and the Australian Securities and Investments Commission (ASIC). However, upon closer inspection, these claims appear to be misleading.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| NFA | 0557016 | USA | Not Regulated |

| FINTRAC | - | Canada | No Record Found |

| ASIC | 001305305 | Australia | Limited Authority |

The NFA has confirmed that InbaseTrader is not a member, and there is no record of its registration with FINTRAC. While ASIC does recognize InbaseTrader under a limited capacity, this does not grant it the right to conduct retail forex trading. This lack of robust regulation raises significant concerns about the broker's legitimacy and the safety of client funds.

Company Background Investigation

InbaseTrader operates under the entity name Inbase Holding Limited, which was registered in August 2023. However, the company claims to have been in operation since 2005, a statement that lacks verifiable support. The discrepancies between its claimed history and actual registration details suggest a lack of transparency and possibly deceptive practices.

The management team behind InbaseTrader appears to be anonymous, with no publicly available information regarding their professional backgrounds or experience in the financial sector. This anonymity is a red flag, as reputable brokers typically provide information about their leadership and operational teams. The overall transparency level of the company is low, which could hinder potential investors from making informed decisions.

Trading Conditions Analysis

Understanding the trading conditions offered by InbaseTrader is crucial for potential investors. The broker offers various trading instruments, but the specific costs associated with trading remain unclear. A lack of transparency regarding fees can be indicative of potential scams.

| Fee Type | InbaseTrader | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | 0-10% |

| Overnight Interest Range | Not disclosed | 0.5-3% |

The absence of clear information regarding spreads, commissions, and overnight fees raises concerns about the broker's operating practices. Traders should be wary of hidden fees that could significantly impact their profitability.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a forex broker. InbaseTrader claims to implement various safety measures, including fund segregation and negative balance protection. However, the lack of robust regulatory oversight casts doubt on the effectiveness of these measures.

There have been no significant historical issues reported regarding fund safety, but the lack of a compensation scheme or insurance for clients further exacerbates concerns. Without adequate regulatory protection, clients funds may not be secure, leading to potential losses in the event of broker insolvency.

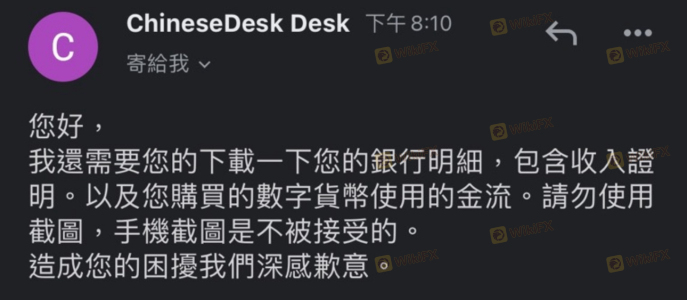

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of InbaseTrader reveal a mixed bag of experiences, with several users expressing dissatisfaction regarding withdrawal processes and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow to respond |

| Poor Customer Support | Medium | Inconsistent |

| Hidden Fees | High | No clear response |

Typical complaints include delays in fund withdrawals and unresponsive customer service, both of which are critical issues for any trading platform. For example, one user reported that their withdrawal request took an unusually long time to process, raising concerns about the broker's reliability.

Platform and Execution

InbaseTrader utilizes the cTrader platform, which is known for its user-friendly interface and advanced trading capabilities. However, user experiences with execution quality have been mixed. Reports of slippage and rejected orders have surfaced, which can significantly affect trading outcomes.

Traders have noted instances where market orders were not executed at the expected prices, leading to increased costs and frustration. Such issues can indicate potential manipulation or inefficiencies within the trading platform, further undermining trust in the broker.

Risk Assessment

Engaging with InbaseTrader presents several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of solid regulatory oversight |

| Fund Safety Risk | High | Potential for fund mismanagement |

| Execution Risk | Medium | Reports of slippage and order rejections |

| Customer Service Risk | Medium | Inconsistent responses to complaints |

To mitigate these risks, traders are advised to approach InbaseTrader with caution. It is recommended to withdraw funds regularly and avoid investing large sums until the broker demonstrates a consistent track record of reliability.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that InbaseTrader exhibits several characteristics commonly associated with scam brokers. The lack of robust regulation, questionable claims regarding its history, and numerous customer complaints raise significant red flags.

For traders seeking a reliable platform, it is advisable to consider well-regulated brokers with transparent practices and positive user feedback. Alternatives such as brokers regulated by tier-1 authorities like the FCA or ASIC should be prioritized. Ultimately, traders should exercise extreme caution and conduct thorough research before committing any funds to InbaseTrader or similar platforms.

Is InbaseTrader a scam, or is it legit?

The latest exposure and evaluation content of InbaseTrader brokers.

InbaseTrader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

InbaseTrader latest industry rating score is 1.90, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.90 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.