Global Next Trade 2025 Review: Everything You Need to Know

Executive Summary

Global Next Trade is a regulated forex broker that offers multiple trading instruments and fair business practices. It works well for different types of traders who want access to global markets through a reliable platform. This global next trade review shows that the platform targets both individual and corporate clients, especially investors who want to make returns through CFDs and forex trading. Two key features stand out: the minimum deposit requirement of $5,000 USD and zero commission trading structure. These features can attract intermediate-level traders who have enough capital to start.

The broker works under joint supervision from FSA (Financial Service Authority of Saint Vincent & Grenadines) and CIMA. This shows legitimate regulatory oversight that protects traders. Global Next Trade uses STP (Straight Through Processing) services, which means they focus on fair commercial practices and client interest protection. The platform gives access to CFDs, forex, stocks, futures, and options. This provides traders with many different financial instruments to choose from.

However, future clients should know that while the broker offers competitive commission rates at $0 USD, the spread starts at 8 pips. This may be high compared to some competitors in the market. The company is registered at Two Artillery Court, 2nd Floor, 161 Shedden Road, George Town, PO Box 799, KY1-1103, Cayman Islands. It operates under the trading brand Global Next Trade through GNT Capital Ltd.

Important Disclaimers

Global Next Trade operates under FSA and CIMA regulation, so investors should pay attention to its legal rules in different regions. Regulatory frameworks may vary across different countries and areas. Future clients should check if the broker can provide services in their specific location before opening an account.

This review uses comprehensive analysis of public information and user feedback. The information shown reflects data available when this was written and may change over time. Future traders should do their own research and check current terms and conditions directly with the broker before making any investment decisions.

Overall Rating Framework

Broker Overview

Global Next Trade operates through GNT Capital Ltd and has its headquarters in the Cayman Islands. It provides forex and other financial product trading services to both individual and corporate clients. The company has positioned itself as a comprehensive trading ecosystem that welcomes traders of all experience levels. Their motto "trading within everyone's reach" shows their inclusive approach to market access.

The broker uses an STP (Straight Through Processing) business model. This emphasizes fair commercial practices and client interest protection. This approach typically means that orders go directly to liquidity providers without dealer intervention, which can reduce conflicts of interest between the broker and its clients. Global Next Trade serves clients who want access to global markets through CFD trading and related financial instruments.

The platform offers many different tradeable assets including CFDs, forex, stocks, futures, and options. This provides traders with multiple opportunities across different market sectors. The company operates under joint regulatory supervision from the Financial Service Authority of Saint Vincent & Grenadines (FSA) and CIMA. This helps ensure transparency, security, and confidence for investors. This dual regulatory framework maintains high-quality standards and provides a safe, reliable environment for all traders using the platform.

Regulatory Jurisdictions: Global Next Trade operates under the supervision of FSA (Financial Service Authority of Saint Vincent & Grenadines) and CIMA. This joint regulatory oversight ensures that the broker maintains fair commercial practices and operates with high-quality standards. It provides legal protection for client interests.

Minimum Deposit Requirements: The platform requires a minimum deposit of $5,000 USD. This positions it in the mid-tier range for forex brokers. This requirement may appeal to serious traders while potentially limiting access for beginners with smaller capital.

Available Trading Assets: The broker provides access to multiple asset classes including CFDs, forex, stocks, futures, and options. This diverse offering allows traders to build varied portfolios and explore different market opportunities within a single platform.

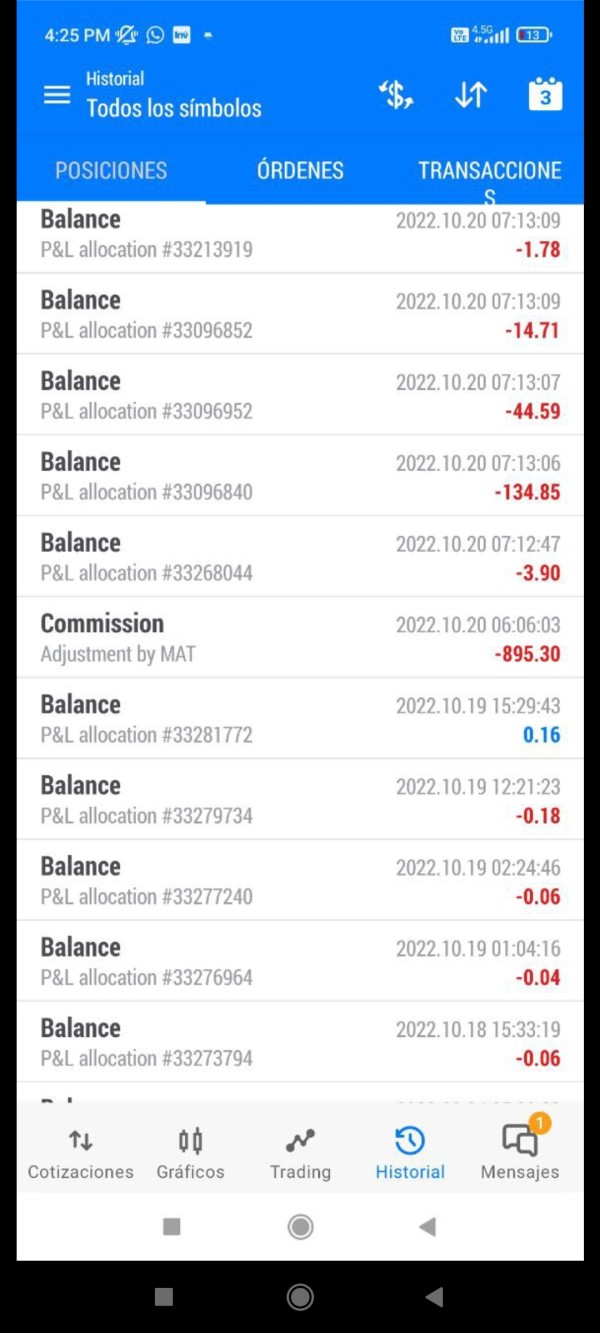

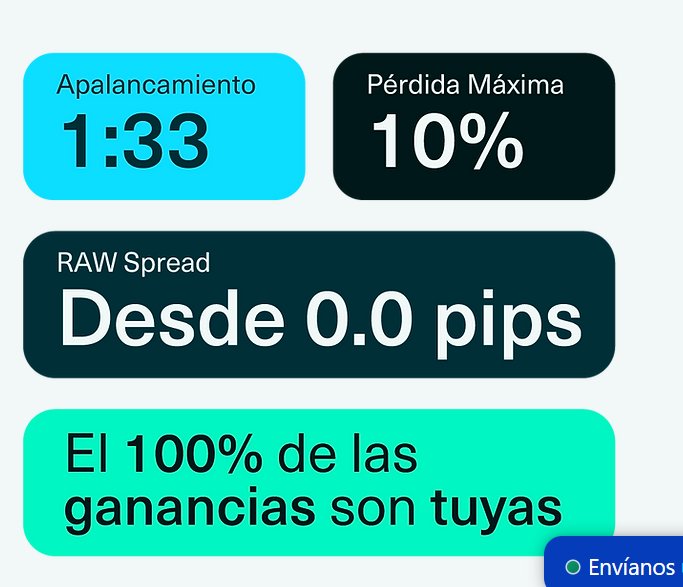

Cost Structure: Global Next Trade offers zero commission trading ($0 USD commission). This can significantly reduce trading costs for active traders. However, the spread starts at 8 pips, which may be high compared to some competitors. The cost per side per lot is listed at $5 USD. This provides transparency in fee structure.

Payment Methods and Withdrawal Options: Specific information about deposit and withdrawal methods was not detailed in available source materials. Future clients need to contact the broker directly for complete payment processing information.

Leverage Ratios: Detailed leverage information was not specified in the available documentation. This is an important consideration for traders planning their risk management strategies.

Trading Platform Options: The broker mentions advanced technology and connectivity through their GNT-X account type. However, specific trading platform details were not comprehensively outlined in source materials.

Geographic Restrictions: Information about regional limitations or restricted territories was not specified in available materials.

Customer Support Languages: Specific language support details were not provided in the source documentation. The broker appears to operate with multilingual capabilities based on their international positioning.

This global next trade review shows that while the broker provides essential trading services, some operational details require direct inquiry with the company for complete information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Global Next Trade's account conditions present a mixed picture that earns a solid rating of 7 out of 10. The broker's minimum deposit requirement of $5,000 USD puts it in the intermediate range. This makes it accessible to serious traders while potentially excluding beginners with limited capital. This threshold suggests the platform targets committed traders who are ready to engage with substantial capital. This can be viewed as both a strength and limitation depending on trader demographics.

The zero commission structure ($0 USD commission) represents a significant advantage. This is particularly true for high-frequency traders who would otherwise face substantial transaction costs. This feature alone makes Global Next Trade competitive in the cost-conscious trading environment. However, the 8 pips spread partially offsets this benefit. It's relatively high compared to industry standards where major currency pairs often trade with spreads of 1-3 pips.

The broker offers what they term "trading within everyone's reach," though the $5,000 minimum deposit contradicts this accessibility claim for entry-level traders. The account structure appears designed to attract intermediate to advanced traders who value zero commissions over ultra-tight spreads. Unfortunately, specific information about different account types, Islamic accounts, or special features was not available in source materials. This limits our ability to provide a comprehensive assessment.

For traders evaluating account conditions, Global Next Trade offers reasonable terms for those meeting the capital requirements. However, it lacks the flexibility and detailed information that would earn a higher rating. The global next trade review of account conditions suggests adequate but not exceptional offerings in this category.

The tools and resources offered by Global Next Trade receive a moderate rating of 6 out of 10. This reflects both strengths and notable information gaps. The broker provides access to multiple asset classes including CFDs, forex, stocks, futures, and options. This demonstrates a commitment to offering diverse trading opportunities. This variety allows traders to implement different strategies and diversify their portfolios within a single platform.

The platform emphasizes their GNT-X account type, which they describe as designed to offer the best experience, technology, and connectivity in the CFD market. They mention features like instant funding and capital boost capabilities (X10 from deposit). This suggests advanced account management tools. However, specific details about trading platforms, charting tools, technical analysis resources, or market research capabilities were not comprehensively outlined in available materials.

Educational resources, which are crucial for trader development, were not mentioned in the source documentation. Similarly, automated trading support, expert advisors, or API access information was not available. The absence of detailed information about research and analysis tools represents a significant gap in our assessment capability.

While the broker appears to offer modern technology and connectivity, the lack of specific platform details, educational content, and analytical tools prevents a higher rating. Traders seeking comprehensive resources may need to inquire directly with the broker about available tools, research capabilities, and educational support programs.

Customer Service and Support Analysis (Score: N/A)

Customer service and support information was not available in the source materials reviewed. This makes it impossible to provide a reliable rating for this crucial category. This represents a significant information gap that potential clients should address through direct inquiry with the broker.

Effective customer support is essential for forex trading, where technical issues, account questions, or urgent trading concerns can arise at any time. Key factors that typically influence customer service ratings include availability of multiple contact channels (phone, email, live chat), response times, service quality, multilingual support capabilities, and operating hours that accommodate different time zones.

The absence of detailed customer service information in available materials suggests that prospective clients should specifically inquire about support availability, response times, and communication channels before opening an account. This is particularly important for traders who may require assistance during volatile market conditions or technical difficulties.

Given the international nature of Global Next Trade's operations and their targeting of both individual and corporate clients, robust customer support would be expected. However, without specific information about their support infrastructure, service quality, or user feedback regarding customer service experiences, no rating can be assigned to this category.

Trading Experience Analysis (Score: N/A)

The trading experience category cannot be adequately rated due to insufficient information about platform performance, execution quality, and user feedback in available source materials. This global next trade review identified that while the broker mentions advanced technology and connectivity through their GNT-X offering, specific details about platform stability, execution speeds, order fulfillment quality, and overall trading environment were not provided.

Critical factors for trading experience typically include platform reliability, order execution speed, slippage rates, server stability, mobile trading capabilities, and overall user interface design. The broker's emphasis on STP (Straight Through Processing) suggests a commitment to fair execution practices. However, without specific performance data or user testimonials, the actual trading experience quality remains unclear.

The mention of 8 pips spread indicates the cost component of trading experience, which is relatively high and could impact scalping or high-frequency trading strategies. However, other crucial elements like platform features, charting capabilities, order types available, and mobile app functionality were not detailed in source materials.

Prospective traders should request demo accounts or detailed platform demonstrations to evaluate the trading experience firsthand. This information gap prevents an accurate assessment of this important category.

Trust and Reliability Analysis (Score: 8/10)

Global Next Trade earns a strong rating of 8 out of 10 in trust and reliability. This is primarily due to its regulatory oversight and transparent business practices. The broker operates under joint supervision from the Financial Service Authority of Saint Vincent & Grenadines (FSA) and CIMA. This provides dual regulatory protection that enhances client confidence and legal recourse options.

The FSA supervision ensures that Global Next Trade maintains transparency, security, and reliability in its financial activities. CIMA oversight adds an additional layer of regulatory compliance. This dual regulatory framework is designed to ensure fair commercial practices, protect client interests, and maintain high operational standards. It creates a secure and reliable environment for traders.

The company's registration in the Cayman Islands at a specific business address (Two Artillery Court, 2nd Floor, 161 Shedden Road, George Town) provides transparency about its legal structure and operational base. Operating through GNT Capital Ltd under the Global Next Trade brand demonstrates clear corporate organization and accountability.

The broker's emphasis on STP processing and fair commercial practices further supports its reliability profile. However, the rating doesn't reach 9 or 10 due to limited information about specific fund protection measures, segregated account policies, insurance coverage, or detailed risk management procedures. These would provide additional security assurances for client funds.

User Experience Analysis (Score: N/A)

User experience cannot be accurately assessed due to the absence of specific user reviews, satisfaction ratings, and detailed feedback in available source materials. This represents a critical information gap for potential clients seeking to understand real-world user experiences with Global Next Trade's services.

Typical user experience factors include account opening procedures, verification processes, platform usability, deposit and withdrawal efficiency, overall customer satisfaction, and common user complaints or praise. The broker's claim that "trading is within everyone's reach" suggests a focus on user accessibility. However, without concrete user feedback, this claim cannot be verified.

The introduction of the GNT-X account type with instant funding and capital boost features suggests attention to user convenience and experience enhancement. However, actual user responses to these features, ease of use, and satisfaction levels were not documented in available materials.

Interface design, navigation ease, account management functionality, and mobile experience quality are crucial components of user experience that require direct user feedback for accurate assessment. Prospective clients should seek out independent user reviews, testimonials, or trial periods to evaluate the user experience before committing to the platform.

Conclusion

This comprehensive global next trade review reveals a regulated forex broker with both strengths and areas requiring further investigation. Global Next Trade demonstrates regulatory compliance through FSA and CIMA oversight, offers zero commission trading, and provides access to multiple asset classes including CFDs, forex, stocks, futures, and options. These features make it potentially suitable for intermediate to advanced traders with sufficient capital to meet the $5,000 minimum deposit requirement.

The broker's main advantages include regulatory protection, zero commission structure, and diverse trading instruments. However, the relatively high spread of 8 pips and limited publicly available information about customer service, trading platforms, and user experiences represent notable concerns for potential clients.

Global Next Trade appears most suitable for serious traders who prioritize regulatory oversight and zero commissions over ultra-tight spreads. It works best for those who have adequate capital to meet the minimum deposit requirements. However, the significant information gaps identified in this review suggest that prospective clients should conduct thorough due diligence. This includes direct communication with the broker to clarify platform features, customer support capabilities, and user experience details before making investment decisions.