Is GFS safe?

Pros

Cons

Is GFS A Scam?

Introduction

GFS, also known as Global Femic Services, positions itself as a forex and CFD broker, offering a range of trading instruments to clients worldwide. Established in 2013, GFS claims to provide competitive trading conditions and access to various financial markets. However, the increasing number of scam reports and complaints surrounding the broker raises significant concerns among potential investors. As the forex market is rife with both legitimate and fraudulent entities, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective analysis of GFS, utilizing a combination of narrative insights and structured information to assess its credibility and safety.

To evaluate GFS, we employed a comprehensive investigative approach, analyzing its regulatory status, company background, trading conditions, customer safety measures, and user feedback. This multifaceted framework enables us to draw informed conclusions about the broker's legitimacy and reliability.

Regulation and Legitimacy

One of the primary factors in determining a broker's trustworthiness is its regulatory status. Regulatory bodies enforce strict standards that brokers must adhere to, ensuring investor protection and fair trading practices. In the case of GFS, it operates under the auspices of the Australian Securities and Investments Commission (ASIC), which is regarded as a top-tier regulatory authority. However, the broker's lack of transparency regarding its registration and regulatory compliance raises red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001299400 | Australia | Verified |

Despite being registered with ASIC, GFS has faced scrutiny for its operational practices. Reports indicate that the broker may not fully comply with the stringent requirements set forth by the regulatory body. Moreover, many users have reported issues related to withdrawals and customer support, which further compounds the concerns about its legitimacy. The absence of clear information regarding the broker's adherence to regulatory standards and any past compliance issues necessitates caution among prospective clients.

Company Background Investigation

GFS was founded in 2013 and claims to have established a presence in the forex market by offering a diverse range of trading instruments, including forex pairs, CFDs on commodities, indices, and cryptocurrencies. However, the broker's operational history is relatively short, and it lacks a robust track record that would typically inspire confidence among traders.

The ownership structure of GFS remains ambiguous, with limited information available about its management team and their professional backgrounds. This lack of transparency can be concerning, as a reputable broker typically provides detailed information about its team and their qualifications. Furthermore, the company's website does not disclose sufficient information regarding its operational practices or financial health, which further diminishes its credibility.

In summary, while GFS positions itself as a legitimate brokerage, the lack of transparency and comprehensive information about its ownership and management raises significant concerns. Prospective clients should be wary of engaging with a broker that does not provide clear insights into its operational framework.

Trading Conditions Analysis

An essential aspect of evaluating a broker is understanding its trading conditions, including fees, spreads, and commission structures. GFS claims to offer competitive trading conditions, but a closer examination reveals potential issues that could affect traders' bottom lines. The broker provides access to a variety of trading instruments, but the fees associated with trading may not be as favorable as advertised.

| Fee Type | GFS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $10 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by GFS, particularly for major currency pairs, appear to be higher than the industry average. Additionally, the commission structure, which charges $10 per lot, is also comparatively steep. These factors could significantly impact a trader's profitability, especially for those engaging in high-frequency trading or scalping strategies.

Furthermore, GFS has been accused of hidden fees and unclear policies regarding overnight interest rates, which could lead to unexpected costs for traders. Such practices are often indicative of a broker that lacks transparency and may not prioritize its clients' best interests. Therefore, potential clients should carefully consider these trading conditions before deciding to open an account with GFS.

Customer Funds Safety

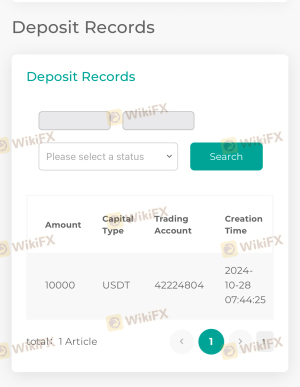

The safety of client funds is paramount when evaluating a broker. GFS claims to implement various safety measures to protect its clients' investments, including segregating client funds from company funds. However, the effectiveness of these measures remains uncertain, especially in light of numerous complaints regarding withdrawal issues.

GFS does not provide clear information about its investor protection policies or whether it participates in any compensation schemes that would safeguard clients' funds in the event of insolvency. The lack of such measures is concerning, as it leaves traders vulnerable to potential losses without any recourse.

Furthermore, historical reports of fund security issues and disputes with clients raise questions about the broker's commitment to safeguarding client assets. Traders should be cautious when dealing with a broker that does not offer robust protections for their funds and lacks transparency in its operational practices.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reliability. GFS has received a mixed bag of reviews, with numerous users expressing dissatisfaction with its services. Common complaints include difficulties with withdrawals, poor customer support, and unexpected fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

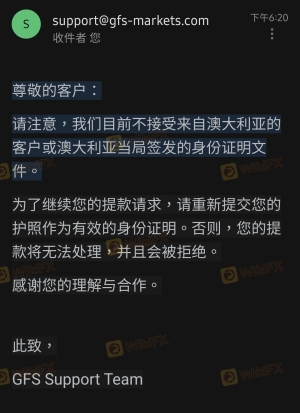

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Inconsistent |

| Hidden Fees | High | Lack of transparency |

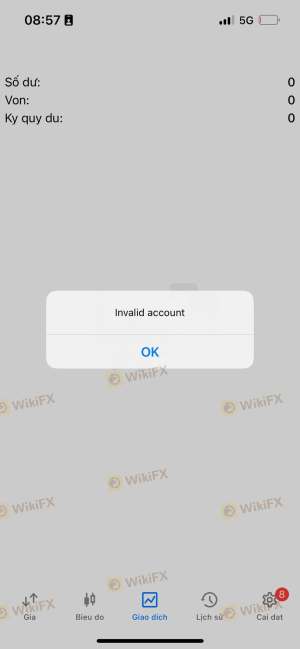

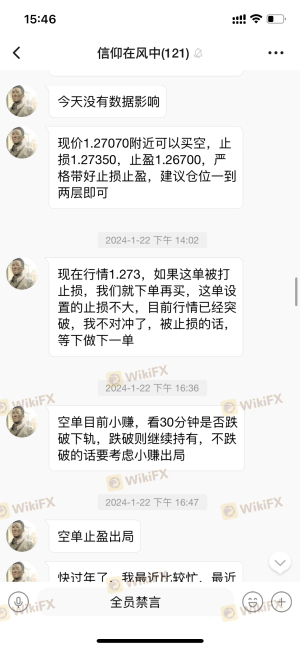

Several users have reported that their withdrawal requests were delayed or denied, leading to frustration and financial losses. Additionally, the quality of customer support has been criticized, with clients noting long response times and inadequate assistance. These issues highlight a concerning trend that potential traders should consider before engaging with GFS.

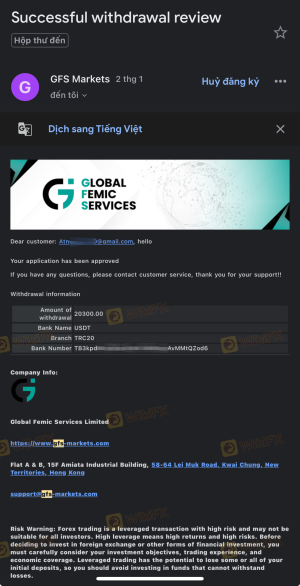

In one notable case, a trader reported that after successfully depositing funds, they faced significant challenges when attempting to withdraw their profits. The broker cited various reasons for the delays, which ultimately led the trader to suspect that GFS was engaging in unfair practices. Such experiences are indicative of a broker that may not prioritize its clients' interests and could be operating in a manner that raises ethical concerns.

Platform and Execution

The trading platform offered by GFS is MetaTrader 5 (MT5), which is widely regarded for its advanced features and user-friendly interface. However, user experiences vary, with some reporting issues related to platform stability, order execution speed, and slippage.

Traders have expressed concerns about the platform's performance during volatile market conditions, with reports of significant slippage and rejected orders. These issues can severely impact a trader's ability to execute their strategies effectively and may indicate potential manipulation or inefficiencies within the trading environment.

While MT5 is generally considered a reliable platform, the experiences reported by GFS users suggest that there may be underlying issues that could affect trading performance. Traders should be cautious and consider these factors when deciding whether to use GFS as their brokerage.

Risk Assessment

Engaging with GFS presents several risks that potential traders should carefully consider. The combination of regulatory concerns, customer complaints, and issues with trading conditions creates an environment that may not be conducive to safe trading.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of transparency and issues with regulatory adherence. |

| Fund Security | High | Concerns regarding fund protection and withdrawal issues. |

| Customer Support Reliability | Medium | Inconsistent support and slow response times. |

| Trading Conditions | High | Higher-than-average costs and potential hidden fees. |

To mitigate these risks, traders should conduct thorough research and consider opening accounts with brokers that have established reputations and robust regulatory oversight. Additionally, it is advisable to start with smaller amounts and utilize risk management strategies to protect investments.

Conclusion and Recommendations

After a comprehensive analysis of GFS, it is clear that potential traders should exercise caution when considering this broker. While GFS presents itself as a legitimate trading platform, the numerous red flags raised in terms of regulatory compliance, fund safety, and customer feedback indicate that it may not be a safe option for trading.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated by top-tier authorities, have transparent fee structures, and demonstrate a commitment to customer service. Some reputable alternatives include brokers such as IG, OANDA, and Forex.com, which have established track records and positive user experiences.

In conclusion, while GFS may offer various trading opportunities, the associated risks and concerns suggest that it may be prudent for traders to look elsewhere for their forex trading needs.

Is GFS a scam, or is it legit?

The latest exposure and evaluation content of GFS brokers.

GFS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GFS latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.