GFS 2025 Review: Everything You Need to Know

Executive Summary

GFS is a Hong Kong-registered forex platform established in September 2016. It offers foreign exchange trading and financial services to retail traders. Based on available user feedback and market analysis, this gfs review reveals a mixed performance profile with an overall rating of 6 out of 10 points. According to customer review data, only 15% of reviewers recommend GFS. This indicates significant room for improvement in user satisfaction.

The platform's key strengths include its MetaTrader 4 trading platform and support for over 50 forex currency pairs alongside multiple trading assets. These assets include indices, oil, stocks, commodities, CFDs, gold, silver, and other precious metals. However, the broker operates without regulatory oversight. This significantly impacts its trustworthiness rating and overall market positioning.

GFS primarily targets traders with some forex trading experience who seek access to diverse asset classes through established trading platforms. The broker's mobile forex trading platform provides additional accessibility for users preferring on-the-go trading. Despite offering a comprehensive range of trading instruments, the lack of regulatory protection and relatively low user recommendation rate suggest that potential clients should carefully consider their risk tolerance before engaging with this platform.

Important Notice

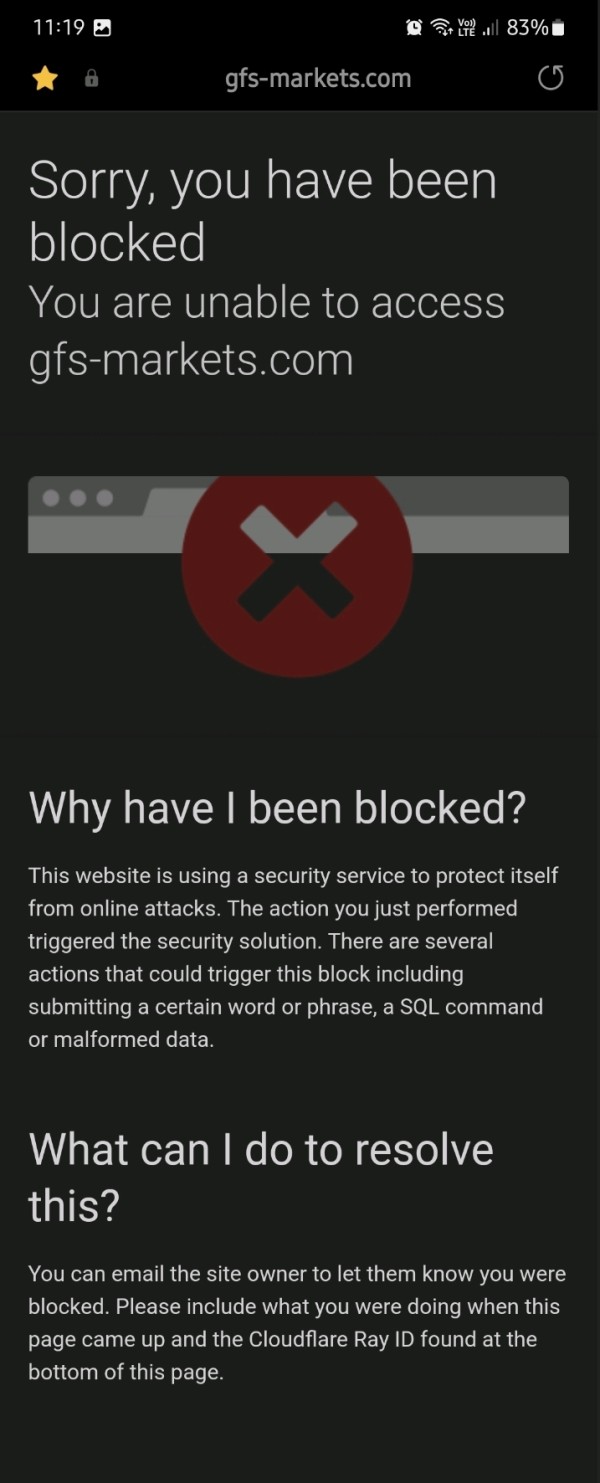

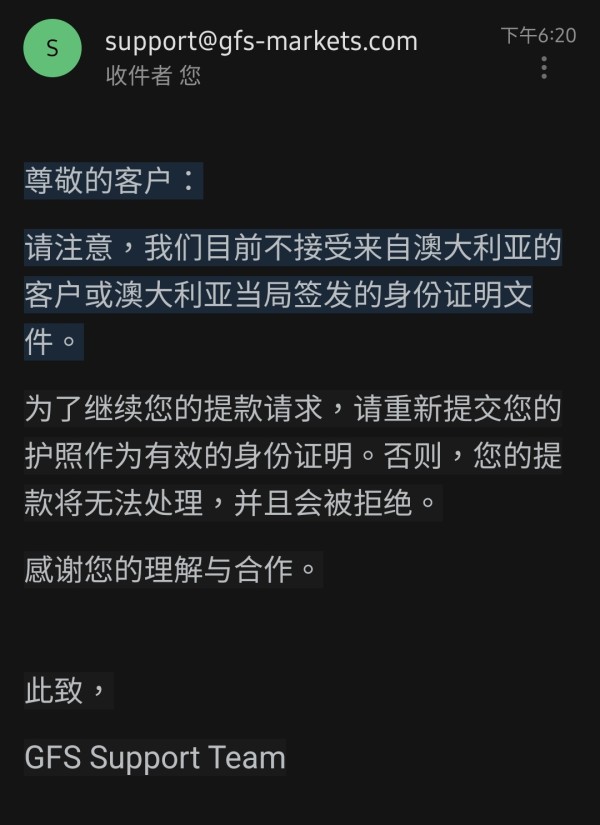

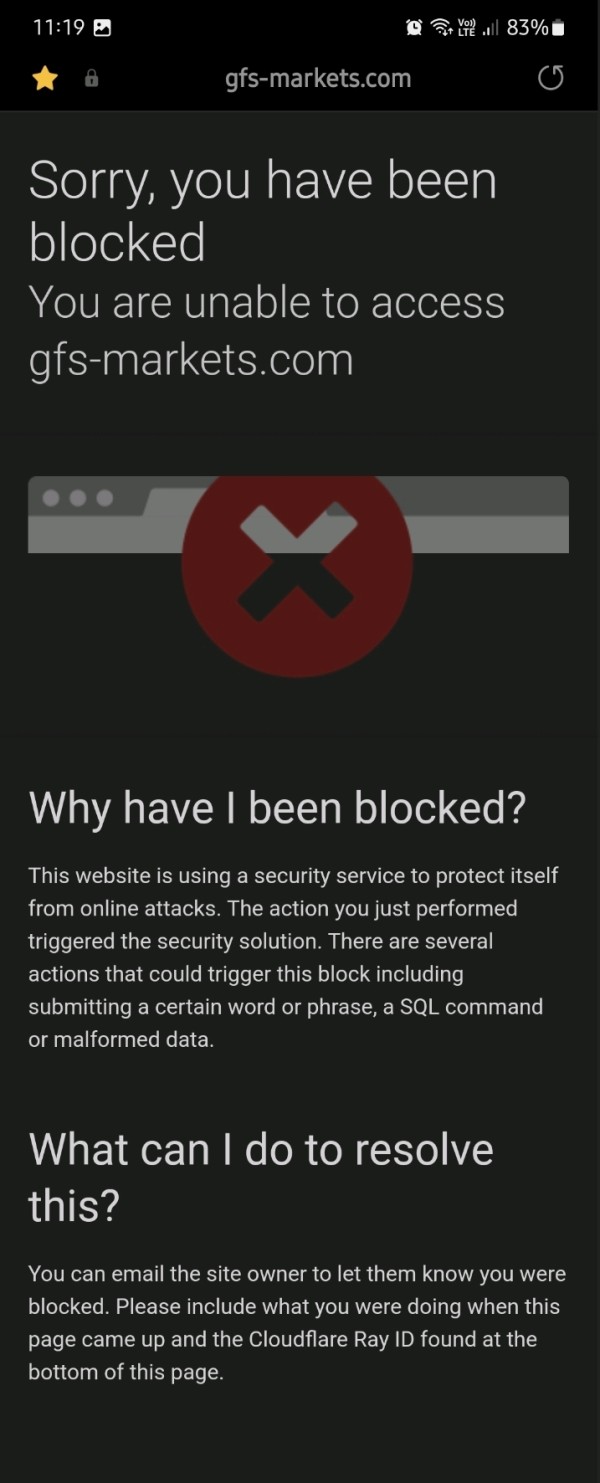

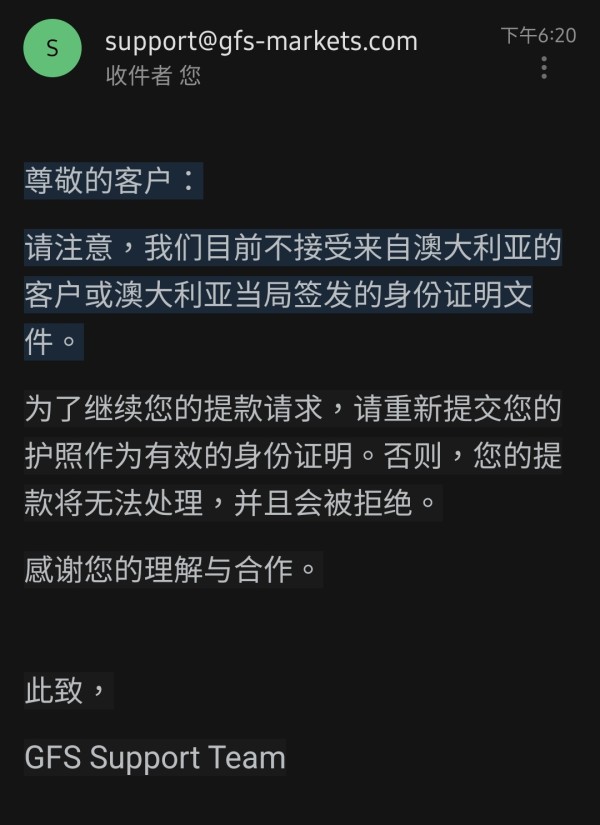

Regional Entity Differences: GFS operates as a Hong Kong-registered entity but currently lacks regulatory supervision from recognized financial authorities. This unregulated status significantly increases trading risks for clients, as there are no official oversight mechanisms to protect trader funds or ensure fair trading practices. Potential users should be aware that trading with unregulated brokers carries inherent risks including potential loss of deposits and limited recourse options.

Review Methodology: This evaluation is based on available user feedback from multiple review platforms, publicly accessible company information, and industry standard assessment criteria. Due to limited transparent disclosure from the broker, some sections of this review reflect information gaps that prospective clients should consider when making their decision.

Rating Framework

Broker Overview

GFS entered the forex trading market in September 2016 as a Hong Kong-based financial services provider. It specializes in foreign exchange trading and related financial products. The company positions itself as a multi-asset broker offering access to global financial markets through established trading platforms. Over its operational years, GFS has developed a business model focused on providing CFD and forex trading services to retail clients seeking exposure to international currency markets and other financial instruments.

The broker's core business revolves around facilitating online trading across multiple asset classes. It places particular emphasis on forex trading which remains its primary service offering. This comprehensive gfs review indicates that the company has maintained its market presence despite operating in an increasingly competitive environment where regulatory compliance has become a key differentiating factor among brokers.

GFS provides trading services through MetaTrader 4, one of the industry's most recognized trading platforms. It also offers its proprietary mobile forex trading application. The platform supports trading in over 50 forex currency pairs, covering major, minor, and exotic currency combinations. Additionally, clients can access indices, energy commodities like oil, individual stocks, various commodities, contracts for difference (CFDs), and precious metals including gold and silver. However, the broker operates without oversight from major regulatory authorities. This places it in the high-risk category for potential clients seeking regulated trading environments.

Regulatory Status: GFS operates from Hong Kong but currently lacks regulation from recognized financial authorities such as the Securities and Futures Commission (SFC) or other international regulatory bodies. This unregulated status classifies the broker as high-risk for potential clients.

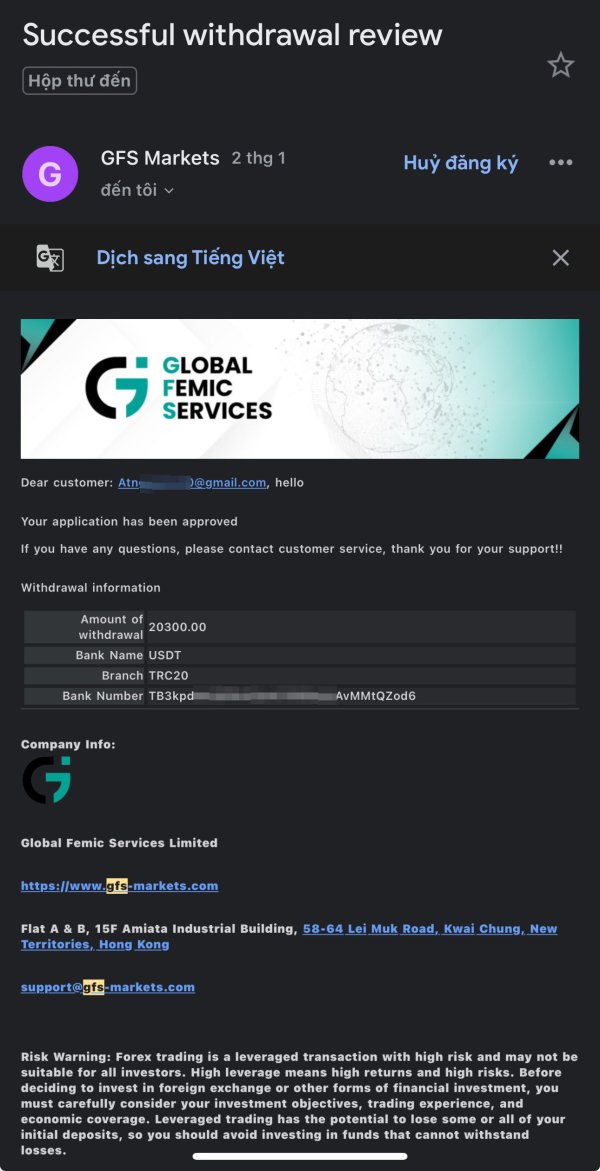

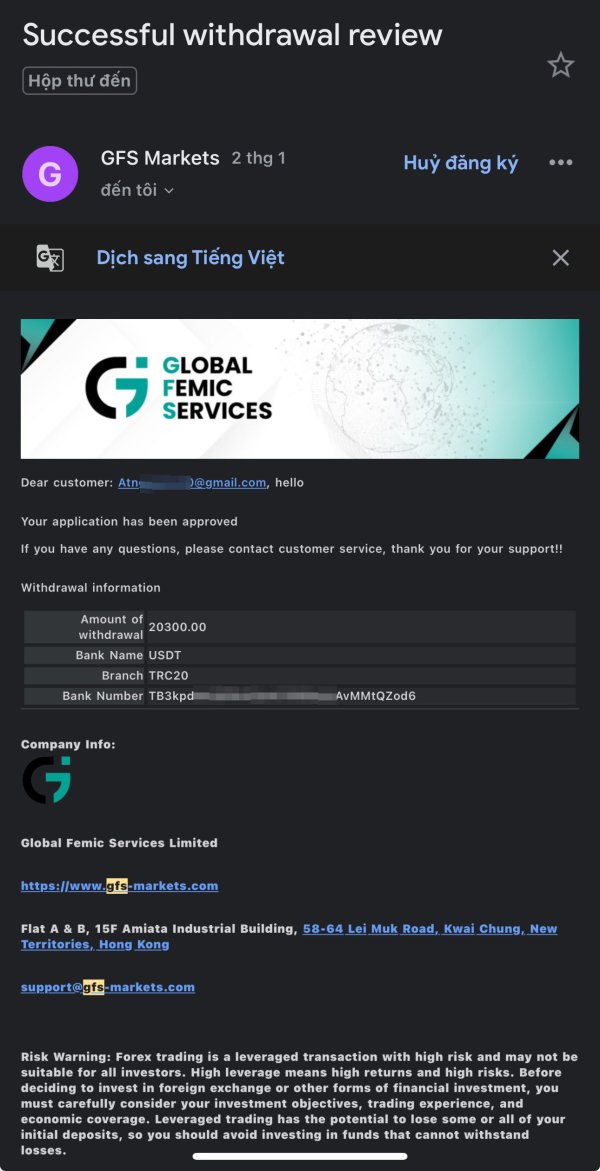

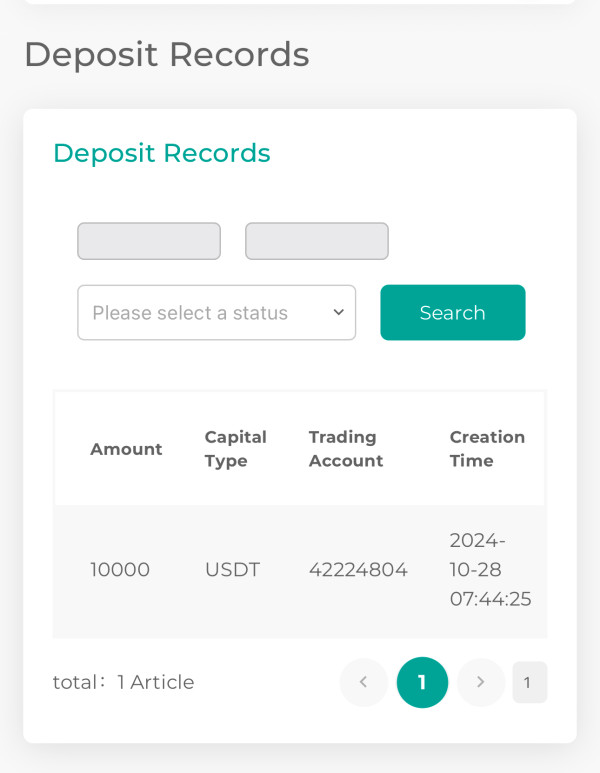

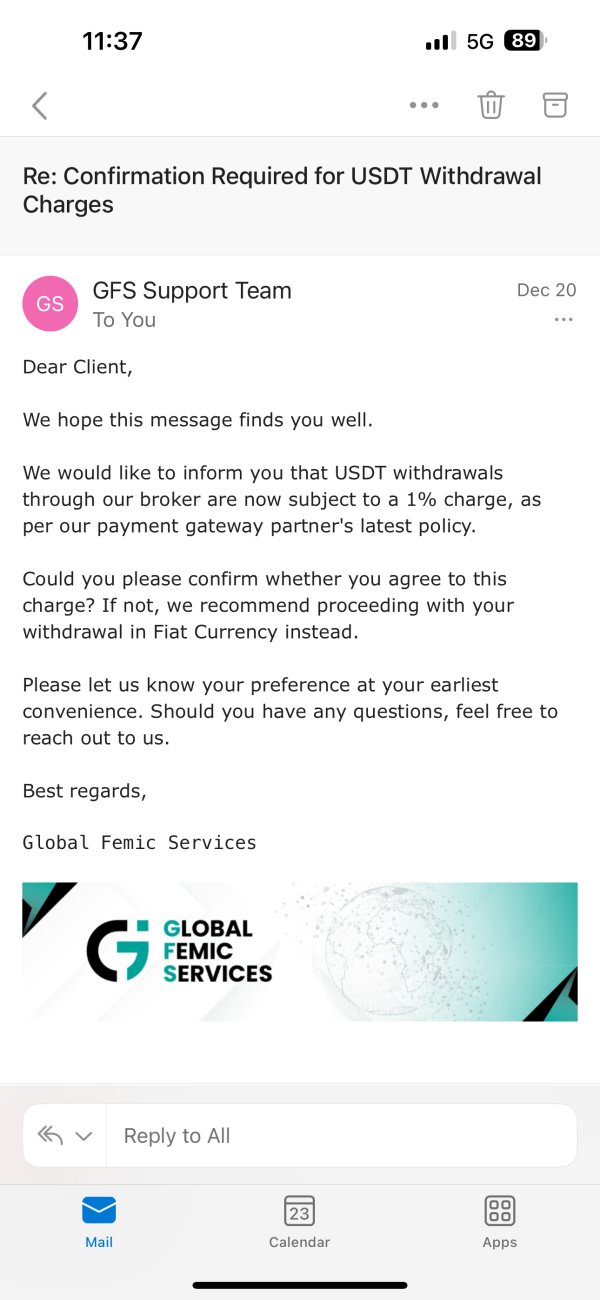

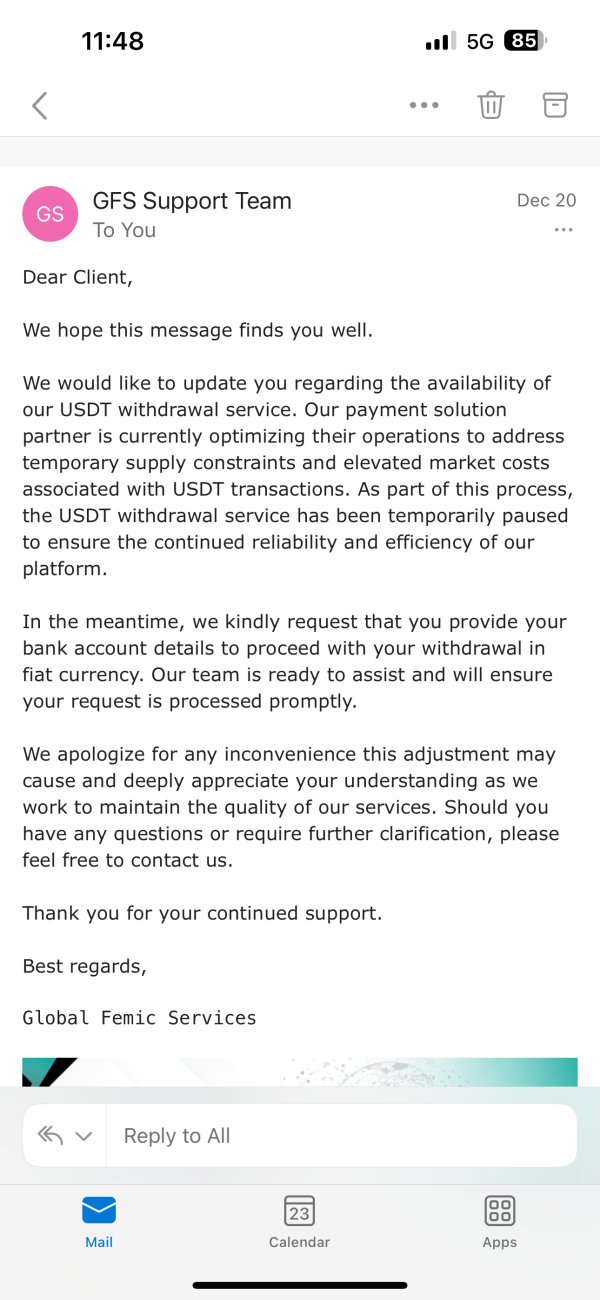

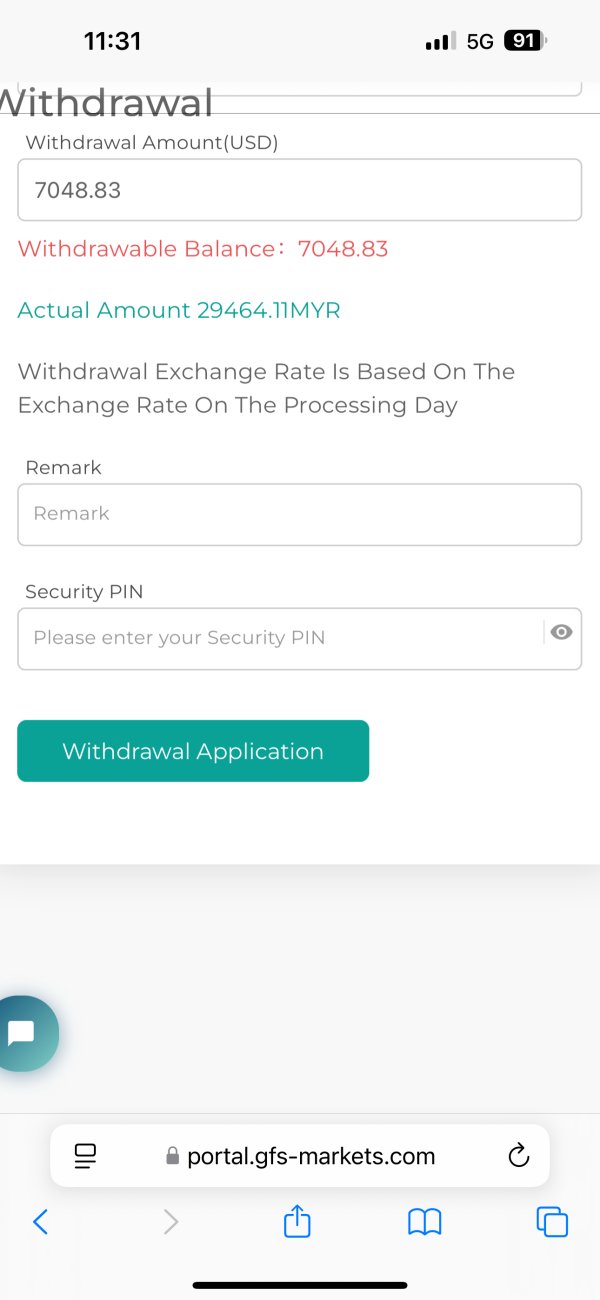

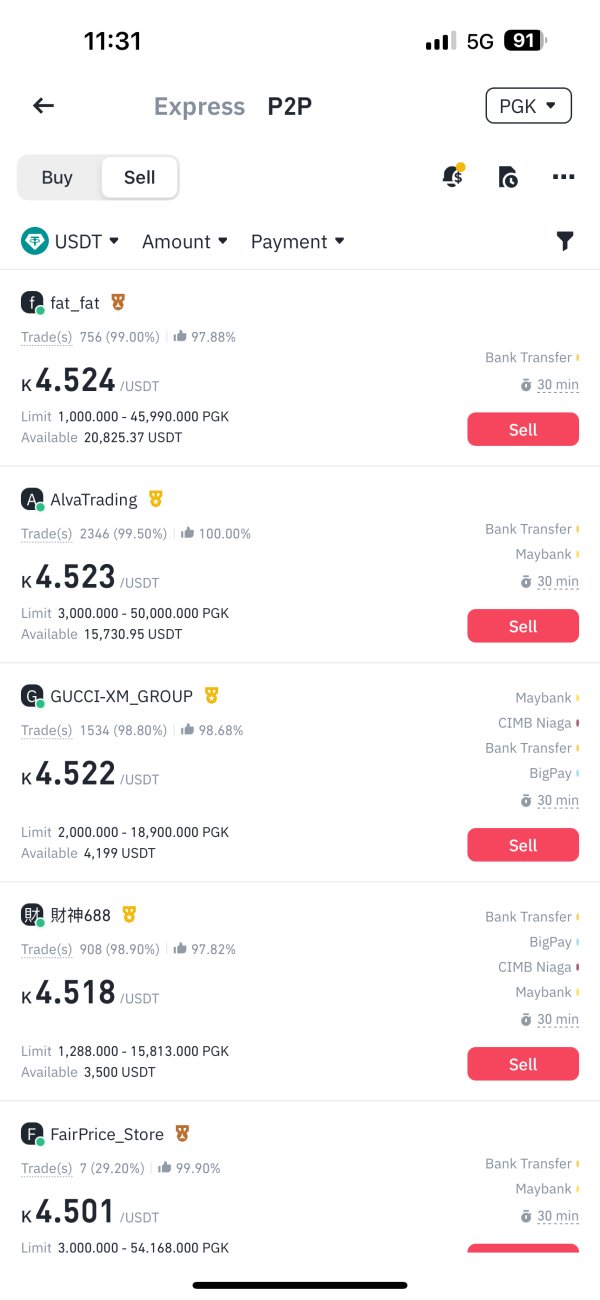

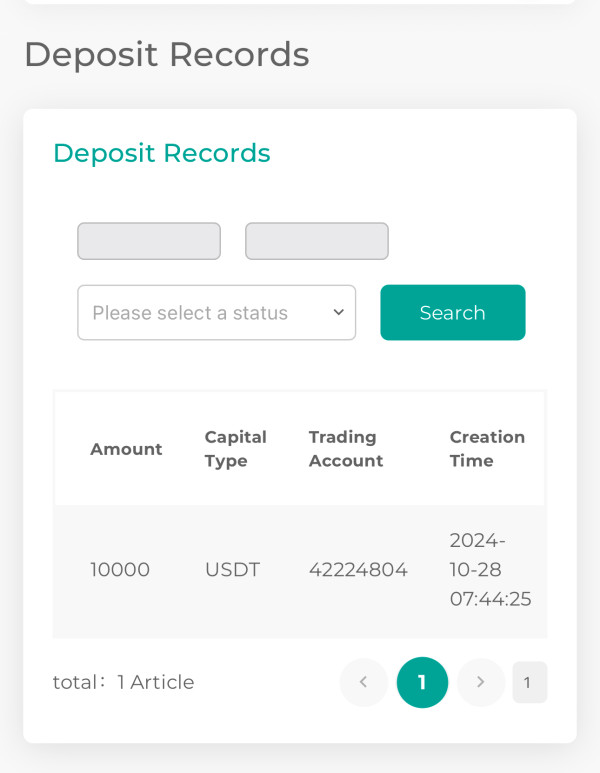

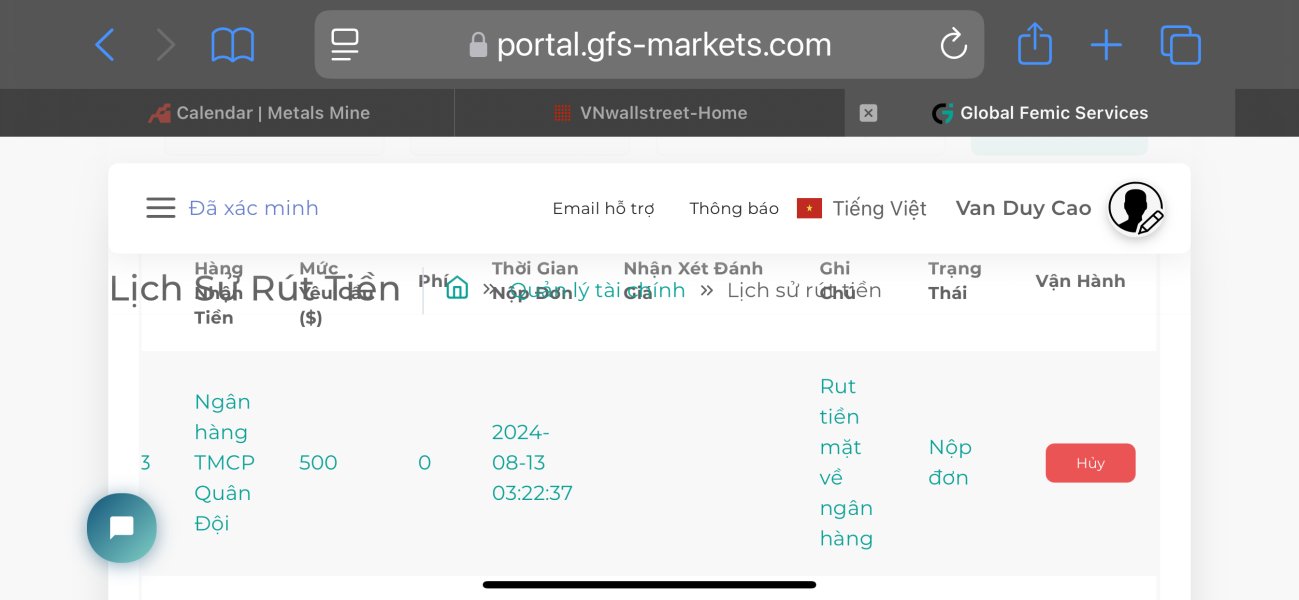

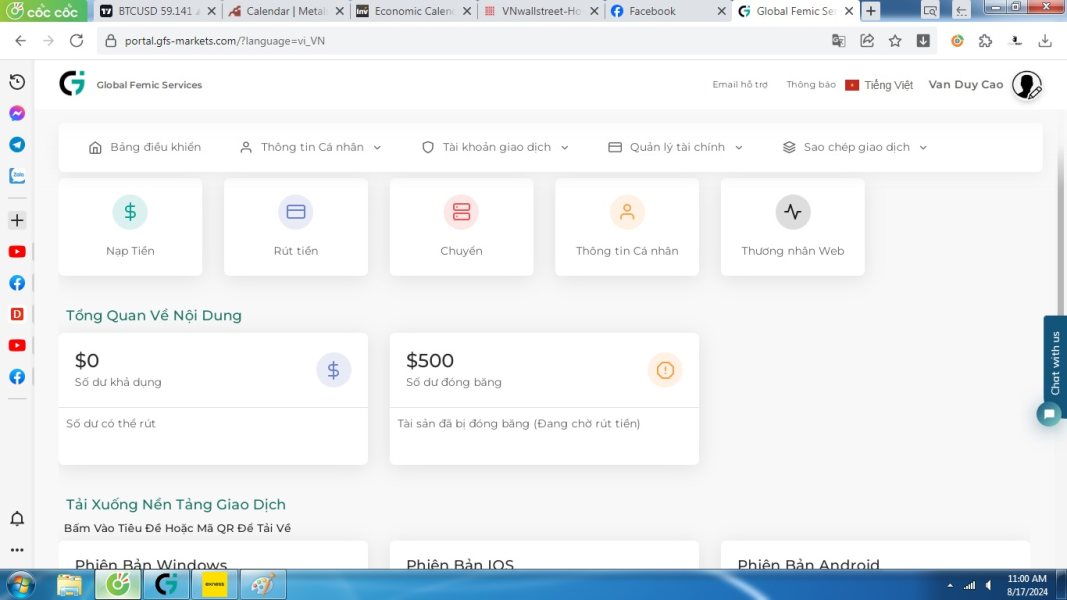

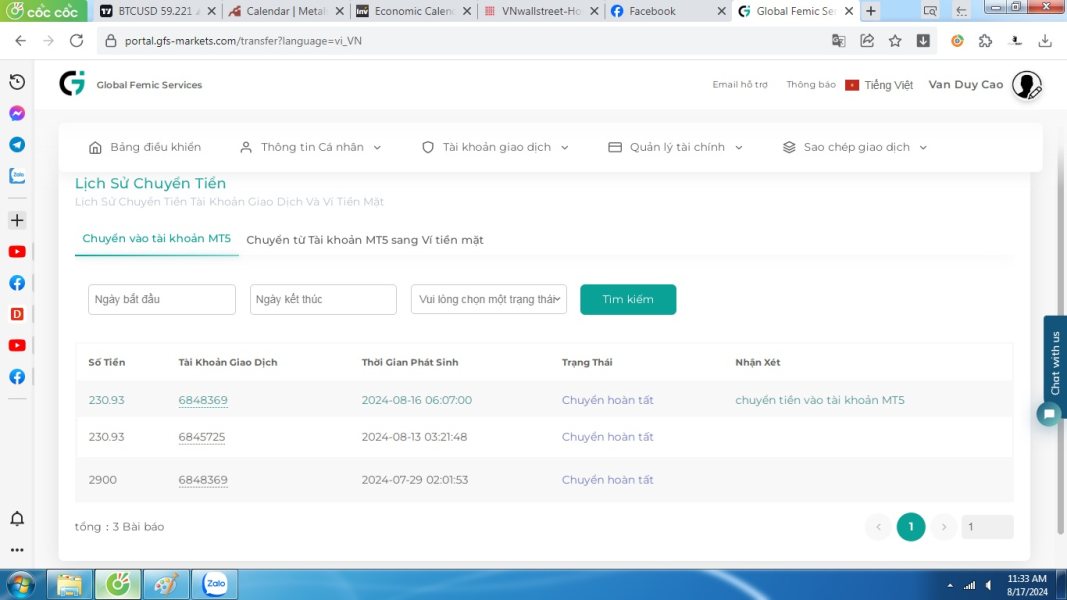

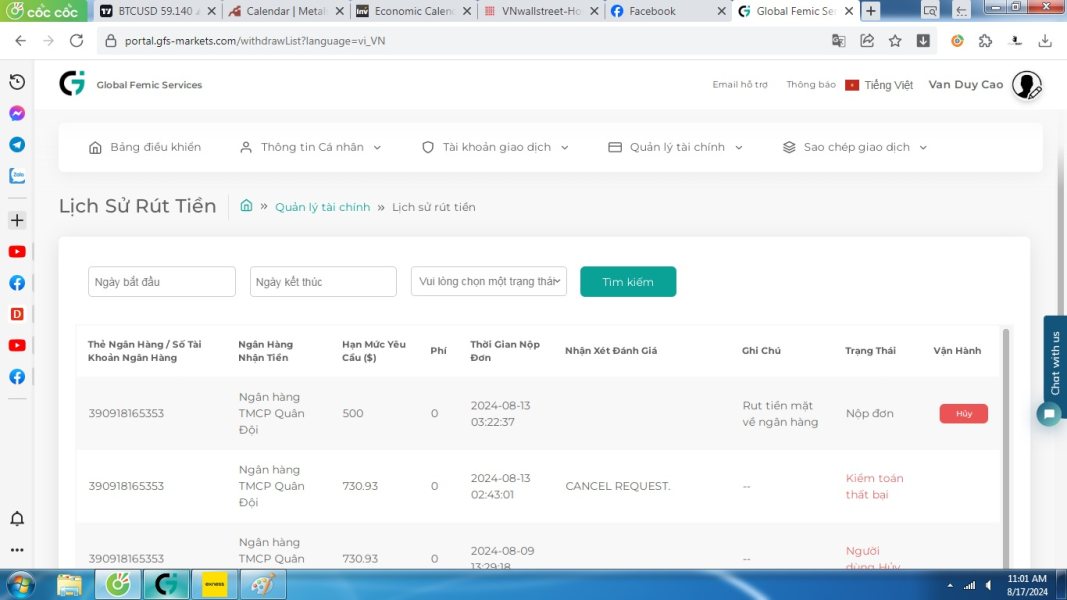

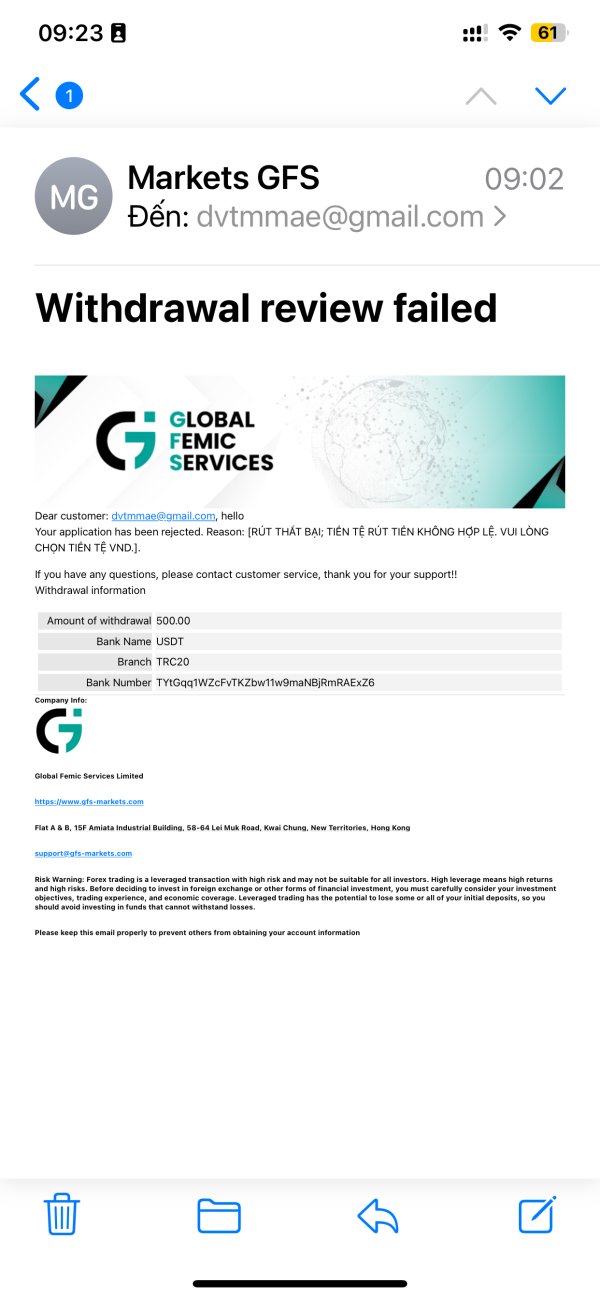

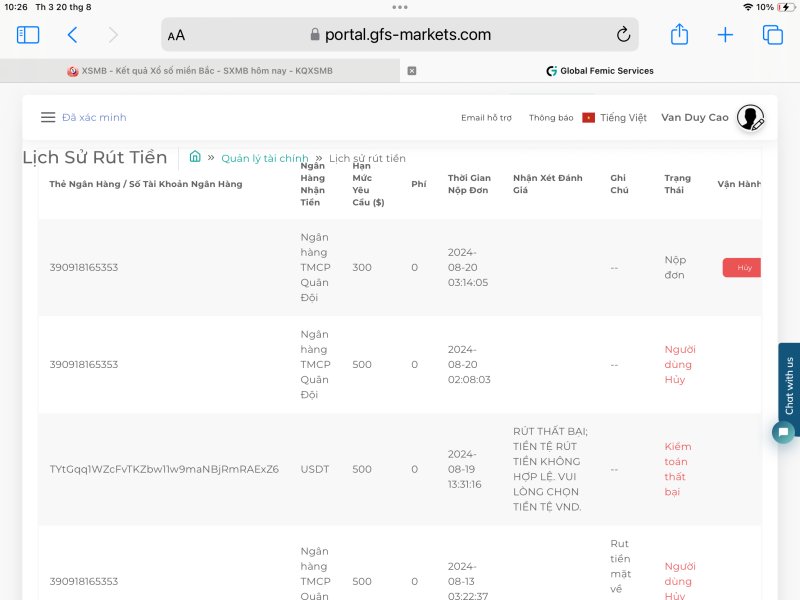

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available source materials. Prospective clients should directly contact the broker for comprehensive information about funding options and processing procedures.

Minimum Deposit Requirements: The minimum deposit threshold for opening trading accounts with GFS is not specified in available documentation. This information gap requires direct inquiry with the broker's customer service team.

Bonus and Promotional Offers: Available source materials do not mention any specific bonus programs or promotional campaigns offered by GFS. The absence of promotional information may indicate a focus on core trading services rather than marketing incentives.

Tradeable Assets: This detailed gfs review confirms that GFS offers an extensive range of trading instruments. These include over 50 forex currency pairs, stock indices, energy commodities, individual equities, various commodities, CFD products, and precious metals trading opportunities covering gold, silver, and other valuable metals.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not available in the source materials. Trading costs represent a crucial factor for trader profitability and should be verified directly with the broker before account opening.

Leverage Ratios: Leverage offerings and maximum leverage ratios are not specified in available information. Given the importance of leverage in forex trading, potential clients should request detailed leverage information from GFS directly.

Platform Options: GFS provides access to MetaTrader 4, the widely-used trading platform known for its analytical tools and automated trading capabilities. It also offers a dedicated mobile forex trading platform for smartphone and tablet users.

Geographic Restrictions: Specific regional limitations or restricted jurisdictions are not detailed in available source materials.

Customer Service Languages: Available customer support languages are not specified in the provided information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by GFS remain largely undisclosed in publicly available information. This creates a significant transparency gap for potential clients. Without specific details about account types, minimum deposit requirements, or account tier structures, it becomes challenging to assess the broker's competitiveness in this crucial area. This aspect of our gfs review highlights a concerning lack of transparency that prospective traders should address directly with the broker.

Traditional forex brokers typically offer multiple account types ranging from basic starter accounts to premium accounts with enhanced features. The absence of clear account information suggests either limited account variety or insufficient marketing transparency. Professional traders often require detailed account specifications including spread structures, commission rates, and minimum balance requirements to make informed decisions.

The account opening process details are similarly unavailable. This leaves questions about verification requirements, documentation needs, and approval timeframes unanswered. Modern brokers typically provide streamlined digital onboarding processes, but without specific information about GFS procedures, potential clients cannot properly evaluate the convenience and efficiency of getting started with this broker. This information gap represents a significant weakness in the broker's market presentation and client communication strategy.

GFS demonstrates strength in its platform and tools offering, primarily through its MetaTrader 4 integration and diverse asset selection. MetaTrader 4 remains one of the most respected trading platforms in the forex industry. It provides comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors. The platform's reliability and feature set contribute significantly to the broker's tools and resources rating.

The broker's asset diversity spanning over 50 forex pairs plus multiple other instrument categories provides traders with substantial market exposure opportunities. This range includes major currency pairs like EUR/USD and GBP/USD, minor pairs, and exotic combinations, alongside commodities, indices, and precious metals. Such variety enables portfolio diversification and multiple trading strategy implementations.

However, information about research resources, market analysis, educational materials, and trading tools beyond the basic platform offering is not available in source materials. Modern brokers typically provide daily market analysis, economic calendars, trading signals, and educational content to support trader development. The absence of information about these supplementary resources suggests either limited offerings or inadequate communication about available services. Both of these impact the overall value proposition for clients seeking comprehensive trading support.

Customer Service and Support Analysis

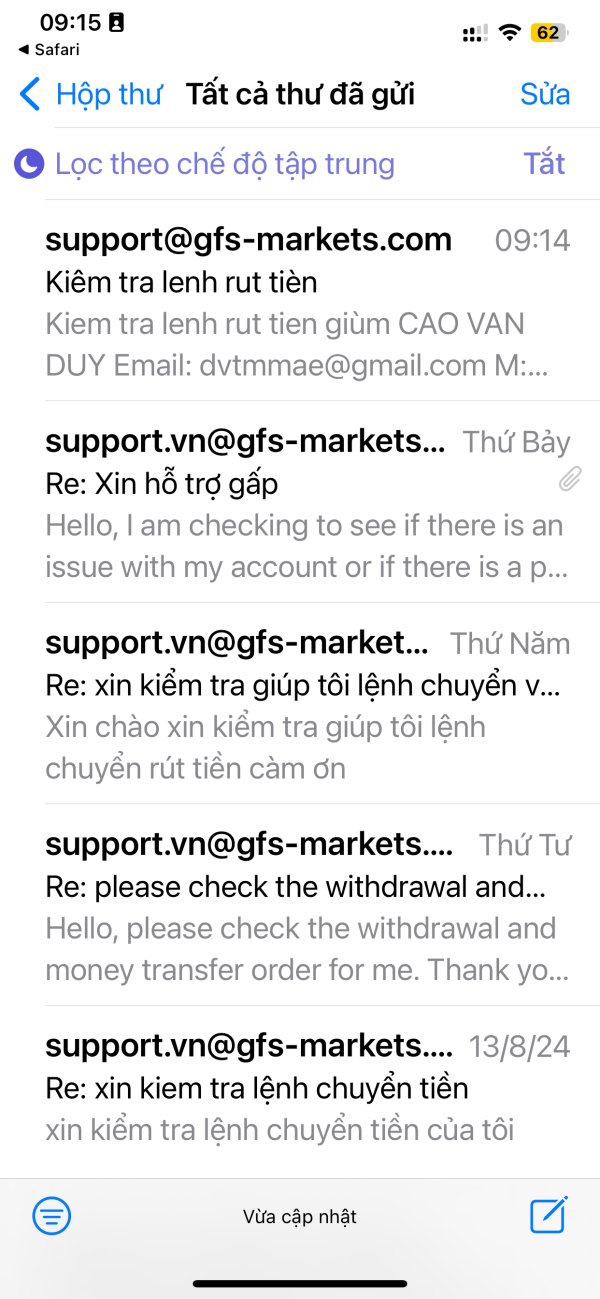

Customer service quality and availability represent critical factors in broker selection. Yet specific information about GFS customer support infrastructure is not available in the source materials. Without details about support channels, response times, or service quality metrics, potential clients cannot properly evaluate this essential service component.

Effective forex broker customer support typically includes multiple contact methods such as live chat, email, phone support, and help desk systems operating across extended hours to accommodate global trading schedules. The availability of multilingual support also plays a crucial role for international brokers serving diverse client bases. The lack of information about GFS support capabilities creates uncertainty about service accessibility and quality.

Response time expectations, problem resolution procedures, and escalation processes are similarly undisclosed. Professional traders often require quick resolution of technical issues, account problems, or trading disputes. This makes support efficiency a key operational consideration. Without specific service level information or user feedback about support experiences, this aspect of the broker's offering remains an unknown quantity that could significantly impact user satisfaction and trading effectiveness.

Trading Experience Analysis

The trading experience evaluation for GFS faces limitations due to insufficient specific information about platform performance, execution quality, and user interface design. While the broker offers MetaTrader 4, which provides a solid foundation for trading activities, the actual implementation quality and additional platform features remain unclear from available sources.

Critical elements of this gfs review regarding trading experience include platform stability, order execution speed, slippage rates, and overall system reliability during high-volatility market conditions. These factors directly impact trading profitability and user satisfaction. Yet specific performance metrics or user testimonials about trading conditions are not available in the source materials.

Mobile trading capabilities through the broker's dedicated mobile platform potentially enhance accessibility and convenience for active traders. However, without detailed information about mobile platform features, functionality, or user experience quality, it's difficult to assess how well this offering compares to industry standards. The integration between desktop and mobile platforms, synchronization capabilities, and feature parity represent important considerations for modern traders who require seamless multi-device trading experiences.

Trustworthiness Analysis

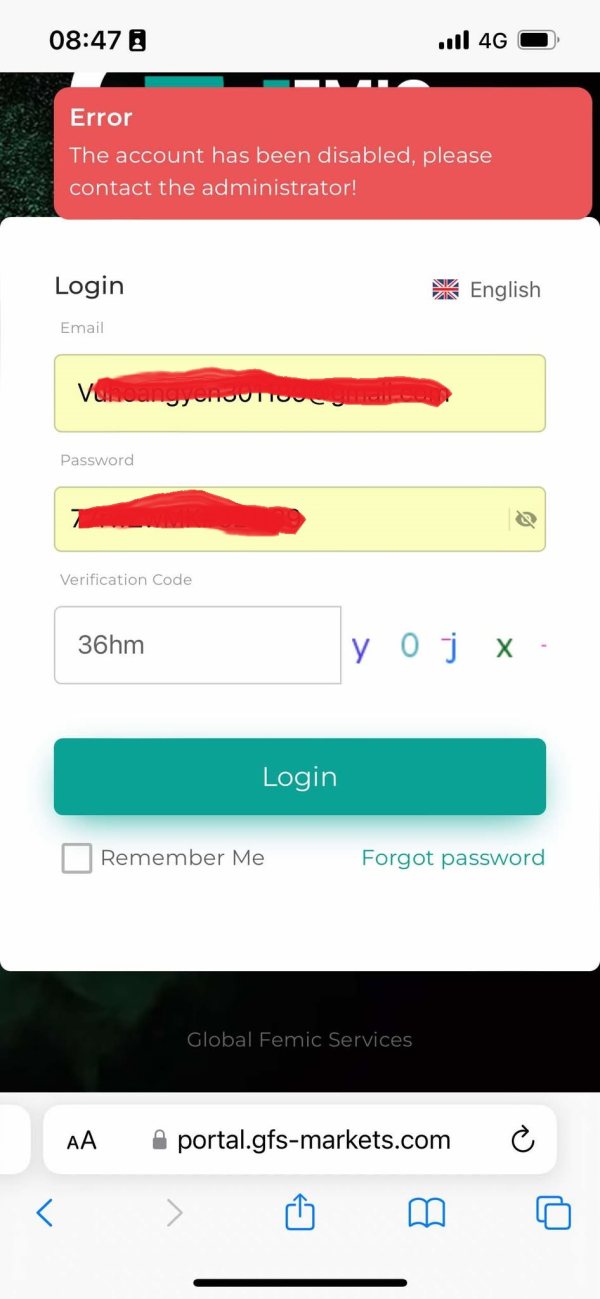

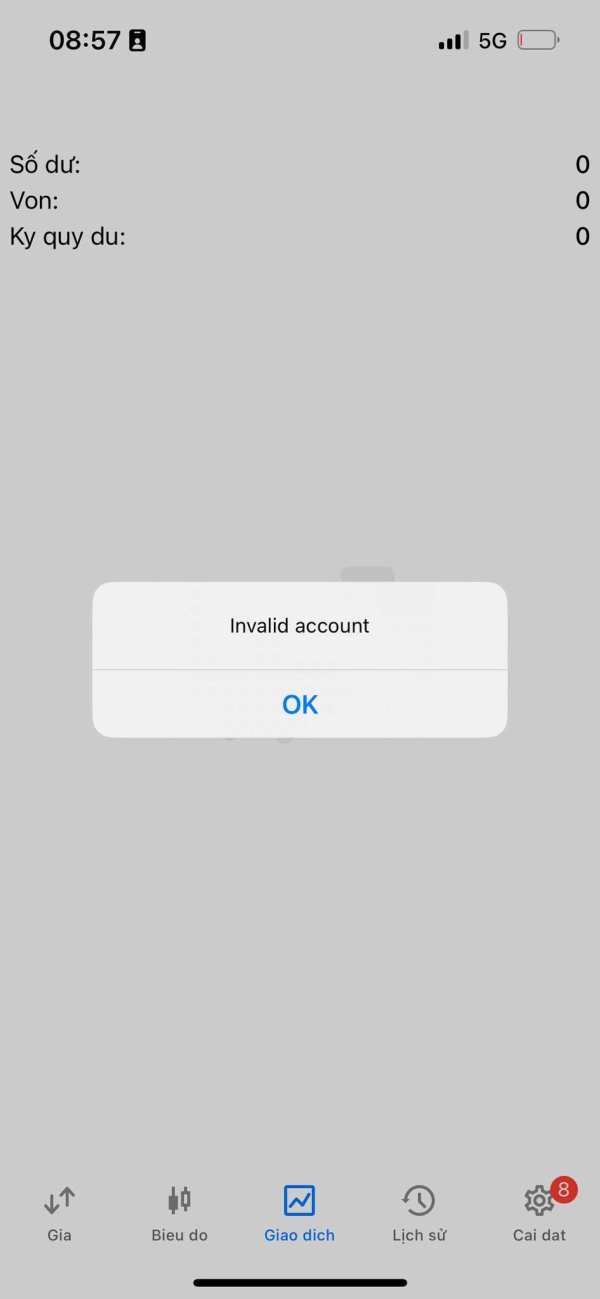

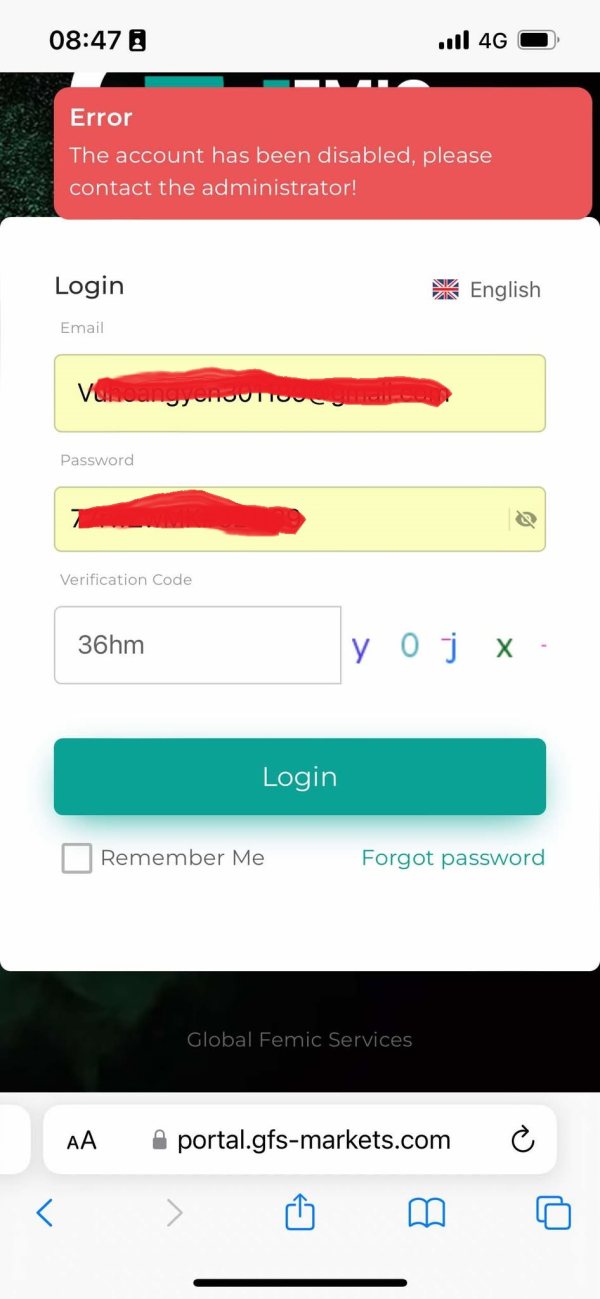

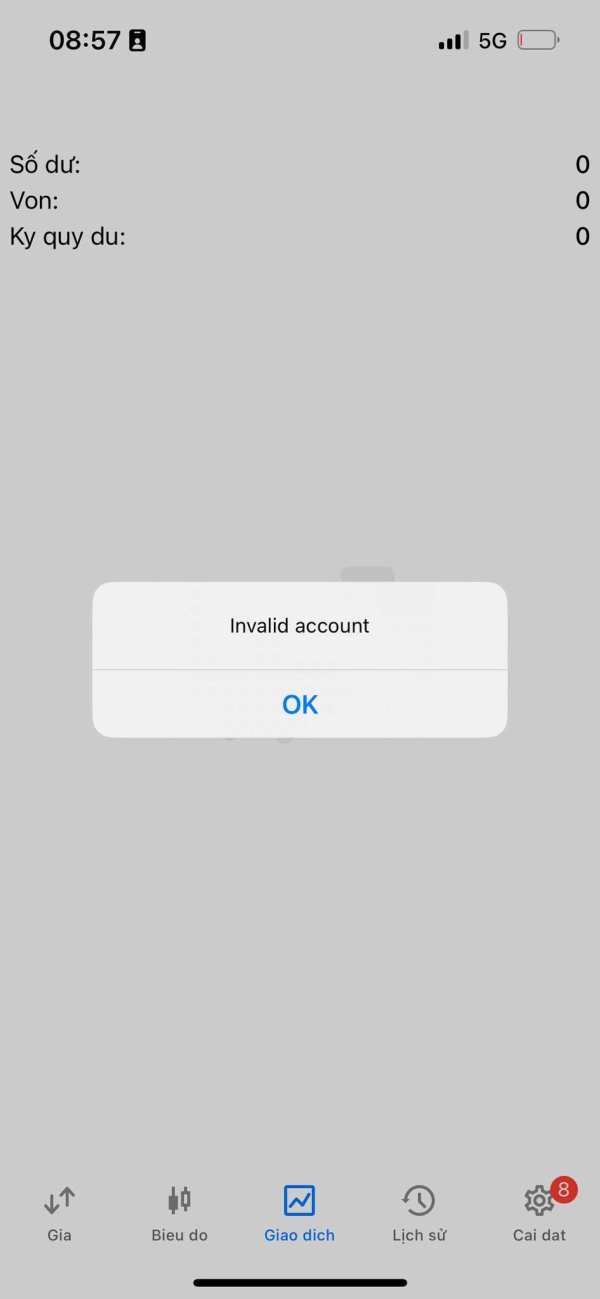

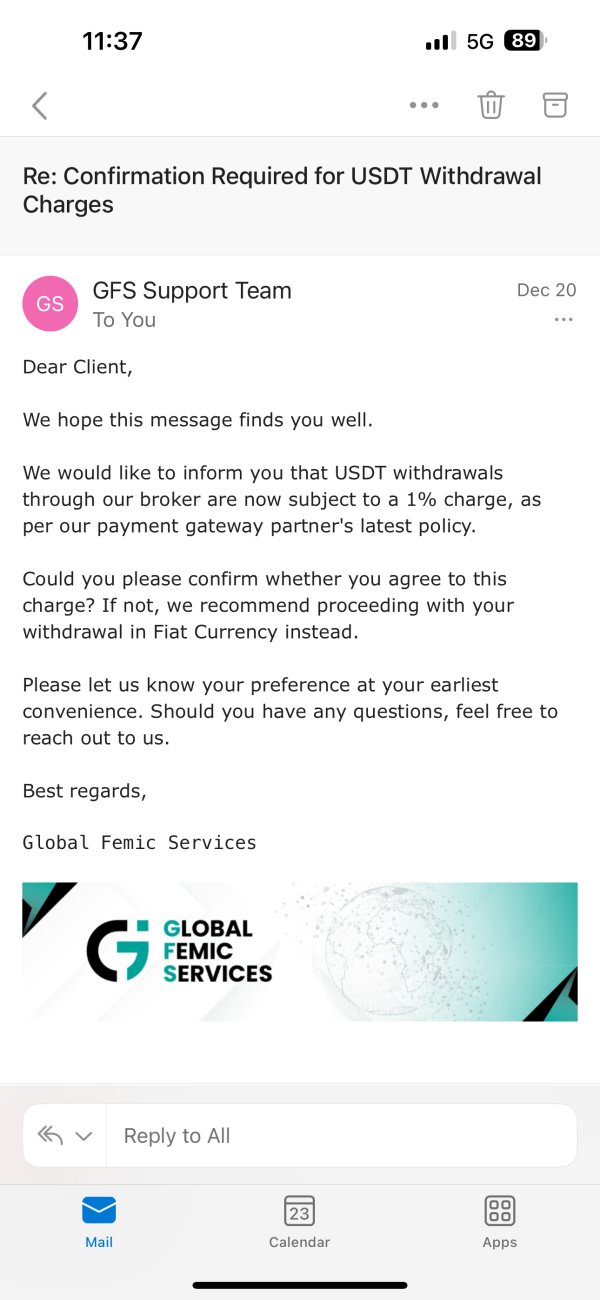

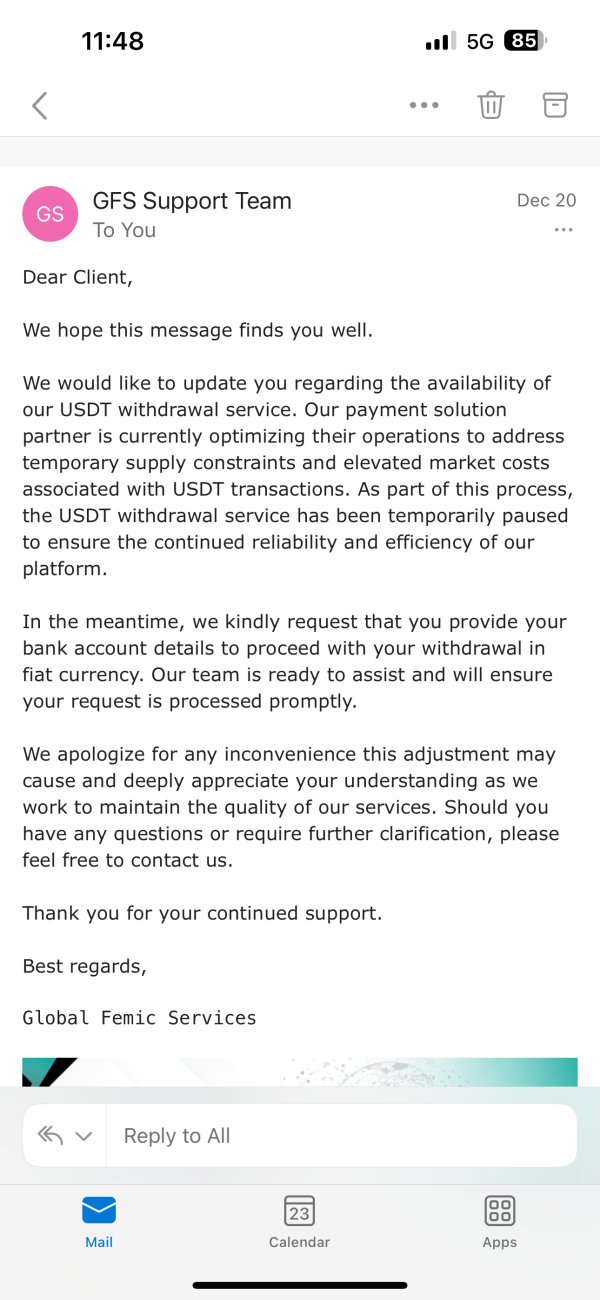

The trustworthiness evaluation for GFS reveals significant concerns primarily stemming from its unregulated operational status. Operating without oversight from recognized financial authorities such as the Hong Kong Securities and Futures Commission or other international regulatory bodies places the broker in the high-risk category for potential clients. Regulatory supervision provides essential protections including segregated client funds, dispute resolution mechanisms, and operational oversight that unregulated brokers cannot guarantee.

The low user recommendation rate of only 15% from available review data further compounds trustworthiness concerns. While user reviews can vary based on individual experiences and expectations, such a low recommendation percentage suggests widespread dissatisfaction or significant issues with the broker's services. This metric, combined with the unregulated status, creates a challenging trust profile for potential clients.

Fund safety measures, company financial transparency, and operational history details are not available in source materials. This prevents comprehensive assessment of the broker's stability and reliability. Established brokers typically provide clear information about client fund protection, company ownership, and operational track records to build client confidence. The absence of such transparency from GFS represents additional trustworthiness challenges that potential clients must carefully consider before committing funds to trading accounts.

User Experience Analysis

User experience assessment for GFS is partially informed by the available rating data showing an overall score of 6 out of 10 with only 15% of reviewers recommending the broker. These metrics suggest significant user satisfaction challenges that impact the overall client experience. This user-focused aspect of our gfs review indicates that while some traders may find adequate service, the majority experience falls short of expectations.

The specific factors contributing to user dissatisfaction are not detailed in available information. This leaves questions about whether issues stem from platform performance, customer service quality, trading conditions, or other operational aspects. Understanding these pain points would be crucial for potential clients to assess whether their specific needs and expectations align with the broker's actual service delivery capabilities.

Interface design quality, navigation efficiency, and overall platform usability represent important user experience components that are not specifically addressed in available source materials. Modern traders expect intuitive, responsive platforms that facilitate efficient trade execution and account management. Without specific feedback about GFS platform design and usability, potential clients cannot properly evaluate whether the broker meets contemporary user experience standards that have become industry expectations.

Conclusion

This comprehensive gfs review reveals a broker with mixed characteristics that require careful consideration by potential clients. GFS offers solid platform infrastructure through MetaTrader 4 and provides access to a diverse range of trading instruments spanning forex, commodities, indices, and precious metals. These strengths position the broker as potentially suitable for experienced traders seeking multi-asset exposure through established trading technology.

However, significant concerns emerge from the broker's unregulated status and low user satisfaction metrics. The lack of regulatory oversight creates inherent risks for client fund protection and dispute resolution. Meanwhile, the 15% recommendation rate suggests widespread user dissatisfaction. These factors combine to create a high-risk profile that may not align with the needs of traders prioritizing security and service quality.

GFS appears most suitable for experienced forex traders who understand the risks associated with unregulated brokers and prioritize asset diversity over regulatory protection. New traders or those seeking comprehensive support services may find better alternatives among regulated brokers with stronger user satisfaction records and transparent operational practices.