Is Global Next Trade safe?

Software Index

License

Is Global Next Trade A Scam?

Introduction

Global Next Trade is a forex broker that has positioned itself in the competitive online trading market, primarily targeting traders in regions such as Brazil, China, and the United States. Established in 2018, the broker offers a variety of trading instruments, including forex pairs, commodities, and indices. However, the lack of regulatory oversight raises significant concerns about the safety and legitimacy of trading with them. It is crucial for traders to conduct thorough evaluations of forex brokers to protect their investments and ensure they are trading with a reputable entity. This article investigates Global Next Trades regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks to determine whether it is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. Global Next Trade operates without regulation from any recognized financial authority, which is a significant red flag for potential investors. The absence of regulatory oversight means that there are no safeguards in place to protect traders funds or ensure fair trading practices.

Here is a summary of the broker's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation implies that Global Next Trade does not adhere to the stringent compliance and transparency standards that regulated brokers must follow. This absence of oversight can leave traders vulnerable to fraudulent activities and makes it challenging to seek recourse in the event of disputes. Additionally, the broker's registration in offshore jurisdictions, such as Saint Vincent and the Grenadines, further complicates the situation, as these locations are often associated with lax regulatory environments.

Company Background Investigation

Global Next Trade, owned by GNT Capital Ltd., has a relatively brief history in the forex market. Founded in 2018, the company has not yet established a track record that demonstrates resilience through market fluctuations or crises. The ownership structure remains opaque, which raises concerns about accountability and the ability to address client grievances effectively.

The management team‘s background is another area of concern. Information on the team’s professional experience is limited, which could indicate a lack of expertise in the financial services industry. Transparency in company operations is vital for building trust with clients, and Global Next Trades limited disclosure raises questions about its commitment to ethical business practices.

The lack of comprehensive information regarding the companys history and management can deter potential clients, as it suggests a lack of accountability and reliability. In an industry where trust is paramount, the absence of clear communication and transparency can be detrimental to a broker's reputation.

Trading Conditions Analysis

When evaluating a broker, understanding their trading conditions is essential. Global Next Trade offers various account types with different features and fee structures. The broker claims to provide competitive spreads and leverage options, but the specifics can be misleading.

The overall cost structure at Global Next Trade is as follows:

| Fee Type | Global Next Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.8 pips | From 1.5 pips |

| Commission Model | No commission | Varies (typically $5 per lot) |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Global Next Trade may appear competitive, they are on the higher end compared to industry averages. Additionally, the absence of a clear commission structure can lead to unexpected costs, particularly for high-frequency traders. The broker's vague references to overnight interest rates and other fees can create confusion, making it essential for traders to clarify these details before opening an account.

Client Fund Safety

The safety of client funds is a critical aspect of any trading platform. Global Next Trade does not provide sufficient information regarding its fund protection measures. Without regulation, there are no guarantees that client funds are held in segregated accounts, which is a standard practice among reputable brokers.

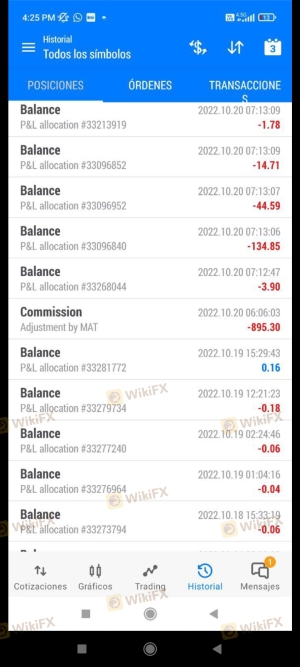

Moreover, the lack of investor protection schemes raises concerns about the security of deposited funds. In the event of insolvency or operational issues, clients may have no recourse to recover their investments. Historical complaints from users indicate potential issues with fund withdrawals, which further emphasizes the risks associated with trading with an unregulated broker.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability. Global Next Trade has received a number of complaints regarding its services, particularly concerning withdrawal issues and customer support responsiveness.

Here is a summary of the major complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Unresponsive |

| Account Management Issues | High | Inconsistent |

Several users have reported difficulties in accessing their funds, claiming that the broker imposes unnecessary hurdles during the withdrawal process. Additionally, clients have expressed dissatisfaction with the quality of customer support, often citing long wait times and unhelpful responses. These recurring issues highlight a pattern of operational inefficiency and raise significant concerns about the broker's commitment to client satisfaction.

Platform and Trade Execution

The trading platform offered by Global Next Trade is another critical factor in assessing its reliability. The broker provides access to popular platforms like MetaTrader 5, which is known for its advanced features and user-friendly interface. However, the platform's performance is crucial for traders, as it directly impacts execution quality and overall trading experience.

Concerns have been raised regarding order execution quality, including instances of slippage and rejected orders. Traders have reported experiencing delays during high volatility periods, which can lead to missed opportunities or unexpected losses.

Risk Assessment

Trading with Global Next Trade presents several risks that potential clients should consider. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated, no investor protection |

| Withdrawal Risk | High | Complaints about withdrawal issues |

| Operational Risk | Medium | Limited transparency and support |

Given these risks, traders should exercise caution when considering this broker. It is advisable to conduct thorough research and consider alternative options that offer more robust regulatory protection and better customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Global Next Trade operates in a manner that raises significant concerns regarding its legitimacy and reliability. The absence of regulatory oversight, combined with a history of customer complaints and operational inefficiencies, indicates that this broker may not be a safe choice for traders.

For those considering trading with Global Next Trade, it is crucial to weigh the potential risks against the benefits. Traders seeking a more secure trading environment are encouraged to explore regulated alternatives that provide better investor protection and support. Brokers such as eToro, IG, and OANDA are recommended for their strong regulatory frameworks and positive customer feedback.

In summary, while Global Next Trade may offer attractive trading conditions, the associated risks and lack of regulatory oversight make it a broker that warrants caution and thorough consideration before engaging in trading activities.

Is Global Next Trade a scam, or is it legit?

The latest exposure and evaluation content of Global Next Trade brokers.

Global Next Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global Next Trade latest industry rating score is 2.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.