InbaseTrader 2025 Review: Everything You Need to Know

InbaseTrader has garnered a mix of skepticism and concern since its inception. This review synthesizes insights from various sources, revealing significant red flags regarding its regulatory status and user experiences. Key findings indicate that while it offers a range of trading instruments, its legitimacy is highly questionable.

Note: It is crucial to recognize that InbaseTrader operates under multiple entities across different regions, which complicates its regulatory standing. This review aims to present a fair and accurate assessment based on available data.

Rating Summary

How We Rate Brokers: Ratings are based on a combination of user reviews, expert opinions, and factual data regarding services offered.

Broker Overview

InbaseTrader, operated by Inbase Holding Limited, claims to have been established in 2005, yet its domain was registered only in June 2023. The company purports to offer a variety of trading services, including forex, stocks, indices, cryptocurrencies, and commodities. It primarily utilizes the cTrader platform for trading, which, while reputable, raises questions about the broker's overall integrity given its dubious regulatory claims.

In terms of regulation, InbaseTrader asserts compliance with several authorities, including the NFA in the United States, the MSB in Canada, and ASIC in Australia. However, investigations reveal that these claims are largely unfounded, with the NFA explicitly stating that InbaseTrader is not a member.

Detailed Analysis

Regulatory Status

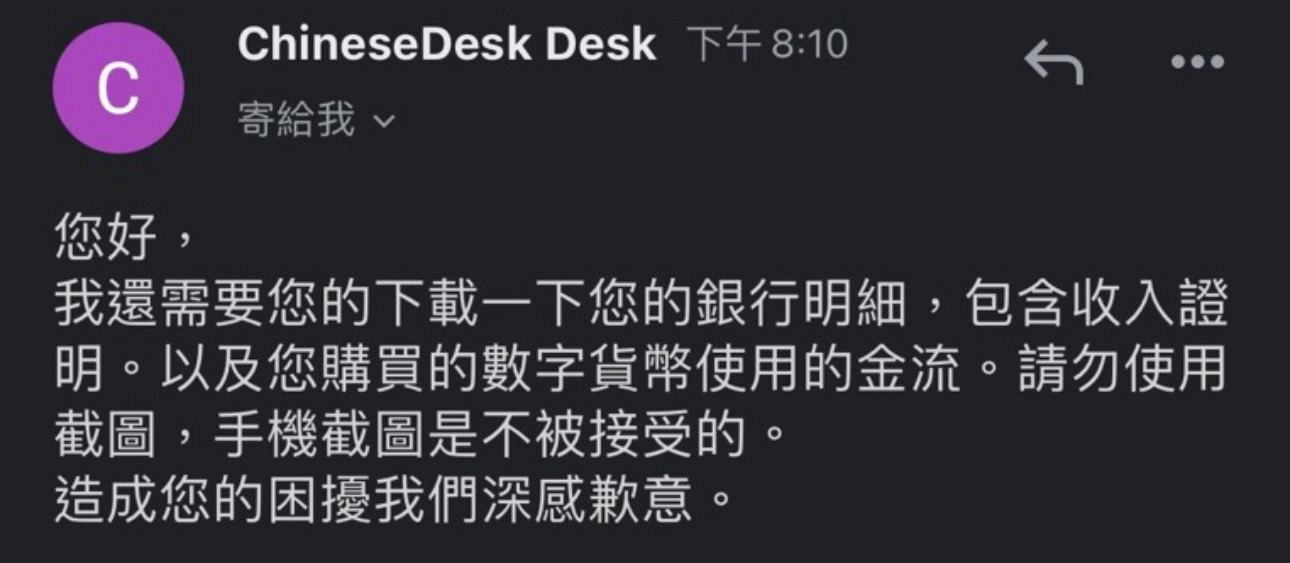

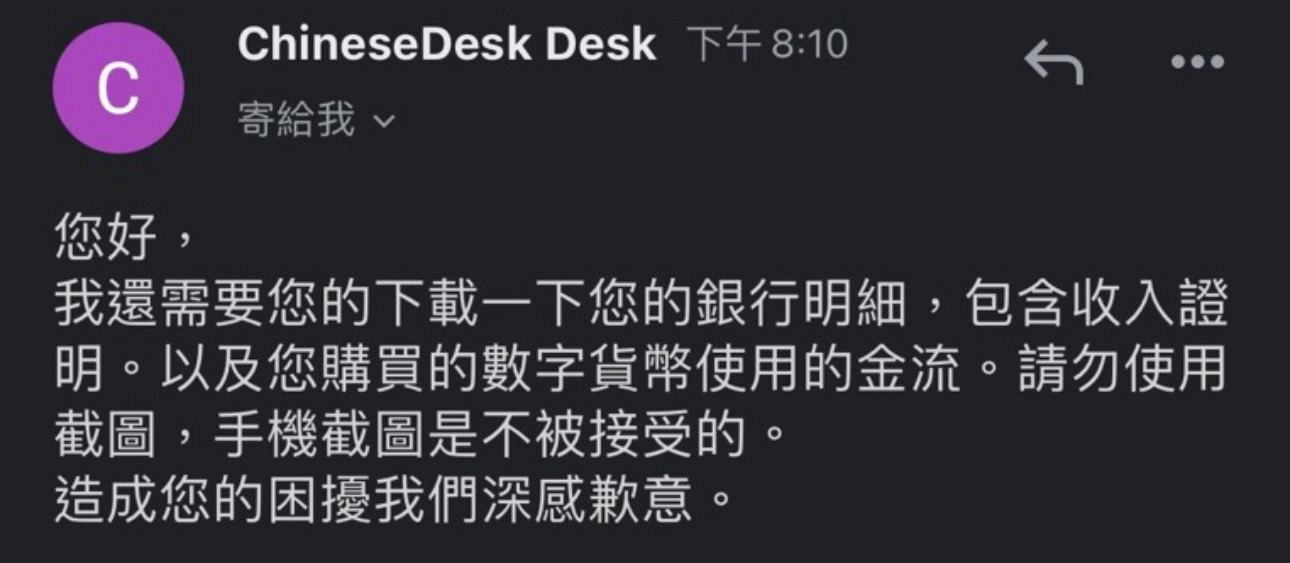

InbaseTrader operates under the guise of being regulated by multiple entities, including the National Futures Association (NFA) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, these claims are misleading. According to multiple sources, including TraderKnows, InbaseTrader is not listed as a member of the NFA, and there is no verifiable information regarding its registration with FINTRAC. The only regulatory connection appears to be with ASIC, which has authorized a related entity that does not grant retail forex trading permissions.

Deposit and Withdrawal Policies

InbaseTrader does not provide clear information regarding deposit and withdrawal procedures. Reports suggest that while the platform claims swift processing times, many users have experienced delays. For instance, one user noted that withdrawal requests were not processed as quickly as advertised, contradicting the broker's claims of ten-minute processing times. Additionally, the absence of transparency regarding fees and processing times raises concerns about potential hidden costs.

Trading Instruments

InbaseTrader offers a variety of trading instruments, including forex pairs, commodities like gold and crude oil, and cryptocurrencies such as Bitcoin and Ethereum. However, the lack of clarity regarding leverage options and trading conditions casts doubt on the overall trading experience. Reports indicate that the broker does not disclose crucial information such as spreads and commissions, which is a significant concern for potential traders.

Customer Service

Customer service for InbaseTrader is available 24/5, with multiple channels for support, including live chat and email. While some users have reported satisfactory experiences with the support team, others have expressed frustration over slow response times and unfulfilled promises regarding withdrawal processing. This inconsistency suggests that while customer service may be responsive at times, it does not meet the expectations set by the broker.

User Experience

The user experience on InbaseTrader's platform has been described as mixed. While some users appreciate the user-friendly interface of the cTrader platform, others have reported technical issues and slow performance. The overall sentiment leans towards caution, with many users expressing skepticism about the broker's legitimacy and operational integrity.

Pros and Cons

Pros:

- A wide range of trading instruments available.

- User-friendly cTrader platform.

- 24/5 customer support.

Cons:

- Dubious regulatory claims.

- Lack of transparency regarding fees and trading conditions.

- Mixed user experiences with withdrawals and technical issues.

Conclusion

InbaseTrader presents a complex picture for potential investors. While it offers a variety of trading options through a user-friendly platform, its regulatory status is highly questionable, and user experiences reflect significant concerns about its integrity. Traders are advised to exercise extreme caution and conduct thorough research before engaging with this broker. The absence of credible regulatory oversight and the mixed reviews from users highlight the importance of choosing a reputable and licensed brokerage for trading activities.